Geofencing Market by Component (Solution and Services), Geofencing Type (Fixed and Mobile), Organization Size, Vertical (Transportation & Logistics, Government & Defense, Retail, Healthcare & Life Sciences), and Region - Global Forecast to 2022

[145 Pages Report] The geofencing market accounted for USD 458.3 Million in 2016 and is projected to reach USD 1,825.3 Million by 2022, at a Compound Annual Growth Rate (CAGR) of 27.5% during the forecast period.

Years considered for the report:

- Base Year: 2016

- Estimated Year: 2017

- Projected Year: 2022

Objectives of the Study:

The main objective of the report is to define, describe, and forecast the market size on the basis of components (solution and services), geofencing types, organization size, verticals, and regions. The report provides detailed information about the major factors (drivers, restraints, opportunities, and challenges) influencing the growth of the geofencing market. The report attempts to forecast the market size of the 5 main regions, namely, North America, Europe, Asia Pacific (APAC), Middle East and Africa (MEA), and Latin America. The report strategically profiles the key market players and comprehensively analyzes their core competencies. It also tracks and analyzes the competitive developments, such as joint ventures, mergers and acquisitions, and new product developments, in the market.

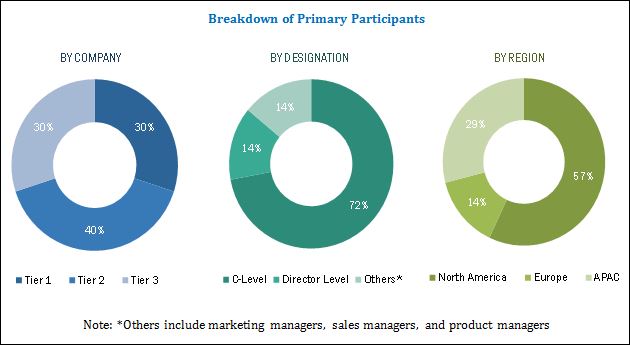

The research methodology used to estimate and forecast the geofencing market size began with the collection and analysis of data on the key vendor revenues through secondary sources, including annual reports and press releases, investor presentations, technology journals, certified publications, articles from recognized authors, directories, and databases. International Journal of Computer Networks and Wireless Communications (IJCNWC), American Marketing Association, World Wide Journal of Multidisciplinary Research and Development, Mobile Marketing Association, and Telecommunications Industry Associations were also referred to. The vendor offerings were also taken into consideration to determine the market segmentation. The bottom-up procedure was employed to arrive at the overall market size of the geofencing market from the revenue of the key players and their market shares. The market spending across all regions along with the geographical split in various verticals was considered to arrive at the overall market size. After arriving at the overall market size, the total market was split into several segments and subsegments, which were then verified through primary research by conducting extensive interviews with key people, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), directors, and executives. The data triangulation and market breakdown procedures were employed to complete the overall market engineering process and arrive at the exact statistics for all the segments and subsegments. The breakdown of the profiles of the primary participants is depicted in the below figure:

To know about the assumptions considered for the study, download the pdf brochure

The geofencing market includes various vendors who provide geofencing services, inclusive of deployment and integration, support and maintenance, consulting and advisory, and API management and testing services. Companies such as Apple (US), Bluedot Innovation (US), DreamOrbit (India), Embitel (India), Esri (US), Factual (US), GeoMoby (Australia), GPSWOX (UK), InVisage (US), Localytics (US), LocationSmart (US), MAPCITE (UK), Maven Systems (India), Mobinius Technologies (India), MobiOcean (India), Nisos Technologies (US), Plot Projects (Netherlands), Pulsate (US), Raveon Technologies (US), Simpli.fi (US), SuccorfishM2M (UK), Swirl Networks (US), Thumbvista (US), Urban Airship (US), and Visioglobe (France) have adopted various growth strategies, including partnerships, agreements, and collaborations, to enhance their presence in the market. These Geofencing Solutions Vendors are rated and listed by us on the basis of product quality, reliability, and their business strategy. Please visit 360Quadrants to see the vendor listing of Geofencing Solutions.

Key Target Audience for Geofencing Market

- Geofencing solution providers

- Geofencing service providers

- System integrators

- Consultancy and advisory firms

- Managed service providers and middleware companies

- Governments

- Wireless infrastructure providers and service providers

- Sensor, location, and detection solution providers

The study answers several questions for the stakeholders, primarily, which market segments to focus on in the next 2 to 5 years for prioritizing efforts and investments.

Scope of the Report

|

Report Metrics |

Details |

|

Market size available for years |

2016-2022 |

|

Base year considered |

2016 |

|

Forecast period |

2017-2022 |

|

Forecast units |

Value (USD) |

|

Segments covered |

Component (Solutions and Services), Geofencing Type (Fixed and Mobile), Organization Size, Vertical and Region |

|

Geographies covered |

North America, Europe, Asia Pacific, Middle East & Africa, Latin America |

|

Companies covered |

Apple (US), Bluedot Innovation (US), DreamOrbit (India), Embitel (India), Esri (US), Factual (US), GeoMoby (Australia), GPSWOX (UK), InVisage (US), Localytics (US), LocationSmart (US), MAPCITE (UK), Maven Systems (India), Mobinius Technologies (India), MobiOcean (India), Nisos Technologies (US), Plot Projects (Netherlands), Pulsate (US), Raveon Technologies (US), Simpli.fi (US), SuccorfishM2M (UK), Swirl Networks (US), Thumbvista (US), Urban Airship (US), and Visioglobe (France) |

The research report segments the market into the following submarkets:

Geofencing Market By Component

- Solution

- Services

Geofencing Market By Service:

- Deployment and integration services

- Support and maintenance services

- Consulting and advisory services

- API management and testing services

Geofencing Market By Geofencing Type:

- Fixed geofencing

- Mobile geofencing

Geofencing Market By Organization Size:

- Small and Medium-sized Enterprises (SMEs)

- Large enterprises

Geofencing Market By Vertical:

- Transportation and logistics

- Retail

- Healthcare and life sciences

- Industrial manufacturing

- Media and entertainment

- Government and defense

- Banking, Financial Services, and Insurance (BFSI)

- Others (agriculture, education, construction and engineering, and energy and utilities)

Geofencing Market By Region:

- North America

- Europe

- APAC

- MEA

- Latin America

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the companys specific needs. The following customization options are available for the report:

Geographic Analysis

- Further breakdown of the North American market into the US and Canada

- Further breakdown of the European market into the UK, Germany, and France

Company Information

- Detailed analysis and profiling of additional market players

MarketsandMarkets forecasts the global geofencing market size to grow from USD 542.7 Million in 2017 to USD 1,825.3 Million by 2022, at a Compound Annual Growth Rate (CAGR) of 27.5%.

The geofencing market is segmented on the basis of components (solution and services), geofencing type, organization size, verticals, and regions. Geofencing services are further segmented into deployment and integration, support and maintenance, consulting and advisory, and API management and testing services.

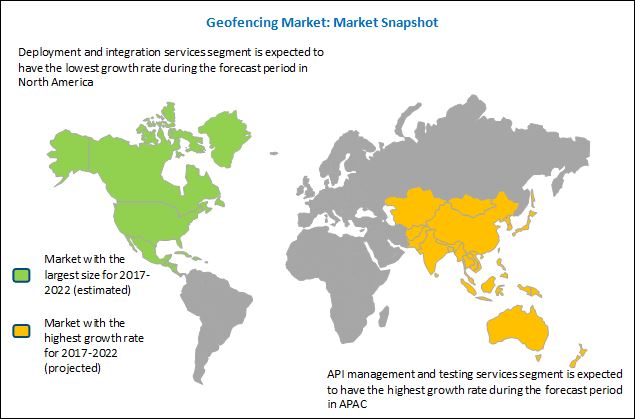

The API management and testing services segment is expected to grow at the highest CAGR during the forecast period, as the segment offers application access management, device data communication and interaction, and security services. Additionally, application operation, production support, release and change support, and middleware product support are also carried out by API management services. Application testing service providers offer automated and manual mobile application testing to the commercial customers, for testing both native and hybrid mobile applications. The service providers deliver mobile application testing services for core functionality testing; user interface testing; mobile applications testing in wireless disconnectivity, low connectivity, Wi-Fi, and 2G and 3G networks; memory and battery leakage testing; and mobile application backward compatibility testing.

On the basis of organization size, the geofencing market is segmented into Small and Medium-sized Enterprises (SMEs) and large enterprises. The market, on the basis of verticals, is segmented into transportation and logistics; retail; healthcare and life sciences; industrial manufacturing; media and entertainment; government and defense; Banking, Financial Services, and Insurance (BFSI); and others (agriculture, education, construction and engineering, and energy and utilities).

The transportation and logistics vertical is expected to have the largest market share during the forecast period. Transportation and logistics is one of the most dominating verticals with respect to the deployment of geofencing market solutions. Industry applications of geofencing solutions in the transportation and logistics vertical include asset monitoring, speed limiting, fleet and freight management, and commercial transportation management.

The major factors driving the growth of the geofencing market are the penetration of new technologies, rise in the use of spatial data and analytical tools, higher adoption of location-based applications among consumers, and the growth of competitive intelligence. Furthermore, the rise in Business Intelligence (BI) and the need to track the competitors marketing activities are some of the other factors supporting the overall growth of the market.

North America has the major presence of sustainable and well-established economies who invest heavily in Research and Development (R&D) activities, thereby contributing to the development of new technologies. The startup culture in North America is growing at a faster pace as compared to the other regions. The rising number of developing SMEs and the increasing digitization in large organizations have aided the growth of the North American market. SMEs are flexible in incorporating new technologies into their existing systems, whereas large organizations have heavy budgets for digitization. All these factors are driving the growth of the geofencing market in North America. The market is gaining pace in the North American region, majorly due to the growing penetration of smartphones, growth in social networking and mobile-based advertising, and the increase in the deployment of 3G and 4G networks.

Asia Pacific (APAC) has witnessed the advanced and dynamic adoption of new technologies, and it has always been a lucrative market. The region is expected to grow at the highest CAGR during the forecast period in the geofencing market, as the governments in the APAC countries are continuously investing in the R&D of location-based and geofencing services. The rise in the use of content management systems and location analytics is one of the major factors driving the growth of the APAC market.

Legal and privacy concerns, and the rising awareness regarding safety and security among customers are some of the restraining factors in the geofencing market. However, the recent developments, including new product launches and acquisitions, undertaken by the major market players are boosting the growth of the market.

The study measures and evaluates the offerings and key strategies undertaken by the major market players in geofencing market, including Apple Inc. (US), Bluedot Innovation (US), DreamOrbit (India), Embitel (India), Esri (US), Factual Inc. (US), GeoMoby (Australia), Gpswox.com (UK), InVisage (US), Localytics (US), LocationSmart (US), MAPCITE (UK), Maven Systems (India), Mobinius Technologies (India), MobiOcean Mobility Software Solutions (India), Nisos Technologies (US), Plot Projects (Netherlands), Pulsate (US), Raveon Technologies (US), Simpli.fi (US), SuccorfishM2M (UK), Swirl Networks (US), Thumbvista (US), Urban Airship (US), and Visioglobe (France). These companies have been at the forefront in offering reliable geofencing solutions to commercial clients across the globe.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 15)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.4 Years Considered for the Study

1.5 Currency

1.6 Stakeholders

2 Research Methodology (Page No. - 18)

2.1 Research Data

2.1.1 Secondary Data

2.1.2 Primary Data

2.1.2.1 2.1.2.1 Breakdown of Primaries

2.1.2.2 2.1.2.2 Key Industry Insights

2.2 Market Size Estimation

2.3 Microquadrant Research Methodology

2.3.1 Microquadrant: Weightage Criteria

2.3.2 Quadrant Description

2.4 Research Assumptions

2.5 Limitations

3 Executive Summary (Page No. - 26)

4 Premium Insights (Page No. - 29)

4.1 Attractive Market Opportunities in the Geofencing Market

4.2 Geofencing Market, By Region (2017 vs 2022)

4.3 Market Investment Scenario

4.4 Geofencing Market, Top 3 Services, 20172022

4.5 Geofencing Market: Market Share of the Top 3 Verticals and Regions, 2017

4.6 Life Cycle Analysis, By Region, 2017

5 Market Overview and Industry Trends (Page No. - 33)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Technological Advancements and Rise in the Use of Spatial Data and Analytical Tools

5.2.1.2 Increasing Applications in Numerous Industry Sectors

5.2.1.3 Higher Adoption of Location-Based Application Among Consumers

5.2.1.4 Rise in Growth of Competitive Intelligence

5.2.2 Restraints

5.2.2.1 Legal and Privacy Concerns

5.2.2.2 Rising Awareness Regarding Safety and Security Among Consumers

5.2.3 Opportunities

5.2.3.1 Frequent Incidents of National Border Intrusions

5.2.3.2 Ease of Integration and Deployment of Geofencing Solutions

5.2.4 Challenges

5.2.4.1 Lack of Uniform Regulatory Standards

5.2.4.2 Lack of Awareness, Expertise, and Other Operational Challenges

5.3 Innovation Spotlight

5.4 Geofencing Use Cases

5.4.1 Asset Monitoring Solutions

5.4.1.1 Seabed Ploughing Monitoring Project Aiding the Port of Cork

5.4.2 Asset Monitoring Solutions

5.4.2.1 Driving the Visits and Sales of A Store By Deploying Customized Location-Based Mobile Advertisements

5.4.3 Safety and Security Solutions

5.4.3.1 Mapping Technology Enables Magtecs Continuous Innovation

5.4.3.2 Global Transportation Company Uses Fleetmatics to Monitor Driver Location, Safety, and Productivity

5.4.4 Customer Satisfaction Solutions

5.4.4.1 Engage Customers Through Mobile Applications and Push Notifications

5.4.5 Workforce Management Solutions

5.4.5.1 Increased Productivity in Real Estate By Geofencing

5.5 Geofencing Connectivity Technologies

5.5.1 Active Geofencing

5.5.1.1 RFID

5.5.1.2 GPS

5.5.2 Passive Geofencing

5.5.2.1 Wi-Fi

5.5.2.2 Cellular Data

5.6 Geofencing Notification Types

5.6.1 Static Geo-Notifications

5.6.2 Dynamic Geo-Notifications

5.6.3 Peer-To-Peer Geo-Notifications

5.7 Platform Providers

5.7.1 Roximity

5.7.1.1 Overview

5.7.2 Google

5.7.2.1 Overview

5.7.3 Microsoft

5.7.3.1 Overview

5.7.4 IBM

5.7.4.1 Overview

5.7.5 Samsung

5.7.5.1 Overview

5.7.6 Gimbal

5.7.6.1 Overview

6 Geofencing Market Analysis, By Component (Page No. - 48)

6.1 Introduction

6.2 Solution

6.3 Services

7 Geofencing Market Analysis, By Service (Page No. - 52)

7.1 Introduction

7.2 Deployment and Integration Services

7.3 Support and Maintenance Services

7.4 Consulting and Advisory Services

7.5 API Management and Testing Services

8 Market Analysis, By Geofencing Type (Page No. - 58)

8.1 Introduction

8.2 Fixed Geofencing

8.3 Mobile Geofencing

9 Market Analysis, By Organization Size (Page No. - 62)

9.1 Introduction

9.2 Small and Medium-Sized Enterprises

9.3 Large Enterprises

10 Geofencing Market Analysis, By Vertical (Page No. - 66)

10.1 Introduction

10.2 Transportation and Logistics

10.2.1 Asset Monitoring

10.2.2 Speed Limiting

10.2.3 Yard and Site Transportation

10.2.4 Real-Time Dispatch and Delivery

10.2.5 Fleet and Freight Management

10.3 Retail

10.3.1 Workforce Management

10.3.2 Customer Satisfaction

10.3.3 User Location Alerts

10.3.4 Logistics Management

10.3.5 Competitor Tracking

10.3.6 Asset Management

10.3.7 Promotions and Advertising

10.4 Healthcare and Life Sciences

10.4.1 Patient Care

10.4.2 Asset Management

10.4.3 Workforce Management

10.5 Industrial Manufacturing

10.5.1 Asset Monitoring

10.5.2 Workforce Management

10.6 Media and Entertainment

10.6.1 Social Media

10.6.2 Advertising and Marketing

10.7 Government and Defense

10.7.1 Marine Defense

10.7.2 Drone Management

10.7.3 Airforce Defense

10.7.4 Military Vehicle Management

10.7.5 Law Enforcement

10.7.6 Geographic Event Alerts

10.8 Banking, Financial Services, and Insurance

10.8.1 Customer Tracking and Fraud Prevention

10.8.2 Marketing and Promotions

10.9 Others

10.9.1 Agriculture

10.9.2 Education

10.9.3 Construction and Engineering

10.9.4 Energy and Utilities

11 Geographic Analysis (Page No. - 82)

11.1 Introduction

11.2 North America

11.2.1 United States

11.2.2 Canada

11.3 Europe

11.4 Asia Pacific

11.5 Middle East and Africa

11.6 Latin America

12 Company Profiles (Page No. - 106)

(Business Overview, Strength of Product Portfolio, Business Strategy Excellence, Recent Developments)*

12.1 Thumbvista

12.2 Pulsate

12.3 Simpli.Fi

12.4 Mobinius Technologies

12.5 ESRI

12.6 Bluedot Innovation

12.7 Geomoby

12.8 Gpswox

12.9 Apple

12.10 Localytics

12.11 Mapcite

12.12 Swirl Networks

*Details on Overview, Strength of Product Portfolio, Business Strategy Excellence, Recent Developments Might Not Be Captured in Case of Unlisted Companies.

12.13 Key Innovators

12.13.1 Dreamorbit

13 Appendix (Page No. - 136)

13.1 Industry Experts

13.2 Discussion Guide

13.3 Knowledge Store: MarketsandMarkets Subscription Portal

13.4 Introducing RT: Real-Time Market Intelligence

13.5 Available Customizations

13.6 Related Reports

13.7 Author Details

List of Tables (62 Tables)

Table 1 Geofencing Market Size, By Component, 20172022 (USD Million)

Table 2 Geofencing Solution Market Size, By Region, 20172022 (USD Million)

Table 3 Geofencing Services Market Size, By Region, 20172022 (USD Million)

Table 4 Geofencing Market Size, By Service, 20152022 (USD Million)

Table 5 Deployment and Integration Services: Market Size, By Region, 20152022 (USD Million)

Table 6 Support and Maintenance Services: Market Size, By Region, 20152022 (USD Million)

Table 7 Consulting and Advisory Services: Market Size, By Region, 20152022 (USD Million)

Table 8 API Management and Testing Services: Market Size, By Region, 20152022 (USD Million)

Table 9 Geofencing Market Size, By Geofencing Type, 20152022 (USD Million)

Table 10 Fixed Geofencing: Market Size, By Region, 20152022 (USD Million)

Table 11 Mobile Geofencing: Market Size, By Region, 20152022 (USD Million)

Table 12 Market Size, By Organization Size, 20152022 (USD Million)

Table 13 Small and Medium-Sized Enterprises: Market Size, By Region, 20152022 (USD Million)

Table 14 Large Enterprises: Market Size, By Region, 20152022 (USD Million)

Table 15 Geofencing Market Size, By Vertical, 20152022 (USD Million)

Table 16 Transportation and Logistics: Market Size, By Region, 20152022 (USD Million)

Table 17 Retail: Market Size, By Region, 20152022 (USD Million)

Table 18 Healthcare and Life Sciences: Market Size, By Region, 20152022 (USD Million)

Table 19 Industrial Manufacturing: Market Size, By Region, 20152022 (USD Million)

Table 20 Media and Entertainment: Market Size, By Region, 20152022 (USD Million)

Table 21 Government and Defense: Market Size, By Region, 20152022 (USD Million)

Table 22 Banking, Financial Services, and Insurance: Market Size, By Region, 20152022 (USD Million)

Table 23 Others: Market Size, By Region, 20152022 (USD Million)

Table 24 Geofencing Market Size, By Region, 20152022 (USD Million)

Table 25 North America: Geofencing Market Size, By Component, 20152022 (USD Million)

Table 26 North America: Market Size, By Service, 20152022 (USD Million)

Table 27 North America: Market Size, By Geofencing Type, 20152022 (USD Million)

Table 28 North America: Market Size, By Organization Size, 20152022 (USD Million)

Table 29 North America: Market Size, By Vertical, 20152022 (USD Million)

Table 30 North America: Market Size, By Country, 20152022 (USD Million)

Table 31 United States: Geofencing Market Size, By Component, 20152022 (USD Million)

Table 32 United States: Market Size, By Service, 20152022 (USD Million)

Table 33 United States: Market Size, By Geofencing Type, 20152022 (USD Million)

Table 34 United States: Market Size, By Organization Size, 20152022 (USD Million)

Table 35 United States: Market Size, By Vertical, 20152022 (USD Million)

Table 36 Canada: Geofencing Market Size, By Component, 20152022 (USD Million)

Table 37 Canada: Market Size, By Service, 20152022 (USD Million)

Table 38 Canada: Market Size, By Geofencing Type, 20152022 (USD Million)

Table 39 Canada: Market Size, By Organization Size, 20152022 (USD Million)

Table 40 Canada: Market Size, By Vertical, 20152022 (USD Million)

Table 41 Europe: Geofencing Market Size, By Component, 20152022 (USD Million)

Table 42 Europe: Market Size, By Service, 20152022 (USD Million)

Table 43 Europe: Market Size, By Geofencing Type, 20152022 (USD Million)

Table 44 Europe: Market Size, By Organization Size, 20152022 (USD Million)

Table 45 Europe: Market Size, By Vertical, 20152022 (USD Million)

Table 46 Europe: Market Size, By Country, 20152022 (USD Million)

Table 47 Asia Pacific: Geofencing Market Size, By Component, 20152022 (USD Million)

Table 48 Asia Pacific: Market Size, By Service, 20152022 (USD Million)

Table 49 Asia Pacific: Market Size, By Geofencing Type 20152022 (USD Million)

Table 50 Asia Pacific: Market Size, By Organization Size, 20152022 (USD Million)

Table 51 Asia Pacific: Market Size, By Vertical, 20152022 (USD Million)

Table 52 Asia Pacific: Market Size, By Country, 20152022 (USD Million)

Table 53 Middle East and Africa: Geofencing Market Size, By Component, 20152022 (USD Million)

Table 54 Middle East and Africa: Market Size, By Service, 20152022 (USD Million)

Table 55 Middle East and Africa: Market Size, By Geofencing Type, 20152022 (USD Million)

Table 56 Middle East and Africa: Market Size, By Organization Size, 20152022 (USD Million)

Table 57 Middle East and Africa: Market Size, By Vertical, 20152022 (USD Million)

Table 58 Latin America: Geofencing Market Size, By Component, 20152022 (USD Million)

Table 59 Latin America: Market Size, By Service, 20152022 (USD Million)

Table 60 Latin America: Market Size, By Geofencing Type, 20152022 (USD Million)

Table 61 Latin America: Market Size, By Organization Size, 20152022 (USD Million)

Table 62 Latin America: Market Size, By Vertical, 20152022 (USD Million)

List of Figures (38 Figures)

Figure 1 Geofencing Market: Market Segmentation

Figure 2 Market: Research Design

Figure 3 Data Triangulation

Figure 4 Market Size Estimation Methodology: Bottom-Up Approach

Figure 5 Market Size Estimation Methodology: Top-Down Approach

Figure 6 Geofencing Market: Assumptions

Figure 7 North America is Estimated to Hold the Largest Market Share in 2017

Figure 8 Segments Dominating the Global Market in 2017

Figure 9 Large Enterprises Segment is Expected to Hold A Major Market Share in 2017

Figure 10 Rising Use of Spatial Data and Market Intelligence Activities are Driving the Geofencing Market

Figure 11 North America is Expected to Hold the Largest Market Size During the Forecast Period

Figure 12 Asia Pacific is Expected to Emerge as the Best Market for Investments in the Next 5 Years

Figure 13 API Management and Integration Service Type is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 14 Transportation and Logistics, and North America are Estimated to Have the Largest Market Shares in 2017

Figure 15 Asia Pacific is Expected to Grow at A Significant Pace During the Forecast Period

Figure 16 Market: Drivers, Restraints, Opportunities, and Challenges

Figure 17 Services Segment is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 18 North America is Expected to Dominate the Solution Segment in the Geofencing Market During the Forecast Period

Figure 19 North America is Expected to Have the Largest Market Size in the Geofencing Services Market During the Forecast Period

Figure 20 API Management and Testing Services Segment is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 21 Asia Pacific is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 22 Asia Pacific is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 23 Mobile Geofencing Segment is Expected to Exhibit A Higher CAGR During the Forecast Period

Figure 24 APAC is Estimated to Grow at Highest CAGR From 2017-2022

Figure 25 SMEs Segment is Expected to Have the Larger CAGR During the Forecast Period

Figure 26 Transportation and Logistics Segment is Expected to Have the Largest Market Size During the Forecast Period

Figure 27 North America is Expected to Have the Largest Market Size During the Forecast Period

Figure 28 North America is Expected to Have the Largest Market Size During the Forecast Period

Figure 29 APAC is Expected to Have the Larger CAGR During the Forecast Period

Figure 30 Asia Pacific is Expected to Exhibit the Highest CAGR in the Geofencing Market During the Forecast Period

Figure 31 North America: Market Snapshot

Figure 32 In North America, API Management and Testing Services Segment is Expected to Exhibit the Highest CAGR During the Forecast Period

Figure 33 API Management and Testing Services Segment is Expected to Exhibit the Highest CAGR in Europe During the Forecast Period

Figure 34 Asia Pacific: Market Snapshot

Figure 35 In APAC, Deployment and Integration Services Segment is Estimated to Have the Largest Market Share in 2017

Figure 36 API Management and Testing Services Segment is Expected to Exhibit the Highest CAGR in Middle East and Africa During the Forecast Period

Figure 37 API Management and Testing Services Segment is Expected to Exhibit the Highest CAGR Latin America During the Forecast Period

Figure 38 Apple: Company Snapshot

Growth opportunities and latent adjacency in Geofencing Market