Food Safety Testing Automation Market By Testing Type (Microbiological Testing, Chemical Testing, Physical Testing, Nutritional Testing, Others), Technology (Robotics, Software Solutions, IOT, And Sensors), End-User (Food Processors, Testing Laboratories, Regulatory Agencies), And Region - Global Forecast To 2029

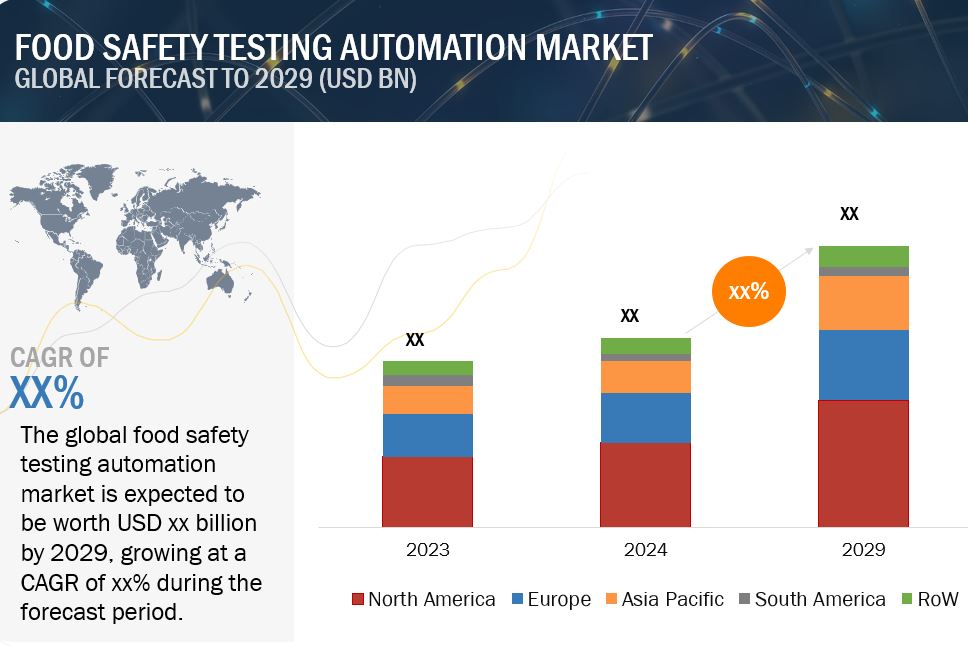

The global food safety testing automation market growth is on a trajectory of significant expansion, with an estimated value projected to reach USD XX.X billion by 2029 from the 2024 valuation of USD XX.X billion, displaying a promising Compound Annual Growth Rate (CAGR) of X.X%. The rapidly growing food safety testing automation market is attributed to the rising regulatory pressure, advanced technology, and rising consumer awareness regarding the food safety. Governments regulations are becoming more stringent. This also calls for a faster and reliable method for the testing of the increased requirement of the global population to acquire food. Increasingly, emerging markets are also embracing automation in production toward enhancing their food production capacity and international standards. In general, the market is likely to grow significantly because businesses look for cost-effective solutions that help with saving on labour costs and reduced human error in food safety testing.

Food Safety Testing Automation Market Trends

Market Dynamics

Drivers:

Various regulatory compliances

Regulatory compliance is a significant driver for the food safety testing automation market due to the implementation of stringent food safety laws and standards aimed at protecting public health. While regulatory bodies can demand more tests, exposing companies to the risk of fines and product recall, they also compel them to expand their dependency on automated testing solutions as the number of demanded tests increases. Traceability and reports also become easier since it allows accurate documentation, which is required during audits. Furthermore, automated systems eradicate human error which creates room for inconsistency and unreliability of test results, of which the compliance culture cannot afford such a thing. As global trade grows, it becomes relatively hard to deal with diverse International regulatory needs thus, the automation of such systems further fuels its importance in the food safety testing landscape. In essence, regulatory compliance drives the demand for automation but shapes the practices in food safety.

Restraints:

Complexity in testing techniques hinders food safety testing automation market.

Automated systems are complex in nature and require specific knowledge and training, making it difficult for companies to either find or develop personnel with that know-how. Further, owing to the diversity of various pathogens and contaminants, multi-step testing techniques become complicated and creates complications in automation process and comprehensive solutions. Incorporation of a new technology into the laboratory processes is technically challenging, time-consuming, and may even prove to be operationally hindering. Validation and calibration of an automated system for accuracy requirements involve huge efforts that are considered resource-intensive, hence discouraging companies from shifting towards automation. Furthermore, the testing method's high complexity may make it difficult for firms to match the stipulated regulatory standards, not only because accurate and reliable automated solutions require explicit requirements.

Opportunities:

Technological advancements.

Technological advancements are anticipated to drive the food safety testing automation market more in the coming years. For example, innovation in automation technology with robotics, AI, and machine learning have been improving the speed of the testing process with more accurate results so that pathogens and contaminants could be detected with utmost speed. This leads to an efficient flow, saving much time in testing and analysis, which is critical in food production, as it is all fast paced. Newer analytical methods, including real-time PCR and biosensors, now offer increased sensitivity with more reliable detection which can often enable a safety issue to be detected before it is serious. Technologies such as these become progressively more accessible and affordable, thereby further encouraging greater adoption across the industry, even among smaller-scale producers.

Challenges:

High implementation cost hinders market growth.

The major challenge for the food safety testing automation market is that its implementation incurs relatively high costs. The main reason behind this lies in the high cost required as initial investment for advanced automation technologies-for example, robotics, AI systems, or specialized testing equipment. Therefore, it can sometimes be challenging for small companies or new firms with low budgets to adopt automated solutions that may advance their testing capabilities.

Besides, the cost also revolves around the tools, which incurs costs of setting them up, training people, and routine service and maintenance. Companies may be subjected to a heavy investment of their resources so that their employees are well trained to work and maintain the complex automated systems; budgets are further stretched.

Market Ecosystem

Microbiological Testing Segment Accounted For A Higher Market Share Among Testing Type Segment In 2023.

Microbiological testing segment accounts for a relatively larger part of the food safety testing automation market. The testing of microbiological samples will form the highest share in the food safety testing automation market for a variety of compelling reasons. Stricter regulations concerning food safety require periodic tests for harmful pathogens such as Salmonella, E. coli, and Listeria, which makes compliance necessary for food manufacturers to avoid fines and product recalls. Demand for reliable testing has been further spurred by consumer awareness and concern over foodborne illness, as consumers have come to demand the highest standards of safety. The speed and accuracy with which methodologies and automated platforms improve in the rapid testing detection of pathogens give companies the pace to rapidly respond to possible safety issues. Moreover, the world is witnessing more production and processing of food; therefore, there is a potential need to embrace efficient microbiological testing for quality assurance as well as safety in food products.

The Software Solutions Segment Is Projected To Be The Dominant During The Forecast Period In By Technolgy Segment.

The software solutions segments is projected to be a dominant segment. Advanced analytics can be rich sources of inputs that could provide trend and compliance insights, further aiding companies in optimizing their testing processes. At the same time, the software can connect with automated testing equipment to be able to monitor and control protocols real-time, which helps in improving efficiency across the board. Again, from a regulatory point of view, software helps in ensuring compliance through documentation tools, reporting, and traceability that minimize chances of human error, hence making auditing easier.

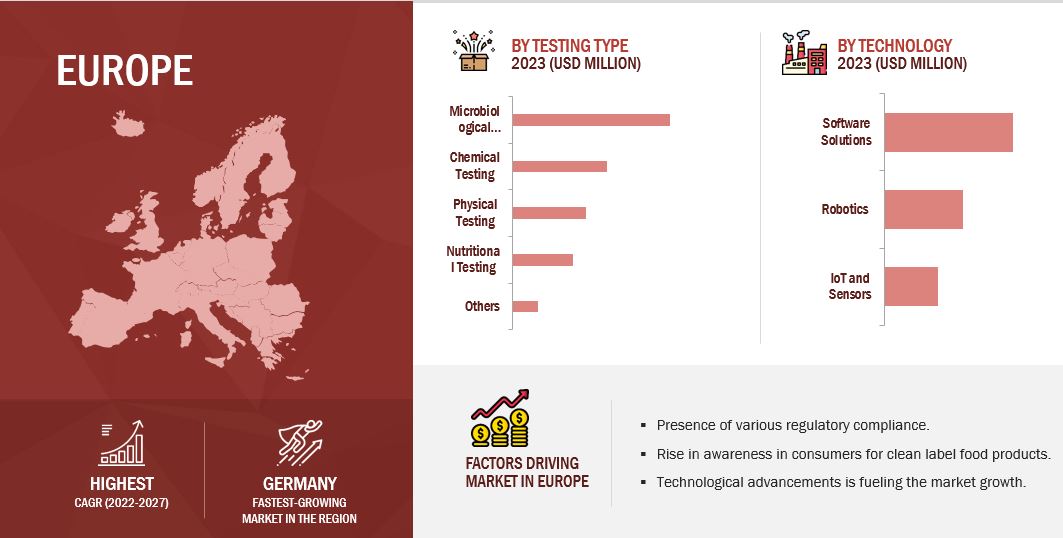

European Region Is Expected To Dominate For Food Safety Testing Automation Market Among The Regions.

The Europe food safety testing automation market is growing substantially. Increased food safety regulations across European countries are making such testing and compliance more stringent, thus propelling demand. Additionally, increased awareness on foodborne illnesses and the quality of food products among consumers has made them seek more transparency as well as assurance regarding food safety. In response to these needs, manufacturers have had to adopt automated testing technology. Technological advancement, like the faster methods of testing, artificial intelligence, and advanced data analytics are making food safety testing fast and accurate. Therefore, this has stimulated investment in automation. Not only the trend, but also with the high production rate of food coupled with the rapid trade going on in the region, proper testing solution provision to ensure food safety across markets is a requirement. Also, government initiatives and investment in improved food safety infrastructure motivate the uptake of automation in testing processes.

Key Market Players

The key players in this market include Cotecna (Switzerland), FOSS (Denmark), GOAUDITS (US), SGS (Switzerland), Agilent Technologies, Inc (US), IFOODDS (US), Mérieux Nutrisciences (US), Inspectly Holdings OÜ (Finland), SMARTFOODSAFE (Canada), Safefood 360° (Dublin), JR automation (US), KUKA AG (Germany), Invert Robotics (Ireland), SCIEX (US).

Recent Developments

- In July 2024, Alden announced new food safety testing technology. Its new suspended simultaneous sandwich assay (SSSA) aims to be a breakthrough in food safety and quality testing the industry has been waiting for, and it fits in the palm of your hand.

- In September 2024, NEMIS Technologies is preparing to enter the U.S. food safety industry with its innovative on-site testing technology aimed at reducing contamination risks in food production. The company has partnered with major brands in Europe, including Barilla, and in Africa with companies like Tiger Brands. They are focused on providing rapid, actionable results to help food manufacturers make immediate decisions and prevent large-scale recalls.

Frequently Asked Questions (FAQ):

What is the current size of the food safety testing automation market?

The food safety testing automation market forecast is estimated at USD XX.X billion in 2024 and is projected to reach USD XX.X billion by 2029, at a CAGR of X.X% from 2024 to 2029.

Which are the key players in the market, and how intense is the competition?

Food safety testing automation market players include Cotecna (Switzerland), FOSS (Denmark), GOAUDITS (US), SGS (Switzerland), Agilent Technologies, Inc (US), IFOODDS (US), Mérieux Nutrisciences (US), Inspectly Holdings OÜ (Finland), SMARTFOODSAFE (Canada), Safefood 360° (Dublin), JR automation (US), KUKA AG (Germany), Invert Robotics (Ireland), SCIEX (US). These companies boast reliable food safety testing automation facilities alongside robust distribution networks spanning crucial regions. They possess a well-established portfolio of esteemed services, commanding a sturdy market presence supported by sound business strategies. Additionally, they hold substantial market share, offer services with versatile applications, cater to a diverse geographical clientele, and maintain an extensive service range.

Which region is projected to account for the largest share of the food safety testing automation market?

The Europe holds the largest market share in food safety testing automation market it is driven due to the implementation of stringent food safety laws and standards aimed at protecting public health.

What kind of information is provided in the company profile section?

The company profiles mentioned above offer valuable information such as a comprehensive business overview, including details on the company's various business segments, financial performance, geographical reach, revenue composition, and the breakdown of their business revenue. Additionally, these profiles offer insights into the company's product offerings, significant milestones, and expert analyst perspectives to further explain the company's potential.

What are the growth prospects for the food safety testing automation market in the next five years?

Technological advancements are anticipated to drive the food safety testing automation market more in the coming years. For example, innovation in automation technology with robotics, AI, and machine learning have been improving the speed of the testing process with more accurate results so that pathogens and contaminants could be detected with utmost speed.

TABLE OF CONTENTS

1 INTRODUCTION

Growth opportunities and latent adjacency in Food Safety Testing Automation Market