Hydrogen Cars Market By Refueling Station Deployment (Asia Pacific, Europe, And North America), Vehicle Type Outlook (Passenger Car, LCV, Bus, And Truck), Technology and Propulsion Analysis (FCEV, FCHEV, And H2-ICEV), And Region – Global Forecast 2035

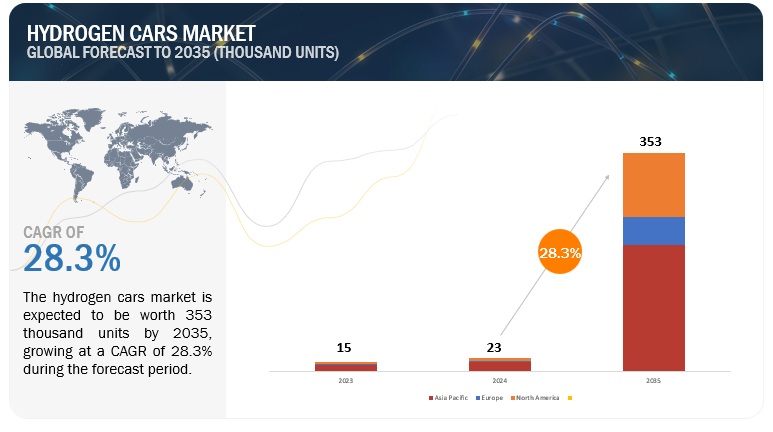

[25 Pages Report] The hydrogen cars market size is projected to grow from 23 thousand units in 2024 to 353 thousand units by 2035, at a CAGR of 28.3%. Factors such as the extended driving range of FCEVs and the increasing interest among consumers indicate hydrogen's potential as an alternative for zero-emission mobility. Additionally, the rising involvement of investors, advancements in technology by OEMs, and governmental initiatives toward zero-emission transportation are expected to boost the market growth. This shift towards hydrogen-based mobility is already experiencing global traction, notably in heavy-duty transportation, where FCEVs are progressively gaining favor.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Market Dynamics:

Driver: Reduced oil dependency

According to the US Energy Information Administration (EIA), 100.99 million barrels of crude oil were consumed per day in 2023. The limited petroleum reserves and rising prices of fuel have led automakers to consider alternative fuel sources for their vehicles. Hydrogen can be generated from renewable sources such as water, agricultural waste, and biogas, as well as from natural gas and coal. Currently, 76% of the hydrogen produced is from natural gases, 22% from oil, 18% from coal, and 2% through water electrolysis. However, there have been developments to increase the production of hydrogen from water electrolysis. For instance, in September 2022, Advent Technologies Holdings (US) announced a three-year agreement with the German State of Brandenburg. Under this agreement, Advent will supply methanol-powered fuel cell systems to the German State of Brandenburg. These fuel cell systems will be installed in select critical communication sites in the region. Due to the developments in extracting hydrogen from natural resources other than oil, dependency on oil for hydrogen-related products would be reduced. This can drive the overall demand for hydrogen in automotive.

Restraint: High initial investments in hydrogen fueling infrastructure

The higher initial investment required for establishing hydrogen fuel stations and associated infrastructure compared to traditional petroleum, diesel, and other fuel counterparts has resulted in a slower expansion of hydrogen refueling infrastructure globally. This discrepancy arises from the considerable expenses associated with procuring specialized equipment tailored for hydrogen fuel dispensation, coupled with the imperative implementation of stringent safety protocols due to hydrogen's inherent combustibility. The construction cost of a single hydrogen fuel station typically ranges between USD 1-2 million, whereas conventional petrol stations demand an investment of around USD 200,000, followed by CNG stations at USD 150,000, and both diesel and electric fuel stations at approximately USD 200,000.

Opportunity: Government initiatives promoting hydrogen infrastructure

Governments are progressively directing resources towards alternative energy sources, such as hydrogen, in response to escalating concerns regarding carbon emissions. As per data from the US Environmental Protection Agency (EPA) in 2022, carbon dioxide emissions stemming from energy-related activities exhibited a 0.9% increase, surging to an unprecedented level surpassing 36.8 gigatons. In light of this, governmental bodies are undertaking proactive measures, allocating investments, and advocating for the utilization of hydrogen. Alongside the advancement of hydrogen-based technologies, there arises a critical imperative to establish a robust infrastructure capable of supporting hydrogen-powered transportation networks. As a result, governments are intensifying their investments in the development of requisite hydrogen infrastructure, thereby fostering a conducive environment for the prospective expansion of hydrogen within the automotive sector. Moreover, the proliferation of green hydrogen resources is expected to bolster the adoption of FCEVs in the foreseeable future.

Challenge: Rising demand for BEVs and HEVs

The increasing demand for battery and hybrid electric vehicles is one of the major challenges for the growth of hydrogen-powered vehicles. There are many models and types of cars, such as hatchbacks, sedans, and SUVs, available as BEVs and HEVs. Also, the cost of BEVs and HEVs is lower than FCEVs. Hence, customers can choose as per their requirements and convenience from many BEV and HEV models. On the other hand, only a few FCEV models are available, and that too in limited countries due to the unavailability of hydrogen fueling stations. Many prominent automobile manufacturers, such as BYD, Tesla, and Volkswagen, are focusing more on the development of BEVs.

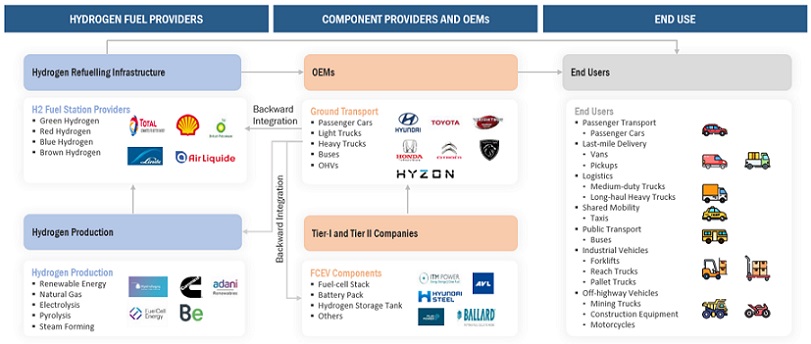

Market Ecosystem

The H2 Bus segment to have rapid growth during the forecast period

The H2 bus segment is projected to demonstrate a notable growth rate, with a CAGR of 21.0% anticipated during the forecast period, resulting in approximately 16 thousand units by the year 2035. China leads the global hydrogen-powered bus segment, demonstrating over 95% of sales worldwide, primarily due to government support aimed at enhancing interstate logistics. Similarly, the UK has announced plans to deploy 4,000 fuel cell buses by the year 2025. Technological advancements by prominent OEMs such as Hyundai Motor Company (South Korea), Wrightbus (Ireland), and others, alongside government support, are expected to boost the future of hydrogen within the automotive market. For instance, notable hydrogen-powered bus models include the Zhongtong LCK series bus, Yutong ZK series bus, Hyundai ElecCity, among others.

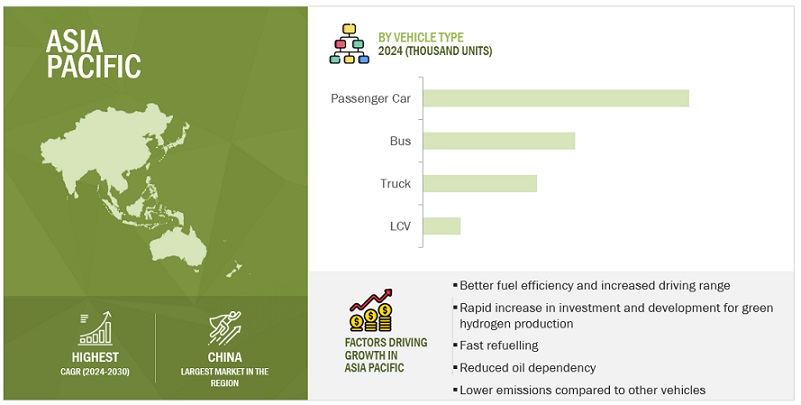

Asia Pacific is the largest market for hydrogen-p-owered vehicles during the forecast period.

The Asia Pacific region is expected to be the largest hydrogen vehicle market during forecast period, propelled by the sales of hydrogen-powered buses and trucks. In 2023, China led the Asia Pacific market, commanding nearly 49% of the market share, totaling 5,980 units. Within this market landscape, hydrogen trucks and buses continue to assert dominance, experiencing robust growth particularly within the truck segment. Advancements in hydrogen infrastructure are evident in the region, highlighted by China's establishment of over 400 refueling points as of January 2024. Hyundai Motor Company emerges as the leading OEM in the Asia Pacific market, holding a share of 61% in the realm of hydrogen-powered vehicles.

Key Market Players

The hydrogen cars market is dominated by established players such as Toyota Motor Corporation (Japan), Hyundai Motor Company (South Korea), SAIC Motors (China), FAW (China), Yutong (China), and among others. These companies manufacture fuel cell cars, buses, trucks, and LCVs and have set up R&D facilities to develop best-in-class products as an alternative to EVs.

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

2020–2035 |

|

Base year considered |

2023 |

|

Forecast period |

2024-2035 |

|

Forecast units |

Volume (Thousand Units) |

|

Segments covered |

Market by Vehicle Type (Buses, Trucks, LCVs, Passenger Cars), Propulsion, Hydrogen Fuel Points, and Region |

|

Geographies covered |

Asia-Pacific, Europe, and North America |

|

Companies Covered |

Toyota Motor Corporation (Japan), Hyundai Motor Company (South Korea), SAIC Motors (China), FAW (china), and Yutong (China) |

This research report categorizes the hydrogen cars market based on vehicle type, propulsion, hydrogen fuel points, and region.

Based on Vehicle Type:

- Buses

- LCVs

- Passenger Cars

- Trucks

Based on Propulsion:

- FCEV

- FCHEV

- H2-ICE

Based on Hydrogen Fuel Points:

- Asia-Pacific

- Europe

- North America

Based on Region:

-

Asia-Pacific

- China

- Japan

- India

- South Korea

-

North America

- US

- Canada

-

Europe

- Belgium

- Denmark

- Germany

- Norway

- Switzerland

- UK

- France

- Italy

- Netherlands

- Spain

- Sweden

Recent Developments

- In January 2024, Bosch announced plans for commercial launch of its hydrogen IC engine, developed for use in HCVs

- In January 2024, Volvo announced. plans to develop H2-4CE engines as an alternative for FCEVs as part of its Hydrogen based plans

- In November 2023, Porsche announced plans for development of H2-ICE engine and future launch of H2-ICE cars

- In October 2023, Toyota launched its Corolla Cross H2 Concept car, which uses its prototype H2-ICE engine

- In October 2023, Honda showcased its HySE-X1 ATV. The ATV runs on Toyota's H2-ICE engine.

- In March 2023, Hyundai's Doosan Intracore announced plans to develop H2-ICE based engines for its H2 cars by 2025

Frequently Asked Questions (FAQ):

What is the current size of the hydrogen cars market by volume?

The current size of the hydrogen cars market is estimated at 23 thousand units in 2024.

Who are the winners in the hydrogen cars market?

The hydrogen cars market is dominated by Toyota Motor Corporation (Japan), Hyundai Motor Company (South Korea), SAIC Motors (China), FAW (China), Yutong (China), and among others.

Which region will have the fastest-growing market for hydrogen cars market?

Europe will be the fastest-growing market for future of hydrogen in automotive due to the increasing awareness of environmental sustainability, and supportive government initiatives.

What are the key drivers impacting the growth of the hydrogen cars market?

Higher driving range of hydrogen-powered vehicles than battery electric vehicles, zero-emission nature of the hydrogen-powered vehicle, and government plans for zero-emission transport across the globe will have a major impact on the hydrogen cars market in the future.

What are different countries covered in Asia Pacific region for hydrogen cars market?

The countries covered in report for hydrogen cars market are China, India, Japan, and South Korea. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

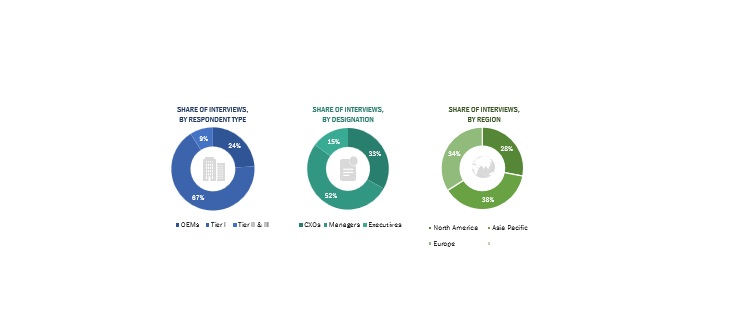

The study involved four major activities in estimating the current size of the hydrogen cars market. Exhaustive secondary research was done to collect information on the market, the peer market, and the child markets. The next step was to validate these findings, assumptions, and sizing with the industry experts across value chains through primary research. The top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation processes were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources such as company annual reports/presentations, press releases, industry association publications [for example, Fuel Cell and Hydrogen Energy Association (FCHEA), International Organization of Motor Vehicle Manufacturers, European Alternative Fuels Observatory (EAFO), International Energy Association (IEA)], articles, directories, technical handbooks, trade websites, technical articles, and databases (for example, Marklines, and Factiva) have been used to identify and collect information useful for an extensive commercial study of the globalhydrogen cars market.

Primary Research

Extensive primary research was conducted after acquiring an understanding of the hydrogen cars market scenario through secondary research. Several primary interviews were conducted with market experts from both the demand (automotive OEMs) and supply (automotive fuel cell providers) sides across major regions, namely, North America, Europe, and Asia-Pacific. Approximately 30% and 70% of primary interviews were conducted from the demand and supply sides, respectively. Primary data was collected through questionnaires, emails, and telephonic interviews.

In the canvassing of primaries, various departments within organizations, such as sales, operations, and marketing, were covered to provide a holistic viewpoint in the report. After interacting with industry experts, brief sessions were also conducted with highly experienced independent consultants to reinforce the findings from primaries. This, along with the in-house subject matter experts’ opinions, led to the findings described in the remainder of this report.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The bottom-up approach has been used to estimate and validate the size of the hydrogen cars market by vehicle type. In this approach, the vehicle sales statistics for each vehicle type [Passenger Cars, Light Commercial Vehicles, Buses, and Trucks] have been considered at the country level.

To determine the market size, in terms of volume, a mapping of fuel cell vehicles has been carried out for each country and vehicle type. The number of fuel cell electric models varied from country to country. After this, the types of FCEVs sold were identified, which derived the volume of each segment type. The country-level data was summed up to arrive at the region-level data in terms of volume. The summation of the country-level market size gives the regional market size, and a further summation of the regional market size provides the global hydrogen cars market size.

To know about the assumptions considered for the study, Request for Free Sample Report

Market Size Validation

The top-down approach has been used to estimate and validate the size of the hydrogen cars market at the global level, and by miles covered, power capacity, fuel cell type in terms of volume.

The top-down approach has been used to estimate and validate the size of the automotive market. This approach identifies key fuel cell type, miles covered and power capacity segments of Automotive fuel cells at the regional level. The penetration of each identified segment is multiplied by the volume of each vehicle at the regional level to derive the total segment volume.

For instance,

- The hydrogen cars market for propulsion was derived using the top-down approach to estimate the subsegments- FCEV, FCHEV, and H2-ICE.

- The market size, in terms of volume, was derived at the regional level for each segment using this method. The total volume of the automotive market was multiplied by the adoption rate breakup percentage of these segments in regional level.

Data Triangulation

After arriving at the overall market size of the global market through the above-mentioned methodology, this market was split into several segments and subsegments. The data triangulation and market breakdown procedure were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact market value data for the key segments and subsegments. The extrapolated market data was triangulated by studying various macro indicators and regional trends from both the demand- and supply-side participants.

Market Definition

A fuel cell electric vehicle (FCEV) is a type of electric vehicle that uses a fuel cell. A fuel cell can also be used in combination with a battery or supercapacitor to power the onboard electric motor. In an FCEV, hydrogen is pumped into the car and then fed to the fuel cell stack. The fuel cell stack is the center where hydrogen is electrochemically converted into electricity with no combustion and zero emissions. Fuel cells in vehicles generate electricity to power the motor. As long as hydrogen is available, the fuel cell will continue to produce electricity. Most fuel cell vehicles are classified as zero-emission vehicles that emit only water and heat.

List of Key Stakeholders

- Alternative Fuels Data Center (AFDC)

- Automobile OEMs

- Automotive fuel cell raw material suppliers

- Automotive fuel cell suppliers

- California Fuel Cell Partnership (CaFCP)

- California Hydrogen Business Council (CHBC)

- Canadian Hydrogen Fuel Cell Association (CHFCA)

- Environmental Protection Agency (EPA)

- Fuel Cell and Hydrogen Energy Association (FCHEA)

- Hydrogen gas suppliers

- Hydrogen station service providers

- United States Council for Automotive Research LLC (USCAR)

Report Objectives

- To segment and forecast the hydrogen cars market size in terms of volume (thousand units)

- To define, describe, and forecast the hydrogen cars market based on vehicle type, H2 fuel station, propulsion, and region.

- To segment and forecast the market based on vehicle type (passenger car, light commercial vehicle, bus, truck)

- To segment and forecast the market based on H2 Fuel Station (Asia-Pacific, Europe, and North America)

- To segment and forecast the market based on propulsion (FCEV, FCHEV, and H2-ICE)

- To segment the market and forecast its size, by volume, based on region (Asia-Pacific, Europe, and North America)

- To analyze the technological developments impacting the hydrogen cars market

- To analyze opportunities for stakeholders and the competitive landscape for market leaders

- To provide detailed information regarding the major factors influencing the market growth (drivers, challenges, restraints, and opportunities)

- To strategically analyze markets with respect to individual growth trends, future prospects, and contribution to the total market

-

To study the following with respect to the market

- Business Models

- Pricing Analysis

- Technological Roadmap

- Ecosystem

- Technology Trends

- To strategically profile key players and comprehensively analyze their market shares and core competencies.

Available Customizations

With the given market data, MarketsandMarkets offers customizations in line with company-specific needs.

- hydrogen cars market, By Propulsion at Country Level

- hydrogen cars market, Additional Countries (Up to 3)

- Profiling of additional market players (Up to 3)

Growth opportunities and latent adjacency in Hydrogen Cars Market