Functional Composites Market by Type (Metal Matrix Composites, Polymer Matrix Composites), Function (Thermally Conductive, Electrically Conductive); End-User (Consumer Goods & Electronics, Transportation), Region - Global Forecast to 2021

[159 Pages] Functional Composites Market was valued at USD 26.33 Billion in 2015 and is expected to reach USD 43.35 Billion by 2021, at a CAGR of 8.7% between 2016 and 2021. The main objectives of this market study are

- To define and segment the global market by matrix type, function, end-user, and region

- To estimate and forecast the global market, in terms of value and volume

- To estimate and forecast the global market by matrix type, function, and end-user at country level in each region

- To identify and analyze the key drivers, restraints, and opportunities influencing the global advanced functional composites market

- To analyze significant region-specific trends in North America, Europe, Asia-Pacific, South America, and the Middle East & Africa

- To strategically identify and profile the key market players and analyze their core competencies in each matrix type

- To draw a competitive landscape by analyzing recent developments and competitive strategies, such as alliances, joint ventures, and mergers & acquisitions adopted by various key players operating in the global advanced functional composites market

The global market is mainly segmented on the basis of type, function, end-user, and region. The years considered for the report are:

- Base Year - 2015

- Estimated Year - 2016

- Projected Year - 2021

- Forecast Period - 2016-2021

The base year used for company profiles is 2015; where the information was not available for the base year, the prior year was taken into consideration.

Research Methodology:

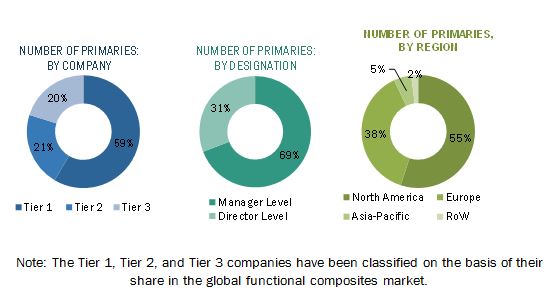

Different secondary sources, such as company websites, directories, and database have been used to identify and collect information that is useful for this extensive commercial study of the global advanced functional composites market. The primary sources, which include experts from related industries, have been interviewed to verify and collect critical information as well as to assess the future prospects of the market. The top-down approach has been implemented to validate the market size, in terms of value. With the data triangulation procedure and validation of data through primaries, the exact values of the overall parent market size and individual market sizes have been determined and confirmed in this study.

Market Ecosystem:

The ecosystem for the global advanced functional composites market consists of suppliers of key raw materials, such as calcium, barium, phosphorous, and other chemicals. Many companies, such as 3M Company (U.S.), Applied Materials, Inc. (U.S.), Momentive Performance Materials Inc. (U.S.), Kyocera Corporation (Japan), E.I. DuPont de Nemours (U.S.), Covestro AG (Bayer AG, Germany), Air Products (U.S.) Materion Corporation (U.S.), Aerospace Metal Composites Limited (U.K.), and GKN PLC (England), among others, have a backward integrated network to meet their production demands. The demand side includes end-user industries, such as aerospace & defense, wind energy, transportation, consumer goods & electronics. Some of the major players from these industries consist of Airbus Group SE (France), the Boeing Company (U.S.), China Guodian Corporation (China), Alstom Wind (Spain), General Electric Company (U.S.), Foxconn Technology Group (Taiwan), Daimler AG (Germany), Volkswagen AG (Germany), Ferrari S.p.A. (Italy), and others

Target Audience of the Report:

The target audience of the report includes:

- Manufacturers of Advanced Functional Composites

- Traders, Distributors, and Suppliers of Advanced Functional Composites

- Companies Operational Across Various End-Use Market Segments of Advanced Functional Composites

- Government and Research Organizations

- Associations and Industrial Bodies

- Research and Consulting Firms

- National & Local Government Organizations/Agencies

- R&D Institutions

- Environment Support Agencies

- Investment Banks and Private Equity Firms

Scope of the Report:

- By Matrix Type:

- Metal Matrix Composites

- Polymer Matrix Composites

- Ceramic Matrix Composites

- Hybrid Matrix Composites

- By Function:

- Thermally Conductive

- Electrically Conductive

- Magnetic

- Barrier

- Optics

- Others

- By End User:

- Aerospace & Defense

- Wind Energy

- Transportation

- Consumer goods & Electronics

- Building, Construction, Storage & Piping

- Others

- By Region:

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- France

- U.K.

- Italy

- Rest of Europe

- Asia-Pacific

- China

- South Korea

- Japan

- Rest of Asia-Pacific

- Middle-East & Africa

- Middle-East

- Africa

- South America

- Brazil

- Argentina

- Rest of South America

- North America

Available Customizations:

The following customization options are available for the report:

Product Analysis

- Product Matrix which gives a detailed comparison of product portfolio of each company

Country Level Analysis

- Further breakdown of the global advanced functional composites market by major countries from Europe, including Spain, Belgium, Holland, and so on.

- Further breakdown of the global advanced functional composites market by major countries from Asia-Pacific, including Taiwan, Indonesia, South Korea, and so on.

- Further breakdown of the global advanced functional composites market by emerging economies of Middle-East & Africa and South America.

Company Information

- Detailed analysis and profiling of additional market players

The functional composites market is expected to grow from USD 28.62 Billion in 2016 to USD 43.35 Billion by 2021, at a CAGR of 8.7% from 2016 to 2021. The market has witnessed considerable growth in recent years, due to applications of functional composites in various end-user industries. Functional composites are designed to perform various functions, such as thermal conductivity, electrical conductivity, barrier functions, and magnetic functions, among others, depending upon their composition.

Based on matrix materials, functional composites can be segmented into metal, polymer, ceramics, and hybrid matrix composites. Polymer matrix composites are widely used in electronics and semiconductors industries, as they exhibit piezo-electric, magnetic, semiconducting, and conducting properties. Therefore, they are used in casings, structural parts, electronic papers, magnetic coils, and electrical boards.

Functional composites are extensively used in thermal and electrical conduction. The thermally conductive segment of the functional composites market accounted for the largest share in 2015. Other functions of functional composites include magnetic, barrier, optic, and others.

Functional composites are mainly used in end-user industries, such as aerospace & defense; consumer goods & electronics; transportation; building, construction, storage & piping; wind energy; and others. Based on end-user industry segment, aerospace & defense is the largest segment of the functional composites market, having accounted for largest share in 2015. This high share can be attributed to the increased usage of functional composites in key application areas, such as body parts of aircraft, combustion systems, and others.

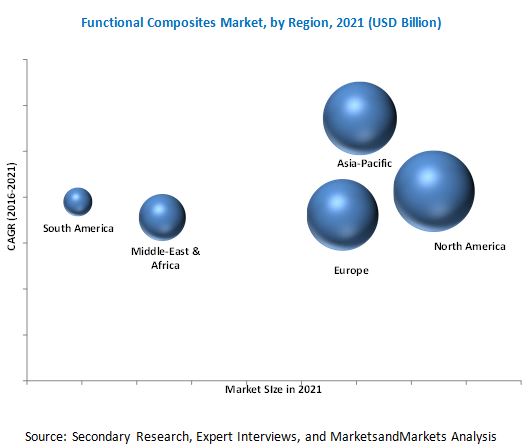

North America and Europe accounted for a major share of the global market, owing to the presence of developed aerospace & defense industry in these regions. Major manufacturers of functional composites are mainly based in these regions, with operations across the globe. Asia-Pacific is the fastest-growing market for functional composites market owing to the high demand from consumer goods & electronics and transportation industry in this region.

The high cost of raw materials, especially with the addition of reinforcement, is the major threat to the growth of functional composites market. In most cases, carbon fibers are used as reinforcements. The price of carbon fiber is generally on the higher side of the cost and is thus, the major contributor to this high price.

Key players operational in the functional composites market, such as Momentive Performance Material Inc. (U.S.), 3M Company (U.S.), Bayer AG (Germany), 3A Composites (Switzerland), and E. I. du Pont de Nemours and Company (U.S.), have adopted various growth strategies, such as expansions, new product launches, and agreements & collaborations. Several new entrants have also adopted mergers & acquisitions as a growth strategy to increase their market share.

Table of Contents

1 Introduction (Page No. - 15)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency & Pricing

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 18)

2.1 Research Data

2.2 Market Size Estimation

2.3 Market Breakdown & Data Triangulation

2.4 Market Share Estimation

2.4.1 Key Data From Secondary Sources

2.4.2 Key Data From Primary Sources

2.4.2.1 Key Industry Insights

2.5 Assumptions

3 Executive Summary (Page No. - 26)

3.1 Introduction

3.2 Historical Backdrop and Evolution

3.3 Current Scenario

3.4 Future Outlook

3.5 Conclusion

4 Premium Insights (Page No. - 32)

4.1 Attractive Opportunities in the Functional Composites Market

4.2 Functional Composites Market, By End-User

4.3 Market: Major Segments

4.4 Market Growth

4.5 Market, Developing & Emerging Nations

4.6 Life Cycle Analysis, By Region

5 Market Overview (Page No. - 36)

5.1 Introduction

5.2 Market Segmentation

5.2.1 By Matrix Type

5.2.2 By Function

5.2.3 By End-User

5.2.4 By Region

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Increasing Usage Across Various End-User Industries

5.3.1.2 Growing Demand in Healthcare Applications

5.3.2 Restraints

5.3.2.1 High Raw Material Cost

5.3.3 Opportunities

5.3.3.1 Potential Use in Eco-Friendly Constructions

5.3.3.2 High Growth Opportunities for the Market in Asia-Pacific

5.3.4 Challenges

5.3.4.1 Lack of Standardization in the Industry

6 Industry Trends (Page No. - 45)

6.1 Introduction

6.2 Value Chain Analysis

6.2.1 Raw Materials for Functional Composites

6.2.2 Functional Composites Manufacturers

6.2.3 Distribution Network

6.2.4 End-User

6.3 Porters Five Forces Analysis

6.3.1 Bargaining Power of Suppliers

6.3.2 Threat of New Entrants

6.3.3 Threat of Substitutes

6.3.4 Bargaining Power of Buyers

6.3.5 Intensity of Competitive Rivalry

7 Functional Composites Market, By Matrix Type (Page No. - 50)

7.1 Introduction

7.2 Market Size and Projection

7.3 Metal Matrix Composites

7.4 Polymer Matrix Composites

7.5 Ceramic Matrix Composites

7.6 Hybrid Matrix Composites

8 Functional Composites Market, By Function (Page No. - 60)

8.1 Introduction

8.2 Market Size and Projection

8.3 Thermally Conductive

8.4 Electrically Conductive

8.5 Magnetic

8.6 Barrier

8.7 Optic

9 Functional Composites Market, By End-User (Page No. - 71)

9.1 Introduction

9.2 Aerospace & Defense

9.3 Wind Energy

9.4 Transportation

9.5 Building, Construction, Storage & Piping

9.6 Consumer Goods & Electronics

9.7 Others

10 Regional Analysis (Page No. - 84)

10.1 Introduction

10.2 North America

10.2.1 U.S.

10.2.2 Canada

10.2.3 Mexico

10.3 Europe

10.3.1 Germany

10.3.2 France

10.3.3 U.K.

10.3.4 Italy

10.3.5 Rest of Europe

10.4 Asia-Pacific

10.4.1 China

10.4.2 South Korea

10.4.3 Japan

10.4.4 Rest of Asia-Pacific

10.5 Middle East & Africa

10.5.1 Middle East

10.5.2 Africa

10.6 South America

10.6.1 Brazil

10.6.2 Argentina

11 Competitive Landscape (Page No. - 117)

11.1 Overview

11.2 Expansions: One of the Most Popular Growth Strategies

11.3 Maximum Developments in 2012

11.4 Competitive Situation and Trends

11.4.1 Expansions

11.4.2 New Product Launches

11.4.3 Collaborations/Agreements

11.4.4 Mergers & Acquisitions

12 Company Profiles (Page No. - 124)

12.1 Introduction

(Business Overview, Products & Services, Key Insights, Recent Developments, SWOT Analysis, Ratio Analysis, MnM View)*

12.2 3M Company

12.3 3A Composites Inc.

12.4 Air Products and Chemicals, Inc.

12.5 Bayer AG

12.6 E. I. Du Pont De Nemours and Company

12.7 Ametek, Inc.

12.8 Applied Materials, Inc.

12.9 Kyocera Corporation

12.10 Momentive Performance Materials Inc.

12.11 Materion Corporation

*Details on Business Overview, Products & Services, Key Insights, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

13 Appendix (Page No. - 149)

13.1 Insights of Industry Experts

13.2 Developments

13.3 Discussion Guide

13.4 Knowledge Store: Marketsandmarkets Subscription Portal

13.5 Introducing RT: Real Time Market Intelligence

13.6 Available Customizations

13.7 Related Reports

List of Tables (86 Tables)

Table 1 Increase in Auto Production After Economic Slowdown Will Increase the Demand for Functional Composites

Table 2 Functional Composites Market: Different Matrix Materials Used

Table 3 Functional Composites Market Size, By Matrix Type, 20142021 (USD Billion)

Table 4 Functional Composites Market Size, By Matrix Type, 20142021 (Kilotons)

Table 5 Metal Matrix-Based Functional Composites Market Size, By End-User, 20142021 (USD Billion)

Table 6 Metal Matrix-Based Functional Composites Market Size, By End-User, 20142021 (Kilotons)

Table 7 Polymer Matrix-Based Functional Composites Market Size, By End-User, 20142021 (USD Billion)

Table 8 Polymer Matrix-Based Functional Composites Market Size, By End-User, 20142021 (Kilotons)

Table 9 Ceramics Matrix-Based Functional Composites Market Size, By End-User, 20142021 (USD Billion)

Table 10 Ceramics Matrix-Based Functional Composites Market Size, By End-User, 20142021 (Kilotons)

Table 11 Hybrid Matrix-Based Functional Composites Market Size, By End-User, 20142021 (USD Billion)

Table 12 Hybrid Matrix-Based Functional Composites Market Size, By End-User, 20142021 (Kilotons)

Table 13 Functional Composites Market Size, By Function, 20142021 (USD Billion)

Table 14 Functional Composites Market Size, By Function, 20142021 (Kilotons)

Table 15 Market for Thermally Conductive Function, By End-User, 20142021 (USD Billion)

Table 16 Market for Thermally Conductive Function, By EndUser, 20142021 (Kilotons)

Table 17 Market for Electrically Conductive Function, By End-User 20142021 (USD Billion)

Table 18 Market for Electrically Conductive, By End-User, 20142021 (Kilotons)

Table 19 Market for Magnetic Function, By End-User, 20142021 (USD Billion)

Table 20 Market for Magnetic Function, By End-User, 20142021 (Kilotons)

Table 21 Functional Composites Market for Barrier Function, By End-User, 20142021 (USD Billion)

Table 22 Functional Composites Market for Barrier Function, By End-User, 20142021 (Kilotons)

Table 23 Market for Optic Function, By End-User, 20142021 (USD Billion)

Table 24 Market for Optic Function, By End-User, 20142021 (Kt)

Table 25 Market Size, By End-User, 20142021 (USD Billion)

Table 26 Market Size, By End-User, 20142021 (Kilotons)

Table 27 Market in Aerospace & Defense, By Matrix Type, 20142021 (USD Billion)

Table 28 Market in Aerospace & Defense, By Matrix Type, 20142021 (Kilotons)

Table 29 Market in Wind Energy, By Matrix Type, 20142021 (USD Billion)

Table 30 Market in Wind Energy, By Matrix Type, 20142021 (Kilotons)

Table 31 Market in Transportation, By Matrix Type, 20142021 (USD Billion)

Table 32 Market in Transportation, By Matrix Type, 20142021 (Kilotons)

Table 33 Market in Building, Construction, Storage & Piping, By Matrix Type, 20142021 (USD Billion)

Table 34 Market in Building, Construction, Storage & Piping, By Matrix Type, 20142021 (Kilotons)

Table 35 Functional Composites Market in Consumer Goods & Electronics, By Matrix Type, 20142021 (USD Billion)

Table 36 Functional Composites Market in Consumer Goods & Electronics, By Matrix Type, 20142021 (Kilotons)

Table 37 Market in Other End-User, By Matrix Type, 20142021 (USD Billion)

Table 38 Market in Other End-User, By Matrix Type, 20142021 (Kilotons)

Table 39 Market Size, By Region, 20142021 (USD Billion)

Table 40 Market Size, By Region, 20142021 (Kilotons)

Table 41 North America: Functional Composites Market Size, By End-User, 20142021 (USD Billion)

Table 42 North America: Market Size, By End-User, 20142021 (Kilotons)

Table 43 U.S.: Market Size, By End-User, 20142021 (USD Billion)

Table 44 U.S.: Market Size, By End-User, 20142021 (Kilotons)

Table 45 Canada: Market Size, By End-User, 20142021 (USD Billion)

Table 46 Canada: Market Size, By End-User, 20142021 (Kilotons)

Table 47 Mexico: Market Size, By End-User, 20142021 (USD Billion)

Table 48 Mexico: Market Size, By End-User, 20142021 (Kilotons)

Table 49 Europe: Market Size, By End-User, 20142021 (USD Billion)

Table 50 Europe: Market Size, By End-User, 20142021 (Kilotons)

Table 51 Germany: Market Size, By End-User, 20142021 (USD Billion)

Table 52 Germany: Market Size, By End-User, 20142021 (Kilotons)

Table 53 France: Functional Composites Market Size, By End-User, 20142021 (USD Billion)

Table 54 France: Functional Composites Market Size, By End-User, 20142021 (Kilotons)

Table 55 U.K.: Market Size, By End-User, 20142021 (USD Billion)

Table 56 U.K.: Market Size, By End-User, 20142021 (Kilotons)

Table 57 Italy: Market Size, By End-User, 20142021 (USD Billion)

Table 58 Italy: Market Size, By End-User, 20142021 (Kilotons)

Table 59 Rest of Europe: Functional Composites Market Size, By End-User, 20142021 (USD Billion)

Table 60 Rest of Europe: Market Size, By End-User, 20142021 (Kilotons)

Table 61 Asia-Pacific: Market Size, By End-User, 20142021 (USD Billion)

Table 62 Asia-Pacific: Market Size, By End-User, 20142021 (Kilotons)

Table 63 China: Market Size, By End-User, 20142021 (USD Billion)

Table 64 China: Market Size, By End-User, 20142021 (Kilotons)

Table 65 South Korea: Market Size, By End-User, 20142021 (USD Billion)

Table 66 South Korea: Market Size, By End-User, 20142021 (Kilotons)

Table 67 Japan: Market Size, By End-User, 20142021 (USD Billion)

Table 68 Japan: Market Size, By End-User, 20142021 (Kilotons)

Table 69 Rest of Asia-Pacific: Market Size,By End-User , 20142021 (USD Billion)

Table 70 Rest of Asia-Pacific: Market Size, By End-User, 20142021 (Kilotons)

Table 71 Middle East & Africa: Market Size, By End-User, 20142021 (USD Billion)

Table 72 Middle East & Africa: Market Size, By End-User, 20142021 (Kilotons)

Table 73 Middle East: Functional Composites Market Size, By End-User, 20142021 (USD Billion)

Table 74 Middle East: Functional Composites Market Size, By End-User, 20142021 (Kilotons)

Table 75 Africa: Market Size, By End-User, 20142021 (USD Billion)

Table 76 Africa: Market Size, By End-User, 20142021 (Kilotons)

Table 77 South America: Market Size, By End-User, 20142021 (USD Billion)

Table 78 South America: Market Size, By End-User, 20142021 (Kilotons)

Table 79 Brazil: Market Size, By End-User, 20142021 (USD Billion)

Table 80 Brazil: Market Size, By End-User, 20142021 (Kilotons)

Table 81 Argentina: Functional Composites Market Size, By End-Use, 20142021 (USD Billion)

Table 82 Argentina: Functional Composites Market Size, By End-User, 20142021 (Kilotons)

Table 83 Expansions, 2013-2015

Table 84 New Product Launches, 2012-2015

Table 85 Collaborations/Agreements, 2012-2016

Table 86 Mergers & Acquisitions, 2012-2015

List of Figures (67 Figures)

Figure 1 Functional Composites: Market Segmentation

Figure 2 Functional Composites Market: Research Design

Figure 3 Market Size Estimation: Bottom-Up Approach

Figure 4 Market Size Estimation: Top-Down Approach

Figure 5 Breakdown of Primary Interviews, By Company, Designation, and Region

Figure 6 Market Breakdown & Data Triangulation

Figure 7 Historical Backdrop and Evolution of Modern Day Composites

Figure 8 The Aerospace & Defense Segment is Expected to Drive the Growth of the Functional Composites Market

Figure 9 Functional Composites Market Size, By End-User and Matrix Type

Figure 10 Asia-Pacific Projected to Be the Fastest-Growing Market for Functional Composites

Figure 11 Asia-Pacific is Projected to Have the Highest Growth Potential in the Functional Composites Market

Figure 12 Functional Composites Market Projected to Register High Growth Between 2016 and 2021

Figure 13 The Aerospace and Defense Industry Segment Projected to Witness the Highest Growth During the Period Under Consideration

Figure 14 North America Contributed the Largest Share to the Functional Composites Market

Figure 15 South Korea Projected to Grow at the Highest CAGR During the Forecast Period

Figure 16 China Expected to Be Most Lucrative Market for Functional Composites During the Forecast Period

Figure 17 The Functional Composites Market has Significant Growth Opportunities in Asia-Pacific

Figure 18 Market, By Matrix Type

Figure 19 Market, By Function

Figure 20 Market, By End-User

Figure 21 Market, By Region

Figure 22 Increasing Usage Across Various End-Use Industries Expected to Drive the Growth of the Functional Composites Market

Figure 23 High Growth in the Drug Delivery Market Will Increase the Demand for Functional Composites in Near Future

Figure 24 Overview of Functional Composites Value Chain

Figure 25 Porters Five Forces Analysis

Figure 26 The Polymer Matrix Composites Segment to Register the Highest CAGR Between 2016 & 2021

Figure 27 The Aerospace & Defense Segment is Expected to Drive the Growth of Metal Matrix-Based Functional Composites

Figure 28 The Aerospace & Defense Segment Expected to Drive the Growth of the Polymer Matrix-Based Functional Composites Market

Figure 29 The Transportation Segment is A Major Segment of the Ceramic Matrix-Based Composites Market

Figure 30 Transportation Expected to Be the Fastest-Growing Segment of the Hybrid Matrix-Based Composites Market in the Coming Years

Figure 31 The Thermally Conductive Segment Accounted for the Largest Share of the Functional Composites Market

Figure 32 The Increased Demand From Aerospace & Defense is Expected to Boost the Growth of the Functional Composites Market for Thermally Conductive Function

Figure 33 Transportation: Second-Largest Market for Functional Composites for Electrically Conductive Function

Figure 34 The Increased Demand From the Transportation Industry is Expected to Drive the Growth of the Functional Composites Market for Magnetic Function

Figure 35 Aerospace & Defense: Largest Market for Functional Composites for Barrier Function

Figure 36 The Increased Demand From Transportation Industry is Expected to Drive the Growth of the Functional Composites Market for Optic Function

Figure 37 The Aerospace & Defense Segment Expected to Drive the Functional Composites Market, 2016 to 2021

Figure 38 Polymer Matrix Composites: Most Widely Used Composite Types in the Aerospace & Defense End-User

Figure 39 Hybrid Matrix Composites: the Fastest-Growing Segment of the Functional Composites Market in Wind Energy

Figure 40 Polymer Matrix Composites: the Largest Segment of the Functional Composites Market in Transportation

Figure 41 Polymer Matrix Composites: the Largest Segment of the Functional Composites Market in Building, Construction, Storage & Piping

Figure 42 Polymer Matrix Composites: the Largest Segment of the Functional Composites Market in Consumer Goods & Electronics

Figure 43 Market, By Region, 2015 (USD Billion)

Figure 44 North America Functional Composites Market Snapshot, 20152021

Figure 45 Europe Market Snapshot, 20152021

Figure 46 Asia-Pacific Market Snapshot,

Figure 47 Middle East & Africa Functional Composites Market Snapshot, 20152021

Figure 48 South America Functional Composites Market Snapshot, 20152021

Figure 49 Key Growth Strategies in the Functional Composites Market, 2011-2016

Figure 50 Companies Primarily Adopted Organic Growth Strategies From

Figure 51 Market: Year-Wise Share of the Total Developments in the Market, 20102016 (Till March)

Figure 52 Regional Revenue Mix of Top 5 Market Players

Figure 53 3M Company: Company Snapshot

Figure 54 3M Company: SWOT Analysis

Figure 55 3A Composites Inc.: Company Snapshot

Figure 56 Air Products and Chemicals, Inc.: Company Snapshot

Figure 57 Air Products & Chemicals, Inc.: SWOT Analysis

Figure 58 Bayer AG: Company Snapshot

Figure 59 Bayer AG: SWOT Analysis

Figure 60 E. I. Du Pont De Nemours and Company: Company Snapshot

Figure 61 E. I. Du Pont De Nemours and Company: SWOT Analysis

Figure 62 Ametek, Inc.: Company Snapshot

Figure 63 Applied Materials, Inc.: Company Snapshot

Figure 64 Kyocera Corporation: Company Snapshot

Figure 65 Momentive Performance Materials Inc.: Company Snapshot

Figure 66 Momentive Performance Materials Inc: SWOT Analysis

Figure 67 Materion Corporation: Company Snapshot

Growth opportunities and latent adjacency in Functional Composites Market