Gelling Agents Market by Product Type (Agar-agar, Gellan Gum, Curdlan, Xanthan Gum, Karaya Gum, Gelatin, Guar Gum, Pectin), Function Type, Nature (Organic, Artificial), Application and Region - Global Forecast to 2027

The gelling agents market is projected to reach USD 8,890 billion by 2027, at a CAGR of 5.2% from USD 4,520 billion in 2022. One of the major factors contributing to the growth of the gelling agents market is increasing demand of natural ingredients by the growing health-conscious population.

To know about the assumptions considered for the study, Request for Free Sample Report

Market Dynamics

Driver: Rising demand for pectin

Pectin is used as a gelling agent and stabilizer in a broad range of fruit products, such as fruit-based preparations for yogurts and desserts, marmalades and bakery products. It also finds application in confectionery, such as jam and jellies, to give them the structure of a gel. Reduction in cooking time, improve texture and color, and increase the shelf life are some of the key advantages of incorporating pectin in food. Thus, increasing application of gelling agents in the confectionaries, are expected to be a driving factor for the market.

Restraints: Higher content of gelling agents may result in health-associated problems

Higher content of artificial gelling agents in food might impact causes health-associated problems such as abnormalities in gum linings, stomach cramps, diarrhea. Moreover, people who are allergic to citrus fruits are advisable not to consume gelling agents. Gelling agents such as pectin can reduce the body’s ability to absorb beta-carotene, an important nutrient. Moreover, some gelling agents lack antimicrobial properties, necessitating testing for compatibility with other ingredients in the formulation, and rising government regulations regarding food safety are among the major factors acting as restraints.

Opportunities: Demand for natural additives in food industry

Surging need for natural ingredients and additives in the food industry to open new avenues of growth in gelling agents market during the forecast period. Increase in the number of health-conscious consumers who prefer products made from natural ingredients such as pectin, xanthan gum, and gelatin. These natural and biodegradable-extracted components are free from any chemical reactions, and thus, hold an upper edge in the market for their use. Therefore, natural gelling agents is poised to provide remunerative growth opportunity owing to its high use in the production of packaged food products such as marshmallows, jellies and fruit snacks.

Challenges: Stringent regulations towards food additives

Stringent regulations towards food additives might pose challnege in the gelling agents market. Several organizations, such as the Food Administrative Organization, the United States Department of Agriculture, and JECFA (Joint FAO/WHO Expert Committee on Food Additives, are introducing a general standard for food additives (GSFA) to increase the trade among countries.

|

Report Metric |

Details |

|

Kima Chemical |

Raw Material |

|

SIDLEY CHEMICAL CO.,LTD. |

Raw Material |

|

Roquette Freres |

Raw Material |

|

Cargill Incorporated |

Product Manufacturing |

|

Tate & Lyle |

Product Manufacturing |

|

Archer Daniels Midland Company |

Product Manufacturing |

|

E. I. DuPont De Nemours |

Product Manufacturing |

|

AmbraPolymers |

Compounder |

|

Haribo GmbH & Co. K.G. |

End User |

|

Hershey Co. |

End-User |

“Gelatin was the largest product type of gelling agents market in 2021, in terms of value”

The gelatin gelling agent market accounted for the largest share, in terms of value, in 2021. This dominance is expected to continue during the forecast period owing to its health benefits offered by gelatin. It is found that gelatin has been identified as an important substance for treating bone and joint problems such as osteoarthritis by research studies. Additionally, extensive use of gelatin in hair and skin care products has driven its consumption in the personal care industry.

“Food & Beverage was the largest application for gelling agents market in 2021, in terms of value”

The food and beverage application segment accounted for the largest share of the global gelling agents market, in terms of value, in 2021. The demand for gelling agents in the food & beverage application is expected to increase mainly because of the rise in processed food in the Asia Pacific.

“Asia Pacific was the largest market for gelling agents in 2021, in terms of value.”

Asia Pacific is the largest gelling agents market and is projected to register the highest CAGR, in terms of volume, between 2022 and 2027. This is mainly attributed to the rise in the consumption of packaged food along with growing demand for various personal care products. Growth in disposable income coupled with sizeable number of young population in the region has been bolstering demand for gelling agents. Since gelling agents are used as supplements to enhance skin moisture, growth of the personal care segment in the especially in the Southeast Asia will directly impact the market growth.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The key players in this market are Cargill Incorporated (US), Tate & Lyle (UK), Archer Daniels Midland Company(US), E. I. DuPont De Nemours (US), Ingredion Incorporated (US), Naturex, Nexira, Kerry Group(Ireland) , Agro Gums (India). Continuous developments in the market—including new product launches, mergers & acquisitions, agreements, and expansions—are expected to help the market grow. Leading manufacturers of gelling agents market have opted for new product launches to sustain their market position.

Scope of the Report

|

Report Metric |

Details |

|

Years considered for the study |

2017-2027 |

|

Base Year |

2021 |

|

Forecast period |

2022–2027 |

|

Units considered |

Volume (Tons); Value (USD Million) |

|

Segments |

Product type, Function, Nature and Region |

|

Regions |

Asia Pacific, North America, Europe, Middle East & Africa, and South America |

|

Companies |

The key players in this market are Cargill Incorporated (US), Tate & Lyle (UK), Archer Daniels Midland Company(US), E. I. DuPont De Nemours (US), Ingredion Incorporated (US), Naturex, Nexira, Kerry Group(Ireland) |

This report categorizes the global gelling agents market based on product type, function, nature, and region.

On the basis of product type, the gelling agents market has been segmented as follows:

- Agar-agar

- Gellan Gum

- Curdlan

- Xanthan Gum

- Karaya Gum

- Gelatin

- Guar Gum

- Pectin

- Others

On the basis of nature, the gelling agents market has been segmented as follows:

- Organic

- Artificial

On the basis of function type, the gelling agents market has been segmented as follows:

- Stabilizer

- Thickener

- Texturizer

- Emulsifier

On the basis of application, the gelling agents market has been segmented as follows:

- Food and Beverage

- Personal Care

- Pharmaceuticals

- Others

On the basis of region, the gelling agents market has been segmented as follows:

- Asia Pacific

- Europe

- North America

- Middle East & Africa

- South America

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 SCOPE OF THE STUDY

1.3.1 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY

1.5 PACKAGE SIZE

1.6 STAKEHOLDERS

2 RESEARCH METHODOLOGY

2.1 RESEARCH DATA

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Breakdown of primary interviews

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

2.3 DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS

2.5 LIMITATIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 INTRODUCTION

5.2 MARKET SEGMENTATION

5.3 MARKET DYNAMICS

5.3.1 DRIVERS

5.3.2 RESTRAINTS

5.3.3 OPPORTUNITIES

5.3.4 CHALLENGES

6 INDUSTRY TRENDS

6.1 INTRODUCTION

6.2 VALUE CHAIN ANALYSIS

6.3 PORTER’S FIVE FORCES ANALYSIS

6.3.1 THREAT OF SUBSTITUTES

6.3.2 BARGAINING POWER OF BUYERS

6.3.3 THREAT OF NEW ENTRANTS

6.3.4 BARGAINING POWER OF SUPPLIERS

6.3.5 INTENSITY OF COMPETITIVE RIVALRY

6.4 PATENT ANALYSIS

6.5 IMPACT OF COVID-19

7 GELLING AGENTS MARKET, BY TYPE

7.1 INTRODUCTION

7.2 AGAR-AGAR

7.3 GELLAN GUM

7.4 CURDLAN

7.5 XANTHAN GUM

7.6 KARAYA GUM

7.7 GELATIN

7.8 GUAR GUM

7.9 PECTIN

7.10 OTHERS

8 GELLING AGENTS MARKET, BY FUNCTION

8.1 INTRODUCTION

8.2 STABILIZER

8.3 THICKENER

8.4 TEXTURIZER

8.5 EMULSIFIER

9 GELLING AGENTS MARKET, BY NATURE

9.1 INTRODUCTION

9.2 ORGANIC

9.3 ARTIFICIAL

10 GELLING AGENTS MARKET, BY APPLICATION

10.1 INTRODUCTION

10.2 FOOD AND BEVERAGE

10.3 PERSONAL CARE & COSMETICS

10.4 PHARMACEUTICALS

10.5 OTHERS

11 GELLING AGENTS MARKET, BY REGION

11.1 INTRODUCTION

11.1 NORTH AMERICA

11.1.1 US

11.1.2 CANADA

11.1.3 MEXICO

11.2 EUROPE

11.2.1 GERMANY

11.2.2 FRANCE

11.2.3 UK

11.2.4 ITALY

11.2.5 RUSSIA

11.2.6 REST OF EUROPE

11.3 ASIA PACIFIC

11.3.1 CHINA

11.3.2 INDIA

11.3.3 JAPAN

11.3.4 SOUTH KOREA

11.3.5 REST OF ASIA PACIFIC

11.4 SOUTH AMERICA

11.4.1 BRAZIL

11.4.2 ARGENTINA

11.4.3 REST OF SOUTH AMERICA

11.5 MIDDLE EAST & AFRICA

11.5.1 SOUTH AFRICA

11.5.2 SAUDI ARABIA

11.5.3 REST OF MEA

12 COMPETITIVE LANDSCAPE

12.1 OVERVIEW

12.2 COMPETITIVE LANDSCAPE MAPPING (DIVE)

12.3 COMPETITIVE BENCHMARKING

12.4 MARKET RANKING OF KEY PLAYERS

12.5 COMPETITIVE SITUATION AND TRENDS

13 COMPANY PROFILES

(Overview, Financial*, Products & Services, Strategy, and Developments)

13.1 CARGILL INCORPORATED

13.2 TATE & LYLE

13.3 ARCHER DANIELS MIDLAND COMPANY

13.4 E. I. DUPONT DE NEMOURS

13.5 INGREDION INCORPORATED

13.6 NATUREX, NEXIRA

13.7 KERRY GROUP

13.8 CP KELCO

13.9 DANGSHAN HAISHENG PECTIN CO., LTD.

13.10 DEOSEN BIOCHEMICAL LTD.

(This is a tentative list. Total list of 25 players will be provided and top 10 will be profiled in the report)

*Details might not be captured in case of unlisted companies.

The study involved four major activities to estimate the size of gelling agents market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, the market breakdown and data triangulation procedures were used to estimate the market size of the segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources have been referred to for identifying and collecting information for this study. These secondary sources include annual reports, press releases, investor presentations of companies, white papers, certified publications, trade directories, certified publications, articles from recognized authors, gold standard and silver standard websites, and databases.

Secondary research has been used to obtain key information about the value chain of the industry, monetary chain of the market, the total pool of key players, market classification and segmentation according to industry trends to the bottom-most level, and regional markets. It was also used to obtain information about the key developments from a market-oriented perspective.

Primary Research

The gelling agents market comprises several stakeholders in the value chain, which include raw material suppliers, manufacturers, distributors, and end users. Various primary sources from the supply and demand sides of the gelling agents market have been interviewed to obtain qualitative and quantitative information.

The primary interviewees from the demand side include key opinion leaders in end-use sectors. The primary sources from the supply side include manufacturers, associations, and institutions involved in the gelling agents industry.

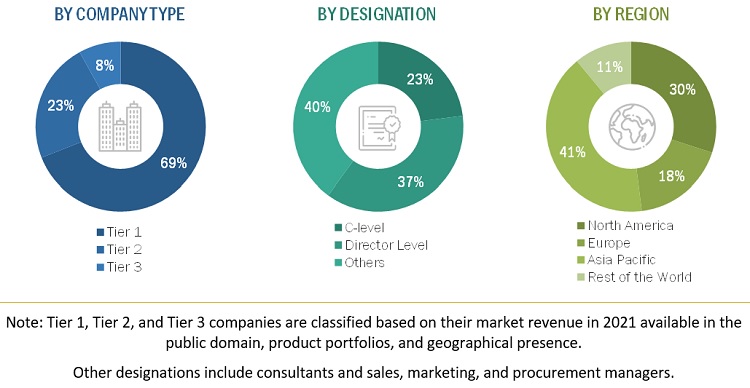

The breakdown of profiles of the primary interviewees is illustrated in the figure below:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

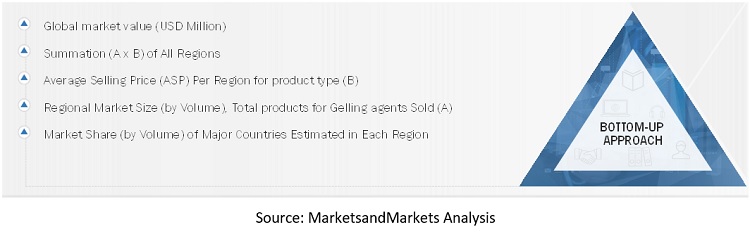

The top-down and bottom-up approaches have been used to estimate and validate the size of the gelling agents market.

- The key players in the industry have been identified through extensive secondary research.

- The supply chain of the industry has been determined through primary and secondary research.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research includes the study of reports, reviews, and newsletters of the key market players, along with extensive interviews for opinions with leaders such as directors and marketing executives.

Gelling Agents Market: Bottom-Up Approach 1

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the total market size from the estimation process explained above, the overall market has been split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics for all the segments and sub-segments, the data triangulation and market breakdown procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market size has been validated by using both the top-down and bottom-up approaches and primary interviews. Hence, for every data segment, there have been three sources—top-down approach, bottom-up approach, and expert interviews. The data was assumed correct when the values arrived from the three sources matched.

Report Objectives

- To define, describe, and forecast the size of the gelling agents market, in terms of value and volume

- To provide detailed information regarding the major factors (drivers, opportunities, restraints, and challenges) influencing the growth of the market

- To estimate and forecast the market size based on product type, function, nature, application and region

- To forecast the size of the market with respect to major regions, namely, Europe, North America, Asia Pacific, and Middle East & Africa, and South America along with their key countries

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and their contribution to the overall market

- To analyze opportunities in the market for stakeholders and provide a competitive landscape of market leaders

- To track and analyze recent developments such as expansions, new product launches, partnerships & agreements, and acquisitions in the market

- To strategically profile key market players and comprehensively analyze their core competencies2

Growth opportunities and latent adjacency in Gelling Agents Market