GPON Market by Component (OLT, and ONT), Technology (2.5G PON, XG-PON, XGS-PON, and NG-PON2), Application (FTTH, Mobile Backhaul), Vertical (Transportation, Telecom, Healthcare, Energy & Utilities, MTU), Region - Global Forecast To 2025

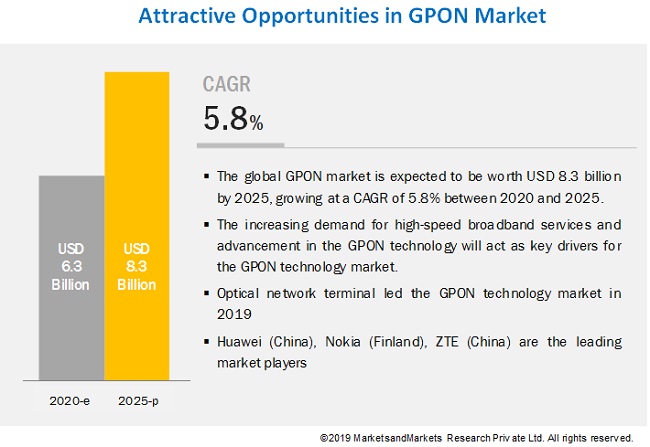

The Global GPON Market Size is estimated to grow from USD 6.3 billion in 2020 to USD 8.3 billion by 2025, at a CAGR of 5.8%.

The market growth is propelled by the high demand for GPON network for triple and quad-play services, increasing demand for high speed broadband services, advancement in GPON technology, and trial and deployment of the 5G network.

Optical network terminal (ONT) to lead the GPON market during the forecast period

Optical network terminal (ONT), also known as optical network units (ONU), is another important networking hardware installed at the user premise, which is used for the transmission of traffic through the GPON network. Its primary function is to convert optical signals transmitted via optical fiber to electrical signals, which are forwarded to business and residential users.

The GPON market is expected to be led by ONT components in terms of volume and value during the forecast period. This, coupled with the increasing number of users availing voice, video, and data services that need to be connected through the ONT hardware component, will lead to an increase in demand for the market.

NG-PON2 technology expected to witness the fastest growth rate during the forecast period

NG-PON2 technology offers more bandwidth allocation than the current network technologies, higher split ratio, faster upstream and downstream data speed, and enhanced security. Additionally, NG-PON2 deployment for mobile backhaul and fronthaul applications in 4G and 5G network technologies is expected to provide an incremental opportunity for the GPON vendors. The telecom sector is relying on the optical fiber-based network technology for providing the 5G services, which require low latency, higher speeds, and NG-PON2 fits the billing.

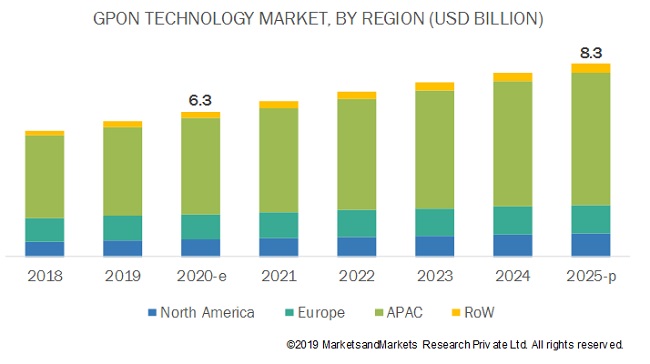

Asia Pacific to be the largest market GPON during the forecast period

The GPON market in Asia Pacific has been segmented further based on the countries into China, Japan, Republic of Korea, Indonesia, Thailand, Taiwan, and Rest of Asia-Pacific. Matured GPON industry, government spending on infrastructure, and widespread deployment of next-generation GPON networks are major factors fuelling the growth of the market in this region.

Key Market Players

As of 2019, Huawei (China), Nokia (Finland), ZTE (China), FiberHome (China), DASAN Zhone (US), Calix (US), and ADTRAN (US) dominated the global GPON market.

Huawei holds the leading position in the GPON market as it has the most comprehensive array of OLT and ONT products that support GPON and 10G-PON technologies. Huawei’s GPON OLT and ONT products are the most popular GPON products in the market, primarily because of their superior quality and brand value. Huawei’s worldwide presence has enabled it to lead the global market and participate in the drafting of international standards for GPON. This, coupled with the commercial launch of XGS-PON, has enabled Huawei to gain the first-mover advantage in the 10 Gbps downlink range. Along with organic strategies, Huawei has adopted the inorganic strategy of collaboration; for instance, it collaborated with TIME dotCom jointly to build a pilot 10G-PON, aiming to provide gigabit ultra-broadband for fixed access users in Malaysia.

GPON solutions provided by Nokia include high-capacity PONs for cable operators, fixed networks for mobile transport, universal next-generation PONs, passive optical LAN, and ONT Easy Start. Nokia is considered to have the highest brand value in the market, primarily because of its strong presence in the networking market. Moreover, the acquisition of Alcatel-Lucent has helped its technological innovation in GPON. This is expected to be a key factor driving the growth of this company. Nokia is the second-largest player in the GPON market. It is further cementing its position in the market by entering into agreements to test its GPON products.

Other companies involved in the GPON market are ZTE (China), FiberHome (China), DASAN Zhone (US), Calix (US), ADTRAN (US), CISCO (US), NEC (Japan), Allied Telesis (Japan), Iskratel (Slovenia), Unizyx (China), and Alphion (US)

GPON Market Report Scope:

|

Report Metric |

Details |

|

Years considered |

2020–2025 |

|

Base year |

2019 |

|

Forecast period |

2020–2025 |

|

Forecast units |

Volume in thousand and Value (USD) in billion |

|

Segments covered |

Component, technology, application, and vertical |

|

Regions covered |

North America, APAC, Europe, and RoW |

|

Companies covered |

Huawei (China), Nokia (Finland), ZTE (China), FiberHome (China), DASAN Zhone (US), Calix (US), and ADTRAN (US), etc. |

In this report, the overall GPON market is segmented into components, technology, application, vertical, and geography.

By Component:

- Optical Line Terminal

- Optical Network Terminal

By Technology:

- 2.5G PON

- XG-PON

- XGS-PON

- NG-PON2

By Application:

- Fiber to the Home (FTTH)

- Fiber to the Building (FTTB), Fiber to the Curb (FTTC), and Fiber to the Node (FTTN)

- Mobile Backhaul

By Vertical:

- Transportation

- Telecommunications

- Healthcare

- Energy & Utilities

- Residential (MTU)

- Commercial Industries

Geographic Analysis

-

North America

- US

- Canada

- Mexico

-

Europe

- Russia

- Spain

- France

- Ukraine

- Romania

- Portugal

- Italy

- Rest of Europe

-

Asia Pacific (APAC)

- China

- Japan

- Republic of Korea

- Indonesia

- Thailand

- Taiwan

- Rest of Asia Pacific

-

Rest of the World (RoW)

- Turkey

- Saudi Arabia

- Rest of Middle East

- Africa

- Brazil

- Rest of South America

Critical Questions:

- Which type of application in GPON is expected to have the highest demand in the future?

- Who are the top 5 players in the GPON market?

- What would be the growth opportunities for manufacturers in various industries?

- What are the key industry trends in the market?

- How can GPON manufacturers tap high-growth opportunities in the GPON application market?

Frequently Asked Questions (FAQ):

Which are the major technologies of GPON ? How huge is the opportunity for their growth in the next five years? How huge is the opportunity for their growth in the next five years?

XG-PON, XGS-PON, and NG-PON2 are expected to be the fastest growing technologies in the GPON technology market. The rising demand for quad-play services that require high-speed broadband, declining prices of XG-PON systems, and a growing number of field trials of XGS-PON technology followed by its commercialization are the key reasons behind the growth of these two technologies. The market for NG-PON2 technology is expected to grow primarily because it has an advantage of wavelength mobility, and it is the most preferred choice of technology for use in 5G mobile backhaul applications, which is the primary reason for the highest growth rate of NG-PON2 technology in the coming years. This will lead to USD 3.5 billion opportunity in 2025..

Which are the major companies in the GPON market? What are their major strategies to strengthen their market presence?

Huawei (China), Nokia (Finland), ZTE (China), FiberHome (China), DASAN Zhone (US), Calix (US), and ADTRAN (US) dominated the global GPON market. Product launches and developments, acquisitions, partnerships, collaborations, and agreements are the major strategies adopted by players to achieve growth in the GPON market.

Which region is expected to witness significant demand for GPON in the coming years?

The maturity of the GPON market, the government spending on infrastructure expansion, and widespread deployment of next-generation GPON networks have attributed to the leading position of APAC in the GPON market. In Europe, rising penetration of FTTx services, including fiber to the home (FTTH), has resulted in the increased demand for GPON network technologies in the region. Rising deployment of 4G and 5G mobile networks is expected to increase the demand for GPON technologies in Europe.

What are the drivers and opportunities for the GPON market?

Key factors contributing to the growth of the GPON market include the increased demand for triple- and quad-play services, high demand for high-speed broadband services, rapid advancements in GPON technology, and high penetration of FTTH services in APAC. Trial and deployment of 5G networks and the rise in demand for video content are the opportunities for the growth of the market players in the coming years.

Which end users are expected to drive the growth of the market in the next 5 years?

The residential vertical led the GPON market in 2019 and it expected to grow at a CAGR of 3.6% from 2020 to 2025. This growth is primarily due to the private investments and the involvement of government and local authorities in many fiber optic projects. The growing deployment of FTTH networks is another factor driving the GPON market growth for the residential vertical. The market for the transportation vertical will primarily grow due to the growing production of connected cars and rising use of the internet to increase productivity in the logistics industry. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 21)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION AND SCOPE

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 STUDY SCOPE

1.3.1 MARKETS COVERED

FIGURE 1 GPON MARKET SEGMENTATION

1.3.2 GEOGRAPHIC SCOPE

1.3.3 YEARS CONSIDERED

1.4 CURRENCY

1.5 PACKAGE SIZE

1.6 LIMITATIONS

1.7 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 26)

2.1 RESEARCH DATA

FIGURE 2 GPON MARKET: RESEARCH DESIGN

2.1.1 SECONDARY & PRIMARY RESEARCH

2.1.2 SECONDARY DATA

2.1.2.1 Major secondary sources

2.1.2.2 Secondary sources

2.1.3 PRIMARY DATA

2.1.3.1 Key data from primary sources

2.1.3.2 Key industry insights

2.1.3.3 Breakdown of primaries

2.2 MARKET SIZE ESTIMATION

2.3 BOTTOM-UP AND TOP-DOWN METHODOLOGY

2.3.1 BOTTOM-UP APPROACH

2.3.1.1 Approach for arriving at market size by bottom-up analysis (demand side)

FIGURE 3 GPON MARKET: BOTTOM-UP APPROACH

2.3.2 TOP-DOWN APPROACH

2.3.2.1 Approach for capturing market size by top-down analysis (supply side)

FIGURE 4 GPON MARKET: TOP-DOWN APPROACH

2.4 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 5 DATA TRIANGULATION

2.5 RESEARCH ASSUMPTIONS

3 EXECUTIVE SUMMARY (Page No. - 35)

FIGURE 6 TRANSPORTATION VERTICAL TO WITNESS HIGHEST CAGR IN MARKET DURING FORECAST PERIOD

FIGURE 7 OLT COMPONENT TO WITNESS HIGHER CAGR IN MARKET DURING FORECAST PERIOD

FIGURE 8 NG-PON2 TECHNOLOGY TO REGISTER HIGHEST CAGR IN MARKET DURING FORECAST PERIOD

FIGURE 9 ASIA PACIFIC TO REGISTER HIGHEST CAGR IN MARKET FROM 2020 TO 2025

4 PREMIUM INSIGHTS (Page No. - 39)

4.1 ATTRACTIVE GROWTH OPPORTUNITIES IN GPON MARKET

FIGURE 10 HIGH DEMAND FOR HIGH-SPEED BROADBAND SERVICES AND RAPID ADVANCEMENTS IN GPON TO BOOST MARKET GROWTH

4.2 GPON MARKET, BY COMPONENT

FIGURE 11 OPTICAL NETWORK TERMINAL TO HOLD MAJOR SHARE OF MARKET IN 2025

4.3 GPON MARKET, BY TECHNOLOGY

FIGURE 12 2.5G PON TO ACCOUNT FOR LARGEST SIZE OF MARKET IN 2020

4.4 GPON MARKET, BY APPLICATION

FIGURE 13 FIBER TO THE HOME APPLICATION TO HOLD LARGEST SIZE OF MARKET IN 2025

4.5 GPON MARKET, BY VERTICAL

FIGURE 14 RESIDENTIAL VERTICAL TO HOLD LARGEST SIZE OF MARKET IN 2020

4.6 GPON MARKET, BY REGION

FIGURE 15 ASIA PACIFIC TO CAPTURE LARGEST SIZE OF MARKET IN 2025

5 MARKET OVERVIEW (Page No. - 42)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Increased demand for triple- and quad-play services

5.2.1.2 High demand for high-speed broadband services

5.2.1.3 Rapid advancements in GPON technology

5.2.1.4 High penetration of FTTH services in APAC

5.2.2 RESTRAINTS

5.2.2.1 Availability of substitute technologies

5.2.2.2 High installation and operational costs, along with requirement for continuous power supply

5.2.3 OPPORTUNITIES

5.2.3.1 Trial and deployment of 5G networks

FIGURE 16 PERCENTAGE OF CONNECTIONS WORLDWIDE, BY TECHNOLOGY (2018 VS. 2025)

FIGURE 17 GLOBAL PROJECTION OF 5G ADOPTION

5.2.3.2 Rise in demand for video content

5.2.4 CHALLENGES

5.2.4.1 Interoperability issues and operational difficulties associated with fiber optics

5.3 VALUE CHAIN ANALYSIS

FIGURE 18 MAJOR VALUE IS ADDED BY MANUFACTURERS OF GPON OLT AND ONT

5.4 RECENT DEVELOPMENTS IN NG-PON2

6 GPON MARKET, BY TECHNOLOGY (Page No. - 52)

6.1 INTRODUCTION

FIGURE 19 GPON MARKET, BY TECHNOLOGY

FIGURE 20 NG-PON2 TECHNOLOGY TO REGISTER HIGHEST CAGR IN MARKET DURING FORECAST PERIOD

TABLE 1 MARKET, BY TECHNOLOGY, 2018–2025 (USD MILLION)

TABLE 2 MARKET, BY TECHNOLOGY, 2018–2025 (THOUSAND UNITS)

6.2 2.5G PON

6.2.1 HIGHER SPLIT RATIO OF 2.5G PON ENABLES SERVING MORE USERS WITH SINGLE NETWORK, THEREBY LEADING TO COST SAVINGS

TABLE 3 2.5G PON TECHNOLOGY MARKET, BY COMPONENT, 2018–2025 (USD MILLION)

TABLE 4 2.5G PON TECHNOLOGY MARKET, BY APPLICATION,2018–2025 (USD MILLION)

TABLE 5 2.5G PON TECHNOLOGY MARKET, BY REGION, 2018–2025 (USD MILLION)

6.3 XG-PON

6.3.1 XG-PON TECHNOLOGY HELD SECOND-LARGEST SIZE OF GPON MARKET IN 2019

TABLE 6 XG-PON TECHNOLOGY MARKET, BY COMPONENT, 2018–2025 (USD MILLION)

TABLE 7 XG-PON TECHNOLOGY MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 8 XG-PON TECHNOLOGY MARKET, BY REGION, 2018–2025 (USD MILLION)

6.4 XGS-PON

6.4.1 HIGHER BANDWIDTH AND SPEED OF XGS-PON MAKES IT MORE SUITABLE FOR 5G MOBILE NETWORKS

TABLE 9 XGS-PON TECHNOLOGY MARKET, BY COMPONENT, 2018–2025 (USD MILLION)

TABLE 10 XGS-PON TECHNOLOGY MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 11 XGS-PON TECHNOLOGY MARKET, BY REGION, 2018–2025 (USD MILLION)

6.5 NG-PON2

6.5.1 MARKET FOR NG-PON2 TO GROW AT HIGHEST RATE DURING 2020–2025

TABLE 12 NG-PON2 TECHNOLOGY MARKET, BY COMPONENT, 2018–2025 (USD MILLION)

TABLE 13 NG-PON2 TECHNOLOGY MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 14 NG-PON2 TECHNOLOGY MARKET, BY REGION, 2018–2025 (USD MILLION)

7 GPON MARKET, BY COMPONENT (Page No. - 60)

7.1 INTRODUCTION

FIGURE 21 GPON MARKET, BY COMPONENT

FIGURE 22 OPTICAL LINE TERMINALS TO WITNESS HIGHER CAGR IN MARKET DURING FORECAST PERIOD

TABLE 15 MARKET, BY COMPONENT, 2018–2025 (USD MILLION)

TABLE 16 MARKET, BY COMPONENT, 2018–2025 (MILLION UNITS)

7.2 OPTICAL LINE TERMINAL (OLT)

7.2.1 HIGH BANDWIDTH REQUIREMENT AND RAPID ADVANCEMENTS IN MOBILE NETWORK TECHNOLOGIES TO FUEL GROWTH OF OLT COMPONENT

TABLE 17 MARKET FOR OLT COMPONENT, BY TECHNOLOGY, 2018–2025 (USD MILLION)

TABLE 18 MARKET FOR OLT COMPONENT, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 19 MARKET FOR OLT COMPONENT, BY REGION, 2018–2025 (USD MILLION)

7.3 OPTICAL NETWORK TERMINAL (ONT)

7.3.1 INCREASE IN PENETRATION OF ONT IN FTTX NETWORKS TO BOOST ONT MARKET GROWTH

TABLE 20 MARKET FOR ONT COMPONENT, BY TECHNOLOGY, 2018–2025 (USD MILLION)

TABLE 21 MARKET FOR ONT COMPONENT, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 22 MARKET FOR ONT, BY REGION, 2018–2025 (USD MILLION)

8 GPON MARKET, BY APPLICATION (Page No. - 65)

8.1 INTRODUCTION

FIGURE 23 GPON MARKET, BY APPLICATION

FIGURE 24 MOBILE BACKHAUL APPLICATION TO EXHIBIT HIGHEST CAGR IN MARKET DURING FORECAST PERIOD

TABLE 23 MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 24 MARKET, BY APPLICATION, 2018–2025 (MILLION UNITS)

8.2 FTTH

8.2.1 INCREASING NUMBER OF FTTH SUBSCRIBERS

TABLE 25 MARKET FOR FTTH APPLICATION, BY TECHNOLOGY, 2018–2025 (USD MILLION)

TABLE 26 MARKET FOR FTTH APPLICATION, BY COMPONENT, 2018–2025 (USD MILLION)

TABLE 27 MARKET FOR FTTH APPLICATION, BY REGION, 2018–2025 (USD MILLION)

8.3 OTHER FTTX

8.3.1 RISING DEMAND OF TRIPLE-AND QUAD-PLAY SERVICES

TABLE 28 MARKET FOR OTHER FTTX APPLICATION, BY TECHNOLOGY, 2018–2025 (USD MILLION)

TABLE 29 MARKET FOR OTHER FTTX APPLICATION, BY COMPONENT, 2018–2025 (USD MILLION)

TABLE 30 MARKET FOR OTHER FTTX APPLICATION, BY REGION, 2018–2025 (USD MILLION)

8.4 MOBILE BACKHAUL

8.4.1 INCREASING BANDWIDTH CAPACITY AND REDUCING OPERATIONAL COSTS OF GPON

TABLE 31 MARKET FOR MOBILE BACKHAUL APPLICATION, BY TECHNOLOGY, 2018–2025 (USD MILLION)

TABLE 32 MARKET FOR MOBILE BACKHAUL APPLICATION, BY COMPONENT, 2018–2025 (USD MILLION)

TABLE 33 MARKET FOR MOBILE BACKHAUL APPLICATION, BY REGION, 2018–2025 (USD MILLION)

9 GPON MARKET, BY VERTICAL (Page No. - 72)

9.1 INTRODUCTION

FIGURE 25 GPON MARKET, BY VERTICAL

FIGURE 26 TRANSPORTATION VERTICAL TO WITNESS HIGHEST CAGR IN MARKET DURING FORECAST PERIOD

TABLE 34 MARKET, BY VERTICAL, 2018–2025 (USD MILLION)

9.2 RESIDENTIAL

9.2.1 USE OF GPON FOR HIGH-SPEED DATA, IPTV, VOICE, AND CATV SERVICES IN RESIDENTIAL VERTICAL

9.3 TELECOMMUNICATIONS

9.3.1 HIGH DEMAND FROM NETWORK SERVICE PROVIDERS TO EXPAND THEIR MOBILE BACKHAULING CAPACITY

9.4 TRANSPORTATION

9.4.1 GROWTH IN IOT APPLICATIONS IN PUBLIC AND PRIVATE TRANSPORTATION

9.5 ENERGY & UTILITIES

9.5.1 IMPLEMENTATION OF SMART GRIDS TO SURGE GPON DEMAND IN ENERGY & UTILITIES

9.6 HEALTHCARE

9.6.1 USE OF GPON TO IMPROVE OPERATIONAL EFFICIENCY OF ALL STAKEHOLDERS INVOLVED IN VALUE CHAIN OF HEALTHCARE VERTICAL

9.7 COMMERCIAL

9.7.1 MANUFACTURING INDUSTRIES AND BUSINESS SERVICES ARE MAJOR SEGMENTS OF COMMERCIAL VERTICALS USING GPON

10 GPON SERVICES (Page No. - 78)

10.1 INTRODUCTION

10.2 FIXED INTERNET AND VOICE

10.3 INTERNET PROTOCOL TV (IPTV)

10.4 MOBILE VOICE AND INTERNET

11 GEOGRAPHIC ANALYSIS (Page No. - 79)

11.1 INTRODUCTION

FIGURE 27 GEOGRAPHIC SNAPSHOT: BRAZIL TO REGISTER HIGHEST CAGR IN GLOBAL GPON MARKET DURING 2020–2025

FIGURE 28 MARKET IN ROW TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 35 MARKET, BY REGION, 2018–2025 (USD MILLION)

TABLE 36 MARKET, BY REGION, 2018–2025 (MILLION UNITS)

11.2 NORTH AMERICA

FIGURE 29 SNAPSHOT: GPON MARKET IN NORTH AMERICA

FIGURE 30 MEXICO TO RECORD HIGHEST CAGR IN MARKET IN NORTH AMERICA DURING FORECAST PERIOD

TABLE 37 MARKET IN NORTH AMERICA, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 38 MARKET IN NORTH AMERICA, BY COMPONENT, 2018–2025 (USD MILLION)

11.2.1 US

11.2.1.1 US to continue to hold second-largest share of market globally during forecast period

TABLE 39 MARKET IN US, BY COMPONENT, 2018–2025 (USD MILLION)

11.2.2 CANADA

11.2.2.1 Canada to continue to account for second-largest share of North American market

TABLE 40 MARKET IN CANADA, BY COMPONENT, 2018–2025 (USD MILLION)

11.2.3 MEXICO

11.2.3.1 Mexico to be fastest-growing market in North America owing to for foreign investments in telecom sector

TABLE 41 MARKET IN MEXICO, BY COMPONENT, 2018–2025 (USD MILLION)

11.3 EUROPE

FIGURE 31 SNAPSHOT: GPON MARKET IN EUROPE

FIGURE 32 MARKET IN ITALY TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 42 MARKET IN EUROPE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 43 MARKET IN EUROPE, BY COMPONENT, 2018–2025 (USD MILLION)

11.3.1 RUSSIA

11.3.1.1 Russia to continue to account for largest share of European market

TABLE 44 MARKET IN RUSSIA, BY COMPONENT, 2018–2025 (USD MILLION)

11.3.2 SPAIN

11.3.2.1 Growth in FTTH connections is fostering demand for ONT installations

TABLE 45 MARKET IN SPAIN, BY COMPONENT, 2018–2025 (USD MILLION)

11.3.3 FRANCE

11.3.3.1 Large base of mobile users availing 4G network services propelling growth of GPON market in France

TABLE 46 MARKET IN FRANCE, BY COMPONENT, 2018–2025 (USD MILLION)

11.3.4 UKRAINE

11.3.4.1 Investments from telecom companies in building optical fiber network infrastructure surging demand for GPON technology

TABLE 47 MARKET IN UKRAINE, BY COMPONENT, 2018–2025 (USD MILLION)

11.3.5 ROMANIA

11.3.5.1 Increased use of GPON infrastructure to develop transportation, power & utilities, and healthcare industries in Romania

TABLE 48 MARKET IN ROMANIA, BY COMPONENT, 2018–2025 (USD MILLION)

11.3.6 PORTUGAL

11.3.6.1 Growing demand for broadband services and expanding FTTH subscriber base to foster market growth in Portugal

TABLE 49 MARKET IN PORTUGAL, BY COMPONENT, 2018–2025 (USD MILLION)

11.3.7 ITALY

11.3.7.1 Rapid expansion of GPON infrastructure in Italy

TABLE 50 MARKET IN ITALY, BY COMPONENT, 2018–2025 (USD MILLION)

11.3.8 REST OF EUROPE (ROE)

TABLE 51 MARKET IN REST OF EUROPE, BY COMPONENT, 2018–2025 (USD MILLION)

11.4 APAC

FIGURE 33 SNAPSHOT: GPON MARKET IN APAC

FIGURE 34 INDONESIA TO EXHIBIT HIGHEST CAGR IN MARKET IN APAC DURING FORECAST PERIOD

TABLE 52 MARKET IN APAC, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 53 MARKET IN APAC, BY COMPONENT, 2018–2025 (USD MILLION)

11.4.1 CHINA

11.4.1.1 China to hold largest share of global GPON market throughout forecast period

TABLE 54 MARKET IN CHINA, BY COMPONENT, 2018–2025 (USD MILLION)

11.4.2 JAPAN

11.4.2.1 High penetration of FTTH and increased adoption of 4K TV content

TABLE 55 MARKET IN JAPAN, BY COMPONENT, 2018–2025 (USD MILLION)

11.4.3 REPUBLIC OF KOREA

11.4.3.1 Increased government spending on network infrastructure and penetration of mobile network applications

TABLE 56 MARKET IN REPUBLIC OF KOREA, BY COMPONENT, 2018–2025 (USD MILLION)

11.4.4 INDONESIA

11.4.4.1 Rising government spending to expand optical fiber networks

TABLE 57 MARKET IN INDONESIA, BY COMPONENT, 2018–2025 (USD MILLION)

11.4.5 THAILAND

11.4.5.1 Auctioning of 5G spectrum by Thailand government

TABLE 58 MARKET IN THAILAND, BY COMPONENT, 2018–2025 (USD MILLION)

11.4.6 TAIWAN

11.4.6.1 Rise in penetration of FTTH in Taiwan

TABLE 59 MARKET IN TAIWAN, BY COMPONENT, 2018–2025 (USD MILLION)

11.4.7 REST OF APAC

TABLE 60 MARKET IN REST OF APAC, BY COMPONENT, 2018–2025 (USD MILLION)

11.5 ROW

FIGURE 35 BRAZIL TO REGISTER HIGHEST CAGR IN GPON MARKET IN ROW DURING FORECAST PERIOD

TABLE 61 MARKET IN ROW, BY GEOGRAPHY, 2018–2025 (USD MILLION)

TABLE 62 MARKET IN ROW, BY COMPONENT, 2018–2025 (USD MILLION)

11.5.1 TURKEY

11.5.1.1 Turkey accounted for larger share of GPON market in RoW

TABLE 63 MARKET IN TURKEY, BY COMPONENT, 2018–2025 (USD MILLION)

11.5.2 SAUDI ARABIA

11.5.2.1 Increasing adoption of internet connection on mobile devices

TABLE 64 MARKET IN SAUDI ARABIA, BY COMPONENT, 2018–2025 (USD MILLION)

11.5.3 AFRICA

11.5.3.1 Improved data connectivity and increased mobile penetration

TABLE 65 MARKET IN AFRICA, BY COMPONENT, 2018–2025 (USD MILLION)

11.5.4 BRAZIL

11.5.4.1 Brazil accounted for larger share of GPON market in South America

TABLE 66 MARKET IN BRAZIL, BY COMPONENT, 2018–2025 (USD MILLION)

11.5.5 REST OF SOUTH AMERICA

11.5.5.1 Uruguay, Chile, Columbia, Argentina, Chile, and Ecuador contribute to growth of market in Rest of South America

TABLE 67 MARKET IN REST OF SOUTH AMERICA, BY COMPONENT, 2018–2025 (USD MILLION)

11.5.6 REST OF MIDDLE EAST

11.5.6.1 Deployment of National Broadband Networks and development of smart cities

TABLE 68 MARKET IN REST OF MIDDLE EAST, BY COMPONENT, 2018–2025 (USD MILLION)

12 COMPETITIVE LANDSCAPE (Page No. - 102)

12.1 OVERVIEW

FIGURE 36 KEY DEVELOPMENTS IN MARKET (2017 TO 2019)

12.2 MARKET RANKING ANALYSIS: GPON MARKET

FIGURE 37 RANKING OF KEY PLAYERS IN MARKET, 2019

12.3 COMPETITIVE LEADERSHIP MAPPING, 2019

12.3.1 VISIONARIES

12.3.2 INNOVATORS

12.3.3 DYNAMIC DIFFERENTIATORS

12.3.4 EMERGING COMPANIES

FIGURE 38 COMPETITIVE LEADERSHIP MAPPING IN GPON MARKET, 2019

12.4 STRENGTH OF PRODUCT PORTFOLIO (FOR 26 COMPANIES)

12.5 BUSINESS STRATEGY EXCELLENCE (FOR 26 COMPANIES)

12.6 COMPETITIVE SITUATIONS AND TRENDS

12.6.1 CONTRACTS, COLLABORATIONS, AGREEMENTS, AND PARTNERSHIPS

TABLE 69 CONTRACTS, COLLABORATIONS, AGREEMENTS, AND PARTNERSHIPS, 2017–2020

12.6.2 PRODUCT LAUNCHES AND DEVELOPMENTS

TABLE 70 PRODUCT LAUNCHES AND DEVELOPMENTS, 2017–2020

12.6.3 ACQUISITIONS

TABLE 71 ACQUISITIONS, 2019

13 COMPANY PROFILES (Page No. - 111)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, and MnM View)*

13.1 KEY PLAYERS

13.1.1 HUAWEI

FIGURE 39 HUAWEI: COMPANY SNAPSHOT

13.1.2 NOKIA

FIGURE 40 NOKIA: COMPANY SNAPSHOT

13.1.3 ZTE

FIGURE 41 ZTE: COMPANY SNAPSHOT

13.1.4 FIBERHOME

13.1.5 DASAN ZHONE

FIGURE 42 DASAN ZHONE: COMPANY SNAPSHOT

13.1.6 CALIX

FIGURE 43 CALIX: COMPANY SNAPSHOT

13.1.7 ADTRAN

FIGURE 44 ADTRAN: COMPANY SNAPSHOT

13.1.8 CISCO

FIGURE 45 CISCO: COMPANY SNAPSHOT

13.1.9 NEC

FIGURE 46 NEC: COMPANY SNAPSHOT

13.1.10 ALLIED TELESIS

FIGURE 47 ALLIED TELESIS: COMPANY SNAPSHOT

13.1.11 ISKRATEL

13.1.12 UNIZYX

FIGURE 48 UNIZYX: COMPANY SNAPSHOT

13.1.13 ALPHION

13.1.14 TEJAS NETWORKS

FIGURE 49 TEJAS NETWORKS: COMPANY SNAPSHOT

13.2 RIGHT TO WIN

13.3 KEY INNOVATORS

13.3.1 ECONET

13.3.2 SHENZHEN GIGALIGHT

13.3.3 NCIS GROUP

13.3.4 GPONDOCTOR

13.3.5 SHENZHEN C-DATA

13.4 OTHER COMPANIES

13.4.1 TELLABS

13.4.2 FUJIKURA

13.4.3 UTSTARCOM

13.4.4 TP-LINK

13.4.5 GCOM TECHNOLOGIES

13.4.6 COMMVERGE

13.4.7 MULTICOM

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, and MnM View might not be captured in case of unlisted companies.

14 APPENDIX (Page No. - 147)

14.1 INSIGHTS OF INDUSTRY EXPERTS

14.2 DISCUSSION GUIDE - GPON MARKET

14.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

14.4 AVAILABLE CUSTOMIZATIONS

14.5 RELATED REPORTS

14.6 AUTHOR DETAILS

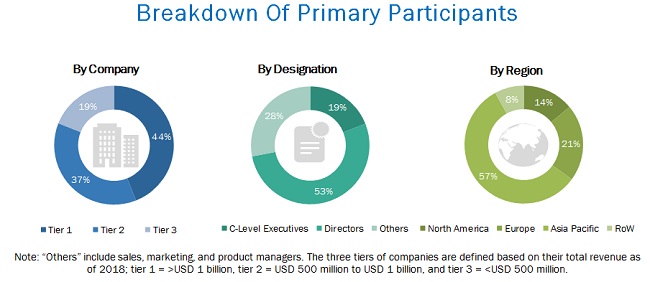

The study involved four major activities for estimating the size of the global GPON market. Exhaustive secondary research has been conducted to collect information on the market. The next step involved has been validating these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches have been employed to estimate the overall market size. After that, market breakdown and data triangulation techniques have been used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources have been referred to for identifying and collecting information important for this study. Secondary sources such as corporate filings (such as annual reports, investor presentations, and financial statements); trade, business, and professional associations; white papers and GPON-related journals and certified publications; articles of recognized authors; gold- and silver-standard websites; directories; and databases have been used to identify and collect information for an extensive technical and commercial study of the GPON market.

Primary Research

In the primary research process, primary sources from both supply and demand sides have been interviewed to obtain qualitative and quantitative information important for this report. Primary sources, such as experts from related industries and suppliers, have been interviewed to obtain and verify critical information, as well as assess prospects. Key players in the GPON market have been identified through secondary research, and their respective market rankings have been determined through primary and secondary research. This research included studying annual reports of top market players and interviewing key opinion leaders such as CEOs, directors, and marketing personnel.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the complete market engineering process, both top-down and bottom-up approaches have been implemented, along with several data triangulation methods, to estimate and validate the size of the GPON market and other dependent submarkets listed in this report.

- Key players in the industry and markets have been identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size, the total market has been split into several segments. To complete the overall market engineering process and arrive at exact statistics for all segments, market breakdown, and data triangulation procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides. The market has also been validated using both top-down and bottom-up approaches.

Study Objectives:

- To describe and forecast the GPON market, by component, technology, application, vertical, and geography

- To describe and forecast the market size for various segments with regard to four main regions-North America, Europe, Asia Pacific (APAC), and Rest of the World (RoW)

- To provide detailed information regarding drivers, restraints, opportunities, and challenges influencing the growth of the GPON market

- To strategically analyze micromarkets1 with respect to growth trends, prospects, and contributions to the total market

- To analyze opportunities for stakeholders by identifying high-growth segments within the GPON market

- To study the complete value chain and allied industry segments and perform a value chain analysis of the GPON ecosystem

- To analyze competitive developments such as partnerships, mergers and acquisitions, product launches, and research and development (R&D) in the GPON market

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to a company’s specific needs. The following customization options are available for the GPON market report.

Company information:

- Detailed analysis and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in GPON Market

To understand what is the market trends and products platform. Is COB products gaining more in this PON markets replacing GTMS packages?

We are manufacturer of semiconductor lasers, and like to better understand the market for such lasers to the GPON market for FTTx and 5G NR LTE.

We are start-up company for Gpon market, we will like to be the leading Gpon CPE supplier in the world.