Future of Autonomous World - Global Forecast to 2035

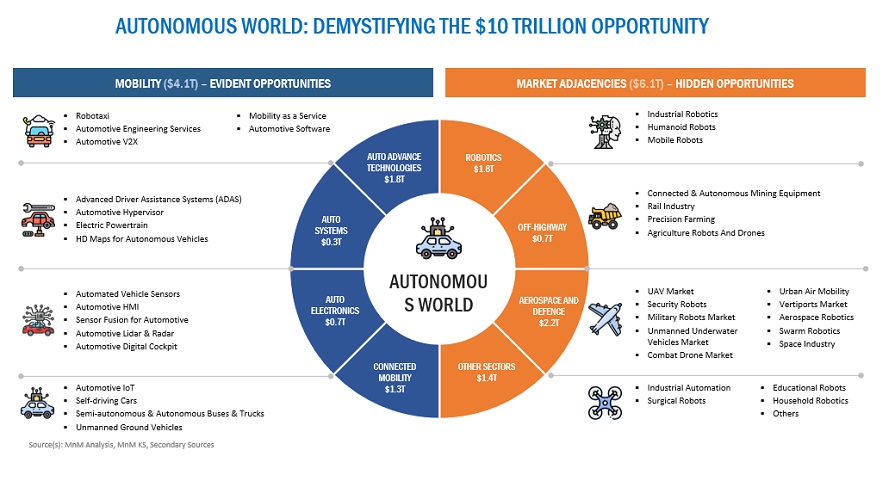

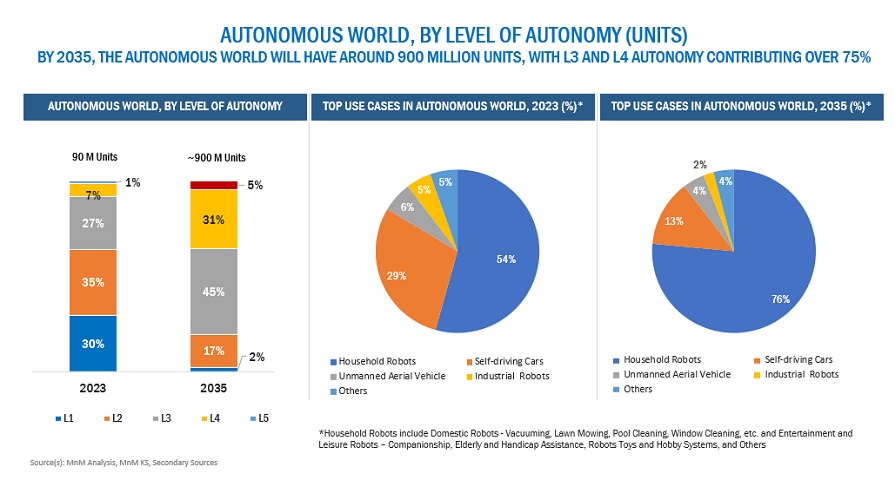

The autonomous world study explores the rapid evolution and future potential of autonomous systems, which function independently through sensing, perceiving, planning, and acting without human intervention. This study projects a USD 10 trillion economy for autonomous systems by 2035, with 900 million units, predominantly L3 and L4 systems. It emphasizes a shift from CAPEX to OPEX business models, focusing on service-based solutions and predicting job displacement in some sectors while creating economic opportunities.

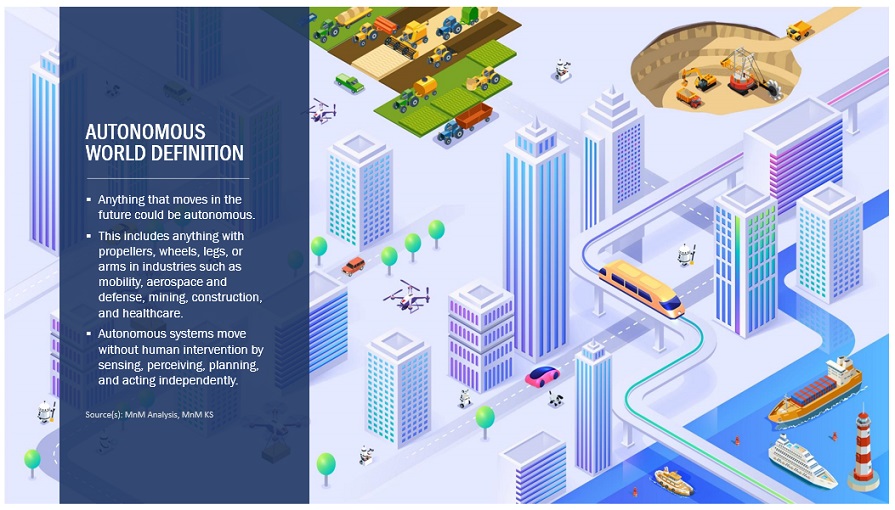

The rise of autonomous systems is set to revolutionize multiple industries by 2035, with significant advancements across mobility, aerospace, defense, mining, construction, and healthcare. These systems are rapidly progressing to higher levels of autonomy. The transition from mechanical systems to automation spanned 200 years. Still, the leap from automation to Level 4 (L4) autonomy is expected to occur in less than 25 years, with Level 5 (L5) autonomy projected to be a decade or more away.

In terms of market growth, the L3 autonomous car market is expected to expand at a compound annual growth rate (CAGR) of 86%, reaching over 6 million units by 2030. However, the L4 market will see limited commercial growth, with around 1 million units by 2030, while L5 cars are not expected to witness any market penetration by that time. OEMs will increasingly offer semi-automated features on subscription models, particularly in the L4 ride-hailing sector.

The regulatory landscape for autonomous vehicles remains fragmented globally, with notable progress in countries such as the UK, where the Automated Vehicles Act has been enacted, and the US, where L5 autonomy is permitted in seven states. China is also working towards full legislation, while other countries have varied regulations on autonomy levels and liabilities.

Autonomous systems are also poised to impact other sectors. In agriculture, autonomous robots, particularly drones, will be significant contributors. In mining, autonomous machinery will dominate, while autonomous trains and humanoid robots will see substantial growth in their respective markets. Security robots and UAVs (drones) will also experience significant growth driven by affordability and advanced capabilities. Urban Air Mobility (UAM) and autonomous airport technologies will further transform transportation infrastructure, with key industry players leading these advancements.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Market Dynamics:

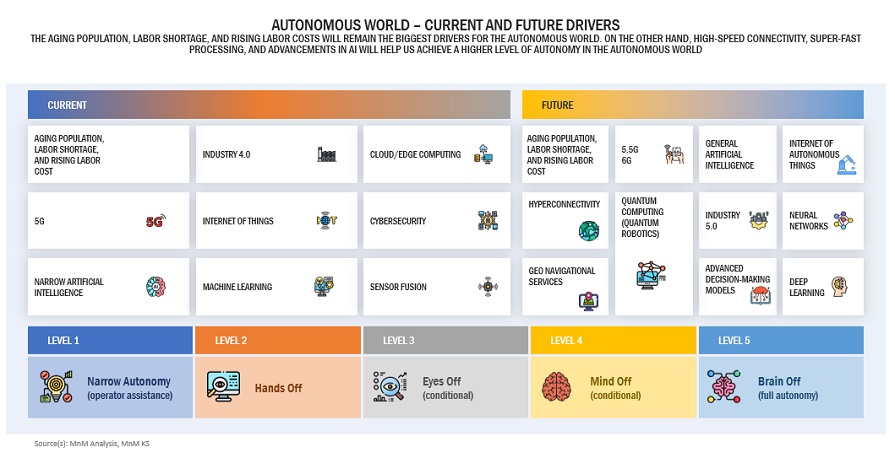

Driver: Aging population, labor shortage, rising labor cost, high-speed connectivity, super-fast processing, AI advancements

Significant demographic and technological shifts drive the advancement of autonomous systems. An aging population, labor shortages, and rising labor costs are the primary forces pushing industries toward greater reliance on autonomous systems. These challenges compel companies to seek automation solutions to maintain productivity and efficiency. On the technological front, rapid developments in high-speed connectivity, super-fast processing capabilities, and advancements in AI enable the creation of more sophisticated and reliable autonomous systems. These technologies are critical for achieving higher levels of autonomy, allowing autonomous systems to operate with minimal human intervention across sectors. Together, these factors are shaping the present and future of the autonomous world, where economic and technological imperatives drive the adoption of autonomous solutions.

Restraint: Data-related challenges and lack of clear accountability

Despite the promising developments in autonomous systems, significant barriers and challenges to achieving a fully autonomous world remain. One of the primary challenges is dealing with data-related issues, such as ensuring data quality and addressing the complexities of data collection needed for machine learning. Additionally, there is a need for clear accountability frameworks to ensure safety and build trust in autonomous systems. While these systems excel at performing defined tasks, they still struggle to match human adaptability when confronted with unfamiliar situations. The accuracy of autonomous systems often depends on specific conditions, and validating deep learning models requires considerable expert time. Furthermore, the limitations of simulated behavior are not fully understood, highlighting the need for further research and improvements. Concerns about safety and a general fear of change also contribute to the slow adoption of autonomous systems, emphasizing the need for comprehensive training and robust regulatory frameworks to ensure a seamless and safe integration of autonomy into our world.

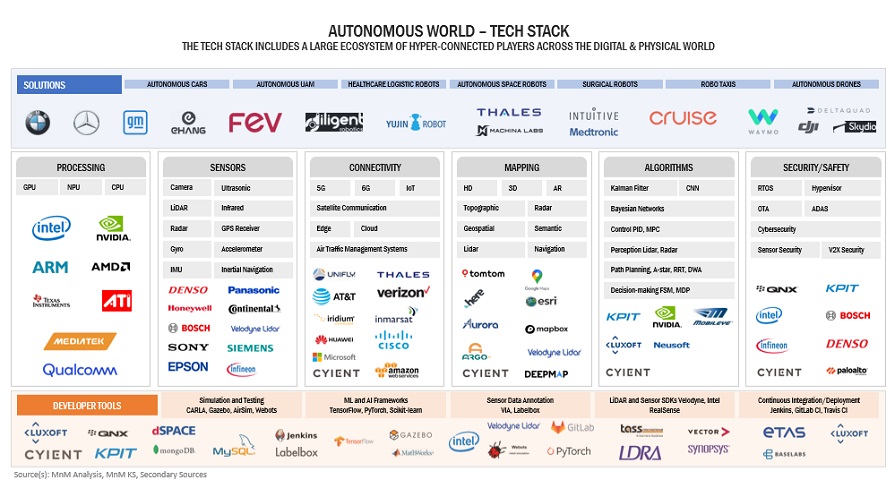

Market Ecosystem

Frequently Asked Questions (FAQ):

What industries are expected to be most affected by the rise of autonomous systems by 2035?

By 2035, autonomous systems are set to revolutionize multiple industries, including mobility, aerospace, defense, mining, construction, and healthcare. These sectors will benefit from advancements in sensing, perceiving, planning, and acting, allowing for higher levels of autonomy and more efficient operations.

What are the key drivers behind the adoption of autonomous systems globally?

The major drivers include demographic changes such as an aging population, labor shortages, and rising labor costs. Additionally, technological advancements like high-speed connectivity, enhanced processing power, and AI development enable the integration of autonomous systems across industries.

How will the market for autonomous systems evolve by 2035?

The autonomous systems market is projected to become a USD 10 trillion economy with approximately 900 million units in operation, mainly comprising Level 3 (L3) and Level 4 (L4) systems. The market will shift from capital expenditure (CAPEX) to operational expenditure (OPEX), emphasizing service-based solutions, which will drive economic growth and job creation, despite potential job displacement in certain sectors.

What are the challenges facing the deployment of autonomous systems?

Key challenges include data management, the need for clear accountability frameworks, and the necessity of training autonomous systems to handle unfamiliar situations. These challenges must be addressed to ensure the safe and seamless integration of autonomous systems across industries.

What is the projected timeline for the adoption of different levels of autonomy in vehicles?

By 2030, the L3 autonomous car market is expected to grow at a compound annual growth rate (CAGR) of 86%, reaching over 6 million units. However, L4 vehicles will see limited commercial growth, with around 1 million units by 2030, and L5 vehicles are not expected to have any market penetration by that time. The adoption timeline reflects technological advancements and regulatory developments across regions. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

The study involved two major activities in estimating the market size of the ‘Autonomous World’. Exhaustive secondary research was done to collect information on the market, the peer market, and the child markets. The next step was to validate these findings, assumptions and sizing with the existing MnM reports on related markets. The bottom-up approach was employed to estimate the complete market size. Thereafter, market breakdown processes were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources were used to identify and collect information for this study. The secondary sources include annual reports, press releases, and investor presentations of companies; whitepapers, certified publications; articles from recognized authors, directories, and databases; and articles from recognized associations and government publishing sources. Secondary research has been used to obtain key information about the industry’s value chain, the overall pool of key players, market classification and segmentation according to industry trends to the bottom-most level, regional markets, and key developments from the market- and technology-oriented perspectives.

Market Size Estimation

The bottom-up approach was used to estimate and validate the total market size. This method was also used extensively to estimate the size of various subsegments in the market.

All the markets/topics discussed in the report are from existing MnM studies, which were used to estimate the total market size of Autonomous World both in terms of units and USD trillion.

Market Definition

In the near future, the concept of autonomy could extend to virtually anything that moves, encompassing vehicles, machinery, and devices equipped with propellers, wheels, legs, or arms. This includes applications across a broad range of industries such as mobility, aerospace and defense, mining, construction, and healthcare. Autonomous systems, defined by their ability to operate independently without human intervention, achieve this through sophisticated processes of sensing, perceiving their environment, planning actions, and executing those actions autonomously. These systems are designed to carry out complex tasks by integrating advanced technologies that allow them to navigate, adapt, and respond to dynamic conditions, making them integral to the future of multiple industries.

List of Key Stakeholders

- Autonomous World OEMs

- Technology players – hardware. Software, and IT service providers

- Consulting companies in the Autonomous World

- Regulators

- Government and research organizations

- Repairs and maintenance service providers

- State and national regulatory authorities

- Research and consulting companies in the Autonomous World

- Organizations, forums, alliances, and associations

- Industrial authorities and associations

- Research institutes

- End Users and customers

Report Objectives

- Evaluate the Transformational Impact on Industries: Investigate how AW will transform key sectors such as mobility, aerospace, defense, mining, construction, and healthcare, and identify the specific areas within these industries that will benefit the most from higher levels of autonomy.

- Analyze Demographic and Economic Drivers: Examine how demographic changes, including an aging population and labor shortages, along with rising labor costs, are propelling the global adoption of AW.

- Identify Technological Advancements and Challenges: Explore the role of advancements in AI, high-speed connectivity, enhanced processing power, and sensor technologies in enabling the integration of AW, while addressing challenges related to data management, system training, and simulation accuracy.

- Estimate Market Size and Growth, and Economic Shifts: Project the growth of the AW market, estimating its value by 2035, the number of autonomous systems in operation, and the anticipated shift from CAPEX to OPEX, with a focus on the implications for global economic growth and sector-specific job creation or displacement.

- Examine Regulatory Landscape and Global Differences: Analyze the current state of regulations governing AW across different countries, highlighting the fragmented nature of global regulations, and identify best practices for establishing clear accountability frameworks and safety standards.

- Assess the Adoption Trajectory of Autonomous Vehicles: Evaluate the expected growth and market penetration of L3, L4, and L5 autonomous vehicles, considering factors such as consumer adoption, OEM strategies, and the emergence of new business models like subscription services.

- Study the Role of Autonomous Systems in Infrastructure and Transportation: Investigate how AW will impact urban air mobility, autonomous trains, and airport technologies, and identify key industry players and technologies driving these changes.

- Provide Strategic Recommendations for Stakeholders: Develop a set of recommendations for policymakers, industry leaders, and businesses on how to effectively prepare for and leverage the rise of AW, ensuring a balanced approach to economic, technological, and ethical considerations.

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

2022–2035 |

|

Base year considered |

2023 |

|

Forecast period |

2024-2035 |

|

Forecast units |

Value (USD billion/trillion), Units (Million) |

Growth opportunities and latent adjacency in Future of Autonomous