Geocells Market by Raw Material (High-density Polyethylene, Polypropylene), Design Type (Perforated, and Non-Perforated), Application (Load Support, Channel & Slope Protection, Retention of Walls), and Region - Global Forecast to 2022

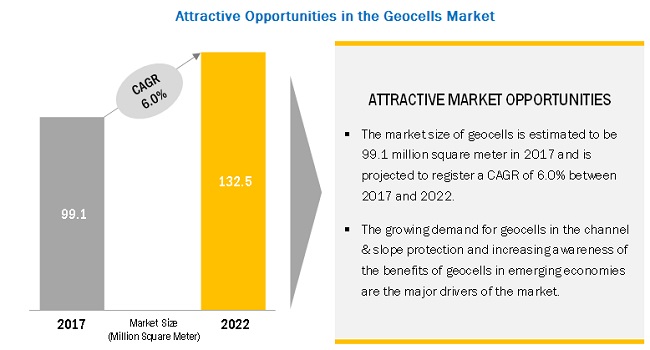

[102 Pages Report] The global geocells market was valued at USD 352.0 million in 2016 and is projected to register a CAGR of 8.0% between 2017 and 2022. The market size of the geocells market was 99.1 million square meters in 2017 and is expected to reach 132.5 million square meters with a CAGR of 6% in terms of volume. Increased cost savings in road construction is the major driver of the market.

Geocells are lightweight, strong, and mostly three-dimensional systems that are fabricated from strips of polymer sheets or geotextiles. These are also known as cellular confinement systems. These geocells are advanced geosynthetic materials that increase the bearing capacity and strength of the structure up to five times. The use of geocells reduces the vertical stresses and the pavement thickness significantly. These cells are used in various applications, such as load support, channel & slope protection, retention of walls, and shoreline protection.

The geocells market is mainly driven by highly sophisticated technologies and designs developed by the key manufacturers of geocells.

HDPE to be the largest raw material of geocells, during the forecast period

The growth of this segment can be attributed to the superior properties of HDPE such as chemical resistance, weather resistance, ultraviolet protection, and high durability. In addition, easy availability and relatively low cost of HDPE drive its use in geocells.

Perforated to be the leading design type for geocells during the forecast period

This design is preferred over the non-perforated design as it helps in the dissipation of pore-water pressure. The dissipation of pore-water pressure results in proper perforation reducing the overall weight of the geocells, which is essential for the systems stability on slopes. All these design advantages have increased the consumption of perforated geocells, globally.

Channel & slope protection to be the fastest-growing application of geocells

Channel & slope protection is projected to be the fastest-growing application of geocells during the forecast period. Geocells are widely used in the field of geotechnical engineering to control erosion of river banks, channel beds, and slopes. They are used on embankments to stabilize the upper soil layer and prevent its erosion caused due to the surface runoff. Cellular confinement systems with aggregate or vegetated topsoil ensure the long-term stability of slopes.

The interaction between geocells and plants limits the impact of raindrops and prevents downslope movement. It also channelizes flow and reduces hydraulic shear stresses.

APAC to be the fastest-growing geocells market during the forecast period

APAC is the fastest-growing geocells market during the forecast period, in terms of value. The growth is primarily attributed to the huge demand for geocells in the retention of walls, load support, and channel & slope protection applications in the region. Growing infrastructural activities in the region and increasing awareness of the benefits of geocells are the major factors driving the demand for geocells in the region. For example, for the development of the worlds tallest dam in China, and highway projects and the development of six megacities in India, there is a high demand for geocells. Similarly, the Indonesian government has selected 30 infrastructure development projects on priority (2016-2019). These infrastructural developments are also expected to drive the consumption of geocells

Market Dynamics:

Driver: Increasing usage of geocells in channel & slope protection

Governments of various countries are offering companies projects for soil protection. For example, ABG Ltd. completed a Blackmoss Reservoir project in Lancashire (UK). Similarly, Strata Systems completed a reservoir slope protection project in Chennai, India. Increasing usage of geocells in channel & slope protection is expected to drive the market during the forecast period.

Restraint: Volatile raw material prices

The price and availability of raw materials are the key factors considered by geocells manufacturers for determining the cost structure of their products. Raw materials used to manufacture geocells are polyester, polyethylene, and polypropylene. Most of these raw materials are petroleum-based derivatives that are vulnerable to price fluctuations. The continuous fluctuations in oil prices directly impact the profit margin of geocells manufacturers, significantly restraining their market growth.

Opportunity: Growing infrastructural development activities in emerging economies

Geocells are mainly used for building roads, railways, and soil reinforcement.Therefore, growth in infrastructural development plays a significant role in driving the use of geocells globally.

Construction activities are growing in developed as well as developing countries. Emerging economies such as China, India, Brazil, Saudi Arabia, Qatar, Vietnam, and Indonesia are witnessing extensive infrastructural development, which plays a crucial role in providing growth opportunities to the manufacturers of geocells.

Challenge: Lack of quality control across developing countries

The geocells are mostly used in government projects. Hence, the manufacturing and installation standards are set by the governments of respective countries. Players in developing countries insist their governments match their standards with international standards. Strata Systems, PRS Geosynthetics, and Presto are some of the companies that abide by the international standards or standards imposed by the respective governments. Proper policies and standards will be beneficial for both, companies and governments, to run their geocells projects. If the governments do not standardize their policies, it may hamper both environmental and commercial projects. This may lead to the breaking of regulatory rules of the governments which are not supported by associations, such as the International Nonwovens and Disposables Association (INDA), Geosynthetics Materials Association (GMA), and American Society for Testing and Materials (ASTM). In this case, the products manufactured by the players in the developing countries will not be accepted in the international market.

Sri Lanka, Pakistan, South Africa, and other developing nations face similar issues as the regulatory policies are not set. Furthermore, lack of autonomous and competent regulatory authority in line with international authorities and fabric associations restricts the market growth in these countries

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

20152022 |

|

Base year considered |

2016 |

|

Forecast period |

20172022 |

|

Forecast units |

USD million and million square meters |

|

Segments covered |

Raw Material, Design Type, Application, and Region |

|

Geographies covered |

North America (US, Canada, Mexico), Europe (UK, Italy, Spain, and Rest of Europe), Asia Pacific (China, Japan, India, South Korea, and Rest of Asia Pacific), Middle East, Africa, and South America, and Rest of Middle East, Africa, and South America |

|

Companies covered |

Strata Systems (US), PRS Geo-Technologies (UK), Presto Geosystems (US), Koninklijke Ten Cate B.V. (Netherlands), TMP Geosynthetics (China), Terram Geosynthetics-now part of Berry Plastics (UK), Officine Maccaferri (Italy), Flexituff International (India), Geo Products (US) and BOSTD Geosynthetics Qingdao (China) |

This research report categorizes the geocells market based on design type, application, raw material, and region.

Based on Raw Material:

- High-density Polyethylene (HDPE)

- Polypropylene (PP)

- Others

Based on Design Type:

- Perforated

- Non-Perforated

Based on Application:

- Load Support

- Channel & Slope Protection

- Retention of Walls

- Others

Based on Region:

- North America

- Asia Pacific

- Europe

- Middle East & Africa, and South America

- Rest of the Middle East, Africa, and South America

The market has been further analyzed on the basis of key countries in each of these regions.

Note 1: Other raw materials considered are polyester, Low-density polyethylene (LDPE), and proprietary materials.

Note 2: Other applications considered are reservoirs & landfills, shoreline protection, and tree root protectionKey Market Players

Strata Systems, PRS Geo-Technologies, Terram, Ten Cate, and Officine Maccaferri

Recent Developments

- In February 2018, PRS Geo-Technologies completed a project in Amtrak, US. In this project, Neoloy geocells were used to stabilize the railway track under the US Federal Railroad (FRA) program in Amtraks Northeast corridor. The company strengthened its brand image in the region.

- In December 2017, Terram Geosynthetics completed a project in South Wales for The Roots Foundation Wales. The company provided geocells and geotextile to rebuild a support center and constructed temporary accommodation for users of The Roots Foundation Wales. Through this development, the company increased its market presence in Europe.

- In August 2017, Strata Systems completed its project with the Indian Central government to supply and install StrataWeb (geocells) for National Highway 44. The project increased the market share of the company in the Indian geocells market.

- In November 2016, Ten Cate sold its stake in Edel Grass BV, a synthetic turf sports systems manufacturer, to Oranjewoud Realisatie Holding BV, a subsidiary of Oranjewoud NV. This development has aided the company to focus on its geosynthetics segment.

- In February 2016, Officine Maccaferri opened a new innovation center dedicated to R&D for new products and innovative solutions, improved manufacturing process, and new applications. The development will help the company develop new applications and help in improving its existing product portfolio.

Critical questions the report answers:

- What are the key strategies adopted by major market players?

- Which are the most significant revenue-generating regions for the market?

- What will be the future product mix of the market?

- Which key developments are expected to have a long-term impact on the market?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 12)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Years Considered for the Study

1.4 Currency

1.5 Unit Considered

1.6 Limitations

1.7 Stakeholders

2 Research Methodology (Page No. - 15)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primary Interviews

2.2 Market Size Estimation

2.3 Data Triangulation

2.4 Assumptions

3 Executive Summary (Page No. - 22)

4 Premium Insights (Page No. - 25)

4.1 Attractive Opportunities In the Geocells Market

4.2 Geocells Market, By Raw Material

4.3 Geocells Market, By Design Type

4.4 Geocells Market, By Region

4.5 Geocells Market Size, By Application

4.6 North America Geocells Market, By Application and Country

5 Market Overview (Page No. - 28)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 High-Cost Savings In Road Construction and Maintenance

5.2.1.2 Increasing Usage of Geocells In Channel & Slope Protection

5.2.2 Restraints

5.2.2.1 Volatile Raw Material Prices

5.2.3 Opportunities

5.2.3.1 Growing Infrastructural Development Activities In Emerging Economies

5.2.4 Challenges

5.2.4.1 Lack of Quality Control Across Developing Countries

5.3 Porters Five Forces Analysis

5.3.1 Threat of New Entrants

5.3.2 Threat of Substitutes

5.3.3 Bargaining Power of Suppliers

5.3.4 Bargaining Power of Buyers

5.3.5 Intensity of Competitive Rivalry

6 Macroeconomic Indicators (Page No. - 34)

6.1 Introduction

6.2 Real GDP Growth Rate Forecast of Major Economies

6.3 Total Road Spending

7 Geocells Market, By Design Type (Page No. - 36)

7.1 Introduction

7.2 Perforated Geocells

7.3 Non-Perforated Geocells

8 Geocells Market, By Raw Material (Page No. - 39)

8.1 Introduction

8.2 HDPE

8.3 PP

8.4 Others

9 Geocells Market, By Application (Page No. - 42)

9.1 Introduction

9.2 Load Support

9.3 Channel & Slope Protection

9.4 Retention of Walls

9.5 Others

10 Geocells Market, By Region (Page No. - 46)

10.1 Introduction

10.2 North America

10.2.1 US

10.2.2 Canada

10.2.3 Mexico

10.3 Europe

10.3.1 UK

10.3.2 Italy

10.3.3 Spain

10.3.4 Rest of Europe

10.4 APAC

10.4.1 China

10.4.2 Japan

10.4.3 India

10.4.4 South Korea

10.4.5 Rest of APAC

10.5 Middle East, Africa, and South America

10.5.1 Brazil

10.5.2 South Africa

10.5.3 Rest of Middle East, Africa, and South America

11 Competitive Landscape (Page No. - 74)

11.1 Overview

11.2 Market Ranking of Key Players

11.3 Competitive Scenario

11.3.1 Expansions

11.3.2 Divestments

11.3.3 Projects

11.3.4 New Product Developments

11.3.5 R&D

11.3.6 Mergers & Acquisitions

12 Company Profiles (Page No. - 81)

12.1 Strata Systems

12.2 PRS Geo-Technologies

12.3 Presto Geosystems

12.4 Ten Cate

12.5 Terram Geosynthetics

12.6 Officine Maccaferri Spa

12.7 TMP Geosynthetics

12.8 BOSTD Geosynthetics Qingdao

12.9 Flexituff International Limited

12.10 GEO Products, LLC

12.11 Other Key Players

12.11.1 ABG Ltd.

12.11.2 Anhui Huifeng New Synthetic Materials Co., Ltd.

12.11.3 Armtec LP

12.11.4 Ceteau Group

12.11.5 Fibertex Nonwoven

12.11.6 Miakom

12.11.7 Prestorus, LLC

12.11.8 SABK International Est.

12.11.9 Wall Tag Pte Ltd.

13 Appendix (Page No. - 94)

13.1 Insights From Industry Experts

13.2 Discussion Guide

13.3 Knowledge Store: Marketsandmarkets Subscription Portal

13.4 Introducing RT: Real-Time Market Intelligence

13.5 Available Customizations

13.6 Related Reports

13.7 Author Details

List of Tables (70 Tables)

Table 1 Trends and Forecast of Real GDP Growth Rates From 2016 to 2022

Table 2 Trends of Road Spending From 2011 to 2015 (Euro Billion)

Table 3 Geocells Market Size, By Design Type, 20152022 (USD Thousand)

Table 4 Geocells Market Size, By Design Type, 20152022 (Thousand Square Meter)

Table 5 Geocells Market Size, By Raw Material, 20152022 (USD Thousand)

Table 6 Geocells Market Size, By Raw Material, 20152022 (Thousand Square Meter)

Table 7 Geocells Market Size, By Application, 20152022 (USD Thousand)

Table 8 Geocells Market Size, By Application, 20152022( Thousand Square Meter)

Table 9 Geocells Market Size, By Region, 20152022 (USD Thousand)

Table 10 Geocells Market Size, By Region, 20152022 ( Thousand Square Meter)

Table 11 North America: Geocells Market Size, By Country, 20152022 (USD Thousand)

Table 12 North America: Geocells Market Size, By Country, 20152022 (Thousand Square Meter)

Table 13 North America: Geocells Market Size, By Raw Material, 20152022 (USD Thousand)

Table 14 North America: Geocells Market Size, By Raw Material, 20152022 (Thousand Square Meter)

Table 15 North America: Geocells Market Size, By Application, 20152022 (USD Thousand)

Table 16 North America: Geocells Market Size, By Application, 20152022 (Thousand Square Meter)

Table 17 US: Geocells Market Size, By Application, 20152022 (USD Thousand)

Table 18 US: Geocells Market Size, By Application, 20152022 (Thousand Square Meter)

Table 19 Canada: Geocells Market Size, By Application, 20152022 (USD Thousand)

Table 20 Canada: Geocells Market Size, By Application, 20152022 (Thousand Square Meter)

Table 21 Mexico: Geocells Market Size, By Application , 20152022 (USD Thousand)

Table 22 Mexico: Geocells Market Size, By Application , 20152022 (Thousand Square Meter)

Table 23 Europe: Geocells Market Size, By Country, 20152022 (USD Thousand)

Table 24 Europe: Geocells Market Size, By Country, 20152022 (Thousand Square Meter)

Table 25 Europe: Geocells Market Size, By Raw Material, 20152022 (USD Thousand)

Table 26 Europe: Geocells Market Size, By Raw Material, 20152022 (Thousand Square Meter)

Table 27 Europe: Geocells Market Size, By Application, 20152022 (USD Thousand)

Table 28 Europe: Geocells Market Size, By Application, 20152022 (Thousand Square Meter)

Table 29 UK: Geocells Market Size, By Application, 20152022 (USD Thousand)

Table 30 UK: Geocells Market Size, By Application, 20152022 (Thousand Square Meter)

Table 31 Italy: Geocells Market Size, By Application, 20152022 (USD Thousand)

Table 32 Italy: Geocells Market Size, By Application, 20152022 (Thousand Square Meter)

Table 33 Spain: Geocells Market Size, By Application, 20152022 (USD Thousand)

Table 34 Spain: Geocells Market Size, By Application, 20152022 (Thousand Square Meter)

Table 35 Rest of Europe: Geocells Market Size, By Application, 20152022 (USD Thousand)

Table 36 Rest of Europe: Geocells Market Size, By Application, 20152022 (Thousand Square Meter)

Table 37 APAC: Geocells Market Size, By Country, 20152022 (USD Thousand)

Table 38 APAC: Geocells Market Size, By Country, 20152022 (Thousand Square Meter)

Table 39 APAC: Geocells Market Size, By Raw Material, 20152022 (USD Thousand)

Table 40 APAC: Geocells Market Size, By Raw Material, 20152022 (Thousand Square Meter)

Table 41 APAC: Geocells Market Size, By Application, 20152022 (USD Thousand)

Table 42 APAC: Geocells Market Size, By Application, 20152022(Thousand Square Meter)

Table 43 China: Geocells Market Size, By Application, 20152022 (USD Thousand)

Table 44 China: Geocells Market Size, By Application, 20152022 (Thousand Square Meter )

Table 45 Japan: Geocells Market Size, By Application, 20152022 (USD Thousand)

Table 46 Japan: Geocells Market Size, By Application, 20152022 (Thousand Square Meter)

Table 47 India: Geocells Market Size, By Application, 20152022 (USD Thousand)

Table 48 India: Geocells Market Size, By Application, 20152022 (USD Square Meter)

Table 49 South Korea: Geocells Market Size, By Application, 20152022 (USD Thousand)

Table 50 South Korea: Geocells Market Size, By Application, 20152022 (Thousand Square Meter)

Table 51 Rest of APAC: Geocells Market Size, By Application, 20152022 (USD Thousand)

Table 52 Rest of APAC: Geocells Market Size, By Application, 20152022 (Thousand Square Meter)

Table 53 Middle East, Africa, and South America: Geocells Market Size, By Country, 20152022 (USD Thousand)

Table 54 Middle East, Africa, and South America: Geocells Market Size, By Country, 20152022 (Thousand Square Meter)

Table 55 Middle East, Africa, and South America: Geocells Market Size, By Raw Material, 20152022 (USD Thousand)

Table 56 Middle East, Africa, and South America: Geocells Market Size, By Raw Material, 20152022 (Thousand Square Meter)

Table 57 Middle East, Africa, and South America: Geocells Market Size, By Application, 20152022 (USD Thousand)

Table 58 Middle East, Africa, and South America: Geocells Market Size, By Application, 20152022 (Thousand Square Meter)

Table 59 Brazil: Geocells Market Size, By Application, 20152022 (USD Thousand)

Table 60 Brazil: Geocells Market Size, By Application, 20152022 (Thousand Square Meter)

Table 61 South Africa: Geocells Market Size, By Application, 20152022 (USD Thousand)

Table 62 South Africa: Geocells Market Size, By Application, 20152022 (Thousand Square Meter)

Table 63 Rest of Middle East, Africa, and South America: Geocells Market Size, By Application, 20152022 (USD Thousand)

Table 64 Rest of Middle East, Africa, and South America: Geocells Market Size, By Application, 20152022 (USD Square Meter)

Table 65 Expansions, 20132018

Table 66 Divestments , 20132018

Table 67 Projects, 20132018

Table 68 New Product Developments, 20132018

Table 69 R&D, 20132018

Table 70 Mergers & Acquisitions, 20132018

List of Figures (28 Figures)

Figure 1 Geocells Market Segmentation

Figure 2 Geocells Market: Research Methodology

Figure 3 Bottom-Up Approach

Figure 4 Top-Down Approach

Figure 5 Geocells Market: Data Triangulation

Figure 6 HDPE to Be the Largest Raw Material of Geocells

Figure 7 Perforated to Be the Leading Design Type for Geocells

Figure 8 Channel & Slope Protection to Be the Fastest-Growing Application of Geocells

Figure 9 APAC to Be the Fastest-Growing Geocells Market

Figure 10 Geocells Market to Achieve Significant Growth Between 2017 and 2022

Figure 11 HDPE Was the Largest Raw Material of Geocells In 2016

Figure 12 Perforated to Be the Largest Design Type

Figure 13 North America Accounted for the Largest Market Share In 2016

Figure 14 Load Support to Be the Largest Application of Geocells

Figure 15 Load Support Was the Largest Application of Geocells

Figure 16 Factors Governing the Geocells Market

Figure 17 Geocells Market:Porters Five Forces Analysis

Figure 18 Perforated to Be the Fastest-Growing Design Type

Figure 19 HDPE to Be the Largest Raw Material of Geocells

Figure 20 Load Support to Be the Largest Application of Geocells

Figure 21 Regional Geocells Market Snapshot: India to Be the Fastest-Growing Geocells Market

Figure 22 North America: Geocells Market Snapshot

Figure 23 Spain to Be the Fastest-Growing Geocells Market In Europe

Figure 24 APAC: Geocells Market Snapshot

Figure 25 Companies Have Undertaken Various New Projects to Cater the Growing Demand for Geocells Between 2013 and 2017

Figure 26 Market Ranking of Top Five Geocell Manufacturers, 2016

Figure 27 Ten Cate: Company Snapshot

Figure 28 Flexituff International: Company Snapshot

Growth opportunities and latent adjacency in Geocells Market