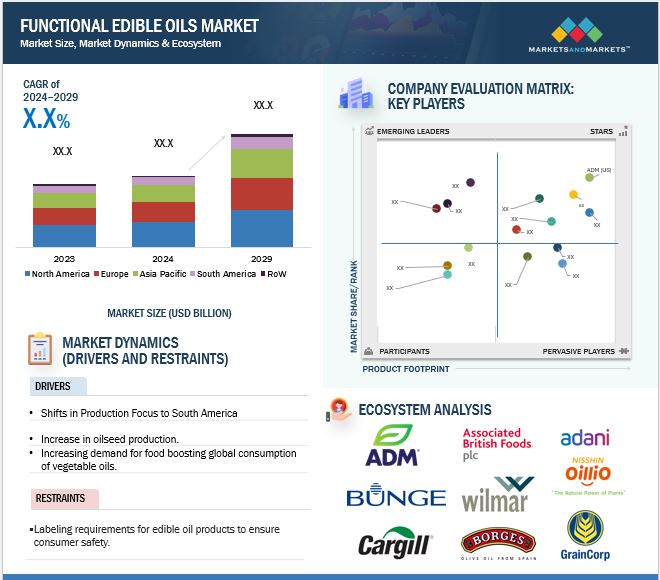

Functional Edible Oils Market

The functional edible oils market is estimated at USD XX billion in 2024 and is projected to reach USD XX billion by 2029, at a CAGR of XX% from 2024 to 2029. The functional edible oils market is poised for significant growth due to increasing consumer demand for healthier food options and the rising awareness about the nutritional benefits of functional oils. As people become more health-conscious, they are opting for oils with enhanced nutritional profiles, such as omega-3-rich oils (e.g., flaxseed, fish, and avocado oils) and oils that promote heart health (e.g., olive oil). Additionally, the trend of incorporating plant-based diets and clean-label products is further driving this growth.

The market is also benefiting from innovations in oil extraction techniques, which improve the quality and functional properties of oils. Manufacturers are focusing on creating oils with higher stability, longer shelf life, and added health benefits, such as anti-inflammatory and antioxidant properties.

Regional growth in emerging economies, particularly in Asia-Pacific and south America, is also boosting market expansion. Growing urbanization, rising disposable incomes, and changing consumer lifestyles are contributing to an increased demand for convenient, healthy, and functional edible oils in food processing, cooking, and nutraceutical applications.

This market growth is in line with the upward trend in world median incomes, according to the World Bank report in October 2023. U.S. average daily median income rose from USD 53.18 in 2013 to USD 66.65 by 2023, making it a 25% increase over ten years. Canada, Germany, and the UK were also seen on this upward trajectory, getting USD 56.30, USD 55.68, and USD 46.87, respectively. Its daily median income grew to USD 10.39 in emerging markets like China, which indicates an expanding middle class and rising living standards.

Growing income levels are directly correlated with more spending on food products, including functional edible oils, since consumers want to ensure health, quality, and sustainability. This trend, as well as innovations and expansions by leading global edible oil producers, is advancing the steady growth of the market worldwide.

Market Dynamics

Drivers: Shifts In Production Focus To South America

South America is emerging as a pivotal player in the global soybean market, significantly influencing the functional edible oils industry. According to the OECD-FAO Agricultural Outlook 2023-2032 (published July 2023), global soybean production is projected to grow by 0.9% annually over the next decade, a deceleration from the previous decade’s 2.2% growth rate. However, soybean's future is being tapped in South America with certain practices such as double cropping where soybeans are planted after maize or wheat. Brazil, the biggest soybean producer in the world, is expected to increase its production by 0.8% annually than the U.S, which will grow by 0.6% annually.

Other important contributors include Argentina and Paraguay, whose projected outputs stand at 51 million and 12 million tons, respectively, by 2032. In contrast, rapeseed and sunflower are the two other major oilseeds whose growth is rather slow due to land competition and regulatory constraints, particularly in the EU and China.

While the leaders of South America in soybean production manage to provide stability in the edible oil supply chain, they also raise concerns about price volatility and supply security. The soybean stock-to-use ratio is set to stand at 12% by 2032, with potential vulnerabilities from harvest shortfalls, further reiterating the importance of this region in the global functional edible oils market.

Restraint: High Price Volatility for Functional edible oils

Edible oil is considered to be a commodity that is extremely exposed to the risks of various factors such as the global economic condition, trade, and agricultural policies other than oilseeds crop productivity. The recent economic changes with the Ukraine-Russia war are slowing down the growth of the functional edible oils market. Variations in the constant pricing of vegetable oils, coupled with the rising fertilizer prices, are hampering the growth of the functional edible oils market due to inadequacy in supply against the growing demand. Globally, concerns about the future of food commodity security are increasing due to the hike in commodity prices.

Petroleum price increases are also boosting the rise in commodity prices, particularly the functional edible oils. The fast-changing economic conditions of developing nations lead to increased demand for energy and also as a source of transport fuel, raising oil prices. This further raises the agricultural cost of production.

An important concern for developing countries is an increase in edible oil prices because it is the most significant source of fat for them. The new price rise will have a gushing effect throughout the edible oil supply chain and adversely affect the functioning of the edible oil market.

Opportunity: Rising Sunflower Oil Demand Offers Growth Potential Due to High Olive Oil Prices

High demand for sunflower oil in Spain offers high growth opportunities since consumers are less able to afford olive oil, whose prices are on the rise. The National Association of Edible Oil Bottlers and Refiners Industrialists (Anierac) reports that sales of sunflower oil increased 24.5% between October 2023 and March 2024, while sales of olive oil decreased by 17.5%. This came at the back of higher olive oil prices by 61% from May 2023 to May 2024, with production slashing for the second successive year. Meanwhile, sunflower oil experienced a decline of 35%, which is relatively cheaper compared with quality cooking oils offered to households.

With economic substitutes prominent among Spanish consumers, sunflower oil will gain greater market share. If olive oil production levels off in 2024/25, then the existing price difference gives producers of sunflower oil a critical chance to consolidate their market position while responding to shifting consumer tastes.

Challenge: High dependence on imports, leading to high costs of end-products

There is a significant gap between the demand and supply of oilseed processed products, such as edible oil, owing to the limited availability of oilseeds in some domestic markets. For instance, India and European countries import palm oil on a large scale from Indonesia and Malaysia, which are the leading producers, owing to the favorable climatic conditions of these countries. Palm oil is widely used in the confectionery products sector, which experiences high demand in India and other European countries.

Similarly, European personal care product manufacturers depend on high-cost imports of shea butter from South Africa, which accounts for a significant share of its production. Due to the high dependence of these countries on imports of palm oil and shea butter, respectively, their import cost as well as the cost of the end products increases, which serves as a challenge for the market.

In regions where there's a high demand for specialty oils like olive oil or coconut oil, but local production is limited or non-existent, imports become indispensable. The transport and logistics involved in bringing these oils from distant regions add layers of cost, further escalating the retail prices compared to regions where such oils are locally produced in abundance.

Market Ecosystems

Food and beverage end use holds significant market share in the functional edible oils market.

Food and beverage use is the major contributor in the functional edible oils market, with the food processing industry being the biggest driver. The increasing demand for vegetable oils in baking, frying, and processed food production remains the foundation of growth since most functional edible oils enhance the texture, flavor, and shelf life of these food products.

According to the AHFE report that came out in November 2021, the enormous bakery market in Europe is estimated at USD 226 billion in 2020, accounting for 41% of the global market share. Countries such as Germany, France, and the United Kingdom, where bread and pastries are staple food products, lead in high production and consumption of bakery products. This creates consistent demand for functional edible oils, including palm oil, sunflower oil, which become integral parts of bakery operations.

The bakery producers increased operation to meet both domestic and export demands, thereby enhancing the demand for a consistent edible oil supply chain. This, therefore, implies that the food processing industry drives the global functional edible oils market, providing a feasible warranty for sustained growth in this sector.

The soybean oil segment holds a significant share by type in the functional edible oils market.

Soybean oil accounts for a significant share in the functional edible oils market as it is used in a wide range of applications and nutritionally excellent. The demand for the same has been increasing through mass consumption in cooking, baking, and other processed food items. Soybean oil contains unsaturated fats, omega-3 fatty acids, and Vitamin E which helps in heart health and immunity and becomes favorite among the health-conscious consumers.

The OECD-FAO Agricultural Outlook 2024-2033 report foresees an increase of 5% in global soybean production for the 2023/24 season, mainly driven by a strong recovery in Argentina. This increase in production will provide adequate supply support to offset growth in the market. Moreover, soybean oil is cheaper and more sustainable than many available alternatives, which weighs in favor of soybean oil in terms of consumer preference for economy in consumption and environmentally friendly choices.

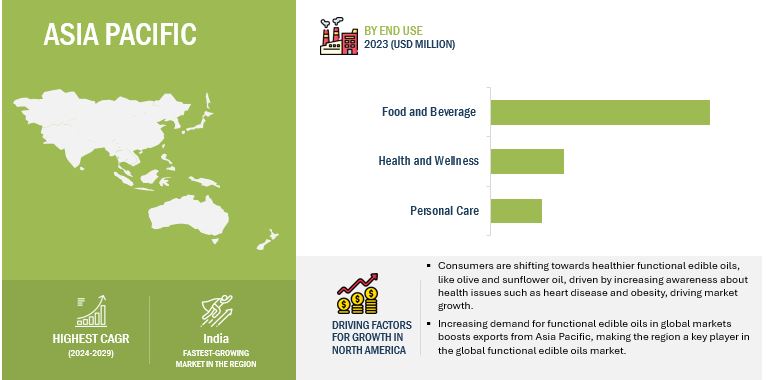

The Asia Pacific region is anticipated to experience the fastest growth between 2024 and 2029.

The Asia-Pacific region would tend to grow more rapidly in the functional edible oils market due to a growing population, rising disposable incomes, and an increasing preference towards healthy cooking oils. Wilmar International Ltd (Singapore), United Plantations Berhad (Malaysia), and the Adani Group (India) are key players which fundamentally form part of the region's dynamic market landscape.

In June 2020, subsidiary Unitate of United Plantations Berhad rolled out NutroOlive, a healthy combination of Extra Virgin Olive Oil and Red Palm Oil. This is an innovative product rich in carotenoids, monounsaturated fatty acids, antioxidants, and natural vitamins that are healthy and environmentally friendly for frying, baking, salad dressings, and cooking. Furthermore, NutroOlive is certified sustainable by the Round Table on Sustainable Palm Oil, a trend toward health-conscious and eco-friendly functional edible oils.

These innovations surely reflect the increasing market in the Asia-Pacific region wherein consumer demand for premium and sustainable products further cements the region as a leader in the global functional edible oils market.

Key Market Players

- ADM (US)

- Bunge (US)

- Associated British Foods plc (UK)

- Wilmar International Ltd (Singapore)

- United Plantations Berhad (Malaysia)

- Sime Darby Berhad (Malaysia)

- BORGES AGRICULTURAL & INDUSTRIAL FUNCTIONAL EDIBLE OILS, S.A.U. (Spain)

- Cargill Incorporated (US)

- GrainCorp (Australia)

- Adani Group (India)

- The Nisshin OilliO Group, Ltd. (Japan)

- Beidahuang Group (China)

- AJANTA SOYA LIMITED (India)

- Patanjali Foods Ltd. (India)

- Louis Dreyfus Company (Netherlands)

These market players are focusing on increasing their presence through agreements and collaborations. These companies have a strong presence in North America, Asia Pacific, and Europe. They also have manufacturing facilities along with strong distribution networks across these regions.

Recent Developments

- In September 2024, ADM (US) acquired Vandamme Hungaria Kft (Hungary). This added a 700 metric ton/day non-GM multi-seed and corn germ processing facility. It will boost ADM's capacity to fulfill the growing demand for non-GM functional edible oils in Europe while associated with its global sustainability efforts and increased commitment to food security throughout the world.

- In August 2024, Bunge (US) Launched Fiona Refined Sunflower Oil in Hyderabad, Telangana. It is further fortified with vitamins A, D, and E and boasts the novel VitoProtect formula, which increases vitamin transfer during cooking by as much as 50 per cent in comparison with standard sunflower oils. This launch addressed increasing consumer demand for healthier oils to cook with while maintaining nutritional value.

- In March 2023, Wilmar International Ltd acquired the remaining 24% stake in Calofic Corporation (Vietnam), the leading producer and distributor of vegetable oils. This acquisition makes Calofic an indirect wholly owned subsidiary of Wilmar, enhancing its presence as well as the market position of functional edible oils in Vietnam. This shows that the company is committed to an aggressive expansion of regional footholds.

- In November 2022, Cargill, Incorporated (US) acquired Owensboro Grain Company (US), a fifth-generation family-owned soybean processing and refining facility. Being integrated into Cargill's North American agricultural supply chain, the opportunities will now expand to scale the soybean oil business of the farmer to greater access and influence within the agricultural sector.

- In December 2021, Borges Agricultural & Industrial Functional edible oils, S.A.U. (Spain) inaugurated a USD 10.8 million seed oil extraction plant in Tárrega, Spain, increasing production capacity by 30%. Within its $25 million master plan, the facility boasts the most up-to-date technology and equipment in pursuit of maximum extraction efficiency, minimal environmental impact, and undiminished safety in operation, reflecting Borges' commitment to the future of producing sustainably premium edible oil.

Frequently Asked Questions (FAQ):

What is the current size of the functional edible oils market?

The functional edible oils market is estimated at USD XX billion in 2024 and is projected to reach USD XX billion by 2029, at a CAGR of XX% from 2024 to 2029.

Which are the key players in the functional edible oils market, and how intense is the competition?

Key players include ADM (US), Bunge (US), Associated British Foods plc (UK), Wilmar International Ltd (Singapore), and United Plantations Berhad (Malaysia). The market competition is intense, with continuous R&D investments, mergers, acquisitions, and innovations in encapsulation technologies.

Which region is projected to account for the largest share of the functional edible oils market?

The Asia-Pacific region accounts for the largest portion of market share in the functional edible oils market on account of high consumption countries such as China and India, driven by population growths, increasing disposable incomes, and widespread use in traditional cuisines and cooking.

What kind of information is provided in the company profiles section?

The company profiles cover comprehensive business overviews, financial data, geographic reach, product lines, strategic initiatives, and key innovations, offering detailed insights into the companies' market strategies.

What are the key factors driving the growth of the functional edible oils market?

Demand from developing countries due to rising health awareness, increasing demand for healthier oil options like olive oil, the growth of food processing industries, rising urbanization, and higher disposable incomes, which boosts preferences for premium, nutrient-rich cooking oils.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Growth opportunities and latent adjacency in Functional Edible Oils Market