Future of E-fuels Market by Renewable Source (Solar, Winds), Fuel Type (E-Methane, E-Kerosene, E-methanol, E-Ammonia, E-Gasoline), State (Gaseous, Liquid), End-Use Application (Transportation, Power Generation) & Region - Global Forecast to 2035

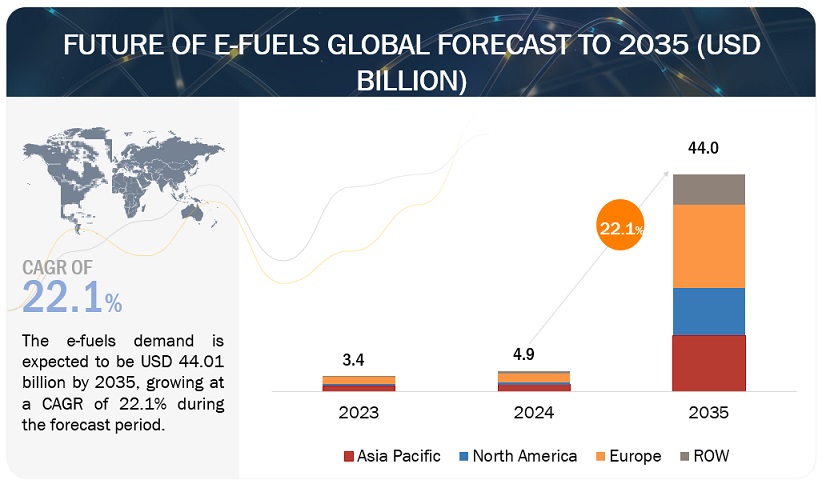

The future of e-fuel study comprehensively examines the demand for different types of e-fuels which caters to various end use application such as mobility, chemical, and power generation. The study also investigates the demand for various technologies utilized for the production of e-fuels. Further, it also assesses developments in the automotive ecosystem, and scrutinizes major advancements undertaken by original equipment manufacturers (OEMs) and Tier Is. The global e-fuels demand is projected to grow from USD 4.9 billion in 2024 to USD 44.0 billion in 2035, growing at a CAGR of 22.1% from 2024-2035.

The global e-fuels market is witnessing growth, driven by the demand for renewable liquid and gaseous fuels to replace conventional fossil fuels in challenging sectors like aviation and heavy industries. E-fuels, including e-diesel and e-kerosene, are gaining prominence globally due to their versatility. These synthetic hydrocarbon-based fuels serve as a transitional solution, seamlessly integrating into existing transportation infrastructure without significant modifications. Leading original equipment manufacturers (OEMs), including, Saudi Arabian Oil Co. (Saudi Arabia), Audi AG (Germany), Siemens Energy (Germany), Sunfire GmbH (Germany), Electrochaea GmbH (Germany), are actively engaged in the production of e-fuels, marking significant contributions to the future of e-fuels.

Factors such as rising demand for sustainable transportation, government subsidies and tax breaks for zero-emission vehicles, and lower environmental degradation will create lucrative opportunities for e-fuels. They are expected to be an alternative for biofuels and EVs in the coming years. Many premium car manufacturers including, Ferrari, Lamborghini, BMW, Bentley, and Audi, have also started developing new business models around e-fuels. Porsche, for instance, invested USD 75 million HIF to bring e-fuels to mainstream petrol stations in Chile. Similarly, BMW invested USD 12.5 million in Prometheus Fuels, an e-fuel startup that aims to produce cost-competitive, carbon-neutral fuels. Further, Aramco and Repsol, two global energy companies, have joined forces to develop and commercialize e-fuels in Spain. Such developments are expected to drive the demand for e-fuels market in the coming decade.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Market Dynamics:

Driver: Technological advancements, increased investments and energy security considerations

The future of e-fuels has witnessed promising developments that are expected to accelerate the e-fuels market growth in the future. One of the primary drivers of the e-fuels market is continuous technological advancements in the production and utilization of electrofuels. Recent breakthroughs in catalysts and reactor design have improved the efficiency and scalability of e-fuel production processes, reducing the energy requirements and the cost associated with manufacturing these fuels. Similarly, enhanced carbon capture technologies have also contributed to the supply of CO2 for e-fuel production. As technology continues to evolve, it is becoming increasingly feasible to produce e-fuels at a highly competitive cost, making them an attractive option for reducing carbon emissions in challenging sectors, such as aviation and heavy-duty transportation. The e-fuels market is also witnessing a surge in investments from governments, private corporations, and venture capital firms. Governments, recognizing the role of e-fuels in achieving carbon reduction targets and transitioning to a low-carbon economy, are allocating substantial funding for research, development, and commercialization efforts. Additionally, private companies are investing in e-fuel projects and pilot plants, aiming to scale up production and make e-fuels more accessible to consumers. E-fuels also contribute to energy security by diversifying the sources of energy for transportation and industrial sectors

Restraint: High cost of e-fuels

The substantial initial capital investment needed acts as a deterrent for new entrants into the e-fuels market. The infrastructure necessary for the production, storage, and transportation of e-fuels necessitates advanced and specialized technology. The associated initial investment and ongoing maintenance costs of these technologies can be substantial, contributing to the overall high cost of e-fuels. The production of e-fuels involves a considerable investment in novel infrastructure, including electrolyzers, methanators, and Fischer-Tropsch reactors. Furthermore, the current cost of e-fuels surpasses that of conventional fossil fuels. This discrepancy arises because the e-fuels industry is still in its early developmental stages, resulting in elevated production costs.

Opportunity: Global e-fuel investments by major automakers

Several auto component suppliers, oil majors, and a few carmakers who don’t want their vehicles weighed down by heavy batteries support e-fuels. Increased developments and investments to promote e-fuels across various region have created lucrative opportunities for the market growth. For instance, Aramco and Repsol, two global energy companies, have joined forces to develop and commercialize e-fuels in Spain. Similarly, Porsche invested USD 75 million in HIF Global to bring e-fuels to mainstream petrol stations. HIF used the funding to construct an e-fuel production facility in Chile. Furthermore, according to the German Energy Agency (dena), the EU's goal of decreasing passenger car emissions by 37.5% by 2030 (based on an average target of 95 g CO2/km in 2020) necessitates the development of PtX capacity. Such developments would create significant opportunities for the growth of e-fuels in future.

Challenge: Variable and high feedstock costs

The variable and high costs of feedstocks create challenges for the players in the e-fuels market. The most common feedstocks for e-fuels are renewable energy sources, such as solar and wind power, captured carbon dioxide, and hydrogen. The fluctuating availability and costs of these feedstocks can pose obstacles to the economic viability and competitiveness of e-fuels. The cost of feedstock can vary depending on a number of factors, including the cost of renewable energy, the cost of carbon capture and storage (CCS) technology, and the availability of feedstock. The high and variable cost of feedstock can make it difficult for e-fuels companies to produce e-fuels at a competitive price.

Market Ecosystem

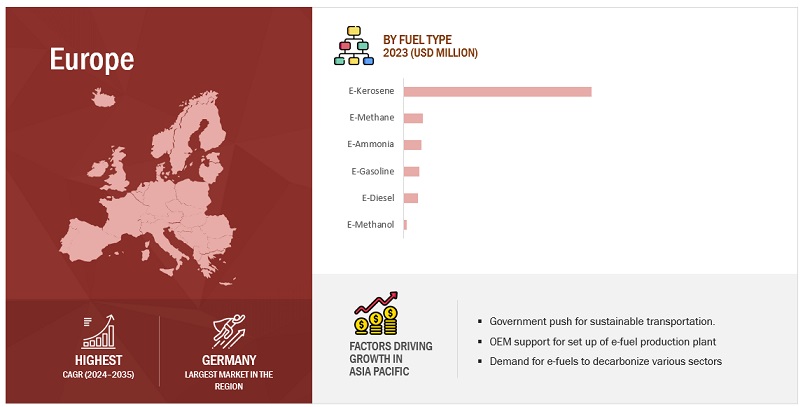

The e-kerosene segment to be the largest segment during the forecast period

E-kerosene, also known as efuels and synthetic kerosene, has the potential to drastically reduce the environmental impact of aviation, one of the most carbon-intensive industries in the economy. E-kerosene leads with the largest market share, during the forecasted period in future of e-fuels. E-kerosene can lessen the creation of contrails, which contribute to climate warming due to their greenhouse influence on terrestrial radiation. E-kerosene contains less particles and aromatic compounds, resulting in less soot, which is the primary cause of trail production. These advantages contributes to create lucrative opportunities for e-kerosene in the future of e-fuels study. Additionally, E-ammonia anticipates the highest CAGR during the forecast period due to rising demand for sustainable energy solutions.

Europe to be the prominent market for E-fuels during the forecast period.

Europe is expected to be the largest region in the e-fuels market between 2024–2035, followed by Asia Pacific. Europe has been leading the e-fuels market. The e-fuels market is experiencing growth due to the presence of leading solution providers like Saudi Arabian Oil Co. (Saudi Arabia), Audi AG (Germany), Siemens Energy (Germany), Sunfire GmbH (Germany), and Norsk E-fuel (Norway). For instance, Norsk E-fuel is constructing a large-scale e-fuel facility in Mosjøen, Norway, set to begin production in late 2026. The plant will employ collected CO2 and green hydrogen to generate sustainable aviation fuel (SAF). Furthermore, in 2023, Nordic Electrofuel AS, a pioneer in producing electric sustainable aviation fuel (E-SAF), has received a EUR 40 million grant from the EU Innovation Fund (EUIF) pilot programme to build one of the world's first commercial scale e-fuel production plants in Herøya Industrial Park, Norway. Similarily, in 2020, Siemens Energy and Porsche AG and other partners have partnered up to produce e-fuels. These innovations from Germany is to industrialize synthetic fuels and decarbonize the mobility sector. As part of Germany’s national hydrogen strategy, to support the project Siemens Energy will get a grant of some 8 million euros from the Federal Ministry for Economic Affairs and Energy.

Key Market Players

The e-fuel space is dominated by established players such as Saudi Arabian Oil Co. (Saudi Arabia), AUDI AG (Germany), Siemens Energy (Germany), Sunfire GmbH (Germany), and Electrochaea GmbH (Germany),and among others. While, the e-fuel space is automotive is dominated by established players such as Toyota Motor Corporation (Japan), Hyundai Motor Company (South Korea), BMW Group (Germany), Repsol (Spain), among others. These companies develop new technologies in the e-fuels domain. They have invested in R&D for related technologies and offer best-in-class products to their customers.

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

2022–2035 |

|

Base year considered |

2023 |

|

Forecast period |

2024-2035 |

|

Forecast units |

Value (USD million/billion), Volume (Million Litres) |

|

Segments Covered |

Fuel Type, State, End-use application, and Region |

|

Geographies covered |

Asia Pacific, Europe, North America, and Rest of the World. |

|

Companies Covered |

Saudi Arabian Oil Co. (Saudi Arabia), Audi AG (Germany), Siemens Energy (Germany), Sunfire GmbH (Germany), Mitsubishi Corporation (Japan), Repsol (Spain), Porsche AG (Germany), Uniper SE (Germany), Orsted (Denmark), MAN Energy Solutions (Germany), Perstorp Holding AB (Sweden), HIF Global (Chile), INFINIUM (US), INERATECH GmbH (Germany), and Liquid Wind (Sweden). |

This research report categorizes the future of e-fuels based on fuel type, state, and end-use application, and Region.

Based on Fuel Type:

- E-methane

- E-kerosene

- E-methanol

- E-ammonia

- E-diesel

- E-gasoline

Based on State:

- Gaseous

- Liquid

Based on End-use application:

- Mobility

- Chemical Feedstock

- Power Generation

- Others

Based on the region:

-

Asia Pacific

- China

- India

- Australia

- Rest of Asia Pacific

-

Europe

- Germany

- UK

- Norway

- Denmark

- Sweden

- Rest of Europe

-

North America

- US

- Canada

-

Rest of the World

- Middle East and Africa

- South America

Recent Developments

- In October 2023, HIF Global and ENEOS Holdings, Inc., a Japanese oil refiner, collaborated on e-fuel production in the Japanese market.

- In July 2023, INERATECH GmbH collaborated with GIZ, a provider of international cooperation services, to boost Chile's e-fuel development.

- In January 2023, Liquid Wind expanded its presence in Northern Sweden with its 3rd e-methanol production facility.

- In December 2022, Porsche AG and international partners opened a Haru Oni plant in Chile to produce e-fuels. Further, Porsche AG invested USD 75 million HIF to bring e-fuels to mainstream petrol stations.

- In May 2022, Aramco and Repsol, two global energy companies, have joined forces to develop and commercialize e-fuels in Spain.

Frequently Asked Questions (FAQ):

What is facial recognition?

Facial recognition is a biometric technology that involves individuals' identification, authentication, or verification based on their facial features. This advanced system uses complex algorithms to analyze unique facial patterns, such as the distance between eyes, nose shape, and jawline, creating a facial template for each person.

What is the market size of the managed facial recognition market?

The global facial recognition market is estimated to be worth USD 6.3 billion in 2023 and is projected to reach USD 13.4 billion by 2028, at a CAGR of 16.3% during the forecast period.

What are the major drivers in the facial recognition market?

The major drivers in the facial recognition market include growing concerns about security and the rising need for robust surveillance systems, advancements in facial recognition algorithms, machine learning, AI, and contactless technologies post-COVID-19.

Who are the major players operating in the facial recognition market?

The major players in the facial recognition market are NEC (Japan), Microsoft (US), Thales (France), AWS (US), IDEMIA (France), Aware (US), Daon (Ireland), Megvii (China), Facephi (Spain), Herta Security (Spain), OneSpan (US), Q3 Technologies (US), Neurotechnology (Lithuania), Cognitec Systems (Germany), Ayonix (Japan), NVISO.ai (Switzerland), FaceFirst (US), Clarifai (US), Iproov (UK), Oosto (Israel), Pangiam (US), Clearview AI (US), Corsight AI (Israel), Facia (UK) Veridium (US), and Visage Technology (Sweden).

Which key technology trends prevail in the facial recognition market?

Primarily, deep learning and artificial intelligence advancements have significantly improved facial recognition accuracy, enabling systems to handle complex scenarios and diverse datasets more effectively. Secondly, the shift towards edge computing has allowed for processing facial recognition data closer to the source, reducing latency and enhancing real-time applications. Additionally, there's a growing emphasis on ethical considerations, with increased attention on mitigating biases in facial recognition algorithms and addressing privacy concerns. Integrating facial recognition with other biometric modalities, such as voice recognition or iris scanning, is also a notable trend, offering more robust and multi-modal authentication solutions. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

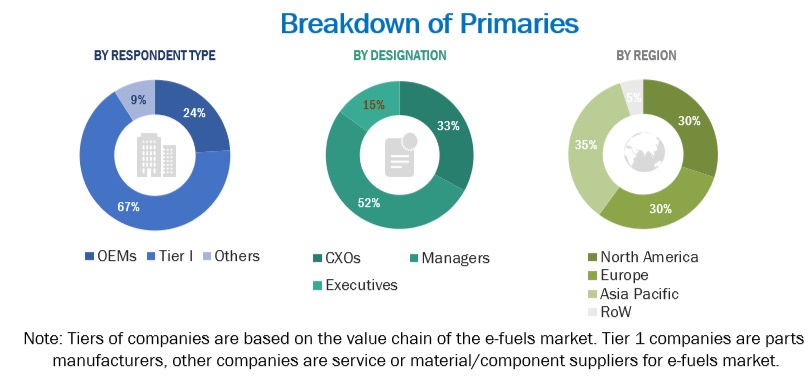

The study involved four major activities in estimating the market size of the ‘Future of E-fuels’ study. Exhaustive secondary research was done to collect information on the market, the peer market, and the child markets. The next step was to validate these findings, assumptions, and sizing with the industry experts across value chains through primary research. The top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation processes were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources were used to identify and collect information for this study. The secondary sources include annual reports, press releases, and investor presentations of companies; whitepapers, certified publications; articles from recognized authors, directories, and databases; and articles from recognized associations and government publishing sources. Secondary research has been used to obtain key information about the industry’s value chain, the overall pool of key players, market classification and segmentation according to industry trends to the bottom-most level, regional markets, and key developments from the market- and technology-oriented perspectives.

Primary Research

Extensive primary research has been conducted after acquiring an understanding of this market scenario through secondary research. Several primary interviews have been conducted with market experts from the demand- and supply-side OEMs (in terms of component supply, country-level government associations, and trade associations) and component manufacturers across five regions, namely, Asia Pacific, Europe, North America, South America, and Middle East & Africa. Approximately 23% and 77% of primary interviews have been conducted from the demand and supply side, respectively. Primary data has been collected through questionnaires, emails, LinkedIn, and telephonic interviews. In the canvassing of primaries, we have strived to cover various departments within organizations, such as sales, operations, and administration, to provide a holistic viewpoint in our report.

After interacting with industry experts, we conducted brief sessions with highly experienced independent consultants to reinforce the findings from our primaries. This, along with the in-house subject matter experts’ opinions, has led us to the findings as described in the remainder of this report. Following is the breakdown of primary respondents.

To know about the assumptions considered for the study, download the pdf brochure

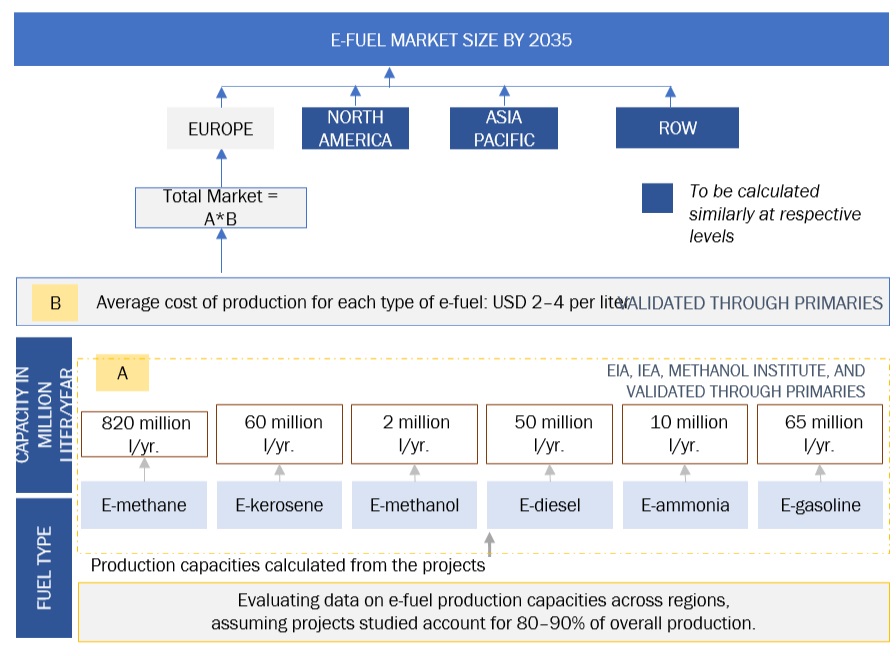

Market Size Estimation

The bottom-up approach was used to estimate and validate the total market size. This method was also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

The key players in the industry and markets have been identified through extensive secondary research

The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes

All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources

Future of E-fuels: Bottom-Up Approach for Global E-fuels Market Size

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Market Definition

E-fuels or electrofuels are renewable or low-carbon liquid or gaseous fuels. They are produced by combining renewable electricity, often sourced from wind or solar power, with carbon dioxide (CO2). This process results in the creation of synthetic hydrocarbon-based fuels such as e-diesel or e-kerosene that can replace conventional fossil fuels. E-fuels are particularly useful for aviation and heavy industries because direct electrification is difficult in these sectors. However, producing e-fuels requires a significant amount of renewable energy input and faces challenges regarding costs and scalability. Despite these challenges, e-fuels can play a crucial role in achieving a sustainable and carbon-neutral energy landscape, helping to combat climate change and reduce greenhouse gas emissions.

The market size for e-fuels is the sum of revenue generated by suppliers of various types of e-fuels, such as e-diesel, e-ammonia, e-kerosene, e-gasoline, e-methane, and e-methanol. The e-fuels market has been analyzed for North America, Europe, Asia Pacific, and Rest of the World (RoW).

List of Key Stakeholders

- E-fuel vendors

- Consulting companies in the energy & power sector

- Consulting companies related to the energy & power sector

- Energy regulators

- Government and research organizations

- Power and energy associations

- Repairs and maintenance service providers

- State and national regulatory authorities

- Research and consulting companies in the clean energy generation sector

- Organizations, forums, alliances, and associations

- Industrial authorities and associations

- State and national regulatory authorities

- Research institutes

Report Objectives

- To define, describe, segment, and forecast the size of the e-fuels market based on fuel type, state, end-use application, and region, in terms of value

- To describe information about the renewable sources used in manufacturing e-fuels

- To segment and forecast the market size, by region (Asia Pacific, Europe, North America, and Rest of the World) in terms of value and volume

- To understand the market dynamics (drivers, restraints, opportunities, and challenges) of the future of e-fuels

- To understand the dynamics of competitors in market, and distinguish them into visionary leaders, innovators, emerging companies, and dynamic differentiators according to their product portfolio strength and business strategies

- To analyze opportunities for stakeholders and the competitive landscape for market leaders

- To strategically profile key players and comprehensively analyze their market share and core competencies

- To analyze the opportunities offered by various segments of the market to its stakeholders

- To analyze and forecast the trends and orientation for the e-fuels market in the global industry

Available Customizations

With the given market data, MarketsandMarkets offers customizations in accordance with company-specific needs.

- Future of E-fuels, By End-use Application, at the country level (For countries covered in the report)

- Profiling of Additional Market Players (Up to 5)

Growth opportunities and latent adjacency in Future of E-fuels Market