SUV Market by Type (Sub-Compact, Compact, Mid-size, Full-size and MPV), by Propulsion (Internal Combustion Engine, Hybrid and Electric Vehicles) and Region (North America, Europe and Asia-Pacific), Competitive Benchmarking, Pricing Analysis, and Future Technology Trends - Global Forecast 2030

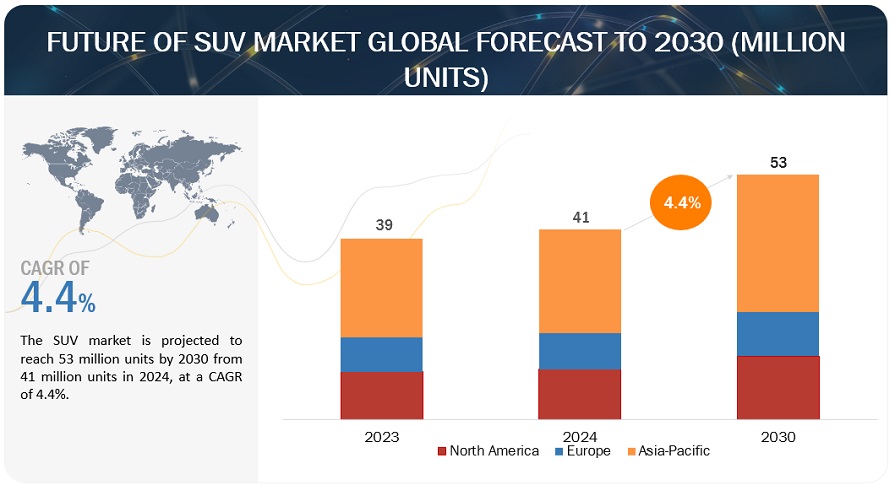

[87 Pages Report] The SUV market is projected to reach 53 million units by 2030 from 41 million units in 2024, at a CAGR of 4.4%. The SUV segment has rapidly gained popularity among consumers owing to its road presence, space & size, stylish design, and advanced safety and comfort features. Mid-size and full-size SUVs with in-cabin safety and comfort features such as 4WD/AWD, automatic transmission, advanced powerful engine, heated/ventilated seats, heated steering and rear air conditioning have increased across all regions. Consumers around the globe prefer compact and mid-size SUVs over sedans and hatchback cars because of their versatility and cargo space.

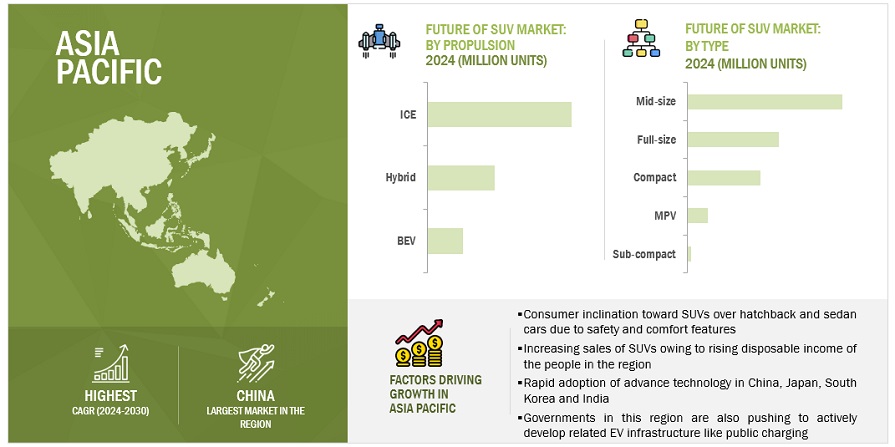

The Asia Pacific dominates the SUV market by volume, owing to the high share of passenger vehicles and SUV production in China, Japan, India, and South Korea. The growth drivers of the SUV market include the rising demand for comfort features in premium SUVs as well as the shifting trend for compact and stylish SUVs, mainly in developing countries of the Asia Pacific, which offers a combined functionality of premium hatchbacks and SUVs at an affordable cost. The Asia-Pacific market holds over half of the share of the global market. Whereas North America holds just over 1/4th and Europe comprises below 1/5th of the share in the global market.

The mid-size SUV holds the largest share, by type segment, due to its larger passenger capacity and ample cargo space during long journeys. Consumers opt for mid-size SUVs due to their large interior, comfort, and safety features for both the driver and passenger. Large families prefer mid-size SUVs for long drives because of their ample space for luggage and passengers. Moreover by propulsion, the ICE type holds the largest share of the SUV market. However, the latest NOx and PM limits have forced OEMs to develop fuel-efficient vehicles, leading to higher vehicle costs. This would restrict new buyers from buying diesel SUVs, increasing their vehicle acquisition and maintenance costs. This would serve as a promising growth opportunity for BEV and hybrid SUVs.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Market Dynamics:

Driver: Demand for premium vehicles with advanced features

The growing state of the world economy and generally rising consumer lifestyles, which result in more disposable income, are driving the future of SUV market. SUVs are popular due to changing consumer preferences and modern lifestyles along with increasing sales of ultra-luxury variants. Customers expect advanced connectivity technologies that enhance comfort, safety, and entertainment. The market is also impacted by the latest electrification of powertrain technology and increasing interest in autonomous driving. OEMs offer the latest technologies using artificial intelligence and machine learning in these SUVs, such as ADAS, personal assistance voice control, retina recognition, remote services, and real-time traffic information, among others, to keep consumers connected with the outside world. The premium SUV market growth is expected to remain strong as consumers perceive safety, styling, and attractive aesthetics. Wide subsegment offerings by OEMs with advanced upgrades would attract and create a new set of customers for this segment in the coming years.

Driver: Consumer inclination toward compact SUVs

Compact SUVs have comparatively smaller engines, resulting in higher fuel efficiency, better maneuvering ability, high ground clearance, and chassis-framed body structure for off-road performance. It is modified for urban areas with relatively better maneuverability around city streets and a sporty body design. It is preferred over premium hatchbacks as it is available at an almost similar price range with rugged styling, upright driver seating position, and high ground clearance. The cost of compact SUVs is near to sedans and hatchbacks. The compact SUV is focused on the young generation, mainly in the North American and Asia Pacific countries such as China and India.

Restraint: High cost of SUVs

Due to their higher cost than sedans and hatchbacks, which makes them less affordable for consumers on a tight budget and may prevent the growth of SUV market. The compact SUVs market grew significantly in developing nations whereas the mid-size witnessed a growth in developed as well as developing nations. On the contrary, the consumers in the developed nations prefer full-size SUVs which are generally loaded with premium features. These SUVs have powerful engines and high flexibility for off-roading manoeuvring. Moreover, the htop end models are equipped with wide touchscreen infotainment screens, heated seats, strong air conditioiner for last row seats, sunroofs, assistance for parking as well as while driving. These makes the full-size SUVs costlier compared to hatchbacks and sedans. In addition, several of these features are not included in the compact and mid-size SUVs as they are specifically designed for costumers with budget constraints. Including these features in compact and mid-size SUVs will increase the overall prices of the SUVs and act as a restraint to the growth of overall SUV market.

Opportunity: Growing adoption of connected vehicles

With the growing increase in global vehicle sales, government & regulatory bodies such as European Commission (EC) and the US Environmental Protection Agency (US EPA) have implemented stringent emission norms for controlling GHG emissions. Stringent emissions regulations have shifted the global focus towards electric vehicles, which has resulted in exponential growth of these vehicles in recent years and simultaneously for electric SUVs. Many automotive OEMs are launching their electric SUVs in the market. According to IEA Global EV Outlook 2021, more than 55% of announced models globally are SUVs and pickups. The potential reason for electrification is that the SUV is amongst the heaviest and most fuel-consuming vehicles, and electrification would help to meet stringent emission targets.

Challenge: Challenges in meeting fuel economy and emission limits

The SUV market has grown at a decisive pace in recent years. According to IEA, the number of SUVs increased by more than 35 million globally in 2021, driving up annual CO2 emissions by 120 million tonnes. Typically, full-size and mid-size SUVs are equipped with larger engines, generating higher emissions and offering lower fuel economy. The engine sizes of top-selling full-size SUVs or large SUVs in the US range from 355HP to 420 HP, whereas in Europe, the engine sizes of top-selling large SUVs are between 315 HP to 400 HP. Considering the stringent emission targets by regional bodies, SUVs, especially mid-size and full-size segments, continue to dominate conventional powertrains, which run on gasoline or diesel fuel. Though OEMs are developing hybrid powertrains to join the race of electric vehicles, a handful of SUV models run hybrid or electric powertrains. Thus, rising stringent government regulations on conventional SUVs and less fuel economy can hinder the growth of the ICE engine SUV Market.

“Asia-Pacific holds the major share in the market”

The Asia Pacific dominates the SUV market share by volume and value, owing to the high share of passenger vehicles and SUV production in China, Japan, India, and South Korea. The growth drivers of the SUV market include the rising demand for comfort features in premium SUVs as well as the shifting trend for compact and stylish SUVs, mainly in developing countries of the Asia Pacific, which offers a combined functionality of premium hatchbacks and SUVs at an affordable cost. Full-size SUVs offer several advantages such as versatility, multiple drivetrain options, off-roading capabilities on rough and unpaved terrains, heavy towing capacity, larger seats and trunk space, as well as a higher level of comfort and competitive price range against sedan cars.

Key Market Players

Toyota Group, Hyundai Group and Volkswagen Group are the top three market share holders with 10% and above share each in the global market. Approximately 50% of the share in the SUV market is held by Toyota, Hyundai, Volkswagen, Renault-Nissan-Mitsubhishi, General Motors and Stellantis N. V. There are over 40 other groups/OEMs holding market share less than 4%. These are mostly regional OEMs or only luxury SUV manufacturers. The EV companies are focused on battery technology development and investing into the battery ecosystem to ensure a sustainable supply chain. These companies adopted new product launches, acquisitions, partnerships, collaborations, and other key strategies to gain traction in the automotive market.

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

2023–2030 |

|

Forecast units |

Volume (Million Units) |

|

Segments covered |

Type, Propulsion and Region. |

|

Geographies covered |

North America, Europe and Asia-Pacific |

Type

- Sub-Compact

- Compact

- Mid-size

- Full-size

- MPV

Propulsion

- Internal Combustion Engine (ICE)

- Electric Vehicles (EV)

- Hybrid (HEV, PHEV)

Region

-

North America

- US

- Canada

- Mexico

-

Europe

- Germany

- France

- UK

- Spain

- Italy

- Rest of Europe

-

Asia Pacific

- China

- India

- Japan

- South Korea

- UAE

Recent Developments

- In February 2024, VinFast conducted the ground-breaking ceremony for its upcoming manufacturing plant in Thoothukudi, Tamil Nadu, India. The proposed investment amounts to USD 2 billion, with an initial investment of USD 500 million.

- In February 2024, Toyota announced to invest $1.3 billion in a Kentucky plant to produce a three-row SUV for the US market. The plant will be functional from late 2025 or early 2026, wherein the plan is to manufacture EV SUVs.

- In January 2024, General Motors Co. and Honda Motor Co. announced the start of hydrogen fuel cell production from their 50-50 joint venture in Michigan.

- In December 2023, Neta Auto has started production at its first overseas electric vehicle plant in Thailand, further expanding its presence in the Southeast Asian country. The facility is expected to have an annual capacity of 20,000 cars, with large-scale production scheduled to begin in 2024.

- In December 2023, BYD announced the construction of a new manufacturing and production center in Szeged, Hungary.

- In November 2023, Hyundai Motors and Amazon signed a strategic partnership to sell Hyundai cars on through Amazon.com from 2024.

- In September 2023, Lucid Group Inc. has officially opened the first-ever car manufacturing facility in Saudi Arabia. The facility will produce Lucid’s electric vehicles (EVs) for Saudi Arabia and export to other markets

- In July 2023, Stellantis announced to build a electric vehicle battery factory in a joint venture with Samsung by early 2027 in US, Indiana.

- In June 2023, Ford Motor Company (Ford) and SK On signed a joint venture agreement to set up EV battery plants in Tennessee and Kentucky. This joint venture to get $9.2 billion loan from the US government.

- In June 2023, Hyundai Motor Group and Vodafone Business signed a partnership to provide customers with advanced in-car connected streaming and infotainment services in more than 40 countries across Europe.

- In May 2023, Hyundai Motor Group and LG Energy Solution (LGES) announced an EV battery cell manufacturing joint venture in US.

- In May 2023, ACC opened its first car battery manufacturing plant in France with an aim to be self-sufficient in vehicle battery production by 2027.

Frequently Asked Questions (FAQ):

What is the size of the SUV market?

The SUV market is projected to reach 53.5 million units by 2030 from 39.4 million units in 2023, at a CAGR of 4.4%.

What are the driving factor impacting the growth of the SUV market?

Increasing customer preference for compact size, advanced safety, stylish design, and comfort features. Inclination of people towards mid-size and full-size SUVs with in-cabin safety and features such as 4WD/AWD, automatic transmission, advanced powerful engine, heated/ventilated seats, heated steering, rear air conditioning, etc., is a major driving growth factor of the SUV market

What are the new market trends impacting the growth of the SUV market?

Electic SUVs alog with Fast & Ultra-fast charging, ADAS and LiDAR technologies, and 5G connectivity are some of the major trends affecting this market.

What are the new market trends Hybrid & EV SUV Market?

Fast & ultra-fast charging, increasing battery pack capacity and ranges, new chemistries are some of the key future focus of the Hybrid & EV SUV segment.

Which region will have the fastest growing SUV Market?

Asia Pacific was the largest market in 2023 and is expected to be the fastest growing during the forecast period. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

-

5.1 SUV L*H ANALYSIS, BY REGIONNORTH AMERICA: SUV L*H ANALYSISEUROPE: SUV L*H ANALYSISASIA PACIFIC: SUV L*H ANALYSIS

- 5.2 GLOBAL AVERAGE BATTERY COST ANALYSIS

- 5.3 TOTAL COST OF OWNERSHIP ANALYSIS (BEV VS. ICE)

- 5.4 EV VS. ICE PRICE COMPARISON

- 5.5 E-SUV BATTERY CAPACITY VS. RANGE, BY MODEL ANALYSIS

- 5.6 E-SUV PRICING VS. RANGE ANALYSIS

- 5.7 E-SUV TECHNICAL COMPARISON

- 5.8 FUEL CELLS IN SUV

-

5.9 SUV PLATFORMCURRENT SUV PLATFORMSFUTURE OF SUV PLATFORMS

- 5.10 GOVERNMENT REGULATIONS FOR SUV

-

6.1 MAJOR SUV OEMS AND THEIR REGIONAL SALES SHARENORTH AMERICA: OEM SALES SHARE ANALYSIS, 2023EUROPE: OEM SALES SHARE ANALYSIS, 2023ASIA PACIFIC: OEM SALES SHARE ANALYSIS, 2023

- 6.2 SUV MANUFACTURING PLANTS BY OEM AND LOCATION

-

6.3 SUV L*H ANALYSIS, BY OEMTOYOTA GROUP: SUV L*H ANALYSISVOLKSWAGEN GROUP: SUV L*H ANALYSISHYUNDAI GROUP: SUV L*H ANALYSIS

- 6.4 SUV LAUNCHES IN 2022−2023

- 6.5 UPCOMING LAUNCHES, 2024 AND BEYOND

- 6.6 FUTURE FOCUS OF KEY OEMS

- 7.1 RISING ADOPTION OF SUVS

- 7.2 POPULARITY OF COMPACT AND MID-SIZE SUVS

- 7.3 GROWING ADOPTION OF E-SUVS

- 7.4 DECREASING BATTERY COSTS TO BOOST E-SUV AFFORDABILITY

- 7.5 ASIA PACIFIC TO BE MAJOR SUV MARKET

- 7.6 FINDING RIGHT SIZE FIT

- 7.7 GLOBAL SUV MARKET: KEY PLAYERS AND REGIONAL DYNAMICS

- 7.8 FCEV: NEXT GENERATION OF FUEL

- 7.9 STANDARDIZED PLATFORMS TO DRIVE COST EFFICIENCY

- 7.10 ADAS FEATURES ENHANCE SUV APPEAL AND SAFETY

-

8.1 SUV SALES BY TYPE AND REGIONSUB-COMPACT SUV SALES, BY REGIONCOMPACT SUV SALES, BY REGIONMID-SIZE SUV SALES, BY REGIONFULL-SIZE SUV SALES, BY REGIONMPV SALES, BY REGION

-

8.2 SUV SALES BY PROPULSION AND REGIONICE SUV SALES, BY REGIONBEV SUV SALES, BY REGIONHYBRID SUV SALES, BY REGION

-

8.3 REGIONAL SUV SALES, BY COUNTRYNORTH AMERICA: COUNTRY-WISE SUV SALESEUROPE: SUV COUNTRY-WISE SALESASIA PACIFIC: SUV COUNTRY-WISE SALES

-

8.4 SUV SALES, BY COUNTRYNORTH AMERICA: SUV SALES- US: SUV Sales- Canada: SUV Sales- Mexico: SUV SalesEUROPE: SUV SALES- Germany: SUV Sales- UK: SUV Sales- France: SUV Sales- Italy: SUV Sales- Spain: SUV Sales- Rest of Europe: SUV SalesASIA PACIFIC: SUV SALES- China: SUV Sales- Japan: SUV Sales- India: SUV Sales- South Korea: SUV Sales- Australia: SUV Sales- Rest of Asia Pacific: SUV Sales

- 8.5 PRODUCT PORTFOLIO

- 8.6 LUXURY SUV PORTFOLIO

- 8.7 DEVELOPMENT OF ADVANCED AUTONOMOUS SUV TECHNOLOGY

- 8.8 HEAD-UP DISPLAY IN SUV

- 8.9 OEM STRATEGIC DEALS

- 8.10 OEM MANUFACTURING EXPANSIONS

- 8.11 KEY PLAYER STRATEGIES, JANUARY 2021– FEBRUARY 2024

- TABLE 1 MARKET SCOPE

- TABLE 2 RESEARCH ASSUMPTIONS

- TABLE 3 ASSUMPTIONS, ASSOCIATED RISKS, AND IMPACT

- TABLE 4 E-SUV TECHNICAL COMPARISON

- TABLE 5 SUV MANUFACTURING PLANTS BY OEM AND LOCATION (NUMBER OF MANUFACTURING PLANTS)

- TABLE 6 SUV LAUNCHES IN 2022−2023

- TABLE 7 SUV LAUNCHES IN 2024−2027

- TABLE 8 SUV PORTFOLIO

- TABLE 9 LUXURY SUV PORTFOLIO

- TABLE 10 AUTONOMOUS SUVS AND THEIR FEATURES

- TABLE 11 HEAD-UP DISPLAY IN SUV

- TABLE 12 DEALS, JANUARY 2021−FEBRUARY 2024

- TABLE 13 EXPANSIONS, JANUARY 2021–FEBRUARY 2024

- TABLE 14 KEY PRODUCT DEVELOPMENTS AND EXPANSIONS, 2021−2024

- FIGURE 1 SUV SALES, BY TYPE, 2023 VS. 2027 VS. 2030

- FIGURE 2 SUV SALES, BY PROPULSION, 2023 VS. 2027 VS. 2030

- FIGURE 3 SUV SALES, BY REGION, 2023 VS. 2027 VS. 2030

- FIGURE 4 OEM SUV SALES SHARE, 2023

- FIGURE 5 SUV L*H GLOBAL ANALYSIS, 2023

- FIGURE 6 E-SUV L*H GLOBAL ANALYSIS, 2023

- FIGURE 7 SUV MARKET SEGMENTATION

- FIGURE 8 RESEARCH METHODOLOGY MODEL

- FIGURE 9 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 10 SUV VS. TOTAL PASSENGER VEHICLE VOLUME SALES (2018−2023)

- FIGURE 11 SUV VS. TOTAL PASSENGER VEHICLE VOLUME SALES (2024−2030)

- FIGURE 12 SUV PENETRATION IN TOTAL PASSENGER VEHICLE SALES (2018−2030)

- FIGURE 13 GLOBAL SUV SALES, BY TYPE (2023−2030)

- FIGURE 14 GLOBAL SUV SALES, BY PROPULSION (2023−2030)

- FIGURE 15 GLOBAL SUV SALES, BY REGION (2018−2022)

- FIGURE 16 GLOBAL SUV SALES, BY REGION (2023−2030)

- FIGURE 17 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 18 NORTH AMERICA: SUV L*H ANALYSIS

- FIGURE 19 EUROPE: SUV L*H ANALYSIS

- FIGURE 20 ASIA PACIFIC: SUV L*H ANALYSIS

- FIGURE 21 GLOBAL AVERAGE BATTERY PACK PRICE

- FIGURE 22 AUXILIARIES COST VS. CELL COST (%)

- FIGURE 23 EV BATTERY COST IN SUV

- FIGURE 24 EV VS. ICE SUV TOTAL COST OF OWNERSHIP ANALYSIS

- FIGURE 25 ICE VS. EV PRICE COMPARISON

- FIGURE 26 E-SUV BATTERY CAPACITY VS. RANGE, BY MODEL ANALYSIS

- FIGURE 27 E- SUV PRICING VS. RANGE ANALYSIS

- FIGURE 28 FUEL CELLS IN SUV

- FIGURE 29 CURRENT SUV PLATFORMS

- FIGURE 30 FUTURE OF SUV PLATFORMS

- FIGURE 31 NORTH AMERICA: OEM SALES SHARE ANALYSIS, 2023

- FIGURE 32 EUROPE: OEM SALES SHARE ANALYSIS, 2023

- FIGURE 33 ASIA PACIFIC: OEM SALES SHARE ANALYSIS, 2023

- FIGURE 34 SUV MANUFACTURING PLANTS

- FIGURE 35 TOYOTA GROUP: SUV L*H ANALYSIS

- FIGURE 36 VOLKSWAGEN GROUP: SUV L*H ANALYSIS

- FIGURE 37 HYUNDAI GROUP: SUV L*H ANALYSIS

- FIGURE 38 FUTURE FOCUS OF KEY OEMS

- FIGURE 39 SUB-COMPACT SUV SALES, BY REGION, 2023−2030

- FIGURE 40 COMPACT SUV SALES, BY REGION, 2023−2030

- FIGURE 41 MID-SIZE SUV SALES, BY REGION, 2023−2030

- FIGURE 42 FULL-SIZE SUV SALES, BY REGION, 2023−2030

- FIGURE 43 MPV SALES, BY REGION, 2023−2030

- FIGURE 44 ICE SUV SALES, BY REGION, 2023−2030

- FIGURE 45 BEV SUV SALES, BY REGION, 2023−2030

- FIGURE 46 HYBRID SUV SALES, BY REGION, 2023−2030

- FIGURE 47 NORTH AMERICA: COUNTRY-WISE SUV SALES (2023−2030)

- FIGURE 48 EUROPE: COUNTRY-WISE SUV SALES (2023−2030)

- FIGURE 49 ASIA PACIFIC: COUNTRY-WISE SUV SALES (2023−2030)

- FIGURE 50 US: SUV SALES, BY TYPE, 2023−2030

- FIGURE 51 US: SUV SALES, BY PROPULSION, 2023−2030

- FIGURE 52 CANADA: SUV SALES, BY TYPE, 2023−2030

- FIGURE 53 CANADA: SUV SALES, BY PROPULSION, 2023−2030

- FIGURE 54 MEXICO: SUV SALES, BY TYPE, 2023−2030

- FIGURE 55 MEXICO: SUV SALES, BY PROPULSION, 2023−2030

- FIGURE 56 GERMANY: SUV SALES, BY TYPE, 2023−2030

- FIGURE 57 GERMANY: SUV SALES, BY PROPULSION, 2023−2030

- FIGURE 58 UK: SUV SALES, BY TYPE, 2023−2030

- FIGURE 59 UK: SUV SALES, BY PROPULSION, 2023−2030

- FIGURE 60 FRANCE: SUV SALES, BY TYPE, 2023−2030

- FIGURE 61 FRANCE: SUV SALES, BY PROPULSION, 2023−2030

- FIGURE 62 ITALY: SUV SALES, BY TYPE, 2023−2030

- FIGURE 63 ITALY: SUV SALES, BY PROPULSION, 2023−2030

- FIGURE 64 SPAIN: SUV SALES, BY TYPE, 2023−2030

- FIGURE 65 SPAIN: SUV SALES, BY PROPULSION, 2023−2030

- FIGURE 66 REST OF EUROPE: SUV SALES, BY TYPE, 2023−2030

- FIGURE 67 REST OF EUROPE: SUV SALES, BY PROPULSION, 2023−2030

- FIGURE 68 CHINA: SUV SALES, BY TYPE, 2023−2030

- FIGURE 69 CHINA: SUV SALES, BY PROPULSION, 2023−2030

- FIGURE 70 JAPAN: SUV SALES, BY TYPE, 2023−2030

- FIGURE 71 JAPAN: SUV SALES, BY PROPULSION, 2023−2030

- FIGURE 72 INDIA: SUV SALES, BY TYPE, 2023−2030

- FIGURE 73 INDIA: SUV SALES, BY PROPULSION, 2023−2030

- FIGURE 74 SOUTH KOREA: SUV SALES, BY TYPE, 2023−2030

- FIGURE 75 SOUTH KOREA: SUV SALES, BY PROPULSION, 2023−2030

- FIGURE 76 AUSTRALIA: SUV SALES, BY TYPE, 2023−2030

- FIGURE 77 AUSTRALIA: SUV SALES, BY PROPULSION, 2023−2030

- FIGURE 78 REST OF ASIA PACIFIC: SUV SALES, BY TYPE, 2023−2030

- FIGURE 79 REST OF ASIA PACIFIC: SUV SALES, BY PROPULSION, 2023−2030

The study involved analyzing the recent developments, trends and the performance of the players as well as the SUV market in 2023 along with the projections for 2030. The analysis was based on the sales volume of the SUV segment around the world. The study is also based on analysis of the major milestones in SUVs such as its design, size and technology. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with the industry experts. The bottom-up approach was employed to estimate the complete market size in terms of SUV sales for the segments considered.

Secondary Research

The secondary sources referred for this research study include automotive OEMs, Tier I/II companies, and publication from government sources, automotive associations & databases; [such as country level automotive associations and organizations, International Energy Agency (IEA), MarkLines and others]; corporate filings (annual reports, investor presentations, and financial statements); and trade, business, and automotive associations. Secondary data has been collected and analyzed to arrive at the overall sales volume.

Market Size Estimation

The bottom-up approach was used to estimate and validate the total SUV vehicle sales volume. This approach was also used to identify the sales of various subsegments in the SUV market. The research methodology used to estimate the market includes the following:

Bottom- up Approach-

To know about the assumptions considered for the study, download the pdf brochure

Market Definition

Global automotive industry outlook for 2024 includes analysis on the performance and key developments in the automotive industry in 2023 and insights on most anticipated technological developments & growth across electric vehicles, smart manufacturing, connected cars & features and other major aspects of the automotive industry.

Key Stakeholders

- Automobile Organizations/Associations

- Automotive Component Manufacturers

- Automotive Component Suppliers

- Automotive OEMs

- Automotive System Manufacturers

- Automotive Electronics Manufacturers

- Country-specific Automotive Associations

- European Automobile Manufacturers Association (ACEA)

- EV Manufacturers

- EV Component Manufacturers

- EV Charging Infrastructure Companies

- Government & Research Organizations

- Raw Material Suppliers for Automotive Industry

- Software Providers

- Traders, Distributors, and Suppliers of Automotive Components

Report Objectives

- To analyze the SUV market performance till 2030

- To provide key developments expected to take place till 2030.

- To identify the trends that are likely to impact the market during the forecast period.

- To identify major growth segments and opportunities till 2030.

- To project the SUV sales from 2024 to 2030

- To track and analyze competitive developments such as deals (joint ventures, mergers & acquisitions, partnerships, collaborations), product developments, and other activities carried out by key industry participants.

Growth opportunities and latent adjacency in SUV Market