Functional Films Market by Type (Conductive Films, Optical Films, Protective Films, Barrier Films, Adhesive Films), Material (Polyethylene), End-Use (Packaging, Electronics, Automotive), Substrate (Glass, Plastic) and Region - Global Forecast to 2030

Updated on : November 25, 2024

Functional Films Market

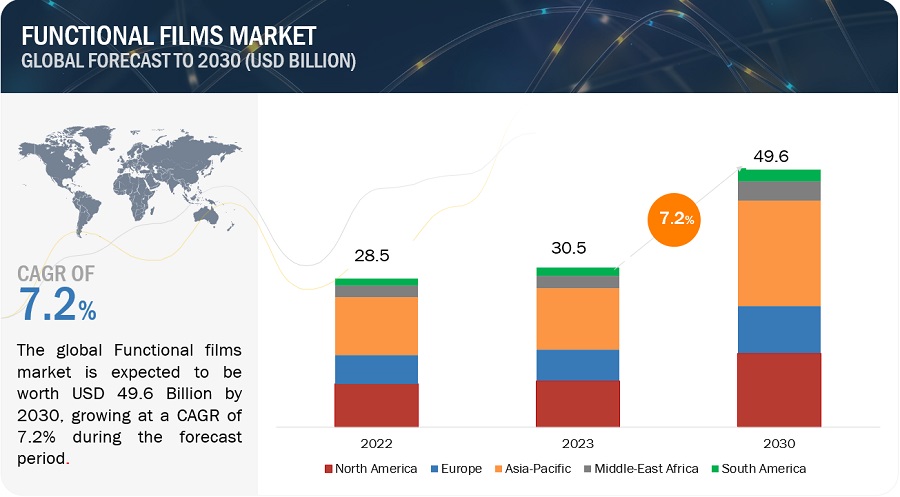

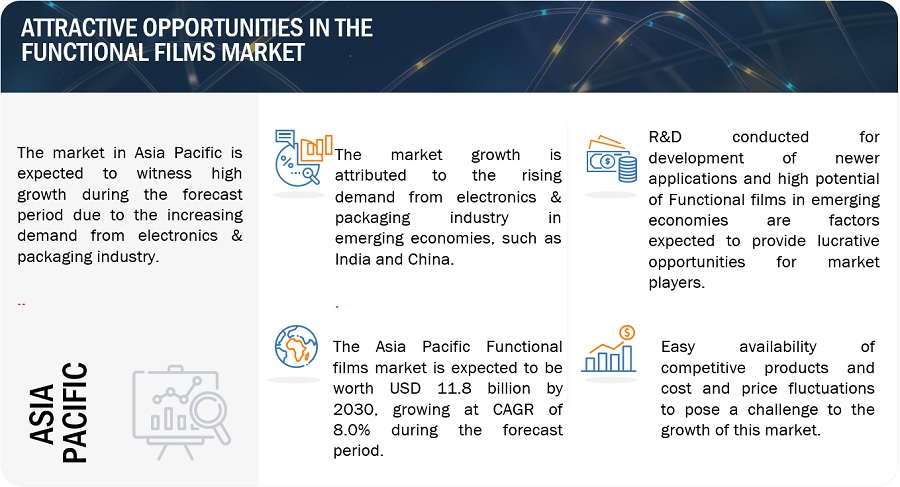

Functional Films Market was valued at USD 30.5 billion in 2023 and is projected to reach USD 49.6 billion by 2030, growing at 7.2% cagr from 2023 to 2030. The market experiences robust growth driven by a multitude of influential factors. These functional films, engineered materials with exceptional properties, find applications across a diverse range of high-tech industries.

Attractive Opportunities in the Functional Films Market

To know about the assumptions considered for the study, Request for Free Sample Report

Functional Films Market Dynamics

Driver: Growing demand for smart packaging solutions

Growing demand for smart packaging solutions might increase demand for functional films by up to 20% over the next five years. It is a prominent driver of the functional films market, notably in the food & beverage, pharmaceutical, and logistics industries. Functional films are increasingly being used to create smart packaging solutions that can effectively monitor and track the status of diverse products throughout transportation and storage. Because of their customized features, functional films play an important role in a wide range of smart packaging applications. These specialized materials are designed to have specific qualities such as barrier capabilities, conductivity, or antibacterial properties. Functional films play an important role in smart packaging applications such as time-temperature indicators (TTIs), radio-frequency identification (RFID) tags, and active packaging systems.

Restraint: Limited availability of high-purity raw materials

The growing demand for functional films in the automotive industry is being driven by the need for lightweight and durable materials for car bodies, interiors, and windows, as well as the growing trend towards autonomous and semi-autonomous vehicles, the increasing demand for safety features, and the growing awareness of environmental issues. Functional films are thin, flexible materials that can be created to have a range of features such as barrier capabilities, conductivity properties, and antibacterial qualities. This makes them suitable for a wide range of automotive applications. For example, by replacing traditional materials such as metal and plastic, functional films can be used to make lightweight and durable materials for automobile bodies. This can help to enhance vehicle fuel efficiency and reduce pollutants. Functional films can also be utilized to make interior components that are more durable and easier to clean. Furthermore, functional films can be utilized to make windows that are lighter, stronger, and less prone to scratching and breaking. The use of functional films in the automobile sector is predicted to increase by 15% over the next few years, as these materials have certain advantages over traditional materials. Functional films are lightweight and robust and can be created with a range of qualities to satisfy specific requirements.

Opportunities: Use of functional films in agriculture

The development of new functional films for emerging applications is an important opportunity element for the functional films market. This is primarily due to increased demand for creative solutions in a variety of industries, such as wearable electronics, smart packaging, and energy storage. Functional films are critical components in the production of flexible, lightweight, and durable electronic devices in the field of wearable electronics. As the need for wearable technology grows, functional films will play a critical role in addressing customer demands for pleasant and multifunctional gadgets. Smart packaging is another growing use where functional films might help. Sensors, RFID technology, and even antimicrobial qualities can be incorporated into these films to improve product protection, traceability, and ease. The market for functional films in smart packaging is predicted to grow significantly as the emphasis on sustainable packaging and customer involvement grows. Another possible application for functional films is energy storage.

Challenges: Competition from traditional packaging materials

Traditional packaging materials might present considerable obstacles to the functional film sector. For many years, traditional packaging materials such as glass, metal, and paper have been frequently employed for packing. When compared to some functional films, these materials are well-established, trusted, and frequently viewed as more ecologically benign solutions. One significant challenge arising from this competition is resistance to change. Many sectors and consumers have long-standing associations with traditional packaging materials, so the transition to functional films may be difficult. Furthermore, the impression of functional films as less eco-friendly due to their reliance on plastics can stymie their uptake, particularly in areas with severe environmental regulations or growing environmental consciousness. Cost can also be an important consideration. Functional films may necessitate investments in new production techniques or equipment, which may be more expensive at first than continuing to use standard materials. This cost barrier may dissuade businesses from switching to functional films, even if they offer improved performance or novel features.

Functional Films Market Ecosystem

Prominent companies in this market include well-established, financially stable manufacturers of wet room waterproofing solutions. These companies have been operating in the market for several years and possess a diversified product portfolio and strong global sales and marketing networks. Prominent companies in this market include Toray Industries Inc. (Japan), Eastman Chemical Company (US), Covestro AG (Germany), Honeywell International (US), 3M Company (US), Nitto Denko Corporation (Japan), Dupont Teijin Films US Limited (US), Mitsubishi Chemical Corporation (Japan), Toyobo Co., Ltd (Japan), Dai Nippon Printing Co., Ltd (Japan).

Based on material, Polyethylene Terephthalate is projected to account for the second largest share of the Functional films market.

PET (polyethylene terephthalate) is the fastest-growing material in the functional film market due to its favorable properties such as high strength, transparency, and recyclability. It is also lightweight and has good barrier properties, making it suitable for a variety of applications, including food packaging, flexible electronics, and medical devices.

Based on type, barrier film is projected to account for the second largest share of the Functional films market.

Due to their capacity to protect items against moisture, oxygen, and other dangerous elements, barrier films are the fastest-growing material in the functional film market. This is especially crucial for food and pharmaceutical products, which must be kept safe from rotting and contamination. Barrier films are also employed in a range of other applications, including flexible electronics, medical devices, and building materials. The growing popularity of flexible electronics is fuelling demand for barrier films. Flexible electronics are gadgets made of thin, flexible materials such as plastics and metals. Barrier films are used in flexible electronics to protect the devices from moisture, oxygen, and other dangerous substances.

Based on substrates, Glass is projected to account for the second largest share of the Functional films market.

Because of its unique qualities, such as high surface smoothness, chemical stability, and optical clarity, glass is the fastest-growing substrate in the functional film industry. The increasing demand for smartphones and other mobile devices, the expanding popularity of touch displays, and the increasing acceptance of solar energy are all driving the expansion of the glass substrate market. Smartphones and other mobile devices are the biggest users of glass substrates, and demand for these devices is likely to rise in the future years. Touch screens are another key application for glass substrates, and their demand is likely to rise as they become more widely used in a variety of applications such as car displays and industrial control systems.

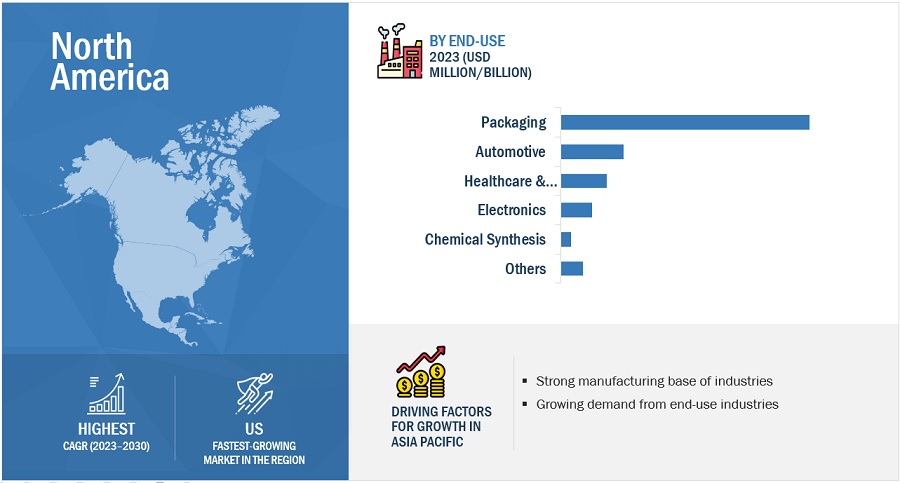

North America is expected to be the fastest growing market during the forecast period.

North America is the fastest-growing area in the functional films market due to numerous factors, including its strong economy, high disposable income, and advanced technical infrastructure. The region is home to a large number of renowned functional film manufacturers, including Dow Chemical Company, DuPont, and Eastman Chemical Company. These companies are heavily spending on research and development to generate new and innovative functional film products. The growing need for functional films in a variety of applications, such as packaging, electronics, and medical devices, is also driving the North American functional films market. The need for longer shelf life and greater protection for food goods is driving the demand for functional films in packaging.

To know about the assumptions considered for the study, download the pdf brochure

Functional Films Market Players

The Functional films market is dominated by a few major players that have a wide regional presence. The key players in the Functional films market are Toray Industries Inc. (Japan), Eastman Chemical Company (US), Covestro AG (Germany), Honeywell International (US), 3M Company (US), Nitto Denko Corporation (Japan), Dupont Teijin Films US Limited (US), Mitsubishi Chemical Corporation (Japan), Toyobo Co., Ltd (Japan), Dai Nippon Printing Co., Ltd (Japan). In the last few years, the companies have adopted growth strategies such as Product launches, Investments, Acquisitions, and expansions to capture a larger share of the Functional films market.

Functional Films Market Report Scope

|

Report Metric |

Details |

|

Years considered for the study |

2021-2028 |

|

Base Year |

2022 |

|

Forecast period |

2023–2028 |

|

Units considered |

Value (USD Million/Billion) |

|

Segments |

Material, Type, Substrates, end-use, and Region |

|

Regions |

Asia Pacific, North America, Europe, Middle East & Africa, and South America |

|

Companies |

Toray Industries Inc. (Japan), Eastman Chemical Company (US), Covestro AG (Germany), Honeywell International (US), 3M Company (US), Nitto Denko Corporation (Japan), Dupont Teijin Films US Limited (US), Mitsubishi Chemical Corporation (Japan), Toyobo Co., Ltd (Japan), Dai Nippon Printing Co., Ltd (Japan). |

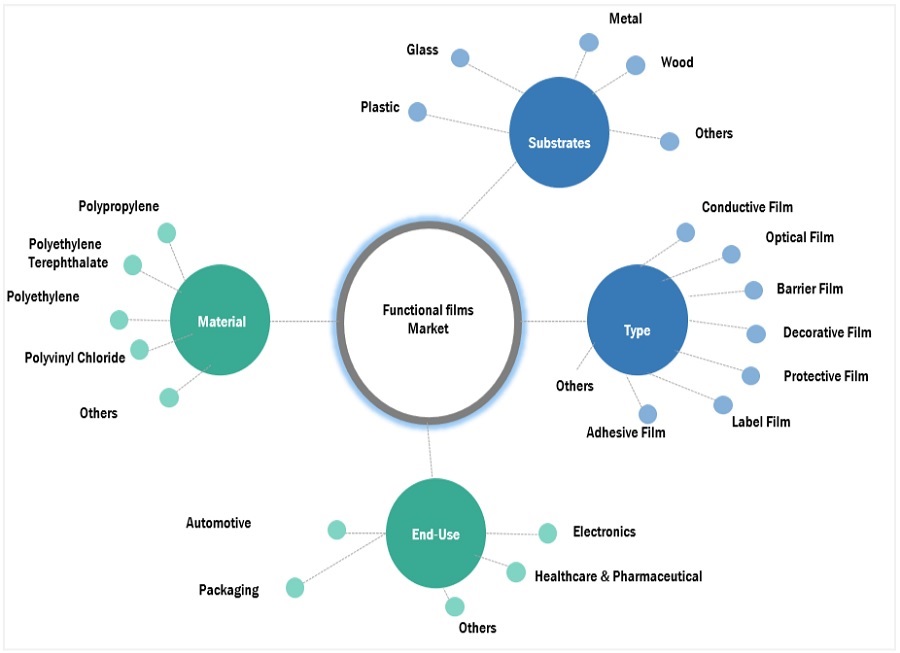

This report categorizes the global functional films market based on raw material, Type, uses, application, and region.

On the basis of type, the functional films market has been segmented as follows:

- Conductive Films

- Optical Films

- Protective Films

- Barrier Films

- Adhesive Films

- Decorative Films

- Label Films

- Others

On the basis of material, the functional films market has been segmented as follows

- Polypropylene

- Polyethylene Terephthalate

- Polyethylene

- Polyvinyl Chloride

- Others

On the basis of Substrates, the functional films market has been segmented as follows

- Glass

- Plastic

- Metal

- Wood

- Others

On the basis of end-use, the functional films market has been segmented as follows:

- Automotive

- Packaging

- Healthcare & Pharmaceutical

- Electronic

- Others

On the basis of region, the functional films market has been segmented as follows:

- Asia Pacific

- Europe

- North America

- Middle East & Africa

- South America

Recent Developments

- In August 2020, Dai Nippon Printing Co., LTD (Japan) acquired Toyo Seikan's (Japan), a leading manufacturer of functional films. This acquisition expanded DNP's functional film portfolio and strengthened its position in the market. DNP is now one of the leading providers of functional films in the world.

- In December 2020, Honeywell acquired Pluvitec, a leading provider of optical coatings and surface treatments for display and semiconductor applications. The acquisition expands Honeywell's portfolio of functional films and enhances its capabilities in the development and manufacturing of high-performance optical coatings.

- In March 2021, DNP partnered with Covestro AG to develop new functional films. This partnership combined DNP's expertise in materials science and printing with Covestro's expertise in polymer chemistry and materials development.

Frequently Asked Questions (FAQ):

What are the factors influencing the growth of the Functional films market?

The growth of this market can be attributed to the increasing demand from emerging industries and growing awareness of the benefits of functional films.

Which are the key applications driving the Functional films market?

The sectors driving the demand for functional films are the growing demand for smart packaging solutions and the rising demand for functional films in the automotive industry.

Who are the major manufacturers?

Major manufacturers include Toray Industries Inc. (Japan), Eastman Chemical Company (US), Covestro AG (Germany), Honeywell International (US), 3M Company (US), Nitto Denko Corporation (Japan), Dupont Teijin Films US Limited (US), Mitsubishi Chemical Corporation (Japan), Toyobo Co., Ltd (Japan), Dai Nippon Printing Co., Ltd (Japan) among others.

What will be the growth prospects of the Functional films market?

Rising demand from the packaging industry and growing demand from the automotive industry are some of the driving factors.

Which end-use segment has the largest market share in the specialty advanced ceramics market?

Electronics is the end-use segment that covers the largest market share in the market.

What innovations are shaping the European functional films sector?

The development of bio-based and advanced coating technologies is enhancing sustainability in functional films.

How does the demand for electric vehicles affect the functional films market in North America?

Increased electric vehicle production drives the need for lightweight functional films for battery insulation and displays.

How are European regulations impacting the functional films market?

European regulations like REACH are pushing manufacturers to innovate in compliance with stricter safety and environmental standards, promoting sustainable functional film solutions.

What are the key challenges faced by North American manufacturers in the functional films market?

North American manufacturers are navigating supply chain disruptions and rising raw material costs, while adapting to evolving sustainability requirements and technological innovations.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Growing demand for smart packaging solutions- Rising need for functional films in automotive industry- Miniaturization of electronic devicesRESTRAINTS- Increasing competition from emerging technologies- Limited understanding of functional films- Low availability of high-purity raw materialsOPPORTUNITIES- Development of new functional films for emerging applications- Use of functional films in modern agriculture- Development of new quantum computersCHALLENGES- Use of traditional packaging materials- Immature recycling infrastructure

- 6.1 INTRODUCTION

-

6.2 PORTER’S FIVE FORCES ANALYSISTHREAT FROM NEW ENTRANTSTHREATS OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

-

6.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER’S BUSINESS

-

6.4 PRICING ANALYSISAVERAGE SELLING PRICE TREND, BY REGIONAVERAGE SELLING PRICE, BY MATERIALAVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY TOP 3 MATERIALS

- 6.5 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY TOP 3 MATERIALS

-

6.6 VALUE CHAIN ANALYSISRAW MATERIAL SUPPLIERSMANUFACTURERSDISTRIBUTORSEND CONSUMERS

-

6.7 ECOSYSTEM/MARKET MAP

- 6.8 TECHNOLOGY ANALYSIS

-

6.9 PATENT ANALYSISMETHODOLOGYGRANTED PATENTS, 2012–2022PATENT PUBLICATION TRENDSINSIGHTSLEGAL STATUSJURISDICTION-WISE PATENT ANALYSISTOP APPLICANTSTOP 10 PATENT OWNERS IN LAST 10 YEARS

-

6.10 TRADE ANALYSISIMPORT-EXPORT SCENARIO OF FUNCTIONAL FILMS MARKET

- 6.11 KEY CONFERENCES & EVENTS IN 2023–2024

-

6.12 TARIFF AND REGULATORY LANDSCAPETARIFF AND REGULATIONS RELATED TO FUNCTIONAL FILMSREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONSNORTH AMERICAEUROPEASIA PACIFIC

-

6.13 KEY STAKEHOLDERS & BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

-

6.14 CASE STUDY ANALYSISHYDROGEL-BASED FUNCTIONAL FILMS TO PRODUCE 3D SCAFFOLDSFUNCTIONAL FILM HYDROGELS TO ACHIEVE SITE-SPECIFIC DRUG DELIVERY

-

6.15 MACROECONOMIC INDICATORSGLOBAL GDP TRENDS

- 7.1 INTRODUCTION

-

7.2 OPTICAL & CONDUCTIVE FILMSDEMAND IN ANTI-STATIC PACKAGING, FOOD PACKAGING, AND MEDICAL DEVICES TO DRIVE MARKET

-

7.3 PROTECTIVE & BARRIER FILMSAPPLICATIONS IN ELECTRONIC DEVICES AND ELECTRONIC PACKAGING TO FUEL DEMAND

-

7.4 ADHESIVE FILMSDEMAND IN PACKAGING APPLICATIONS TO SUPPORT MARKET GROWTH

-

7.5 DECORATIVE FILMSDECORATIVE FILMS WIDELY USED TO ENHANCE APPEARANCE OF VARIOUS CONSUMER GOODS

- 7.6 OTHERS

- 8.1 INTRODUCTION

-

8.2 GLASSOFFERS OPTICAL CLARITY, DURABILITY, AND RESISTANCE TO VARIOUS CHEMICALS

-

8.3 PLASTICMOST WIDELY USED FUNCTIONAL FILM SUBSTRATE

-

8.4 METALMETAL SUBSTRATES WIDELY USED IN ELECTRONIC COMPONENTS

-

8.5 WOODDEMAND FOR SUSTAINABLE MEDICAL PACKAGING SOLUTIONS TO DRIVE MARKET

- 8.6 OTHERS

- 9.1 INTRODUCTION

-

9.2 POLYPROPYLENE (PP)PP FILMS WIDELY USED IN VARIETY OF MEDICAL DEVICES

-

9.3 POLYETHYLENE TEREPHTHALATE (PET)VERSATILE AND COST-EFFECTIVE MATERIAL FOR FUNCTIONAL FILMS

-

9.4 POLYETHYLENE (PE)HIGH DEMAND IN FOOD PACKAGING TO FUEL MARKET GROWTH

-

9.5 POLYVINYL CHLORIDE (PVC)SIGNIFICANT APPLICATIONS IN MEDICAL SECTOR DUE ITS BIOCOMPATIBILITY AND RESISTANCE TO CHEMICALS

- 9.6 OTHERS

- 10.1 INTRODUCTION

- 10.2 AUTOMOTIVE

- 10.3 PACKAGING

- 10.4 HEALTHCARE

- 10.5 ELECTRONICS

- 10.6 OTHERS

- 11.1 INTRODUCTION

-

11.2 ASIA PACIFICRECESSION IMPACTCHINA- Rising disposable incomes of consumers to drive marketJAPAN- Increasing consumption in automotive sector to fuel demandINDIA- Increasing demand for packaging materials with advanced functionalities to drive marketSOUTH KOREA- Technological advancements and innovation in electronics and automotive sectors to support market growthASEAN- Rapid expansion of electronics sectors to drive demandREST OF ASIA PACIFIC

-

11.3 EUROPERECESSION IMPACTGERMANY- Rising demand from automotive industry to drive marketFRANCE- Increasing need for customized functional films to drive marketITALY- Technological innovation, robust research, and development to drive marketUK- Technological advancements in aerospace and pharmaceuticals sectors to support market growthSPAIN- Increasing focus on sustainable practices and environmental consciousness to drive demandREST OF EUROPE

-

11.4 NORTH AMERICARECESSION IMPACTUS- Stringent regulatory standards and strong emphasis on sustainability to fuel demandCANADA- Transition toward low-carbon economy to drive marketMEXICO- Favorable trade agreements to support market growth

-

11.5 SOUTH AMERICARECESSION IMPACTBRAZIL- Expanding construction sector to drive marketARGENTINA- Increasing demand for biodegradable and compostable films to drive marketREST OF SOUTH AMERICA

-

11.6 MIDDLE EAST & AFRICARECESSION IMPACTUAE- Increasing demand for conductive and anti-glare films to drive marketTURKEY- Expansion of textile and apparel industry to fuel demandSAUDI ARABIA- Robust expansion of automotive, construction, and packaging industries to drive marketSOUTH AFRICA- Construction industry to support growth of functional films marketREST OF GCCREST OF MIDDLE EAST & AFRICA

- 12.1 INTRODUCTION

- 12.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

-

12.3 MARKET SHARE ANALYSISRANKING OF KEY MARKET PLAYERSMARKET SHARE OF KEY PLAYERS

- 12.4 REVENUE ANALYSIS

-

12.5 COMPANY EVALUATION MATRIX, 2022STARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTSCOMPANY FOOTPRINT

-

12.6 STARTUP/SME EVALUATION MATRIX, 2022PROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKSCOMPETITIVE BENCHMARKINGFUNCTIONAL FILMS MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

-

12.7 COMPETITIVE SCENARIO AND TRENDSPRODUCT LAUNCHESDEALSOTHERS

-

13.1 KEY PLAYERSTORAY INDUSTRIES, INC.- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewEASTMAN CHEMICAL COMPANY- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewCOVESTRO AG- Business overview- Products/Services/Solutions offered- MnM viewDAI NIPPON PRINTING CO., LTD.- Business overview- Products/Services/Solutions offered- Recent developments- MnM view3M COMPANY- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewHONEYWELL INTERNATIONAL INC.- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewNITTO DENKO CORPORATION- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewDUPONT TEIJIN FILMS U.S. LIMITED PARTNERSHIP- Business overview- Products/Services/Solutions offeredMITSUBISHI CHEMICAL CORPORATION- Business overview- Products/Services/Solutions offeredTOYOBO CO., LTD.- Business overview- Products/Services/Solutions offered- Recent developments- MnM view

-

13.2 OTHER PLAYERSAVERY DENNISON CORPORATIONTATSUTA ELECTRIC WIRE AND CABLE CO., LTD.GUNZE LIMITEDSABICMONDIINNOVIA FILMSPOLIFILMCLARIANTINEOSAVIENT CORPORATIONLINTEC CORPORATIONNAGASE & CO., LTD.TOYOCHEM CO., LTD.COVERISTOPPAN INC.

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS

- TABLE 1 FUNCTIONAL FILMS MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 2 AVERAGE SELLING PRICE, BY REGION, 2020–2028 (USD/TON)

- TABLE 3 AVERAGE SELLING PRICE, BY MATERIAL, 2020–2028 (USD/TON)

- TABLE 4 AVERAGE SELLING PRICE OF KEY PLAYERS, BY MATERIAL, 2020–2028 (USD/TON)

- TABLE 5 FUNCTIONAL FILMS MARKET: ECOSYSTEM

- TABLE 6 TOTAL NUMBER OF PATENTS

- TABLE 7 TOP TEN PATENT OWNERS

- TABLE 8 FUNCTIONAL FILMS MARKET: KEY CONFERENCES & EVENTS, 2023–2024

- TABLE 9 TARIFF RELATED TO FUNCTIONAL FILMS MARKET

- TABLE 10 GLOBAL: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 INFLUENCE OF INSTITUTIONAL BUYERS ON BUYING PROCESS FOR TOP FOUR APPLICATIONS

- TABLE 15 KEY BUYING CRITERIA IN KEY END-USE INDUSTRIES

- TABLE 16 PROJECTED REAL GDP GROWTH (ANNUAL PERCENTAGE CHANGE) OF KEY COUNTRIES, 2018–2025

- TABLE 17 FUNCTIONAL FILMS MARKET SIZE, BY TYPE, 2020–2022 (USD MILLION)

- TABLE 18 FUNCTIONAL FILMS MARKET SIZE, BY TYPE, 2023–2030 (USD MILLION)

- TABLE 19 FUNCTIONAL FILMS MARKET SIZE, BY TYPE, 2020–2022 (KILOTON)

- TABLE 20 FUNCTIONAL FILMS MARKET SIZE, BY TYPE, 2023–2030 (KILOTON)

- TABLE 21 FUNCTIONAL FILMS MARKET SIZE, BY TYPE, AS PER REGION, 2020–2022 (USD MILLION)

- TABLE 22 FUNCTIONAL FILMS MARKET SIZE, BY TYPE, AS PER REGION, 2023–2030 (USD MILLION)

- TABLE 23 FUNCTIONAL FILMS MARKET SIZE, BY TYPE, AS PER REGION, 2020–2022 (KILOTON)

- TABLE 24 FUNCTIONAL FILMS MARKET SIZE, BY TYPE, AS PER REGION, 2023–2030 (KILOTON)

- TABLE 25 FUNCTIONAL FILMS MARKET SIZE, BY SUBSTRATE, 2020–2022 (USD MILLION)

- TABLE 26 FUNCTIONAL FILMS MARKET SIZE, BY SUBSTRATE, 2023–2030 (USD MILLION)

- TABLE 27 FUNCTIONAL FILMS MARKET SIZE, BY SUBSTRATE, 2020–2022 (KILOTON)

- TABLE 28 FUNCTIONAL FILMS MARKET SIZE, BY SUBSTRATE, 2023–2030 (KILOTON)

- TABLE 29 FUNCTIONAL FILMS MARKET SIZE, BY MATERIAL, 2020–2022 (USD MILLION)

- TABLE 30 FUNCTIONAL FILMS MARKET SIZE, BY MATERIAL, 2023–2030 (USD MILLION)

- TABLE 31 FUNCTIONAL FILMS MARKET SIZE, BY MATERIAL, 2020–2022 (KILOTON)

- TABLE 32 FUNCTIONAL FILMS MARKET SIZE, BY MATERIAL, 2023–2030 (KILOTON)

- TABLE 33 FUNCTIONAL FILMS MARKET SIZE, BY MATERIAL, AS PER REGION, 2020–2022 (USD MILLION)

- TABLE 34 FUNCTIONAL FILMS MARKET SIZE, BY MATERIAL, AS PER REGION, 2023–2030 (USD MILLION)

- TABLE 35 FUNCTIONAL FILMS MARKET SIZE, BY MATERIAL, AS PER REGION, 2020–2022 (KILOTON)

- TABLE 36 FUNCTIONAL FILMS MARKET SIZE, BY MATERIAL, AS PER REGION, 2023–2030 (KILOTON)

- TABLE 37 FUNCTIONAL FILMS MARKET SIZE, BY END-USE INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 38 FUNCTIONAL FILMS MARKET SIZE, BY END-USE INDUSTRY, 2023–2030 (USD MILLION)

- TABLE 39 FUNCTIONAL FILMS MARKET SIZE, BY END-USE INDUSTRY, 2020–2022 (KILOTON)

- TABLE 40 FUNCTIONAL FILMS MARKET SIZE, BY END-USE INDUSTRY, 2023–2030 (KILOTON)

- TABLE 41 FUNCTIONAL FILMS MARKET SIZE, BY END-USE INDUSTRY, AS PER REGION, 2020–2022 (USD MILLION)

- TABLE 42 FUNCTIONAL FILMS MARKET SIZE, BY END-USE INDUSTRY, AS PER REGION, 2023–2030 (USD MILLION)

- TABLE 43 FUNCTIONAL FILMS MARKET SIZE, BY END-USE INDUSTRY, AS PER REGION, 2020–2022 (KILOTON)

- TABLE 44 FUNCTIONAL FILMS MARKET SIZE, BY END-USE INDUSTRY, AS PER REGION, 2023–2030 (KILOTON)

- TABLE 45 FUNCTIONAL FILMS MARKET, BY REGION, 2020–2022 (USD MILLION)

- TABLE 46 FUNCTIONAL FILMS MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 47 FUNCTIONAL FILMS MARKET, BY REGION, 2020–2022 (KILOTON)

- TABLE 48 FUNCTIONAL FILMS MARKET, BY REGION, 2023–2030 (KILOTON)

- TABLE 49 FUNCTIONAL FILMS MARKET, BY MATERIAL, 2020–2022 (USD MILLION)

- TABLE 50 FUNCTIONAL FILMS MARKET, BY MATERIAL, 2023–2030 (USD MILLION)

- TABLE 51 FUNCTIONAL FILMS MARKET, BY MATERIAL, 2020–2022 (KILOTON)

- TABLE 52 FUNCTIONAL FILMS MARKET, BY MATERIAL, 2023–2030 (KILOTON)

- TABLE 53 FUNCTIONAL FILMS MARKET, BY TYPE, 2020–2022 (USD MILLION)

- TABLE 54 FUNCTIONAL FILMS MARKET, BY TYPE, 2023–2030 (USD MILLION)

- TABLE 55 FUNCTIONAL FILMS MARKET, BY TYPE, 2020–2022 (KILOTON)

- TABLE 56 FUNCTIONAL FILMS MARKET, BY TYPE, 2023–2030 (KILOTON)

- TABLE 57 FUNCTIONAL FILMS MARKET, BY SUBSTRATE, 2020–2022 (USD MILLION)

- TABLE 58 FUNCTIONAL FILMS MARKET, BY SUBSTRATE, 2023–2030 (USD MILLION)

- TABLE 59 FUNCTIONAL FILMS MARKET, BY SUBSTRATE, 2020–2022 (KILOTON)

- TABLE 60 FUNCTIONAL FILMS MARKET, BY SUBSTRATE, 2023–2030 (KILOTON)

- TABLE 61 FUNCTIONAL FILMS MARKET, BY END-USE INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 62 FUNCTIONAL FILMS MARKET, BY END-USE INDUSTRY, 2023–2030 (USD MILLION)

- TABLE 63 FUNCTIONAL FILMS MARKET, BY END-USE INDUSTRY, 2020–2022 (KILOTON)

- TABLE 64 FUNCTIONAL FILMS MARKET, BY END-USE INDUSTRY, 2023–2030 (KILOTON)

- TABLE 65 ASIA PACIFIC: FUNCTIONAL FILMS MARKET, BY COUNTRY, 2020–2022 (USD MILLION)

- TABLE 66 ASIA PACIFIC: FUNCTIONAL FILMS MARKET, BY COUNTRY, 2022–2030 (USD MILLION)

- TABLE 67 ASIA PACIFIC: FUNCTIONAL FILMS MARKET, BY COUNTRY, 2020–2022 (KILOTON)

- TABLE 68 ASIA PACIFIC: FUNCTIONAL FILMS MARKET, BY COUNTRY, 2022–2030 (KILOTON)

- TABLE 69 ASIA PACIFIC: FUNCTIONAL FILMS MARKET, BY MATERIAL, 2020–2022 (USD MILLION)

- TABLE 70 ASIA PACIFIC: FUNCTIONAL FILMS MARKET, BY MATERIAL, 2023–2030 (USD MILLION)

- TABLE 71 ASIA PACIFIC: FUNCTIONAL FILMS MARKET, BY MATERIAL, 2020–2022 (KILOTON)

- TABLE 72 ASIA PACIFIC: FUNCTIONAL FILMS MARKET, BY MATERIAL, 2023–2030 (KILOTON)

- TABLE 73 ASIA PACIFIC: FUNCTIONAL FILMS MARKET, BY TYPE, 2020–2022 (USD MILLION)

- TABLE 74 ASIA PACIFIC: FUNCTIONAL FILMS MARKET, BY TYPE, 2023–2030 (USD MILLION)

- TABLE 75 ASIA PACIFIC: FUNCTIONAL FILMS MARKET, BY TYPE, 2020–2022 (KILOTON)

- TABLE 76 ASIA PACIFIC: FUNCTIONAL FILMS MARKET, BY TYPE, 2023–2030 (KILOTON)

- TABLE 77 ASIA PACIFIC: FUNCTIONAL FILMS MARKET, BY END-USE INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 78 ASIA PACIFIC: FUNCTIONAL FILMS MARKET, BY END-USE INDUSTRY, 2023–2030 (USD MILLION)

- TABLE 79 ASIA PACIFIC: FUNCTIONAL FILMS MARKET, BY END-USE INDUSTRY, 2020–2022 (KILOTON)

- TABLE 80 ASIA PACIFIC: FUNCTIONAL FILMS MARKET, BY END-USE INDUSTRY, 2023–2030 (KILOTON)

- TABLE 81 CHINA: FUNCTIONAL FILMS MARKET, BY END-USE INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 82 CHINA: FUNCTIONAL FILMS MARKET, BY END-USE INDUSTRY, 2023–2030 (USD MILLION)

- TABLE 83 CHINA: FUNCTIONAL FILMS MARKET, BY END-USE INDUSTRY, 2020–2022 (KILOTON)

- TABLE 84 CHINA: FUNCTIONAL FILMS MARKET, BY END-USE INDUSTRY, 2023–2030 (KILOTON)

- TABLE 85 CHINA: FUNCTIONAL FILMS MARKET, BY TYPE, 2020–2022 (USD MILLION)

- TABLE 86 CHINA: FUNCTIONAL FILMS MARKET, BY TYPE, 2023–2030 (USD MILLION)

- TABLE 87 CHINA: FUNCTIONAL FILMS MARKET, BY TYPE, 2020–2022 (KILOTON)

- TABLE 88 CHINA: FUNCTIONAL FILMS MARKET, BY TYPE, 2023–2030 (KILOTON)

- TABLE 89 CHINA: FUNCTIONAL FILMS MARKET, BY MATERIAL, 2020–2022 (USD MILLION)

- TABLE 90 CHINA: FUNCTIONAL FILMS MARKET, BY MATERIAL, 2023–2030 (USD MILLION)

- TABLE 91 CHINA: FUNCTIONAL FILMS MARKET, BY MATERIAL, 2020–2022 (KILOTON)

- TABLE 92 CHINA: FUNCTIONAL FILMS MARKET, BY MATERIAL, 2023–2030 (KILOTON)

- TABLE 93 JAPAN: FUNCTIONAL FILMS MARKET, BY END-USE INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 94 JAPAN: FUNCTIONAL FILMS MARKET, BY END-USE INDUSTRY, 2023–2030 (USD MILLION)

- TABLE 95 JAPAN: FUNCTIONAL FILMS MARKET, BY END-USE INDUSTRY, 2020–2022 (KILOTON)

- TABLE 96 JAPAN: FUNCTIONAL FILMS MARKET, BY END-USE INDUSTRY, 2023–2030 (KILOTON)

- TABLE 97 INDIA: FUNCTIONAL FILMS MARKET, BY END-USE INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 98 INDIA: FUNCTIONAL FILMS MARKET, BY END-USE INDUSTRY, 2023–2030 (USD MILLION)

- TABLE 99 INDIA: FUNCTIONAL FILMS MARKET, BY END-USE INDUSTRY, 2020–2022 (KILOTON)

- TABLE 100 INDIA: FUNCTIONAL FILMS MARKET, BY END-USE INDUSTRY, 2023–2030 (KILOTON)

- TABLE 101 SOUTH KOREA: FUNCTIONAL FILMS MARKET, BY END-USE INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 102 SOUTH KOREA: FUNCTIONAL FILMS MARKET, BY END-USE INDUSTRY, 2023–2030 (USD MILLION)

- TABLE 103 SOUTH KOREA: FUNCTIONAL FILMS MARKET, BY END-USE INDUSTRY, 2020–2022 (KILOTON)

- TABLE 104 SOUTH KOREA: FUNCTIONAL FILMS MARKET, BY END-USE INDUSTRY, 2023–2030 (KILOTON)

- TABLE 105 ASEAN: FUNCTIONAL FILMS MARKET, BY END-USE INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 106 ASEAN: FUNCTIONAL FILMS MARKET, BY END-USE INDUSTRY, 2023–2030 (USD MILLION)

- TABLE 107 ASEAN: FUNCTIONAL FILMS MARKET, BY END-USE INDUSTRY, 2020–2022 (KILOTON)

- TABLE 108 ASEAN: FUNCTIONAL FILMS MARKET, BY END-USE INDUSTRY, 2023–2030 (KILOTON)

- TABLE 109 REST OF ASIA PACIFIC: FUNCTIONAL FILMS MARKET, BY END-USE INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 110 REST OF ASIA PACIFIC: FUNCTIONAL FILMS MARKET, BY END-USE INDUSTRY, 2023–2030 (USD MILLION)

- TABLE 111 REST OF ASIA PACIFIC: FUNCTIONAL FILMS MARKET, BY END-USE INDUSTRY, 2020–2022 (KILOTON)

- TABLE 112 REST OF ASIA PACIFIC: FUNCTIONAL FILMS MARKET, BY END-USE INDUSTRY, 2023–2030 (KILOTON)

- TABLE 113 EUROPE: FUNCTIONAL FILMS MARKET, BY COUNTRY, 2020–2022 (USD MILLION)

- TABLE 114 EUROPE: FUNCTIONAL FILMS MARKET, BY COUNTRY, 2022–2030 (USD MILLION)

- TABLE 115 EUROPE: FUNCTIONAL FILMS MARKET, BY COUNTRY, 2020–2022 (KILOTON)

- TABLE 116 EUROPE: FUNCTIONAL FILMS MARKET, BY COUNTRY, 2022–2030 (KILOTON)

- TABLE 117 EUROPE: FUNCTIONAL FILMS MARKET, BY MATERIAL, 2020–2022 (USD MILLION)

- TABLE 118 EUROPE: FUNCTIONAL FILMS MARKET, BY MATERIAL, 2023–2030 (USD MILLION)

- TABLE 119 EUROPE: FUNCTIONAL FILMS MARKET, BY MATERIAL, 2020–2022 (KILOTON)

- TABLE 120 EUROPE: FUNCTIONAL FILMS MARKET, BY MATERIAL, 2023–2030 (KILOTON)

- TABLE 121 EUROPE: FUNCTIONAL FILMS MARKET, BY TYPE, 2020–2022 (USD MILLION)

- TABLE 122 EUROPE: FUNCTIONAL FILMS MARKET, BY TYPE, 2023–2030 (USD MILLION)

- TABLE 123 EUROPE: FUNCTIONAL FILMS MARKET, BY TYPE, 2020–2022 (KILOTON)

- TABLE 124 EUROPE: FUNCTIONAL FILMS MARKET, BY TYPE, 2023–2030 (KILOTON)

- TABLE 125 EUROPE: FUNCTIONAL FILMS MARKET, BY END-USE INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 126 EUROPE: FUNCTIONAL FILMS MARKET, BY END-USE INDUSTRY, 2023–2030 (USD MILLION)

- TABLE 127 EUROPE: FUNCTIONAL FILMS MARKET, BY END-USE INDUSTRY, 2020–2022 (KILOTON)

- TABLE 128 EUROPE: FUNCTIONAL FILMS MARKET, BY END-USE INDUSTRY, 2023–2030 (KILOTON)

- TABLE 129 GERMANY: FUNCTIONAL FILMS MARKET, BY END-USE INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 130 GERMANY: FUNCTIONAL FILMS MARKET, BY END-USE INDUSTRY, 2023–2030 (USD MILLION)

- TABLE 131 GERMANY: FUNCTIONAL FILMS MARKET, BY END-USE INDUSTRY, 2020–2022 (KILOTON)

- TABLE 132 GERMANY: FUNCTIONAL FILMS MARKET, BY END-USE INDUSTRY, 2023–2030 (KILOTON)

- TABLE 133 FRANCE: FUNCTIONAL FILMS MARKET, BY END-USE INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 134 FRANCE: FUNCTIONAL FILMS MARKET, BY END-USE INDUSTRY, 2023–2030 (USD MILLION)

- TABLE 135 FRANCE: FUNCTIONAL FILMS MARKET, BY END-USE INDUSTRY, 2020–2022 (KILOTON)

- TABLE 136 FRANCE: FUNCTIONAL FILMS MARKET, BY END-USE INDUSTRY, 2023–2030 (KILOTON)

- TABLE 137 ITALY: FUNCTIONAL FILMS MARKET, BY END-USE INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 138 ITALY: FUNCTIONAL FILMS MARKET, BY END-USE INDUSTRY, 2023–2030 (USD MILLION)

- TABLE 139 ITALY: FUNCTIONAL FILMS MARKET, BY END-USE INDUSTRY, 2020–2022 (KILOTON)

- TABLE 140 ITALY: FUNCTIONAL FILMS MARKET, BY END-USE INDUSTRY, 2023–2030 (KILOTON)

- TABLE 141 UK: FUNCTIONAL FILMS MARKET, BY END-USE INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 142 UK: FUNCTIONAL FILMS MARKET, BY END-USE INDUSTRY, 2023–2030 (USD MILLION)

- TABLE 143 UK: FUNCTIONAL FILMS MARKET, BY END-USE INDUSTRY, 2020–2022 (KILOTON)

- TABLE 144 UK: FUNCTIONAL FILMS MARKET, BY END-USE INDUSTRY, 2023–2030 (KILOTON)

- TABLE 145 SPAIN: FUNCTIONAL FILMS MARKET, BY END-USE INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 146 SPAIN: FUNCTIONAL FILMS MARKET, BY END-USE INDUSTRY, 2023–2030 (USD MILLION)

- TABLE 147 SPAIN: FUNCTIONAL FILMS MARKET, BY END-USE INDUSTRY, 2020–2022 (KILOTON)

- TABLE 148 SPAIN: FUNCTIONAL FILMS MARKET, BY END-USE INDUSTRY, 2023–2030 (KILOTON)

- TABLE 149 REST OF EUROPE: FUNCTIONAL FILMS MARKET, BY END-USE INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 150 REST OF EUROPE: FUNCTIONAL FILMS MARKET, BY END-USE INDUSTRY, 2023–2030 (USD MILLION)

- TABLE 151 REST OF EUROPE: FUNCTIONAL FILMS MARKET, BY END-USE INDUSTRY, 2020–2022 (KILOTON)

- TABLE 152 REST OF EUROPE: FUNCTIONAL FILMS MARKET, BY END-USE INDUSTRY, 2023–2030 (KILOTON)

- TABLE 153 NORTH AMERICA: FUNCTIONAL FILMS MARKET, BY COUNTRY, 2020–2022 (USD MILLION)

- TABLE 154 NORTH AMERICA: FUNCTIONAL FILMS MARKET, BY COUNTRY, 2022–2030 (USD MILLION)

- TABLE 155 NORTH AMERICA: FUNCTIONAL FILMS MARKET, BY COUNTRY, 2020–2022 (KILOTON)

- TABLE 156 NORTH AMERICA: FUNCTIONAL FILMS MARKET, BY COUNTRY, 2022–2030 (KILOTON)

- TABLE 157 NORTH AMERICA: FUNCTIONAL FILMS MARKET, BY MATERIAL, 2020–2022 (USD MILLION)

- TABLE 158 NORTH AMERICA: FUNCTIONAL FILMS MARKET, BY MATERIAL, 2023–2030 (USD MILLION)

- TABLE 159 NORTH AMERICA: FUNCTIONAL FILMS MARKET, BY MATERIAL, 2020–2022 (KILOTON)

- TABLE 160 NORTH AMERICA: FUNCTIONAL FILMS MARKET, BY MATERIAL, 2023–2030 (KILOTON)

- TABLE 161 NORTH AMERICA: FUNCTIONAL FILMS MARKET, BY TYPE, 2020–2022 (USD MILLION)

- TABLE 162 NORTH AMERICA: FUNCTIONAL FILMS MARKET, BY TYPE, 2023–2030 (USD MILLION)

- TABLE 163 NORTH AMERICA: FUNCTIONAL FILMS MARKET, BY TYPE, 2020–2022 (KILOTON)

- TABLE 164 NORTH AMERICA: FUNCTIONAL FILMS MARKET, BY TYPE, 2023–2030 (KILOTON)

- TABLE 165 NORTH AMERICA: FUNCTIONAL FILMS MARKET, BY END-USE INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 166 NORTH AMERICA: FUNCTIONAL FILMS MARKET, BY END-USE INDUSTRY, 2023–2030 (USD MILLION)

- TABLE 167 NORTH AMERICA: FUNCTIONAL FILMS MARKET, BY END-USE INDUSTRY, 2020–2022 (KILOTON)

- TABLE 168 NORTH AMERICA: FUNCTIONAL FILMS MARKET, BY END-USE INDUSTRY, 2023–2030 (KILOTON)

- TABLE 169 US: FUNCTIONAL FILMS MARKET, BY END-USE INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 170 US: FUNCTIONAL FILMS MARKET, BY END-USE INDUSTRY, 2023–2030 (USD MILLION)

- TABLE 171 US: FUNCTIONAL FILMS MARKET, BY END-USE INDUSTRY, 2020–2022 (KILOTON)

- TABLE 172 US: FUNCTIONAL FILMS MARKET, BY END-USE INDUSTRY, 2023–2030 (KILOTON)

- TABLE 173 CANADA: FUNCTIONAL FILMS MARKET, BY END-USE INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 174 CANADA: FUNCTIONAL FILMS MARKET, BY END-USE INDUSTRY, 2023–2030 (USD MILLION)

- TABLE 175 CANADA: FUNCTIONAL FILMS MARKET, BY END-USE INDUSTRY, 2020–2022 (KILOTON)

- TABLE 176 CANADA: FUNCTIONAL FILMS MARKET, BY END-USE INDUSTRY, 2023–2030 (KILOTON)

- TABLE 177 MEXICO: FUNCTIONAL FILMS MARKET, BY END-USE INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 178 MEXICO: FUNCTIONAL FILMS MARKET, BY END-USE INDUSTRY, 2023–2030 (USD MILLION)

- TABLE 179 MEXICO: FUNCTIONAL FILMS MARKET, BY END-USE INDUSTRY, 2020–2022 (KILOTON)

- TABLE 180 MEXICO: FUNCTIONAL FILMS MARKET, BY END-USE INDUSTRY, 2023–2030 (KILOTON)

- TABLE 181 SOUTH AMERICA: FUNCTIONAL FILMS MARKET, BY COUNTRY, 2020–2022 (USD MILLION)

- TABLE 182 SOUTH AMERICA: FUNCTIONAL FILMS MARKET, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 183 SOUTH AMERICA: FUNCTIONAL FILMS MARKET, BY COUNTRY, 2020–2022 (KILOTON)

- TABLE 184 SOUTH AMERICA: FUNCTIONAL FILMS MARKET, BY COUNTRY, 2023–2030 (KILOTON)

- TABLE 185 SOUTH AMERICA: FUNCTIONAL FILMS MARKET, BY MATERIAL, 2020–2022 (USD MILLION)

- TABLE 186 SOUTH AMERICA: FUNCTIONAL FILMS MARKET, BY MATERIAL, 2023–2030 (USD MILLION)

- TABLE 187 SOUTH AMERICA: FUNCTIONAL FILMS MARKET, BY MATERIAL, 2020–2022 (KILOTON)

- TABLE 188 SOUTH AMERICA: FUNCTIONAL FILMS MARKET, BY MATERIAL, 2023–2030 (KILOTON)

- TABLE 189 SOUTH AMERICA: FUNCTIONAL FILMS MARKET, BY TYPE, 2020–2022 (USD MILLION)

- TABLE 190 SOUTH AMERICA: FUNCTIONAL FILMS MARKET, BY TYPE, 2023–2030 (USD MILLION)

- TABLE 191 SOUTH AMERICA: FUNCTIONAL FILMS MARKET, BY TYPE, 2020–2022 (KILOTON)

- TABLE 192 SOUTH AMERICA: FUNCTIONAL FILMS MARKET, BY TYPE, 2023–2030 (KILOTON)

- TABLE 193 SOUTH AMERICA: FUNCTIONAL FILMS MARKET, BY END-USE INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 194 SOUTH AMERICA: FUNCTIONAL FILMS MARKET, BY END-USE INDUSTRY, 2023–2030 (USD MILLION)

- TABLE 195 SOUTH AMERICA: FUNCTIONAL FILMS MARKET, BY END-USE INDUSTRY, 2020–2022 (KILOTON)

- TABLE 196 SOUTH AMERICA: FUNCTIONAL FILMS MARKET, BY END-USE INDUSTRY, 2023–2030 (KILOTON)

- TABLE 197 BRAZIL: FUNCTIONAL FILMS MARKET, BY END-USE INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 198 BRAZIL: FUNCTIONAL FILMS MARKET, BY END-USE INDUSTRY, 2023–2030 (USD MILLION)

- TABLE 199 BRAZIL: FUNCTIONAL FILMS MARKET, BY END-USE INDUSTRY, 2020–2022 (KILOTON)

- TABLE 200 BRAZIL: FUNCTIONAL FILMS MARKET, BY END-USE INDUSTRY, 2023–2030 (KILOTON)

- TABLE 201 ARGENTINA: FUNCTIONAL FILMS MARKET, BY END-USE INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 202 ARGENTINA: FUNCTIONAL FILMS MARKET, BY END-USE INDUSTRY, 2023–2030 (USD MILLION)

- TABLE 203 ARGENTINA: FUNCTIONAL FILMS MARKET, BY END-USE INDUSTRY, 2020–2022 (KILOTON)

- TABLE 204 ARGENTINA: FUNCTIONAL FILMS MARKET, BY END-USE INDUSTRY, 2023–2030 (KILOTON)

- TABLE 205 REST OF SOUTH AMERICA: FUNCTIONAL FILMS MARKET, BY END-USE INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 206 REST OF SOUTH AMERICA: FUNCTIONAL FILMS MARKET, BY END-USE INDUSTRY, 2023–2030 (USD MILLION)

- TABLE 207 REST OF SOUTH AMERICA: FUNCTIONAL FILMS MARKET, BY END-USE INDUSTRY, 2020–2022 (KILOTON)

- TABLE 208 REST OF SOUTH AMERICA: FUNCTIONAL FILMS MARKET, BY END-USE INDUSTRY, 2023–2030 (KILOTON)

- TABLE 209 MIDDLE EAST & AFRICA: FUNCTIONAL FILMS MARKET, BY COUNTRY, 2020–2022 (USD MILLION)

- TABLE 210 MIDDLE EAST & AFRICA: FUNCTIONAL FILMS MARKET, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 211 MIDDLE EAST & AFRICA: FUNCTIONAL FILMS MARKET, BY COUNTRY, 2020–2022 (KILOTON)

- TABLE 212 MIDDLE EAST & AFRICA: FUNCTIONAL FILMS MARKET, BY COUNTRY, 2023–2030 (KILOTON)

- TABLE 213 MIDDLE EAST & AFRICA: FUNCTIONAL FILMS MARKET, BY MATERIAL, 2020–2022 (USD MILLION)

- TABLE 214 MIDDLE EAST & AFRICA: FUNCTIONAL FILMS MARKET, BY MATERIAL, 2023–2030 (USD MILLION)

- TABLE 215 MIDDLE EAST & AFRICA: FUNCTIONAL FILMS MARKET, BY MATERIAL, 2020–2022 (KILOTON)

- TABLE 216 MIDDLE EAST & AFRICA: FUNCTIONAL FILMS MARKET, BY MATERIAL, 2023–2030 (KILOTON)

- TABLE 217 MIDDLE EAST & AFRICA: FUNCTIONAL FILMS MARKET, BY TYPE, 2020–2022 (USD MILLION)

- TABLE 218 MIDDLE EAST & AFRICA: FUNCTIONAL FILMS MARKET, BY TYPE, 2023–2030 (USD MILLION)

- TABLE 219 MIDDLE EAST & AFRICA: FUNCTIONAL FILMS MARKET, BY TYPE, 2020–2022 (KILOTON)

- TABLE 220 MIDDLE EAST & AFRICA: FUNCTIONAL FILMS MARKET, BY TYPE, 2023–2030 (KILOTON)

- TABLE 221 MIDDLE EAST & AFRICA: FUNCTIONAL FILMS MARKET, BY END-USE INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 222 MIDDLE EAST & AFRICA: FUNCTIONAL FILMS MARKET, BY END-USE INDUSTRY, 2023–2030 (USD MILLION)

- TABLE 223 MIDDLE EAST & AFRICA: FUNCTIONAL FILMS MARKET, BY END-USE INDUSTRY, 2020–2022 (KILOTON)

- TABLE 224 MIDDLE EAST & AFRICA: FUNCTIONAL FILMS MARKET, BY END-USE INDUSTRY, 2023–2030 (KILOTON)

- TABLE 225 UAE: FUNCTIONAL FILMS MARKET, BY END-USE INDUSTRY, 2020–2022 (MILLION)

- TABLE 226 UAE: FUNCTIONAL FILMS MARKET, BY END-USE INDUSTRY, 2023–2030 (USD MILLION)

- TABLE 227 UAE: FUNCTIONAL FILMS MARKET, BY END-USE INDUSTRY, 2020–2022 (KILOTON)

- TABLE 228 UAE: FUNCTIONAL FILMS MARKET, BY END-USE INDUSTRY, 2023–2030 (KILOTON)

- TABLE 229 TURKEY: FUNCTIONAL FILMS MARKET, BY END-USE INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 230 TURKEY: FUNCTIONAL FILMS MARKET, BY END-USE INDUSTRY, 2023–2030 (USD MILLION)

- TABLE 231 TURKEY: FUNCTIONAL FILMS MARKET, BY END-USE INDUSTRY, 2020–2022 (KILOTON)

- TABLE 232 TURKEY: FUNCTIONAL FILMS MARKET, BY END-USE INDUSTRY, 2023–2030 (KILOTON)

- TABLE 233 SAUDI ARABIA: FUNCTIONAL FILMS MARKET, BY END-USE INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 234 SAUDI ARABIA: FUNCTIONAL FILMS MARKET, BY END-USE INDUSTRY, 2023–2030 (USD MILLION)

- TABLE 235 SAUDI ARABIA: FUNCTIONAL FILMS MARKET, BY END-USE INDUSTRY, 2020–2022 (KILOTON)

- TABLE 236 SAUDI ARABIA: FUNCTIONAL FILMS MARKET, BY END-USE INDUSTRY, 2023–2030 (KILOTON)

- TABLE 237 SOUTH AFRICA: FUNCTIONAL FILMS MARKET, BY END-USE INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 238 SOUTH AFRICA: FUNCTIONAL FILMS MARKET, BY END-USE INDUSTRY, 2023–2030 (USD MILLION)

- TABLE 239 SOUTH AFRICA: FUNCTIONAL FILMS MARKET, BY END-USE INDUSTRY, 2020–2022 (KILOTON)

- TABLE 240 SOUTH AFRICA: FUNCTIONAL FILMS MARKET, BY END-USE INDUSTRY, 2023–2030 (KILOTON)

- TABLE 241 REST OF GCC: FUNCTIONAL FILMS MARKET, BY END-USE INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 242 REST OF GCC: FUNCTIONAL FILMS MARKET, BY END-USE INDUSTRY, 2023–2030 (USD MILLION)

- TABLE 243 REST OF GCC: FUNCTIONAL FILMS MARKET, BY END-USE INDUSTRY, 2020–2022 (KILOTON)

- TABLE 244 REST OF GCC: FUNCTIONAL FILMS MARKET, BY END-USE INDUSTRY, 2023–2030 (KILOTON)

- TABLE 245 REST OF MIDDLE EAST & AFRICA: FUNCTIONAL FILMS MARKET, BY END-USE INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 246 REST OF MIDDLE EAST & AFRICA: FUNCTIONAL FILMS MARKET, BY END-USE INDUSTRY, 2023–2030 (USD MILLION)

- TABLE 247 REST OF MIDDLE EAST & AFRICA: FUNCTIONAL FILMS MARKET, BY END-USE INDUSTRY, 2020–2022 (KILOTON)

- TABLE 248 REST OF MIDDLE EAST & AFRICA: FUNCTIONAL FILMS MARKET, BY END-USE INDUSTRY, 2023–2030 (KILOTON)

- TABLE 249 OVERVIEW OF STRATEGIES ADOPTED BY KEY FUNCTIONAL FILM MANUFACTURERS

- TABLE 250 FUNCTIONAL FILMS MARKET: DEGREE OF COMPETITION

- TABLE 251 COMPANY TYPE FOOTPRINT

- TABLE 252 COMPANY SUBSTRATE FOOTPRINT

- TABLE 253 COMPANY MATERIAL FOOTPRINT

- TABLE 254 COMPANY END-USE INDUSTRY FOOTPRINT

- TABLE 255 COMPANY REGION FOOTPRINT

- TABLE 256 FUNCTIONAL FILMS MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 257 TYPE FOOTPRINT OF STARTUPS/SMES

- TABLE 258 SUBSTRATE FOOTPRINT OF STARTUPS/SMES

- TABLE 259 MATERIAL FOOTPRINT OF STARTUPS/SMES

- TABLE 260 END-USE INDUSTRY FOOTPRINT OF STARTUPS/SMES

- TABLE 261 REGION FOOTPRINT OF STARTUPS/SMES

- TABLE 262 FUNCTIONAL FILMS MARKET: PRODUCT LAUNCHES (2020–2023)

- TABLE 263 FUNCTIONAL FILMS MARKET: DEALS (2020–2023)

- TABLE 264 FUNCTIONAL FILMS MARKET: OTHER DEVELOPMENTS (2020–2023)

- TABLE 265 TORAY INDUSTRIES, INC.: COMPANY OVERVIEW

- TABLE 266 TORAY INDUSTRIES, INC.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 267 TORAY INDUSTRIES, INC.: OTHER DEVELOPMENTS

- TABLE 268 EASTMAN CHEMICAL COMPANY: COMPANY OVERVIEW

- TABLE 269 EASTMAN CHEMICAL COMPANY: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 270 EASTMAN CHEMICAL COMPANY: DEALS

- TABLE 271 COVESTRO AG: COMPANY OVERVIEW

- TABLE 272 COVESTRO AG: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 273 DAI NIPPON PRINTING CO., LTD.: COMPANY OVERVIEW

- TABLE 274 DAI NIPPON PRINTING CO., LTD.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 275 DAI NIPPON PRINTING CO., LTD.: DEALS

- TABLE 276 3M COMPANY: COMPANY OVERVIEW

- TABLE 277 3M COMPANY: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 278 3M COMPANY: PRODUCT LAUNCHES

- TABLE 279 HONEYWELL INTERNATIONAL INC.: COMPANY OVERVIEW

- TABLE 280 HONEYWELL INTERNATIONAL INC: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 281 HONEYWELL INTERNATIONAL INC.: DEALS

- TABLE 282 NITTO DENKO CORPORATION: COMPANY OVERVIEW

- TABLE 283 NITTO DENKO CORPORATION: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 284 NITTO DENKO CORPORATION: PRODUCT LAUNCHES

- TABLE 285 DUPONT TEIJIN FILMS U.S. LIMITED PARTNERSHIP: COMPANY OVERVIEW

- TABLE 286 DUPONT TEIJIN FILMS U.S. LIMITED PARTNERSHIP: PRODUCTS/SERVICES/ SOLUTIONS OFFERED

- TABLE 287 MITSUBISHI CHEMICAL CORPORATION: COMPANY OVERVIEW

- TABLE 288 MITSUBISHI CHEMICAL CORPORATION: PRODUCTS/SERVICES/ SOLUTIONS OFFERED

- TABLE 289 TOYOBO CO., LTD.: COMPANY OVERVIEW

- TABLE 290 TOYOBO CO., LTD.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 291 TOYOBO CO., LTD.: PRODUCT LAUNCHES

- TABLE 292 AVERY DENNISON CORPORATION: COMPANY OVERVIEW

- TABLE 293 TATSUTA ELECTRIC WIRE AND CABLE CO., LTD.: COMPANY OVERVIEW

- TABLE 294 GUNZE LIMITED: COMPANY OVERVIEW

- TABLE 295 SABIC: COMPANY OVERVIEW

- TABLE 296 MONDI: COMPANY OVERVIEW

- TABLE 297 INNOVIA FILMS: COMPANY OVERVIEW

- TABLE 298 POLIFILM: COMPANY OVERVIEW

- TABLE 299 CLARIANT: COMPANY OVERVIEW

- TABLE 300 INEOS: COMPANY OVERVIEW

- TABLE 301 AVIENT CORPORATION: COMPANY OVERVIEW

- TABLE 302 LINTEC CORPORATION: COMPANY OVERVIEW

- TABLE 303 NAGASE & CO., LTD.: COMPANY OVERVIEW

- TABLE 304 TOYOCHEM CO., LTD.: COMPANY OVERVIEW

- TABLE 305 COVERIS: COMPANY OVERVIEW

- TABLE 306 TOPPAN INC.: COMPANY OVERVIEW

- FIGURE 1 FUNCTIONAL FILMS MARKET SEGMENTATION

- FIGURE 2 FUNCTIONAL FILMS MARKET: RESEARCH DESIGN

- FIGURE 3 FUNCTIONAL FILMS MARKET: DATA TRIANGULATION

- FIGURE 4 PROTECTIVE & BARRIER FILM TO LEAD FUNCTIONAL FILMS MARKET DURING FORECAST PERIOD

- FIGURE 5 PE SEGMENT TO LEAD FUNCTIONAL FILMS MARKET DURING FORECAST PERIOD

- FIGURE 6 PACKAGING SEGMENT TO LEAD FUNCTIONAL FILMS MARKET DURING FORECAST PERIOD

- FIGURE 7 PLASTIC TO LEAD FUNCTIONAL FILMS MARKET DURING FORECAST PERIOD

- FIGURE 8 ASIA PACIFIC DOMINATED FUNCTIONAL FILMS MARKET IN 2023

- FIGURE 9 EXPANSION OF PACKAGING, PHARMACEUTICAL, AND HEALTHCARE SECTORS TO DRIVE MARKET

- FIGURE 10 OPTICAL & CONDUCTIVE FILMS TO BE FASTEST-GROWING SEGMENT DURING FORECAST PERIOD

- FIGURE 11 ASIA PACIFIC TO BE FASTEST-GROWING MARKET FOR FUNCTIONAL FILMS DURING FORECAST PERIOD

- FIGURE 12 PACKAGING TO BE FASTEST-GROWING SEGMENT DURING FORECAST PERIOD

- FIGURE 13 PET TO BE FASTEST-GROWING SEGMENT DURING FORECAST PERIOD

- FIGURE 14 PLASTIC TO BE FASTEST-GROWING SEGMENT DURING FORECAST PERIOD

- FIGURE 15 FUNCTIONAL FILMS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 16 PORTER’S FIVE FORCES ANALYSIS: FUNCTIONAL FILMS MARKET

- FIGURE 17 REVENUE SHIFT AND NEW REVENUE POCKETS IN FUNCTIONAL FILMS MARKET

- FIGURE 18 AVERAGE SELLING PRICE, BY REGION, 2020–2028 (USD/TON)

- FIGURE 19 OVERVIEW OF FUNCTIONAL FILMS MARKET VALUE CHAIN

- FIGURE 20 FUNCTIONAL FILMS MARKET: ECOSYSTEM/MARKET MAP

- FIGURE 21 NUMBER OF PATENTS PUBLISHED IN LAST 10 YEARS

- FIGURE 22 LEGAL STATUS OF PATENTS

- FIGURE 23 TOP JURISDICTIONS FOR FUNCTIONAL FILM PATENTS

- FIGURE 24 TOP 10 COMPANIES/APPLICANTS WITH HIGHEST NUMBER OF PATENTS

- FIGURE 25 IMPORT TRADE DATA FOR FUNCTIONAL FILMS

- FIGURE 26 EXPORT TRADE DATA FOR FUNCTIONAL FILMS

- FIGURE 27 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS IN TOP END-USE INDUSTRIES

- FIGURE 28 KEY BUYING CRITERIA IN KEY END-USE INDUSTRIES

- FIGURE 29 PROTECTIVE & BARRIER FILMS TO LEAD OVERALL FUNCTIONAL FILMS MARKET DURING FORECAST PERIOD

- FIGURE 30 FUNCTIONAL FILMS MARKET, BY SUBSTRATE

- FIGURE 31 FUNCTIONAL FILMS MARKET, BY MATERIAL

- FIGURE 32 PACKAGING TO DOMINATE OVERALL FUNCTIONAL FILMS MARKET

- FIGURE 33 ASIA PACIFIC TO BE FASTEST-GROWING MARKET DURING FORECAST PERIOD

- FIGURE 34 ASIA PACIFIC: FUNCTIONAL FILMS MARKET SNAPSHOT

- FIGURE 35 EUROPE: FUNCTIONAL FILMS MARKET SNAPSHOT

- FIGURE 36 NORTH AMERICA: FUNCTIONAL FILMS MARKET SNAPSHOT

- FIGURE 37 RANKING OF TOP FIVE PLAYERS IN FUNCTIONAL FILMS MARKET, 2022

- FIGURE 38 FUNCTIONAL FILMS MARKET: SHARE OF KEY PLAYERS

- FIGURE 39 REVENUE OF KEY PLAYERS, 2020–2024

- FIGURE 40 FUNCTIONAL FILMS MARKET: COMPANY EVALUATION MATRIX, 2022

- FIGURE 41 FUNCTIONAL FILMS MARKET: COMPANY OVERALL FOOTPRINT

- FIGURE 42 FUNCTIONAL FILMS MARKET: STRENGTH OF PRODUCT PORTFOLIO

- FIGURE 43 FUNCTIONAL FILMS MARKET: STARTUP/SME EVALUATION MATRIX, 2022

- FIGURE 44 TORAY INDUSTRIES, INC.: COMPANY SNAPSHOT

- FIGURE 45 TORAY INDUSTRIES, INC.: COMPANY SNAPSHOT

- FIGURE 46 COVESTRO AG.: COMPANY SNAPSHOT

- FIGURE 47 DAI NIPPON PRINTING CO., LTD.: COMPANY SNAPSHOT

- FIGURE 48 3M COMPANY: COMPANY SNAPSHOT

- FIGURE 49 HONEYWELL INTERNATIONAL INC.: COMPANY SNAPSHOT

- FIGURE 50 NITTO DENKO CORPORATION: COMPANY SNAPSHOT

- FIGURE 51 TOYOBO CO., LTD.: COMPANY SNAPSHOT

The study involved four major activities in estimating the market size of the functional films market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, the market breakdown and data triangulation procedures were used to estimate the market size of the segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources have been referred to for identifying and collecting information for this study. These secondary sources include annual reports, press releases, investor presentations of companies, white papers, certified publications, trade directories, certified publications, articles from recognized authors, gold standard and silver standard websites, and databases.

Secondary research has been used to obtain key information about the value chain of the industry, monetary chain of the market, the total pool of key functional films, market classification and segmentation according to industry trends to the bottom-most level, and regional markets. It was also used to obtain information about the key developments from a market-oriented perspective.

Primary Research

The functional films market comprises several stakeholders in the value chain, which include raw material suppliers, manufacturers, and end users. Various primary sources from the supply and demand sides of the functional film market have been interviewed to obtain qualitative and quantitative information. The primary interviewees from the demand side include key opinion leaders in end-use sectors. The primary sources from the supply side include manufacturers, associations, and institutions involved in the functional films industry.

Primary interviews were conducted to gather insights such as market statistics, data of revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to chemistry, application, and region. Stakeholders from the demand side, such as CIOs, CTOs, and CSOs were interviewed to understand the buyer’s perspective on the suppliers, products, component providers, and their current usage of functional films and future outlook of their business which will affect the overall market.

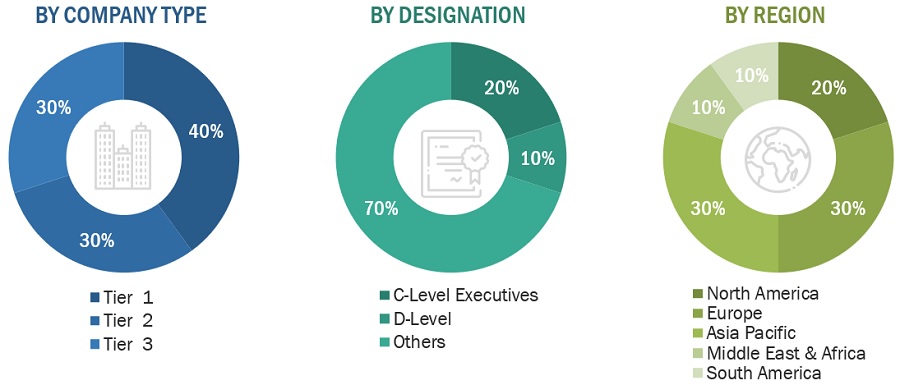

The breakdown of profiles of the primary interviewees is illustrated in the figure below:

Note: Tier 1, Tier 2, and Tier 3 companies are classified based on their market revenue in 2022 available in the public domain, product portfolios, and geographical presence.

Other designations include sales representatives, production heads, and technicians.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The top-down approach was used to estimate and validate the size of various submarkets for functional films for each region. The research methodology used to estimate the market size included the following steps:

- The key players in the industry have been identified through extensive secondary research.

- The supply chain of the industry has been determined through primary and secondary research.

- The global market was then segmented into five major regions and validated by industry experts.

- All percentage shares, splits, and breakdowns based on material, type, end-use, and country were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. This data was consolidated and added with detailed inputs and analysis and presented in this report.

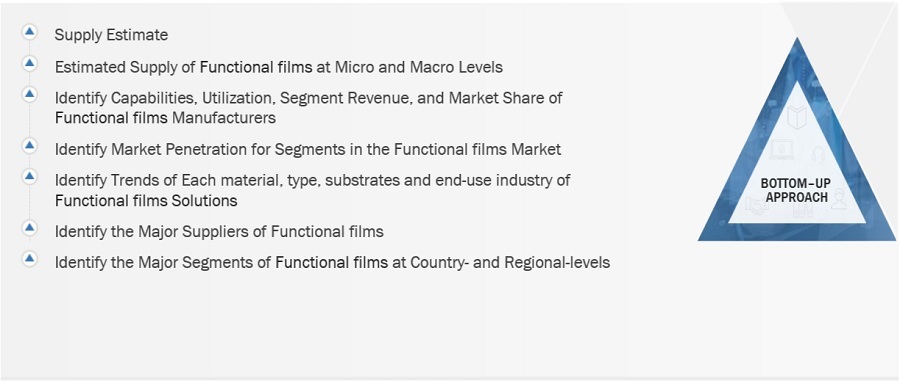

Functional Films Market: Bottum-Up Approach

Source: Secondary Research, Interviews with Experts, and MarketsandMarkets Analysis

To know about the assumptions considered for the study, Request for Free Sample Report

Functional Films Market: Top-Down Approach

Source: Secondary Research, Interviews with Experts, and MarketsandMarkets Analysis

Data Triangulation

After arriving at the total market size from the estimation process functional films above, the overall market has been split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics for all the segments and sub-segments, the data triangulation and market breakdown procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market size has been validated by using both the top-down and bottom-up approaches and primary interviews. Hence, for every data segment, there have been three sources—top-down approach, bottom-up approach, and expert interviews. The data was assumed correct when the values arrived from the three sources matched.

Market Definition

The functional films market is quickly expanding, driven by rising demand from a wide range of industries such as packaging, automotive, electronics, and healthcare and pharmaceutical. Functional films are thin, flexible sheets of material that are put to a substrate in order to modify or improve its qualities. Polymers such as polyethylene, polypropylene, polyester, and polyvinyl chloride are used to make them. Functional films are classed according to their function, such as barrier films, conductive films, optical films, and decorative films. Packaging, automotive, electronics, renewable energy, and medical devices are just a few of the industries that use functional films. Functional films are used in the packaging sector to increase the barrier qualities, strength, and durability of packaging materials.

Key Stakeholders

- functional films Manufacturers

- functional films Traders, Distributors, and Suppliers

- Raw Type Suppliers

- Government and Private Research Organizations

- Associations and Industrial Bodies

- R&D Institutions

- Environmental Support Agencies

Report Objectives

- To define, describe, and forecast the size of the functional films market, in terms of value and volume.

- To provide detailed information regarding the major factors (drivers, opportunities, restraints, and challenges) influencing the growth of the market.

- To estimate and forecast the market size based on substrate,material, type, end-use, and region.

- To forecast the size of the market with respect to major regions, namely, Europe, North America, Asia Pacific, Middle East & Africa, and South America, along with their key countries.

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and their contribution to the overall market.

- To analyze opportunities in the market for stakeholders and provide a competitive landscape of market leaders.

- To track and analyze recent developments such as expansions, new product launches, partnerships & agreements, and acquisitions in the market.

- To strategically profile key market players and comprehensively analyze their core competencies.

Available Customizations

Along with the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Regional Analysis

- Further breakdown of a region with respect to a particular country or additional application

Company Information

- Detailed analysis and profiles of additional market players

Tariff & Regulations

- Regulations and impact on functional films market

By Form Analysis

- Market size for functional films in terms of value and volume

Growth opportunities and latent adjacency in Functional Films Market