Green Coatings Market by Technology (Waterborne, Powder, High-solids, Radiation-Cure), Application (Architectural, Automotive, Industrial, High-Performance, Wood, Packaging, Product Finishes) and Region - Global Forecast to 2027

Green Coatings Market

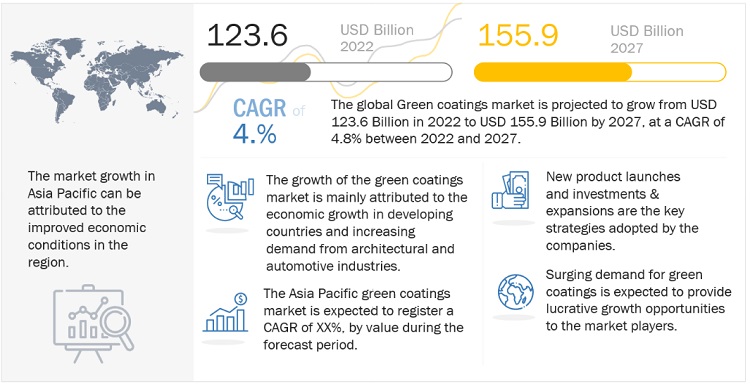

Green Coatings Market was valued at USD 123.6 billion in 2022 and is projected to reach USD 155.9 billion by 2027, growing at a cagr 4.8% from 2022 to 2027. The architectural, by application segment in Asia Pacific region is expecting a boom in the forecasted period and will lead to an increase in the demand for green coatings.

Attractive Opportunities in the Green Coatings Market

Note: e – estimated, p - projected

Source: Expert Interviews, Secondary Sources, and MarketsandMarkets Analysis

To know about the assumptions considered for the study, Request for Free Sample Report

Green Coatings Market Dynamics

Drivers: Increasing focus on health and sustainability brings “going green” idea into greater limelight

With growing awareness regarding the harmful effects of VOC emissions and increasing global warming, supported by the aforementioned regulations, there has been a gradual shift in demand from solvent-borne coatings to environment-friendly products, such as waterborne, powder coatings, high solids, and UV-curable coatings, since these products contain fewer solvents that evaporate during the curing phase. Powder coating has gained substantial popularity, since it releases negligible VOCs, if any, into the atmosphere, and contains no solvents. This market is achieving rapid growth due to the development of new products, new formulations, and advancements in the application processes. Over the forecast period, Asia Pacific is projected to be the largest as well as the fastest-growing market for green coatings. This can be attributed to the rapidly-growing automotive and construction industries in the region.

Restraints: Availability and cost of specialized raw materials needed for green coatings

Rising awareness around issues like global warming, climate change, and individual health, are pushing the demand for green coatings with minimal or no solvent content, but there are several hurdles to be overcome by this sector, before it can compete with fossil-based coatings. There are a number of factors to look over. On the economic front, the cost of renewable materials used is much higher compared to petrochemical products. Green coatings undergo a complex process to become environment friendly, which increases their cost on reaching their final stage. Users are hesitant while paying an increased amount when other alternatives are available at a much lower rate.

Opportunities: Rising demand for renewable raw materials

Many manufacturers are looking to reduce their carbon footprint as per regulations and receive benefit from government incentives for the use of renewable resources. Also, green materials offer consistent availability, and do not show the price volatility as exhibited by oil and its derivatives. Different resins manufacturers offer alkyds, acrylics, and other resins derived from bio sources to increase the performance of green coatings over traditional coating technologies.

Challenges: To develop synthetic technologies that possess little or no toxicity to human health and environment

Green chemistry can be applied to design environmentally benign synthetic protocols, to produce environmentally-friendly coatings. The use of “green” solvents and industrial reactions have been applied to numerous industrial processes to reduce toxicity by a large extent, which is very challenging. Every synthetic reaction has some byproducts left over in the environment, which can create toxicity for the environment and human health.

Automotive application accounted for the largest segment of the green coatings market between 2022 and 2027.

Automotive OEM coatings are an integral part of automobile manufacturing. They offer excellent quality and durability. They possess excellent mechanical properties to protect automobiles from scratches, the environment, and chemical exposure. Interior automotive coatings improve the surface area of an automobile. Automobile and truck production is increasing, which is driving the demand for coatings. According to OICA, in 2021, the global production of passenger cars was 80.1 million units. These numbers are further expected to increase over the forecast period owing to the increasing popularity of EVs. Technological innovations have benefitted the automotive industry in various ways; for instance, the introduction of IoT and the use of robots in the production cycle have resulted in increased efficiency, reduced workforce, and shorter cycles. Owing to innovation, many manufacturers have realized the rising need of customers; and to deal with their health-related concerns, they are switching towards green coatings. It also resonates with the green environment approach of electric vehicle manufacturers.

To know about the assumptions considered for the study, download the pdf brochure

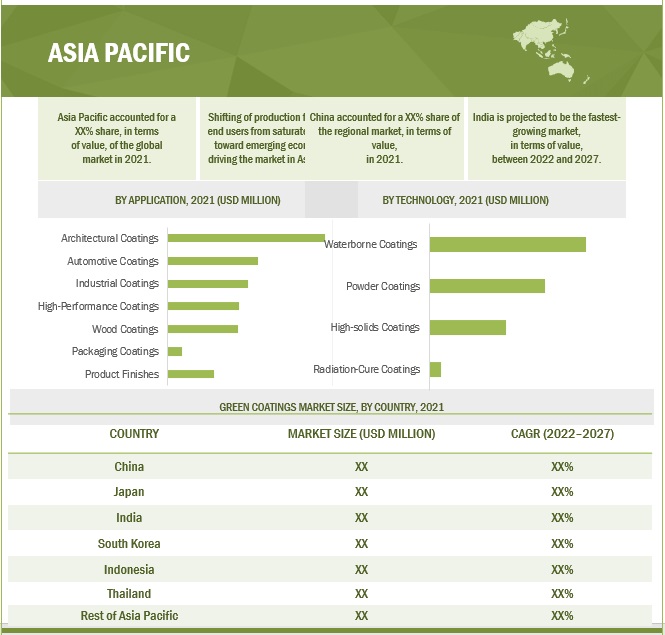

Asia Pacific is the fastest-growing green coatings market.

Asia Pacific is the fastest green coatings market in terms of value and volume during the forecast period. The development of the market is mainly attributed to the high economic growth rate followed by heavy investment across industries, such as automotive, consumer goods & appliances, building & construction, and furniture.

Green Coatings Market Players

AkzoNobel N.V. (Netherlands), PPG Industries (US), Axalta Coating Systems (US), BASF SE (Germany), and The Sherwin-Williams Company (US) are the key players in the global green coatings market.

Please visit 360Quadrants to see the vendor listing of Top paint and coating companies

AkzoNobel N.V. is a diversified chemical company and one of the market leaders in the fields of decorative paints, performance coatings, and specialty chemicals. It operates through two business segments, namely, decorative paints and performance coatings. AkzoNobel N.V. offers specialty paints, powder paints, and other coatings for various applications such as architectural and decorative, automotive, industrial, marine, protective, and yachts. Coral, Dulux, Flexa, Hammerite, Sadolin, Sikkens, Awlgrip, International, Interpon, Dissolvine, Eka, Expancel, Jozo, Levasil, and Kromasil are some of the renowned brands of the company.

Green Coatings Market Report Scope

|

Report Metric |

Details |

|

Market Size Value in 2022 |

USD 123.6 billion |

|

Revenue Forecast in 2027 |

USD 155.9 billion |

|

CAGR |

4.8% |

|

Years Considered for the study |

2018-2027 |

|

Base year |

2021 |

|

Forecast period |

2022–2027 |

|

Units considered |

Value (USD) and Volume (Kiloton) |

|

Segments |

By Technology |

|

Regions covered |

Asia Pacific, Europe, North America, Middle East & Africa, South America |

|

Companies profiled |

AkzoNobel N.V. (Netherlands), PPG Industries (US), Axalta Coating Systems (US), BASF SE (Germany), and The Sherwin-Williams Company (US). A total of 21 players have been covered. |

This research report categorizes the green coatings market based on type, end-use industry, and region.

By Technology:

- Waterborne

- Powder

- High-solids

- Radiation-cure

By Application:

- Architectural

- Automotive

- Industrial

- High-performance

- Wood

- Packaging

- Product finishes

By Region:

- Asia Pacific

- Europe

- North America

- Middle East & Africa

- South America

Recent Developments

- In August 2021, AkzoNobel N.V. launched this product in the Indian market. The product is India’s first USDA-certified green paint.

- In October 2020, AkzoNobel N.V. launched this product in the Vietnam market. Air Clean Green (Vietnam) contains 22 percent USDA-Certified green content.

Frequently Asked Questions (FAQ):

What are the factors influencing the growth of green coatings?

The global green coatings market is driven by the stringent environmental policies.

What are the major applications for green coatings?

The major end-use industries of green coatings are architectural coatings, automotive coatings, industrial coatings, high-performance coatings, wood coatings, packaging coatings, and product finishes.

Who are the major manufacturers?

AkzoNobel N.V. (Netherlands), PPG Industries (US), Axalta Coating Systems (US), BASF SE (Germany), and The Sherwin-Williams Company (US) are some of the leading players operating in the global green coatings market.

Why green coatings are gaining market share?

The growth of this market is attributed to the growing preference for green coatings in automotive coatings segment. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 31)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.2.1 MARKET INCLUSIONS

1.2.2 MARKET EXCLUSIONS

1.3 MARKET SEGMENTATION

1.3.1 REGIONS COVERED

1.3.2 YEARS CONSIDERED

1.4 CURRENCY

1.5 UNIT CONSIDERED

1.6 STAKEHOLDERS

1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 35)

2.1 RESEARCH DATA

FIGURE 1 GREEN COATINGS MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Key industry insights

2.1.2.3 Breakdown of primary interviews

2.1.2.4 Primary data sources

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

FIGURE 2 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

FIGURE 3 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

2.3 DATA TRIANGULATION

FIGURE 4 GREEN COATINGS MARKET: DATA TRIANGULATION

2.4 ASSUMPTIONS & LIMITATIONS

TABLE 1 RESEARCH ASSUMPTIONS

TABLE 2 RESEARCH LIMITATIONS

TABLE 3 RISK ANALYSIS

2.5 GROWTH RATE ASSUMPTIONS/GROWTH FORECAST

2.6 PRICING ASSUMPTIONS

3 EXECUTIVE SUMMARY (Page No. - 45)

TABLE 4 GREEN COATINGS MARKET SNAPSHOT, 2022 VS. 2027

FIGURE 5 WATERBORNE TYPE TO DOMINATE MARKET DURING FORECAST PERIOD (USD MILLION)

FIGURE 6 ARCHITECTURAL APPLICATION TO DOMINATE MARKET DURING FORECAST PERIOD

FIGURE 7 ASIA PACIFIC TO BE FASTEST-GROWING MARKET DURING FORECAST PERIOD

4 PREMIUM INSIGHTS (Page No. - 49)

4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN GREEN COATINGS MARKET

FIGURE 8 SIGNIFICANT DEMAND GROWTH EXPECTED FOR GREEN COATINGS DURING FORECAST PERIOD

4.2 MARKET, BY TECHNOLOGY

FIGURE 9 WATERBORNE TO REMAIN LARGEST SEGMENT OF GREEN COATINGS MARKET

4.3 ASIA PACIFIC: GREEN COATINGS MARKET, BY APPLICATION AND COUNTRY

FIGURE 10 ARCHITECTURAL APPLICATION ACCOUNTED FOR LARGEST MARKET SHARE IN ASIA PACIFIC

4.4 MARKET, BY DEVELOPED VS. EMERGING ECONOMIES

FIGURE 11 CHINA TO ACCOUNT FOR LARGEST SHARE

4.5 MARKET: MAJOR COUNTRIES

FIGURE 12 INDIA TO BE FASTEST-GROWING MARKET DURING FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 52)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN GREEN COATINGS MARKET

5.2.1 DRIVERS

5.2.1.1 Increasing focus on health and sustainability to bring “going green” idea into greater limelight

5.2.1.2 Stringent environmental policies

5.2.2 RESTRAINTS

5.2.2.1 Availability and cost of specialized raw materials needed for green coatings

5.2.3 OPPORTUNITIES

5.2.3.1 Rising demand for renewable raw materials

5.2.3.2 Technological advancements for real-time in-process monitoring and control prior to formation of hazardous substances

5.2.3.3 Growing investments in emerging markets

5.2.4 CHALLENGES

5.2.4.1 Development of synthetic technologies with little or no toxicity to human health and the environment

5.2.4.2 Designing of chemical products that do not persist in the environment after degradation

5.3 PORTER'S FIVE FORCES ANALYSIS

TABLE 5 GREEN COATINGS MARKET: PORTER'S FIVE FORCES ANALYSIS

FIGURE 14 MARKET: PORTER'S FIVE FORCES ANALYSIS

5.3.1 THREAT OF NEW ENTRANTS

5.3.2 THREAT OF SUBSTITUTES

5.3.3 BARGAINING POWER OF BUYERS

5.3.4 BARGAINING POWER OF SUPPLIERS

5.3.5 INTENSITY OF COMPETITIVE RIVALRY

5.4 KEY STAKEHOLDERS & BUYING CRITERIA

5.4.1 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 15 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS

TABLE 6 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP INDUSTRIES

5.4.2 BUYING CRITERIA

FIGURE 16 KEY BUYING CRITERIA FOR GREEN COATINGS

TABLE 7 KEY BUYING CRITERIA FOR GREEN COATINGS

5.5 MACROINDICATOR ANALYSIS

5.5.1 INTRODUCTION

5.5.2 GDP TRENDS AND FORECAST

TABLE 8 TRENDS AND FORECAST OF GDP, PERCENTAGE CHANGE, BY COUNTRY, 2019–2027

5.5.3 TRENDS AND FORECAST OF GLOBAL CONSTRUCTION INDUSTRY

FIGURE 17 GLOBAL SPENDING IN CONSTRUCTION INDUSTRY, 2014–2035

5.5.4 TRENDS IN AUTOMOTIVE INDUSTRY

TABLE 9 AUTOMOTIVE PRODUCTION, BY REGION, 2018-2021

5.6 VALUE CHAIN ANALYSIS

FIGURE 18 GREEN COATINGS VALUE CHAIN

FIGURE 19 GREEN COATINGS VALUE CHAIN: PLAYERS AT EACH NODE

5.7 PRICING ANALYSIS

FIGURE 20 AVERAGE PRICE COMPETITIVENESS IN GREEN COATINGS MARKET, BY REGION

FIGURE 21 AVERAGE PRICE COMPETITIVENESS IN MARKET, BY TECHNOLOGY

FIGURE 22 AVERAGE PRICE COMPETITIVENESS IN MARKET, BY APPLICATION

5.8 GREEN COATINGS ECOSYSTEM AND INTERCONNECTED MARKETS

TABLE 10 GREEN COATINGS MARKET: SUPPLY CHAIN

FIGURE 23 PAINTS & COATINGS: ECOSYSTEM

5.9 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

FIGURE 24 TRENDS & DISRUPTIONS IMPACTING CUSTOMER BUSINESS

5.10 TRADE ANALYSIS

TABLE 11 COUNTRY-WISE EXPORT DATA, PAINTS, AND VARNISHES BASED ON SYNTHETIC OR CHEMICALLY MODIFIED POLYMERS DISPERSED AND DISSOLVED IN AQUEOUS MEDIUM, (2019-2021)

TABLE 12 COUNTRY-WISE EXPORT DATA, PAINTS, AND VARNISHES BASED ON SYNTHETIC OR CHEMICALLY MODIFIED POLYMERS DISPERSED AND DISSOLVED IN NON-AQUEOUS MEDIUM, 2019-2021

TABLE 13 COUNTRY-WISE IMPORT DATA, PAINTS, AND VARNISHES BASED ON SYNTHETIC OR CHEMICALLY MODIFIED POLYMERS DISPERSED AND DISSOLVED IN AQUEOUS MEDIUM, 2019 -2021

TABLE 14 COUNTRY-WISE IMPORT DATA, PAINTS, AND VARNISHES BASED ON SYNTHETIC OR CHEMICALLY MODIFIED POLYMERS DISPERSED AND DISSOLVED IN NON-AQUEOUS MEDIUM, 2019-2021

5.11 REGULATIONS

5.11.1 COATINGS STANDARD

TABLE 15 BASIC COATING SYSTEM REQUIREMENTS FOR DEDICATED SEAWATER BALLAST TANKS OF ALL TYPES OF SHIPS AND DOUBLE-SIDE SKIN SPACES OF BULK CARRIERS OF 150 METER AND UPWARD

5.11.2 MODEL LEAD PAINT LAW

5.12 PATENT ANALYSIS

5.12.1 METHODOLOGY

5.12.2 PUBLICATION TRENDS

FIGURE 25 NUMBER OF PATENTS PUBLISHED, 2017-2022

5.12.3 TOP JURISDICTION

FIGURE 26 PATENTS PUBLISHED BY JURISDICTION, 2021

5.12.4 TOP APPLICANTS

FIGURE 27 PATENTS PUBLISHED BY MAJOR APPLICANTS, 2021

TABLE 16 TOP 10 PATENT OWNERS (US) IN LAST 10 YEARS

5.13 CASE STUDY ANALYSIS

5.14 TECHNOLOGY ANALYSIS

5.15 KEY CONFERENCES & EVENTS IN 2022-2023

TABLE 17 GREEN COATINGS MARKET: DETAILED LIST OF CONFERENCES & EVENTS

5.16 TARIFF AND REGULATORY LANDSCAPE

5.16.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 18 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 19 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 20 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 21 REST OF WORLD: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

6 GREEN COATINGS MARKET, BY TECHNOLOGY (Page No. - 97)

6.1 INTRODUCTION

FIGURE 28 WATERBORNE COATINGS TO BE LARGEST TECHNOLOGY SEGMENT DURING FORECAST PERIOD

TABLE 22 GREEN COATINGS MARKET SIZE, BY TECHNOLOGY, 2018–2021 (USD MILLION)

TABLE 23 MARKET SIZE, BY TECHNOLOGY, 2022–2027 (USD MILLION)

TABLE 24 MARKET SIZE, BY TECHNOLOGY, 2018–2021 (KILOTON)

TABLE 25 MARKET SIZE, BY TECHNOLOGY, 2022–2027 (KILOTON)

6.2 WATERBORNE COATINGS

6.2.1 WATERBORNE COATINGS TO REPLACE SOLVENT-BORNE DOMINATED AREAS

6.2.2 TYPE

FIGURE 29 TYPES OF WATERBORNE COATINGS

6.2.3 RESIN TYPES USED IN FORMULATION OF WATERBORNE COATINGS

6.2.4 APPLICATIONS OF WATERBORNE COATINGS

6.2.5 ADVANTAGES AND DISADVANTAGES OF WATERBORNE COATINGS

FIGURE 30 DRIVERS AND RESTRAINTS IN WATERBORNE COATINGS MARKET

TABLE 26 WATERBORNE COATINGS: GREEN COATINGS MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 27 WATERBORNE COATINGS: MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

TABLE 28 WATERBORNE COATINGS: MARKET SIZE, BY REGION, 2018–2021 (KILOTON)

TABLE 29 WATERBORNE COATINGS: MARKET SIZE, BY REGION, 2022–2027 (KILOTON)

6.3 POWDER COATINGS

6.3.1 INCREASING ENVIRONMENTAL REGULATIONS FOR ZERO VOC COATINGS

6.3.2 TYPE

FIGURE 31 TYPES OF POWDER COATINGS

FIGURE 32 DRIVERS AND RESTRAINTS IN POWDER COATINGS MARKET

TABLE 30 POWDER COATINGS: GREEN COATINGS MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 31 POWDER COATINGS: MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

TABLE 32 POWDER COATINGS: MARKET SIZE, BY REGION, 2018–2021 (KILOTON)

TABLE 33 POWDER COATINGS: MARKET SIZE, BY REGION, 2022–2027 (KILOTON)

6.4 HIGH-SOLIDS COATINGS

6.4.1 AUTOMOTIVE SEGMENT TO INCREASE DEMAND FOR HIGH-SOLIDS COATINGS

6.4.1.1 Type

FIGURE 33 TYPES OF HIGH-SOLIDS COATINGS

6.4.1.2 Application

6.4.1.2.1 Product finishing

6.4.1.2.2 Automotive applications

6.4.1.3 Advantages and disadvantages

FIGURE 34 DRIVERS AND RESTRAINTS IN HIGH-SOLIDS COATINGS MARKET

TABLE 34 HIGH-SOLIDS COATINGS: GREEN COATINGS MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 35 HIGH-SOLIDS COATINGS: MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

TABLE 36 HIGH-SOLIDS COATINGS: MARKET SIZE, BY REGION, 2018–2021 (KILOTON)

TABLE 37 HIGH-SOLIDS COATINGS: MARKET SIZE, BY REGION, 2022–2027 (KILOTON)

6.5 RADIATION-CURE COATINGS

6.5.1 ADAPTING RADIATION-CURE COATINGS DUE TO SHORT CURE TIME AND HIGH-QUALITY FILM

6.5.1.1 Type

FIGURE 35 TYPES OF RADIATION-CURE COATINGS

6.5.1.2 Resin systems

6.5.1.3 Applications

6.5.1.4 Advantages

6.5.1.5 Disadvantages

FIGURE 36 DRIVERS AND RESTRAINTS IN RADIATION-CURE COATINGS MARKET

TABLE 38 RADIATION-CURE COATINGS: GREEN COATINGS MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 39 RADIATION-CURE COATINGS: MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

TABLE 40 RADIATION-CURE COATINGS: MARKET SIZE, BY REGION, 2018–2021 (KILOTON)

TABLE 41 RADIATION-CURE COATINGS: MARKET SIZE, BY REGION, 2022–2027 (KILOTON)

7 GREEN COATINGS MARKET, BY APPLICATION (Page No. - 115)

7.1 INTRODUCTION

FIGURE 37 ARCHITECTURAL SEGMENT DOMINATED OVERALL GREEN COATINGS MARKET

TABLE 42 MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 43 MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 44 MARKET SIZE, BY APPLICATION, 2018–2021 (KILOTON)

TABLE 45 MARKET SIZE, BY APPLICATION, 2022–2027 (KILOTON)

7.2 ARCHITECTURAL COATINGS

7.2.1 HIGH DEMAND FOR ENVIRONMENTALLY FRIENDLY COATINGS TO INCREASE DEMAND IN ARCHITECTURAL SEGMENT

TABLE 46 GREEN COATINGS MARKET SIZE IN ARCHITECTURAL, BY REGION, 2018–2021 (USD MILLION)

TABLE 47 MARKET SIZE IN ARCHITECTURAL, BY REGION, 2022–2027 (USD MILLION)

TABLE 48 MARKET SIZE IN ARCHITECTURAL, BY REGION, 2018–2021 (KILOTON)

TABLE 49 MARKET SIZE IN ARCHITECTURAL, BY REGION, 2022–2027 (KILOTON)

7.3 AUTOMOTIVE COATINGS

7.3.1 GROWING DEMAND FOR ELECTRIC VEHICLES TO DRIVE GREEN COATINGS MARKET

TABLE 50 MARKET SIZE IN AUTOMOTIVE, BY REGION, 2018–2021 (USD MILLION)

TABLE 51 MARKET SIZE IN AUTOMOTIVE, BY REGION, 2022–2027 (USD MILLION)

TABLE 52 MARKET SIZE IN AUTOMOTIVE, BY REGION, 2018–2021 (KILOTON)

TABLE 53 MARKET SIZE IN AUTOMOTIVE, BY REGION, 2022–2027 (KILOTON)

7.4 INDUSTRIAL COATINGS

7.4.1 EVERYDAY USES OF POWDER-COATED PRODUCTS TO FUEL DEMAND FOR GENERAL INDUSTRIAL EQUIPMENT

TABLE 54 GREEN COATINGS MARKET SIZE IN INDUSTRIAL, BY REGION, 2018–2021 (USD MILLION)

TABLE 55 MARKET SIZE IN INDUSTRIAL, BY REGION, 2022–2027 (USD MILLION)

TABLE 56 MARKET SIZE IN INDUSTRIAL, BY REGION, 2018–2021 (KILOTON)

TABLE 57 MARKET SIZE IN INDUSTRIAL, BY REGION, 2022–2027 (KILOTON)

7.5 HIGH-PERFORMANCE COATINGS

7.5.1 HEALTH-RELATED AWARENESS TO INCREASE USE OF GREEN COATINGS

TABLE 58 GREEN COATINGS MARKET SIZE IN HIGH-PERFORMANCE, BY REGION, 2018–2021 (USD MILLION)

TABLE 59 MARKET SIZE IN HIGH-PERFORMANCE, BY REGION, 2022–2027 (USD MILLION)

TABLE 60 MARKET SIZE IN HIGH-PERFORMANCE, BY REGION, 2018–2021 (KILOTON)

TABLE 61 MARKET SIZE IN HIGH-PERFORMANCE, BY REGION, 2022–2027 (KILOTON)

7.6 WOOD COATINGS

7.6.1 FURNITURE INDUSTRY TO PROGRESS TOWARD USE OF NON-TOXIC COATINGS

TABLE 62 GREEN COATINGS MARKET SIZE IN WOOD, BY REGION, 2018–2021 (USD MILLION)

TABLE 63 MARKET SIZE IN WOOD, BY REGION, 2022–2027 (USD MILLION)

TABLE 64 MARKET SIZE IN WOOD, BY REGION, 2018–2021 (KILOTON)

TABLE 65 MARKET SIZE IN WOOD, BY REGION, 2022–2027 (KILOTON)

7.7 PACKAGING COATINGS

7.7.1 FAVORABLE REGULATIONS IN FOOD & BEVERAGE INDUSTRY TO DRIVE MARKET

TABLE 66 GREEN COATINGS MARKET SIZE IN PACKAGING, BY REGION, 2018–2021 (USD MILLION)

TABLE 67 MARKET SIZE IN PACKAGING, BY REGION, 2022–2027 (USD MILLION)

TABLE 68 MARKET SIZE IN PACKAGING, BY REGION, 2018–2021 (KILOTON)

TABLE 69 MARKET SIZE IN PACKAGING, BY REGION, 2022–2027 (KILOTON)

7.8 PRODUCT FINISHES

7.8.1 DIFFERENT INDUSTRIES TO MAKE THEIR PRODUCT GREENER TO BOOST DEMAND FOR THESE COATINGS

TABLE 70 GREEN COATINGS MARKET SIZE IN PRODUCT FINISHES, BY REGION, 2018–2021 (USD MILLION)

TABLE 71 MARKET SIZE IN PRODUCT FINISHES, BY REGION, 2022–2027 (USD MILLION)

TABLE 72 MARKET SIZE IN PRODUCT FINISHES, BY REGION, 2018–2021 (KILOTON)

TABLE 73 MARKET SIZE IN PRODUCT FINISHES, BY REGION, 2022–2027 (KILOTON)

8 GREEN COATINGS MARKET, BY REGION (Page No. - 131)

8.1 INTRODUCTION

FIGURE 38 ASIA PACIFIC PROJECTED TO BE FASTEST-GROWING GREEN COATINGS MARKET

TABLE 74 MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 75 MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

TABLE 76 MARKET SIZE, BY REGION, 2018–2021 (KILOTON)

TABLE 77 MARKET SIZE, BY REGION, 2022–2027 (KILOTON)

8.2 ASIA PACIFIC

FIGURE 39 ASIA PACIFIC: GREEN COATINGS MARKET SNAPSHOT

TABLE 78 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 79 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 80 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2018–2021 (KILOTON)

TABLE 81 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2022–2027 (KILOTON)

TABLE 82 ASIA PACIFIC: MARKET SIZE, BY TECHNOLOGY, 2018–2021 (USD MILLION)

TABLE 83 ASIA PACIFIC: MARKET SIZE, BY TECHNOLOGY, 2022–2027 (USD MILLION)

TABLE 84 ASIA PACIFIC: MARKET SIZE, BY TECHNOLOGY, 2018–2021 (KILOTON)

TABLE 85 ASIA PACIFIC: MARKET SIZE, BY TECHNOLOGY, 2022–2027 (KILOTON)

TABLE 86 ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 87 ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 88 ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2018–2021 (KILOTON)

TABLE 89 ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2022–2027 (KILOTON)

8.2.1 CHINA

8.2.1.1 Favorable market conditions to drive demand for green coatings

8.2.2 JAPAN

8.2.2.1 High production of vehicles to spur demand for green coatings

8.2.3 INDIA

8.2.3.1 Boom in real estate sector to drive green coatings market

8.2.4 INDONESIA

8.2.4.1 New infrastructure and FDI laws to boost market

8.2.5 THAILAND

8.2.5.1 Automotive industry to influence green coatings market

8.2.6 SOUTH KOREA

8.2.6.1 Automotive industry to support growth of market

8.2.7 REST OF ASIA PACIFIC

8.3 NORTH AMERICA

FIGURE 40 NORTH AMERICA: GREEN COATINGS MARKET SNAPSHOT

TABLE 90 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 91 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 92 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2018–2021 (KILOTON)

TABLE 93 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2022–2027 (KILOTON)

TABLE 94 NORTH AMERICA: MARKET SIZE, BY TECHNOLOGY, 2018–2021 (USD MILLION)

TABLE 95 NORTH AMERICA: MARKET SIZE, BY TECHNOLOGY, 2022–2027 (USD MILLION)

TABLE 96 NORTH AMERICA: MARKET SIZE, BY TECHNOLOGY, 2018–2021 (KILOTON)

TABLE 97 NORTH AMERICA: MARKET SIZE, BY TECHNOLOGY, 2022–2027 (KILOTON)

TABLE 98 NORTH AMERICA: MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 99 NORTH AMERICA: MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 100 NORTH AMERICA: MARKET SIZE, BY APPLICATION, 2018–2021 (KILOTON)

TABLE 101 NORTH AMERICA: MARKET SIZE, BY APPLICATION, 2022–2027 (KILOTON)

8.3.1 US

8.3.1.1 Increasing private residential and non-residential constructions to drive market

8.3.1.2 US paints & coatings toll manufacturing to boost market

8.3.1.3 Benefits of toll manufacturing to drive market

TABLE 102 LIST OF US PAINTS & COATINGS TOLL MANUFACTURERS

8.3.2 CANADA

8.3.2.1 Residential construction to be major contributor to market growth

8.3.3 MEXICO

8.3.3.1 New constructions in residential segment to drive market

8.4 EUROPE

FIGURE 41 EUROPE: GREEN COATINGS MARKET SNAPSHOT

TABLE 103 EUROPE: MARKET SIZE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 104 EUROPE: MARKET SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 105 EUROPE: MARKET SIZE, BY COUNTRY, 2018–2021 (KILOTON)

TABLE 106 EUROPE: MARKET SIZE, BY COUNTRY, 2022–2027 (KILOTON)

TABLE 107 EUROPE: MARKET SIZE, BY TECHNOLOGY, 2018–2021 (USD MILLION)

TABLE 108 EUROPE: MARKET SIZE, BY TECHNOLOGY, 2022–2027 (USD MILLION)

TABLE 109 EUROPE: MARKET SIZE, BY TECHNOLOGY, 2018–2021 (KILOTON)

TABLE 110 EUROPE: MARKET SIZE, BY TECHNOLOGY, 2022–2027 (KILOTON)

TABLE 111 EUROPE: MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 112 EUROPE: MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 113 EUROPE: MARKET SIZE, BY APPLICATION, 2018–2021 (KILOTON)

TABLE 114 EUROPE: MARKET SIZE, BY APPLICATION, 2022–2027 (KILOTON)

8.4.1 GERMANY

8.4.1.1 Favorable economic environment for construction sector and rising demand for new homes to drive market

8.4.2 UK

8.4.2.1 Growing construction sector, along with government spending, to boost the demand for architectural coatings

8.4.3 FRANCE

8.4.3.1 Reviving economy coupled with investment in infrastructure to boost demand for architectural coatings

8.4.4 RUSSIA

8.4.4.1 Architectural and woodworking applications to drive market

8.4.5 ITALY

8.4.5.1 New project finance rules and investment policies in construction sector to boost market

8.4.6 TURKEY

8.4.6.1 Rapid urbanization to drive demand for architectural green coatings

8.4.7 SPAIN

8.4.7.1 Government investments in infrastructure to drive market

8.4.8 REST OF EUROPE

8.5 SOUTH AMERICA

TABLE 115 SOUTH AMERICA: GREEN COATINGS MARKET SIZE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 116 SOUTH AMERICA: MARKET SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 117 SOUTH AMERICA: MARKET SIZE, BY COUNTRY, 2018–2021 (KILOTON)

TABLE 118 SOUTH AMERICA: MARKET SIZE, BY COUNTRY, 2022–2027 (KILOTON)

TABLE 119 SOUTH AMERICA: MARKET SIZE, BY TECHNOLOGY, 2018–2021 (USD MILLION)

TABLE 120 SOUTH AMERICA: MARKET SIZE, BY TECHNOLOGY, 2022–2027 (USD MILLION)

TABLE 121 SOUTH AMERICA: MARKET SIZE, BY TECHNOLOGY, 2018–2021 (KILOTON)

TABLE 122 SOUTH AMERICA: MARKET SIZE, BY TECHNOLOGY, 2022–2027 (KILOTON)

TABLE 123 SOUTH AMERICA: MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 124 SOUTH AMERICA: MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 125 SOUTH AMERICA: MARKET SIZE, BY APPLICATION, 2018–2021 (KILOTON)

TABLE 126 SOUTH AMERICA: MARKET SIZE, BY APPLICATION, 2022–2027 (KILOTON)

8.5.1 BRAZIL

8.5.1.1 Rising home ownership and living standards to drive market

8.5.2 ARGENTINA

8.5.2.1 Increase in population and improved economic conditions to boost demand for architectural green coatings

8.5.3 REST OF SOUTH AMERICA

8.6 MIDDLE EAST & AFRICA

TABLE 127 MIDDLE EAST & AFRICA: GREEN COATINGS MARKET SIZE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 128 MIDDLE EAST & AFRICA: MARKET SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 129 MIDDLE EAST & AFRICA: MARKET SIZE, BY COUNTRY, 2018–2021 (KILOTON)

TABLE 130 MIDDLE EAST & AFRICA: MARKET SIZE, BY COUNTRY, 2022–2027 (KILOTON)

TABLE 131 MIDDLE EAST & AFRICA: MARKET SIZE, BY TECHNOLOGY TYPE, 2018–2021 (USD MILLION)

TABLE 132 MIDDLE EAST & AFRICA: MARKET SIZE, BY TECHNOLOGY TYPE, 2022–2027 (USD MILLION)

TABLE 133 MIDDLE EAST & AFRICA: MARKET SIZE, BY TECHNOLOGY TYPE, 2018–2021 (KILOTON)

TABLE 134 MIDDLE EAST & AFRICA: MARKET SIZE, BY TECHNOLOGY TYPE, 2022–2027 (KILOTON)

TABLE 135 MIDDLE EAST & AFRICA: MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 136 MIDDLE EAST & AFRICA: MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 137 MIDDLE EAST & AFRICA: MARKET SIZE, BY APPLICATION, 2018–2021 (KILOTON)

TABLE 138 MIDDLE EAST & AFRICA: MARKET SIZE, BY APPLICATION, 2022–2027 (KILOTON)

8.6.1 SAUDI ARABIA

8.6.1.1 Mega housing projects to boost the demand for architectural green coatings

8.6.2 SOUTH AFRICA

8.6.2.1 Substantial demand for architectural green coatings witnessed in building projects

8.6.3 UAE

8.6.3.1 Automotive industry to be one of the biggest drivers of economic growth

8.6.4 REST OF MIDDLE EAST & AFRICA

9 COMPETITIVE LANDSCAPE (Page No. - 173)

9.1 OVERVIEW

TABLE 139 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS

9.2 COMPANY EVALUATION QUADRANT MATRIX: DEFINITIONS AND METHODOLOGY, 2021

9.2.1 STARS

9.2.2 EMERGING LEADERS

9.2.3 PERVASIVE PLAYERS

9.2.4 PARTICIPANTS

FIGURE 42 GREEN COATINGS MARKET (GLOBAL): COMPETITIVE LEADERSHIP MAPPING, 2021

FIGURE 43 STRENGTH OF PRODUCT PORTFOLIO

9.3 SMALL AND MEDIUM-SIZED ENTERPRISES (SMES) MATRIX, 2021

9.3.1 RESPONSIVE COMPANIES

9.3.2 PROGRESSIVE COMPANIES

9.3.3 STARTING BLOCKS

9.3.4 DYNAMIC COMPANIES

FIGURE 44 GREEN COATINGS MARKET: SMALL AND MEDIUM-SIZED ENTERPRISES (SMES) COMPETITIVE LEADERSHIP MAPPING, 2021

9.4 MARKET SHARE ANALYSIS

FIGURE 45 MARKET SHARE, BY KEY PLAYER (2021)

9.5 REVENUE ANALYSIS

FIGURE 46 REVENUE ANALYSIS OF TOP FIVE PLAYERS, 2017–2021

9.5.1 AKZONOBEL N.V.

9.5.2 AXALTA COATING SYSTEMS, LLC

9.5.3 BASF SE

9.5.4 PPG INDUSTRIES, INC.

9.5.5 THE SHERWIN-WILLIAMS COMPANY

9.6 RANKING ANALYSIS

FIGURE 47 MARKET RANKING ANALYSIS, 2021

9.7 COMPETITIVE BENCHMARKING

TABLE 140 GREEN COATINGS MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS

TABLE 141 MARKET: COMPETITIVE BENCHMARKING OF SME PLAYERS

TABLE 142 DETAILED LIST OF KEY STARTUPS/SMES

9.7.1 COMPETITIVE SITUATIONS AND TRENDS

TABLE 143 GREEN COATINGS MARKET: PRODUCT LAUNCHES, 2017–2022

TABLE 144 MARKET: DEALS, 2017–2022

10 COMPANY PROFILES (Page No. - 188)

10.1 KEY PLAYERS

(Business overview, Products offered, Recent Developments, MNM view)*

10.1.1 AKZONOBEL N.V.

TABLE 145 AKZONOBEL N.V.: COMPANY OVERVIEW

FIGURE 48 AKZONOBEL N.V.: COMPANY SNAPSHOT

TABLE 146 AKZONOBEL N.V.: NEW PRODUCT LAUNCHES

TABLE 147 AKZONOBEL N.V.: DEAL

10.1.2 AXALTA COATING SYSTEMS, LLC

TABLE 148 AXALTA COATING SYSTEMS, LLC: COMPANY OVERVIEW

FIGURE 49 AXALTA COATING SYSTEMS, LLC: COMPANY SNAPSHOT

TABLE 149 AXALTA COATING SYSTEMS, LLC: NEW PRODUCT LAUNCHES

10.1.3 BASF SE

TABLE 150 BASF SE: COMPANY OVERVIEW

FIGURE 50 BASF SE: COMPANY SNAPSHOT

TABLE 151 BASF SE: NEW PRODUCT LAUNCHES

TABLE 152 BASF SE: DEALS

10.1.4 PPG INDUSTRIES, INC.

TABLE 153 PPG INDUSTRIES, INC.: COMPANY OVERVIEW

FIGURE 51 PPG INDUSTRIES, INC.: COMPANY SNAPSHOT

TABLE 154 PPG INDUSTRIES, INC.: NEW PRODUCT LAUNCHES

TABLE 155 PPG INDUSTRIES, INC.: DEALS

10.1.5 THE SHERWIN-WILLIAMS COMPANY

TABLE 156 THE SHERWIN-WILLIAMS COMPANY: COMPANY OVERVIEW

FIGURE 52 THE SHERWIN-WILLIAMS COMPANY: COMPANY SNAPSHOT

10.1.6 ASIAN PAINTS LIMITED

TABLE 157 ASIAN PAINTS LIMITED: COMPANY OVERVIEW

FIGURE 53 ASIAN PAINTS LIMITED: COMPANY SNAPSHOT

10.1.7 BERGER PAINTS INDIA LIMITED

TABLE 158 BERGER PAINTS INDIA LIMITED: COMPANY OVERVIEW

FIGURE 54 BERGER PAINTS INDIA LIMITED: COMPANY SNAPSHOT

10.1.8 HEMPEL A/S

TABLE 159 HEMPEL A/S: COMPANY OVERVIEW

FIGURE 55 HEMPEL A/S: COMPANY SNAPSHOT

TABLE 160 HEMPEL A/S: NEW PRODUCT LAUNCHES

TABLE 161 HEMPEL A/S: DEALS

10.1.9 JOTUN A/S

TABLE 162 JOTUN A/S: COMPANY OVERVIEW

FIGURE 56 JOTUN A/S: COMPANY SNAPSHOT

10.1.10 DAW SE

TABLE 163 DAW SE: COMPANY OVERVIEW

10.2 OTHER PLAYERS

10.2.1 KANSAI PAINT CO. LTD.

TABLE 164 KANSAI PAINT CO. LTD.: COMPANY OVERVIEW

10.2.2 MASCO CORPORATION

TABLE 165 MASCO CORPORATION: COMPANY OVERVIEW

10.2.3 RPM INTERNATIONAL INC.

TABLE 166 RPM INTERNATIONAL INC.: COMPANY OVERVIEW

10.2.4 LIFETIME GREEN COATINGS

TABLE 167 LIFETIME GREEN COATINGS: COMPANY OVERVIEW

10.2.5 DSM

TABLE 168 DSM: COMPANY OVERVIEW

10.2.6 EVONIK INDUSTRIES AG

TABLE 169 EVONIK INDUSTRIES AG: COMPANY OVERVIEW

10.2.7 EASTMAN CHEMICAL COMPANY

TABLE 170 EASTMAN CHEMICAL COMPANY: COMPANY OVERVIEW

10.2.8 NIPPON PAINT HOLDINGS CO., LTD.

TABLE 171 NIPPON PAINT HOLDINGS CO., LTD.: COMPANY OVERVIEW

10.2.9 CHENYANG GROUP LTD

TABLE 172 CHENYANG GROUP LTD: COMPANY OVERVIEW

10.2.10 CIRANOVA

TABLE 173 CIRANOVA: COMPANY OVERVIEW

10.2.11 CORTEC CORPORATION

TABLE 174 CORTEC CORPORATION: COMPANY OVERVIEW

10.2.12 ECO SAFETY PRODUCTS

TABLE 175 ECO SAFETY PRODUCTS: COMPANY OVERVIEW

10.2.13 TEKNOS GROUP

TABLE 176 TEKNOS GROUP: COMPANY OVERVIEW

10.2.14 STAHL HOLDINGS B.V.

TABLE 177 STAHL HOLDINGS B.V.: COMPANY OVERVIEW

*Details on Business overview, Products offered, Recent Developments, MNM view might not be captured in case of unlisted companies.

11 ADJACENT/RELATED MARKETS (Page No. - 234)

11.1 INTRODUCTION

11.2 LIMITATIONS

11.3 BIO-BASED COATINGS MARKET

11.3.1 MARKET DEFINITION

11.3.2 MARKET OVERVIEW

11.3.3 BIO-BASED COATINGS MARKET, BY RESIN TYPE

TABLE 178 BIO-BASED COATINGS MARKET SIZE, BY RESIN TYPE, 2018–2021 (USD MILLION)

TABLE 179 BIO-BASED COATINGS MARKET SIZE, BY RESIN TYPE, 2022–2027 (USD MILLION)

TABLE 180 BIO-BASED COATINGS MARKET SIZE, BY RESIN TYPE, 2018–2021 (KILOTON)

TABLE 181 BIO-BASED COATINGS MARKET SIZE, BY RESIN TYPE, 2022–2027 (KILOTON)

11.3.4 BIO-BASED COATINGS MARKET, BY APPLICATION

TABLE 182 BIO-BASED COATINGS MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 183 BIO-BASED COATINGS MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 184 BIO-BASED COATINGS MARKET SIZE, BY APPLICATION, 2018–2021 (KILOTON)

TABLE 185 BIO-BASED COATINGS MARKET SIZE, BY APPLICATION, 2022–2027 (KILOTON)

11.3.5 BIO-BASED COATINGS MARKET, BY REGION

TABLE 186 BIO-BASED COATINGS MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 187 BIO-BASED COATINGS MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

TABLE 188 BIO-BASED COATINGS MARKET SIZE, BY REGION, 2018–2021 (KILOTON)

TABLE 189 BIO-BASED COATINGS MARKET SIZE, BY REGION, 2022–2027 (KILOTON)

12 APPENDIX (Page No. - 240)

12.1 DISCUSSION GUIDE

12.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

12.3 CUSTOMIZATION OPTIONS

12.4 RELATED REPORTS

12.5 AUTHOR DETAILS

Coatings Market Overview

The coatings market involves the production and sale of various types of coatings used in a wide range of industries such as automotive, construction, and aerospace. Coatings are used to protect surfaces, enhance aesthetics, and provide functionality to various products.

Green coatings are environmentally friendly coatings that are made using sustainable materials and have a lower impact on the environment compared to traditional coatings. The coatings market is connected with the green coatings market as manufacturers are increasingly adopting green technologies and materials to produce coatings that meet regulatory requirements and consumer demand for sustainable products.

The coatings market is expected to impact the green coatings market positively by driving innovation in sustainable coating technologies and materials. As consumer demand for sustainable products continues to grow, the coatings market will likely shift towards the production of more eco-friendly coatings, thereby increasing the adoption of green coatings.

Coatings Market Trends

One futuristic growth use-case of the coatings market is the development of self-healing coatings that can repair themselves in response to damage. Another use-case is the development of coatings that can change color in response to different stimuli, such as temperature or light.

Top Players in Coatings Market

Some of the top players in the coatings market include PPG Industries, Akzo Nobel, Sherwin-Williams, BASF, and Axalta.

Impact of Coatings Market on Other Industries

The coatings market impacts several other industries, including automotive, aerospace, and construction. For example, the automotive industry uses coatings to enhance the aesthetic appeal of vehicles, protect them from corrosion, and improve their durability. In the aerospace industry, coatings are used to protect aircraft from environmental factors and enhance their aerodynamic performance. In the construction industry, coatings are used to protect building materials and surfaces from wear and tear, weathering, and fire.

Speak to our Analyst today to know more about Coatings Market!

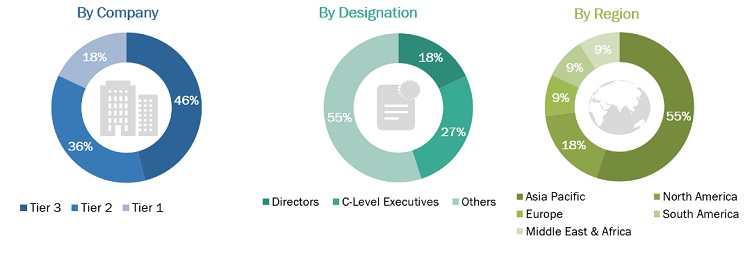

The study involves four major activities in estimating the current market size of Green coatings. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both the top-down and bottom-up approaches were employed to estimate the complete market size. After that, the market breakdown and data triangulation methods were used to estimate the size of the segments and sub-segments of the overall market.

Secondary Research

In the secondary research process, various secondary sources, such as Hoovers, Bloomberg BusinessWeek, and Dun & Bradstreet, have been referred to for identifying and collecting information for this study. These secondary sources also included annual reports, press releases & investor presentations of companies; white papers; certified publications; articles by recognized authors; gold standard & silver standard websites; regulatory bodies; trade directories; and databases.

Primary Research

The Green coatings market comprises several stakeholders, such as raw material suppliers, end-product manufacturers, and regulatory organizations. The demand side of this market is characterized by the development in applications, such as architectural, automotive, industrial, high-performance, wood packaging, and product finishes. The supply side is characterized by advancements in technology. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the Green coatings market. These methods were also used extensively to estimate the sizes of various sub-segments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the market have been identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Global Green coatings Market Size: Top-down Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and sub-segment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To analyze and forecast the size of the green coatings market, in terms of value and volume

- To define, describe, and forecast the green coatings market by technology, application, and region

- To forecast the green coatings market size with respect to five main regions, namely, North America, Europe, Asia Pacific, the Middle East & Africa, and South America

- To provide detailed information about the drivers, restraints, opportunities, and challenges influencing the growth of the market

- To strategically analyze micromarkets1 with respect to individual growth trends, growth prospects, and their contribution to the overall market

- To analyze the opportunities in the market for stakeholders and provide a competitive landscape for the market leaders

- To analyze competitive developments, such as mergers & acquisitions, new product launches, and investments & expansions, in the green coatings market

- To strategically profile key players and comprehensively analyze their market shares and core competencies2

Note: 1. Micromarkets are defined as the sub-segments of the GREEN COATINGS market included in the report.

Note 2: Core competencies of the companies are captured in terms of their key developments and key strategies adopted to sustain their position in the market.

Available Customizations

MarketsandMarkets offers customizations according to the specific needs of the companies with the given market data.

The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of the green coatings market, by country

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Green Coatings Market