Gas Turbine Air Filtration Market - Global Forecast to 2030

The air filters used in gas turbines help companies to minimize downtime, help to maintain clean engine performance, and save maintenance costs. These air filtration devices and systems protect gas turbines from the pollutants present in the air and help prevent erosion, fouling, and cooling holes in turbines. In addition, air filters help prevent contaminants such as airborne salts and particulate matter for various industries. For instance, owing to the development of high-efficiency particulate arrestor (HEPA) filters, the efficiency of gas turbines has been increased because these filters can protect the turbines from water and salts within the intake air.

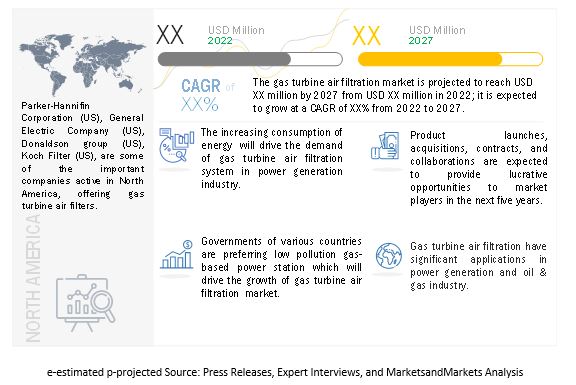

The Gas Turbine Air Filtration market is expected to grow from USD XX million in 2022 to USD XX million by 2027, at a CAGR of XX%. The key factors boosting market growth are the adoption of natural gas-based power plants, owing to the rising demand for clean power generation, which will drive the development of the Gas Turbine Air Filtration market.

To know about the assumptions considered for the study, Request for Free Sample Report

Drivers: Increasing consumption of energy to drive the demand for air filters

The rising energy consumption across the world has promoted the use of natural gas and other sources for power generation. An industry like power generation depends on gas turbines for their energy generation needs, and inefficient running of gas turbines can be costly. As the power generation industries aim to reduce their footprint, their move towards efficient power generation with minimal wastage is becoming vital. In addition, inadequate air filtration systems in the power generation industry can result in severe loss of power capacity, damage to turbines, and reduced runtime.

Growing demand for clean energy in power generation

The governments of various countries prefer low-pollution gas-based power stations. For instance, in China, the natural gas power generation industry is working toward the clean energy process and the operation of low-carbon energy to explore sustainable development in power generation. Similarly, other countries are also working towards clean energy in power generation. This development is expected to drive growth in the Turbine Air Filtration Systems market in the near future.

Challenges: A high degree of turbine corrosion near a coastal area

Several countries with gas turbine sites near the coastal area experience the problem of turbine corrosion at high levels owing to heavy moisture and salt aerosol. Further, while visiting these sites, air intake issues are regularly found, such as inadequate drainage, poor sealing of flanges, under-performing weather protection, and incorrect filter sealing. These are the main contributors to a corrosive contaminant that bypasses the gas turbine, leading to system failure and increasing the risk to the system.

Key Market Players

Parker-Hannifin Corporation (US), Camfil (Sweden), General Electric Company (US), Donaldson Group (US), Koch Filter (US), Shinwa Corporation (Japan), American Air Filter Company, Inc. (US), Nordic Air Filtration (Denmark) and MANN+HUMMEL (Germany) are few key players in the Gas Turbine Air Filtration market globally.

Recent Developments

- In September 2021, MANN+HUMMEL launched combi filters that help to reduce harmful gases and odors in vehicles.

- In June 2021, Camfil announced the expansion of its ultramodern technical center in Sweden, and this new expansion unit is intended to meet the growing demands of Camfil’s filtration solutions.

- In May 2021, Parker-Hannifin Corporation, the global leader in motion and control technologies, launched the clearcurrent ASSURE filters for high-performance gas turbines that help remove all the contaminants from the turbine.

TABLE OF CONTENTS

1 Introduction

1.1. Study Objective

1.2. Market Definition

1.2.1. Inclusions and Exclusions

1.3. Market Scope

1.3.1. Markets Covered

1.3.2. Geographic Scope

1.3.3. Years considered for the study

1.4. Currency

1.5. Limitations

1.6. Market Stakeholders

2 Research Methodology

2.1. Research Data

2.1.1. Secondary and Primary Research

2.1.2. Secondar Data

2.1.3. Primary Data

2.2. Market Size Estimation

2.2.1. Bottom-up Approach

2.2.2. Top-down Approach

2.3. Data Triangulation

2.4. Research Assumptions

2.5. Risk Assessment

3 Executive Summary

4 Market Overview

4.1. Introduction

4.2. Market Dynamics

4.2.1. Drivers

4.2.2. Restraints

4.2.3. Opportunities

4.2.4. Challenges

4.3. Value Chain Analysis

4.4. Ecosystem

4.5. Pricing Analysis

4.5.1. Average Selling Price of Key Players

4.6. Trends/Disruptions Impacting Customer’s Business

4.7. Technology Analysis

4.8. Porter Five Force Analysis

4.9. Key Stakeholders & Buying Criteria

4.10. Case Study Analysis

4.11. Trade Analysis

4.12. Patent Analysis

4.13. Key Conferences & Events in 2022-2023

4.14. Tariff and Regulatory Landscape

4.14.1. Regulatory Bodies, Government Agencies, And Other Organizations

4.14.2. Regulations and Standards

5 Gas Turbine Air Filtration Market Analysis, by Filter Type

5.1. Introduction

5.2. Panel Filter

5.3. Pulse Filter

5.4. Compact Filter

5.5. Bag Filter

5.6. Cartridge Filter

5.7. Pre-cleaning Filter

6 Gas Turbine Air Filtration Market Analysis, by Application

6.1. Introduction

6.2. Power Generation

6.3. Oil & Gas

6.4. Other Industrial Applications

7 Gas Turbine Air Filtration Market Analysis, by Geography

7.1. Introduction

7.2. North America

7.3. Europe

7.4. Asia Pacific

7.5. Rest of the World

8 Competitive Landscape

8.1. Introduction

8.2. Top 5 Company Revenue Analysis

8.3. Market Share Analysis

8.4. Company Evaluation Quadrant, 2021

8.4.1. Star

8.4.2. Emerging Leader

8.4.3. Pervasive

8.4.4. Participants

8.5. Small and Medium-sized Enterprises (SMEs) Evaluation Quadrant, 2021

8.5.1. Progressive Company

8.5.2. Responsive Company

8.5.3. Dynamic Company

8.5.4. Starting Block

8.6. Gas Turbine Air Filtration Market: Company Footprint

8.7. Competitive Benchmarking

8.8. Competitive Scenarios and Trends

9 Company Profiles

9.1. Introduction

9.2. Parker Hannifin

9.3. Camfil

9.4. GE Energy

9.5. Donaldson

9.6. Koch Filter

9.7. Denco Happel

9.8. Shinwa Corporation

9.9. American Air Filter Company

9.10. Nordic Air Filtration

9.11. Mann + Hummel

9.12. SPX Flow

9.13. Mikropor

9.14. Other Important Players

10 Appendix

Note: The above table of content is tentative, and we may change once we start working on the study.

Growth opportunities and latent adjacency in Gas Turbine Air Filtration Market