GigE Camera Market by Type (Line and Area), Imaging Technology (CMOS, CCD), Application (Pharmaceutical, Security & Surveillance, Transportation, Automotive, Defense, Packaging ) and Geography - Global Forecast to 2020

GigE cameras are based on the GigE vision interface standard developed for cameras that transmit images over gigabit Ethernet. It is mainly useful for applications that require a high rate of data transfer over long cable distances with low cost cabling. APAC is the major market for GigE cameras and is expected to grow at the highest rate in next five years. The application market for the GigE camera can be divided into manufacturing and non-manufacturing segment. The market for the Intelligent Transportation System and Security & Surveillance segment is expected to account for a major share during the forecast period.

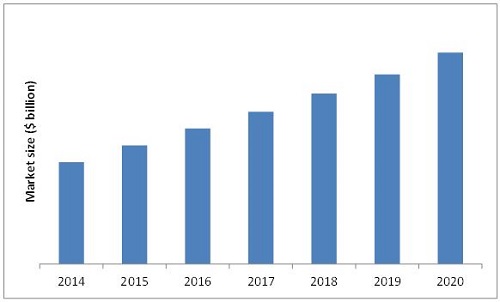

The report provides profiles of all major companies in the GigE camera market. It also provides the competitive landscape of key players, which indicate the growth strategy of the market. It covers the entire value chain for the market from a raw material supplier to an end user. Along with the value chain, this report also provides an in-depth view on the market segmentation such as application, technology, type, and geography. The growth of the GigE camera market is expected to be remarkable; it is expected to reach a market size of $1.2 Billion by 2020, at a CAGR of 12.27% between 2015 and 2020.

The report provides the market dynamics such as drivers, restraints, and opportunities. Apart from the market segmentation, the report also includes the critical market data and qualitative information for each product type along with the qualitative analysis, such as the Porter’s five force analysis, value chain analysis, and market breakdown analysis.

The key players in this industry include Teledyne DALSA (Canada), Basler AG (Germany), Allied Vision GmbH (Germany), Jai (Denmark), Point Grey Research, Inc. (Canada), Toshiba Teli Corporation (Japan), Baumer Optronic GmbH (Germany),Sony Corporation (Japan), Matrox Electronic Systems Ltd (Canada), Qualitas Technologies ( India) among others.

Market, by technology:

The technology segment includes CMOS and CCD sensor technologies.

Market, by type:

The major types considered for analyses are: Area scan and Line scan

Market, by application:

The application market is classified into manufacturing and non-manufacturing segments.

Market, by geography:

The GigE camera market is segmented by geography into four different regions; namely, North America, Europe, APAC, and RoW.

GigE cameras are used for capturing high speed images, video, and related data over Ethernet networks using low cost standard cables such as CAT 5 and CAT 6. They are broadly classified into CCD (Charge Coupled Device) and CMOS (Complementary Metal Oxide Semiconductor) technology based cameras. The CMOS-based cameras are currently gaining market share over CCD cameras because of their improved image quality, resolution, and lower cost compared to CCD- sensor based cameras. CMOS basically has a high price/performance ratio compared to CCD sensors. Areas scan GigE cameras are more significantly being used for the non-manufacturing segment, while line cameras find a major application in the manufacturing segment.

Among all applications, security and surveillance is expected to be the largest contributor to the overall GigE camera market of the non-manufacturing segment, in 2014. The Intelligent Transportation System (ITS) application is estimated to have the highest growth potential during 2015 to 2020 in GigE camera market.

The market for non-manufacturing GigE camera applications such as security and surveillance, and intelligent transportation system is dominated by APAC region. These cameras are used in various ITS applications such as electronic tolling, speed enforcement, and travel time information.

The report is segmented into technology, type, application, and geography; each of these segments is further divided into sub-segments. The total GigE camera market is expected to reach $1.2 Billion by 2020, at a CAGR of 12.27% between 2015 and 2020. Sony Corporation (Japan) dominates the CMOS sensor segment for vision cameras, whereas Basler AG (Germany) dominates the overall GigE camera market.

Some of the other major players in the market are Teledyne Dalsa, Inc. (Canada), Allied Vision GmbH (Germany), Jai (Denmark), Point Grey Research, Inc. (Canada), Baumer Optronic GmbH (Germany), Matrox Electronic Systems Ltd (Canada), Sony Corporation (Japan) and Toshiba Teli Corporation (Japan).

Global GigE Camera Market (2014–2020)

Source: MarketsandMarkets analysis

Table of Contents

1 Introduction (Page No. - 12)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 15)

2.1 Secondary Data

2.1.1 Key Data From Secondary Sources

2.2 Primary Data

2.2.1 Key Data From Primary Sources

2.2.2 Key Industry Insights

2.3 Market Size Estimation

2.3.1 Bottom-Up Approach

2.3.2 Top-Down Approach

2.4 Market Breakdown & Data Triangulation

2.5 Research Assumptions

3 Cover Story (Page No. - 23)

4 Executive Summary (Page No. - 25)

5 Premium Insights (Page No. - 30)

5.1 Attractive Opportunities in the GigE Camera Market

5.2 Market – Product Segments

5.3 Market in Asia-Pacific Region, 2014

5.4 APAC is Expected to Be the Fastest Growing Region in the Market From 2015 to 2020

5.5 Market: Application (2020)

5.6 Life Cycle Analysis, By Geography

6 Market Overview (Page No. - 35)

6.1 Introduction

6.2 Market Segmentation

6.3 Market Dynamics

6.3.1 Drivers

6.3.1.1 Highly Efficient Video Transmission With Simple Configuration and Distribution Options

6.3.1.2 Increased Triggering and Synchronization

6.3.2 Restraints

6.3.2.1 Requirement of Universal Drivers for Interoperability

6.3.2.2 Increased CPU Load

6.3.3 Opportunities

6.3.3.1 Manufacturing Opportunities in China and India

6.3.3.2 Multi-Camera Networking Likely to Create Opportunities for Intelligent Traffic Systems (ITS) and Security Applications

6.3.4 Challenges

6.3.4.1 Educating Users on Rapidly Changing Machine Vision Standards

7 Industry Trends (Page No. - 43)

7.1 Introduction

7.2 Value Chain Analysis

7.2.1 Component Manufacturing

7.2.2 Original Device Manufacturing

7.2.3 Original Device Manufacturing and System Integration

7.2.4 End Users

7.3 Porter’s Five Forces Analysis

7.3.1 Threat of New Entrants

7.3.2 Threat of Substitutes

7.3.3 Bargaining Power of Buyers

7.3.4 Bargaining Power of Suppliers

7.3.5 Intensity of Competitive Rivalry

7.4 Industry Trends

8 GigE Camera Market, By Type (Page No. - 49)

8.1 Introduction

8.1.1 Line Scan Camera

8.1.2 Area Scan Camera

9 GigE Camera Market, By Imaging Technology (Page No. - 53)

9.1 Introduction

9.2 Complementary Metal–Oxide–Semiconductor (CMOS)

9.3 Charge Coupled Device (CCD)

10 GigE Camera Market, By Application (Page No. - 60)

10.1 Introduction

10.2 Applications of GigE Cameras in the Manufacturing Segment

10.2.1 Introduction

10.2.2 Automotive

10.2.3 IC/Semiconductor & Electrical/Electronics

10.2.3.1 IC/Semiconductor

10.2.3.2 Consumer Electronics

10.2.4 Food & Packaging

10.2.5 Pharmaceutical/Medical Device Manufacturing

10.2.5.1 Pharmaceutical

10.2.5.2 Medical Devices

10.2.6 Printing/Publishing

10.2.7 Miscellaneous Manufacturing Applications

10.3 Applications of GigE Cameras in the Non-Manufacturing Segment

10.3.1 Introduction

10.3.2 Medical Imaging & Lab Automation

10.3.3 Postal and Logistics

10.3.4 Security and Surveillance

10.3.5 Military & Defense

10.3.6 Intelligent Transportation System (ITS)

10.3.7 Miscellaneous Non-Manufacturing Applications

11 Geographic Analysis (Page No. - 75)

11.1 Introduction

11.2 North America

11.3 Europe

11.4 APAC

11.5 RoW

12 Competitive Landscape (Page No. - 84)

12.1 Overview

12.2 Market: Comparative Analysis

12.3 Market Ranking Analysis, Market, 2014

12.4 Competitive Situation and Trends

12.4.1 New Product Launches

12.4.2 Agreements, Partnerships, Collaborations, and Joint Ventures

12.4.3 Alliances, Mergers and Acquisitions

12.4.4 Other Developments

13 Company Profiles (Page No. - 89)

(Overview, Products and Services, Financials, Strategy & Development)*

13.1 Introduction

13.2 Allied Vision Technologies, GmbH

13.3 Basler AG

13.4 Baumer Group

13.5 JAI

13.6 Matrox Electronic Systems Ltd.

13.7 Pleora Technologies

13.8 Point Grey Research Inc.

13.9 Qualitas Technologies Pvt Ltd

13.10 Sony Electronics Inc.

13.11 Teledyne Dalsa Inc

13.12 Toshiba Teli Corporation

13.13 Vision Components GmbH

*Details on Overview, Products and Services, Financials, Strategy & Development Might Not Be Captured in Case of Unlisted Companies.

14 Appendix (Page No. - 113)

14.1 Insights of Industry Experts

14.2 Discussion Guide

14.3 Introducing RT: Real Time Market Intelligence

14.4 Available Customizations

14.5 Related Reports

List of Tables (41 Tables)

Table 1 Exceptional Features of GigE Vision Compatibility for Machine Vision Cameras is Propelling the Growth of the Market

Table 2 Changing Customer Requirement is Restraining the Growth of Market

Table 3 Increasing Manufacturing Opportunities and Technological Advancements are Creating Growth Avenues for Players in the Market

Table 4 Rapid Change in Technology is A Major Challenge for the Market

Table 5 Global GigE Camera Market Size, By Type, 2014–2020 ($Million)

Table 6 GigE Camera Market Size, By Line Scan Type, 2014–2020 ($Million)

Table 7 GigE Camera Market Size, By Area Scan Type, 2014–2020 ($Million)

Table 8 Global GigE Camera Market Size, By Imaging Technology, 2014–2020 ($Million)

Table 9 CMOS-Based GigE Camera Market Size, By Application Segment, 2014–2020 ($Million)

Table 10 CMOS-Based GigE Camera Market Size, By Manufacturing Application, 2014–2020 ($Million)

Table 11 CMOS-Based GigE Camera Market Size, By Non-Manufacturing Application, 2014–2020 ($Million)

Table 12 CCD-Based GigE Camera Market Size, By Application, 2014–2020 ($Million)

Table 13 CCD-Based GigE Camera Market Size, By Manufacturing Application, 2014–2020 ($Million)

Table 14 CCD-Based GigE Camera Market Size, By Non-Manufacturing Application, 2014–2020 ($Million)

Table 15 Global Market Size, By Application, 2014–2020 ($Million)

Table 16 Market Size, By Manufacturing Application, 2014–2020 ($Million)

Table 17 Market Size for Manufacturing Application, By Region, 2014–2020 ($Million)

Table 18 Market Size for Automotive Manufacturing Application, By Geography, 2014-2020 ($Million)

Table 19 Market Size for IC/Semiconductor & Electrical/Electronics Manufacturing Application, By Geography, 2014-2020 ($Million)

Table 20 Market Size for Food & Packaging Manufacturing Application, By Geography, 2014-2020 ($Million)

Table 21 Market Size for Pharmaceutical/Medical Device Manufacturing Application , By Geography, 2014-2020 ($Million)

Table 22 Market Size for Printing/Publishing Manufacturing Application, By Geography, 2014-2020 ($Million)

Table 23 Market Size for Miscellaneous Manufacturing Application, By Geography, 2014-2020 ($Million)

Table 24 Market Size, By Non-Manufacturing Application, 2014–2020 ($Million)

Table 25 Market Size for Non-Manufacturing Application, By Region, 2014–2020 ($Million)

Table 26 Market Size for Medical Imaging & Lab Automation Non-Manufacturing Application, By Geography, 2014-2020 ($Million)

Table 27 Market Size for Postal & Logistics Non-Manufacturing Application, By Geography, 2014-2020 ($Million)

Table 28 Market Size for Security and Surveillance Non-Manufacturing Application, By Geography, 2014-2020 ($Million)

Table 29 Market Size for Military and Defense Non-Manufacturing Application, By Geography, 2014-2020 ($Million)

Table 30 Market Size for Intelligent Transportation System (ITS) Non-Manufacturing Application, By Geography, 2014-2020 ($Million)

Table 31 Market Size for Miscellaneous Non-Manufacturing Application, By Geography, 2014-2020 ($Million)

Table 32 Global Market, By Geography, 2014-2020 ($Million)

Table 33 North America: GigE Camera Market Size, By Application, 2014-2020 ($Million)

Table 34 Europe: GigE Camera Market Size, By Application, 2014-2020 ($Million)

Table 35 APAC: GigE Camera Market Size, By Application, 2014-2020 ($Million)

Table 36 RoW: GigE Camera Market Size, By Application, 2014-2020 ($Million)

Table 37 Global GigE Camera Market Ranking, By Key Player, 2014

Table 38 New Product Launches, 2012–2015

Table 39 Agreements, Partnerships, Collaborations, and Joint Ventures, 2012–2015

Table 40 Strategic Alliances, 2012–2015

Table 41 Other Developments, 2011–2014

List of Figures (39 Figures)

Figure 1 GigE Camera Market, By Segmentation

Figure 2 Market: Research Design

Figure 3 Breakdown of Primary Interviews: By Company Type, Designation, & Region

Figure 4 Market Size Estimation Methodology: Bottom-Up Approach

Figure 5 Market Size Estimation Methodology: Top-Down Approach

Figure 6 Market Breakdown and Data Triangulation

Figure 7 Assumptions

Figure 8 ITS Application in the Non Manufaturing Segment is Expected to Grow at the Highest CAGR Between 2015 and 2020

Figure 9 APAC has the Highest Growth Potential in the Market

Figure 10 Global GigE Camera Market, By Application, 2014

Figure 11 New Product Development is One of the Key Strategies

Figure 12 Continuous Reduction in the Cost of Development is Driving the Growth of GigE Vision Cameras

Figure 13 Rapid Growth is Expected in the Market for CMOS-Based GigE Cameras, From 2014 to 2020

Figure 14 Automotive Sector Accounted for A Large Share of the GigE Camera Market in APAC

Figure 15 APAC Accounted for the Largest Market Share in 2014

Figure 16 The Manufacturing Segment Dominated the Global Market in 2014

Figure 17 The Market in APAC is Expected to Have High Growth During the Review Period

Figure 18 Overview of Machine Vision Standards

Figure 19 GigMarket Segmentation

Figure 20 Low Latency, High Efficiency, and Simple Configuration Features Pave the Way for the GigE Camera Market

Figure 21 GigMarket: Value Chain Analysis

Figure 22 Porter’s Five Forces Analysis

Figure 23 There is A Growing Demand of GigE Cameras in Transportation System, Security, and Medical Sectors

Figure 24 GigE Camera Market, By Type

Figure 25 GigE Camera Market, By Imaging Technology

Figure 26 Market: Application Segmentation

Figure 27 Geographic Snapshot Rapid Growth Markets are Emerging as New Hot Spots

Figure 28 North America Market Snapshot: Demand Likely to Be Driven By Technological Advancements and Component Improvements

Figure 29 Asia-Pacific Market Snapshot: Semiconductor and Electronics Manufacturing is the Most Lucrative Applications of GigE Camera Market

Figure 30 Players in the Market Adopted New Product Launches as A Key Strategy By the Key Players

Figure 31 Battle for Market Share: Companies Adopted New Product Launches as A Key Strategy

Figure 32 Competitive Benchmarking of Key Players: Teledyne Dalsa, Inc. is Among the Top Established Companies Offering A Wide Market Focus

Figure 33 Allied Vision Technologies, GmbH: SWOT Analysis

Figure 34 Basler AG: Company Snapshot

Figure 35 Basler AG: SWOT Analysis

Figure 36 JAI: SWOT Analysis

Figure 37 Sony Corporation: Company Snapshot

Figure 38 Sony Corporation: SWOT Analysis

Figure 39 Teledyne Dalsa Inc.: SWOT Analysis

Growth opportunities and latent adjacency in GigE Camera Market