Froth Flotation Equipment Market by Machine Type (Cell-to-Cell Flotation, and Free-Flow Flotation), Component, Application (Mineral & Ore Processing, Wastewater Treatment, and Paper Recycling), Region - Global Forecast to 2025

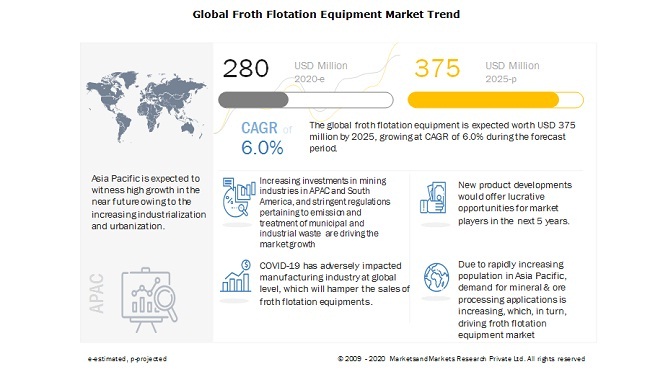

[135 Pages Report] The global froth flotation equipment market size is expected to grow from USD 280 million in 2020 to USD 375 million by 2025, at a Compound Annual Growth Rate (CAGR) of 6.0% during the forecast period. This high growth is due to the increasing investment in mining in APAC and South America and high demand in mineral & ore processing, wastewater treatment, and paper recycling applications.

To know about the assumptions considered Request for Free Sample Report, Request for Free Sample Report

COVID-19 Impact on the Global HTFs market

The outbreak of novel coronavirus (COVID-19) pandemic has affected people in more than 100 countries across the globe. According to the International Monetary Fund (IMF), the global economy is expected to shrink by 3.0% in 2020. According to IMF, the pandemic has forced the global economy into the worst ever recession since the Great Depression of the 1930s. Many countries are under strict lockdown, which has forced several sectors to shut down their operations. Due to lockdown, mining activities are at a halt, and this has reduced the demand for froth flotation equipment. In the second half of 2020, some countries have started to lift restrictions and gradually start business operations in various sectors. Even if the lockdown is being lifted, it will be challenging for the mining sector to get back to normal working conditions. This will subsequently affect the froth flotation equipment market

HTFs Market Dynamics

Driver: Increasing investments in mining industries in APAC and South America

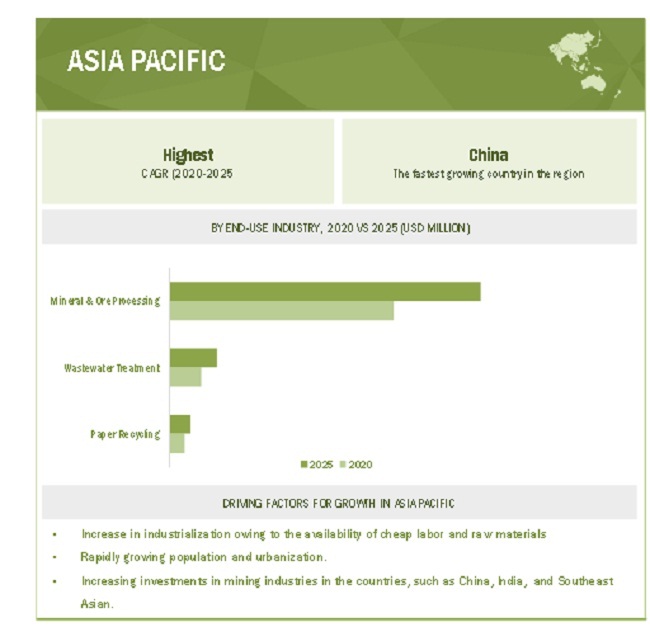

The growth of the global mining industry is a major factor boosting the demand for froth flotation equipment. Investments in mining and mineral processing industries in APAC and South America are driving the demand for flotation equipment in these regions. Rapid industrialization and urbanization in key countries such as China and India have spurred the demand for metals and minerals in the past few years. China is a leading producer of rare-earth metals, gold, copper, coal, limestone, and iron & steel, while India has witnessed significant investments in the iron & steel industry over the past few years.

South America is a high-growth region for the mining industry. It has become a preferred destination for mining investments by major global mining companies. Key countries such as Chile, Peru, and Brazil have large mining capacities and have witnessed increased investments from foreign companies over the past five years. The demand for metals and minerals from Asia is expected to drive the mining industry in Chile, with increasing investments from Indian and Chinese companies. Peru and Brazil are also attracting significant investments from foreign companies based in Canada, Australia, China, and India.

Restrain: Slow growth of mining industry in developed countries

Developed countries of North America and Europe have witnessed slow or negative growth in the mining industry over the past few years. In North America, factors such as stringent environmental regulations, high energy costs, weak domestic demand, and low profitability have contributed to the industry’s slow growth. Developed economies of Western Europe such as the UK, Germany, France, Italy, and Spain are not the preferred destinations for the mining and mineral processing industry. The global economic crisis in 2008 hit the mining industry in the region. The weak demand from key end-use industries such as infrastructure, transportation, and industrial equipment have resulted in a decline of the regional mining industry. Hence, the slow growth of the mining industry in these regions has hindered the froth flotation equipment market.

Opportunity: High demand for large flotation cells

In order to improve capital and operating costs per unit of metals produced, large size mining and mineral processing equipment were developed. The advantages of large size flotation cell are less floor space, low power consumption, low wear rate, high selectivity, reduction in reagent consumption, and easy start upon full load. Flotation columns are extensively installed in lead, zinc, molybdenum, gold, and sulfide ore flotation plants. Hence, many companies are more focused on the manufacturing of these large size flotation cell. This is expected to provide opportunities to the froth flotation equipment manufacturers.

Challenge: Environmental concerns related to mining industry

Mining operations routinely alter the surrounding landscape by exposing previously undisturbed earthen materials. It results in the erosion of exposed soils, extracted mineral ores, tailings, and fine materials in waste rock piles that can bring substantial sediment loading to surface waters and drainage ways. In addition, spills and leaks of hazardous chemicals, coupled with the deposition of contaminated windblown dust, contribute significantly to soil contamination. Conventional treatment processes are expensive and chemical-intensive. Consequently, the development of economical and effective treatment processes for mine-waste remediation is a critical issue facing the mining industry. These factors pose a challenge to the growth of the froth flotation equipment market.

By machine type, free-flow segment accounts for the fastest growing market during the forecast period

Free-flow flotation is the fastest-growing machine type segment in terms of value between 2020 and 2025. Free-flow flotation to witness high growth due to its increasing demand for various applications such as mineral & ore processing and wastewater treatment. These types of machines provide mineral beneficiation to achieve higher profits from their concentrate, lower shipping costs, decreasing plant footprint, and lower smelter penalties. Column flotation is one of the major machines used for free-flow flotation.

Mineral & ore processing application is projected to have the largest value market size during the forecast period

Mineral & Ore processing is the largest application of the froth flotation equipment market owing to increasing demand for good ore grades in the industry across the globe. The wastewater treatment segment is projected to register the highest CAGR during the forecast period. Some of the major factors driving this market are increased demand for better quality treated water, reduction in water wastage, and stringent environmental regulations. Recycling of water because of depleting freshwater resources is another important process where treatment is a necessary process.

To know about the assumptions considered for the study, download the pdf brochure

APAC is expected to account for the largest market size during the forecast period

Based on region, the froth flotation equipment market has been segmented into APAC, South America, North America, Europe & CIS, and Middle East & Africa. APAC froth flotation equipment market is the largest and fastest-growing market, owing to the increasing investments in the mining industries in this region. The growing demand from the mineral & ore processing and wastewater treatment is playing a crucial role in fueling the market. The favorable government initiatives of countries such as China and India are also expected to help the market growth in APAC. These factors are expected to lead to increasing demand for froth flotation equipment in the region during the forecast period.

Key Market Players

The major vendors in the froth flotation equipment market are Metso Outotec (Finland), JXSC (China), FLSmidth (US), Eriez Flotation (US), Yantai Jingpeng Mining Technology (China), SGS (Switzerland), Shandong Xinhai Mining Technology & Equipment (China), Tenova (Italy), Della Toffola (Italy), Prominer (China), EWAC (Czech Republic), Henan Fote Heavy Machinery (China), Shanghai Joyal Machinery (China), Westpro (Canada), and Zoneding (China).

Mesto Outotec (Finland) is a leading froth flotation equipment manufacturer. It is mainly focusing on low-cost production to serve emerging markets worldwide. The development of new products, along with merger, was a key strategy to penetrate the global froth flotation equipment market for the company. FLSmidth (US) global operations and regional brand identity have provided it a competitive edge in the market and opportunities to increase its revenues. Expansion of its downstream operation units with respect to the froth flotation equipment might enhance its global presence and help it meet the growing demand of the market.

Scope of the Report:

|

Report Metric |

Details |

|

Market size available for years |

2018-2025 |

|

Base year considered |

2019 |

|

Forecast period |

2020-2025 |

|

Forecast units |

Value(USD) |

|

Segments covered |

Machine Type, Application, and Region |

|

Geographies covered |

North America, APAC, Europe & CIS, South America, and Middle East & Africa |

|

Companies covered |

Metso Outotec (Finland), JXSC (China), Flsmidth (US), Eriez Flotation (US), Yantai Jingpeng Mining Technology (China). |

This research report categorizes the froth flotation equipment market based on machine type, application, and region.

Based on Machine Type:

- Cell-to-Cell Flotation

- Free-Flow Flotation

Based on Application:

- Mineral & Ore Processing

- Wastewater Treatment

- Paper Recycling

Based on Region:

- Asia Pacific

- Europe & CIS

- North America

- Middle East & Africa

- South America

Recent Developments

- In February 2020, Metso Outotec (Finland) launched a new product under the Outotec Tankcell S series which is designed to enhance throughput, grades, and recovery of ores with cost-effective standardized equipment. This product launch has widened the company’s product portfolio for froth flotation equipment.

- In July 2019, Metso Minerals and Outotec announced the merger to form a company named Metso Outotec. This development will result in formation of a leading company in minerals, metals, and aggregates industry that provides process technology, equipment, and services.

- In October 2019, FLSmidth and Rio Tinto (US) have executed a five-year, fixed term Global Framework Agreement (GFA) which enables the two companies to engage on the supply of fixed equipment, including mineral processing, material handling technologies, spare parts, consumables, maintenance, consultancy, and professional services.

Frequently Asked Questions (FAQ):

What is the current market size of the global froth flotation equipment market?

The global HTFs market is estimated to be USD 280.5 million in 2020 and projected to reach USD 375.4 million by 2025, at a CAGR of 6.0%

Which machine type of froth flotation equipment has a high demand in the market?

Free-flow flotation is the fastest-growing machine type segment in terms of value between 2020 and 2025. These types of machines provide mineral beneficiation to achieve higher profits from their concentrate, lower shipping costs, decreasing plant footprint, and lower smelter penalties. Column flotation is one of the major machines used for free-flow flotation.

How is the market dynamics changing for different applications of froth flotation equipment?

The wastewater treatment segment is projected to register the highest CAGR during the forecast period. Some of the major factors driving this market are increased demand for better quality treated water, reduction in water wastage, and stringent environmental regulations. Recycling of water because of depleting freshwater resources is another important process where treatment is a necessary process.

Who are the major manufacturers of froth flotation equipment?

Companies such as Metso Outotec, JXSC, FLSmidth, Eriez Flotation, Yantai Jingpeng Mining Technology are the major manufacturers of froth flotation equipment. These companies have a strong global distribution network and effective supply chain strategies. Such advantages give these companies an edge over other companies.

What is the COVID-19 impact on the froth flotation equipment market?

COVID-19 has proved to have an adverse effect on the mining sector. The lockdowns have caused delays in the upcoming projects due to supply chain disruptions, and already established plants have also stopped production due to the unavailability of manpower and issues in financing. Due to COVID-19, the current demand for mineral & ore processing, wastewater treatment, and paper recycling applications has dropped significantly. This has led to declining demand for froth flotation equipment in the global market. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 MARKET SCOPE

1.3.1 MARKET SEGMENTATION

1.3.2 REGIONS COVERED

1.3.3 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY

1.5 LIMITATIONS

1.6 STAKEHOLDERS

2 RESEARCH METHODOLOGY

2.1 RESEARCH DATA

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Key industry insights

2.1.2.3 Breakdown of primary interviews

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

2.3 DATA TRIANGULATION

2.3.1 FROTH FLOTATION EQUIPMENT MARKET ANALYSIS THROUGH PRIMARY INTERVIEWS

2.4 LIMITATIONS

2.5 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 ATTRACTIVE OPPORTUNITIES IN FROTH FLOTATION EQUIPMENT MARKET

4.2 FROTH FLOTATION EQUIPMENT MARKET, BY MACHINE TYPE

4.3 FROTH FLOTATION EQUIPMENT MARKET, BY APPLICATION

4.4 FROTH FLOTATION EQUIPMENT MARKET, BY KEY COUNTRIES

4.5 APAC FROTH FLOTATION EQUIPMENT MARKET, BY APPLICATION AND COUNTRY, 2019

5 MARKET OVERVIEW

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Increased investments in mining industry in APAC and South America

5.2.1.2 Stringent regulations pertaining to emission and treatment of municipal and industrial waste

5.2.2 RESTRAINTS

5.2.2.1 Slow growth of mining industry in developed countries

5.2.3 OPPORTUNITIES

5.2.3.1 High demand for large size flotation cells

5.2.3.2 Increase in wastewater treatment due to depleting freshwater resources

5.2.4 CHALLENGES

5.2.4.1 Environmental concerns related to mining industry

5.3 TECHNOLOGY ANALYSIS

5.4 PORTER'S FIVE FORCES

5.4.1 THREAT OF SUBSTITUTES

5.4.2 BARGAINING POWER OF SUPPLIERS

5.4.3 THREAT OF NEW ENTRANTS

5.4.4 BARGAINING POWER OF BUYERS

5.4.5 INTENSITY OF COMPETITIVE RIVALRY

5.5 IMPACT OF COVID-19 PANDEMIC OUTBREAK ON FROTH FLOTATION EQUIPMENT MARKET

5.6 MACROECONOMIC INDICATORS

5.6.1 GLOBAL GDP TRENDS AND FORECASTS

5.6.2 TRENDS IN MINING INDUSTRY

5.7 AVERAGE SELLING PRICE ANALYSIS

5.8 VALUE CHAIN ANALYSIS

5.9 CASE STUDY

6 FROTH FLOTATION EQUIPMENT MARKET, BY MACHINE TYPE

6.1 CELL-TO-CELL FLOTATION

6.1.1 CELL-TO-CELL H FLOTATION ARE MOST WIDELY USED FOR MINERAL & ORE PROCESSING

6.2 FREE-FLOW FLOTATION

6.2.1 LOW OPERATING COST INCREASING THE DEMAND

7 FROTH FLOTATION EQUIPMENT MARKET, BY COMPONENT

7.1 INTRODUCTION

7.2 FLOTATION CELLS

7.3 FLOTATION COLUMNS

7.4 SENSORS

7.4.1 LIST OF SENSOR SUPPLIERS

7.4.1.1 Metso Outotec (Finland)

7.4.1.2 Yokogawa Electric (Japan)

7.4.1.3 Endress+Hauser (Switzerland)

7.4.1.4 Foxboro (Schneider electric) (US)

7.4.1.5 Zeroday Enterprises (US)

7.4.1.6 Sensigent (US)

7.4.1.7 Process IQ Pty Ltd. (Australia)

7.4.1.8 Mintek (South Africa)

7.4.1.9 Greyline Instruments Inc. (US)

7.4.2 KEY DEVELOPMENTS UNDERTAKEN BY SENSOR SUPPLIERS

7.5 SPARGERS

7.6 OTHERS

8 FROTH FLOTATION EQUIPMENT MARKET, BY APPLICATION

8.1 INTRODUCTION

8.2 MINERAL & ORE PROCESSING

8.2.1 INCREASING DEMAND FOR GOOD GRADE ORES IN MINERAL & ORE INDUSTRY TO BOOST THE MARKET

8.3 WASTEWATER TREATMENT

8.3.1 INCREASING GLOBAL POPULATION AND INDUSTRIALIZATION RESULTING IN HIGH WASTEWATER TREATMENT

8.4 PAPER RECYCLING

8.4.1 INCREASING DEINKING PROCESS IN PULP & PAPER INDUSTRY TO BOOST THE MARKET

9 FROTH FLOTATION EQUIPMENT MARKET, BY REGION

9.1 INTRODUCTION

9.2 APAC

9.2.1 CHINA

9.2.1.1 Growing demand for base metals and precious metals to have positive impact on the market

9.2.2 AUSTRALIA

9.2.2.1 Australia to register second-fastest growth in APAC

9.2.3 INDIA

9.2.3.1 New government initiatives to drive the market

9.2.4 INDONESIA

9.2.4.1 Indonesia's mineral & ore processing industry driving the market

9.2.5 REST OF APAC

9.3 SOUTH AMERICA

9.3.1 BRAZIL

9.3.1.1 Brazil offers lucrative opportunities in froth flotation equipment market

9.3.2 CHILE

9.3.2.1 Strong growth in mineral & ore processing to fuel the market

9.3.3 PERU

9.3.3.1 Presence of major mining companies to boost the market

9.3.4 REST OF SOUTH AMERICA

9.4 NORTH AMERICA

9.4.1 US

9.4.1.1 Presence of strong mining industry and stringent regulations boosting the market

9.4.2 CANADA

9.4.2.1 Recovery of country's economy favorable for market growth

9.4.3 MEXICO

9.4.3.1 Large mining industry generates high demand for froth flotation equipment

9.5 EUROPE & CIS

9.5.1 RUSSIA

9.5.1.1 Increasing industrial output to drive the market

9.5.2 KAZAKHSTAN

9.5.2.1 Huge investments from major mining industries to drive the market

9.5.3 SWEDEN

9.5.3.1 Investments in iron ore beneficiation to drive froth flotation equipment market

9.5.4 POLAND

9.5.4.1 Large base metals reserves in the country to drive froth flotation equipment market

9.5.5 SPAIN

9.5.5.1 Wastewater treatment application will drive the froth flotation equipment market

9.5.6 REST OF EUROPE

9.6 MIDDLE EAST & AFRICA

9.6.1 SOUTH AFRICA

9.6.1.1 South Africa witnessing increasing foreign investment in mining & ore processing

9.6.2 IRAN

9.6.2.1 Exploration of new reserves to spur demand for froth flotation equipment

9.6.3 TURKEY

9.6.3.1 Increase in FDI in mining industry to increase the demand

9.6.4 REST OF MIDDLE EAST & AFRICA

10 COMPETITIVE LANDSCAPE

10.1 INTRODUCTION

10.2 COMPETITIVE LEADERSHIP MAPPING, 2020

10.2.1 VISIONARY LEADERS

10.2.2 INNOVATORS

10.2.3 DYNAMIC DIFFERENTIATORS

10.2.4 EMERGING PLAYERS

10.2.5 STRENGTH OF PRODUCT PORTFOLIO

10.2.6 BUSINESS STRATEGY EXCELLENCE

10.3 RANKING OF KEY PLAYERS

10.3.1 METSO OUTOTEC

10.3.2 JXSC

10.3.3 FLSMIDTH

10.3.4 ERIEZ FLOTATION

10.3.5 YANTAI JINGPENG MINING TECHNOLOGY

10.4 COMPETITIVE SCENARIO

10.4.1 NEW PRODUCT LAUNCH

10.4.2 INVESTMENT & EXPANSION

10.4.3 MERGERS

10.4.4 JOINT VENTURE

11 COMPANY PROFILES

11.1 METSO OUTOTEC

11.1.1 BUSINESS OVERVIEW

11.1.2 PRODUCTS OFFERED

11.1.3 RECENT DEVELOPMENTS

11.1.4 SWOT ANALYSIS

11.1.5 CURRENT FOCUS AND STRATEGIES

11.1.6 THREAT FROM COMPETITION

11.1.7 METSO OUTOTEC RIGHT TO WIN

11.2 JXSC

11.2.1 BUSINESS OVERVIEW

11.2.2 PRODUCTS OFFERED

11.2.3 SWOT ANALYSIS

11.2.4 CURRENT FOCUS AND STRATEGIES

11.2.5 THREAT FROM COMPETITION

11.2.6 JXSC RIGHT TO WIN

11.3 FLSMIDTH

11.3.1 BUSINESS OVERVIEW

11.3.2 PRODUCTS OFFERED

11.3.3 RECENT DEVELOPMENTS

11.3.4 SWOT ANALYSIS

11.3.5 CURRENT FOCUS AND STRATEGIES

11.3.6 THREAT FROM COMPETITORS

11.3.7 FLSMIDTH RIGHT TO WIN

11.4 ERIEZ FLOTATION

11.4.1 BUSINESS OVERVIEW

11.4.2 PRODUCTS OFFERED

11.4.3 RECENT DEVELOPMENTS

11.4.4 SWOT ANALYSIS

11.4.5 CURRENT FOCUS AND STRATEGIES

11.4.6 THREAT FROM COMPETITION

11.4.7 ERIEZ FLOTATION RIGHT TO WIN

11.5 YANTAI JINGPENG MINING MACHINERY

11.5.1 BUSINESS OVERVIEW

11.5.2 PRODUCTS OFFERED

11.5.3 SWOT ANALYSIS

11.5.4 CURRENT FOCUS AND STRATEGIES

11.5.5 THREAT FROM COMPETITION

11.5.6 YANTAI JINGPENG MINING TECHNOLOGY RIGHT TO WIN

11.6 SGS

11.6.1 BUSINESS OVERVIEW

11.6.2 PRODUCTS OFFERED

11.7 SHANDONG XINHAI MINING TECHNOLOGY & EQUIPMENT

11.7.1 BUSINESS OVERVIEW

11.7.2 PRODUCTS OFFERED

11.8 TENOVA

11.8.1 BUSINESS OVERVIEW

11.8.2 PRODUCTS OFFERED

11.9 DELLA TOFFOLA

11.9.1 BUSINESS OVERVIEW

11.9.2 PRODUCTS OFFERED

11.1 PROMINER

11.10.1 BUSINESS OVERVIEW

11.10.2 PRODUCTS OFFERED

12 ADDITIONAL COMPANY PROFILES

12.1 EWAC

12.2 HENAN FOTE HEAVY MACHINERY

12.3 SHANGHAI JOYAL MACHINERY

12.4 WESTPRO

12.5 ZONEDING

13 APPENDIX

13.1 DISCUSSION GUIDE

13.2 KNOWLEDGE STORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

13.3 AVAILABLE CUSTOMIZATIONS

13.4 RELATED REPORTS

13.5 AUTHOR DETAILS

LIST OF TABLES (45 Tables)

TABLE 1 APAC TO LEAD MINING CAPEX SURGE

TABLE 2 ANNUAL PERCENT CHANGE OF REAL GDP GROWTH RATES FROM 2016 TO 2021

TABLE 3 MINERALS PRODUCTION STATISTICS, BY REGION, 2014-2018 (BILLION METRIC TONS)

TABLE 4 FROTH FLOTATION EQUIPMENT MARKET SIZE, BY MACHINE TYPE, 2018-2025 (USD MILLION)

TABLE 5 FROTH FLOTATION EQUIPMENT MARKET SIZE, BY MACHINE TYPE, 2018-2025 (UNITS)

TABLE 6 FROTH FLOTATION EQUIPMENT MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 7 FROTH FLOTATION EQUIPMENT MARKET SIZE IN MINERAL & ORE PROCESSING, BY TYPE OF ORE, 2018-2025 (USD MILLION)

TABLE 8 FROTH FLOTATION EQUIPMENT MARKET SIZE, BY REGION, 2018-2025 (USD MILLION)

TABLE 9 FROTH FLOTATION EQUIPMENT MARKET SIZE, BY REGION, 2018-2025 (UNITS)

TABLE 10 APAC: FROTH FLOTATION EQUIPMENT MARKET SIZE, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 11 APAC: FROTH FLOTATION EQUIPMENT MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 12 CHINA: FROTH FLOTATION EQUIPMENT MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 13 AUSTRALIA: FROTH FLOTATION EQUIPMENT MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 14 INDIA: FROTH FLOTATION EQUIPMENT MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 15 INDONESIA: FROTH FLOTATION EQUIPMENT MARKET SIZE, BY APPLICATION, 2018-2025 (USD THOUSAND)

TABLE 16 REST OF APAC: FROTH FLOTATION EQUIPMENT MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 17 SOUTH AMERICA: FROTH FLOTATION EQUIPMENT MARKET SIZE, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 18 SOUTH AMERICA: FROTH FLOTATION EQUIPMENT MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 19 BRAZIL: FROTH FLOTATION EQUIPMENT MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 20 CHILE: FROTH FLOTATION EQUIPMENT MARKET SIZE, BY APPLICATION, 2018-2025 (USD THOUSAND)

TABLE 21 PERU: FROTH FLOTATION EQUIPMENT MARKET SIZE, BY APPLICATION, 2018-2025 (USD THOUSAND)

TABLE 22 REST OF SOUTH AMERICA: FROTH FLOTATION EQUIPMENT MARKET SIZE, BY APPLICATION, 2018-2025 (USD THOUSAND)

TABLE 23 NORTH AMERICA: FROTH FLOTATION EQUIPMENT MARKET SIZE, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 24 NORTH AMERICA: FROTH FLOTATION EQUIPMENT MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 25 US: FROTH FLOTATION EQUIPMENT SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 26 CANADA: FROTH FLOTATION EQUIPMENT MARKET SIZE, BY APPLICATION, 2018-2025 (USD THOUSAND)

TABLE 27 MEXICO: FROTH FLOTATION EQUIPMENT MARKET SIZE, BY APPLICATION, 2018-2025 (USD THOUSAND)

TABLE 28 EUROPE & CIS: FROTH FLOTATION EQUIPMENT MARKET SIZE, BY COUNTRY, 2018-2025 (USD THOUSAND)

TABLE 29 EUROPE & CIS: FROTH FLOTATION EQUIPMENT MARKET SIZE, BY APPLICATION, 2018-2025 (USD THOUSAND)

TABLE 30 RUSSIA: FROTH FLOTATION EQUIPMENT MARKET SIZE, BY APPLICATION, 2018-2025 (USD THOUSAND)

TABLE 31 KAZAKHSTAN: FROTH FLOTATION EQUIPMENT MARKET SIZE, BY APPLICATION, 2018-2025 (USD THOUSAND)

TABLE 32 SWEDEN: FROTH FLOTATION EQUIPMENT MARKET SIZE, BY APPLICATION, 2018-2025 (USD THOUSAND)

TABLE 33 POLAND: FROTH FLOTATION EQUIPMENT MARKET SIZE, BY APPLICATION, 2018-2025 (USD THOUSAND)

TABLE 34 SPAIN: FROTH FLOTATION EQUIPMENT MARKET SIZE, BY APPLICATION, 2018-2025 (USD THOUSAND)

TABLE 35 REST OF EUROPE: FROTH FLOTATION EQUIPMENT MARKET SIZE, BY APPLICATION, 2018-2025 (USD THOUSAND)

TABLE 36 MIDDLE EAST & AFRICA: FROTH FLOTATION EQUIPMENT MARKET SIZE, BY COUNTRY, 2018-2025 (USD THOUSAND)

TABLE 37 MIDDLE EAST & AFRICA: FROTH FLOTATION EQUIPMENT MARKET SIZE, BY APPLICATION, 2018-2025 (USD THOUSAND)

TABLE 38 SOUTH AFRICA: FROTH FLOTATION EQUIPMENT MARKET SIZE, BY APPLICATION, 2018-2025 (USD THOUSAND)

TABLE 39 IRAN: FROTH FLOTATION EQUIPMENT MARKET SIZE, BY APPLICATION, 2018-2025 (USD THOUSAND)

TABLE 40 TURKEY: FROTH FLOTATION EQUIPMENT MARKET SIZE, BY APPLICATION, 2018-2025 (USD THOUSAND)

TABLE 41 REST OF MIDDLE EAST & AFRICA: FROTH FLOTATION EQUIPMENT MARKET SIZE, BY APPLICATION, 2018-2025 (USD THOUSAND)

TABLE 42 NEW PRODUCT LAUNCH, 2016-2020

TABLE 43 INVESTMENT & EXPANSION, 2016-2020

TABLE 44 MERGERS, 2016-2020

TABLE 45 JOINT VENTURE, 2016-2020

LIST OF FIGURES (37 Figures)

FIGURE 1 FROTH FLOTATION EQUIPMENT MARKET: RESEARCH DESIGN

FIGURE 2 FROTH FLOTATION EQUIPMENT MARKET: DATA TRIANGULATION

FIGURE 1 FROTH FLOTATION EQUIPMENT MARKET ANALYSIS THROUGH SECONDARY INTERVIEWS

FIGURE 2 FROTH FLOTATION EQUIPMENT MARKET ANALYSIS

FIGURE 3 CELL-TO-CELL DOMINATED FROTH FLOTATION EQUIPMENT MARKET IN 2019

FIGURE 4 MINING & ORE PROCESSING APPLICATION TO LEAD FROTH FLOTATION EQUIPMENT MARKET

FIGURE 5 APAC ACCOUNTED FOR LARGEST MARKET SHARE IN 2019

FIGURE 6 HIGH GROWTH PROJECTED DURING THE FORECAST PERIOD

FIGURE 7 FREE-FLOW FLOTATION TO WITNESS HIGHER GROWTH DURING FORECAST PERIOD

FIGURE 8 MINERAL & ORE PROCESSING TO BE LARGEST APPLICATION OF FROTH FLOTATION EQUIPMENT

FIGURE 9 CHINA TO REGISTER HIGHEST CAGR IN GLOBAL FROTH FLOTATION EQUIPMENT MARKET

FIGURE 10 MINERAL & ORE PROCESSING ACCOUNTED FOR LARGEST SHARE IN APAC

FIGURE 11 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN FROTH FLOTATION EQUIPMENT MARKET

FIGURE 12 FROTH FLOTATION EQUIPMENT MARKET: PORTER'S FIVE FORCES ANALYSIS

FIGURE 13 FROTH FLOTATION EQUIPMENT VALUE CHAIN ANALYSIS

FIGURE 14 CELL-TO-CELL FLOTATION TO BE THE LEADING TYPE IN OVERALL MARKET

FIGURE 15 MINERAL & ORE PROCESSING TO BE LARGEST APPLICATION OF FROTH FLOTATION EQUIPMENT

FIGURE 16 APAC TO BE LARGEST AND FASTEST-GROWING FROTH FLOTATION EQUIPMENT MARKET

FIGURE 17 APAC: FROTH FLOTATION EQUIPMENT MARKET SNAPSHOT

FIGURE 18 SOUTH AMERICA: FROTH FLOTATION EQUIPMENT MARKET SNAPSHOT

FIGURE 19 NORTH AMERICA: FROTH FLOTATION EQUIPMENT MARKET SNAPSHOT

FIGURE 20 COMPANIES ADOPTED NEW PRODUCT LAUNCH AS THE KEY GROWTH STRATEGY BETWEEN 2016 AND 2020

FIGURE 21 FROTH FLOTATION EQUIPMENT MARKET: COMPETITIVE LEADERSHIP MAPPING, 2020

FIGURE 22 METSO OUTOTEC LED THE MARKET IN 2020

FIGURE 23 METSO OUTOTEC: COMPANY SNAPSHOT

FIGURE 24 METSO OUTOTEC: SWOT ANALYSIS

FIGURE 25 JXSC: COMPANY SNAPSHOT

FIGURE 26 JXSC: SWOT ANALYSIS

FIGURE 27 FLSMIDTH: COMPANY SNAPSHOT

FIGURE 28 FLSMIDTH: SWOT ANALYSIS

FIGURE 29 ERIEZ FLOTATION: COMPANY SNAPSHOT

FIGURE 30 ERIEZ FLOTATION: SWOT ANALYSIS

FIGURE 31 YANTAI JINGPENG MINING MACHINERY: COMPANY SNAPSHOT

FIGURE 32 YANTAI JINGPENG MINING TECHNOLOGY: SWOT ANALYSIS

FIGURE 33 SGS: COMPANY SNAPSHOT

FIGURE 34 SHANDONG XINHAI MINING TECHNOLOGY & EQUIPMENT: COMPANY SNAPSHOT

FIGURE 35 TENOVA: COMPANY SNAPSHOT

FIGURE 36 DELLA TOFFOLA: COMPANY SNAPSHOT

FIGURE 37 PROMINER: COMPANY SNAPSHOT

The study involved four major activities in estimating the current market size of froth flotation equipment. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and sub-segments.

Secondary Research

In the secondary research process, various secondary sources such as Hoovers, Bloomberg Business Week, Factiva, World Bank, and Industry Journals have been referred to identify and collect information for this study. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, and databases.

Primary Research

The froth flotation equipment market comprises several stakeholders, such as raw material suppliers, processors, end-product manufacturers, and regulatory organizations in the supply chain. The demand side of this market is characterized by the development of the mineral & ore processing, wastewater treatment, and Paper recycling applications. The supply side is characterized by advancements in technology and diverse application industries. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following the breakdown of primary respondents –

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the froth flotation equipment market. These methods were also used extensively to estimate the size of various sub-segments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets have been identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and sub-segments. In order to complete the overall market engineering process and arrive at the exact statistics of each market segment and sub-segment, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the mineral & ore processing, wastewater treatment, and paper recycling applications.

Report Objectives

- To define, segment, and project the global market size for froth flotation equipment

- To provide detailed information about the key factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To analyze the micromarkets with respect to individual growth trends, future prospects, and their contribution to the total market

- To project the size of the market and its submarkets, in terms of value, with respect to the four regions (along with their respective key countries)

- To profile key players and comprehensively analyze their core competencies

- To understand the competitive landscape and identify major growth strategies adopted by players across key regions

- To analyze the competitive developments such as expansions & investments, new product launches, mergers & acquisitions, joint ventures, and agreements in the froth flotation equipment market

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of the Rest of Europe & CIS market into Ukraine, the UK, and Greece

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Growth opportunities and latent adjacency in Froth Flotation Equipment Market