Global Digital Signal Processors (DSP) Market by Intellectual Property (IP), Design Architecture & Applications (2011 – 2016)

Please click here to get the relevant report of Digital Signal Processors Market, by Core (Single Core, Multi-Core), Configuration (Low-end, Mid-range, High-end), Type (General-purpose, Application-specific), Category, IC Design, Application, End-User Industry and Region - Global Forecast to 2029

The by Core (Single Core, Multi-Core), Configuration (Low-end, Mid-range, High-end), Type (General-purpose, Application-specific), Category, IC Design, Application, End-User Industry and Region - Global Forecast to 2029 global market for DSP has returned to the growing phase after the global economic recession and is expected to grow steadily over the next 5 years. Large scale adoption of digital signal processing in the latest range of consumer electronics has led to increased consumption of DSP chips, which are penetrating several applications that use advanced state-of-the art digital signal processing.

The report analyzes the entire DSP industry’s value chain, giving a bird’s eye-view of all the major allied industry segments to the DSP industry. It discusses the markets of various allied industry segments such as EDA vendors, foundry players, fabless players, fab players, IP vendors, and assembly testing and packaging vendors related to the global DSP market. The global DSP intellectual property market is given special focus and also classified and discussed in detail with market estimates & forecasts and landscapes for each of the DSP IP segments. Extensively detailed analysis of the landscape of each of the individual market segments is done in this report to cover the global DSP market from an in-depth point of view. The market estimates and forecasts of the individual market segments and sub-segments are also analyzed in detail.

Since the report mainly covers the DSP market whose parent market is the global semiconductor market, the report also includes various aspects related to the overall semiconductor industry in several instances throughout the report in various chapters. A comparison of various aspects of each market segment with its parent market (for example, DSP IP market with overall Semiconductor IP market) is done at every possible level to give an idea about the total addressable markets for each market segment and the market penetrations.

The leading players of this industry have also been profiled along with their recent developments and other strategic industry activities. The report includes a complete competitive landscape, along with key growth strategies and market share analysis of the key industry players.

Scope of the report

The scope of this research study includes the market for DSP semiconductor chips (ICs and DSP SoCs) only; electronic systems, modules, packages are not included.

In this report, the global DSP market is fully covered and segmented into/by the following categories and aspects:

Allied Industry Segments & Value Chain: DSP Industry Value Chain Analysis, Dynamics of EDA & Design Tool, IP, Foundry, Fabless, Fab (Fabrication) and Assembly, Testing & Packaging (ATP) vendors and their impact on the DSP market.

Intellectual Property Markets: DSP Core IP, Standard DSP Core IP (Non-Customizable), Customizable DSP Core IP, DSP Application Specific (ASIC) Core IP, DSP Programmable (FPGA & PLD) Core IP markets.

Design Architecture Markets: Product Segment Markets, IC Design Segment markets, DSP System-On-Chips market.

Product Segment Markets: General Purpose DSP ICs, Application Specific DSP ICs, and Programmable DSP IC markets.

IC Design Segment Markets: Standard DSP (Non-Embedded), Embedded DSP, Single-Core DSP Processors, Multi-Core DSP Processors markets.

End-User Application Markets: “Computers” Sector (Super Computers, Mainframe Computers and Computer Servers, Personal Computers, Computer Peripherals), “ICT” Sector (Wireless Communication Applications, Mobile Telecommunication Applications, Surveillance Applications, VoIP Applications), “Consumer Electronics” Sector (Smart Phones, Cameras and Projectors, Portable Media Players, Set-top Boxes and Digital TVs, DVD, Blu-Ray Players & Home Audio-Systems, Printer and Xerox Machines, White Goods), “Automotive” Sector (Automotive Body Electronics, Automotive Infotainment Applications, Automotive Control Systems, Automotive Sensors), “Industrial” Sector (Solid State & Electro-Mechanical Systems, Industrial Automation Applications, Industrial Control Systems, Industrial DSP Sensors), “Medical” Sector (Telemetry Devices, High Voltage Medical Devices, Implantable Medical Devices, Biometric Applications), “RF and Others” Sector (RF Digital Signal Processing Applications, SiGe & BiCMOS-based DSP Products, Radar Communication Applications, Oscilloscope and Analyzer Applications, Nanotechnology Applications).

Geographical Markets: Global Market Perspective, North America, Europe, Japan, APAC (excluding Japan) and Rest of the World (ROW) markets.

Competitive Landscape & Company Profiles: Global competitive landscape, market shares and analysis, market share rankings, recent industry activities such as agreements, technology licenses, partnerships, collaborations, JVs, mergers & acquisitions and new product launches; company profiles of the industry’s key players.

KEY TAKE AWAYS

- Estimated total DSP market sizes in 2010 and 2011 and forecasts till 2016

- Classification of the global DSP market with detailed segmentation by intellectual property, form factor, design architecture, product segments and IC design segments with estimates and forecasts of revenue and volume of all the sub-markets

- The future of the DSP technologies from both - technical and market-oriented perspectives

- Identification of the major driving factors and inhibitors for the global DSP market and their impact analysis

- Analytical growth trends of the DSP market and its individual market segments and the potential revenue bases

- The dynamics of the industry segments in the value chain, effect of changes in landscapes of value chain segments such as IP, EDA & Design Tools, Foundry, Fab, Fabless, IDM, ODM, OEM and ATP on the DSP market

- The global consumption of DSPs in several end-user verticals and their application segments

- The major stakeholders in the market and complete competitive landscape of the market leaders, key player market shares, and rankings added with detailed analysis

- Analytical trends and forecasts of the DSP market specific to various geographical regions across the globe

- Special focus on the DSP IP market segment, with dynamics and influential factors of the DSP IP market and its sub-market segments

A “Digital Signal Processor (DSP)”, as the name suggests, is an ultra-fast semiconductor processor chip used for digital signal processing in a number of end-user applications. The first commercial DSP was manufactured in 1983 by the industry leader, Texas Instruments, Inc. Since then, due to constant need for digital signal processing in computing and digital technology applications, the DSP market has grown substantially with several changes in the DSP architectures, designs, structures over the decades. There has been continuous research carried out with respect to DSP chips that perform exceptionally. DSP has been a crucial segment of the digital semiconductor industry over the years.

DSP implementations have mainly been driven by three core reasons: application-specific specialization, data parallelism, and functional flexibility. In most cases, DSP system implementations witness tradeoffs among these three parameters. As a result, several design tools and specialized hardware like bit-processing and systolic processing have been developed for DSP till date. With innovations in implementation technologies, various approaches are being taken by application designers, in order to ebb away this tradeoff.

Owing to challenging real-time constraints, although performance has always been the most crucial parameter for DSP quality comparison; the past two decades have seen a drift in the same. With rapid migration of DSP from military applications to low cost applications in portable devices like cell phones, laptops, and CD players, cost and power consumption has become an important parameter while selecting a DSP. The evolving DSP market is presently revolving around system flexibility in order to support system functionality changes, at any given point of design life cycle.

In 2011, the global DSP market revenue stood at roughly $6 billion and is forecasted to cross $9 billion in 2016, at a CAGR of 9.09% from 2011 to 2016.

The global DSP market’s value chain has grown to a vast network of several players involved in various segments of the value chain today. There have been tremendous changes in the landscape of the DSP industry value chain with several developments in all the segments such as Fabless, Fab, IDM, ATP (Assembly, Testing & Packaging) and IP segments. The global DSP IP segment is one of the fastest growing value chain segments and the DSP IP market is expected to grow at a CAGR of 20.94%, at a faster rate than the overall semiconductor IP market (CAGR 17.32%), from 2011 to 2016.

The global DSP market is well diversified across all the major geographical regions. Asia-Pacific (excluding Japan) holds the largest share in DSP revenue and volume. Owing to the low labor costs, huge market potential, and flexible government policies, the revenue share from Asia-Pacific is expected to grow at a faster rate than the other geographical regions.

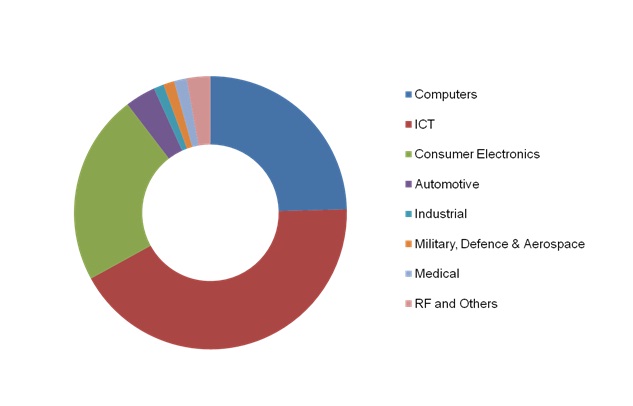

DSP has found its use in endless number of end-user applications pertaining to all the major end-user verticals in the world over the years. The DSP market’s revenue is expected to increase with growth in revenue from all the application sectors – namely, the Computers, ICT, Consumer Electronics, Automotive, Industrial, Military-Aerospace & Defense, Medical, RF and Others, with huge potential revenue bases mainly in the first three sectors. The percentage share of these major end-user verticals in the global DSP market revenue in 2011 is illustrated in the figure below.

GLOBAL DSP MARKET REVENUE SHARE BY APPLICATIONS IN END-USER VERTICALS, 2011 ($MILLION)

Source: MarketsandMarkets Analysis

TABLE OF CONTENTS

1 INTRODUCTION

1.1 KEY TAKE-AWAYS

1.2 ANALYST INSIGHTS

1.3 REPORT DESCRIPTION

1.4 MARKETS COVERED

1.5 STAKEHOLDERS

1.6 RESEARCH METHODOLOGY

1.6.1 MARKET SIZE

1.6.2 MARKET CRACKDOWN

1.6.3 KEY DATA POINTS FROM PRIMARY SOURCES

1.6.4 KEY DATA POINTS FROM SECONDARY SOURCES

1.6.5 ASSUMPTIONS MADE FOR THIS REPORT

2 SUMMARY

3 MARKET OVERVIEW

3.1 INTRODUCTION

3.2 HISTORY & EVOLUTION

3.3 COMPONENTS & BLOCK DIAGRAM OF A DSP

3.4 ALLIED INDUSTRY SEGMENTS TO DSP MARKET

3.4.1 DSP INDUSTRY VALUE CHAIN ANALYSIS

3.4.2 EDA INDUSTRY MARKET OVERVIEW

3.4.3 FOUNDRY INDUSTRY MARKET OVERVIEW

3.4.4 FABLESS INDUSTRY MARKET OVERVIEW

3.4.5 FAB INDUSTRY MARKET OVERVIEW

3.4.6 ASSEMBLY, TESTING & PACKAGING (ATP) MARKET OVERVIEW

3.5 DIGITAL SIGNAL PROCESSOR INTELLECTUAL PROPERTY MARKET

3.5.1 DSP (PROCESSOR) CORE IP MARKET

3.5.1.1 STANDARD DSP CORE IP MARKET

3.5.1.2 CUSTOMIZABLE DSP CORE IP MARKET

3.5.2 DSP ASIC CORE IP MARKET

3.5.3 DSP PROGRAMMABLE (FPGA & PLD) CORE IP MARKET

4 DSP INDUSTRY MARKET ANALYSIS

4.1 GLOBAL DSP INDUSTRY MARKET ESTIMATES AND FORECASTS

4.2 GLOBAL DSP MARKET DYNAMICS

4.2.1 DRIVERS

4.2.1.1 Rapid developments in wireless infrastructure

4.2.1.2 Rising data traffic

4.2.1.3 Emergence of new applications & devices

4.2.1.4 Internet protocol (IP) video surveillance

4.2.2 RESTRAINTS

4.2.2.1 Tradeoff between performance, power consumption & price

4.2.3 OPPORTUNITIES

4.2.3.1 Rising demand for VoIP & IP video

4.2.3.2 Opportunities in emerging economies

4.3 BURNING ISSUES

4.3.1 PROGRAMMING CHALLENGES IN PROGRAMMABLE DSP BASED DEVICES

4.4 WINNING IMPERATIVES

4.4.1 ENHANCED PERFORMANCE, BY MULTICORE PROCESSORS

4.5 PATENT ANALYSIS

5 DSP MARKET, BY DESIGN ARCHITECTURE

5.1 CLASSIFICATION OF DSP MARKET BY PRODUCT SEGMENTS

5.1.1 GENERAL PURPOSE DSP IC MARKET

5.1.2 APPLICATION SPECIFIC DSP IC MARKET

5.1.3 PROGRAMMABLE (FPGA & PLD) DSP IC MARKET

5.2 DSP INDUSTRY MARKET CLASSIFICATION BY IC DESIGN

5.2.1 STANDARD DSP MARKET

5.2.2 EMBEDDED DSP MARKET

5.2.2.1 Single-core DSP processor market

5.2.2.2 Multi-core DSP processor market

5.3 DSP SYSTEM-ON-CHIPS (DSP SOC) MARKET

6 DSP INDUSTRY MARKET BY APPLICATION

6.1 OVERVIEW

6.2 COMPUTERS SECTOR

6.2.1 SUPER COMPUTERS

6.2.2 MAINFRAME COMPUTERS & COMPUTER SERVERS

6.2.3 PERSONAL COMPUTERS

6.2.4 COMPUTER PERIPHERALS

6.3 ICT SECTOR

6.3.1 WIRELESS COMMUNICATION APPLICATIONS

6.3.2 MOBILE TELECOMMUNICATION APPLICATIONS

6.3.3 SURVEILLANCE APPLICATIONS

6.3.4 VOIP APPLICATIONS

6.4 CONSUMER ELECTRONICS SECTOR

6.4.1 SMARTPHONES

6.4.2 CAMERAS & PROJECTORS

6.4.3 PORTABLE MEDIA PLAYERS

6.4.4 SET-TOP BOXES & DIGITAL TVS

6.4.5 DVD, BLU-RAY PLAYERS & HOME AUDIO SYSTEMS

6.4.6 FAX, PRINTERS & PHOTOCOPY MACHINES

6.4.7 WHITE GOODS

6.5 AUTOMOTIVE SECTOR

6.5.1 AUTOMOTIVE BODY ELECTRONICS

6.5.2 AUTOMOTIVE INFOTAINMENT APPLICATIONS

6.5.3 AUTOMOTIVE CONTROL SYSTEMS

6.5.4 AUTOMOTIVE SENSORS

6.6 INDUSTRIAL SECTOR

6.6.1 SOLID STATE & ELECTRO-MECHANICAL SYSTEMS

6.6.2 INDUSTRIAL AUTOMATION APPLICATIONS

6.6.3 INDUSTRIAL CONTROL SYSTEMS

6.6.4 INDUSTRIAL DSP SENSORS

6.7 MILITARY, DEFENSE & AEROSPACE SECTOR

6.7.1 DSP BASED FIELD PROGRAMMABLE ARRAY APPLICATIONS

6.7.2 RAD-HARD ASIC & FPGA BASED DSPS

6.8 MEDICAL SECTOR

6.8.1 MEDICAL TELEMETRY DEVICES

6.8.2 HIGH VOLTAGE MEDICAL DEVICES

6.8.3 IMPLANTABLE MEDICAL DEVICES

6.8.4 BIOMETRIC APPLICATIONS

6.9 RF & OTHERS SECTOR

6.9.1 RF DIGITAL SIGNAL PROCESSING APPLICATIONS

6.9.2 SIGE & BICMOS BASED DSP PRODUCTS

6.9.3 RADAR COMMUNICATION APPLICATIONS

6.9.4 OSCILLOSCOPE & ANALYZER APPLICATIONS

6.9.5 NANOTECHNOLOGY APPLICATIONS

7 DSP MARKET GEOGRAPHIC ANALYSIS

7.1 NORTH AMERICA

7.2 EUROPE

7.3 JAPAN

7.4 APAC (EXCLUDING JAPAN)

7.5 ROW (REST OF THE WORLD)

8 COMPETITIVE LANDSCAPE

8.1 OVERVIEW

8.2 MARKET PLAYERS & MARKET SHARES

8.2.1 DSP MARKET CURRENT SITUATION

8.2.2 DSP MARKET KEY PLAYERS

8.2.3 DSP MARKET SHARE ANALYSIS

8.2.4 DSP INTELLECTUAL PROPERTY (IP) MARKET SHARE ANALYSIS

8.3 COMPETITIVE SITUATION & TRENDS

8.3.1 NEW PRODUCT DEVELOPMENTS & ANNOUNCEMENTS

8.3.2 AGREEMENTS, PARTNERSHIPS, JOINT VENTURES & COLLABORATIONS

8.3.3 MERGERS & ACQUISITIONS

9 COMPANY PROFILES

9.1 ALTERA CORPORATION

9.1.1 OVERVIEW

9.1.2 PRODUCTS & SERVICES

9.1.3 FINANCIALS

9.1.4 STRATEGY

9.1.5 DEVELOPMENTS

9.2 ANALOG DEVICES INCORPORATED

9.2.1 OVERVIEW

9.2.2 PRODUCTS & SERVICES

9.2.3 FINANCIALS

9.2.4 STRATEGY

9.2.5 DEVELOPMENTS

9.3 BROADCOM CORPORATION

9.3.1 OVERVIEW

9.3.2 PRODUCTS & SERVICES

9.3.3 FINANCIALS

9.3.4 STRATEGY

9.3.5 DEVELOPMENTS

9.4 CEVA INCORPORATED

9.4.1 OVERVIEW

9.4.2 PRODUCTS & SERVICES

9.4.3 FINANCIALS

9.4.4 STRATEGY

9.4.5 DEVELOPMENTS

9.5 FREESCALE SEMICONDUCTOR HOLDINGS I, LTD.

9.5.1 OVERVIEW

9.5.2 PRODUCTS & SERVICES

9.5.3 FINANCIALS

9.5.4 STRATEGY

9.5.5 DEVELOPMENTS

9.6 INFINEON TECHNOLOGIES AG

9.6.1 OVERVIEW

9.6.2 PRODUCTS & SERVICES

9.6.3 FINANCIALS

9.6.4 STRATEGY

9.6.5 DEVELOPMENTS

9.7 LSI CORPORATION

9.7.1 OVERVIEW

9.7.2 PRODUCTS & SERVICES

9.7.3 FINANCIALS

9.7.4 STRATEGY

9.7.5 DEVELOPMENTS

9.8 MARVELL TECHNOLOGY GROUP LTD.

9.8.1 OVERVIEW

9.8.2 PRODUCTS & SERVICES

9.8.3 FINANCIALS

9.8.4 STRATEGY

9.8.5 DEVELOPMENTS

9.9 MIPS TECHNOLOGIES INCORPORATED

9.9.1 OVERVIEW

9.9.2 PRODUCTS & SERVICES

9.9.3 FINANCIALS

9.9.4 STRATEGY

9.9.5 DEVELOPMENTS

9.10 NXP SEMICONDUCTORS N.V

9.10.1 OVERVIEW

9.10.2 PRODUCTS & SERVICES

9.10.3 FINANCIALS

9.10.4 STRATEGY

9.10.5 DEVELOPMENTS

9.11 QUALCOMM INCORPORATED

9.11.1 OVERVIEW

9.11.2 PRODUCTS & SERVICES

9.11.3 FINANCIALS

9.11.4 STRATEGY

9.11.5 DEVELOPMENTS

9.12 RENESAS ELECTRONICS CORPORATION

9.12.1 OVERVIEW

9.12.2 PRODUCTS & SERVICES

9.12.3 FINANCIALS

9.12.4 STRATEGY

9.12.5 DEVELOPMENTS

9.13 SAMSUNG ELECTRONICS CO. LTD

9.13.1 OVERVIEW

9.13.2 PRODUCTS & SERVICES

9.13.3 FINANCIALS

9.13.4 STRATEGY

9.13.5 DEVELOPMENTS

9.14 STMICROELECTRONICS N.V.

9.14.1 OVERVIEW

9.14.2 PRODUCTS & SERVICES

9.14.3 FINANCIALS

9.14.4 STRATEGY

9.14.5 DEVELOPMENTS

9.15 TEXAS INSTRUMENTS INCORPORATED

9.15.1 OVERVIEW

9.15.2 PRODUCTS & SERVICES

9.15.3 FINANCIALS

9.15.4 STRATEGY

9.15.5 DEVELOPMENTS

9.16 TOSHIBA CORPORATION

9.16.1 OVERVIEW

9.16.2 PRODUCTS & SERVICES

9.16.3 FINANCIALS

9.16.4 STRATEGY

9.16.5 DEVELOPMENTS

9.17 XILINX INCORPORATED

9.17.1 OVERVIEW

9.17.2 PRODUCTS & SERVICES

9.17.3 FINANCIALS

9.17.4 STRATEGY

9.17.5 DEVELOPMENTS

APPENDIX

U.S. PATENTS

EUROPE PATENTS

JAPAN PATENTS

BILL OF MATERIALS

KEY SECONDARY SOURCES

RECOMMENDED READINGS

LIST OF TABLES

TABLE 1 DSP MARKET REVENUE, BY GEOGRAPHY, 2010 – 2016 ($MILLION)

TABLE 2 GLOBAL DSP MARKET REVENUE ($BILLION) & VOLUME (BILLION UNITS), 2005 – 2011

TABLE 3 DSP IP MARKET REVENUE ($MILLION) & SHARE (%) IN GLOBAL IP MARKET, 2010 – 2016

TABLE 4 GLOBAL DSP MARKET REVENUE ($BILLION) & REVENUE SHARE (%), 2010 – 2016

TABLE 5 COMPARISON OF VARIOUS TYPES OF DSPS

TABLE 6 DSP MARKET REVENUE, BY PRODUCT SEGMENTS, 2010 – 2016 ($MILLION)

TABLE 7 DSP MARKET VOLUME, BY PRODUCT SEGMENTS, 2010 – 2016 (MILLION UNITS)

TABLE 8 DSP MARKET REVENUE, BY INTEGRATED CIRCUIT DESIGN, 2010 – 2016 ($MILLION)

TABLE 9 DSP MARKET VOLUME, BY INTEGRATED CIRCUIT DESIGN, 2010 – 2016 (MILLION UNITS)

TABLE 10 COMPUTERS SECTOR: DSP MARKET REVENUE, BY SEGMENT, 2010 – 2016 ($MILLION)

TABLE 11 COMPUTERS SECTOR: DSP MARKET VOLUME, BY SEGMENT, 2010 – 2016 (MILLION UNITS)

TABLE 12 ICT SECTOR: DSP MARKET REVENUE, BY SEGMENT, 2010 – 2016 ($MILLION)

TABLE 13 ICT SECTOR MARKET: DSP MARKET VOLUME, BY SEGMENT, 2010 – 2016 (MILLION UNITS)

TABLE 14 CONSUMER ELECTRONICS SECTOR: DSP MARKET REVENUE, BY SEGMENT ($MILLION), 2010 – 2016

TABLE 15 CONSUMER ELECTRONICS SECTOR: DSP MARKET VOLUME, BY SEGMENT, 2010 - 2016, (MILLION UNITS)

TABLE 16 AUTOMOTIVE SECTOR: DSP MARKET REVENUE, BY SEGMENT ($MILLION), 2010 – 2016

TABLE 17 AUTOMOTIVE SECTOR: DSP MARKET VOLUME, BY SEGMENT, 2010 – 2016 (MILLION UNITS)

TABLE 18 INDUSTRIAL SECTOR: DSP MARKET REVENUE, BY SEGMENT, 2010 – 2016 ($MILLION)

TABLE 19 INDUSTRIAL SECTOR: DSP MARKET VOLUME, BY SEGMENT, 2010 – 2016 (MILLION UNITS)

TABLE 20 MILITARY, DEFENSE & AEROSPACE SECTOR: DSP MARKET REVENUE, BY SEGMENT, 2010 – 2016 ($MILLION)

TABLE 21 MILITARY, DEFENSE & AEROSPACE SECTOR: DSP MARKET VOLUME, BY SEGMENT, 2010 – 2016 (MILLION UNITS)

TABLE 22 MEDICAL SECTOR: DSP MARKET REVENUE, BY SEGMENT, 2010 – 2016 ($MILLION)

TABLE 23 MEDICAL SECTOR: DSP MARKET VOLUME, BY SEGMENT, 2010 – 2016 (MILLION UNITS)

TABLE 24 RF & OTHERS SECTOR MARKET: DSP MARKET REVENUE, BY SEGMENT, 2010 – 2016 (MILLION)

TABLE 25 RF & OTHERS SECTOR: DSP MARKET VOLUME, BY SEGMENT, 2010 – 2016 (MILLION UNITS)

TABLE 26 DSP MARKET VOLUME, BY GEOGRAPHY, 2010 – 2016 (MILLION UNITS)

TABLE 27 GLOBAL DSP MARKET CURRENT SITUATION ($MILLION), 2011 (E)

TABLE 28 GLOBAL DSP KEY PLAYER REVENUES, 2009 – 2011(E) ($MILLION)

TABLE 29 GLOBAL DSP MARKET PLAYERS MARKET SHARES & RANKINGS, BY REVENUE, 2009 – 2010 ($MILLION)

TABLE 30 GLOBAL DSP IP KEY PLAYERS MARKET SHARES & RANKINGS, BY REVENUE, 2009 – 2010 ($MILLION)

TABLE 31 NEW PRODUCT DEVELOPMENTS, 2008 – 2011

TABLE 32 AGREEMENTS, PARTNERSHIPS, JOINT VENTURES & COLLABORATIONS, 2008 – 2011

TABLE 33 MERGERS & ACQUISITIONS, 2009 – 2011

TABLE 34 ALTERA CORPORATION: MARKET REVENUE, BY PRODUCT, 2009 – 2010 ($MILLION)

TABLE 35 ALTERA CORPORATION: MARKET REVENUE, BY SEGMENT, 2009 – 2010 ($MILLION)

TABLE 36 ALTERA CORPORATION: MARKET REVENUE, BY GEOGRAPHY, 2009 – 2010 ($MILLION)

TABLE 37 ANALOG DEVICES: MARKET REVENUE, BY PRODUCT & SERVICES, 2010 – 2011 ($MILLION)

TABLE 38 ANALOG DEVICES: MARKET REVENUE, BY SEGMENTS, 2010 – 2011 ($MILLION)

TABLE 39 ANALOG DEVICES: MARKET REVENUE, BY GEOGRAPHY, 2010 – 2011 ($MILLION)

TABLE 40 BROADCOM CORPORATION: MARKET REVENUE, BY SEGMENT, 2009 – 2010 ($MILLION)

TABLE 41 CEVA INC.: MARKET REVENUE, BY SEGMENT, 2009 – 2010 ($MILLION)

TABLE 42 CEVA INC.: MARKET REVENUE, BY GEOGRAPHY, 2009 – 2010 ($MILLION)

TABLE 43 FREESCALE SEMICONDUCTOR: MARKET REVENUE, BY PRODUCT, 2009 – 2010 ($MILLION)

TABLE 44 FREESCALE SEMICONDUCTOR: MARKET REVENUE, BY GEOGRAPHY, 2010 – 2011 ($MILLION)

TABLE 45 INFINEON TECHNOLOGIES: MARKET REVENUE, BY SEGMENT, 2010 – 2011 ($MILLION)

TABLE 46 INFINEON TECHNOLOGIES: MARKET REVENUE, BY GEOGRAPHY, 2010 – 2011 ($MILLION)

TABLE 47 LSI CORPORATION: MARKET REVENUE, BY SEGMENT, 2009 – 2010 ($MILLION)

TABLE 48 LSI CORPORATION: MARKET REVENUE, BY GEOGRAPHY, 2009 – 2010 ($MILLION)

TABLE 49 MARVELL: MARKET REVENUE, BY SEGMENT, 2010 – 2011 ($MILLION)

TABLE 50 MARVELL: MARKET REVENUE, BY GEOGRAPHY, 2010 – 2011 ($MILLION)

TABLE 51 MIPS TECHNOLOGIES: MARKET REVENUE, BY SEGMENT, 2010 – 2011 ($MILLION)

TABLE 52 MIPS TECHNOLOGIES: MARKET REVENUE, BY GEOGRAPHY, 2010 – 2011 ($MILLION)

TABLE 53 NXP SEMICONDUCTORS: MARKET REVENUE, BY SEGMENTS, 2009 – 2010 ($MILLION)

TABLE 54 NXP SEMICONDUCTORS: MARKET REVENUE, BY GEOGRAPHY, 2009 – 2010 ($MILLION)

TABLE 55 QUALCOMM INC.: MARKET REVENUE, BY SEGMENTS, 2010 – 2011 ($MILLION)

TABLE 56 QUALCOMM INC.: MARKET REVENUE, BY GEOGRAPHY, 2010 – 2011 ($MILLION)

TABLE 57 RENESAS ELECTRONICS: MARKET REVENUE, BY SEGMENTS, 2011 ($MILLION)

TABLE 58 STMICROELECTRONICS: MARKET REVENUE, BY SEGMENT, 2009 – 2010 ($MILLION)

TABLE 59 STMICROELECTRONICS: MARKET REVENUE, BY GEOGRAPHY, 2009 – 2010 ($MILLION)

TABLE 60 TEXAS INSTRUMENTS: MARKET REVENUE, BY SEGMENTS, 2009 – 2010 ($MILLION)

TABLE 61 TEXAS INSTRUMENTS: MARKET REVENUE, BY GEOGRAPHY, 2009 – 2010 ($MILLION)

TABLE 62 TOSHIBA CORPORATION: MARKET REVENUE, BY SEGMENTS, 2010 – 2011 ($MILLION)

TABLE 63 TOSHIBA CORPORATION: MARKET REVENUE, BY GEOGRAPHY, 2010 – 2011 ($MILLION)

TABLE 64 XILINX INC: MARKET REVENUE, BY GEOGRAPHY, 2010 – 2011 ($MILLION)

LIST OF FIGURES

FIGURE 1 DSP MARKETS COVERED TREE STRUCTURE

FIGURE 2 DSP MARKET CLASSIFICATION

FIGURE 3 DSP MARKET RESEARCH METHODOLOGY

FIGURE 4 DSP MARKET CRACKDOWN STRATEGY

FIGURE 5 DSP MARKET OVERVIEW

FIGURE 6 SAMPLING A WAVEFORM FOR DSP

FIGURE 7 BLOCK DIAGRAM OF A DIGITAL SIGNAL PROCESSOR, DSP

FIGURE 8 BLOCK DIAGRAM OF A DSP DESIGNER

FIGURE 9 KEY COMPONENT BLOCKS INSIDE A DSP

FIGURE 10 DSP INDUSTRY VALUE CHAIN ANALYSIS

FIGURE 11 CLASSIFICATION OF DSP ALLIED INDUSTRY SEGMENTS

FIGURE 12 DSP TOOLS AND METHODOLOGIES EDA ROADMAP

FIGURE 13 CLASSIFICATION OF DSP INTELLECTUAL PROPERTY MARKET

FIGURE 14 DSP CORE IP MARKET REVENUE ($MILLION) & VOLUME (MILLION UNITS), 2010 – 2016

FIGURE 15 STANDARD DSP CORE IP MARKET REVENUE ($MILLION) & VOLUME (MILLION UNITS), 2010 – 2016

FIGURE 16 CUSTOMIZABLE DSP CORE IP MARKET REVENUE ($MILLION) & VOLUME (MILLION UNITS), 2010 – 2016

FIGURE 17 DSP ASIC CORE IP MARKET REVENUE ($MILLION) & VOLUME (MILLION UNITS), 2010 – 2016

FIGURE 18 DSP PROGRAMMABLE CORE IP MARKET REVENUE ($MILLION) & VOLUME (MILLION UNITS), 2010 – 2016

FIGURE 19 DSP MARKET ANALYSIS TREE STRUCTURE

FIGURE 20 GLOBAL DSP & SEMICONDUCTOR MARKET REVENUE, 2006 – 2016 ($BILLION)

FIGURE 21 GLOBAL DSP MARKET REVENUE ($BILLION) & VOLUME (BILLION UNITS), 2010 – 2016

FIGURE 22 IMPACT ANALYSIS OF DRIVERS

FIGURE 23 INCREASING MOBILE DATA TRAFFIC (EXABYTES/MONTH)

FIGURE 24 IMPACT ANALYSIS OF RESTRAINTS

FIGURE 25 IMPACT ANALYSIS OF OPPORTUNITIES

FIGURE 26 DSP PERFORMANCE ENHANCEMENT (1982 – 2010)

FIGURE 27 DSP PATENT ANALYSIS, BY GEOGRAPHY

FIGURE 28 CLASSIFICATION OF DSP MARKET BY DESIGN ARCHITECTURE

FIGURE 29 DSP IMPLEMENTATION SPECTRUM

FIGURE 30 GENERAL PURPOSE DSP IC MARKET REVENUE ($MILLION) & VOLUME (MILLION UNITS), 2010 – 2016

FIGURE 31 APPLICATION SPECIFIC DSP IC MARKET REVENUE ($MILLION) & VOLUME (MILLION UNITS), 2010 – 2016

FIGURE 32 PROGRAMMABLE DSP IC MARKET REVENUE ($MILLION) & VOLUME (MILLION UNITS), 2010 – 2016

FIGURE 33 STANDARD DSP MARKET REVENUE ($MILLION) & VOLUME (MILLION UNITS), 2010 – 2016

FIGURE 34 EMBEDDED DSP MARKET REVENUE ($MILLION) & VOLUME (MILLION UNITS), 2010 – 2016

FIGURE 35 SINGLE-CORE DSP MARKET REVENUE ($MILLION) & VOLUME (MILLION UNITS), 2010 – 2016

FIGURE 36 SYSTEM ARCHITECTURE OF A TYPICAL MULTI-CORE DSP PLATFORM

FIGURE 37 INTERCONNECT TYPES OF MULTI-CORE DSP ARCHITECTURES – (A) HIERARCHICAL NETWORK & (B) MESH NETWORK

FIGURE 38 MULTI-CORE DSP MARKET REVENUE ($MILLION) & VOLUME (MILLION UNITS), 2010 – 2016

FIGURE 39 DSP SYSTEM-ON-CHIPS MARKET REVENUE ($MILLION) & VOLUME (MILLION UNITS), 2010 - 2016

FIGURE 40 CLASSIFICATION OF DSP MARKET BY APPLICATION

FIGURE 41 SHARE OF END USER VERTICALS IN DSP REVENUE, 2011 ($MILLION)

FIGURE 42 SHARE OF END USER VERTICALS IN DSP VOLUME, 2011 (MILLION UNITS)

FIGURE 43 SUB-CLASSIFICATION OF DSP MARKET, COMPUTERS SECTOR

FIGURE 44 COMPUTER SECTOR: DSP MARKET REVENUE ($MILLION) & VOLUME (MILLION UNITS), 2010 – 2016

FIGURE 45 SUPER COMPUTERS: DSP MARKET REVENUE ($MILLION) & VOLUME (MILLION UNITS), 2010 – 2016

FIGURE 46 MAINFRAME COMPUTERS & COMPUTER SERVERS: DSP MARKET REVENUE ($MILLION) & VOLUME (MILLION UNITS), 2010 – 2016

FIGURE 47 PERSONAL COMPUTERS: DSP MARKET REVENUE ($MILLION) & VOLUME (MILLION UNITS), 2010 – 2016

FIGURE 48 COMPUTER PERIPHERALS: DSP MARKET REVENUE ($MILLION) & VOLUME (MILLION UNITS), 2010 – 2016

FIGURE 49 DSP MARKET IN ICT SECTOR

FIGURE 50 ICT SECTOR: DSP MARKET REVENUE ($MILLION) & VOLUME (MILLION UNITS), 2010 – 2016

FIGURE 51 WIRELESS COMMUNICATION APPLICATIONS: DSP MARKET REVENUE ($MILLION) & VOLUME (MILLION UNITS), 2010 – 2016

FIGURE 52 MOBILE TELECOMMUNICATION APPLICATIONS: DSP MARKET REVENUE ($MILLION) & VOLUME (MILLION UNITS), 2010 – 2016

FIGURE 53 SURVEILLANCE APPLICATIONS: DSP MARKET REVENUE ($MILLION) & VOLUME (MILLION UNITS), 2010 – 2016

FIGURE 54 VOIP APPLICATIONS: DSP MARKET REVENUE ($MILLION) & VOLUME (MILLION UNITS), 2010 – 2016

FIGURE 55 DSP MARKET IN CONSUMER ELECTRONICS SECTOR

FIGURE 56 CONSUMER ELECTRONICS SECTOR: DSP MARKET REVENUE ($MILLION) & VOLUME (MILLION UNITS), 2010 – 2016

FIGURE 57 SMARTPHONES: DSP MARKET REVENUE ($MILLION) & VOLUME (MILLION UNITS), 2010 – 2016

FIGURE 58 CAMERAS AND PROJECTORS: DSP MARKET REVENUE ($MILLION) & VOLUME (MILLION UNITS), 2010 – 2016

FIGURE 59 PORTABLE MEDIA PLAYERS: DSP MARKET REVENUE ($MILLION) & VOLUME (MILLION UNITS), 2010 – 2016

FIGURE 60 SET-TOP BOXES & DIGITAL TV: DSP MARKET REVENUE ($MILLION) & VOLUME (MILLION UNITS), 2010 – 2016

FIGURE 61 DVD, BLU-RAY PLAYERS AND HOME AUDIO SYSTEMS: DSP MARKET REVENUE ($MILLION) & VOLUME (MILLION UNITS), 2010 – 2016

FIGURE 62 FAX, PRINTER AND PHOTOCOPY MACHINES: DSP MARKET REVENUE ($MILLION) & VOLUME (MILLION UNITS), 2010 – 2016

FIGURE 63 WHITE GOODS: DSP MARKET REVENUE ($MILLION) & VOLUME (MILLION UNITS), 2010 – 2016

FIGURE 64 SUB-CLASSIFICATION OF DSP MARKET, AUTOMOTIVE SECTOR

FIGURE 65 AUTOMOTIVE SECTOR: DSP MARKET REVENUE ($MILLION) & VOLUME (MILLION UNITS), 2010 – 2016

FIGURE 66 AUTOMOTIVE BODY ELECTRONICS: DSP MARKET REVENUE (MILLION) & VOLUME (MILLION UNITS), 2010 – 2016

FIGURE 67 AUTOMOTIVE INFOTAINMENT APPLICATIONS: DSP MARKET REVENUE (MILLION) & VOLUME (MILLION UNITS), 2010 – 2016

FIGURE 68 AUTOMOTIVE CONTROL SYSTEMS: DSP MARKET REVENUE (MILLION) & VOLUME (MILLION UNITS), 2010 – 2016

FIGURE 69 AUTOMOTIVE SENSORS: DSP MARKET REVENUE (MILLION) & VOLUME (MILLION UNITS), 2010 – 2016

FIGURE 70 CLASSIFICATION OF DSP MARKET, INDUSTRIAL SECTOR

FIGURE 71 INDUSTRIAL SECTOR: DSP MARKET REVENUE (MILLION) & VOLUME (MILLION UNITS), 2010 – 2016

FIGURE 72 SOLID STATE & ELECTRO-MECHANICAL INDUSTRIAL SYSTEMS: DSP MARKET REVENUE (MILLION) & VOLUME (MILLION UNITS), 2010 – 2016

FIGURE 73 INDUSTRIAL AUTOMATION APPLICATIONS: DSP MARKET REVENUE (MILLION) & VOLUME (MILLION UNITS), 2010 – 2016

FIGURE 74 INDUSTRIAL CONTROL SYSTEMS: DSP MARKET REVENUE (MILLION) & VOLUME (MILLION UNITS), 2010 – 2016

FIGURE 75 INDUSTRIAL DSP SENSORS: DSP MARKET REVENUE (MILLION) & VOLUME (MILLION UNITS), 2010 – 2016

FIGURE 76 CLASSIFICATION OF DSP MARKET, MILITARY, AEROSPACE & DEFENSE SECTOR

FIGURE 77 DSP MARKET IN MILITARY, DEFENSE AND AEROSPACE SECTOR REVENUE (MILLION) & VOLUME (MILLION UNITS), 2010 – 2016

FIGURE 78 DSP BASED FIELD PROGRAMMABLE ARRAY APPLICATIONS: DSP MARKET REVENUE (MILLION) & VOLUME (MILLION UNITS), 2010 – 2016

FIGURE 79 RAD-HARD ASIC & FPGA DSP: DSP MARKET REVENUE (MILLION) & VOLUME, 2010 – 2016 (MILLION UNITS)

FIGURE 80 CLASSIFICATION OF DSP MARKET, MEDICAL SECTOR

FIGURE 81 MEDICAL SECTOR: DSP MARKET REVENUE (MILLION) & VOLUME (MILLION UNITS), 2010 – 2016

FIGURE 82 MEDICAL TELEMETRY DEVICES: DSP MARKET REVENUE (MILLION) & VOLUME (MILLION UNITS), 2010 – 2016

FIGURE 83 HIGH VOLTAGE MEDICAL DEVICES: DSP MARKET REVENUE (MILLION) & VOLUME (MILLION UNITS), 2010 – 2016

FIGURE 84 IMPLANTABLE MEDICAL DEVICES: DSP MARKET REVENUE (MILLION) & VOLUME (MILLION UNITS), 2010 – 2016

FIGURE 85 BIOMETRIC APPLICATIONS: DSP MARKET REVENUE (MILLION) & VOLUME (MILLION UNITS), 2010 – 2016

FIGURE 86 CLASSIFICATION OF DSP MARKET, RF & OTHER SECTORS

FIGURE 87 RF & OTHERS SECTOR: DSP MARKET REVENUE (MILLION) & VOLUME (MILLION UNITS), 2010 – 2016

FIGURE 88 RF DIGITAL SIGNAL PROCESSING APPLICATIONS: DSP MARKET REVENUE (MILLION) & VOLUME (MILLION UNITS), 2010 – 2016

FIGURE 89 SIGE AND BICMOS BASED PRODUCTS: DSP MARKET REVENUE (MILLION) & VOLUME (MILLION UNITS), 2010 – 2016

FIGURE 90 RADAR COMMUNICATION APPLICATIONS: DSP MARKET REVENUE (MILLION) & VOLUME (MILLION UNITS), 2010 – 2016

FIGURE 91 OSCILLOSCOPE AND ANALYZER APPLICATIONS: DSP MARKET REVENUE (MILLION) & VOLUME (MILLION UNITS), 2010 – 2016

FIGURE 92 NANOTECHNOLOGY APPLICATIONS: DSP MARKET REVENUE (MILLION) & VOLUME (MILLION UNITS), 2010 – 2016

FIGURE 93 CLASSIFICATION OF DSP MARKET, BY GEOGRAPHY

FIGURE 94 DSP MARKET REVENUE, BY GEOGRAPHY, 2010 – 2016 (%)

FIGURE 95 DSP MARKET VOLUME, BY GEOGRAPHY, 2010 – 2016 (%)

FIGURE 96 NORTH AMERICA: DSP MARKET REVENUE ($MILLION) & VOLUME (MILLION UNITS), 2010 – 2016

FIGURE 97 EUROPE: DSP MARKET REVENUE (MILLION) & VOLUME (MILLION UNITS), 2010 – 2016

FIGURE 98 JAPAN: DSP MARKET REVENUE (MILLION) & VOLUME (MILLION UNITS), 2010 – 2016

FIGURE 99 APAC (EXCLUDING JAPAN): DSP MARKET REVENUE (MILLION) & VOLUME (MILLION UNITS), 2010 – 2016

FIGURE 100 ROW: DSP MARKET REVENUE (MILLION) & VOLUME (MILLION UNITS), 2010 – 2016

FIGURE 101 GLOBAL DSP KEY PLAYERS MARKET SHARES, 2009 – 2010

FIGURE 102 DSP IP MARKET SHARE ANALYSIS, 2009 – 2010

FIGURE 103 APPLE IPAD BILL OF MATERIALS (ESTIMATED), 2010

Growth opportunities and latent adjacency in Global Digital Signal Processors (DSP) Market