Genetic Testing Market by Product (Consumables, Equipment, Software & Services), Technology (NGS, PCR, FISH), Testing Type (Predictive & Presymptomatic, Carrier, Prenatal & Newborn, Preimplantation), Methods (Molecular, Genetic, Biochemical), End User (Hospitals, Clinical Labs) - Global Forecast to 2027

“High volume of genetic screening tests to screen cancer, fetal abnormalities, and other genetic anomalies. The increasing trend of next generation screening for various research studies, personalized medicines and direct-to-consumer genetic testing are pushing the growth of the Genetic Testing Market.”

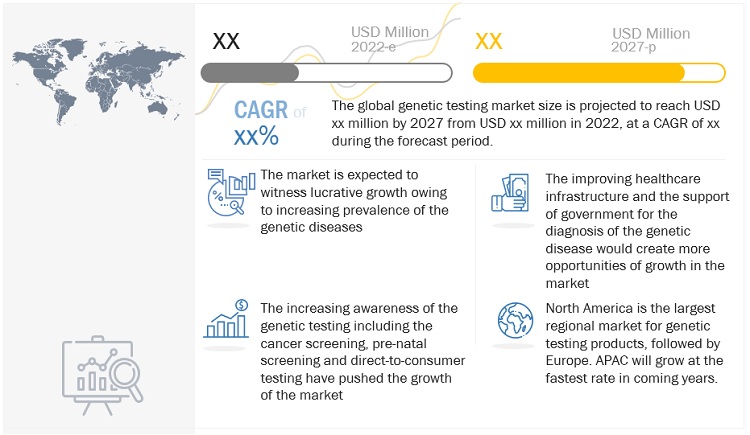

The global Genetic Testing Market is expected to reach USD xx billion by 2027 from USD xx billion in 2022, at a CAGR of xx%. The growth in this market is driven by the increasing prevalence of the genetic disorders, increasing cases of cancer, and genetic anomalies in newborn. The increasing awareness of genetic testing for screening cancer, pre-natal genetic screening of the increasing use of next generation sequencing (NGS) for the studies of various genetic diseases are pushing the growth of the market.

To know about the assumptions considered for the study, Request for Free Sample Report

“The consumables segment held the largest market share in 2021.”

Based on product, the Genetic Testing Market is segmented into consumables, equipment, software and services. The consumable segment held the largest share in 2021, which is driven by the high volume of consumables consumed in the genetic tests.

“The next generation sequencing segment is accounted for the largest share in 2021.”

Based on the technology, the Genetic Testing Market is segmented into Next-Generation Sequencing, Polymerase Chain Reaction, Fluorescence in Situ Hybridization, Chemiluminescence Immunoassay, and Other Technologies. The Next generation Sequencing segment is held the largest share owing to its increasing usage for the detection, studies and management of genetic disorders.

“Asia Pacific is estimated to register the highest CAGR during the study period. North America is expected to dominate the market share”

In this report, the Genetic Testing Market is segmented into four major regional segments, namely, North America, Europe, Asia Pacific, Middle East & Africa and Latin America. North America to dominate the market in 2021, owing to its advanced genetic testing technologies, massive volume of genetic testing, and increasing prevalance of genetic disorders. The increasing awarenss and government programs and support for the genetic testing are also promoting the market growth.

Asia Pacific Market is expected to grow at the fastest CAGR during the forecast period of 2022 to 2027, this is attributed to the vast geriatric popualtion, expaniding population base, huge volume of genetic testing due to the massive prevalance of genetic diseases, increasing use of genetic tests for cancer screening, pre-natal screening and other genetic anomalies.

To know about the assumptions considered for the study, download the pdf brochure

Breakdown of primary supply-side interviews, by company type, designation, and region:

- By Company Type - Tier 1: 48%, Tier 2: 40%, and Tier 3: 12%

- By Designation - C-level: 44%, D-level: 30%, and Others: 26%

- By Region: North America (34%), Europe (26%), AsiaPacific (23%), and Rest of the World (17%)

List of Companies Profiled in the Report

- F. Hoffmann-La Roche Ltd.

- Abbott Laboratories

- Thermo Fisher Scientific, Inc.

- Agilent Technologies, Inc.

- Bio-Rad Laboratories, Inc.

- Illumina, Inc.

- QIAGEN

- Siemens Healthinier

- Danaher Corporation

- Hologic, Inc.

- PerkinElmer Inc.

- Myriad Genetics Inc.

- Sysmex Corporation

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 MARKET SCOPE

1.3.1 MARKETS COVERED

1.3.2 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY

1.5 LIMITATIONS

1.6 STAKEHOLDERS

2 RESEARCH METHODOLOGY

2.1 RESEARCH DATA

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

2.4 ASSUMPTIONS FOR THE STUDY

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

5.2.1 DRIVERS

5.2.2 RESTRAINTS

5.2.3 OPPORTUNITIES

5.2.4 CHALLENGES

5.4 ECOSYSTEMS ANALYSIS

5.5 SUPPLY CHAIN ANALYSIS

5.6 PRICING ANALYSIS

6 GENETIC TESTING MARKET, BY PRODUCT

6.1 INTRODUCTION

6.2 CONSUMABLES

6.3 EQUIPMENT

6.4 SOFTWARE AND SERVICES

6.5 COVID-19 IMPACT ANALYSIS

7 GENETIC TESTING MARKET, BY TECHNOLOGY

7.1 INTRODUCTION

7.2 NEXT-GENERATION SEQUENCING

7.3 POLYMERASE CHAIN REACTION

7.4 FLUORESCENCE IN SITU HYBRIDIZATION

7.5 CHEMILUMINESCENCE IMMUNOASSAY

7.6 OTHER TECHNOLOGIES

7.7 COVID-19 IMPACT ANALYSIS

8 GENETIC TESTING MARKET, BY TESTING TYPE

8.1 INTRODUCTION

8.2 PREDICTIVE TESTING AND PRESYMPTOMATIC TESTING

8.3 CARRIER TESTING

8.4 PRENATAL AND NEWBORN TESTING

8.5 PREIMPLANTATION TESTING

8.6 DIAGNOSTIC TESTING

8.7 PHARMACOGENOMIC TESTING

8.8 NUTRIGENOMIC TESTING

8.9 FORENSIC TESTING

8.10 COVID-19 IMPACT ANALYSIS

9 GENETIC TESTING MARKET, BY METHODS

9.1 INTRODUCTION

9.2 MOLECULAR GENETIC TESTING

9.3 CHROMOSOMAL GENETIC TESTING

9.4 BIOCHEMICAL GENETIC TESTING

9.5 OTHERS (IF ANY)

9.6 COVID-19 IMPACT ANALYSIS

10 GENETIC TESTING MARKET, BY END USERS

10.1 INTRODUCTION

10.2 HOSPITALS

10.3 CLINICAL LABORATORIES

10.4 OTHERS (IF ANY)

10.5 COVID-19 IMPACT ANALYSIS

11 GENETIC TESTING MARKET, BY REGION

11.1 INTRODUCTION

11.2 EUROPE

11.2.1 ITALY

11.2.2 GERMANY

11.2.3 FRANCE

11.2.4 UK

11.2.5 SPAIN

11.2.6 REST OF EUROPE

11.3 NORTH AMERICA

11.3.1 US

11.3.2 CANADA

11.4 ASIA PACIFIC

11.4.1 JAPAN

11.4.2 CHINA

11.4.3 INDIA

11.4.4 REST OF ASIA PACIFIC

11.5 LATIN AMERICA

11.6 MIDDLE EAST AND AFRICA

12 COMPANY EVALUATION MATRIX AND COMPANY PROFILES

12.1 COMPANY EVALUATION MATRIX DEFINITION & METHODOLOGY

12.2 MARKET SHARE ANALYSIS (2021, % OF USD MILLION)

12.3 COMPETITIVE SCENARIO

12.3.1 PRODUCT LAUNCHES AND APPROVALS

12.3.2 COLLABORATIONS

12.3.3 EXPANSIONS

12.3.4 ACQUISITIONS

12.3.5 OTHER DEVELOPMENTS

12.4 COMPETITIVE LEADERSHIP MAPPING

12.4.1 VENDOR INCLUSION CRITERIA

12.4.2 STARS

12.4.3 EMERGING LEADERS

12.4.4 PERVASIVE

12.4.5 EMERGING COMPANIES

13 COMPANY PROFILES

(Business overview, Products offered, Recent developments)*

13.1 F. HOFFMANN-LA ROCHE LTD.

13.2 ABBOTT LABORATORIES

13.3 THERMO FISHER SCIENTIFIC, INC.

13.4 AGILENT TECHNOLOGIES, INC.

13.5 BIO-RAD LABORATORIES, INC.

13.6 ILLUMINA, INC.

13.7 QIAGEN

13.8 SIEMENS HEALTHINIER

13.9 DANAHER CORPORATION

13.10 HOLOGIC, INC.

13.11 PERKINELMER INC.

13.12 MYRIAD GENETICS INC.

14 APPENDIX

14.1 DISCUSSION GUIDE

14.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

14.3 AVAILABLE CUSTOMIZATIONS

14.4 RELATED REPORTS

14.5 AUTHOR DETAILS

Growth opportunities and latent adjacency in Genetic Testing Market