Future Of Automotive Industry Covers Original Equipment Manufacturer (OEM) Landscape, Connected Vehicles, Autonomous Driving Technologies, Electric Vehicles (Evs), Innovations In Battery Technology, Powertrains and Shared Mobility - Global Forecast 2030

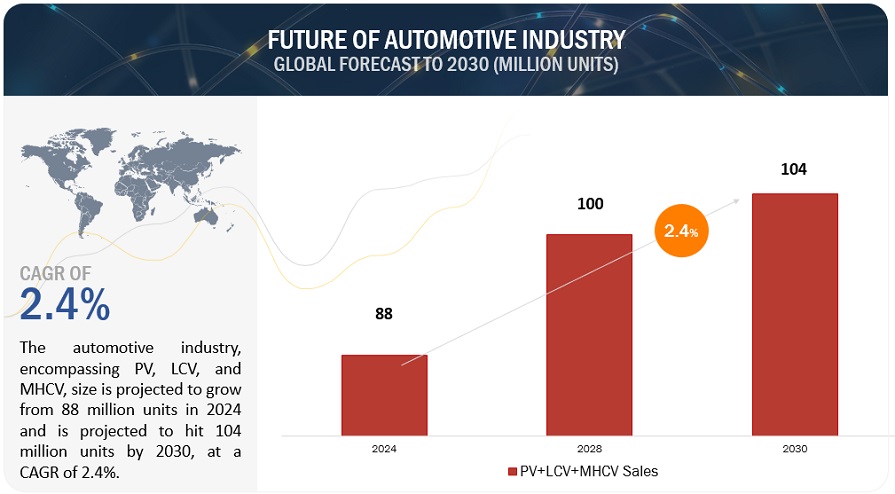

[100 Pages Report] The automotive industry, encompassing PV, LCV, and MHCV, size is projected to grow from 88 million units in 2024 and is projected to hit 104 million units by 2030, at a CAGR of 2.4%. Factors such as the extended driving range of EVs and the increasing interest among consumers indicate EVs potential as an alternative for zero-emission mobility. Additionally, the rising involvement of investors, advancements in technology by OEMs, and governmental initiatives toward zero-emission transportation are expected to boost the market growth. This shift towards shared mobility and connected living is already experiencing global traction, notably in passenger vehicles, where autonomous driving is also progressively gaining favor.

Dedicated to achieving zero emission targets, the OEMs have planned to invest over USD 500 Billion by 2030 for EV production facilities. Moreover, OEMs have attempted to regulate the EV battery supply chain to further cut down the raw material, manufacturing and maintenance of the batteries.

Tracking the rise of automotive market, in 1980 the sales of PV, LCV, and MHCV was over 38 million, it reached 52 million in 2000, further it increased to about 90 million in 2019 and was just below 88 million in 2023. It is further estimated to cross 104 million in 2030. Despite facing challenges like economic downturns and supply chain disruptions occasionally and the COVID-19 pandemic in 2020, the automotive market has historically rebounded within 2-3 years.

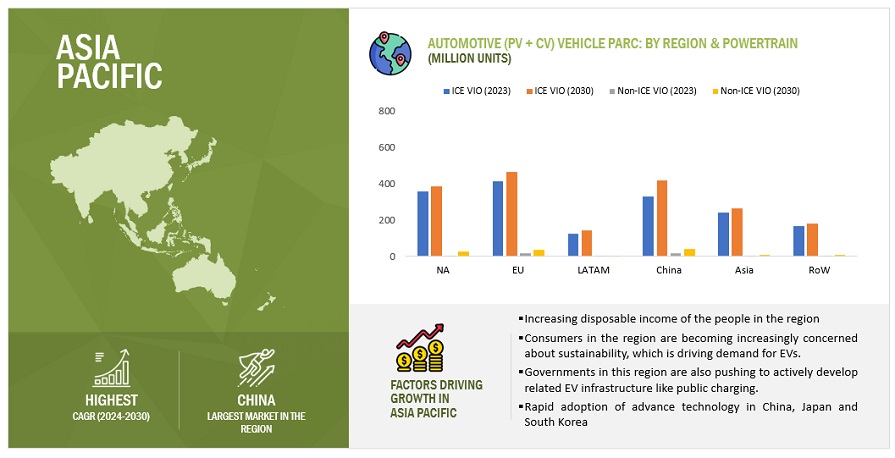

The global vehicle parc, including PV and CV, to reach 2 billion by 2030. The average age of vehicles, currently 12.1 years, will increase by 1 month annually in most markets. Over the period from 2023 to 2030, the parc of ICE vehicles will grow at a CAGR of 2.1%, while the parc of non-ICE vehicles will grow at a CAGR of 18.9%.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Market Summary:

The automotive industry has a great history of strongly bouncing back after every economic downfall. This has proved right after the COVID-19 impact and is expected to continue its growth in future. The pattern of recovery is either U shaped or V shaped. It has been observed that the future of automotive industry has a strong correlation with real GDP growth, specially for LDVs, indicating its connection with the economic growth.

There might be slight slowdown in with the growth of EVs, however by 2036 the EVs are expected to surpass the ICEs. This will be driven by increased environmental concerns, advancement in battery technology and OEM strategies. It is observed the OEMs are rapidly innovating and adopting to the newer technology. Wherein, Chinese OEMs such as BYD, SAIC, Geely, Changan and Chery will lead the race in future. The stronger the EV portfolio, stronger will be the OEMs position in the market.

Not all the automotive OEMs can innovate and perform with all the aspects of the future technology. Therefore, it will be very crucial to develop strategic partnerships with other technology leaders to innovate and leverage the gaps for collaborative effort in implementing new technologies.

Developing nations such as India, Mexico, Brazil, Indonesia, Turkey, Nigeria and others will significantly contribute to the automotive industry in terms of manufacturing as well as sales. However, countries like China, and US will be the market leaders. On the other hand, Gen Z population will influence the vehicle sales, distribution, and marketing strategies as they have a strong inclination towards innovative, tech-savvy, and eco-friendly automotive solutions. This demographic shift will redefine the product development and market strategies.

SUV's will be the largest selling cars in the future. Compact and mid-size SUV it will be popular due to its affordability, safety, design and stylish looks.

The future will witness consolidation of manufacturing platforms by the OEMs. Highly flexible platforms will be developed that can produce hatchbacks, sedans SUV's as well as vans and light pickup trucks on a single platform does witnessing efficiency and scalability in production process.

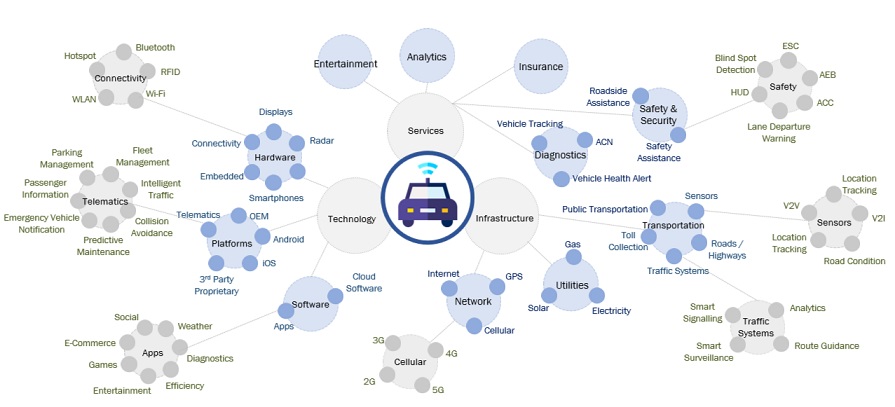

The connected smart technology through IoT with around 300 features in the car will lead to safety is in commuting which will also lead to integration of smart cities and urban driving. This will also open a new window for commercialization of services through software-defined vehicles (SDVs) and services provided by the OEMs. In addition to this L5 vehicles it's a long target to achieve however L2.5, L3 and L 3.5 will be the ADAS updates in the cars in the recent future.

Market Ecosystem

Digital connected living services to cross $500 billion mark by 2035

The connected living integrates smart technologies through the Internet of Things (IoT) to create an efficient, automated lifestyle, connecting home devices, wearables, vehicles, and urban infrastructure for enhanced convenience and security. The advanced vehicle connectivity and digital features will integrate vehicles, occupants, and the external environment, revolutionizing the lifecycle from pre-purchase to end-of-life management. The total addressable market (TAM) for connected vehicle technologies is forecasted to surge from USD 0.8 billion in 2023 to USD 568 billion by 2035. This growth is driven by enhanced features and services, with potential earnings of USD 1,600 per car annually. The future cars will offer over 300 connected features, signaling the automotive industry's shift towards more connected, autonomous, shared, and electric vehicles, driving a fundamental transformation in mobility.

Asia holds the major share of vehicle parc

Asia regions hold the major share of vehicle parc in terms of volume of PV and CV combined. The major factor for this is the intensive manufacturing and export of cars in China. The Chinese market is the worlds largest market in terms of vehicle sales as well as production. In 2023, China’s sales volume for passenger vehicles was over 25 million units, with a share of around 50% globally. Moreover, the Chinese market has significantly grown post COVID halt. The recovery effect of the economy in China has led to intensifying of the manufacturing sector. One of the key strategies followed by the Chinese EV makers is expansion to the European market for EV sales expansion. Companies such as NIO and Xpeng are aggressively expanding into the European region with plans of establishing their vehicle as well as battery production plants. Moreover, countries such as Japan, India and South Korea significantly contribute to the growth of the automobile sector in the Asian region, wherein, the Asian region (excluding China) holds over 245 million units and China alone holds over 350 million Vehicles In Operation (VIO) in its vehicle parc.

Key Market Players

The top performing OEMs in 2023 were Toyota Motor Corporation, Volkswagen AG, Hyundai Motor Group, General Motors, Renault-Nissan-Mitsubishi, Stellantis N.V. accounting over 50% of the market share. By 2030, 3 automotive groups will contribute over 10 million units in light vehicle sales. By 2035, market will be led by companies with robust EV portfolios with more Chinese manufacturers in the top 10. Wherein BYD Auto, Tesla and Volkswagen group will lead the EV segment. By 2035, Chinese players such as Geely, Chery, SAIC and Changan will join BYD in top 10.

These companies adopted new product launches, acquisitions, partnerships, collaborations, and other key strategies to gain traction in the automotive market.

Recent Developments

- In June 2024, Honda started the of production of its new 2025 Honda CR-V e:FCEV fuel cell electric vehicle (FCEV) at the Performance Manufacturing Center (PMC) in Ohio, US.

- In May 2024, BYD launched the e-Platform 3.0 Evo, an upgraded version of its BEV model platform and Sea Lion 07 EV SUV will be the first model based on this model.

- In May 2024, Exicom, a leading EV charger and power solution provider in India launched a Harmony Gen 1.5 DC fast charger.

- In May 2024, Polestar announces the expansion of its collaboration with Canadian EV subscription platform, Weeve.

- In June 2024, Nissan demonstrated autonomous Leaf prototype, featuring 14 cameras, 10 radars, and sic lidar sensors on public roads in Japan.

- In April 2024, CATL launched the battery pack with Yutung Bus Co to power commercial vehicles like buses and different classes of trucks.

- In January 2024, Tata Motors announced its new Acti.ev electric vehicle platform, which is developed to manufacture electric versions of its cars such as Punch, Curvv, Sierra and Harrier.

- In May 2023, Ford announced a collaboration with CATL to setup a EV battery plant in Michigan, US by investing $3.5 billion, which will be operational by 2026.

- In February 2023, bp announced to invest $1 billion in EN charging across US by 2030 to meet the demands from Hertz’s EV rentals.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Frequently Asked Questions (FAQ):

What is the current size of PV, LCV, and MHCV automotive industry?

The automotive industry, encompassing PV, LCV, and MHCV, size is projected to grow from 88 million units in 2024 and is projected to hit 104 million units by 2030

What are the driving factor impacting the growth of the automotive industry?

Increasing customer preference for electric vehicles, convenience, premium features, and advanced safety features, integration of connectivity, use of variety of lightweight & advanced materials and innovative finish, enhanced manufacturing process, growing demand for advanced infotainment systems, growing penetration of ADAS systems are the driving factor impacting the growth of the automotive market.

What are the new market trends impacting the growth of the automotive industry?

Fast & Ultra-fast charging, ADAS and LiDAR technologies, 5G connectivity and autonomous vehicles are some of the major trends affecting this market.

What are the new market trends EV Passenger Vehicle Market?

Fast & Ultra-fast charging, Increasing Battery Pack capacity and Ranges, New Chemistries are some of the key future focus of the EV passenger vehicle segment.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

The study involved analyzing the recent developments, trends and the performance of the players as well as the overall automobile industry with the projections and trends that will take place till 2030. The study is also based on analysis of the major milestones in the automotive industry across vehicle connectivity, electrification, autonomous vehicles, shared mobility, online sales and other critical aspects that are likely to transform the automotive industry. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with the industry experts across value chains. The top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation processes were used to estimate the market size of segments and subsegments.

Secondary Research

The secondary sources referred for this research study include automotive OEMs, Tier I/II companies, and publication from government sources, automotive associations & databases; [such as country level automotive associations and organizations, International Energy Agency (IEA), Organization Internationale des Constructeurs d’Automobiles (OICA), European Automobile Manufacturers Association (ACEA), MarkLines, International Monetary Fund, Oxford Economics, and others]; corporate filings (annual reports, investor presentations, and financial statements); and trade, business, and automotive associations. Secondary data has been collected and analyzed to arrive at the overall sales volume.

Market Size Estimation

The bottom-up and top-down approaches were used to estimate and validate the total automotive vehicle sales volume. This approach was also used to identify the sales of various subsegments in the market. The research methodology used to estimate the market includes the following:

Bottom- up Approach-

To know about the assumptions considered for the study, download the pdf brochure

Top-down Approach-

To know about the assumptions considered for the study, Request for Free Sample Report

Market Definition

Future of automotive industry includes analysis on the performance and key developments in the automotive industry and insights on most anticipated technological developments & growth across electric vehicles, connected cars & features, shared mobility, powertrain, platforms and other major aspects of the automotive industry.

KEY STAKEHOLDERS

- Automobile Organizations/Associations

- Automotive Component Manufacturers

- Automotive Component Suppliers

- Automotive OEMs

- Automotive System Manufacturers

- Automotive Electronics Manufacturers

- Country-specific Automotive Associations

- European Automobile Manufacturers Association (ACEA)

- EV Manufacturers

- EV Component Manufacturers

- EV Charging Infrastructure Companies

- Government & Research Organizations

- Raw Material Suppliers for Automotive Industry

- Software Providers

- Traders, Distributors, and Suppliers of Automotive Components

Report Objectives

- To analyze the automotive market performance

- To provide key developments achieved

- To identify the trends that are likely to impact the market till 2030

- To identify major growth segments and opportunities till 2030

- To project the automotive vehicle sales till 2030

- To track and analyze competitive developments such as deals (joint ventures, mergers & acquisitions, partnerships, collaborations), product developments, and other activities carried out by key industry participants.

Growth opportunities and latent adjacency in Future Of Automotive