Food Metal Detector Market by Product Type (Rectangular aperture, Conveyor, X-ray inspection, Others), by Frequency type (Low and High frequency), by Application (Bread & bakery products, Meat & sausages, Fruits & vegetables, Dairy products, Others) and by Region - Global Forecast to 2027

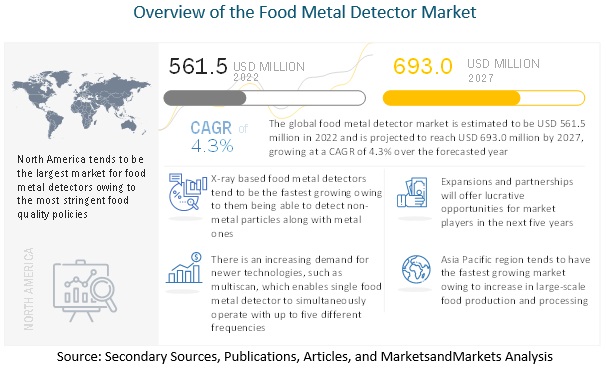

According to MarketsandMarkets, the global Food metal detector market is estimated to be valued at USD 561.5 million in 2022. It is projected to reach USD 693.0 million by 2027, with a CAGR of 4.3%, in terms of value between 2022 and 2027. Food metal detectors sense the presence of ferrous, nonferrous and stainless metals in a process, or within a packaged item, thereby helping producers prohibit selling such specific items to consumers owing to health concerns.

Food Metal Detector Market Dynamics

Drivers: Demand for food metal detectors are primarily driven by more stringent quality check mechanisms in multiple points throughout the manufacturing process

Global demand for food metal detectors is expected to be driven by the rising regulations around multiple food quality checks by regulatory agencies. Further, in order to protect their brand image, food manufacturers are increasingly requiring multiple quality checks, with a considerable demand for detection of both ferrous and non-ferrous materials in many stages of their products.

Restraints: Owing to resource constrains, usage of metal detectors in food processing industry is mainly limited to large food production brands

Usage of food metal detectors is not much prominent in small to medium scale food production plants. This is owing to multiple constraints including spatial and financial limitations. Food metal detectors are thereby currently only prevalent in large manufacturing units with partially or fully automated facilities.

Opportunities: Demand for X-ray based detectors owing to their capability to detect non-metallic contaminants in addition to metallic ones

There exists a key opportunity in market with regards to demand for X-ray technology-based metal detectors. This is since such metal detectors are able to detect other contaminants, such as ceramics, glass, and stones as well, thereby increasing the ambit of contaminant detection.

Challenges: Questionable accuracy due to technological constraints

Present day food metal detectors face limitations with regards to their capability to detect each and every particle of metal passing through them. This is owing to limitations in physical laws, which govern functioning of metal detectors in general. However, manufacturers are constantly investing in R&D to improve on this aspect in order to offer food metal detectors which can detect even trace elements of metals.

In terms of operating frequency, there has been a rising demand for food metal detectors with both low and high frequency detection options

Conventional food metal detectors operate either on lower or higher frequency detection technologies. However, there has been a rising demand for ‘multiscan technology’, which enables one food metal detector to be able to deploy up to five frequencies, ranging from low (50kHz) to high (1,000kHz). Such enablement helps manufacturing units detect both ferrous and non-ferrous metal contaminants with one machine, thereby saving efforts, space and time.

By product type, X-ray food metal detector market is expected to showcase the fastest growth

X-ray based food metal detectors market is set to grow the fastest over the forecasted period. This is owing to their usability in detecting non-metal particles as well, which gives them a competitive advantage over other metal detectors, which are limited to detecting either ferrous or non-ferrous metal particles.

Asia Pacific tends to have the fastest growing food metal detector market. This is driven by a rising number of large-scale food production and processing facilities opening up in the region. The market is further supported by developed economies, such as North America and Europe opening their food production units in Asia-Pacific to shorten their supply chains, thereby further supplementing food metal detectors as a supplementary market. This is owing to Asia-Pacific region being the fastest growing in terms of food consumption, owing to rising population and rising disposable income.

Key Market Players:

Key players in this market include Mettler-Toledo (US), Eriez (US), CEIA (Italy), Nissin Electronics (Japan), Fortress Technology (Canada), among others.

FAQs:

- Which are the major Food metal detector segments considered in this study and which of them are projected to have promising growth rates in the future?

- I am interested in the Asia Pacific market for conveyor and X-ray inspection type food metal detectors segment. Is the customization available for the same? What all information would be included in the same?

- What are some of the drivers fuelling the growth of the Food metal detector market?

- I am interested in understanding the research methodology on how you arrived at the market size and segmental splits before making a purchase decision. Can you provide me with an explanation on the same?

- What kind of information is provided in the competitive landscape section?

TABLE OF CONTENTS

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 STUDY SCOPE

1.4 REGIONAL SEGMENTATION

1.5 PERIODIZATION CONSIDERED

1.6 CURRENCY CONSIDERED

1.7 VOLUME UNITS CONSIDERED

1.8 STAKEHOLDERS

2 RESEARCH METHODOLOGY

2.1 RESEARCH DATA

2.1.1 SECONDARY DATA

2.1.1.1 Key Data from Secondary Sources

2.1.2 PRIMARY DATA

2.1.2.1 Key Data from Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primaries

2.2 MARKET SIZE ESTIMATION

2.2.1 MARKET SIZE ESTIMATION - METHOD 1

2.2.2 MARKET SIZE ESTIMATION - METHOD 2

2.3 DATA TRIANGULATION

2.4 ASSUMPTIONS FOR THE STUDY

2.5 LIMITATIONS OF THE STUDY

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

5.2.1 DRIVERS

5.2.2 RESTRAINTS

5.2.3 OPPORTUNITIES

5.2.4 CHALLENGES

6 INDUSTRY TRENDS

6.1 INTRODUCTION

6.2 VALUE CHAIN/SUPPLY CHAIN ANALYSIS

6.3 TECHNOLOGY ANALYSIS

6.4 PRICING ANALYSIS

6.5 ECOSYSTEM/ MARKET MAP

6.6 TRENDS/ DISRUPTION IMPACTING THE CUSTOMER’S BUSINESS

6.7 PATENT ANALYSIS

6.8 TRADE ANALYSIS

6.9 KEY CONFERENCES AND EVENTS IN 2022-2023

6.10 TARIFF AND REGULATORY LANDSCAPE

6.11 PORTER’S FIVE FORCES ANALYSIS

6.12 KEY STAKEHOLDERS & BUYING CRITERIA

6.13 CASE STUDY ANALYSIS

7 FOOD METAL DETECTOR MARKET, BY PRODUCT TYPE

7.1 INTRODUCTION

7.2 RECTANGULAR APERTURE

7.3 CONVEYOR

7.4 X-RAY INSPECTION

7.5 OTHERS

8 FOOD METAL DETECTOR MARKET, BY FREQUENCY TYPE

8.1 INTRODUCTION

8.2 LOW FREQUENCY

8.3 HIGH FREQUENCY

8 FOOD METAL DETECTOR MARKET, BY APPLICATION

8.1 INTRODUCTION

8.2 BREAD & BAKERY PRODUCTS

8.3 MEAT & SAUSAGES

8.4 FRUITS & VEGETABLES

8.5 DAIRY PRODUCTS

8.6 OTHER APPLICATIONS

9 FOOD METAL DETECTOR MARKET, BY REGION

9.1 INTRODUCTION

9.2 NORTH AMERICA

9.2.1 US

9.2.2 CANADA

9.2.3 MEXICO

9.3 EUROPE

9.3.1 GERMANY

9.3.2 FRANCE

9.3.3 UK

9.3.4 ITALY

9.3.5 SPAIN

9.3.6 REST OF EUROPE

9.4 ASIA PACIFIC

9.4.1 CHINA

9.4.2 INDIA

9.4.3 JAPAN

9.4.4 AUSTRALIA & NEW ZEALAND

9.4.5 REST OF ASIA PACIFIC

9.5 SOUTH AMERICA

9.5.1 BRAZIL

9.5.2 ARGENTINA

9.5.3 REST OF SOUTH AMERICA

9.6 REST OF THE WORLD

9.6.1 AFRICA

9.6.2 MIDDLE EAST

10 COMPETITIVE LANDSCAPE

10.1 OVERVIEW

10.2 MARKET SHARE ANALYSIS

10.3 KEY PLAYERS STRATEGIES

10.4 COMPANY REVENUE ANALYSIS OF TOP 5 MARKET PLAYERS

10.5 COMPANY EVALUATION QUADRANT

10.5.1 STARS

10.5.2 EMERGING LEADERS

10.5.3 PERVASIVE PLAYERS

10.5.4 PARTICIPANTS

10.5.5 COMPETITIVE BENCHMARKING

10.6 PRODUCT FOOTPRINTS

10.7 STARTUP/SME EVALUATION QUADRANT

10.7.1 PROGRESSIVE COMPANIES

10.7.2 STARTING BLOCKS

10.7.3 RESPONSIVE COMPANIES

10.7.4 DYNAMIC COMPANIES

10.8 PRODUCT LAUNCHES, DEALS, AND OTHER DEVELOPMENTS

10.8.1 NEW PRODUCT LAUNCHES

10.8.2 DEALS

10.8.3 OTHER DEVELOPMENTS

10.8.4 PARTNERSHIPS, COLLABORATIONS, AND JOINT VENTURES

11 COMPANY PROFILES

11.1 METTLER-TOLEDO

11.2 ERIEZ

11.3 CEIA

11.4 SESOTEC

11.5 NISSIN ELECTRONICS

11.6 FORTRESS TECHNOLOGY

11.7 NIKKA DENSOK

11.8 VINSYST

Note: Currently, list of only 8 companies have been provided. However, this section covers 12-15 key company profiles which include business overview, recent financials, product offerings, key strategies, and swot analysis. recent financials can be provided based on data/information availability in public domain. The list of companies mentioned above can be altered depending upon client’s interest.

12 APPENDIX

Note: The TOC prepared above is tentative and may subject to change, based on the research progress

Growth opportunities and latent adjacency in Food Metal Detector Market