Gluten-free Baking Mixes Market by Application (Cookies, Cakes and Pastries, Bread, Pizza, Others), Distribution Channel (Supermarkets & Hypermarkets, Health Food Stores, Convenience & Grocery Stores, Others) and Key Region - Forecasted to 2027

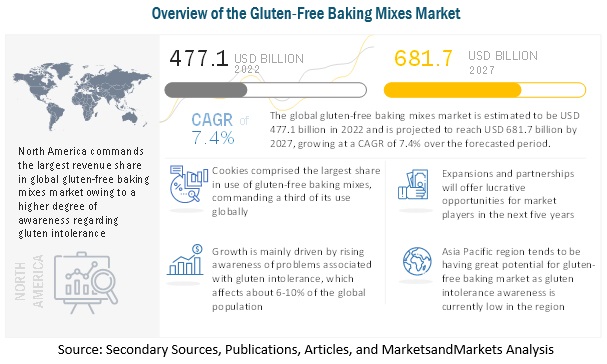

According to MarketsandMarkets, the global Gluten-free baking mixes market is estimated to be valued at USD 477.1 million in 2022. It is projected to reach USD 681.7 million by 2027, with a CAGR of 7.4%, in terms of value between 2022 and 2027. Growth of gluten-free baking mixes market size is expected to be driven by rising awareness around gluten intolerance, with governments approving the gluten-free labels to raise such awareness amongst consumers.

Gluten-Free Baking Mixes Market Dynamics

Drivers: Key market driver tends to be the rising trend of foods and ingredients labelled ‘free from’

Coming into popularity mainly during 2017, the ‘free from’ foods and ingredients trend has taken traction in the past few years. It remains the main driver for gluten-free baking mixes, as about almost more than half of consumers tend to find ‘free-from’ foods with health claims more appealing, when compared to food products without such labels.

Restraints: Inconvenience in production process and high pricing

Pricing tends to be the key restraint for market growth. When coupled with inconvenience of maintaining multiple ingredients when using gluten-free baking mixes, the higher resultant cost of production of gluten-free products tends to be the key restraint for market growth.

Opportunities: There remains a huge market potential to be tapped in Asia Pacific countries

Prevalence of celiac disease in Asia Pacific countries, such as India, is as high as 10% of the overall population, as per Nizam’s Institute of Medical Sciences (India). However, gluten-free products have only recently been introduced in the market, with consumers still not being as aware of gluten intolerance as the western countries. The region therefore presents an enormous potential opportunity for gluten-free baking mixes market to grow.

Challenges: Maintaining the consistency of gluten-free food products in terms of taste and texture

Managing consistency during preparation of food products using gluten-free baking mixes remains the key challenge for the industry’s adoption. Owing to a greater number of ingredients required, production of gluten-free products using gluten-free baking mixes becomes complicated and sensitive to variations in ingredient ratios.

By application, bread is projected to witness the fastest growth rate during the forecast period.

Bread segment is expected to grow the fastest over the forecasted period, owing to it having the most potential. This is since it is widely consumed as a baking product and is thereby now increasingly preferred in non-gluten format owing to rising awareness regarding gluten intolerance.

By distribution channel, e-commerce expected to showcase the fastest growth.

E-commerce, as a distribution channel for gluten-free baking mixes is expected to showcase the fastest growth over the forecasted period. This is owing to several benefits the channel comes with, such as greater product variety, convenience of home delivery and lower prices when compared to physical retail.

North America commands the largest revenue share in global gluten-free baking mixes market and is also expected to be the fastest growing over the forecasted period. Growth is especially driven by Canada besides the US. Canada showcased a rise in consumption of gluten-free baking mixes, especially after the Canadian government approved ‘gluten-free’ claims on products, in a bid to raise awareness around celiac disease.

Key Market Players:

Key players in this market include Partake Foods (US), Conagra Brands (US), Continental Mills (US), King Arthur Baking Company (US), General Mills (US), among others.

FAQs:

- Which are the major Gluten-free baking mixes segments considered in this study and which of them are projected to have promising growth rates in the future?

- I am interested in the Asia Pacific market for cookies and bread segment. Is the customization available for the same? What all information would be included in the same?

- What are some of the drivers fuelling the growth of the Gluten-free baking mixes market?

- I am interested in understanding the research methodology on how you arrived at the market size and segmental splits before making a purchase decision. Can you provide me with an explanation on the same?

- What kind of information is provided in the competitive landscape section?

TABLE OF CONTENTS

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 STUDY SCOPE

1.4 REGIONAL SEGMENTATION

1.5 PERIODIZATION CONSIDERED

1.6 CURRENCY CONSIDERED

1.7 VOLUME UNITS CONSIDERED

1.8 STAKEHOLDERS

2 RESEARCH METHODOLOGY

2.1 RESEARCH DATA

2.1.1 SECONDARY DATA

2.1.1.1 Key Data from Secondary Sources

2.1.2 PRIMARY DATA

2.1.2.1 Key Data from Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primaries

2.2 MARKET SIZE ESTIMATION

2.2.1 MARKET SIZE ESTIMATION - METHOD 1

2.2.2 MARKET SIZE ESTIMATION - METHOD 2

2.3 DATA TRIANGULATION

2.4 ASSUMPTIONS FOR THE STUDY

2.5 LIMITATIONS OF THE STUDY

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

5.2.1 DRIVERS

5.2.2 RESTRAINTS

5.2.3 OPPORTUNITIES

5.2.4 CHALLENGES

6 INDUSTRY TRENDS

6.1 INTRODUCTION

6.2 VALUE CHAIN/SUPPLY CHAIN ANALYSIS

6.3 TECHNOLOGY ANALYSIS

6.4 PRICING ANALYSIS

6.5 ECOSYSTEM/ MARKET MAP

6.6 TRENDS/ DISRUPTION IMPACTING THE CUSTOMER’S BUSINESS

6.7 PATENT ANALYSIS

6.8 TRADE ANALYSIS

6.9 KEY CONFERENCES AND EVENTS IN 2022-2023

6.10 TARIFF AND REGULATORY LANDSCAPE

6.11 PORTER’S FIVE FORCES ANALYSIS

6.12 KEY STAKEHOLDERS & BUYING CRITERIA

6.13 CASE STUDY ANALYSIS

7 GLUTEN-FREE BAKING MIXES MARKET, BY APPLICATION

7.1 INTRODUCTION

7.2 COOKIES

7.3 CAKES & PASTRIES

7.4 BREAD

7.5 PIZZA

7.6 OTHER APPLICATIONS

8 GLUTEN-FREE BAKING MIXES MARKET, BY DISTRIBUTION CHANNEL

8.1 INTRODUCTION

8.2 SUPERMARKETS & HYPERMARKETS

8.3 HEALTH FOOD STORES

8.4 CONVENIENCE & GROCERY STORES

8.5 OTHER DISTRIBUTION CHANNEL

9 GLUTEN-FREE BAKING MIXES MARKET, BY REGION

9.1 INTRODUCTION

9.2 NORTH AMERICA

9.2.1 US

9.2.2 CANADA

9.2.3 MEXICO

9.3 EUROPE

9.3.1 GERMANY

9.3.2 FRANCE

9.3.3 UK

9.3.4 ITALY

9.3.5 SPAIN

9.3.6 REST OF EUROPE

9.4 ASIA PACIFIC

9.4.1 CHINA

9.4.2 INDIA

9.4.3 JAPAN

9.4.4 AUSTRALIA & NEW ZEALAND

9.4.5 REST OF ASIA PACIFIC

9.5 SOUTH AMERICA

9.5.1 BRAZIL

9.5.2 ARGENTINA

9.5.3 REST OF SOUTH AMERICA

9.6 REST OF THE WORLD

9.6.1 AFRICA

9.6.2 MIDDLE EAST

10 COMPETITIVE LANDSCAPE

10.1 OVERVIEW

10.2 MARKET SHARE ANALYSIS*

10.3 KEY PLAYERS STRATEGIES

10.4 COMPANY REVENUE ANALYSIS OF TOP 5 MARKET PLAYERS

10.5 COMPANY EVALUATION QUADRANT

10.5.1 STARS

10.5.2 EMERGING LEADERS

10.5.3 PERVASIVE PLAYERS

10.5.4 PARTICIPANTS

10.5.5 COMPETITIVE BENCHMARKING

10.6 PRODUCT FOOTPRINTS

10.7 STARTUP/SME EVALUATION QUADRANT

10.7.1 PROGRESSIVE COMPANIES

10.7.2 STARTING BLOCKS

10.7.3 RESPONSIVE COMPANIES

10.7.4 DYNAMIC COMPANIES

10.8 PRODUCT LAUNCHES, DEALS, AND OTHER DEVELOPMENTS

10.8.1 NEW PRODUCT LAUNCHES

10.8.2 DEALS

10.8.3 OTHER DEVELOPMENTS

10.8.4 PARTNERSHIPS, COLLABORATIONS, AND JOINT VENTURES

*Market share analysis will be provided in percentage (value) at Global level

11 COMPANY PROFILES

11.1 PARTAKE FOODS

11.2 CONAGRA BRANDS

11.3 CONTINENTAL MILLS

11.4 KING ARTHUR BAKING COMPANY

11.5 WILLIAMS-SONOMA

11.6 GENERAL MILLS

11.7 SALDOCE FINE FOODS

11.8 KINNIKINNICK FOODS

Note: Currently, list of only 8 companies have been provided. However, this section covers 12-15 key company profiles which include business overview, recent financials, product offerings, key strategies, and swot analysis. recent financials can be provided based on data/information availability in public domain. The list of companies mentioned above can be altered depending upon client’s interest

12 APPENDIX

Note: The TOC prepared above is tentative and may subject to change, based on the research progress

Growth opportunities and latent adjacency in Gluten-free Baking Mixes Market