Grain Silos and Storage System Market by Silo Type (Flat Bottom Silo, Hopper Silo, Grain Bins, and Other Silo Types), Commodity Type (Rice, Wheat, Maize, Soybean, Sunflower, and Other Commodity Types), Region - Global Forecast to 2025

[147 Pages Report] The global grain silos and storage system market size was estimated to account for a value of USD 1.3 billion in 2020 and is projected to grow at a CAGR of 4.8% from 2020, to reach a value of USD 1.6 billion by 2025. The farmers in developing and developed regions are investing in setting-up of silos which helps in facilitating the storage of grains, and with appropriate conditions, they can be stored for a longer period of time, irrespective of the external weather conditions, are some of the factors driving the growth in the market.

Market Dynamics

Driver: Production of high-quality grains through effective storing and efficient post-harvest management to drive the market growth

A majority of the countries, including the US, Canada, Mexica, China, India, Germany, and the UK, which significantly export agricultural produce in the international markets, are focusing on maintaining the quality of their grains for a longer period of time. Their use is higher in the developed regions, as the farmers in these regions cultivate large-scale farmlands and store high quantities of crops for a longer period of time. In addition, due to the increased prevalence of farmers that can invest in set-up silos, the growth of the market is high in the region. The European region consists of many strong grain silo manufacturers. The key players in the silos market, such as Rostfrei Steels, Silos Cordoba, PRADO Silos, and Symaga, are now focusing on developing silos that meet the needs of farmers in different geographies.

Constraint: High initial investments in equipment and its set up affect their demand across developing countries across regions

Smallholder farmers comprise the majority of the cultivator population in all the regions of the world. They are devoid of appropriate resources and facilities to produce large yields. These farmers are increasingly unaware of the importance of effective storage and maintenance of high-quality grains produced. Small-scale farmers reside in rural areas and have limited land resources to be able to establish silos for storage. According to JMS equipment, the budget capital cost of a cylindrical silo vessel can vary from USD 50,000 for a small bolted silo to over USD 1,000,000 depending on the size and materials of construction. Such investments are possible for a small farmer. Hence, they are still adhering to the traditional methods of grain storage, resulting in a loss of at least 8%–10% of their produce.

Opportunity: Rapid advancements and developments in attributes and technological advancements of silos to drive the market growth

The application of grain silos to store grains instead of warehouses provides various advantages, particularly in terms of using the land space. The silos can be manufactured to fit the available land area, and are available in both vertical and horizontal structures to fit the needs of farmers. It is easier to maintain the optimum storage conditions for grains by controlling the temperature, which, if not done appropriately in long-term storage facilities, can result in economic losses. They are increasingly equipped with mechanics that help in carrying out post-harvest processes in farms, such as threshing, cleaning, and disinfecting. With proper maintenance, the grains stored inside silos can be stored for decades. Silos also enable the user to store different grains separately in order to preserve each of them optimally.

Challenge: Safety risks posed by sealed silos to affect their demand

Sealed silos are loaded with harmful gases, such as carbon dioxide and nitrogen, which are generally incorporated for the purpose of controlling pest infestations or the maintenance and regulation of temperature conditions. Further, operators of silos generally face respiratory health hazards due to grain dust, which causes dust-induced breathing issues. Silos help the US meet the global demand for food, feed, and ethanol-based fuel. However, the increase in silo-based accidents and risks in various countries leads to significant challenges for the growth of the market. The need to climb silos to get inside, check levels, or close and seal lids poses risks of falling and serious injuries. The entry into silos poses risks of suffocation due to the lack of oxygen or exposure to noxious gases, explosive gasses, and dust and fumigants such as phosphine gas.

By silo type, grain bins are projected to be the fastest-growing segment in the grain silos and storage system market during the forecast period

The grain bins are constructed as vented, silver, and corrugated steel-structured containers that have a larger diameter than silos, which are offered in various heights. These type of grain bins are generally used for the storage of dry corn and soybeans, which meet the domestic or export demands for the use of feed, food, and fuel. They are also used for the storage of free-flowing grains or other non-corrosive granular materials up to 52 lb/ft3 (833 kg/m3). Grain bins have a storage capacity that ranges between 1,000 and over a million bushels of grains per structure. They are developed for aerating grains at cooler temperatures for safer and longer period of storage.

By commodity type, maize segment is projected to dominate the market.

Maize is an important crop in various developed and developing countries. It is used as livestock feed and processed into various food and industrial products, such as starch, sweeteners, corn oil, beverage & industrial alcohol, and fuel ethanol. The major feed grains consumed in the US are corn, sorghum, barley, and oats. According to the USDA, in the US, corn is a major feed grain, accounting for more than 95% of the total feed grain production and use. It is used as a key energy ingredient in the livestock feed.

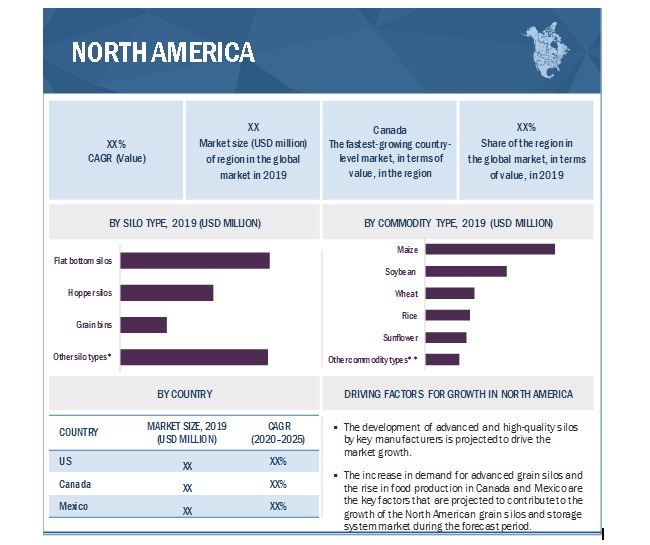

North America to be the largest market for grain silos and storage system during the forecast period.

The on- and off-farm grain storage capacity has reached nearly 20% in the last few years, according to the US Department of Agriculture, with some of the major gains of more than 30% in North and South Dakota in North America, as farmers had switched to corn, which yields nearly twice as many bushels per acre than the area’s traditional wheat crop. Thus, firms, such as CTB, which is a subsidiary of Warren Buffett’s Berkshire Hathaway Inc. (US), are developing advanced metal grain storage silos that are used across North America.

Key Market Players

Some of the major players operating in the grain silos and storage system market include AGCO Corporation (US), AGI (Canada), Silos Córdoba (Spain), PRADO SILOS (Spain), Symaga (Spain), SIMEZA (Spain), Bentall Rowlands Silo Storage Ltd (UK), Mysilo (Turkey), Sukup Manufacturing Co. (US), MICHAL (Poland), Privé SA (France), Dehsetiler Makina (Turkey), MULMIX SpA Unipersonale (Italy), Polnet Sp. z o.o. (Poland), Brock Grain Systems (US), Behlen Mfg. Co. (US), SCAFCO Grain Systems Co. (US), Sioux Steel Company (US), Superior Grain Equipment (US), and Hoffmann, Inc. (US).

Scope of the report

|

Report Metric |

Details |

|

Market size available for years |

2018–2025 |

|

Base year considered |

2019 |

|

Forecast period |

2020–2025 |

|

Forecast units |

Value (USD) |

|

Segments covered |

Silo Type, and Commodity Type |

|

Geographies covered |

North America, Europe, Asia Pacific, South America, RoW |

|

Companies covered |

AGCO Corporation (US), AGI (Canada), Silos Córdoba (Spain), PRADO SILOS (Spain), Symaga (Spain), SIMEZA (Spain), Bentall Rowlands Silo Storage Ltd (UK), Mysilo (Turkey), Sukup Manufacturing Co. (US), MICHA£ (Poland), Privé SA (France), Dehºetiler Makina (Turkey), MULMIX SpA Unipersonale (Italy), Polnet Sp. z o.o. (Poland), Brock Grain Systems (US), Behlen Mfg. Co. (US), SCAFCO Grain Systems Co. (US), Sioux Steel Company (US), Superior Grain Equipment (US), and Hoffmann, Inc. (US). |

This research report categorizes the global market based on silo type, commodity type, and region.

By silo type:

- Flat bottom silos

- Hopper silos

- Grains bins

- Other silo types (bags, bunkers, towers, and synthetic silos)

By commodity type:

- Rice

- Maize

- Wheat

- Soybean

- Sunflower

- Other commodity types (barley, and sorghum)

By region:

- North America

- Europe

- Asia Pacific

- South America

- Rest of World (RoW)

Recent Developments:

- In March 2020, PRADO SILOS completed the installation of two flat bottom silos in Argentina for the storage of wheat. Each silo has a capacity of 9,300 tons of wheat.

- In March 2020, PRADO SILOS collaborated with Machinery Group Nine (Saudi Arabia) to supply two hopper silos, each having a capacity of 460 tons for wheat.

- In May 2020, Symaga installed a storage facility of 14 silos, having a capacity of 6,500m3 / 5,000t per silo for Bühler (Switzerland) in Egypt. The wheat storage plant with a total capacity of 91,000m3 / 70,000 tons is expected to play a key role in logistics and storage under the Egyptian food safety strategy.

- In May 2020, Symaga installed a storage facility consisting of 12 silos for Enselco Agro, a Kernel Group company in Ukraine. The plant has a total capacity of 306,000 m3.

- In January 2020, Symaga installed a storage facility for Ab Inbev (Belgium), a leading brewing company. Its famous Brahma brand expanded its storage capacity at the Brazil plants of Uberlandia and Itapisuma. The two projects, 8 and 4 silos, have a total storage area of 13,380 m3.

Frequently Asked Questions (FAQ):

Which region is projected to account for the largest share in the grain silos & storage system market?

North America accounted for the major market share for grain silos & storage system due to the presence of major players in these regions and the high adoption rate of sustainable agricultural practices

What is the current size of the global grain silos & storage system market?

The global grain silos & storage system market is estimated to be USD 1.3 billion in 2020 and projected to reach USD 1.6 billion by 2025, at a CAGR of 4.8%.

Which are the key players in the market, and how intense is the competition?

The key market players include AGCO Corporation (US), AGI (Canada), Silos Córdoba (Spain), PRADO SILOS (Spain), Symaga (Spain), SIMEZA (Spain). These companies cater to the requirements of the grain industry by providing customized grain silos & storage systems products. Moreover, these companies have effective global manufacturing operations and supply chain strategies. Such advantages give these companies an edge over other companies.

What is the COVID-19 impact on global grain silos & storage system manufacturers?

Grain silos & storage system suppliers have their manufacturing facilities spread across various countries across Asia Pacific, Europe, North America, South America, and RoW. Though COVID-19 has impacted their businesses as well, there is no significant impact on the global operations and supply chain of their products. Multiple manufacturing facilities of players are still in operation.

Which regions are expected to show an increase in grain silos and storage system consumption based on data for regional infestation?

Asia Pacific, Europe, North America, South America are major regions to have an increase in the grain silos & storage system market .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 21)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 STUDY SCOPE

FIGURE 1 GRAIN SILOS AND GRAIN STORAGE SYSTEMS MARKET SEGMENTATION

1.3.1 REGIONAL SEGMENTATION

1.3.2 PERIODIZATION CONSIDERED

1.4 CURRENCY CONSIDERED

TABLE 1 USD EXCHANGE RATES, 2016-2019

1.5 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 25)

2.1 RESEARCH DATA

FIGURE 2 GRAIN SILO AND STORAGE SYSTEM MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

2.1.2.1 Key industry insights

2.1.2.2 Breakdown of primary interviews

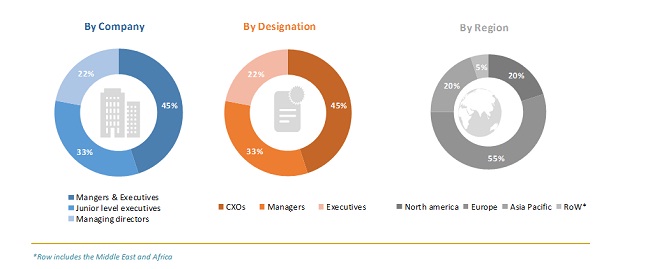

FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

2.2 MARKET SIZE ESTIMATION

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.3 DATA TRIANGULATION

FIGURE 6 DATA TRIANGULATION METHODOLOGY

2.4 RESEARCH ASSUMPTIONS

2.5 LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 31)

FIGURE 7 GRAIN SILOS AND STORAGE SYSTEM MARKET SHARE (VALUE), BY COMMODITY TYPE, 2020-2025

FIGURE 8 GRAIN SILO AND STORAGE SYSTEM MARKET: REGIONAL SNAPSHOT

4 PREMIUM INSIGHTS (Page No. - 34)

4.1 ATTRACTIVE OPPORTUNITIES IN THE GLOBAL MARKET

FIGURE 9 INCREASE IN DEMAND FOR ADVANCED GRAIN SILOS TO DRIVE THE MARKET GROWTH

4.2 GRAIN SILO AND STORAGE SYSTEM MARKET, BY SILO TYPE AND REGION

FIGURE 10 NORTH AMERICA DOMINATED THE SILO TYPE SEGMENT IN THE GRAIN SILOS AND STORAGE SYSTEM MARKET IN 2019

4.3 NORTH AMERICA: GRAIN SILOS AND STORAGE SYSTEM MARKET, BY SILO TYPE AND COUNTRY

FIGURE 11 GRAIN SILOS AND STORAGE SYSTEMS WERE MOSTLY USED FOR CEREALS & GRAINS IN NORTH AMERICA IN 2019

4.4 GRAIN SILOS AND STORAGE SYSTEM MARKET, BY KEY COUNTRY

FIGURE 12 THE US DOMINATED THE GRAIN SILOS AND STORAGE SYSTEM MARKET IN 2019

5 MARKET OVERVIEW (Page No. - 38)

5.1 INTRODUCTION

5.2 MACROECONOMIC INDICATORS

5.2.1 INCREASE IN PRODUCTION OF FOOD GRAINS PER FARM IN COUNTRIES TO ENCOURAGE THE USE OF SILOS FOR EFFICIENT STORAGE

FIGURE 13 CEREAL, MAIZE, SOYBEAN & WHEAT PRODUCTION LEVELS IN DEVELOPING REGIONS, 2015-2018

5.2.2 RISK OF PEST, INSECT, AND FUNGAL INFESTATIONS TO STORED GRAINS LEAD TO A RISE IN DEMAND FOR SILOS

5.3 MARKET DYNAMICS

FIGURE 14 GRAIN SILOS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.3.1 DRIVERS

5.3.1.1 Production of high-quality grains through effective storing and efficient post-harvest management to drive the market growth

5.3.1.2 Post-harvest losses and food wastage to increase the sales of grain silos

5.3.2 RESTRAINTS

5.3.2.1 High initial investments in equipment and its set up affect their demand across developing countries across regions

FIGURE 15 LEVEL OF SMALLHOLDER FARMS, GLOBALLY, 2018

5.3.3 OPPORTUNITIES

5.3.3.1 Rapid advancements and technological developments in attributes of silos to drive the market growth

5.3.3.2 Initiatives undertaken by governments in various countries for setting up grain silos to drive the market growth

5.3.4 CHALLENGES

5.3.4.1 Safety risks posed by sealed silos to decrease their demand

5.4 PRE-COVID AND POST-COVID IMPACT ON THE GRAIN SILOS AND STORAGE SYSTEM MARKET:

6 GRAIN SILO AND STORAGE SYSTEM MARKET, BY SILO TYPE (Page No. - 44)

6.1 INTRODUCTION

6.2 FLAT BOTTOM SILOS

6.2.1 FLAT BOTTOM SILO SEGMENT IS PROJECTED TO DOMINATE THE ASIA PACIFIC MARKET DURING THE FORECAST PERIOD

6.3 HOPPER SILOS

6.3.1 ASIA PACIFIC IS PROJECTED TO DOMINATE THE HOPPER SILO SEGMENT IN THE GLOBAL MARKET DURING THE FORECAST PERIOD

6.4 GRAIN BINS

6.4.1 NORTH AMERICA IS PROJECTED TO DOMINATE THE GRAIN BINS SEGMENT IN THE GRAIN SILO AND STORAGE SYSTEM MARKET

6.5 OTHER SILO TYPES

7 GRAIN SILO AND GRAIN STORAGE SYSTEMS MARKET, BY COMMODITY TYPE (Page No. - 48)

7.1 INTRODUCTION

FIGURE 16 MAIZE SEGMENT IS PROJECTED TO DOMINATE THE MARKET DURING THE FORECAST PERIOD

TABLE 2 GRAIN SILO AND STORAGE SYSTEM MARKET SIZE, BY COMMODITY TYPE, 2018-2025 (USD MILLION)

7.2 RICE

7.2.1 ASIA PACIFIC TO BE A LEADING REVENUE GENERATOR FOR GRAIN SILO MANUFACTURERS DUE TO THE HIGH DEMAND FOR RICE IN COUNTRIES SUCH AS INDIA AND CHINA

TABLE 3 GRAIN SILO AND STORAGE SYSTEM MARKET SIZE, BY REGION, 2018-2025 (USD MILLION)

7.3 WHEAT

7.3.1 IMPORT OF WHEAT FROM SOUTHEAST ASIAN COUNTRIES TO INCREASE THE INSTALLATION OF GRAIN SILOS

FIGURE 17 INDIA: WHEAT PRODUCTION, 2015-2019 (1000 MT)

TABLE 4 WHEAT: GRAIN SILO AND STORAGE SYSTEM MARKET SIZE, BY REGION, 2018-2025 (USD MILLION)

7.4 MAIZE

7.4.1 HIGH CONSUMPTION OF CORNS IN THE US AS A FEED INGREDIENT TO INCREASE THE STORAGE DEMAND FOR MAIZE

FIGURE 18 US: FEED GRAIN PRODUCTION, 2018/19

TABLE 5 MAIZE: GRAIN SILO AND STORAGE SYSTEM MARKET SIZE, BY REGION, 2018-2025 (USD MILLION)

7.5 SOYBEAN

7.5.1 INCREASE IN THE USE OF SOYBEAN AS A KEY INGREDIENT IN END-USER INDUSTRIES TO DRIVE THE MARKET GROWTH

TABLE 6 SOYBEAN: GRAIN SILO AND STORAGE SYSTEM MARKET SIZE, BY REGION, 2018-2025 (USD MILLION)

7.6 SUNFLOWER

7.6.1 HIGH DEMAND FOR SUNFLOWER SEEDS ATTRIBUTED TO THEIR HEALTH BENEFITS TO REFLECT ON THE GROWTH OF THE MARKET POSITIVELY

TABLE 7 SUNFLOWER: GRAIN SILO AND STORAGE SYSTEM MARKET SIZE, BY REGION, 2018-2025 (USD MILLION)

7.7 OTHER COMMODITY TYPES

TABLE 8 OTHER COMMODITY TYPES: GRAIN SILO AND STORAGE SYSTEM MARKET SIZE, BY REGION, 2018-2025 (USD MILLION)

8 GRAIN SILOS AND STORAGE SYSTEM MARKET, BY REGION (Page No. - 56)

8.1 INTRODUCTION

FIGURE 19 AUSTRALIA IS PROJECTED TO WITNESS HIGH GROWTH RATE IN THE GRAIN SILOS AND STORAGE SYSTEM MARKET BETWEEN 2020 AND 2025

TABLE 9 GRAIN SILOS AND STORAGE SYSTEM MARKET SIZE, BY REGION, 2018-2025 (USD MILLION)

8.2 NORTH AMERICA

FIGURE 20 NORTH AMERICA: MARKET SNAPSHOT

TABLE 10 NORTH AMERICA: GRAIN SILOS AND STORAGE SYSTEM MARKET SIZE, BY COUNTRY, 2018-2020 (USD MILLION)

TABLE 11 NORTH AMERICA: MARKET SIZE, BY SILO TYPE, 2018-2025 (USD MILLION)

TABLE 12 NORTH AMERICA: MARKET SIZE, BY COMMODITY TYPE, 2018-2025 (USD MILLION)

TABLE 13 NORTH AMERICA: MARKET SIZE, BY END-USER, 2018-2025 (USD MILLION)

TABLE 14 NORTH AMERICA: MARKET SIZE, BY CONSTRUCTION MATERIAL, 2018-2025 (USD MILLION)

TABLE 15 NORTH AMERICA: MARKET SIZE IN AGRICULTURE & FOOD PROCESSING, BY CONSTRUCTION MATERIAL, 2018-2025 (USD MILLION)

TABLE 16 NORTH AMERICA: MARKET SIZE IN GRAIN & OILSEED PROCESSING, BY CONSTRUCTION MATERIAL 2018-2025 (USD MILLION)

TABLE 17 NORTH AMERICA: MARKET SIZE IN BREWERY, BY CONSTRUCTION MATERIAL, 2018-2025 (USD MILLION)

TABLE 18 NORTH AMERICA: MARKET SIZE IN ANIMAL FEED, BY CONSTRUCTION MATERIAL, 2018-2025 (USD MILLION)

TABLE 19 NORTH AMERICA: MARKET SIZE IN OTHERS, BY CONSTRUCTION MATERIAL, 2018-2025 (USD MILLION)

8.2.1 US

8.2.1.1 The US is projected to dominate the North American grain silos and storage system market during the forecast period

TABLE 20 US: MARKET SIZE, BY COMMODITY TYPE, 2018-2025 (USD MILLION)

TABLE 21 US: MARKET SIZE, BY END-USER, 2018-2025 (USD MILLION)

8.2.2 CANADA

8.2.2.1 Increase in the use of advanced grain storage systems to drive the growth of the Canadian market

TABLE 22 CANADA: MARKET SIZE, BY COMMODITY TYPE, 2018-2025 (USD MILLION)

TABLE 23 CANADA: MARKET SIZE, BY END-USER, 2018-2025 (USD MILLION)

8.2.3 MEXICO

8.2.3.1 Increase in financial support by government authorities and organizations to drive the growth of this market in Mexico

TABLE 24 MEXICO: MARKET SIZE, BY COMMODITY TYPE, 2018-2025 (USD MILLION)

TABLE 25 MEXICO: MARKET SIZE, BY END-USER, 2018-2025 (USD MILLION)

8.3 ASIA PACIFIC

TABLE 26 ASIA PACIFIC: MARKET SIZE, BY COUNTRY/REGION, 2018-2025 (USD MILLION)

TABLE 27 ASIA PACIFIC: MARKET SIZE, BY COMMODITY TYPE, 2018-2025 (USD MILLION)

TABLE 28 ASIA PACIFIC: MARKET SIZE, BY END-USER, 2018-2025 (USD MILLION)

TABLE 29 ASIA PACIFIC: MARKET SIZE, BY CONSTRUCTION MATERIAL, 2018-2025 (USD MILLION)

TABLE 30 ASIA PACIFIC: MARKET SIZE IN AGRICULTURE & FOOD PROCESSING, BY CONSTRUCTION MATERIAL, 2018-2025 (USD MILLION)

TABLE 31 ASIA PACIFIC: MARKET SIZE IN GRAIN & OILSEED PROCESSING, BY CONSTRUCTION MATERIAL, 2018-2025 (USD MILLION)

TABLE 32 ASIA PACIFIC: MARKET SIZE IN BREWERY, BY CONSTRUCTION MATERIAL, 2018-2025 (USD MILLION)

TABLE 33 ASIA PACIFIC: MARKET SIZE IN ANIMAL FEED, BY CONSTRUCTION MATERIAL, 2018-2025 (USD MILLION)

TABLE 34 ASIA PACIFIC: GRAIN SILOS AND STORAGE SYSTEM MARKET SIZE IN OTHERS, BY CONSTRUCTION MATERIAL, 2018-2025 (USD MILLION)

8.3.1 CHINA

8.3.1.1 Increase in the adoption of green storage grain system in the country to drive the growth of the market

TABLE 35 CHINA: MARKET SIZE, BY COMMODITY TYPE, 2018-2025 (USD MILLION)

TABLE 36 CHINA: MARKET SIZE, BY END-USER, 2018-2025 (USD MILLION)

8.3.2 INDIA

8.3.2.1 India to remain a major producer of pulses and the second-largest producer of fruits and vegetables at the global level

TABLE 37 INDIA: MARKET SIZE, BY COMMODITY TYPE, 2018-2025 (USD MILLION)

TABLE 38 INDIA: MARKET SIZE, BY END-USER, 2018-2025 (USD MILLION)

8.3.3 JAPAN

8.3.3.1 Increase in the adoption of advanced silos to drive the growth of the grain silos and storage systems market in the country

TABLE 39 JAPAN: MARKET SIZE, BY COMMODITY TYPE, 2018-2025 (USD MILLION)

TABLE 40 JAPAN: MARKET SIZE, BY END-USER, 2018-2025 (USD MILLION)

8.3.4 AUSTRALIA

8.3.4.1 Increase in the practice of storage management to increase the sales of grain silos and storage systems in Australia

TABLE 41 AUSTRALIA: MARKET SIZE, BY COMMODITY TYPE, 2018-2025 (USD MILLION)

TABLE 42 AUSTRALIA: MARKET SIZE, BY END-USER, 2018-2025 (USD MILLION)

8.3.5 REST OF ASIA PACIFIC

TABLE 43 REST OF ASIA PACIFIC: MARKET SIZE, BY END-USER, 2018-2025 (USD MILLION)

TABLE 44 REST OF ASIA PACIFIC: MARKET SIZE, BY COMMODITY TYPE, 2018-2025 (USD MILLION)

8.4 EUROPE

TABLE 45 EUROPE: MARKET SIZE, BY COUNTRY/REGION, 2018-2020 (USD MILLION)

TABLE 46 EUROPE: MARKET SIZE, BY COMMODITY TYPE, 2018-2025 (USD MILLION)

TABLE 47 EUROPE: MARKET SIZE, BY END-USER, 2018-2025 (USD MILLION)

TABLE 48 EUROPE: MARKET SIZE, BY CONSTRUCTION MATERIAL, 2018-2025 (USD MILLION)

TABLE 49 EUROPE: MARKET SIZE IN AGRICULTURE & FOOD PROCESSING, BY CONSTRUCTION MATERIAL, 2018-2025 (USD MILLION)

TABLE 50 EUROPE: MARKET SIZE IN GRAIN & OILSEED PROCESSING, BY CONSTRUCTION MATERIAL, 2018-2025 (USD MILLION)

TABLE 51 EUROPE: MARKET SIZE IN BREWERY, BY CONSTRUCTION MATERIAL, 2018-2025 (USD MILLION)

TABLE 52 EUROPE: MARKET SIZE IN ANIMAL FEED, BY CONSTRUCTION MATERIAL, 2018-2025 (USD MILLION)

TABLE 53 EUROPE: MARKET SIZE IN OTHERS, BY CONSTRUCTION MATERIAL, 2018-2025 (USD MILLION)

8.4.1 FRANCE

8.4.1.1 Increase in cereal production to drive the growth of the grain silos and storage system market in France

TABLE 54 FRANCE: GRAIN SILOS AND STORAGE SYSTEM MARKET SIZE, BY COMMODITY TYPE, 2018-2025 (USD MILLION)

TABLE 55 FRANCE: MARKET SIZE, BY END-USER, 2018-2025 (USD MILLION)

8.4.2 GERMANY

8.4.2.1 Increase in awareness regarding grain storage management to drive the growth of the market

TABLE 56 GERMANY: MARKET SIZE, BY COMMODITY TYPE, 2018-2025 (USD MILLION)

TABLE 57 GERMANY: MARKET SIZE, BY END-USER, 2018-2025 (USD MILLION)

8.4.3 RUSSIA

8.4.3.1 Increase in the development of infrastructure and logistics for grains storage to drive the growth of the market

TABLE 58 RUSSIA: MARKET SIZE, BY COMMODITY TYPE, 2018-2025 (USD MILLION)

TABLE 59 RUSSIA: MARKET SIZE, BY END-USER, 2018-2025 (USD MILLION)

8.4.4 SPAIN

8.4.4.1 High usage of flat bottom silos to drive the growth of the market

TABLE 60 SPAIN: GRAIN SILOS AND STORAGE SYSTEM MARKET SIZE, BY COMMODITY TYPE, 2018-2025 (USD MILLION)

TABLE 61 SPAIN: MARKET SIZE, BY END-USER, 2018-2025 (USD MILLION)

8.4.5 UK

8.4.5.1 Adoption of intensive farming for higher grain production to drive the grain silos and storage system market in the UK

TABLE 62 UK: MARKET SIZE, BY COMMODITY TYPE, 2018-2025 (USD MILLION)

TABLE 63 UK: MARKET SIZE, BY END-USER, 2018-2025 (USD MILLION)

8.4.6 ITALY

8.4.6.1 Expansion in the cultivation area for increased grain & cereals production to encourage the usage of grain silo and storage systems

TABLE 64 ITALY: MARKET SIZE, BY COMMODITY TYPE, 2018-2025 (USD MILLION)

TABLE 65 ITALY: MARKET SIZE, BY END-USER, 2018-2025 (USD MILLION)

8.4.7 POLAND

8.4.7.1 Rise in demand for advanced grain silos in the country to drive the growth of the market

TABLE 66 POLAND: MARKET SIZE, BY COMMODITY TYPE, 2018-2025 (USD MILLION)

TABLE 67 POLAND: MARKET SIZE, BY END-USER, 2018-2025 (USD MILLION)

8.4.8 REST OF EUROPE

TABLE 68 REST OF EUROPE: MARKET SIZE, BY COMMODITY TYPE, 2018-2025 (USD MILLION)

TABLE 69 REST OF EUROPE: MARKET SIZE, BY END-USER, 2018-2025 (USD MILLION)

8.5 SOUTH AMERICA

TABLE 70 SOUTH AMERICA: GRAIN SILO AND STORAGE SYSTEM MARKET SIZE, BY COUNTRY, 2018- 2025 (USD MILLION)

TABLE 71 SOUTH AMERICA: GRAIN SILO AND STORAGE SYSTEM MARKET SIZE, BY COMMODITY TYPE, 2018-2025 (USD MILLION)

TABLE 72 SOUTH AMERICA: GRAIN SILOS AND STORAGE SYSTEM MARKET SIZE, BY END-USER, 2018-2025 (USD MILLION)

TABLE 73 SOUTH AMERICA: MARKET SIZE, BY CONSTRUCTION MATERIAL, 2018-2025 (USD MILLION)

TABLE 74 SOUTH AMERICA: MARKET SIZE IN AGRICULTURE & FOOD PROCESSING, BY CONSTRUCTION MATERIAL, 2018-2025 (USD MILLION)

TABLE 75 SOUTH AMERICA: MARKET SIZE IN GRAIN & OILSEED PROCESSING, BY CONSTRUCTION MATERIAL, 2018-2025 (USD MILLION)

TABLE 76 SOUTH AMERICA: MARKET SIZE IN BREWERY, BY CONSTRUCTION MATERIAL, 2018-2025 (USD MILLION)

TABLE 77 SOUTH AMERICA: MARKET SIZE IN ANIMAL FEED, BY CONSTRUCTION MATERIAL, 2018-2025 (USD MILLION)

TABLE 78 SOUTH AMERICA: MARKET SIZE IN OTHERS, BY CONSTRUCTION MATERIAL, 2018-2025 (USD MILLION)

8.5.1 BRAZIL

8.5.1.1 Availability of the largest wheat and rice inventories to drive the growth of the grain silo and storage system market

TABLE 79 BRAZIL: GRAIN SILO AND STORAGE SYSTEM MARKET SIZE, BY COMMODITY TYPE, 2018-2025 (USD MILLION)

TABLE 80 BRAZIL: MARKET SIZE, BY END-USER, 2018-2025 (USD MILLION)

8.5.2 ARGENTINA

8.5.2.1 Increase in demand for food products to drive the growth of the grain silo and storage system market

TABLE 81 ARGENTINA: GRAIN SILO AND STORAGE SYSTEM MARKET SIZE, BY COMMODITY TYPE , 2018-2025 (USD MILLION)

TABLE 82 ARGENTINA: GRAIN SILOS AND STORAGE SYSTEM MARKET SIZE, BY END-USER, 2018-2025 (USD MILLION)

8.5.3 REST OF SOUTH AMERICA

TABLE 83 REST OF SOUTH AMERICA: GRAIN SILO AND STORAGE SYSTEM MARKET SIZE, BY COMMODITY TYPE, 2018-2025 (USD MILLION)

TABLE 84 REST OF SOUTH AMERICA: GRAIN SILO AND STORAGE SYSTEM MARKET SIZE, BY END-USER, 2018-2025 (USD MILLION)

8.6 REST OF THE WORLD

TABLE 85 ROW: GRAIN SILOS AND STORAGE SYSTEM MARKET SIZE, BY REGION, 2018-2025 (USD MILLION)

TABLE 86 ROW: MARKET SIZE, BY COMMODITY TYPE, 2018-2025 (USD MILLION)

TABLE 87 ROW: MARKET SIZE, BY END-USER, 2018-2025 (USD MILLION)

TABLE 88 ROW: MARKET SIZE, BY CONSTRUCTION MATERIAL, 2018-2025 (USD MILLION)

TABLE 89 ROW: MARKET SIZE IN AGRICULTURE & FOOD PROCESSING, BY CONSTRUCTION MATERIAL 2018-2025 (USD MILLION)

TABLE 90 ROW: MARKET SIZE IN GRAIN & OILSEED PROCESSING, BY CONSTRUCTION MATERIAL, 2018-2025 (USD MILLION)

TABLE 91 ROW: GRAIN SILOS AND STORAGE SYSTEM MARKET SIZE IN BREWERY, BY CONSTRUCTION MATERIAL, 2018-2025 (USD MILLION)

TABLE 92 ROW: MARKET SIZE IN ANIMAL FEED, BY CONSTRUCTION MATERIAL, 2018-2025 (USD MILLION)

TABLE 93 ROW: MARKET SIZE IN OTHERS, BY CONSTRUCTION MATERIAL, 2018-2025 (USD MILLION)

8.6.1 AFRICA

8.6.1.1 Rapid increase in consumption to drive the growth of the grain silos and storage system market in Africa

TABLE 94 AFRICA: MARKET SIZE, BY COMMODITY TYPE, 2018-2025 (USD MILLION)

TABLE 95 AFRICA: GRAIN SILOS AND STORAGE SYSTEM MARKET SIZE, BY END-USER, 2018-2025 (USD MILLION)

8.6.2 MIDDLE EAST

8.6.2.1 Improved government support and awareness among farmers to drive the growth of the grain silos and storage system market in the region

TABLE 96 MIDDLE EAST: MARKET SIZE, BY COMMODITY TYPE, 2018-2025 (USD MILLION)

TABLE 97 MIDDLE EAST: MARKET SIZE, BY END-USER, 2018-2025 (USD MILLION)

9 COMPANY EVALUATION MATRIX AND COMPANY PROFILES (Page No. - 101)

9.1 OVERVIEW

9.2 COMPANY EVALUATION MATRIX DEFINITION AND METHODOLOGY

9.2.1 STAR

9.2.2 PERVASIVE

9.2.3 EMERGING LEADER

FIGURE 21 COMPANY EVALUATION MATRIX, 2019

9.3 RANKING OF KEY PLAYERS, 2019

FIGURE 22 AGCO CORPORATION LED THE GRAIN SILO AND GRAIN STORAGE SYSTEMS MARKET IN 2019

10 COMPETITIVE LANDSCAPE (Page No. - 104)

10.1 OVERVIEW

10.2 MARKET EVALUATION FRAMEWORK

FIGURE 23 MARKET EVALUATION FRAMEWORK: MARKET EXPANSIONS AND CONSOLIDATION WITNESSED IN 2019

10.3 KEY MARKET DEVELOPMENTS

10.3.1 EXPANSIONS

TABLE 98 EXPANSIONS, 2018-2020

10.3.2 AGREEMENTS, PARTNERSHIPS, AND COLLABORATIONS

TABLE 99 AGREEMENTS, PARTNERSHIPS, AND COLLABORATIONS, 2018-2020

11 COMPANY PROFILES (Page No. - 109)

(Business overview, Products offered, Recent developments, SWOT analysis & Right to win)*

11.1 AGCO CORPORATION

FIGURE 24 AGCO CORPORATION: COMPANY SNAPSHOT

11.2 AGI

FIGURE 25 AGI: COMPANY SNAPSHOT

11.3 SILOS CÓRDOBA

11.4 PRADO SILOS

11.5 SYMAGA

11.6 SIMEZA

11.7 BENTALL ROWLANDS SILO STORAGE LTD.

11.8 MYSILO

11.9 SUKUP MANUFACTURING CO.

11.10 MICHA?

11.11 PRIVÉ SA

11.12 DEH?ETILER MAKINA

11.13 MULMIX SPA UNIPERSONALE

11.14 POLNET SP. Z O.O.

11.15 BROCK GRAIN SYSTEMS

11.16 BEHLEN MFG. CO.

11.17 SCAFCO GRAIN SYSTEMS CO.

11.18 SIOUX STEEL COMPANY

11.19 SUPERIOR GRAIN EQUIPMENT

11.20 HOFFMANN, INC.

*Details on Business overview, Products offered, Recent developments, SWOT analysis & Right to win might not be captured in case of unlisted companies.

12 APPENDIX (Page No. - 141)

12.1 DISCUSSION GUIDE

12.2 KNOWLEDGE STORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

12.3 AVAILABLE CUSTOMIZATIONS

12.4 RELATED REPORTS

12.5 AUTHOR DETAILS

The study involves four major activities to estimate the current size for grain silos & storage system market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. These findings, assumptions, and market sizes were validated with industry experts across the value chain through primary research. Both the top-down and bottom-up approaches were employed to estimate the complete market size. After that, the market breakdown and data triangulation approaches were used to estimate the sizes of the segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources such as Hoovers, Bloomberg BusinessWeek, and Dun & Bradstreet were referred to identify and collect information for this study. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, food safety organizations, regulatory bodies, trade directories, and databases.

Primary Research

The grain silos & storage system market comprises several stakeholders such as agricultural institutes, crop growers, grain storage manufacturers, suppliers, intermediary suppliers, wholesalers, traders, research institutes and organizations, and regulatory bodies.

The demand side comprises a strong demand for high-value crops, increasing instances of crop losses, and advancements in farming practices and technology. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

*Row includes the Middle East and Africa

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the grain silos & storage system market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players were identified through extensive secondary research.

- The industry’s supply chain and market size were determined through primary and secondary research.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All the possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

Global Grain silos & storage system Market Size: Bottom-Up Approach

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation and market breakdown procedures were employed. The data was triangulated by studying various factors and trends from both the demand and supply sides in the grain silos & storage system market.

Report Objectives

- To define, segment, and estimate the size of the grain silos & storage system market with respect to its silo type, commodity type, and region

- To provide detailed information about the major factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To analyze the complete supply chain and influence of all key stakeholders, such as manufacturers, suppliers, and end users

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To profile the key players and comprehensively analyze their core competencies1

- To analyze the competitive developments, such as investments, expansions, partnerships, agreements, collaborations, in the grain silos & storage system market

1 Core competencies of companies include their key developments and strategies adopted by them to sustain their position in the market

AVAILABLE CUSTOMIZATIONS

With the given market data, MarketsandMarkets offers customizations according to the company’s specific scientific needs. The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

- Further breakdown of the Rest of Europe market into Ukraine, Belgium, Lithuania, the Netherlands, and Ireland

- Further breakdown of the Rest of Asia Pacific market into Thailand, Malaysia, Sri Lanka, Vietnam, and South Korea

- Further breakdown of the Rest of South America market into Chile, Venezuela, and Bolivia

Company Information

- Detailed analyses and profiling of additional market players (up to five)

Growth opportunities and latent adjacency in Grain Silos and Storage System Market

I am looking for current prices of silo equipment, such as rotary grain cleaner, complete bagging plant with compressor, industrial sewing machine, and complete set of thermocouples with readout mechanism. Does your report include this information?