Food Pathogen Safety Testing Equipment and Supplies Market by Type (Systems, Test Kits, and Microbial Culture Media), Site (In-House, Outsourcing Facility, and Government Labs), Food Tested and Region - Global Forecast to 2028

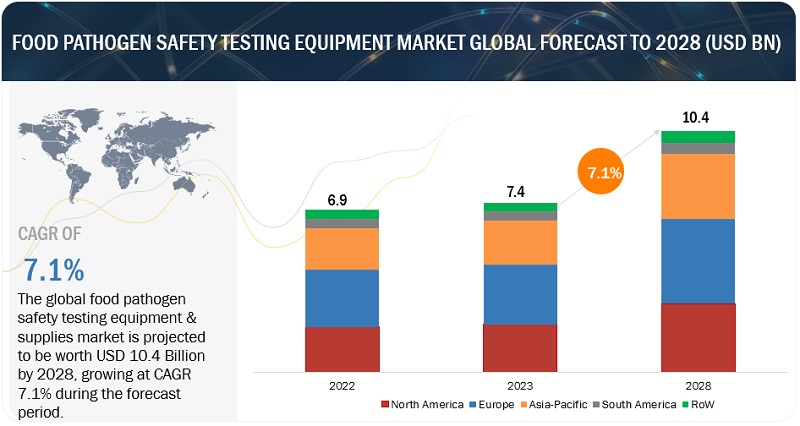

[307 Pages Report] The food pathogen safety testing equipment and supplies market is estimated to be valued at USD 7.4 billion in 2023 and is projected to reach USD 10.4 billion by 2028, at a CAGR of 7.1% from 2023 to 2028.

The food pathogen safety testing equipment and supplies market is experiencing significant global growth due to growing concerns about food safety and its impact on consumer health. Stricter regulations and high-profile foodborne illness outbreaks have increased public awareness, driving the demand for advanced testing solutions. The European region's food industry, known for its strict food safety regulations, demands robust testing procedures to maintain the integrity of its food supply chain. As the food industry expands, the risk of contamination increases, prompting food manufacturers and suppliers to invest in advanced testing technologies. Advancements in testing technology, such as PCR and NGS, have revolutionized the field of food pathogen safety testing, enabling rapid and accurate detection of pathogens. Consumer awareness and demand for safe food products are driving market growth in Europe, with consumers willing to pay a premium for products with higher safety standards. Supportive government initiatives, financial backing, and infrastructure upgrades encourage businesses to adopt modern testing methodologies, leading to market expansion.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Drivers: Food manufacturers' growing emphasis on food quality and protecting brand reputation

Food manufacturers face increasing pressure to protect their brand reputation and gain consumer trust due to the devastating impact of pathogen-contaminated foods on public health and brand image. The presence of harmful pathogens like Salmonella, E. coli, and Listeria in food products can lead to severe consequences, including widespread illnesses, product recalls, lawsuits, and irreversible damage to consumer trust. Consumers today are more vigilant and vocal, making it crucial for manufacturers to prioritize food safety and minimize the risk of contamination. High-profile cases of foodborne illnesses traced back to specific brands have resulted in a loss of consumer confidence, reduced sales, and even the demise of once-thriving businesses. The proliferation of social media and online review platforms has amplified the impact of negative publicity, making investing in rigorous pathogen safety testing a strategic imperative to protect its brand reputation and maintain its competitive edge in the market.

In response to these challenges, food manufacturers are embracing innovative food pathogen safety testing equipment and supplies. These technologies offer rapid and accurate detection of pathogens, enabling manufacturers to identify potential issues early in the production process. Comprehensive testing at various stages of production helps pinpoint the source of contamination and prevent tainted products from reaching consumers. Proactive measures, such as partnering with accredited third-party laboratories for independent safety evaluations, add an extra layer of assurance and demonstrate a commitment to transparency and consumer safety. By demonstrating a relentless dedication to food safety, manufacturers can build and sustain consumer trust, cultivate brand loyalty, and achieve long-term success.

Restraints: Risks of contamination during testing procedures

Ensuring food safety is essential to protect public health, but testing for food pathogens carries inherent contamination risks, compromising result accuracy. Manufacturers of testing equipment and supplies face challenges in minimizing these risks and enhancing safety. One significant risk is cross-contamination, where pathogens from one sample infect subsequent ones or equipment due to inadequate cleaning and handling. Additionally, the introduction of external pathogens during sample collection, transportation, and storage can compromise sample integrity and result accuracy. Equipment and supplies must also be of high quality and well-maintained to avoid harboring pathogens that undermine testing results. Overcoming contamination risks is challenging due to the complexity of the testing process, high sample volumes, and the constant evolution of foodborne pathogens, necessitating continuous research and advanced testing methods. Collaborative efforts are essential among stakeholders to implement stringent protocols and innovative technology to fortify the testing process and ensure a safer food supply.

Opportunities: Growing budgetary focus on ensuring food safety

Recent instances of foodborne illnesses and contaminations have sparked a paradigm shift in how consumers perceive food safety. Governments around the world are allocating more significant resources to bolster their food safety programs, including robust pathogen testing measures. This renewed commitment has provided a favorable environment for businesses operating in the food pathogen safety testing sector. The growing budgetary focus on food safety has driven manufacturers to invest heavily in research and development, leading to innovative solutions and technological advancements. Innovative testing equipment with enhanced sensitivity, accuracy, and rapid detection capabilities is now in demand. Companies are competing to provide innovative equipment and supplies that meet the stringent requirements of food safety regulators and cater to the needs of food processors and laboratories alike.

Challenges: Rapidly evolving pathogen strains

The food pathogen safety testing equipment and supplies market face formidable challenges due to the rapid evolution of pathogen strains, such as bacteria, viruses, and parasites. These strains can mutate and develop resistance mechanisms, rendering current testing methods less effective. For example, Escherichia coli 0157:H7 has evolved into new strains with heightened virulence and antibiotic resistance, leading to significant hurdles for the market and increasing the risk of foodborne outbreaks.

One major challenge is the limited detection capabilities of existing equipment and supplies. Rapidly evolving pathogen strains have unique genetic characteristics that may not be detected by current methods, resulting in false negatives and increased outbreak risks. Developing new testing protocols is crucial, but it requires substantial research, validation, and regulatory approval, posing financial challenges for manufacturers and end-users. Production and distribution of testing equipment and supplies are also vulnerable to the impacts of evolving pathogens. Outbreaks in manufacturing facilities or along the supply chain can disrupt availability, exemplified by the global shortage of critical reagents for PC-based testing methods.

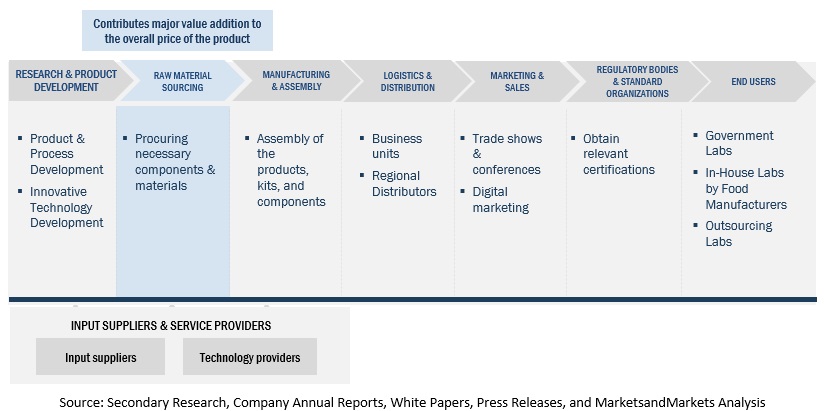

Food Pathogen Safety Testing Equipment and Supplies Market: Value Chain Analysis

Ecosystem Analysis

The market ecosystem for food pathogen safety testing equipment and supplies encompasses various stakeholders and components involved in the production, distribution, and end users of food pathogen safety testing equipment and supplies products. Various regulatory bodies are also involved in this market, and they are one of the significant stakeholders.

Ecosystem Map

Based on food tested, the meat & poultry sub-segment is estimated to account for the largest market share of the food pathogen safety testing equipment and supplies market.

The meat & poultry segment has established its dominance in the food pathogen safety testing equipment and supplies market. This prominent position can be attributed to the unique characteristics of meat and poultry products, which make them highly susceptible to pathogen contamination. Their high protein content and moisture levels create an optimal environment for microbial growth, necessitating stringent testing measures to ensure consumer safety.

Due to the significant contribution of meat and poultry to the global food industry and the substantial consumption volumes, the demand for specialized equipment and supplies for pathogen testing remains consistently high. Stringent food safety regulations and the increasing focus of consumers on the quality and safety of food products further bolster the need for thorough testing in this segment. Regular pathogen testing not only prevents potential outbreaks and foodborne illnesses but also protects the reputation of food producers and maintains consumer confidence in the safety of meat and poultry products.

Based on site, the outsourcing facilities sub-segment is anticipated to dominate as well as grow at the highest CAGR in the food pathogen safety testing equipment and supplies market.

Food producers are increasingly requesting rapid testing technology to speed up results and speed up supply chain operations. Additionally, compared to conventional technology, quick procedures have improved accuracy, sensitivity, and the capacity to test a wide range of pollutants while concurrently generating accurate results. For instance, a new technology that can create and instantly dispense culture media for use in microbiological food testing was introduced by Millipore Sigma, a US, and Canadian-based Life Science business unit of the chemical corporation Merck KGaA, in April 2022. The newly developed technology, known as the ReadyStream system, offers producers increased testing effectiveness and does away with the standard microbiological testing process' five steps.

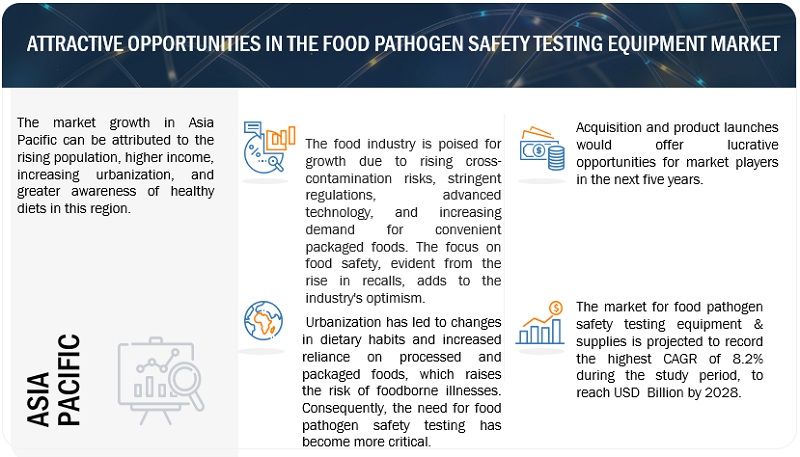

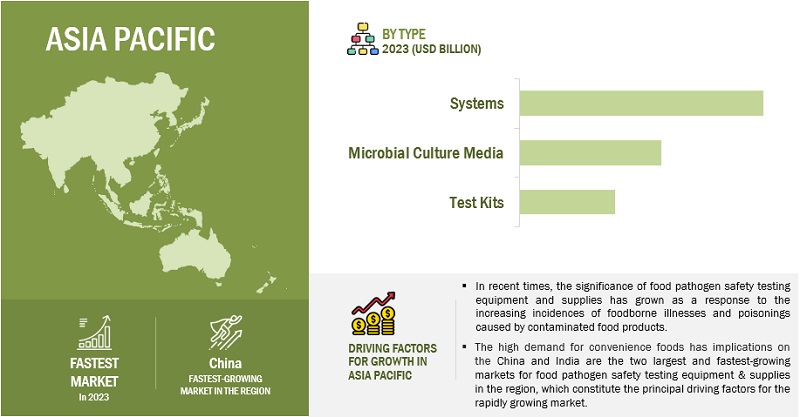

Asia Pacific is estimated to grow at the highest CAGR in the food pathogen safety testing equipment and supplies market.

With the region’s vast population, rapid urbanization, and increasing disposable incomes, there is a growing demand for safe and high-quality food products, prompting the food industry to invest in advanced pathogen safety testing equipment to comply with stringent regulations and ensure consumer trust. Additionally, Asia Pacific countries have been actively working to strengthen their food safety standards, fostering the adoption of advanced testing technologies. The thriving food and beverage industry in the region further fuels the demand for efficient testing methods to monitor and control potential contaminants. Technological advancements and international collaborations have also facilitated the development and dissemination of innovative and cost-effective testing solutions in the region.

Key Market Players

Thermo Fisher Scientific Inc. (US), Bio-Rad Laboratories, Inc. (US), Merck KGaA (Germany), Neogen Corporation (US), BIOMÉRIEUX (France), Agilent Technologies, Inc. (US), QIAGEN (Germany), and Shimadzu Corporation (Japan) are among the key players in the global food pathogen safety testing equipment and supplies market. To increase their company's revenues and market shares, companies are focusing on launching new products, developing partnerships, and expanding their research & production facilities. The key strategies used by companies in the food pathogen safety testing equipment and supplies market include geographical expansion to tap the potential of emerging economies, strategic acquisitions to gain a foothold over the extensive supply chain, and new product launches as a result of extensive research and development (R&D) initiatives.

Scope of the Report

|

Report Metric |

Details |

|

Market size estimation |

2023–2028 |

|

Base year considered |

2022 |

|

Forecast period considered |

2023–2028 |

|

Units considered |

Value (USD) |

|

Segments Covered |

By Type, By Food Tested, By Site, and By Region |

|

Regions covered |

North America, Europe, Asia Pacific, South America, and RoW |

|

Companies studied |

|

Food Pathogen Safety Testing Equipment and supplies Market:

By Type

- Systems

- Test Kits

- Microbial culture Media

By Food Tested

- Meat & Poultry

- Fish & Seafood

- Dairy

- Processed Food

- Fruits & Vegetables

- Cereals & Grains

- Other Food Products

By Site

- In-house (Factory Labs)

- Outsourcing Facility (Service Labs)

- Government Labs

By Region

- North America

- Europe

- Asia Pacific

- South America

- Rest of the World (RoW)

Other food products includes nuts, spices, seeds, colors, flavors, preservatives, and thickening agents.

RoW includes the Middle East & Africa.

Recent Developments

- In September 2022, Neogen Corporation (US) completed its merger with US-based 3M’s food safety business to strengthen its position as one of the major leaders in the food safety business. This merger helped both companies expand their geographical footprint as well as product offerings.

- In April 2022, Thermo Fisher Scientific (US) expanded its research & development facility in Hyderabad, India, to focus on instrument design and create innovative products. This strategy can help the company come up with innovative and technologically advanced products in the field of food pathogen safety testing.

- In February 2019, BIOMÉRIEUX (France) acquired Invisible Sentinel Inc., a Philadelphia-based company that develops and markets molecular diagnostic tools for the rapid, accurate, and reliable detection of pathogens and spoilage organisms in food and beverage. This acquisition helped BIOMÉRIEUX strengthen its position in food pathogen safety testing and spoilage organism detection by widening its product offerings and expanding to new customer segments.

Frequently Asked Questions (FAQ):

Which region is projected to account for the largest share of the food pathogen safety testing equipment and supplies market?

The Europe region accounted for the largest share, in terms of value, of USD 2.6 billion, of the global food pathogen safety testing equipment and supplies market in 2022 and is expected to grow at a CAGR of 6.7%.

What is the current size of the global food pathogen safety testing equipment and supplies market?

The food pathogen safety testing equipment and supplies market is estimated at USD 7.42 billion in 2023 and is projected to reach USD 10.46 billion by 2028, at a CAGR of 7.1% from 2023 to 2028.

Which are the key players in the market?

The key players in this market include Thermo Fisher Scientific Inc. (US), Bio-Rad Laboratories, Inc. (US), Merck KGaA (Germany), Neogen Corporation (US), BIOMÉRIEUX (France), Agilent Technologies, Inc. (US), QIAGEN (Germany), and Shimadzu Corporation (Japan).

What are the factors driving the food pathogen safety testing equipment and supplies market?

Food manufacturers' growing emphasis on food quality and protecting brand reputation and introduction of stringent food safety regulations and standards by governments.

Which segment by food tested accounted for the largest food pathogen safety testing equipment and supplies market share?

The meat & poultry segment dominated the market for food pathogen safety testing equipment and supplies market and was valued at USD 2.81 billion in 2022. The global increase in meat consumption and related food products is what is fueling the expansion. Meat and poultry are regarded as excellent sources of proteins hence, the rising need for food pathogen safety testing equipment and supplies.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MACROECONOMIC INDICATORSGLOBALIZATION OF FOOD TRADERISING HEALTH AWARENESS

-

5.3 MARKET DYNAMICSDRIVERS- Growing emphasis on food quality and protecting brand reputation- Introduction of stringent food safety regulations and standards- Rise in foodborne illnessesRESTRAINTS- High equipment cost- Risk of contamination during food testing proceduresOPPORTUNITIES- Growing demand for food testing in emerging markets- Integration of advanced technologies- Increasing focus on importance of food safetyCHALLENGES- Rapidly evolving pathogen strains- Complex testing methods- Standardization of testing protocols

- 6.1 INTRODUCTION

-

6.2 TARIFF AND REGULATORY LANDSCAPEREGULATORY FRAMEWORK- Global Food Safety Initiative (GFSI)- North America- Europe- Asia Pacific- South America- Rest of the WorldREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

-

6.3 PATENT ANALYSIS

- 6.4 TRADE ANALYSIS

- 6.5 AVERAGE SELLING PRICE ANALYSIS

-

6.6 VALUE CHAIN ANALYSISRESEARCH AND PRODUCT DEVELOPMENTRAW MATERIAL SOURCINGMANUFACTURING AND ASSEMBLYLOGISTICS AND DISTRIBUTIONMARKETING AND SALESREGULATORY BODIES AND STANDARDS ORGANIZATIONSEND USERS

- 6.7 SUPPLY CHAIN ANALYSIS

-

6.8 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

-

6.9 ECOSYSTEM ANALYSIS

-

6.10 CASE STUDY ANALYSISBCN RESEARCH LABORATORIES PARTNERED WITH BIOMÉRIEUX TO INTRODUCE GENE-UP SYSTEMS FOR FOOD SAFETY TESTINGEUROFINS COLLABORATED WITH RHEONIX TO INTRODUCE RHEONIX LISTERIA PATTERNALERT ASSAY

-

6.11 PORTER’S FIVE FORCES ANALYSISINTENSITY OF COMPETITIVE RIVALRYBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSTHREAT OF SUBSTITUTESTHREAT OF NEW ENTRANTS

-

6.12 TECHNOLOGY ANALYSISBIOSENSORSNANOSENSORSLANTHANIDE-BASED ASSAYSLECTIN-BASED BIOSENSOR TECHNOLOGYMICROARRAYS

-

6.13 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

- 6.14 KEY CONFERENCES AND EVENTS, 2023–2024

- 7.1 INTRODUCTION

-

7.2 SYSTEMSHYBRIDIZATION-BASED- Need for high analytical precision in food testing to drive adoption of hybridization-based systems- Polymerase chain reaction (PCR)- Gene amplifiersCHROMATOGRAPHY-BASED- Focus on detecting chemical contaminants in food to encourage use of chromatography-based techniques- High-performance liquid chromatography (HPLC)- Liquid chromatography- Gas chromatography- Other chromatography-based systemsSPECTROMETRY-BASED- Growing demand to gain analytical approach to food pathogen testing to drive marketIMMUNOASSAY-BASED- Focus on building ability to test multiple samples to drive use of immunoassay-based systems

-

7.3 TEST KITSNEED FOR USER-FRIENDLY AND EFFICIENT FOOD TESTING SOLUTIONS TO BOOST GROWTH

-

7.4 MICROBIAL CULTURE MEDIAGROWING DEMAND FOR ADVANCED TECHNOLOGIES TO DRIVE ADOPTION OF FOOD SAFETY TESTING SOLUTIONS

- 8.1 INTRODUCTION

-

8.2 MEAT & POULTRYRISING GLOBAL MEAT AND POULTRY CONSUMPTION TO SPUR DEMAND

-

8.3 FISH & SEAFOODGROWING RISK OF CONTAMINATION OF FISH AND SEAFOOD DUE TO SUPPLY CHAIN COMPLEXITIES TO DRIVE MARKET

-

8.4 DAIRY PRODUCTSMOUNTING CASES OF LISTERIOSIS AND OTHER PATHOGEN-RELATED ILLNESSES IN DAIRY PRODUCTS TO STIMULATE MARKET DEMAND

-

8.5 PROCESSED FOODPROCESSED FOODS’ SUSCEPTIBILITY TO PATHOGEN CONTAMINATION TO DRIVE DEMAND FOR SAFETY TESTING EQUIPMENT

-

8.6 FRUITS & VEGETABLESMULTIPLE OUTBREAKS ASSOCIATED WITH PATHOGENS IN FRUITS AND VEGETABLES TO FUEL MARKET GROWTH

-

8.7 CEREALS & GRAINSGROWING RISK OF CROSS-CONTAMINATION DUE TO WIDE APPLICATION OF CEREALS AND GRAINS IN FOOD INDUSTRY TO BOOST MARKET

- 8.8 OTHER FOOD PRODUCTS

- 9.1 INTRODUCTION

-

9.2 IN-HOUSE LABORATORIES (FACTORY LABS)NEED TO MAINTAIN BRAND REPUTATION AND CONSUMER TRUST TO DRIVE USE OF IN-HOUSE LABORATORIES

-

9.3 OUTSOURCING FACILITIES (SERVICE LABS)NEED TO ACCESS SPECIALIZED EXPERTISE AND ADVANCED TECHNOLOGIES TO DRIVE DEMAND FOR OUTSOURCING LABORATORIES

-

9.4 GOVERNMENT LABSINDEPENDENT AND IMPARTIAL TESTING PROVIDED BY GOVERNMENT LABS TO FUEL MARKET GROWTH

- 10.1 INTRODUCTION

- 10.2 RECESSION MACROINDICATORS

-

10.3 NORTH AMERICANORTH AMERICA: RECESSION IMPACT ANALYSISUS- Stringent food safety regulations to stimulate marketCANADA- Government initiatives aimed at reducing pathogens in meat and poultry to boost growthMEXICO- Growing food exports to US and need for stringent safety measures to boost market

-

10.4 EUROPEEUROPE: RECESSION IMPACT ANALYSISGERMANY- Rising concerns over foodborne illnesses to drive marketFRANCE- Prevalence of multiple product recalls in country to stimulate growthUK- Government funding and support initiatives for tracking foodborne pathogens to propel marketITALY- Thriving tourism and hospitality industry to boost growthSPAIN- Ongoing struggle with listeriosis and other foodborne illnesses to spur growthPOLAND- Growing dairy industry and exports to Ukraine to drive growthREST OF EUROPE

-

10.5 ASIA PACIFICASIA PACIFIC: RECESSION IMPACT ANALYSISCHINA- Government regulations and certifications for food safety to propel marketJAPAN- Rising incidences of food poisoning and increased food safety tests to drive marketINDIA- Growing food processing market to boost demand for food pathogen testing equipmentAUSTRALIA & NEW ZEALAND- Fear of outbreaks of Salmonella and E. coli to boost demand for food pathogen testing equipmentSOUTHEAST ASIA- Increasing awareness regarding safety and quality of food to encourage adoption of food pathogen testing equipmentREST OF ASIA PACIFIC

-

10.6 SOUTH AMERICASOUTH AMERICA: RECESSION IMPACT ANALYSISBRAZIL- Booming food processing industry to spur marketARGENTINA- Awareness among consumers regarding mounting cases of foodborne illnesses to contribute to market growthREST OF SOUTH AMERICA

-

10.7 REST OF THE WORLDROW: RECESSION IMPACT ANALYSISMIDDLE EAST- Heavy reliance on imported foods to drive demand for food pathogen safety testing equipmentAFRICA- Increasing international collaborations dedicated to elevating food safety standards to drive demand

- 11.1 OVERVIEW

- 11.2 MARKET SHARE ANALYSIS, 2022

- 11.3 REVENUE ANALYSIS FOR KEY PLAYERS

- 11.4 ANNUAL REVENUE VS. GROWTH (KEY PLAYERS)

- 11.5 EBITDA ANALYSIS FOR KEY PLAYERS, BY KEY REGION

- 11.6 STRATEGIES ADOPTED BY KEY PLAYERS

- 11.7 GLOBAL SNAPSHOT OF KEY MARKET PARTICIPANTS

-

11.8 COMPANY EVALUATION MATRIX FOR KEY PLAYERS, 2022STARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTSCOMPANY FOOTPRINT, BY TYPE

-

11.9 COMPANY EVALUATION MATRIX FOR STARTUPS/SMES, 2022PROGRESSIVE COMPANIESSTARTING BLOCKSRESPONSIVE COMPANIESDYNAMIC COMPANIESCOMPETITIVE BENCHMARKING OF STARTUPS/SMES

-

11.10 COMPETITIVE SCENARIOPRODUCT LAUNCHESDEALSOTHERS

-

12.1 KEY PLAYERSTHERMO FISHER SCIENTIFIC INC.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewBIO-RAD LABORATORIES, INC.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewMERCK KGAA- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewNEOGEN CORPORATION- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewSHIMADZU CORPORATION- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewBIOMÉRIEUX- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewAGILENT TECHNOLOGIES, INC.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewQIAGEN- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewBRUKER- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewPERKINELMER INC.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewHYGIENA, LLC- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewSOLABIA GROUP (BIOKAR)- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewROKA BIO SCIENCE- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewPROMEGA CORPORATION- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewROMER LABS DIVISION HOLDING- Business overview- Products/Solutions/Services offered- Recent developments- MnM view

-

12.2 STARTUPS/SMESCHARM SCIENCES- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewMICROBIOLOGICS, INC.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewR-BIOPHARM- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewCONDALAB- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewCHROMAGAR- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewGOLD STANDARD DIAGNOSTICSCLEAR LABS, INC.RING BIOTECHNOLOGY CO LTD.NEMIS TECHNOLOGIES AGPATHOGENDX CORPORATION

- 13.1 INTRODUCTION

- 13.2 LIMITATIONS

-

13.3 FOOD SAFETY TESTING MARKETMARKET DEFINITIONMARKET OVERVIEW

-

13.4 FOOD DIAGNOSTICS MARKETMARKET DEFINITIONMARKET OVERVIEW

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS

- TABLE 1 USD EXCHANGE RATES, 2019–2022

- TABLE 2 FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET SNAPSHOT, 2023 VS. 2028

- TABLE 3 FOODBORNE OUTBREAKS IN US, 2021–2023

- TABLE 4 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 5 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 6 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 7 SOUTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 MAJOR PATENTS GRANTED, 2013–2022

- TABLE 9 IMPORT VALUE OF PREPARED CULTURE MEDIA, 2022 (USD THOUSAND)

- TABLE 10 EXPORT VALUE OF PREPARED CULTURE MEDIA, 2022 (USD THOUSAND)

- TABLE 11 INDICATIVE PRICE ANALYSIS, BY TYPE, 2022

- TABLE 12 ROLE OF PLAYERS IN MARKET ECOSYSTEM

- TABLE 13 PORTER’S FIVE FORCES ANALYSIS

- TABLE 14 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR KEY SAFETY TESTING EQUIPMENT TYPES

- TABLE 15 KEY CRITERIA FOR SELECTING SUPPLIERS/VENDORS

- TABLE 16 KEY CONFERENCES AND EVENTS, 2023–2024

- TABLE 17 FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 18 FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 19 SYSTEMS: FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY SUBTYPE, 2018–2022 (USD MILLION)

- TABLE 20 SYSTEMS: FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY SUBTYPE, 2023–2028 (USD MILLION)

- TABLE 21 SYSTEMS: FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 22 SYSTEMS: FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 23 GENE TARGETS USED FOR FOOD PATHOGENS IN DEVELOPED PCR TESTS

- TABLE 24 TEST KITS: FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 25 TEST KITS: FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 26 MICROBIAL CULTURE MEDIA: FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 27 MICROBIAL CULTURE MEDIA: FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 28 FOODBORNE PATHOGENS, BY FOOD SOURCE

- TABLE 29 FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY FOOD TESTED, 2018–2022 (USD MILLION)

- TABLE 30 FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY FOOD TESTED, 2023–2028 (USD MILLION)

- TABLE 31 MEAT & POULTRY: FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 32 MEAT & POULTRY: FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 33 FISH & SEAFOOD: FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 34 FISH & SEAFOOD: FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 35 DAIRY PRODUCTS: FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 36 DAIRY PRODUCTS: FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 37 PROCESSED FOOD: FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 38 PROCESSED FOOD: FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 39 FRUITS & VEGETABLES: FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 40 FRUITS & VEGETABLES: FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 41 CEREALS & GRAINS: FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 42 CEREALS & GRAINS: FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 43 OTHER FOOD PRODUCTS: FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 44 OTHER FOOD PRODUCTS: FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 45 FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY SITE, 2018–2022 (USD MILLION)

- TABLE 46 FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY SITE, 2023–2028 (USD MILLION)

- TABLE 47 IN-HOUSE LABORATORIES: FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 48 IN-HOUSE LABORATORIES: FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 49 OUTSOURCING FACILITIES: FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 50 OUTSOURCING FACILITIES: FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 51 GOVERNMENT LABS: FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 52 GOVERNMENT LABS: FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 53 FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 54 FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 55 NORTH AMERICA: FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY SITE, 2018–2022 (USD MILLION)

- TABLE 56 NORTH AMERICA: FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY SITE, 2023–2028 (USD MILLION)

- TABLE 57 NORTH AMERICA: FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 58 NORTH AMERICA: FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 59 NORTH AMERICA: FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY FOOD TESTED, 2018–2022 (USD MILLION)

- TABLE 60 NORTH AMERICA: FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY FOOD TESTED, 2023–2028 (USD MILLION)

- TABLE 61 NORTH AMERICA: FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 62 NORTH AMERICA: FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 63 US: FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY FOOD TESTED, 2018–2022 (USD MILLION)

- TABLE 64 US: FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY FOOD TESTED, 2023–2028 (USD MILLION)

- TABLE 65 CANADA: FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY FOOD TESTED, 2018–2022 (USD MILLION)

- TABLE 66 CANADA: FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY FOOD TESTED, 2023–2028 (USD MILLION)

- TABLE 67 MEXICO: FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY FOOD TESTED, 2018–2022 (USD MILLION)

- TABLE 68 MEXICO: FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY FOOD TESTED, 2023–2028 (USD MILLION)

- TABLE 69 EUROPE: FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY SITE, 2018–2022 (USD MILLION)

- TABLE 70 EUROPE: FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY SITE, 2023–2028 (USD MILLION)

- TABLE 71 EUROPE: FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 72 EUROPE: FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 73 EUROPE: FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY FOOD TESTED, 2018–2022 (USD MILLION)

- TABLE 74 EUROPE: FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY FOOD TESTED, 2023–2028 (USD MILLION)

- TABLE 75 EUROPE: FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 76 EUROPE: FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 77 GERMANY: FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY FOOD TESTED, 2018–2022 (USD MILLION)

- TABLE 78 GERMANY: FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY FOOD TESTED, 2023–2028 (USD MILLION)

- TABLE 79 FRANCE: FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY FOOD TESTED, 2018–2022 (USD MILLION)

- TABLE 80 FRANCE: FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY FOOD TESTED, 2023–2028 (USD MILLION)

- TABLE 81 UK: FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY FOOD TESTED, 2018–2022 (USD MILLION)

- TABLE 82 UK: FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY FOOD TESTED, 2023–2028 (USD MILLION)

- TABLE 83 ITALY: FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY FOOD TESTED, 2018–2022 (USD MILLION)

- TABLE 84 ITALY: FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY FOOD TESTED, 2023–2028 (USD MILLION)

- TABLE 85 SPAIN: FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY FOOD TESTED, 2018–2022 (USD MILLION)

- TABLE 86 SPAIN: FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY FOOD TESTED, 2023–2028 (USD MILLION)

- TABLE 87 POLAND: FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY FOOD TESTED, 2018–2022 (USD MILLION)

- TABLE 88 POLAND: FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY FOOD TESTED, 2023–2028 (USD MILLION)

- TABLE 89 REST OF EUROPE: FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY FOOD TESTED, 2018–2022 (USD MILLION)

- TABLE 90 REST OF EUROPE: FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY FOOD TESTED, 2023–2028 (USD MILLION)

- TABLE 91 ASIA PACIFIC: FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY SITE, 2018–2022 (USD MILLION)

- TABLE 92 ASIA PACIFIC: FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY SITE, 2023–2028 (USD MILLION)

- TABLE 93 ASIA PACIFIC: FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 94 ASIA PACIFIC: FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 95 ASIA PACIFIC: FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY FOOD TESTED, 2018–2022 (USD MILLION)

- TABLE 96 ASIA PACIFIC: FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY FOOD TESTED, 2023–2028 (USD MILLION)

- TABLE 97 ASIA PACIFIC: FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 98 ASIA PACIFIC: FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 99 CHINA: FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY FOOD TESTED, 2018–2022 (USD MILLION)

- TABLE 100 CHINA: FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY FOOD TESTED, 2023–2028 (USD MILLION)

- TABLE 101 JAPAN: FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY FOOD TESTED, 2018–2022 (USD MILLION)

- TABLE 102 JAPAN: FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY FOOD TESTED, 2023–2028 (USD MILLION)

- TABLE 103 INDIA: FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY FOOD TESTED, 2018–2022 (USD MILLION)

- TABLE 104 INDIA: FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY FOOD TESTED, 2023–2028 (USD MILLION)

- TABLE 105 AUSTRALIA & NEW ZEALAND: FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY FOOD TESTED, 2018–2022 (USD MILLION)

- TABLE 106 AUSTRALIA & NEW ZEALAND: FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY FOOD TESTED, 2023–2028 (USD MILLION)

- TABLE 107 SOUTHEAST ASIA: FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY FOOD TESTED, 2018–2022 (USD MILLION)

- TABLE 108 SOUTHEAST ASIA: FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY FOOD TESTED, 2023–2028 (USD MILLION)

- TABLE 109 REST OF ASIA PACIFIC: FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY FOOD TESTED, 2018–2022 (USD MILLION)

- TABLE 110 REST OF ASIA PACIFIC: FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY FOOD TESTED, 2023–2028 (USD MILLION)

- TABLE 111 SOUTH AMERICA: FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY SITE, 2018–2022 (USD MILLION)

- TABLE 112 SOUTH AMERICA: FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY SITE, 2023–2028 (USD MILLION)

- TABLE 113 SOUTH AMERICA: FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 114 SOUTH AMERICA: FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 115 SOUTH AMERICA: FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY FOOD TESTED, 2018–2022 (USD MILLION)

- TABLE 116 SOUTH AMERICA: FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY FOOD TESTED, 2023–2028 (USD MILLION)

- TABLE 117 SOUTH AMERICA: FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 118 SOUTH AMERICA: FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 119 BRAZIL: FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY FOOD TESTED, 2018–2022 (USD MILLION)

- TABLE 120 BRAZIL: FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY FOOD TESTED, 2023–2028 (USD MILLION)

- TABLE 121 ARGENTINA: FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY FOOD TESTED, 2018–2022 (USD MILLION)

- TABLE 122 ARGENTINA: FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY FOOD TESTED, 2023–2028 (USD MILLION)

- TABLE 123 REST OF SOUTH AMERICA: FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY FOOD TESTED, 2018–2022 (USD MILLION)

- TABLE 124 REST OF SOUTH AMERICA: FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY FOOD TESTED, 2023–2028 (USD MILLION)

- TABLE 125 ROW: FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY SITE, 2018–2022 (USD MILLION)

- TABLE 126 ROW: FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY SITE, 2023–2028 (USD MILLION)

- TABLE 127 ROW: FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 128 ROW: FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 129 ROW: FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY FOOD TESTED, 2018–2022 (USD MILLION)

- TABLE 130 ROW: FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY FOOD TESTED, 2023–2028 (USD MILLION)

- TABLE 131 ROW: FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 132 ROW: FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 133 MIDDLE EAST: FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY FOOD TESTED, 2018–2022 (USD MILLION)

- TABLE 134 MIDDLE EAST: FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY FOOD TESTED, 2023–2028 (USD MILLION)

- TABLE 135 AFRICA: FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY FOOD TESTED, 2018–2022 (USD MILLION)

- TABLE 136 AFRICA: FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY FOOD TESTED, 2023–2028 (USD MILLION)

- TABLE 137 INTENSITY OF COMPETITIVE RIVALRY, 2022

- TABLE 138 STRATEGIES ADOPTED BY KEY PLAYERS

- TABLE 139 COMPANY FOOTPRINT, BY TYPE

- TABLE 140 COMPANY FOOTPRINT, BY CERTIFICATION

- TABLE 141 COMPANY FOOTPRINT, BY REGION

- TABLE 142 OVERALL COMPANY FOOTPRINT

- TABLE 143 LIST OF KEY STARTUPS/SMES

- TABLE 144 COMPETITIVE BENCHMARKING OF STARTUPS/SMES

- TABLE 145 PRODUCT LAUNCHES, 2020–2022

- TABLE 146 DEALS, 2019–2022

- TABLE 147 OTHERS, 2022

- TABLE 148 THERMO FISHER SCIENTIFIC INC.: BUSINESS OVERVIEW

- TABLE 149 THERMO FISHER SCIENTIFIC INC.: DEALS

- TABLE 150 THERMO FISHER SCIENTIFIC INC.: OTHERS

- TABLE 151 BIO-RAD LABORATORIES, INC.: BUSINESS OVERVIEW

- TABLE 152 BIO-RAD LABORATORIES, INC.: PRODUCT LAUNCHES

- TABLE 153 MERCK KGAA: BUSINESS OVERVIEW

- TABLE 154 NEOGEN CORPORATION: BUSINESS OVERVIEW

- TABLE 155 NEOGEN CORPORATION: DEALS

- TABLE 156 SHIMADZU CORPORATION: BUSINESS OVERVIEW

- TABLE 157 BIOMÉRIEUX: BUSINESS OVERVIEW

- TABLE 158 BIOMÉRIEUX: PRODUCT LAUNCHES

- TABLE 159 BIOMÉRIEUX: DEALS

- TABLE 160 AGILENT TECHNOLOGIES, INC.: BUSINESS OVERVIEW

- TABLE 161 AGILENT TECHNOLOGIES, INC.: OTHERS

- TABLE 162 QIAGEN: BUSINESS OVERVIEW

- TABLE 163 BRUKER: BUSINESS OVERVIEW

- TABLE 164 PERKINELMER INC.: BUSINESS OVERVIEW

- TABLE 165 HYGIENA, LLC: BUSINESS OVERVIEW

- TABLE 166 SOLABIA GROUP: BUSINESS OVERVIEW

- TABLE 167 SOLABIA GROUP: DEALS

- TABLE 168 ROKA BIO SCIENCE: BUSINESS OVERVIEW

- TABLE 169 PROMEGA CORPORATION: BUSINESS OVERVIEW

- TABLE 170 ROMER LABS DIVISION HOLDING: BUSINESS OVERVIEW

- TABLE 171 CHARM SCIENCES: BUSINESS OVERVIEW

- TABLE 172 MICROBIOLOGICS, INC.: BUSINESS OVERVIEW

- TABLE 173 R-BIOPHARM: BUSINESS OVERVIEW

- TABLE 174 R-BIOPHARM: DEALS

- TABLE 175 CONDALAB: BUSINESS OVERVIEW

- TABLE 176 CHROMAGAR: BUSINESS OVERVIEW

- TABLE 177 GOLD STANDARD DIAGNOSTICS: BUSINESS OVERVIEW

- TABLE 178 CLEAR LABS, INC.: BUSINESS OVERVIEW

- TABLE 179 RING BIOTECHNOLOGY CO LTD.: BUSINESS OVERVIEW

- TABLE 180 NEMIS TECHNOLOGIES AG: BUSINESS OVERVIEW

- TABLE 181 PATHOGENDX CORPORATION: BUSINESS OVERVIEW

- TABLE 182 MARKETS ADJACENT TO FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET

- TABLE 183 FOOD SAFETY TESTING MARKET, BY TARGET TESTED, 2017–2021 (USD MILLION)

- TABLE 184 FOOD SAFETY TESTING MARKET, BY TARGET TESTED, 2022–2027 (USD MILLION)

- TABLE 185 FOOD DIAGNOSTICS MARKET, BY TYPE, 2018–2025 (USD MILLION)

- FIGURE 1 RESEARCH DESIGN

- FIGURE 2 SUPPLY-SIDE ANALYSIS

- FIGURE 3 DATA TRIANGULATION METHODOLOGY

- FIGURE 4 FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY FOOD TESTED, 2023 VS. 2028 (USD MILLION)

- FIGURE 5 FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY SITE, 2023 VS. 2028 (USD MILLION)

- FIGURE 6 FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY TYPE, 2023 VS. 2028 (USD MILLION)

- FIGURE 7 FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY REGION, 2022

- FIGURE 8 RISING HEALTH AWARENESS TO DRIVE FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET

- FIGURE 9 OUTSOURCING FACILITIES SEGMENT AND GERMANY ACCOUNTED FOR SIGNIFICANT SHARE IN 2022

- FIGURE 10 MEAT & POULTRY SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 11 OUTSOURCING FACILITIES SEGMENT TO LEAD MARKET BY 2028

- FIGURE 12 MEAT & POULTRY SEGMENT AND EUROPE TO ACCOUNT FOR SIGNIFICANT SHARE DURING FORECAST PERIOD

- FIGURE 13 US TO ACCOUNT FOR LARGEST SHARE IN 2023

- FIGURE 14 CHANGE IN EXPORT VALUE, BY PRODUCT {AVERAGE BASE PERIOD (2000–2002) VS. AVERAGE CURRENT PERIOD (2019–2021)}

- FIGURE 15 FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 16 LEGISLATION PROCESS IN EU

- FIGURE 17 MAJOR PATENTS GRANTED, 2012–2021

- FIGURE 18 REGIONAL ANALYSIS OF MAJOR PATENTS GRANTED

- FIGURE 19 IMPORT VALUE OF PREPARED CULTURE MEDIA, 2019–2022 (USD THOUSAND)

- FIGURE 20 EXPORT VALUE OF PREPARED CULTURE MEDIA, 2019–2022 (USD THOUSAND)

- FIGURE 21 VALUE CHAIN ANALYSIS

- FIGURE 22 SUPPLY CHAIN ANALYSIS

- FIGURE 23 REVENUE SHIFT FOR FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET

- FIGURE 24 ECOSYSTEM MAP

- FIGURE 25 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR KEY SAFETY TESTING EQUIPMENT TYPES

- FIGURE 26 KEY CRITERIA FOR SELECTING SUPPLIERS/VENDORS

- FIGURE 27 FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY TYPE, 2023 VS. 2028 (USD MILLION)

- FIGURE 28 FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY FOOD TESTED, 2023 VS. 2028 (USD MILLION)

- FIGURE 29 FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY SITE, 2023 VS. 2028 (USD MILLION)

- FIGURE 30 FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET: GEOGRAPHIC SNAPSHOT

- FIGURE 31 RECESSION MACROINDICATORS

- FIGURE 32 GLOBAL INFLATION RATE, 2011–2022

- FIGURE 33 GLOBAL GDP, 2011–2022 (USD TRILLION)

- FIGURE 34 RECESSION INDICATORS AND THEIR IMPACT ON FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET

- FIGURE 35 GLOBAL FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET: EARLIER FORECAST VS. RECESSION FORECAST

- FIGURE 36 NORTH AMERICA: INFLATION RATES, BY KEY COUNTRY, 2018–2022

- FIGURE 37 NORTH AMERICA: RECESSION IMPACT ANALYSIS, 2022 VS. 2023

- FIGURE 38 EUROPEAN FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET SNAPSHOT

- FIGURE 39 EUROPE: INFLATION RATES, BY KEY COUNTRY, 2017–2022

- FIGURE 40 EUROPE: RECESSION IMPACT ANALYSIS, 2022 VS. 2023

- FIGURE 41 ASIA PACIFIC FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET SNAPSHOT

- FIGURE 42 ASIA PACIFIC: INFLATION RATES, BY KEY COUNTRY, 2017–2022

- FIGURE 43 ASIA PACIFIC: RECESSION IMPACT ANALYSIS, 2022 VS. 2023

- FIGURE 44 SOUTH AMERICA: INFLATION RATES, BY KEY COUNTRY, 2017–2022

- FIGURE 45 SOUTH AMERICA: RECESSION IMPACT ANALYSIS, 2022 VS. 2023

- FIGURE 46 ROW: INFLATION RATES, BY KEY COUNTRY, 2017–2022

- FIGURE 47 ROW: RECESSION IMPACT ANALYSIS, 2022 VS. 2023

- FIGURE 48 REVENUE ANALYSIS FOR KEY PLAYERS, 2018–2022 (USD BILLION)

- FIGURE 49 ANNUAL REVENUE, 2022 (USD BILLION) VS. REVENUE GROWTH, 2020–2022

- FIGURE 50 EBITDA ANALYSIS FOR KEY PLAYERS, BY KEY REGION, 2022 (USD BILLION)

- FIGURE 51 GLOBAL SNAPSHOT OF KEY PARTICIPANTS, 2022

- FIGURE 52 COMPANY EVALUATION MATRIX FOR KEY PLAYERS, 2022

- FIGURE 53 COMPANY EVALUATION MATRIX FOR STARTUPS/SMES, 2022

- FIGURE 54 THERMO FISHER SCIENTIFIC INC.: COMPANY SNAPSHOT

- FIGURE 55 BIO-RAD LABORATORIES, INC.: COMPANY SNAPSHOT

- FIGURE 56 MERCK KGAA: COMPANY SNAPSHOT

- FIGURE 57 NEOGEN CORPORATION: COMPANY SNAPSHOT

- FIGURE 58 SHIMADZU CORPORATION: COMPANY SNAPSHOT

- FIGURE 59 BIOMÉRIEUX: COMPANY SNAPSHOT

- FIGURE 60 AGILENT TECHNOLOGIES, INC.: COMPANY SNAPSHOT

- FIGURE 61 QIAGEN: COMPANY SNAPSHOT

- FIGURE 62 BRUKER: COMPANY SNAPSHOT

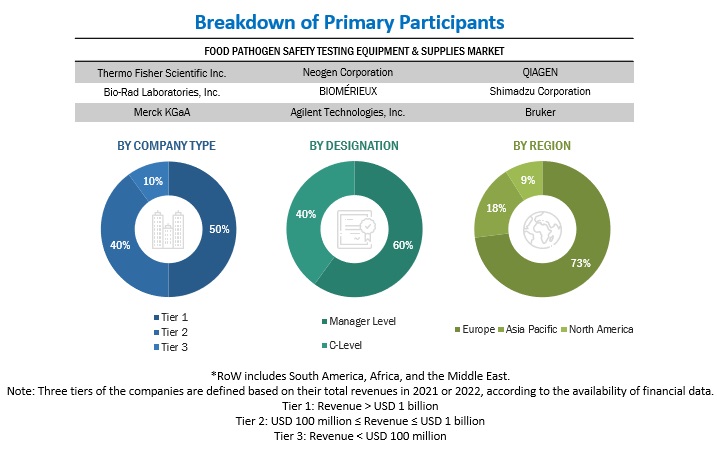

This research study involved the extensive use of secondary sources—directories and databases such as Bloomberg Businessweek and Factiva—to identify and collect information useful for a technical, market-oriented, and commercial study of the food pathogen safety testing equipment and supplies market. In-depth interviews were conducted with various primary respondents—such as key industry participants, subject matter experts (SMEs), C-level executives of key market players, and industry consultants—to obtain and verify critical qualitative and quantitative information as well as to assess prospects.

Secondary Research

The secondary sources referred for this research study include government sources, the EU Commission, the European Food Safety Authority, the German Federal Institute of Risk Assessment, the Food Safety and Standards Authority of India (FSSAI), and the Japanese Ministry of Health, Labor and Welfare have referred to, to identify and collect information for this study. The secondary sources also included food pathogen safety testing equipment and supplies manufacturers' annual reports, press releases & investor presentations of companies, white papers, food journals, certified publications, articles from recognized authors, gold & silver standard websites, regulatory bodies, trade directories, and paid databases.

Secondary research was used to obtain key information about the industry’s supply chain, the total pool of key players, and market classification and segmentation according to industry trends to the bottom-most level, regional markets, and key developments from both market and technology-oriented perspectives. The secondary data was collected and analyzed to arrive at the overall market size, which was further validated by primary research. It was also used to obtain information on the key developments from a market-oriented perspective.

Primary Research

The food pathogen safety testing equipment and supplies market comprises multiple stakeholders, including raw material suppliers, processed food suppliers, and regulatory organizations in the supply chain. Various primary sources from the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Primary interviewees from the supply side include research institutions involved in R&D to introduce to the manufacturers, and importers & exporters of food pathogen safety testing equipment and supplies from the demand side include distributors, wholesalers, and key opinion leaders through questionnaires, emails, and telephonic interviews.

To know about the assumptions considered for the study, download the pdf brochure

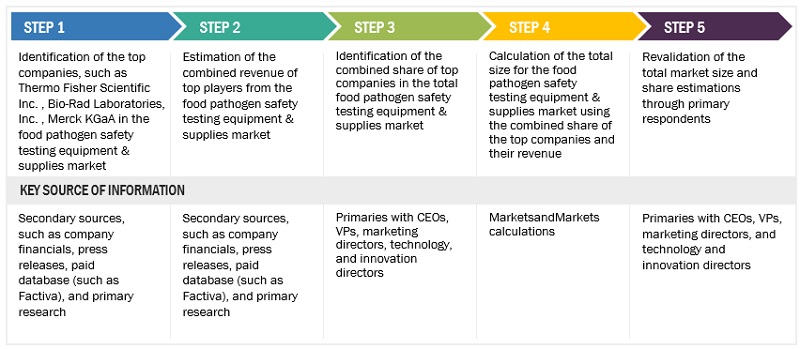

Market Size Estimation

The following approaches represent the overall market size estimation process employed for the purpose of this study.

Both top-down and bottom-up approaches were used to estimate and validate the total size of the market. These approaches were also used extensively to estimate the size of various dependent submarkets. The research methodology used to estimate the market size includes the following:

Top-down approach:

The key players in the industry and the market were identified through extensive secondary research.

The revenues of major food pathogen safety testing equipment and supplies manufacturers were determined through primary and secondary research, such as paid databases, which were used as the basis for market estimation.

Based on the market share analysis of key industry players from all regions, the final market size of the food pathogen safety testing equipment and supplies market has been arrived at.

Food Pathogen Safety Testing Equipment And Supplies Market Size Estimation By Type (Supply Side)

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Bottom-up approach:

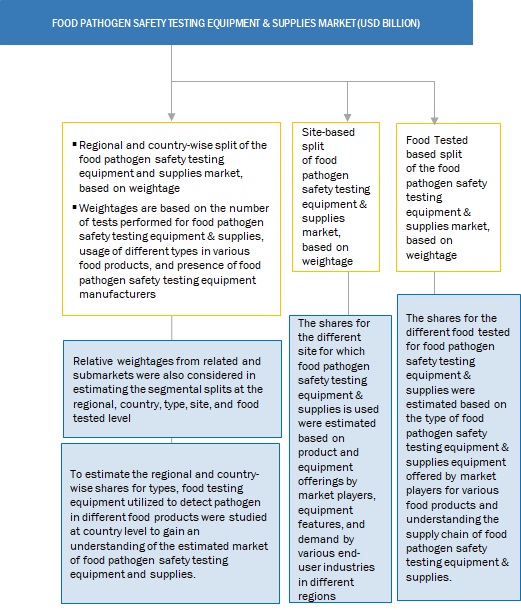

Based on the share of food pathogen safety testing equipment and supplies for each site at regional and country levels, the market sizes were analyzed. Thus, with a bottom-up approach to the site at the country level, the global market for food pathogen safety testing equipment and supplies was estimated.

Based on the demand for food tested, offerings of key players, and the region-wise market share of major players, the global market for food tested was estimated.

Other factors considered include the penetration rate of food pathogen safety testing equipment and supplies, the demand for consumer awareness, functional trends, the adoption rate, patents registered, and organic & inorganic growth attempts.

From this, market sizes for each region were derived.

All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

All macroeconomic and microeconomic factors affecting the growth of the food pathogen safety testing equipment and supplies market were considered while estimating the market size.

All parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain final quantitative and qualitative data.

Food Pathogen Safety Testing Equipment And Supplies Market Size Estimation (Demand Side)

To know about the assumptions considered for the study, Request for Free Sample Report

The following sections (bottom-up & top-down) (supply-demand) depict the overall market size estimation process employed for this study.

Data Triangulation

After arriving at the global market size from the estimation process explained above, the total market was split into various segments and subsegments. The data triangulation and market breakdown procedures were employed, wherever applicable, to estimate the food pathogen safety testing equipment and supplies market and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying a range of factors and trends from the demand and supply sides. Additionally, the market size was validated using both the top-down and bottom-up approaches.

Market Definition

Food diagnostics systems are designed to identify food contamination and quality parameters at various stages of a supply chain, such as storage, manufacturing, processing, and packaging. Food diagnostics include systems that detect the presence of contaminants and analyze the nutritional content of the food sample to help monitor the safety and quality of food samples. It also includes consumables such as reagents, disinfectants, and test accessories that are essential to perform food safety and quality tests and obtain accurate and specific results.

Food safety is a scientific and technical method of handling, manufacturing, and storing food to prevent foodborne diseases. According to Food Safety and Standards Act, 2006, legislated by the Indian Ministry of Law and Justice, to support the establishment of the Food Safety and Standards Authority of India (FFSAI), the definitions are as follows:

“Food safety” means assurance that food is acceptable for human consumption according to its intended use.

“Food safety audit” means a systematic and functionally independent examination of food safety measures adopted by manufacturing units to determine whether such measures and related results meet the objectives of food safety and the claims made on that behalf.

“Food Safety Management System (FSMS)” means adopting good manufacturing practices, good hygienic practices, hazard analysis, critical control points, and such other practices as may be specified by regulations for the food business.

Food pathogen safety testing equipment and supplies is a part of food diagnostic testing, conducted to ensure food safety against pathogen contamination and compliance of food products to safety standards set by regulatory bodies across the globe.

stakeholders

- Research & development (R&D) institutions and financial institutions

- Regulatory bodies

- Organizations such as the FDA, EFSA, USDA, and FSANZ

- Food safety agencies

- Government agencies and NGOs

- Manufacturers, importers & exporters, traders, distributors, and suppliers of food pathogens testing kits, equipment, reagents, chemicals, and other related consumables

- Food pathogens testing service providers

- Food pathogens testing laboratories

- Food manufacturers, food processors, food traders, and distributors

- Government organizations, research organizations, and consulting firms

- Trade associations and industry bodies

Report Objectives

Market Intelligence

- Determining and projecting the size of the food pathogen safety testing equipment and supplies market with respect to its type, food tested, site, and regional presence, over a five-year period ranging from 2023 to 2028.

- Identifying the attractive opportunities in the market by determining the largest and fastest-growing segments across regions

- Providing detailed information about the key factors influencing the market growth (drivers, restraints, opportunities, and industry-specific challenges)

- Providing the regulatory framework for major countries related to the food pathogen safety testing equipment and supplies market.

- Analyzing the micro-markets with respect to individual growth trends, prospects, and their contribution to the total market

Competitive Intelligence

- Identifying and profiling the key players in the food pathogen safety testing equipment and supplies market.

-

Providing a comparative analysis of market leaders based on the following:

- Product offerings

- Business strategies

- Strengths and weaknesses

- Key financials

- Understanding the competitive landscape and identifying the major growth strategies adopted by players across the key regions.

- Analyzing the value chain and products across the key regions and their impact on the prominent market players

- Providing insights on key product innovations and investments in the global food pathogen safety testing equipment and supplies market.

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs.

The following customization options are available for the report:

Product Analysis

- Product Matrix, which gives a detailed comparison of the product portfolio of each company.

Geographic Analysis

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs.

- Further breakdown of the rest of Asia Pacific food pathogen safety testing equipment and supplies market into South Korea, Singapore, Mongolia, Tonga, Taiwan

- Further breakdown of rest of Europe food pathogen safety testing equipment and supplies market into Belgium, Netherlands, other EU, and non-EU countries.

- Further breakdown of the rest of South America's food pathogen safety testing equipment and supplies market into Chile, Venezuela, Peru, Columbia, Paraguay, and Uruguay.

Company Information

- Detailed analyses and profiling of additional market players (up to five)

Growth opportunities and latent adjacency in Food Pathogen Safety Testing Equipment and Supplies Market