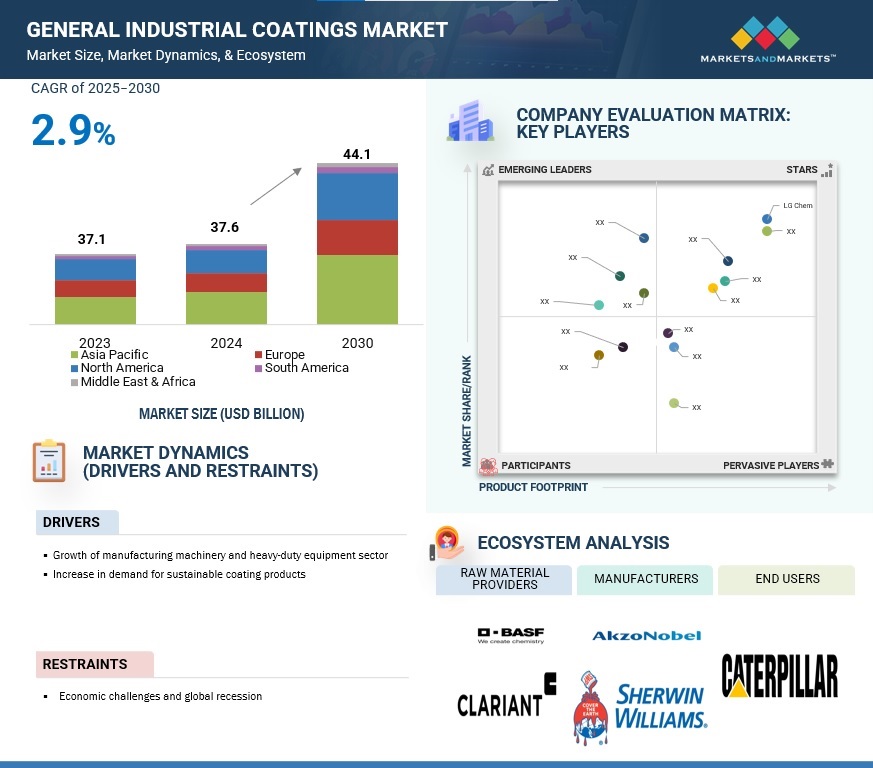

General Industrial Coatings Market by Technology (Waterborne, Solventborne, Powder), Applications (Electrical Components, Manufacturing Machinery, Consumer Goods & Appliances, Automotive Accessories, Heavy-Duty Equipment, Finishing Lines), and Region (2025-2030)

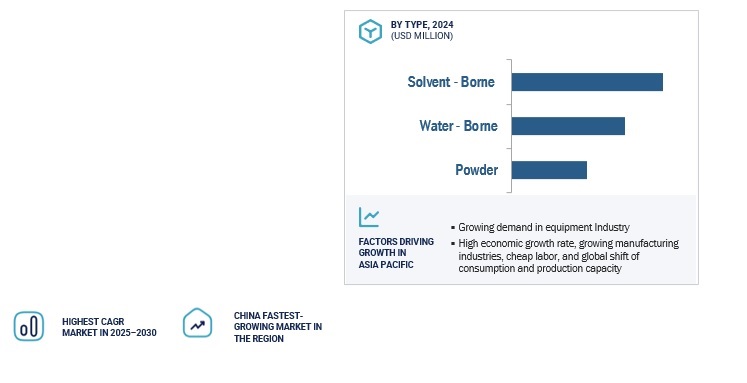

The general industrial coatings market is projected to grow from USD 37.6 billion in 2024 to USD 44.1 billion by 2030, at a CAGR of 2.9% between 2024 and 2030. Solventborne formulations are popular, as they are used in diverse coating applications due to their high performance. These coatings are used mainly in automotive, general industrial, and protective coatings. New high-solid formulations (50–70% solids) successfully meet regulations concerning VOC emissions. Solvent-based coatings have long been a staple in the general industrial coatings market, offering durability and versatility across various applications. These coatings rely on organic solvents, such as mineral spirits or toluene, to keep the resin and pigment in a liquid state until application. Once applied, the solvents evaporate, leaving behind a protective film. However, increasing environmental regulations and growing concerns about volatile organic compound (VOC) emissions have shifted towards more sustainable alternatives, such as water-based and powder coatings.

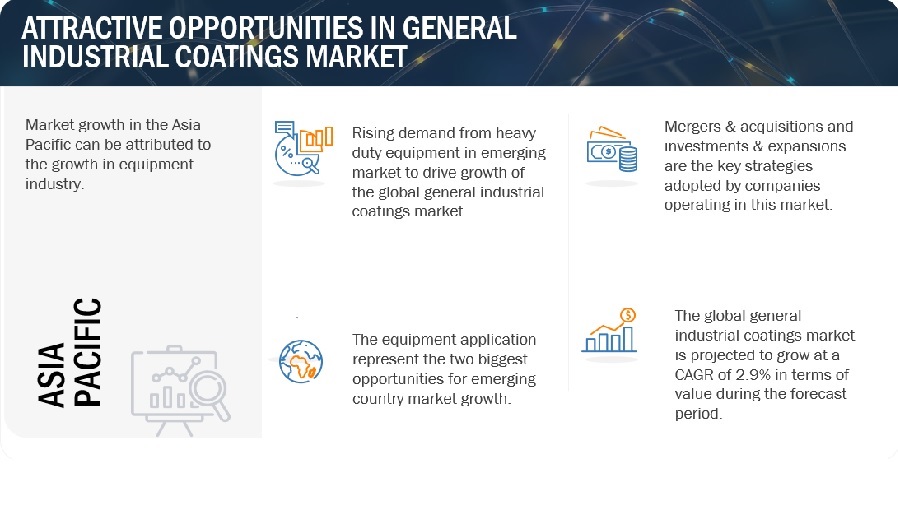

Attractive Opportunities in the General Industrial Coatings Market

Source: Interviews with Experts, Secondary Sources, and MarketsandMarkets Analysis

Source: Interviews with Experts, Secondary Sources, and MarketsandMarkets Analysis

To know about the assumptions considered for the study, Request for Free Sample Report

Source: Expert Interviews, Secondary Sources, and MarketsandMarkets Analysis

Source: Expert Interviews, Secondary Sources, and MarketsandMarkets Analysis

General Industrial Coatings Market Dynamics

Driver: Growth of manufacturing machinery and heavy-duty equipment sector

As the population grows, the agriculture sector expands. Agricultural equipment plays a crucial role in meeting rising food production demands. This has resulted in rapid growth of the global agriculture equipment market. Farm mechanization and precision farming, particularly in Asia Pacific and Latin America, have increased. Electric tractors are expected to provide considerable growth opportunities for market participants. These tractors are gaining popularity because of their cost-effectiveness, eco-friendliness, and efficiency. Mechanization in developing countries is also an important driver for the agricultural equipment business. The Asia Pacific market is predicted to expand faster due to economic growth and stability in China, India, and other agricultural countries in the region. Increased GDP, per capita income, and mechanization and government measures to promote farm equipment have led to growth in these regions.

The market is driven by the commercial, residential, and industrial sectors, as well as greater public-private partnerships and global economic expansion. The construction equipment industry is capitalizing on the global infrastructure and construction sector's rapid development. Growing public and private infrastructure, FDI reforms for the construction sector, highway projects, and a growing economy have resulted in an overall increase in demand for construction equipment. The growth in the construction equipment and farm equipment industry and the demand for other industrial machinery are driving the industrial coatings market.

Restraints: Economic challenges and global recession

Global economic activity is slowing due to tight monetary policy, restricted financial conditions, and sluggish trade growth. Global output growth is expected to slow in 2024, following a severe slowdown in 2022 and another decline last year. This will be the third straight year of slowing. The recent conflict in the Middle East and the Russian Federation's invasion of Ukraine have increased geopolitical risks and uncertainties in commodity markets, potentially harming global growth. The global economy is still dealing with the aftermath of four years of overlapping shocks, including the COVID-19 pandemic. This has resulted in the rise in inflation and subsequent sharp tightening of global monetary conditions. Growth in major economies, including China, is expected to decelerate in 2024, falling below the 2010-19 average pace.

According to the World Bank, economic activity growth in Europe and Central Asia (ECA) is forecast to drop to 2.4% this year, then rise to 2.7% in 2025, driven by stronger domestic demand and a gradual rebound in the eurozone. In most economies, rising inflation will hinder monetary policy easing and impact private spending. In Europe, difficult operating conditions, including slower economic growth, less optimal availability of raw material, relentless cost inflation, decline in the industrial sector, and the Russia-Ukraine war, have impacted the paints & coatings industry. The weakening of industrial activity in Europe has impacted the sales volume of paint and coating manufacturers to a mid-single-digit percentage on a year-over-year basis, where the strong price was fuelled consistently by quarterly operating earnings. Paint and raw material prices are on the rise due to current supply chain challenges, which are impacted by the surge in oil and energy costs resulting from Russia's invasion of Ukraine.

Economic growth of East Asia and Pacific is expected to decline to 4.5% in 2024 and 4.4% in 2025, primarily because of weaker growth in China. China's growth is expected to decelerate to 4.5% in 2024, then to 4.3% in 2025. Growth in 2024 and 2025 has been lowered by 0.1 percentage points from June predictions owing to weaker domestic demand. China's adverse effect on the region, combined with increased geopolitical tensions from the Middle East conflict, may lead to rising energy and food prices and inflation. Unexpected global demand and commerce, along with climate-related catastrophic weather events, pose additional hazards.

Opportunity: Substantial potential for growth in emerging markets

Emerging markets are crucial for the growth of the general industrial coating industry due to their expanding economies, increasing industrialization, and infrastructure development. The Middle East & Africa region is undergoing rapid industrialization and urbanization, fuelled by infrastructure investments, construction projects, and economic diversification efforts. Countries like Saudi Arabia, the United Arab Emirates, and South Africa are witnessing growth in sectors such as construction, oil & gas, automotive, and manufacturing. Africa imports a decent volume of paints and coatings to meet the domestic demand. Despite the importation of European paints and coatings, there is also a growing trend of regional and local manufacturing in Africa. Some African countries are investing in domestic paint and coating production to meet local demand and reduce dependency on imports. Additionally, collaborations between European and African companies may lead to technology transfer, capacity building, and knowledge exchange in the general industrial coatings market. Cooperation between European and African regulators and industry stakeholders can help mitigate potential negative impacts and promote sustainable growth in the sector. The African Continental Free Trade Area offers African nations the opportunity to upgrade domestic service regulations and may serve as a new foundation for EU collaboration. A services trade protocol is part of the 2018 African Continental Free Trade Area (AfCFTA) agreement, and its goal is to liberalize services markets and enhance domestic regulations in those markets. Additionally, it presents an opportunity for the EU to support the AfCFTA negotiations to promote intraregional trade and to expand on the agreement to generate new avenues for diversifying commerce between the EU and Africa.

Challenges: Stringent regulatory policies

Regulations pertaining to the environment are becoming stricter in all regions to reduce emissions of volatile organic compounds (VOCs) and hazardous air pollutants (HAPs. The coatings industry is a significant consumer of solvents, which are mostly produced from petrochemical feedstocks and refinery operations. The coatings sector also employs a large amount of non-petrochemical feedstocks, such as pigments and additives, which are not as sensitive to crude oil and gas prices. Non-petrochemical feedstocks account for roughly one-third of the total volume of coating. Regulations may restrict the use of hazardous substances such as heavy metals, toxic solvents, and carcinogens to prevent contamination of soil, water, and ecosystems. However, regulatory compliance often drives innovation and encourages the development of safer, more environmentally friendly coating technologies. Epoxy coatings often contain volatile organic compounds (VOCs) and other chemicals that can contribute to air pollution and have adverse effects on human health and the environment. Regulatory agencies are imposing stricter limits on VOC emissions to reduce environmental impact and improve air quality. Some components of epoxy coatings, such as bisphenol A (BPA) and certain epoxy resins, have been associated with health risks, including reproductive and developmental toxicity. Regulatory bodies are implementing measures to limit exposure to these substances and protect workers and consumers from potential health hazards.

General Industrial Coatings Market Ecosystem

By technology, powder to grow faster compared to other technologies in general industrial coatings market

Powder coatings have gained popularity in the general industrial market due to their durability, cost-effectiveness, and environmental advantages. These coatings are composed of finely ground particles of resin and pigment that are electrostatically charged and sprayed onto the substrate. They are then cured under heat to form a hard and protective coating. One of the main advantages of powder coatings is their high resistance to corrosion, chemicals, and UV radiation. They also offer excellent coverage and uniformity and a wide range of colors and finishes.

Powder coatings are commonly used in automotive, appliances, and architectural applications, where their toughness and decorative appeal are highly valued. Moreover, the environmental advantages of powder coatings, characterized by minimal VOC emissions and efficient material utilization, align well with sustainability initiatives driving market demand.

Finishing lines segment accounted for one of the largest shares of the market

The finishing lines consist of Cabinets, Shelves, Racks, Shop Displays, and others. In finishing lines for shop displays, industrial coatings serve several important functions, including protection, aesthetics, and durability. Topcoats are applied over the basecoat to provide additional protection, UV resistance, and durability. They enhance the appearance of the shop displays while providing a smooth, glossy finish. Topcoats may be clear or pigmented and are available in various gloss levels to meet aesthetic preferences and branding standards. Shop displays may require specialty coatings tailored to specific requirements or performance criteria. These coatings include scratch-resistant coatings, anti-graffiti coatings, chemical-resistant coatings, and textured coatings for added visual interest. Specialty coatings help protect the displays from damage, enhance durability, and maintain their appearance over time. Cabinets may require specialty coatings tailored to specific requirements or performance criteria. These coatings include scratch-resistant coatings, moisture-resistant coatings, anti-microbial coatings, and textured coatings for added visual interest. Specialty coatings help protect the cabinets from damage, enhance durability, and maintain their appearance over time.

Asia Pacific is the largest and fastest-growing general industrial coatings market.

The Asia Pacific region emerges as a significant growth driver for the global general industrial coatings market, fuelled by rapid industrialization, urbanization, and infrastructure development.

The electronics industry in Asia Pacific presents significant opportunities for general industrial coatings, driven by the proliferation of electronic devices and the demand for protective and functional coatings for electronic components.

Infrastructure development projects such as smart cities and high-speed rail networks in countries like China and India are driving demand for coatings with special properties such as anti-graffiti, anti-corrosion, and anti-fouling.

The growing trend towards lightweight materials in the automotive and aerospace industries is driving the demand for coatings that offer corrosion protection without adding significant weight to the substrate.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The key market players profiled in the report include PPG (US), BASF SE (Germany), Sherwin William (US), Akzo Nobel N.V. (Netherlands).

Akzo Nobel N.V. is a diversified chemical company operating through the following segments: Decorative Paints and Performance Coatings. The Decorative Paints segment manufactures and supplies a range of interior and exterior decoration and protection products for the professional and do-it-yourself sectors. The Performance Coatings segment produces automotive and aerospace coatings; industrial coatings; marine and protective coatings; and powder coatings. Akzo Nobel N.V. has a strong customer base and operates in various countries in Europe, North America, Asia Pacific, South America, and the Middle East. The company operates globally through its subsidiaries, which include Akzo Nobel Chang Cheng (China) Ltd., Akzo Nobel Coatings Inc. (US), Akzo Nobel India Private Ltd. (India), and Akzo Nobel Coatings Ltd. (UK).

Recent Developments in General Industrial Coatings Market

- In April 2024, AkzoNobel, two new research labs are being built by AkzoNobel at its Sassenheim site in the Netherlands to further propel the company's pioneering product development. The total investment in the Sassenheim site – AkzoNobel's largest global R&D centre – amounts to around EUR 8 million (USD 8.6 million).

- In March 2024, AkzoNobel, more than USD 30 million is being invested by AkzoNobel to install advanced technologies and increase total manufacturing capacity at its four powder coatings sites in North America. The company is incorporating new extruders, thermoplastics, and bonding processes at its facilities in Reading, Pennsylvania; Warsaw, Indiana; Nashville, Tennessee; and Monterrey, Mexico. It will unlock numerous benefits, such as increased production efficiency and expanded application capabilities.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Frequently Asked Questions (FAQs):

What are the factors driving the growth of the general industrial coatings market?

The growing heavy-duty equipment application is one of the primary factors driving the general industrial coatings market.

What are the major applications for general industrial coatings?

The major applications of general industrial coatings are heavy-duty equipment.

Who are the major manufacturers of general industrial coatings?

PPG (US), BASF SE (Germany), Sherwin William (US), Akzo Nobel N.V. (Netherlands) are some of the leading players operating in the global general industrial coatings market.

What are the reasons behind general industrial coatings gaining market share?

General industrial coatings are gaining market share due to increasing demand from the Asia Pacific region.

Which is the largest region in the general industrial coatings market?

Asia Pacific is the largest region in the general industrial coatings market.

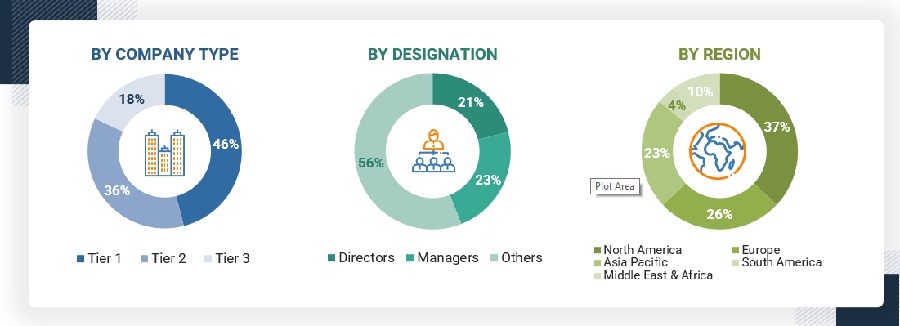

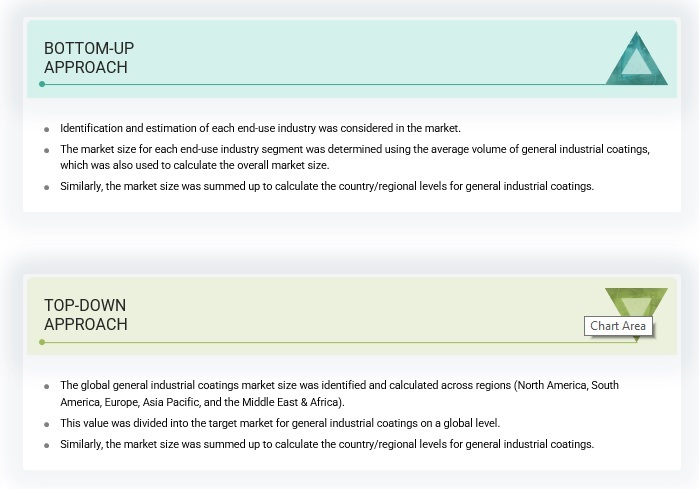

The study involved four major activities to estimating the current size of the general industrial coatings market. Exhaustive secondary research conducted to gather information on the market. The next step was to conduct primary research to validate these findings, assumptions, and sizing with the industry experts across the value chain. Both top-down and bottom-up approaches were used to estimate the total market size. The market size of segments and subsegments was then estimated using market breakdown and data triangulation.

Secondary Research

Secondary sources include annual reports of companies, press releases, investor presentations, white papers, articles by recognized authors, and databases, such as D&B, Bloomberg, and Factiva, and publications and databases from associations.

Primary Research

Extensive primary research was carried out after gathering information about general industrial coatings market through secondary research. In the primary research process, experts from the supply and demand sides have been interviewed to obtain qualitative and quantitative information and validate the data for this report. Questionnaires, emails, and telephonic interviews were used to collect primary data. Primary sources from the supply side include industry experts, such as chief executive officers (CEOs), vice presidents (VPs), marketing directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the general industrial coatings market. Primary interviews were conducted to elicit information such as market statistics, revenue data collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also assisted in comprehending the various trends associated to type, end – use industry, and region.

The breakup of Primary Research:

To know about the assumptions considered for the study, download the pdf brochure

GENERAL INDUSTRIAL COATINGS MANUFACTURERS

|

General Industrial Coatings Manufaturers |

|

|

AkzoNobel |

BASF SE |

|

PPG |

Sherwin Williams |

|

Jotun |

Asian Paints |

General Industrial Coatings Market Size Estimation

After arriving at the overall market size, the market has been split into several segments. To complete the overall market engineering process and arrive at the exact statistics for all segments, the data triangulation and market breakdown procedures have been employed, wherever applicable. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market size was validated using both the top-down and bottom-up approaches.

Global General Industrial Coatings Market Size: Bottom-Up Approach and Top-Down Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size, the market has been split into several segments. To complete the overall market engineering process and arrive at the exact statistics for all segments, the data triangulation and market breakdown procedures have been employed, wherever applicable. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market size was validated using both the top-down and bottom-up approaches.

Market Definition

General industrial coatings encompass a broad category of specialized coatings designed to protect surfaces in industrial environments. These coatings are formulated to withstand harsh conditions such as corrosion, abrasion, chemical exposure, and extreme temperatures. By providing durable and reliable protection, these coatings contribute to the longevity and efficiency of industrial operations across a wide range of sectors. They are utilized across various industries, including manufacturing, automotive, aerospace, marine, oil & gas, and construction.

Key Stakeholder

- End User

- Raw Material Suppliers

- Senior Management

- Procurement Department

Report Objectives:

- To define, describe, segment, and forecast the size of the general industrial coatings market based on width, type, end – use industry, and region.

- To forecast the market size of segments with respect to various regions, including North America, Europe, Asia Pacific, South America, Middle East & Africa, along with major countries in each region

- To identify and analyze key drivers, restraints, opportunities, and challenges influencing the growth of the general industrial coatings market

- To analyze technological advancements and product launches in the market

- To strategically analyze micromarkets, with respect to their growth trends, prospects, and their contribution to the market

- To identify financial positions, key products, and key developments of leading companies in the market

- To provide a detailed competitive landscape of the market, along with market share analysis

- To provide a comprehensive analysis of business and corporate strategies adopted by the key players in the market

- To strategically profile key players in the market and comprehensively analyze their core competencies

Available Customizations:

MarketsandMarkets offers the following customizations for this market report:

- Additional country-level analysis of the general industrial coatings market

- Profiling of additional market players (up to 5)

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company in the general industrial coatings market

Growth opportunities and latent adjacency in General Industrial Coatings Market