Functional Native Starch Market By Source (Corn Starch, Potato Starch, Tapioca Starch, and Others), Form (Powder and Liquid), End-User (Food & Beverages, Paper Industry, Pharmaceutical, Others), and Region - Global Forecast to 2029

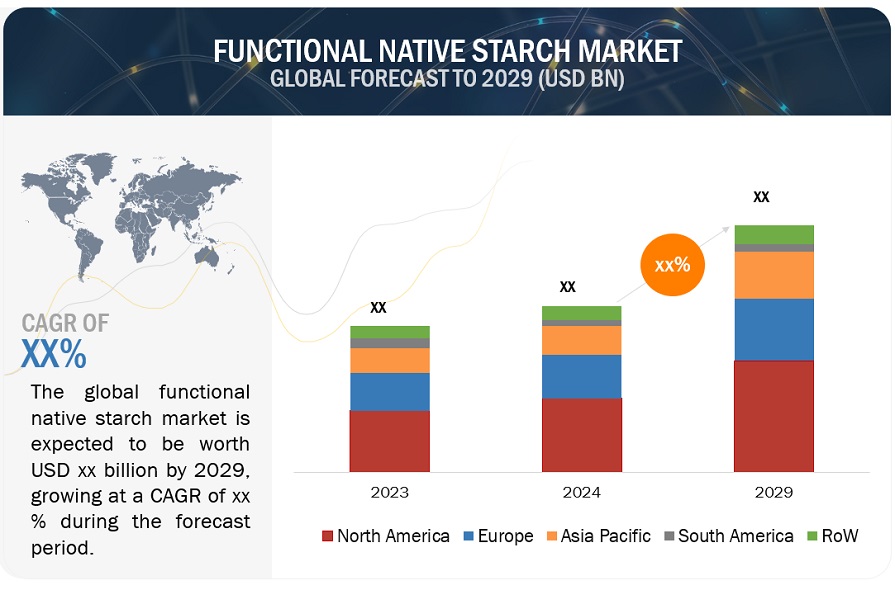

The global functional native starch market growth is on a trajectory of significant expansion, with an estimated value projected to reach USD XX.X billion by 2029 from the 2024 valuation of USD XX.X billion, displaying a promising Compound Annual Growth Rate (CAGR) of X.X%. The demand for processed food and convenience meals continues to grow the demand for functional native starches as basic thickening, stabilizing, and gelling agents. Increasing consumer awareness of health and wellness is also encouraging manufacturers to look for starch that is complementary to health, such as gluten-free or high in dietary fiber. Moreover, innovation in food technology is also pushing the development of new functional native starches designed for specific applications. Thereby, demand expansion is furthered. The clean label trend further supports demand in starches derived from natural sources as consumers increasingly favor natural and minimally processed ingredients. In addition, the emerging markets in Asia-Pacific and Latin America are rapidly experiencing rapid urbanization and changes in diet, which ensures more demand for processed foods and functional ingredients. Favorable food and pharmaceutical regulations also foster the adoption of functional native starches.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Market Dynamics

Drivers: Increasing demand for processed foods favoring the market.

Processed foods are a significant driver for the functional native starch market. Since many processed foods require ingredients that must provide specific functionalities, such as thickening, stabilizing, and gelling. The functional native starches improve the sensory experience of foods and beverages based on texture, as well as consistency-creating effects for products such as sauces, soups, dairy-free yogurt, and snack foods. This convenience factor becomes paramount for the consumer as consumption patterns begin to shift towards busier lifestyles, and indeed, processed foods offer time-saving solutions. Functional native starches play a key role in the preparation of ready-to-eat meals and snacks that look appealing and are easy to prepare.

Restraints: Restraint: Raw material supplies issue can hinder the market growth.

Potential supply chain disruptions by raw material supply issues can have a huge impact on the functional native starch market. Any fluctuation in the cost of major crops such as corn and potatoes related to weather or geopolitical tensions will lead to higher production costs. Therefore, high, and rising production costs can severely affect manufacturing companies. In addition, unpredictable factors like floods or disputes about trade can lead to shortages, thereby limiting the production capacity and delaying one's capability to meet client orders. Variability in the quality of raw materials can also affect the output product, thereby complicating the ability to maintain standards of consistency. Being reliant on such crops makes the crisis of low yields in a particular season a cause for supplementary supply constraints. With high and rising demand elsewhere, competition for these resources in agriculture tends to rise, which could heighten availability concerns.

Opportunities: Rising demand for clean label products.

The consumers are very intent with the transparency about what they are consuming day by day. This rising the demand for clean label products characterized by recognizable and simple ingredients. Functional are derived mostly from corns, potatoes, tapioca, etc. Manufacturers can capitalize on this through casting native starches as 'clean labels' to the avoidance of synthetic additives in their product, set to attract health-conscious consumers. Native starches are multifunctional in that they can be thickeners, binders, and stabilizers in foods. It is this multifunctional potential that makes it possible for a single natural starch to replace several synthetic ones, simplifying formulations and cleaning up the label.

Moreover, several companies offer clean label functional native starch. For example, Ingredion, Tate & Layle, Lyckeby, and many more.

Challenges: Presence of alternate ingredients

There are several alternative options that are relatively easily acquired to shift in case of changes due to cost or desired properties or availability-broad alternatives, including modified starches, gums, hydrocolloids, and other natural thickeners. This mainly is during times when fluctuations in raw material prices happens, some alternatives might prove to be cheaper, and thus the manufacturers would be inclined to include such cheaper substitutes so that they could also go ahead and maintain margin levels.

Besides, some of these replacement ingredients could act better than functional native starches in specific applications, therefore showing enhanced emulsification or stability under extreme conditions and therefore preferred over them.

Market Ecosystem

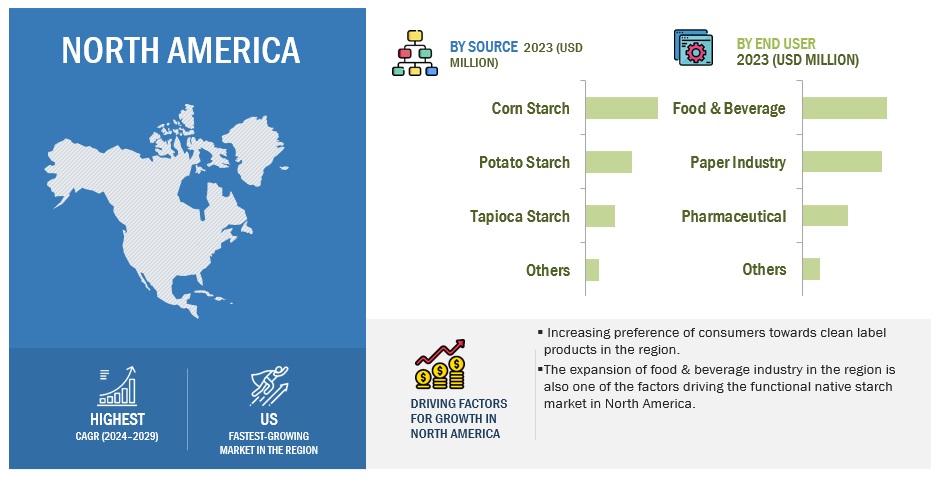

corn starch segment accounted for A HIGHER market SHARE among SOURCE SEGMENT in 2023.

Corn starch segment accounts for a relatively larger part of the functional native starch market than other segments. This is attributed to wide production of corn. Corn is widely cultivated globally. The IGC's revised forecast for the 2023/24 global corn production reflects the dynamic nature of the grain markets on a global scale. The surge in production to a historic high of 1.234 billion metric tons is a testament to the resilience of the corn market. Further, the manufacturers can maintain a constant supply of inexpensive corn starch. Its ability to thicken, gel, bind, and stabilize gives it a wide range of applications in manufacturing such processed foods as sauces, gravies, baked goods, and snack foods. In addition, corn starch has various abilities that provides desirable texture and mouthfeel in a variety of applications, particularly sauces and desserts. As corn starch is considered as a natural ingredient, aligning with the clean label approach, the consumers preference towards adoption it is growing.

THE food and beverage SEGMENT IS PROJECTED TO BE THE dominant DURING THE FORECAST PERIOD IN BY end-user SEGMENT.

Food and beverage segment is considered the largest market share in the functional native starch market. This growth is attributed to the consumer demand for convenience foods and ready-to-eat has increased the need for effective thickening, binding, and stabilizing agents. Native starches have become a popular option owing to their functional properties. This trend for clean label products will pressure food manufacturers to create cleaner labels-natural ingredients and starches sourced natively-thus, aligning perfectly with the movement as being retrieved from sources that can be recognised, such as corn, potatoes, and tapioca. Native starches are also increasingly being used in gluten-free and organic products due to the health and wellness trend, thereby increasing their demand in the food and beverages sector.

Food technology innovation is another contributor as new and better starch formulations in the name of progress are being developed and continue to advance providing an improved texture and stability to food products. The food and beverage area utilizes the highest volume of functional native starches and is one of the main growth driving sectors-meaning one of the most targeted areas for the manufacturers who like to match the evolving preferences of consumers.

NORTH AMERICAN REGION IS EXPECTED TO DOMINATE FOR FUNCTIONAL NATIVE STARCH MARKET AMONG THE REGIONS.

North American is the largest market for functional native starch. The functional native starch market in North America is rapidly expanding. As the consumer preferences and awareness regarding the clean label and natural food product in North America. This trend develops the awareness for plant-based diets and gluten-free, this raises demand for native starches in meat alternatives, dairy substitutes, and gluten-free baked goods. Innovation and product development are also important, wherein companies need to invest in research to come up with new starch formulations that would enhance functionality, such as heat stability and texture. Growing health consciousness and wellness lead consumers to develop healthier choices in products. Native starches are seen as less detrimental to health than artificial additives. Increased demand for food for convenience, with increasingly busy lives, increases the functional native starches need to better enhance product texture and shelf-life.

Key Market Players

The key players in this market include Tate & Lyle (UK), Cargill, Incorporated (US), Ingredion (US), Roquette Frères (France), ADM (US), Avebe (Netherlands), KMC (Denmark), BASF (Germany), Tereos (France), Emsland-Stärke Gesellschaft Mit Beschränkter Haftung (Germany), Angel Starch (India), Agrana Beteiligungs-Ag, Sanstar Limited (Austria).

Recent Developments

- In August 2024, Ingredion Incorporated’s new NOVATION Indulge 2940 starch expands the company’s line of clean label texturizers. New NOVATION Indulge 2940 is the first non-GMO functional native corn starch that provides a unique texture for gelling and co-texturizing for popular dairy and alternative dairy products and desserts.

- In June 2024, Daymer Ingredients, entered into an agreement with AKV, a Danish potato ingredients producer, to sell its native and clean label, functional potato starches in the UK. The new partnership highlights Daymer’s focus on offering food manufacturers natural and sustainable ingredients, including fibres, starches, malt extracts, proteins, flours, and gums.

- In February 2024, Ingredion Incorporated one of the leading global provider of specialty ingredient solutions to the food and beverage manufacturing industry and pioneer of clean label ingredients, announced NOVATION Indulge 2940 starch, expanding their line of clean label texturizers with the first non-GMO functional native corn starch that provides a unique texture for gelling and co-texturizing for popular dairy and alternative dairy products and desserts.

Frequently Asked Questions (FAQ):

What is the current size of the functional native starch market?

The functional native starch market forecast is estimated at USD XX.X billion in 2024 and is projected to reach USD XX.X billion by 2029, at a CAGR of X.X% from 2024 to 2029.

Which are the key players in the market, and how intense is the competition?

Functional native starch market players include Tate & Lyle (UK), Cargill, Incorporated (US), Ingredion (US), Roquette Frères (France), ADM (US), Avebe (Netherlands), KMC (Denmark), BASF (Germany), Tereos (France), Emsland-Stärke Gesellschaft Mit Beschränkter Haftung (Germany), Angel Starch (India), Agrana Beteiligungs-Ag, Sanstar Limited (Austria). These companies boast reliable functional native starch facilities alongside robust distribution networks spanning crucial regions. They possess a well-established portfolio of esteemed services, commanding a sturdy market presence supported by sound business strategies. Additionally, they hold substantial market share, offer services with versatile applications, cater to a diverse geographical clientele, and maintain an extensive service range.

Which region is projected to account for the largest share of the functional native starch market?

The North America holds largest market share in functional native starch market. As the consumer preferences and awareness regarding the clean label and natural food product in North America. This trend develops the awareness for plant-based diets and gluten-free, this raises demand for native starches in meat alternatives, dairy substitutes, and gluten-free baked goods.

What kind of information is provided in the company profile section?

The company profiles mentioned above offer valuable information such as a comprehensive business overview, including details on the company's various business segments, financial performance, geographical reach, revenue composition, and the breakdown of their business revenue. Additionally, these profiles offer insights into the company's product offerings, significant milestones, and expert analyst perspectives to further explain the company's potential.

What are the growth prospects for the functional native starch market in the next five years?

Increasing demand for processed foods are anticipates favouring the market. Processed foods are a significant driver for the functional native starch market. Since many processed foods require ingredients that must provide specific functionalities, such as thickening, stabilizing, and gelling. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Growth opportunities and latent adjacency in Functional Native Starch Market