Generative Design Market by Application (Product Design & Development and Cost Optimization), Component, Deployment Model, Industry Vertical (Automotive, Aerospace & Defense, Industrial Manufacturing), and Region - Global Forecast to 2023

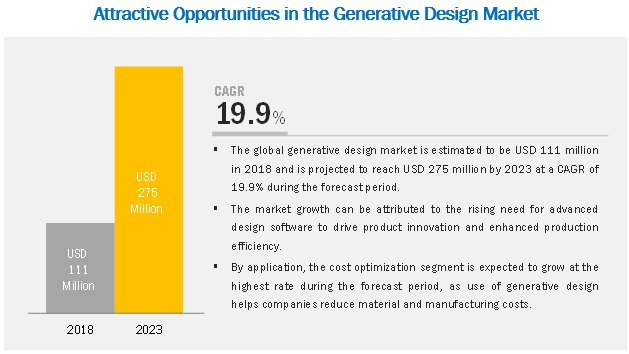

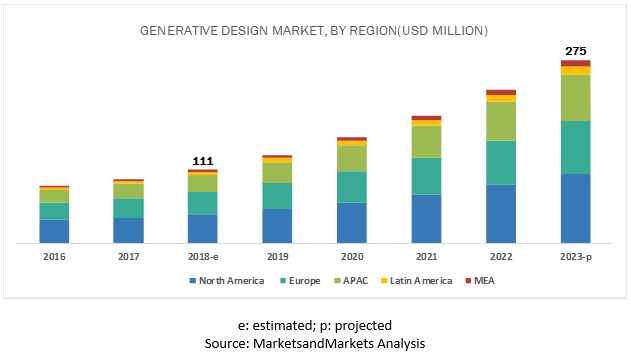

[105 Pages Report] The generative design market size is expected to grow from USD 111 million in 2018 to USD 275 million by 2023, at a CAGR of 19.9% during the forecast period. Factors such as rising need for advanced design software to drive product innovation, growing demand for environment-friendly architecture, and enhanced production efficiency are expected to the drive market during the forecast period.

The generative design market study aims at estimating the market size and future growth potential of the market across segments, such as component (software and services), application, deployment model, industry vertical, and region.

The software segment is expected to lead the generative design market during the forecast period

By component, the generative design market is segmented into software and services. Software that automatically produces optimum forms or products and buildings are considered in this market. This software is set to transform the role of designers and engineers, drastically reducing manufacturing time. This software is gaining traction from the manufacturing and construction sectors to cut costs of operations.

The product design & development application segment is expected to lead the market during the forecast period

With the advent of AI, generative design has gained popularity among engineers and architects as it provides thousands of design suggestions guided by a number of constraints such as weight, load, cost, and material. Designers and engineers can filter through these suggestions and opt for the best-suited outcomes. Generative design finds major application in product design & development, helping companies achieve lower part-consolidation costs, improve product strength, and simplify supply chains.

The on-premises deployment segment is expected to maintain its dominance in revenue generation during the forecast period

On-premises deployment of generative design software provides organizations the ownership of their own data, business processes, and internal policies, and helps them manage risks and adhere to external compliance requirements. The growth of this segment can be attributed to the flexibility it offers to customize software as per an organization’s dynamic requirements, data security, and privacy.

North America would continue to dominate the market due to easy technology adoption

The global generative design market, by region, covers 5 major regions: North America, Asia Pacific (APAC), Europe, the Middle East and Africa (MEA), and Latin America. North America is expected to lead the market during the forecast period due to the presence of a large number of solution vendors in the US.

The generative design market comprises major solution providers, such as Autodesk (US), Altair (US), ANSYS (US), MSC Software (US), Dassault Systèmes (France), ESI Group (France), Bentley Systems (US), Desktop Metal (US), nTopology (US), and Paramatters (US). The study includes an in-depth competitive analysis of these key players in the market with their company profiles, recent developments, and key market strategies.

Scope of the report

|

Report Metric |

Details |

|

Market size available for years |

2016–2023 |

|

Base year considered |

2017 |

|

Forecast period |

2018–2023 |

|

Forecast units |

Million (USD) |

|

Segments covered |

Application, Component, Deployment Model, Industry Vertical, and Region |

|

Regions covered |

North America, APAC, Europe, Latin America, and MEA |

|

Companies covered |

Autodesk (US), Altair (US), ANSYS (US), MSC Software (US), Dassault Systèmes (France), ESI Group (France), Bentley Systems (US), Desktop Metal (US), nTopology (US), and Paramatters (US) |

This research report categorizes the generative design market based on application, component, deployment model, industry vertical, and region.

Based on Application, the generative design market is segmented as follows:

- Product Design & Development

- Cost Optimization

- Others (Learning and Training)

Based on component, the generative design market is segmented as follows:

- Software

- Services

- Design & Consulting Services

- Support & Maintenance Services

Based on deployment models, the generative design market is segmented as follows

- On-premises

- Cloud

Based on Industry Verticals, the generative design market has been segmented as follows

- Automotive

- Aerospace & Defense

- Industrial Manufacturing

- Building

- Architecture & Construction

- Others (Healthcare, Consumer Goods, and Oil & Gas)

Based on regions, the generative design market is segmented as follows:

- North America

- US

- Canada

- Europe

- UK

- Germany

- France

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of APAC

- Latin America

- Mexico

- Brazil

- Rest of Latin America

- MEA

- Middle East

- Africa

Recent Developments:

- In January 2019, Autodesk has collaborated with HP and GE to develop generative design software tools compatible with 3D printers. This would help Autodesk to increase rapid prototyping for 3D-parts.

Key Questions addressed by the report:

- What are the opportunities in the generative design market?

- What is the competitive landscape in the market?

- What are the emerging technologies impacting the overall market?

- What are the key use cases existing in the market?

- What are the key trends and dynamics existing in the market?

Frequently Asked Questions (FAQ):

What is Generative Design?

What are the top companies providing Generative Design software and services?

What is the impact of Generative Design over the IT Industry?

What are various technologies driving Generative Design?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 15)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Market Segmentation

1.3.2 Regional Scope

1.4 Years Considered for the Study

1.5 Currency

1.6 Stakeholders

2 Research Methodology (Page No. - 18)

2.1 Research Data

2.1.1 Secondary Data

2.1.2 Primary Data

2.1.2.1 Breakdown of Primaries

2.1.2.2 Key Industry Insights

2.2 Data Triangulation

2.3 Market Size Estimation

2.3.1 Top-Down Approach

2.3.2 Bottom-Up Approach

2.4 Market Forecast

2.5 Research Assumptions and Limitations

2.6 Limitations

3 Executive Summary (Page No. - 25)

4 Premium Insights (Page No. - 28)

4.1 Attractive Opportunities in the Generative Design Market

4.2 Market Share, By Component

4.3 Market By Deployment Model

4.4 Market By Industry Vertical

4.5 Market By Region

5 Market Overview and Industry Trends (Page No. - 31)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Need for Advanced Design Software to Drive Product Innovation

5.2.1.2 Growing Demand for Environment-Friendly Architecture

5.2.1.3 Enhanced Production Efficiency

5.2.2 Restraints

5.2.2.1 Complexity in Using Generative Design Software

5.2.3 Opportunities

5.2.3.1 Emerging Applications Across Various Industries

5.2.3.2 Technological Advancements in AI and Cloud Computing

5.2.4 Challenges

5.2.4.1 Integration Complexities

5.3 Industry Trends

5.4 Generative Design Market: Use Cases

5.4.1 Use Case 1: Reducing Weight and Optimizing Performance of Vehicles Using Generative Design Software

5.4.2 Use Case 2: Reducing Weight and Creating Strong Components With Generative Design Software

5.4.3 Use Case 3: Reducing Weight and Creating Easy-To-Use Products With Generative Design Software

5.5 Generative Design Process Flow

6 Generative Design Market By Component (Page No. - 37)

6.1 Introduction

6.2 Software

6.2.1 Need to Improve Production Efficiency Would Drive the Growth of Generative Design Software

6.3 Services

6.3.1 Design & Consulting

6.3.1.1 The Need to Explore New Avenues for Improving Business Performance to Drive Growth of Consulting Services

6.3.2 Support & Maintenance

6.3.2.1 Complexity of Operations and the Need for Regular Assistance During the Software Lifecycle to Foster Growth of Support & Maintenance

7 Generative Design Market By Application (Page No. - 43)

7.1 Introduction

7.2 Product Design & Development

7.2.1 Generative Design Software Can Produce A Wide Range of Complex Design Alternatives in Minimal Time

7.3 Cost Optimization

7.3.1 The Use of Generative Design Results in Lower Material and Shipping Costs

7.4 Others

8 Generative Design Market By Deployment Model (Page No. - 47)

8.1 Introduction

8.2 On-Premises

8.2.1 Data Security and Privacy Concerns to Drive Demand for On-Premise Generative Design Software

8.3 Cloud

8.3.1 On-The-Go Access to Generative Design Software to Drive Adoption of Cloud Deployment

9 Generative Design Market By Industry Vertical (Page No. - 51)

9.1 Introduction

9.2 Automotive

9.2.1 Need for Advanced Design Software to Reduce Production and Material Costs to Drive Demand

9.3 Aerospace & Defense

9.3.1 Need for Lightweight Components and Energy Performance Optimization to Drive Adoption of Generative Design

9.4 Industrial Manufacturing

9.4.1 The Use of Machine Learning to Create Multiple Design Iterations to Increase Adoption of Generative Design

9.5 Building

9.5.1 Initiatives to Construct Eco-Friendly Buildings to Spur the Demand for Generative Design

9.6 Architecture & Construction

9.6.1 Need for Optimized Construction Time, Logistics, and Material Costs to Drive Adoption Across Architecture & Construction Sector

9.7 Others

10 Generative Design Market By Region (Page No. - 58)

10.1 Introduction

10.2 North America

10.2.1 US

10.2.1.1 US Held the Largest Market Share in the Region Due to the Presence of Prominent Players and High Technology Spending

10.2.2 Canada

10.2.2.1 Higher Technology Adoption Across Automotive and Industrial Manufacturing to Drive Market Growth

10.3 Europe

10.3.1 Germany

10.3.1.1 Growing Interest in Generative Design Software From the Construction and Automotive Verticals to Drive the Market in Germany

10.3.2 UK

10.3.2.1 UK to Account for the Largest Market Size for Generative Design in Europe

10.3.3 France

10.3.3.1 Strong Distribution Channel of Players Drive Market Growth in France

10.3.4 Rest of Europe

10.4 Asia Pacific (APAC)

10.4.1 China

10.4.1.1 China to Account for the Largest Generative Design Market Size in APAC

10.4.2 Japan

10.4.2.1 Growing Investments in Advanced Manufacturing Design Software to Drive Market Growth

10.4.3 South Korea

10.4.3.1 Inclination of Consumers Toward Learning and Training to Fuel Growth of Market

10.4.4 India

10.4.4.1 Growth of Manufacturing and Automotive Industry Verticals to Trigger Adoption of Generative Design Adoption

10.4.5 Rest of Asia Pacific

10.5 Latin America

10.5.1 Brazil

10.5.1.1 Need for Cost Optimization Across Automotive Industry to Drive Growth of Market

10.5.2 Mexico

10.5.2.1 Adoption of 3d Printing and Additive Manufacturing to Boost Adoption of Generative Design

10.5.3 Rest of Latin America

10.6 Middle East & Africa (MEA)

10.6.1 Middle East

10.6.1.1 Improving Manufacturing Infrastructure to Drive Market Growth

10.6.2 Africa

10.6.2.1 Africa to Exhibit High CAGR During Forecast Period

11 Competitive Landscape (Page No. - 77)

11.1 Overview

11.2 Competitive Scenario

11.2.1 New Product Launches and Product Enhancements

11.2.2 Acquisitions, Partnerships, and Collaborations

11.3 Generative Design Market: Prominent Players

12 Company Profiles (Page No. - 80)

(Business Overview, Software and Services Offered, Recent Developments, SWOT Analysis, and MnM View)*

12.1 Altair

12.2 Bentley Systems

12.3 Autodesk

12.4 Ansys

12.5 Desktop Metal

12.6 Dassault Systèmes

12.7 MSC Software

12.8 ESI Group

12.9 Ntopology

12.10 Paramatters

*Details on Business Overview, Software and Services Offered, Recent Developments, SWOT Analysis, and MnM View Might Not Be Captured in Case of Unlisted Companies.

13 Appendix (Page No. - 99)

13.1 Discussion Guide

13.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

13.3 Available Customization

13.4 Related Reports

13.5 Author Details

List of Tables (56 Tables)

Table 1 United States Dollar Exchange Rate, 2015–2018

Table 2 Generative Design Market Size and Growth Rate, 2016–2023 (USD Million, Y-O-Y%)

Table 3 Market Size By Component, 2016–2023 (USD Million)

Table 4 Software: Market Size By Region, 2016–2023 (USD Million)

Table 5 Generative Design Market Size, By Service, 2016–2023 (USD Million)

Table 6 Services: Market Size By Region, 2016–2023 (USD Million)

Table 7 Design & Consulting Services: Market Size By Region, 2016–2023 (USD Million)

Table 8 Support &D Maintenance Services: Market Size By Region, 2016–2023 (USD Million)

Table 9 Generative Design Market Size, By Application, 2016–2023 (USD Million)

Table 10 Product Design & Development: Market Size, By Region, 2016–2023 (USD Million)

Table 11 Cost Optimization: Market Size By Region, 2016–2023 (USD Million)

Table 12 Other Applications: Market Size By Region, 2016–2023 (USD Million)

Table 13 Generative Design Market Size, By Deployment Model, 2016–2023 (USD Million)

Table 14 On-Premises: Market Size By Region, 2016–2023 (USD Million)

Table 15 Cloud: Market Size By Region, 2016–2023 (USD Million)

Table 16 Generative Design Market Size, By Industry Vertical, 2016–2023 (USD Million)

Table 17 Automotive: Market Size By Region, 2016–2023 (USD Million)

Table 18 Aerospace & Defense: Market Size By Region, 2016–2023 (USD Million)

Table 19 Industrial Manufacturing: Market Size By Region, 2016–2023 (USD Million)

Table 20 Building: Market Size By Region, 2016–2023 (USD Million)

Table 21 Architecture & Construction: Market Size By Region, 2016–2023 (USD Million)

Table 22 Other Industry Verticals: Market Size By Region, 2016–2023 (USD Million)

Table 23 Generative Design Market Size, By Region, 2016–2023 (USD Million)

Table 24 North America: Market Size By Component, 2016–2023 (USD Million)

Table 25 North America: Market Size By Service, 2016–2023 (USD Million)

Table 26 North America: Market Size By Application, 2016–2023 (USD Million)

Table 27 North America: Market Size By Deployment Model, 2016–2023 (USD Million)

Table 28 North America: Market Size By Industry Vertical, 2016–2023 (USD Million)

Table 29 North America: Market Size By Country, 2016–2023 (USD Million)

Table 30 Europe: Generative Design Market Size, By Component, 2016–2023 (USD Million)

Table 31 Europe: Market Size By Service, 2016–2023 (USD Million)

Table 32 Europe: Market Size By Application, 2016–2023 (USD Million)

Table 33 Europe: Market Size By Deployment Model, 2016–2023 (USD Million)

Table 34 Europe: Market Size By Industry Vertical, 2016–2023 (USD Million)

Table 35 Europe: Market Size By Country, 2016–2023 (USD Million)

Table 36 Asia Pacific: Generative Design Market Size, By Component, 2016–2023 (USD Million)

Table 37 Asia Pacific: Market Size By Service, 2016–2023 (USD Million)

Table 38 Asia Pacific: Market Size By Application, 2016–2023 (USD Million)

Table 39 Asia Pacific: Market Size By Deployment Model, 2016–2023 (USD Million)

Table 40 Asia Pacific: Market Size By Industry Vertical, 2016–2023 (USD Million)

Table 41 Asia Pacific: Market Size By Country, 2016–2023 (USD Million)

Table 42 Latin America: Generative Design Market Size, By Component, 2016–2023 (USD Million)

Table 43 Latin America: Market Size By Service, 2016–2023 (USD Million)

Table 44 Latin America: Market Size By Application, 2016–2023 (USD Million)

Table 45 Latin America: Market Size By Deployment Model, 2016–2023 (USD Million)

Table 46 Latin America: Market Size By Industry Vertical, 2016–2023 (USD Million)

Table 47 Latin America: Market Size By Country, 2016–2023 (USD Million)

Table 48 Middle East & Africa: Generative Design Market Size, By Component, 2016–2023 (USD Million)

Table 49 Middle East & Africa: Market Size By Service, 2016–2023 (USD Million)

Table 50 Middle East & Africa: Market Size By Application, 2016–2023 (USD Million)

Table 51 Middle East & Africa: Market Size By Deployment Model, 2016–2023 (USD Million)

Table 52 Middle East & Africa: Market Size By Industry Vertical, 2016–2023 (USD Million)

Table 53 Middle East & Africa: Market Size By Country, 2016–2023 (USD Million)

Table 54 New Product Launches and Product Enhancements, 2017–2018

Table 55 Partnerships and Collaborations, 2018

Table 56 Key Players in the Generative Design Market

List of Figures (28 Figures)

Figure 1 Generative Design Market: Research Design

Figure 2 Breakdown of Primary Interviews: By Company, Designation, and Region

Figure 3 Market Size Estimation Methodology: Bottom-Up Approach and Top-Down Approach

Figure 4 Factor Analysis

Figure 5 Market Assumptions

Figure 6 Market Analysis

Figure 7 Fastest-Growing Segments in Generative Design Market

Figure 8 Generative Design Market is Driven By Rising Need for Advanced Design Software to Enhance Product Innovation

Figure 9 Software Segment is Expected to Dominate During the Forecast Period

Figure 10 On-Premises Deployment Model Segment is Expected to Have A Larger Market Share During the Forecast Period

Figure 11 Aerospace & Defense Vertical is Expected to Witness the Highest Growth Rate During the Forecast Period

Figure 12 North America is Estimated to Have the Largest Market Share in 2018

Figure 13 Generative Design Market: Drivers, Restraints, Opportunities, and Challenges

Figure 14 Generative Design Process Flow

Figure 15 Services Segment to Grow at A Higher CAGR During the Forecast Period

Figure 16 Design & Consulting Services Segment to Grow at A Higher CAGR During the Forecast Period

Figure 17 Cost Optimization Segment to Grow at the Highest CAGR During the Forecast Period

Figure 18 On-Premises Segment to Grow at A Higher CAGR During the Forecast Period

Figure 19 Aerospace & Defense Vertical to Grow at the Highest CAGR During the Forecast Period

Figure 20 Asia Pacific to Grow at the Highest CAGR During the Forecast Period

Figure 21 North America: Market Snapshot

Figure 22 Asia Pacific: Market Snapshot

Figure 23 Key Developments By the Leading Players in the Generative Design Market, 2017–2019

Figure 24 Altair: Company Snapshot

Figure 25 Autodesk: Company Snapshot

Figure 26 Ansys: Company Snapshot

Figure 27 Dassault Systèmes: Company Snapshot

Figure 28 ESI Group: Company Snapshot

The study involved 4 major activities to estimate the current market size for generative design software and services. Exhaustive secondary research was done to collect information on market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with the industry experts across value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources, such as Hoovers, Bloomberg BusinessWeek, and Dun & Bradstreet, were referred for, to identify and collect information for this study. These secondary sources included annual reports; press releases and investor presentations of companies; white papers, certified publications, articles by recognized authors; gold standard and silver standard websites; manufacturing design technology Research and Development (R&D) organizations; regulatory bodies; and databases.

Primary Research

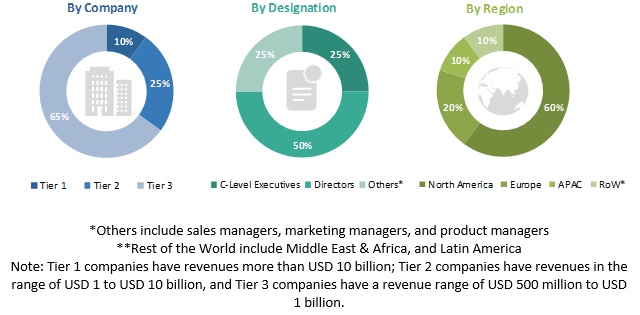

Various primary sources from both supply and demand-sides of the generative design market ecosystem were interviewed to obtain qualitative and quantitative information for this study. Primary sources from the supply-side included industry experts, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), marketing directors, technology and innovation directors, and related key executives from various vendors who provide the generative design software, associated service providers, and system integrators operating in the targeted regions. All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. Following is the breakdown of primary respondents,

To know about the assumptions considered for the study, download the pdf brochure

Generative Design Market Size Estimation

Both, top-down and bottom-up approaches were used for making market estimates and forecasting the generative design market, and the other dependent submarkets. The bottom-up procedure was used to arrive at the overall market size of the global market using key companies’ revenue and their offerings in the market. The research methodology used to estimate the market size includes the following:

- The key players in the market were identified through extensive secondary research.

- The market size, in terms of value, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation

With data triangulation and validation through primary interviews, the exact value of the overall parent market size was determined and confirmed using this study. The overall market size was then used in the top-down procedure to estimate the size of other individual markets via percentage splits of the market segmentation.

Report Objectives

- To define, describe, and forecast the size of the generative design market based on application, component, deployment mode, industry vertical, and region

- To provide detailed information about major factors, such as drivers, restraints, opportunities, and challenges influencing the growth of the market

- To analyze the market’s subsegments with respect to individual growth trends, prospects, and contributions to the total market

- To analyze opportunities in the market for stakeholders and provide a competitive landscape of the market

- To forecast the revenue of the market’s segments with respect to 5 major regions, namely, North America, Europe, Asia Pacific (APAC), Middle East & Africa (MEA), and Latin America

- To profile key players and comprehensively analyze their recent developments and position in the generative design market

- To analyze the competitive developments, such as mergers & acquisitions, partnerships, and new product developments in the market

Available Customizations

Along with the market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product matrix provides a detailed comparison of the product portfolio of each company

Company Information

- Detailed analysis and profiling of additional market players up to 5

Growth opportunities and latent adjacency in Generative Design Market