FRP Vessels Market by Fiber Type (Glass, Carbon), Resin Type (Polyester, Epoxy, Others), Application (Automotive & Transportation, Water and Wastewater, Chemical, Industrial, Oil & Gas), and Region - Global Forecast to 2027

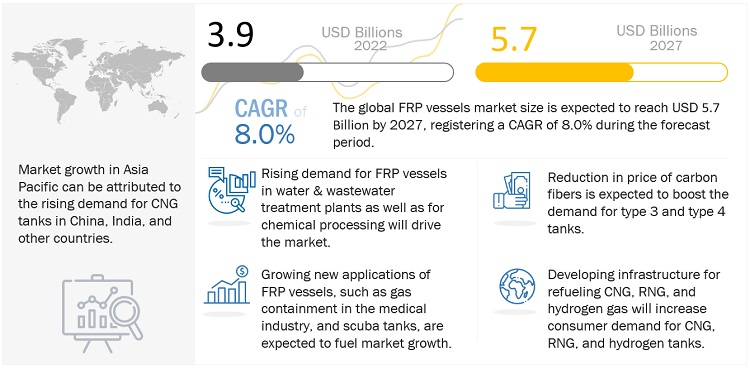

[240 Pages Report] The global FRP vessels market size is estimated to be USD 3.9 billion in 2022 and is expected to reach USD 5.7 billion by 2027, at a CAGR of 8.0% from 2022 to 2027. The demand from the water & wastewater treatment industry is expected to drive the growth of the market during the forecast period between 2022 to 2027. However, factory shutdowns, interrupted supply chains, and reduced demand from end-use industries has negatively affected the FRP vessels market.

Attractive Opportunities in the FRP Vessels Market

To know about the assumptions considered for the study, Request for Free Sample Report

Increasing demand for FRP vessels in automotive industry

The automotive industry is focusing on complying with stringent regulations such as the Corporate Average Fuel Efficiency (CAFE) standards and the European Emission Standards (EES). According to the US Environmental Protection Agency (EPA), the transportation industry in the US accounts for 28% of the greenhouse gas emission. The US government has made it a critical requirement for automakers to follow average miles per gallon standard for their vehicles. Automakers in the country are thus focusing on the production of lightweight vehicles with enhanced fuel efficiency. According to the EU Emissions Trading System (EU ETS), cars are responsible for around 12% of total carbon dioxide gas emission in the European region. European legislation has set mandatory emission targets to improve the fuel economy of cars sold in the European market.

Apart from being used as storage tanks, FRP vessels are used as fuel tanks in automobiles. These vessels are not only lighter than those made of metals and alloys, but also offer excellent features such as superior mechanical properties, increased rigidity, corrosion resistance, and higher impact tolerance. To comply with government regulations, automotive manufacturers are using new, lightweight composite structures in their vehicles. Composites are the best substitute for traditional heavy materials such as steel and aluminum to fabricate fuel tanks such as CNG, RNG, and hydrogen cylinders. The fiber-reinforced polymer material used in the fabrication of fuel tanks provides weight reduction of 25% to 70%. The composite material of the vessels improves the strength to weight ratio of an automobile, making the structure rigid so that it provides protection in the event of an accident, and provides a high level of safety to the passengers.

High manufacturing cost and need for regulatory approvals to restrict the market growth

The market for composites is competitive. In such a scenario, all decisions are governed by commercial considerations. The two most common commercial factors are capital expenditure (CAPEX) and operating expense (OPEX). The high price of raw material and high expenditure required during the manufacturing process results in decreased profitability. Therefore, a cost-effective design and production technology is needed to ensure profitability. Carbon fiber and glass fiber are highly capital intensive, and many potential players are not motivated to enter the market due to the high cost of entry. Relatively cheaper concrete or metal tanks are also preferred over FRP vessels in various price-sensitive end-use applications. Developing countries in regions such as Asia Pacific, West Africa, and Latin America also prefer metal tanks. Thus, the identification and definition of low-cost technologies for the economical commercial production of low-cost carbon and glass fiber FRP vessels are among the critical issues for the manufacturers globally.

Growth of end-use industries in emerging economies to create lucrative opportunities for the market

FRP vessels are mostly used in developed countries such as the US, Germany, and the UK, which have a superior operational spending capacity. Developing economies such as China, Brazil, Qatar, and India are emerging markets for FRP vessels. Rapid urbanization and industrialization have resulted in these economies making huge investments in manufacturing and service industries to increase their quality and production rate. The economic progress has resulted in increasing disposable income of the population in these regions, leading to higher demand for products and services. These economies are significantly investing in infrastructure development, especially in the wastewater, chemicals, and oil & gas sectors. Other small emerging economies such as South Africa are also witnessing high growth due to the rising population and corresponding increase in public and residential infrastructure. This infrastructural growth in emerging economies is creating opportunities for players in the FRP vessels market.

Lack of standardization in manufacturing process for FRP vessels to be a major challenge for market growth

For FRP vessel fabrication, raw materials are directly obtained from manufacturers. The reason for this direct purchase cycle is that fabrication has to be synchronized with the operational requirement of various end-use industries, and raw material quality. FRP vessels require customization, depending upon the end-use conditions. Modifications in FRP vessels might require changes in raw material composition and processing conditions. Such requirements can be fulfilled only if there is close coordination between the raw material manufacturers and FRP vessel fabricators. This constraint in standardization makes large-scale manufacturing of FRP vessels difficult and contributes to their overall high cost.

Glass fiber type accounted for the largest market share, in terms of value and volume

Glass fiber-based composites are the most common type of reinforcements used in FRP vessels as glass fibers are less expensive than other fibers. Glass fibers are also more suited to applications such as chemical storage, water & wastewater, and oil & gas.

Polyester resin segment dominated the FRP Vessels market, in terms of value and volume

Polyester resins are categorized as long-chain synthetic polymers and are formed by the combination of either polyhydric or multi-hydroxyl alcohols with organic acids. These resins are sub-categorized as saturated and unsaturated resins. Unsaturated resins are formed by the combination of organic acids and polyhydric alcohols, whereas saturated resins are produced by using organic acids with multihydroxy alcohols. Unsaturated polyester resin is a condensed product of unsaturated acids or anhydrides and diols with or without diacids. A catalyst that solidifies the resin during curing and accepts a wide range of fillers is required. Polyester resins do not expand with high temperature and exhibit good mechanical, electrical, and heat resistance properties. Other advantages include dimensional stability; competitive cost; and ease of handling or processing. More cost-effective than epoxy resin, polyester resin is one of the most economical resins used in FRP vessels.

Water & wastewater application segment dominated the FRP Vessels market, in terms of value and volume

The water & wastewater application is the biggest application in the FRP vessels market. Composite vessels are used in potable water storage and wastewater storage. Wastewater contains feces, urine, and other solid waste in different concentrations, with varying densities, particle sizes, and hardness; these particles damage the tanks from within. Traditional steel tanks corrode quickly and break due to the nature of the waste they carry. Metal tanks in the sewage system are now being replaced by FRP vessels. They offer high strength, durability, and non-corrosive properties. Major players involved in the manufacturing of FRP vessels for the water & wastewater segment include Worthington Industries, Inc. (US), ZCL Composites (Canada), Enduro Composites (US), and Plasticon Composites (Netherlands), and JRMS Engineering Works (India). NOV Inc. (US) offers fiberglass tanks & vessels for water/rainwater storage and wastewater treatment applications through its Containment Solutions and Ershigs brands.

To know about the assumptions considered for the study, download the pdf brochure

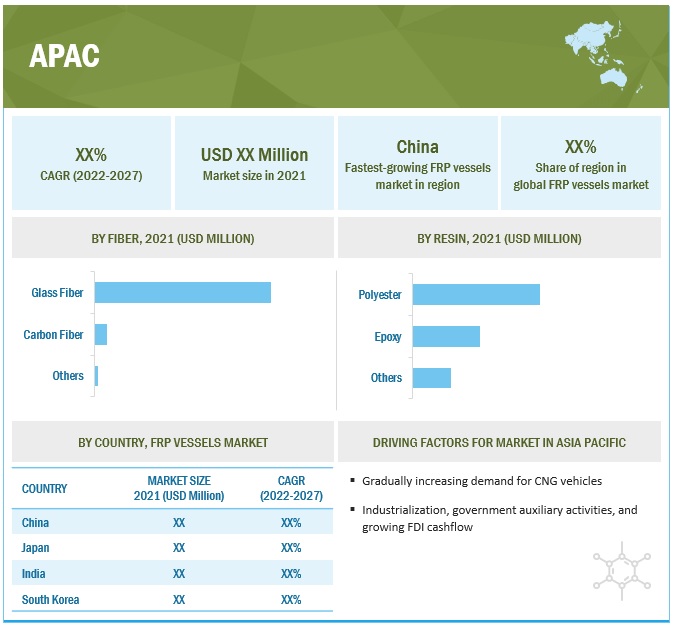

Asia Pacific region held the largest market share in the FRP Vessels market

Asia Pacific led the FRP vessels market globally in 2021, with a share of 35.8%, in terms of value; it is projected to continue to maintain its position during the forecast period. This dominance is attributed to the increasing use of FRP vessels in chemical, oil & gas, water & wastewater, and automotive & transportation applications. North America is the second-largest market for FRP vessels due to stringent government regulations governing the manufacturing sector with respect to effluent discharge & air discharges, and demand for lightweight products with superior properties.

Key Market Players

Some of the key players in the global FRP Vesselsmarket are such as Hexagon Composites ASA (Norway), Luxfer Group (England), Worthington Industries, Inc. (US), Everest Kanto Cylinders Ltd. (India), Quantum Fuel Systems LLC. (US), Faber Industrie SpA (Italy), Avanco Group (Germany), Shawcor Ltd (US), NOV Inc. (US), and Lianyungang Zhongfu Lianzhong Composites Group Co. Ltd. (China).

These companies are involved in adopting various inorganic and organic strategies to increase their foothold in the FRP Vesselsindustry. The study includes an in-depth competitive analysis of these key players in the FRP Vesselsmarket, with their company profiles, recent developments, and key market strategies.

FRP Vessels Market Report Scope

|

Report Metric |

Details |

|

Market Size Value in 2022 |

USD 3.9 billion |

|

Revenue Forecast in 2027 |

USD 5.7 billion |

|

CAGR |

8.0% |

|

Years considered for the study |

2018–2021 |

|

Base year |

2021 |

|

Forecast period |

2022–2027 |

|

Units considered |

Value (USD million/USD Billion), Volume (Kiloton) |

|

Segments |

Resin type, Fiber type, Applications and Region |

|

Regions |

Europe, North America, APAC, MEA, and South America |

|

Companies |

Hexagon Composites ASA (Norway), Luxfer Group (England), Worthington Industries, Inc. (US), Everest Kanto Cylinders Ltd. (India), Quantum Fuel Systems LLC. (US), Faber Industrie SpA (Italy), Avanco Group (Germany), Shawcor Ltd (US), NOV Inc. (US), and Lianyungang Zhongfu Lianzhong Composites Group Co. Ltd. (China) |

This research report categorizes the FRP Vessels market based on resin type, manufacturing process, application, and region.

By Rein Type:

By Fiber Type:

- Glass

- Carbon

- Others

By Application:

- Water & Wastewater

- Chemical

- Automotive & Transportation

- Oil & Gas

- Industrial

- Others

By Region:

- North America

- Europe

- Asia Pacific

- Middle East & Africa

- South America

Recent Developments

- In August 2022, Mitsui & Co., Ltd. invested about USD 8.15 million in Norwegian Hydrogen AS, a company in which Hexagon Purus ASA has the largest share, to improve infrastructure and increase its production capacity.

- In August 2022, Hexagon Purus ASA acquired a 40% stake in the cryogenic equipment maker, Cryoshelter GmbH’s liquid hydrogen business. The acquisition will improve its zero emission mobility technologies.

- In July 2022, Rev1 Ventures partnered with Worthington Industries to accelerate advancements in sustainability technology, and smart manufacturing. Worthington will provide individual investments, up to USD 10 million, to propel emerging technologies that align with its vision and enable the company to better serve current and future markets.

- In December 2021, Worthington Industries acquired Tempel Steel Company, a leading global manufacturer of precision motor and transformer laminations for the electrical steel market that includes transformers, machine motors and electric vehicle (EV) motors. This adds five more plants l in the US (Chicago), Canada, China, India and Mexico, to Worthington’s production facility.

- In March 2021, Hexagon Purus ASA signed a joint venture agreement with CIMC Enric, the world’s largest zero emission hydrogen vehicle manufacturer, for setting up cylinder and systems production for Fuel Cell Electric Vehicles (FCEVs) in China and Southeast Asia.

Frequently Asked Questions (FAQ):

What are the factors influencing the growth of the FRP Vessels market?

Rising demand for natural gas vehicles in Asia Pacific.

Which is the largest country-level market for FRP Vessels market?

China is the largest FRP Vesselsmarket due to high demand from well-established end-use industries.

What are the factors contributing to the final price of FRP Vessels market?

Type of resin and fiber used in the manufacturing process and the end-use industry determine the final price FRP vessels market.

What are the challenges in the FRP Vessels market?

Lack of standardization in manufacturing process for FRP vessel is the major challenge for the FRP Vessels market. .

Which type of resin holds the largest market share?

Polyester resin type hold the largest share in terms of value and volume, in the FRP Vessels market.

How is the FRP Vessels market aligned?

The market is growing at the fastest pace. It is a potential market and many manufacturers are undertaking business strategies to expand their business.

Who are the major manufacturers?

Hexagon Composites ASA (Norway), Luxfer Group (England), Worthington Industries, Inc. (US), Everest Kanto Cylinders Ltd. (India), Quantum Fuel Systems LLC. (US), Faber Industrie SpA (Italy), Avanco Group (Germany), Shawcor Ltd (US), NOV Inc. (US), and Lianyungang Zhongfu Lianzhong Composites Group Co. Ltd. (China).

What is the biggest restraint in the FRP Vessels market?

High manufacturing cost and need for regulatory approvals in the FRP Vessels market. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 37)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS & EXCLUSIONS

1.3 MARKET SCOPE

FIGURE 1 FRP VESSELS MARKET SEGMENTATION

1.3.1 REGIONS COVERED

1.3.2 YEARS CONSIDERED

1.4 CURRENCY CONSIDERED

1.5 UNIT CONSIDERED

1.6 LIMITATIONS

1.7 STAKEHOLDERS

1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 41)

2.1 RESEARCH DATA

FIGURE 2 FRP VESSELS MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

2.1.2.1 Primary interviews - top FRP vessel manufacturers

2.1.2.2 Breakdown of primary interviews

2.1.2.3 Key industry insights

2.2 BASE NUMBER CALCULATION

2.2.1 APPROACH 1: SUPPLY-SIDE ANALYSIS

2.2.2 APPROACH 2: DEMAND-SIDE APPROACH

2.3 FORECAST NUMBER CALCULATION

2.3.1 SUPPLY SIDE

2.3.2 DEMAND SIDE

2.4 MARKET SIZE ESTIMATION

2.4.1 BOTTOM-UP APPROACH

FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.4.2 TOP-DOWN APPROACH

FIGURE 4 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

2.5 DATA TRIANGULATION

FIGURE 5 FRP VESSELS MARKET: DATA TRIANGULATION

2.6 FACTOR ANALYSIS

2.7 ASSUMPTIONS

2.8 LIMITATIONS & RISKS

3 EXECUTIVE SUMMARY (Page No. - 49)

FIGURE 6 POLYESTER RESIN SEGMENT DOMINATED OVERALL FRP VESSELS MARKET IN 2021

FIGURE 7 GLASS FIBER SEGMENT ACCOUNTED FOR LARGEST SHARE IN 2021

FIGURE 8 WATER & WASTEWATER APPLICATION ACCOUNTED FOR LARGEST SHARE OF FRP VESSELS MARKET IN 2021

FIGURE 9 ASIA PACIFIC HELD LARGEST SHARE OF FRP VESSELS MARKET IN 2021

4 PREMIUM INSIGHTS (Page No. - 53)

4.1 SIGNIFICANT OPPORTUNITIES FOR PLAYERS IN FRP VESSELS MARKET

FIGURE 10 FRP VESSELS MARKET TO WITNESS HIGH GROWTH IN ASIA PACIFIC BETWEEN 2022 AND 2027

4.2 FRP VESSELS MARKET, BY FIBER TYPE AND REGION, 2021

FIGURE 11 ASIA PACIFIC ACCOUNTED FOR LARGEST MARKET SHARE IN 2021

4.3 FRP VESSELS MARKET, BY RESIN TYPE, 2021

FIGURE 12 POLYESTER RESIN SEGMENT DOMINATED MARKET IN 2021

4.4 FRP VESSELS MARKET, BY APPLICATION, 2021

FIGURE 13 WATER & WASTEWATER APPLICATION ACCOUNTED FOR LARGEST MARKET SHARE IN 2021

4.5 FRP VESSELS MARKET GROWTH, BY KEY COUNTRIES

FIGURE 14 CHINA TO BE FASTEST-GROWING FRP VESSELS MARKET (2022–2027)

5 MARKET OVERVIEW (Page No. - 56)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN FRP VESSELS MARKET

5.2.1 DRIVERS

5.2.1.1 Increasing demand for FRP vessels in automotive industry

TABLE 1 COMPOSITES VS. STEEL

5.2.1.2 Growing use of FRP vessels in downstream oil & gas industry in US and Canada

5.2.1.3 Greater tax incentives for CNG vehicles and infrastructure

TABLE 2 INCREASE IN CNG/LNG VEHICLES AND INFRASTRUCTURE IN EUROPE

5.2.1.4 Rising demand for natural gas vehicles in Asia Pacific

5.2.2 RESTRAINTS

5.2.2.1 High manufacturing cost and need for regulatory approvals

5.2.3 OPPORTUNITIES

5.2.3.1 Growth of end-use industries in emerging economies

5.2.3.2 Development of low-weight FRP vessels for hydrogen-powered cars

5.2.4 CHALLENGES

5.2.4.1 Lack of standardization in manufacturing process for FRP vessels

5.2.4.2 Well-established infrastructure for electric cars

5.3 PORTER’S FIVE FORCES ANALYSIS

FIGURE 16 FRP VESSELS MARKET: PORTER’S FIVE FORCES ANALYSIS

5.3.1 BARGAINING POWER OF BUYERS

5.3.2 BARGAINING POWER OF SUPPLIERS

5.3.3 THREAT OF NEW ENTRANTS

5.3.4 THREAT OF SUBSTITUTES

5.3.5 INTENSITY OF COMPETITIVE RIVALRY

TABLE 3 FRP VESSELS MARKET: PORTER’S FIVE FORCES ANALYSIS

5.4 SUPPLY CHAIN ANALYSIS

TABLE 4 FRP VESSELS MARKET: SUPPLY CHAIN

5.5 KEY STAKEHOLDERS & BUYING CRITERIA

5.5.1 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 17 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS

TABLE 5 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS

5.5.2 BUYING CRITERIA

FIGURE 18 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

TABLE 6 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

5.6 TECHNOLOGY ANALYSIS

TABLE 7 FRP VESSEL MANUFACTURING PROCESS

5.7 ECOSYSTEM: FRP VESSELS MARKET

5.8 VALUE CHAIN ANALYSIS

FIGURE 19 VALUE CHAIN ANALYSIS

5.9 KEY MARKETS FOR IMPORT/EXPORT

5.9.1 US

5.9.2 CHINA

5.9.3 GERMANY

5.9.4 INDIA

5.10 PRICING ANALYSIS

5.11 AVERAGE SELLING PRICE OF KEY PLAYERS, BY APPLICATION

FIGURE 20 AVERAGE SELLING PRICE OF KEY PLAYERS FOR TOP THREE APPLICATIONS (USD/KG)

TABLE 8 AVERAGE SELLING PRICE OF KEY PLAYERS FOR TOP THREE APPLICATIONS (USD/TON)

5.12 AVERAGE SELLING PRICE

TABLE 9 FRP VESSELS AVERAGE SELLING PRICE, BY REGION

TABLE 10 FRP VESSELS AVERAGE SELLING PRICE, BY RESIN TYPE

TABLE 11 FRP VESSELS AVERAGE SELLING PRICE, BY FIBER TYPE

TABLE 12 FRP VESSELS AVERAGE SELLING PRICE, BY APPLICATION

5.13 FRP VESSELS MARKET: OPTIMISTIC, PESSIMISTIC, AND REALISTIC SCENARIOS

TABLE 13 FRP VESSELS MARKET: CAGR (BY VALUE) IN OPTIMISTIC, PESSIMISTIC, AND REALISTIC SCENARIOS

5.13.1 OPTIMISTIC SCENARIO

5.13.2 PESSIMISTIC SCENARIO

5.13.3 REALISTIC SCENARIO

5.14 TARIFF AND REGULATIONS

5.14.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 14 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 15 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 16 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 17 REST OF THE WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

5.15 KEY CONFERENCES

5.15.1 FRP VESSELS MARKET: CONFERENCES & EVENTS, 2022–2023

5.16 PATENT ANALYSIS

5.16.1 INTRODUCTION

5.16.2 METHODOLOGY

5.16.3 DOCUMENT TYPE

TABLE 18 FRP VESSELS MARKET: GLOBAL PATENTS

FIGURE 21 GLOBAL PATENT ANALYSIS, BY DOCUMENT TYPE

FIGURE 22 GLOBAL PATENT PUBLICATION TREND ANALYSIS: LAST 10 YEARS

5.16.4 INSIGHTS

5.16.5 LEGAL STATUS OF PATENTS

FIGURE 23 FRP VESSELS MARKET: LEGAL STATUS OF PATENTS

5.16.6 JURISDICTION ANALYSIS

FIGURE 24 GLOBAL JURISDICTION ANALYSIS

5.16.7 TOP APPLICANTS ANALYSIS

FIGURE 25 SEMICONDUCTOR ENERGY LABORATORY CO. LTD. HOLDS HIGHEST NUMBER OF PATENTS

5.16.8 PATENTS HELD BY 3M INNOVATIVE PROPERTIES COMPANY

5.16.9 PATENTS HELD BY TOYOTA JIDOSHA KABUSHIKI KAISHA

5.16.10 PATENTS HELD BY MICHELIN RECH TECH

5.16.11 TOP 10 PATENT OWNERS (US) IN LAST 10 YEARS

5.17 CASE STUDY ANALYSIS

5.18 TRENDS AND DISRUPTIONS IMPACTING CUSTOMERS

6 FRP VESSELS MARKET, BY FIBER TYPE (Page No. - 84)

6.1 INTRODUCTION

FIGURE 26 GLASS FIBER TO DOMINATE FRP VESSELS MARKET DURING FORECAST PERIOD

TABLE 19 FRP VESSELS MARKET SIZE, BY FIBER TYPE, 2018–2021 (USD MILLION)

TABLE 20 FRP VESSELS MARKET SIZE, BY FIBER TYPE, 2018–2021 (KILOTONS)

TABLE 21 FRP VESSELS MARKET SIZE, BY FIBER TYPE, 2022–2027 (USD MILLION)

TABLE 22 FRP VESSELS MARKET SIZE, BY FIBER TYPE, 2022–2027 (KILOTONS)

6.2 GLASS FIBER

6.2.1 WIDELY USED TO MANUFACTURE FRP VESSELS

FIGURE 27 ASIA PACIFIC TO HOLD LARGEST SHARE OF GLASS FIBER-BASED FRP VESSELS MARKET

6.2.2 GLASS FIBER-BASED FRP VESSELS MARKET, BY REGION

TABLE 23 GLASS FIBER -BASED FRP VESSELS MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 24 GLASS FIBER -BASED FRP VESSELS MARKET SIZE, BY REGION, 2018–2021 (KILOTONS)

TABLE 25 GLASS FIBER -BASED FRP VESSELS MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

TABLE 26 GLASS FIBER -BASED FRP VESSELS MARKET SIZE, BY REGION, 2022–2027 (KILOTONS)

6.3 CARBON FIBER

6.3.1 OFFERS GREATER STRENGTH AND STIFFNESS THAN OTHER REINFORCEMENT FIBERS

FIGURE 28 ASIA PACIFIC TO DOMINATE CARBON FIBER-BASED FRP VESSELS MARKET

6.3.2 CARBON FIBER-BASED FRP VESSELS MARKET, BY REGION

TABLE 27 CARBON FIBER-BASED FRP VESSELS MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 28 CARBON FIBER-BASED FRP VESSELS MARKET SIZE, BY REGION, 2018–2021 (KILOTONS)

TABLE 29 CARBON FIBER-BASED FRP VESSELS MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

TABLE 30 CARBON FIBER-BASED FRP VESSELS MARKET SIZE, BY REGION, 2022–2027 (KILOTONS)

6.4 OTHERS

6.4.1 ARAMID FIBER

6.4.2 BASALT FIBER

6.4.3 OTHER FIBER-BASED FRP VESSELS MARKET, BY REGION

TABLE 31 OTHER FIBER-BASED FRP VESSELS MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 32 OTHER FIBER-BASED FRP VESSELS MARKET SIZE, BY REGION, 2018–2021 (KILOTONS)

TABLE 33 OTHER FIBER-BASED FRP VESSELS MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

TABLE 34 OTHER FIBER-BASED FRP VESSELS MARKET SIZE, BY REGION, 2022–2027 (KILOTONS)

7 FRP VESSELS MARKET, BY RESIN TYPE (Page No. - 94)

7.1 INTRODUCTION

FIGURE 29 POLYESTER RESIN-BASED FRP VESSELS TO DOMINATE MARKET DURING FORECAST PERIOD

TABLE 35 FRP VESSELS MARKET SIZE, BY RESIN TYPE, 2018–2021 (USD MILLION)

TABLE 36 FRP VESSELS MARKET SIZE, BY RESIN TYPE, 2018–2021 (KILOTONS)

TABLE 37 FRP VESSELS MARKET SIZE, BY RESIN TYPE, 2022–2027 (USD MILLION)

TABLE 38 FRP VESSELS MARKET SIZE, BY RESIN TYPE, 2022–2027 (KILOTONS)

7.2 POLYESTER

7.2.1 RISING POPULARITY OWING TO COST-EFFECTIVENESS

FIGURE 30 ASIA PACIFIC EXPECTED TO BE LARGEST POLYESTER RESIN-BASED FRP VESSELS MARKET

7.2.2 POLYESTER RESIN-BASED FRP VESSELS MARKET, BY REGION

TABLE 39 POLYESTER RESIN-BASED FRP VESSELS MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 40 POLYESTER RESIN-BASED FRP VESSELS MARKET SIZE, BY REGION, 2018–2021 (KILOTONS)

TABLE 41 POLYESTER RESIN-BASED FRP VESSELS MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

TABLE 42 POLYESTER RESIN-BASED FRP VESSELS MARKET SIZE, BY REGION, 2022–2027 (KILOTONS)

7.3 EPOXY RESIN

7.3.1 GROWING DEMAND DUE TO EXCELLENT THERMAL AND MECHANICAL PROPERTIES

FIGURE 31 ASIA PACIFIC EXPECTED TO HOLD LARGEST SHARE OF EPOXY RESIN-BASED FRP VESSELS MARKET

7.3.2 EPOXY RESIN-BASED FRP VESSELS MARKET, BY REGION

TABLE 43 EPOXY RESIN-BASED FRP VESSELS MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 44 EPOXY RESIN-BASED FRP VESSELS MARKET SIZE, BY REGION, 2018–2021 (KILOTONS)

TABLE 45 EPOXY RESIN-BASED FRP VESSELS MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

TABLE 46 EPOXY RESIN-BASED FRP VESSELS MARKET SIZE, BY REGION, 2022–2027 (KILOTONS)

7.4 OTHERS

7.4.1 OTHER RESIN-BASED FRP VESSELS MARKET, BY REGION

TABLE 47 OTHER RESIN-BASED FRP VESSELS MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 48 OTHER RESIN-BASED FRP VESSELS MARKET SIZE, BY REGION, 2018–2021 (KILOTONS)

TABLE 49 OTHER RESIN-BASED FRP VESSELS MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

TABLE 50 OTHER RESIN-BASED FRP VESSELS MARKET SIZE, BY REGION, 2022–2027 (KILOTONS)

8 FRP VESSELS MARKET, BY APPLICATION (Page No. - 103)

8.1 INTRODUCTION

FIGURE 32 WATER & WASTEWATER EXPECTED TO BE LARGEST CONSUMER OF FRP VESSELS

TABLE 51 FRP VESSELS MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 52 FRP VESSELS MARKET SIZE, BY APPLICATION, 2018–2021 (KILOTONS)

TABLE 53 FRP VESSELS MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 54 FRP VESSELS MARKET SIZE, BY APPLICATION, 2022–2027 (KILOTONS)

8.2 AUTOMOTIVE & TRANSPORTATION

8.2.1 NEW FUEL TECHNOLOGY TO DRIVE USAGE OF FRP VESSELS

FIGURE 33 ASIA PACIFIC TO BE LARGEST FRP VESSELS MARKET IN AUTOMOTIVE & TRANSPORTATION APPLICATION

8.2.2 FRP VESSELS MARKET IN AUTOMOTIVE & TRANSPORTATION, BY REGION

TABLE 55 FRP VESSELS MARKET SIZE IN AUTOMOTIVE & TRANSPORTATION, BY REGION, 2018–2021 (USD MILLION)

TABLE 56 FRP VESSELS MARKET SIZE IN AUTOMOTIVE & TRANSPORTATION, BY REGION, 2018–2021 (KILOTONS)

TABLE 57 FRP VESSELS MARKET SIZE IN AUTOMOTIVE & TRANSPORTATION, BY REGION, 2022–2027 (USD MILLION)

TABLE 58 FRP VESSELS MARKET SIZE IN AUTOMOTIVE & TRANSPORTATION, BY REGION, 2022–2027 (KILOTONS)

8.3 OIL & GAS

8.3.1 INCREASING DEMAND FOR OIL & GAS TO DRIVE MARKET

FIGURE 34 ASIA PACIFIC TO BE LARGEST FRP VESSELS MARKET IN OIL & GAS APPLICATION

8.3.2 FRP VESSELS MARKET IN OIL & GAS, BY REGION

TABLE 59 FRP VESSELS MARKET SIZE IN OIL & GAS, BY REGION, 2018–2021 (USD MILLION)

TABLE 60 FRP VESSELS MARKET SIZE IN OIL & GAS, BY REGION, 2018–2021 (KILOTONS)

TABLE 61 FRP VESSELS MARKET SIZE IN OIL & GAS, BY REGION, 2022–2027 (USD MILLION)

TABLE 62 FRP VESSELS MARKET SIZE IN OIL & GAS, BY REGION, 2022–2027 (KILOTONS)

8.4 CHEMICAL

8.4.1 NEED FOR SPECIALIZED CONTAINERS FOR SPECIFIC APPLICATIONS

FIGURE 35 NORTH AMERICAN MARKET TO EXHIBIT SECOND-HIGHEST GROWTH RATE IN CHEMICAL APPLICATION

8.4.2 FRP VESSELS MARKET IN CHEMICAL, BY REGION

TABLE 63 FRP VESSELS MARKET SIZE IN CHEMICAL, BY REGION, 2018–2021 (USD MILLION)

TABLE 64 FRP VESSELS MARKET SIZE IN CHEMICAL, BY REGION, 2018–2021 (KILOTONS)

TABLE 65 FRP VESSELS MARKET SIZE IN CHEMICAL, BY REGION, 2022–2027 (USD MILLION)

TABLE 66 FRP VESSELS MARKET SIZE IN CHEMICAL, BY REGION, 2022–2027 (KILOTONS)

8.5 WATER & WASTEWATER

8.5.1 HIGH DEMAND FOR FRP VESSELS FOR STORAGE PURPOSES

FIGURE 36 NORTH AMERICA TO SHOW HIGHEST GROWTH IN WATER & WASTEWATER APPLICATION

8.5.2 FRP VESSELS MARKET IN WATER & WASTEWATER, BY REGION

TABLE 67 FRP VESSELS MARKET SIZE IN WATER & WASTEWATER, BY REGION, 2018–2021 (USD MILLION)

TABLE 68 FRP VESSELS MARKET SIZE IN WATER & WASTEWATER, BY REGION, 2018–2021 (KILOTONS)

TABLE 69 FRP VESSELS MARKET SIZE IN WATER & WASTEWATER, BY REGION, 2022–2027 (USD MILLION)

TABLE 70 FRP VESSELS MARKET SIZE IN WATER & WASTEWATER, BY REGION, 2022–2027 (KILOTONS)

8.6 INDUSTRIAL

FIGURE 37 ASIA PACIFIC DOMINATED INDUSTRIAL APPLICATION IN 2021

8.6.1 FRP VESSELS MARKET IN INDUSTRIAL, BY REGION

TABLE 71 FRP VESSELS MARKET SIZE IN INDUSTRIAL, BY REGION, 2018–2021 (USD MILLION)

TABLE 72 FRP VESSELS MARKET SIZE IN INDUSTRIAL, BY REGION, 2018–2021 (KILOTONS)

TABLE 73 FRP VESSELS MARKET SIZE IN INDUSTRIAL, BY REGION, 2022–2027 (USD MILLION)

TABLE 74 FRP VESSELS MARKET SIZE IN INDUSTRIAL, BY REGION, 2022–2027 (KILOTONS)

8.7 OTHERS

8.7.1 PULP & PAPER

8.7.2 PHARMACEUTICAL

8.7.3 FOOD PROCESSING

8.7.4 FRP VESSELS MARKET IN OTHER APPLICATIONS, BY REGION

TABLE 75 FRP VESSELS MARKET SIZE IN OTHER APPLICATIONS, BY REGION, 2018–2021 (USD MILLION)

TABLE 76 FRP VESSELS MARKET SIZE IN OTHER APPLICATIONS, BY REGION, 2018–2021 (KILOTONS)

TABLE 77 FRP VESSELS MARKET SIZE IN OTHER APPLICATIONS, BY REGION, 2022–2027 (USD MILLION)

TABLE 78 FRP VESSELS MARKET SIZE IN OTHER APPLICATIONS, BY REGION, 2022–2027 (KILOTONS)

9 FRP VESSELS MARKET, BY REGION (Page No. - 119)

9.1 INTRODUCTION

FIGURE 38 CHINA TO BE FASTEST-GROWING FRP VESSELS MARKET DURING FORECAST PERIOD

9.1.1 FRP VESSELS MARKET, BY REGION

TABLE 79 FRP VESSELS MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 80 FRP VESSELS MARKET SIZE, BY REGION, 2018–2021 (KILOTONS)

TABLE 81 FRP VESSELS MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

TABLE 82 FRP VESSELS MARKET SIZE, BY REGION, 2022–2027 (KILOTONS)

9.2 NORTH AMERICA

FIGURE 39 NORTH AMERICA: FRP VESSELS MARKET SNAPSHOT

9.2.1 NORTH AMERICA: FRP VESSELS MARKET, BY FIBER TYPE

TABLE 83 NORTH AMERICA: FRP VESSELS MARKET SIZE, BY FIBER TYPE, 2018–2021 (USD MILLION)

TABLE 84 NORTH AMERICA: FRP VESSELS MARKET SIZE, BY FIBER TYPE, 2018–2021 (KILOTONS)

TABLE 85 NORTH AMERICA: FRP VESSELS MARKET SIZE, BY FIBER TYPE, 2022–2027 (USD MILLION)

TABLE 86 NORTH AMERICA: FRP VESSELS MARKET SIZE, BY FIBER TYPE, 2022–2027 (KILOTONS)

9.2.2 NORTH AMERICA: FRP VESSELS MARKET, BY RESIN TYPE

TABLE 87 NORTH AMERICA: FRP VESSELS MARKET SIZE, BY RESIN TYPE, 2018–2021 (USD MILLION)

TABLE 88 NORTH AMERICA: FRP VESSELS MARKET SIZE, BY RESIN TYPE, 2018–2021 (KILOTONS)

TABLE 89 NORTH AMERICA: FRP VESSELS MARKET SIZE, BY RESIN TYPE, 2022–2027 (USD MILLION)

TABLE 90 NORTH AMERICA: FRP VESSELS MARKET SIZE, BY RESIN TYPE, 2022–2027 (KILOTONS)

9.2.3 NORTH AMERICA: FRP VESSELS MARKET, BY APPLICATION

TABLE 91 NORTH AMERICA: FRP VESSELS MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 92 NORTH AMERICA: FRP VESSELS MARKET SIZE, BY APPLICATION, 2018–2021 (KILOTONS)

TABLE 93 NORTH AMERICA: FRP VESSELS MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 94 NORTH AMERICA: FRP VESSELS MARKET SIZE, BY APPLICATION, 2022–2027 (KILOTONS)

9.2.4 NORTH AMERICA: FRP VESSELS MARKET, BY COUNTRY

TABLE 95 NORTH AMERICA: FRP VESSELS MARKET SIZE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 96 NORTH AMERICA: FRP VESSELS MARKET SIZE, BY COUNTRY, 2018–2021 (KILOTONS)

TABLE 97 NORTH AMERICA: FRP VESSELS MARKET SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 98 NORTH AMERICA: FRP VESSELS MARKET SIZE, BY COUNTRY, 2022–2027 (KILOTONS)

9.2.5 US

9.2.5.1 Largest FRP vessels market in North America

9.2.6 US: FRP VESSELS MARKET, BY APPLICATION

TABLE 99 US: FRP VESSELS MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 100 US: FRP VESSELS MARKET SIZE, BY APPLICATION, 2018–2021 (KILOTONS)

TABLE 101 US: FRP VESSELS MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 102 US: FRP VESSELS MARKET SIZE, BY APPLICATION, 2022–2027 (KILOTONS)

9.2.7 CANADA

9.2.7.1 Increasing demand from water & wastewater and automotive & transportation applications

9.2.8 CANADA: FRP VESSELS MARKET, BY APPLICATION

TABLE 103 CANADA: FRP VESSELS MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 104 CANADA: FRP VESSELS MARKET SIZE, BY APPLICATION, 2018–2021 (KILOTONS)

TABLE 105 CANADA: FRP VESSELS MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 106 CANADA: FRP VESSELS MARKET SIZE, BY APPLICATION, 2022–2027 (KILOTONS)

9.3 EUROPE

FIGURE 40 EUROPE: FRP VESSELS MARKET SNAPSHOT

9.3.1 EUROPE: FRP VESSELS MARKET, BY FIBER TYPE

TABLE 107 EUROPE: FRP VESSELS MARKET SIZE, BY FIBER TYPE, 2018–2021 (USD MILLION)

TABLE 108 EUROPE: FRP VESSELS MARKET SIZE, BY FIBER TYPE, 2018–2021 (KILOTONS)

TABLE 109 EUROPE: FRP VESSELS MARKET SIZE, BY FIBER TYPE, 2022–2027 (USD MILLION)

TABLE 110 EUROPE: FRP VESSELS MARKET SIZE, BY FIBER TYPE, 2022–2027 (KILOTONS)

9.3.2 EUROPE: FRP VESSELS MARKET, BY RESIN TYPE

TABLE 111 EUROPE: FRP VESSELS MARKET SIZE, BY RESIN TYPE, 2018–2021 (USD MILLION)

TABLE 112 EUROPE: FRP VESSELS MARKET SIZE, BY RESIN TYPE, 2018–2021 (KILOTONS)

TABLE 113 EUROPE: FRP VESSELS MARKET SIZE, BY RESIN TYPE, 2022–2027 (USD MILLION)

TABLE 114 EUROPE: FRP VESSELS MARKET SIZE, BY RESIN TYPE, 2022–2027 (KILOTONS)

9.3.3 EUROPE: FRP VESSELS MARKET, BY APPLICATION

TABLE 115 EUROPE: FRP VESSELS MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 116 EUROPE: FRP VESSELS MARKET SIZE, BY APPLICATION, 2018–2021 (KILOTONS)

TABLE 117 EUROPE: FRP VESSELS MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 118 EUROPE: FRP VESSELS MARKET SIZE, BY APPLICATION, 2022–2027 (KILOTONS)

9.3.4 EUROPE: FRP VESSELS MARKET, BY COUNTRY

TABLE 119 EUROPE: FRP VESSELS MARKET SIZE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 120 EUROPE: FRP VESSELS MARKET SIZE, BY COUNTRY, 2018–2021 (KILOTONS)

TABLE 121 EUROPE: FRP VESSELS MARKET SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 122 EUROPE: FRP VESSELS MARKET SIZE, BY COUNTRY, 2022–2027 (KILOTONS)

9.3.5 GERMANY

9.3.5.1 Largest FRP vessels market in Europe

9.3.6 GERMANY: FRP VESSELS MARKET, BY APPLICATION

TABLE 123 GERMANY: FRP VESSELS MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 124 GERMANY: FRP VESSELS MARKET SIZE, BY APPLICATION, 2018–2021 (KILOTONS)

TABLE 125 GERMANY: FRP VESSELS MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 126 GERMANY: FRP VESSELS MARKET SIZE, BY APPLICATION, 2022–2027 (KILOTONS)

9.3.7 FRANCE

9.3.7.1 Automotive & transportation sector to fuel market

9.3.8 FRANCE: FRP VESSELS MARKET, BY APPLICATION

TABLE 127 FRANCE: FRP VESSELS MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 128 FRANCE: FRP VESSELS MARKET SIZE, BY APPLICATION, 2018–2021 (KILOTONS)

TABLE 129 FRANCE: FRP VESSELS MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 130 FRANCE: FRP VESSELS MARKET SIZE, BY APPLICATION, 2022–2027 (KILOTONS)

9.3.9 UK

9.3.9.1 Significant use of FRP tanks for water & wastewater treatment

9.3.10 UK: FRP VESSELS MARKET, BY APPLICATION

TABLE 131 UK: FRP VESSELS MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 132 UK: FRP VESSELS MARKET SIZE, BY APPLICATION, 2018–2021 (KILOTONS)

TABLE 133 UK: FRP VESSELS MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 134 UK: FRP VESSELS MARKET SIZE, BY APPLICATION, 2022–2027 (KILOTONS)

9.3.11 ITALY

9.3.11.1 Rapid growth of NGV fleet to strengthen demand for FRP vessels

9.3.12 ITALY: FRP VESSELS MARKET, BY APPLICATION

TABLE 135 ITALY: FRP VESSELS MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 136 ITALY: FRP VESSELS MARKET SIZE, BY APPLICATION, 2018–2021 (KILOTONS)

TABLE 137 ITALY: FRP VESSELS MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 138 ITALY: FRP VESSELS MARKET SIZE, BY APPLICATION, 2022–2027 (KILOTONS)

9.3.13 SPAIN

9.3.13.1 Development of transportation industry to boost market

9.3.14 SPAIN: FRP VESSELS MARKET, BY APPLICATION

TABLE 139 SPAIN: FRP VESSELS MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 140 SPAIN: FRP VESSELS MARKET SIZE, BY APPLICATION, 2018–2021 (KILOTONS)

TABLE 141 SPAIN: FRP VESSELS MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 142 SPAIN: FRP VESSELS MARKET SIZE, BY APPLICATION, 2022–2027 (KILOTONS)

9.3.15 REST OF EUROPE

9.3.16 REST OF EUROPE: FRP VESSELS MARKET, BY APPLICATION

TABLE 143 REST OF EUROPE: FRP VESSELS MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 144 REST OF EUROPE: FRP VESSELS MARKET SIZE, BY APPLICATION, 2018–2021 (KILOTONS)

TABLE 145 REST OF EUROPE: FRP VESSELS MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 146 REST OF EUROPE: FRP VESSELS MARKET SIZE, BY APPLICATION, 2022–2027 (KILOTONS)

9.4 ASIA PACIFIC

FIGURE 41 ASIA PACIFIC: FRP VESSELS MARKET SNAPSHOT

9.4.1 ASIA PACIFIC: FRP VESSELS MARKET, BY FIBER TYPE

TABLE 147 ASIA PACIFIC: FRP VESSELS MARKET SIZE, BY FIBER TYPE, 2018–2021 (USD MILLION)

TABLE 148 ASIA PACIFIC: FRP VESSELS MARKET SIZE, BY FIBER TYPE, 2018–2021 (KILOTONS)

TABLE 149 ASIA PACIFIC: FRP VESSELS MARKET SIZE, BY FIBER TYPE, 2022–2027 (USD MILLION)

TABLE 150 ASIA PACIFIC: FRP VESSELS MARKET SIZE, BY FIBER TYPE, 2022–2027 (KILOTONS)

9.4.2 ASIA PACIFIC: FRP VESSELS MARKET, BY RESIN TYPE

TABLE 151 ASIA PACIFIC: FRP VESSELS MARKET SIZE, BY RESIN TYPE, 2018–2021 (USD MILLION)

TABLE 152 ASIA PACIFIC: FRP VESSELS MARKET SIZE, BY RESIN TYPE, 2018–2021 (KILOTONS)

TABLE 153 ASIA PACIFIC: FRP VESSELS MARKET SIZE, BY RESIN TYPE, 2022–2027 (USD MILLION)

TABLE 154 ASIA PACIFIC: FRP VESSELS MARKET SIZE, BY RESIN TYPE, 2022–2027 (KILOTONS)

9.4.3 ASIA PACIFIC: FRP VESSELS MARKET, BY APPLICATION

TABLE 155 ASIA PACIFIC: FRP VESSELS MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 156 ASIA PACIFIC: FRP VESSELS MARKET SIZE, BY APPLICATION, 2018–2021 (KILOTONS)

TABLE 157 ASIA PACIFIC: FRP VESSELS MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 158 ASIA PACIFIC: FRP VESSELS MARKET SIZE, BY APPLICATION, 2022–2027 (KILOTONS)

9.4.4 ASIA PACIFIC: FRP VESSELS MARKET, BY COUNTRY

TABLE 159 ASIA PACIFIC: FRP VESSELS MARKET SIZE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 160 ASIA PACIFIC: FRP VESSELS MARKET SIZE, BY COUNTRY, 2018–2021 (KILOTONS)

TABLE 161 ASIA PACIFIC: FRP VESSELS MARKET SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 162 ASIA PACIFIC: FRP VESSELS MARKET SIZE, BY COUNTRY, 2022–2027 (KILOTONS)

9.4.5 CHINA

9.4.5.1 Largest FRP vessels market in Asia Pacific

9.4.6 CHINA: FRP VESSELS MARKET, BY APPLICATION

TABLE 163 CHINA: FRP VESSELS MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 164 CHINA: FRP VESSELS MARKET SIZE, BY APPLICATION, 2018–2021 (KILOTONS)

TABLE 165 CHINA: FRP VESSELS MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 166 CHINA: FRP VESSELS MARKET SIZE, BY APPLICATION, 2022–2027 (KILOTONS)

9.4.7 JAPAN

9.4.7.1 Rising demand for small passenger cars to encourage use of composites

9.4.8 JAPAN: FRP VESSELS MARKET, BY APPLICATION

TABLE 167 JAPAN: FRP VESSELS MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 168 JAPAN: FRP VESSELS MARKET SIZE, BY APPLICATION, 2018–2021 (KILOTONS)

TABLE 169 JAPAN: FRP VESSELS MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 170 JAPAN: FRP VESSELS MARKET SIZE, BY APPLICATION, 2022–2027 (KILOTONS)

9.4.9 INDIA

9.4.9.1 Increasing awareness of benefits of CNG-powered vehicles to fuel market

9.4.10 INDIA: FRP VESSELS MARKET, BY APPLICATION

TABLE 171 INDIA: FRP VESSELS MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 172 INDIA: FRP VESSELS MARKET SIZE, BY APPLICATION, 2018–2021 (KILOTONS)

TABLE 173 INDIA: FRP VESSELS MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 174 INDIA: FRP VESSELS MARKET SIZE, BY APPLICATION, 2022–2027 (KILOTONS)

9.4.11 SOUTH KOREA

9.4.11.1 Government initiatives to promote fuel-efficient vehicles to drive demand for FRP vessels

9.4.12 SOUTH KOREA: FRP VESSELS MARKET, BY APPLICATION

TABLE 175 SOUTH KOREA: FRP VESSELS MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 176 SOUTH KOREA: FRP VESSELS MARKET SIZE, BY APPLICATION, 2018–2021 (KILOTONS)

TABLE 177 SOUTH KOREA: FRP VESSELS MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 178 SOUTH KOREA: FRP VESSELS MARKET SIZE, BY APPLICATION, 2022–2027 (KILOTONS)

9.4.13 REST OF ASIA PACIFIC

9.4.14 REST OF ASIA PACIFIC: FRP VESSELS MARKET, BY APPLICATION

TABLE 179 REST OF ASIA PACIFIC: FRP VESSELS MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 180 REST OF ASIA PACIFIC: FRP VESSELS MARKET SIZE, BY APPLICATION, 2018–2021 (KILOTONS)

TABLE 181 REST OF ASIA PACIFIC: FRP VESSELS MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 182 REST OF ASIA PACIFIC: FRP VESSELS MARKET SIZE, BY APPLICATION, 2022–2027 (KILOTONS)

9.5 MIDDLE EAST & AFRICA

9.5.1 MIDDLE EAST & AFRICA: FRP VESSELS MARKET, BY FIBER TYPE

TABLE 183 MIDDLE EAST & AFRICA: FRP VESSELS MARKET SIZE, BY FIBER TYPE, 2018–2021 (USD MILLION)

TABLE 184 MIDDLE EAST & AFRICA: FRP VESSELS MARKET SIZE, BY FIBER TYPE, 2018–2021 (KILOTONS)

TABLE 185 MIDDLE EAST & AFRICA: FRP VESSELS MARKET SIZE, BY FIBER TYPE, 2022–2027 (USD MILLION)

TABLE 186 MIDDLE EAST & AFRICA: FRP VESSELS MARKET SIZE, BY FIBER TYPE, 2022–2027 (KILOTONS)

9.5.2 MIDDLE EAST & AFRICA: FRP VESSELS MARKET, BY RESIN TYPE

TABLE 187 MIDDLE EAST & AFRICA: FRP VESSELS MARKET SIZE, BY RESIN TYPE, 2018–2021 (USD MILLION)

TABLE 188 MIDDLE EAST & AFRICA: FRP VESSELS MARKET SIZE, BY RESIN TYPE, 2018–2021 (KILOTONS)

TABLE 189 MIDDLE EAST & AFRICA: FRP VESSELS MARKET SIZE, BY RESIN TYPE, 2022–2027 (USD MILLION)

TABLE 190 MIDDLE EAST & AFRICA: FRP VESSELS MARKET SIZE, BY RESIN TYPE, 2022–2027 (KILOTONS)

9.5.3 MIDDLE EAST & AFRICA: FRP VESSELS MARKET, BY APPLICATION

TABLE 191 MIDDLE EAST & AFRICA: FRP VESSELS MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 192 MIDDLE EAST & AFRICA: FRP VESSELS MARKET SIZE, BY APPLICATION, 2018–2021 (KILOTONS)

TABLE 193 MIDDLE EAST & AFRICA: FRP VESSELS MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 194 MIDDLE EAST & AFRICA: FRP VESSELS MARKET SIZE, BY APPLICATION, 2022–2027 (KILOTONS)

9.5.4 MIDDLE EAST & AFRICA: FRP VESSELS MARKET, BY COUNTRY

TABLE 195 MIDDLE EAST & AFRICA: FRP VESSELS MARKET SIZE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 196 MIDDLE EAST & AFRICA: FRP VESSELS MARKET SIZE, BY COUNTRY, 2018–2021 (KILOTONS)

TABLE 197 MIDDLE EAST & AFRICA: FRP VESSELS MARKET SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 198 MIDDLE EAST & AFRICA: FRP VESSELS MARKET SIZE, BY COUNTRY, 2022–2027 (KILOTONS)

9.5.5 UAE

9.5.5.1 Fastest-growing FRP vessels market in Middle East & Africa

9.5.5.2 UAE: FRP VESSELS MARKET, BY APPLICATION

TABLE 199 UAE: FRP VESSELS MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 200 UAE: FRP VESSELS MARKET SIZE, BY APPLICATION, 2018–2021 (KILOTONS)

TABLE 201 UAE: FRP VESSELS MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 202 UAE: FRP VESSELS MARKET SIZE, BY APPLICATION, 2022–2027 (KILOTONS)

9.5.6 SAUDI ARABIA

9.5.6.1 Increasing demand for FRP vessels from oil industry

9.5.6.2 SAUDI ARABIA: FRP VESSELS MARKET, BY APPLICATION

TABLE 203 SAUDI ARABIA: FRP VESSELS MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 204 SAUDI ARABIA: FRP VESSELS MARKET SIZE, BY APPLICATION, 2018–2021 (KILOTONS)

TABLE 205 SAUDI ARABIA: FRP VESSELS MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 206 SAUDI ARABIA: FRP VESSELS MARKET SIZE, BY APPLICATION, 2022–2027 (KILOTONS)

9.5.7 SOUTH AFRICA

9.5.7.1 Growing demand for FRP vessels from mining and other industries

9.5.7.2 SOUTH AFRICA: FRP VESSELS MARKET, BY APPLICATION

TABLE 207 SOUTH AFRICA: FRP VESSELS MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 208 SOUTH AFRICA: FRP VESSELS MARKET SIZE, BY APPLICATION, 2018–2021 (KILOTONS)

TABLE 209 SOUTH AFRICA: FRP VESSELS MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 210 SOUTH AFRICA: FRP VESSELS MARKET SIZE, BY APPLICATION, 2022–2027 (KILOTONS)

9.5.8 REST OF MIDDLE EAST & AFRICA

9.5.8.1 REST OF MIDDLE EAST & AFRICA: FRP VESSELS MARKET, BY APPLICATION

TABLE 211 REST OF MIDDLE EAST & AFRICA: FRP VESSELS MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 212 REST OF MIDDLE EAST & AFRICA: FRP VESSELS MARKET SIZE, BY APPLICATION, 2018–2021 (KILOTONS)

TABLE 213 REST OF MIDDLE EAST & AFRICA: FRP VESSELS MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 214 REST OF MIDDLE EAST & AFRICA: FRP VESSELS MARKET SIZE, BY APPLICATION, 2022–2027 (KILOTONS)

9.6 LATIN AMERICA

9.6.1 LATIN AMERICA: FRP VESSELS MARKET, BY FIBER TYPE

TABLE 215 LATIN AMERICA: FRP VESSELS MARKET SIZE, BY FIBER TYPE, 2018–2021 (USD MILLION)

TABLE 216 LATIN AMERICA: FRP VESSELS MARKET SIZE, BY FIBER TYPE, 2018–2021 (KILOTONS)

TABLE 217 LATIN AMERICA: FRP VESSELS MARKET SIZE, BY FIBER TYPE, 2022–2027 (USD MILLION)

TABLE 218 LATIN AMERICA: FRP VESSELS MARKET SIZE, BY FIBER TYPE, 2022–2027 (KILOTONS)

9.6.2 LATIN AMERICA: FRP VESSELS MARKET, BY RESIN TYPE

TABLE 219 LATIN AMERICA: FRP VESSELS MARKET SIZE, BY RESIN TYPE, 2018–2021 (USD MILLION)

TABLE 220 LATIN AMERICA: FRP VESSELS MARKET SIZE, BY RESIN TYPE, 2018–2021 (KILOTONS)

TABLE 221 LATIN AMERICA: FRP VESSELS MARKET SIZE, BY RESIN TYPE, 2022–2027 (USD MILLION)

TABLE 222 LATIN AMERICA: FRP VESSELS MARKET SIZE, BY RESIN TYPE, 2022–2027 (KILOTONS)

9.6.3 LATIN AMERICA: FRP VESSELS MARKET, BY APPLICATION

TABLE 223 LATIN AMERICA: FRP VESSELS MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 224 LATIN AMERICA: FRP VESSELS MARKET SIZE, BY APPLICATION, 2018–2021 (KILOTONS)

TABLE 225 LATIN AMERICA: FRP VESSELS MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 226 LATIN AMERICA: FRP VESSELS MARKET SIZE, BY APPLICATION, 2022–2027 (KILOTONS)

9.6.4 LATIN AMERICA: FRP VESSELS MARKET, BY COUNTRY

TABLE 227 LATIN AMERICA: FRP VESSELS MARKET SIZE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 228 LATIN AMERICA: FRP VESSELS MARKET SIZE, BY COUNTRY, 2018–2021 (KILOTONS)

TABLE 229 LATIN AMERICA: FRP VESSELS MARKET SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 230 LATIN AMERICA: FRP VESSELS MARKET SIZE, BY COUNTRY, 2022–2027 (KILOTONS)

9.6.5 BRAZIL

9.6.5.1 Largest FRP vessels market in Latin America

9.6.5.2 BRAZIL: FRP VESSELS MARKET, BY APPLICATION

TABLE 231 BRAZIL: FRP VESSELS MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 232 BRAZIL: FRP VESSELS MARKET SIZE, BY APPLICATION, 2018–2021 (KILOTONS)

TABLE 233 BRAZIL: FRP VESSELS MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 234 BRAZIL: FRP VESSELS MARKET SIZE, BY APPLICATION, 2022–2027 (KILOTONS)

9.6.6 MEXICO

9.6.6.1 Increasing demand for FRP vessels from water & wastewater application

9.6.6.2 MEXICO: FRP VESSELS MARKET, BY APPLICATION

TABLE 235 MEXICO: FRP VESSELS MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 236 MEXICO: FRP VESSELS MARKET SIZE, BY APPLICATION, 2018–2021 (KILOTONS)

TABLE 237 MEXICO: FRP VESSELS MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 238 MEXICO: FRP VESSELS MARKET SIZE, BY APPLICATION, 2022–2027 (KILOTONS)

9.6.7 REST OF LATIN AMERICA

9.6.7.1 REST OF LATIN AMERICA: FRP VESSELS MARKET, BY APPLICATION

TABLE 239 REST OF LATIN AMERICA: FRP VESSELS MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 240 REST OF LATIN AMERICA: FRP VESSELS MARKET SIZE, BY APPLICATION, 2018–2021 (KILOTONS)

TABLE 241 REST OF LATIN AMERICA: FRP VESSELS MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 242 REST OF LATIN AMERICA: FRP VESSELS MARKET SIZE, BY APPLICATION, 2022–2027 (KILOTONS)

10 COMPETITIVE LANDSCAPE (Page No. - 184)

10.1 INTRODUCTION

10.2 MARKET SHARE ANALYSIS

FIGURE 42 SHARES OF TOP COMPANIES IN FRP VESSELS MARKET

TABLE 243 DEGREE OF COMPETITION: FRP VESSELS MARKET

10.3 MARKET RANKING

FIGURE 43 RANKING OF TOP FIVE PLAYERS IN FRP VESSELS MARKET

10.4 MARKET EVALUATION FRAMEWORK

TABLE 244 FRP VESSELS MARKET: PRODUCT LAUNCHES/DEALS, 2018–2022

TABLE 245 FRP VESSELS MARKET: OTHERS, 2018–2022

10.5 REVENUE ANALYSIS OF TOP MARKET PLAYERS

FIGURE 44 REVENUE ANALYSIS

10.6 COMPANY EVALUATION MATRIX

TABLE 246 COMPANY PRODUCT FOOTPRINT

TABLE 247 COMPANY APPLICATION FOOTPRINT

TABLE 248 COMPANY REGION FOOTPRINT

10.7 COMPETITIVE LANDSCAPE MAPPING

10.7.1 STARS

10.7.2 PERVASIVE PLAYERS

10.7.3 PARTICIPANTS

10.7.4 EMERGING LEADERS

FIGURE 45 FRP VESSELS MARKET (GLOBAL): COMPETITIVE LEADERSHIP MAPPING, 2021

10.7.5 STRENGTH OF PRODUCT PORTFOLIO

FIGURE 46 PRODUCT PORTFOLIO ANALYSIS OF TOP PLAYERS IN FRP VESSELS MARKET

10.7.6 BUSINESS STRATEGY EXCELLENCE

FIGURE 47 BUSINESS STRATEGY EXCELLENCE OF TOP PLAYERS IN FRP VESSELS MARKET

10.8 COMPETITIVE BENCHMARKING OF KEY START-UPS/SMES

TABLE 249 FRP VESSELS MARKET: KEY START-UPS/SMES

TABLE 250 FRP VESSELS MARKET: COMPETITIVE BENCHMARKING OF KEY START-UPS/SMES

10.9 SMALL AND MEDIUM-SIZED ENTERPRISES (SME) EVALUATION MATRIX

10.9.1 PROGRESSIVE COMPANIES

10.9.2 RESPONSIVE COMPANIES

10.9.3 DYNAMIC COMPANIES

10.9.4 STARTING BLOCKS

FIGURE 48 FRP VESSELS MARKET: SMALL AND MEDIUM-SIZED ENTERPRISES MAPPING, 2021

11 COMPANY PROFILES (Page No. - 202)

(Business Overview, Products Offered, Recent Developments, MnM View Right to win, Strategic choices made, Weaknesses and competitive threats) *

11.1 MAJOR PLAYERS

11.1.1 HEXAGON COMPOSITES ASA

TABLE 251 HEXAGON COMPOSITES ASA: COMPANY OVERVIEW

FIGURE 49 HEXAGON COMPOSITES ASA: COMPANY SNAPSHOT

11.1.2 LUXFER GROUP

TABLE 252 LUXFER GROUP: COMPANY OVERVIEW

FIGURE 50 LUXFER GROUP: COMPANY SNAPSHOT

11.1.3 WORTHINGTON INDUSTRIES INC.

TABLE 253 WORTHINGTON INDUSTRIES INC.: COMPANY OVERVIEW

FIGURE 51 WORTHINGTON INDUSTRIES INC.: COMPANY SNAPSHOT

11.1.4 EVEREST KANTO CYLINDERS LTD.

TABLE 254 EVEREST KANTO CYLINDERS LTD.: COMPANY OVERVIEW

FIGURE 52 EVEREST KANTO CYLINDERS LTD.: COMPANY SNAPSHOT

11.1.5 QUANTUM FUEL SYSTEMS LLC

TABLE 255 QUANTUM FUEL SYSTEMS LLC: COMPANY OVERVIEW

11.1.6 FABER INDUSTRIE SPA

TABLE 256 FABER INDUSTRIE SPA: COMPANY OVERVIEW

11.1.7 AVANCO GROUP

TABLE 257 AVANCO GROUP: COMPANY OVERVIEW

11.1.8 SHAWCOR LTD.

TABLE 258 SHAWCOR LTD.: COMPANY OVERVIEW

FIGURE 53 SHAWCOR LTD.: COMPANY SNAPSHOT

11.1.9 LIANYUNGANG ZHONGFU LIANZHONG COMPOSITES GROUP CO., LTD.

TABLE 259 LIANYUNGANG ZHONGFU LIANZHONG COMPOSITES GROUP CO. LTD.: COMPANY OVERVIEW

11.1.10 NOV INC.

TABLE 260 NOV INC.: COMPANY OVERVIEW

FIGURE 54 NOV INC.: COMPANY SNAPSHOT

11.2 OTHER COMPANIES

11.2.1 ULLIT SA

11.2.2 AGILITY FUEL SOLUTIONS

11.2.3 AUGUSTA FIBERGLASS

11.2.4 EPP COMPOSITES PVT. LTD.

11.2.5 ENDURO COMPOSITES INC.

11.2.6 JRMS ENGINEERING WORKS

11.2.7 CEVOTEC GMBH

11.2.8 NPROXX

11.2.9 STEELHEAD COMPOSITES, INC.

11.2.10 TIME TECHNOPLAST LTD.

11.2.11 COMPOMEX

11.2.12 DRAGERWERK AG & CO. KGAA

11.2.13 SAUDI ARABIAN AMIANTIT CO

11.2.14 KAYMO FIBER REINFORCED PLASTIC MANUFACTURE CO., LTD.

11.2.15 AERON COMPOSITES PVT. LTD.

*Details on Business Overview, Products Offered, Recent Developments, MnM View, Right to win, Strategic choices made, Weaknesses and competitive threats might not be captured in case of unlisted companies.

12 APPENDIX (Page No. - 234)

12.1 DISCUSSION GUIDE

12.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

12.3 CUSTOMIZATION OPTIONS

12.4 RELATED REPORTS

12.5 AUTHOR DETAILS

The study involves two major activities in estimating the current size of the FRP Vessels market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both the top-down and bottom-up approaches were employed to estimate the total market size. After that, market breakdown and data triangulation procedures were used to determine the extent of market segments and sub-segments.

Secondary Research

In the secondary research process, information was sourced from annual reports, press releases & investor presentations of companies, white papers, certified publications, trade directories, articles from recognized authors, gold standard and silver standard websites, and databases. Secondary research was used to obtain critical information about the industry's value chain, the total pool of key players, market classification, and segmentation according to industry trends to the bottom-most level and regional markets. It was also used to obtain information about the key developments from a market-oriented perspective.

Primary Research

The FRP vessels market comprises several stakeholders in the value chain, including raw material suppliers, processors, end-product manufacturers, and end users. Various primary sources from the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Primary sources from the demand side include key opinion leaders from various end-use applications of FRP vessels. Supply-side primary sources include experts from companies manufacturing FRP vessels.

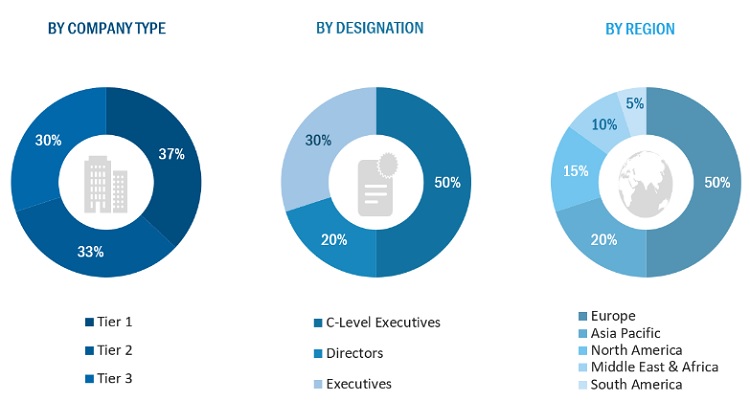

Following is the breakdown of primary respondents:

Notes: Tiers of companies are selected based on their ownership and revenues in 2021.

Others include sales managers, marketing managers, and product managers.

Source: Secondary Research, Expert Interviews, and MarketsandMarkets Analysis

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total FRP Vessels market. These methods were also used extensively to determine the size of various sub-segments in the market. The research methodology used to estimate the market size included the following:

- The key players in the industry and markets were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall FRP Vessels market size using the market size estimation processes as explained above, the market was split into several segments and sub-segments. To complete the whole market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides, mainly from the highways, bridges & buildings, marine structures & waterfronts and other applications.

Report Objectives

- To analyze and forecast the global FRP Vessels market size, in terms of volume and value

- To provide detailed information about the key factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market

- To analyze the market segmentation and forecast the market size based on resin type, fiber type, and applications.

- To analyze and forecast the market size based on five main regions, namely, Asia Pacific (APAC), Europe, North America, Middle East & Africa (MEA), and South America.

- To analyze the market with respect to individual growth trends, prospects, and contribution of submarkets to the total market

- To analyze the market opportunities and the competitive landscape for stakeholders and market leaders

- To analyze competitive developments such as expansions, partnership, agreement, new product/technology launch, joint venture, contract, and merger & acquisition in the market

- To profile key players and comprehensively analyze their market share and core competencies

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs.

The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of Rest of Asia Pacific FRP Vessels market

- Further breakdown of Rest of European FRP Vessels market

- Further breakdown of Rest of Middle East & Africa FRP Vessels market

- Further breakdown of Rest of South American FRP Vessels market

Company Information

- Detailed analysis and profiling of additional market players (up to 10)

FRP Market Overview

FRP Market Trends

Top Companies in FRP Market

FRP Market Impact on Different Industries

Speak to our Analyst today to know more about FRP Market!

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in FRP Vessels Market