Foldable Display Market Size, Share & Industry Growth Analysis Report by Technology (OLED, Direct-view LED), Panel Size (Up to 20”, Above 20”), Application (Smartphones, Laptops and Tablets, Large Format Displays and Digital Signage), Material, Resolution, Type and Region - Global Forecast to 2029

Updated on : September 18, 2025

Foldable Display Market Size & Growth

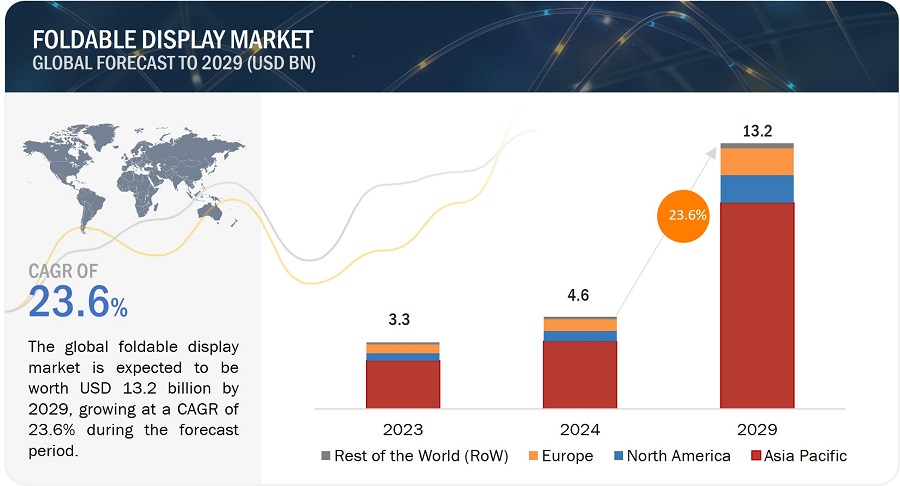

The global Foldable Display Market was valued at USD 4.6 billion in 2024 and is projected to grow from USD 6.1 billion in 2025 to USD 13.29 billion by 2029, at a CAGR of 23.6% during the forecast period. Fueled by consumer preferences for larger screens and the proliferation of 5G networks, the foldable display market is poised for significant expansion. The adoption of innovative multifunctional devices and the extension of foldable displays beyond just smartphones are key growth drivers. However, challenges such as high production costs and durability concerns remain crucial considerations for stakeholders.

Key Takeaways:

• The global Foldable Display Market was valued at USD 4.6 billion in 2024 and is projected to grow from USD 6.1 billion in 2025 to USD 13.29 billion by 2029, at a CAGR of 23.6% during the forecast period.

• By Technology: OLED technology, particularly AMOLED, continues to dominate the market due to its superior image quality and flexibility. The ongoing R&D investments are anticipated to enhance display durability and performance, further boosting market growth.

• By Application: Smartphones remain the primary application for foldable displays, offering enhanced versatility and multitasking capabilities. The market is also witnessing significant growth in laptops and tablets, driven by remote working trends and the demand for flexible work arrangements.

• By Product: The market is seeing an increased demand for devices with screens up to 8 inches due to their improved functionality and user experience, while the 8–20 inches segment is driven by a need for larger workspaces and flexible display options.

• By End User: The consumer electronics sector remains the largest end-user segment, with significant contributions from the gaming, healthcare, and education sectors due to the demand for interactive and high-performance displays.

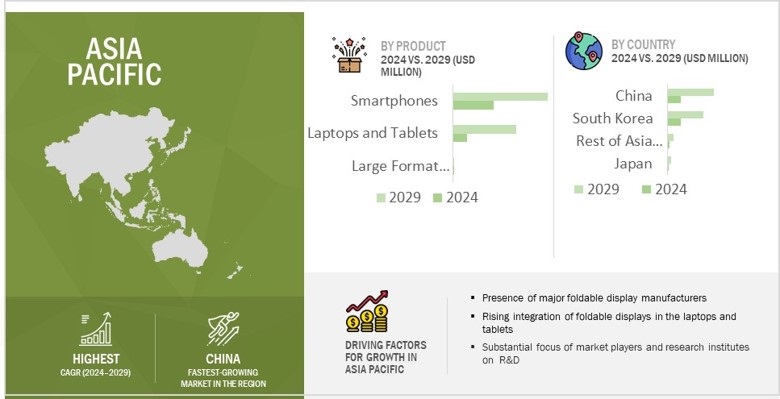

• By Region: ASIA-PACIFIC is expected to grow fastest at a 25.0% CAGR, driven by the presence of major manufacturers and a burgeoning consumer base in China, India, and Japan. The region's economic growth and increasing disposable income levels further support market expansion.

The foldable display market is poised for transformative growth, with advancements in AI and Gen AI playing a pivotal role in enhancing display functionalities and user interactions. Integration of AI promises to revolutionize the ecosystem by offering real-time content enhancement, personalized experiences, and predictive maintenance capabilities. As industries explore new applications for foldable displays, opportunities for innovation and market penetration continue to expand, paving the way for long-term growth and technological breakthroughs.

The surging adoption of OLED foldable displays, including AMOLED and POLED, in a number of applications, along with an increasing demand for foldable displays in consumer electronics, is expected to strongly support regional market growth. Durable, reliable, and portable, with highly efficient foldable displays endorsed by advanced technologies, further propelled the market by introducing innovative foldable devices to meet modern consumer needs. Another key factor is the presence of major companies that play a crucial role in the Asian Pacific foldable display market include the following: Samsung Electronics Co., Ltd. (South Korea), BOE Technology Group Co., Ltd. (China), Visionox Company (China), Royole Corporation (China), and TCL China Star Optoelectronics Co., Ltd. (China). Factors such as the improving economic backdrop, rising disposable incomes, and demand for high-end electronics devices in the region, are expected to drive the market for foldable display panels. Consumers in China, India, and Japan drives interest, while innovations in flexible OLED technology improve durability and performance, raising appeal to both consumers and businesses.

Foldable Display Market Trends:

Imapct of AI/Gen AI on Foldable Display Market

Artificial intelligence (AI) is expected to significantly transform the foldable display ecosystem. The integration of AI with displays and related software offers a wide range of capabilities ranging from the enhancement of videos and images in real-time to facilitating personalized content being displayed in commercial and retail settings. Furthermore, the integration of AI also facilitates the enhancement of smart display features, integration of displays with other smart home devices such as intelligent voice assistants, and development of advanced features tailor-made for augmented and virtual reality (AR and VR) solutions and wearable devices. Furthermore, in the industrial setting, the integration of AI enables predictive maintenance of display hardware, thereby significantly reducing downtime and maintenance costs.

Attractive Opportunities in Foldable Display Market Size

Foldable Display Market Forecast to 2029

To know about the assumptions considered for the study, Request for Free Sample Report

Foldable Display Market Dynamics

Driver: Expansion of application areas

Foldable displays take a lot of industries to a whole new level, which started with just smartphones, but now includes laptops, wearables, and the automotive industry. Laptops bring together the mobility of tablets and the productivity of classic laptops into a compact design with larger screens. Wearables, such as smartwatches, have foldable displays that make them sleeker with enhanced informational visibility. They improve user interfaces in in-car entertainment, dashboards, and infotainment systems. This growth in new applications that fuels the market and satisfies the consumer's demand for flexible, high-performance display solutions.

Restraint: High production costs of foldable displays

High costs are inherent in the manufacturing process of foldable displays, largely due to advanced manufacturing techniques and specialized materials. The most important among them are complicated technology, low yield rates, and high R&D expenses. Advanced technology used in foldable substrates, cutting-edge OLED and Micro-LED panels, and robust hinge mechanisms provide the foundation for the lowering of production costs and increasing defect rates, thereby generating more wastage. It is also the investments in R&D, continuous and necessary for improving technologies and overcoming challenges, that have to a large extent increased these costs, which have been passed down to consumers. In this regard, high production costs would limit market growth due to the lower accessibility and adoption, while continuous innovation and process optimization could result in cost reduction and wider market acceptance.

Opportunity: Advancements in technology

An abundance of applications accompanied by enhanced performance and durability makes foldable display markets resonate due to technological advancement. Some important developments in OLED technology and micro-LED have come with flexibility, brightness, and energy efficiency enhancements, while flexible electronics and advanced materials like graphene will continue to ensure more durable and thinner screens. Manufacturing techniques like precision laser cutting and advanced lamination, are innovating, raising production efficiency, and cutting down on costs. Improvements of this sort should provide a significant impetus to market expansion and consumer adoption, keeping foldable displays at the very frontier of technology.

Challenge: Limited use of foldable displays

Due to the narrow range of applications and the high costs involved, testing foldable displays has remained narrow in scope. Furthermore, there is skepticism by consumers about durability and practicality. Foldable display technology's main application area remains in high-end smartphones and some niche areas. Perceived problems of screen longevity, hinge durability, and overall robustness are some of the perceptions coupled with the higher cost compared to traditional displays that restrict their broader use. It requires advanced technology to bring in durability aspects and cost reductions for wider acceptance and use in laptops, tablets, and automotive displays, besides wearables.

Foldable Display Ecosystem

The prominent players in the foldable display market are Samsung Electronics Co., Ltd. (South Korea), BOE Technology Group Co., Ltd. (China), Visionox Company (China), Royole Corporation (China), and TCL China Star Optoelectronics Co., Ltd. (China). These companies perform organic and inorganic growth strategies to expand themselves globally by providing advanced foldable display solutions.

Foldable Display Market Segmentation

Large Format Displays and Digital Signage segment is projected at the highest CAGR in the foldable display market during the forecast period.

Foldable display technology is set to make a major impact in large format displays and digital signage by providing more dynamic and flexible installation options. Of all the major reasons for foldable technology adoption in large-format displays is the potential for delivery of immersive, very interactive experiences. Moreover, there is an increasing market demand for modern display solutions within commercial and public spaces. Large format displays and digital signage in foldable displays bring in an important development aiming to elevate adaptability and impact of visual communications in various settings. Growth drivers for foldable large format displays and digital signage include technological improvements in the materials and manufacturing processes of displays.

Micro-LED and Direct-view LED based foldable displays accounts for the highest CAGR of the foldable market during the forecast period.

Micro-LED technology is surging in the foldable display market. Micro-LEDs offer several distinct advantages over traditional OLEDs such as higher brightness levels, superior energy efficiency, longer lifespan, excellent color accuracy, and contrast ratios. The market for Micro-LED technology in foldable displays is driven by several key factors such as advancements in technology, demand for high-end consumer electronics and professional applications. The direct-view LED technology is primarily used in larger formats, such as digital signage, outdoor displays, and large-format screens. The increasing demand from several industries in the future for high-performance and large-format displays will further drive innovation and investment in this technology. Companies are heavily investing in R&D to develop flexible LED solutions that might find niche applications in the foldable display industry in the future. As market dynamics change and the dissolving of technological barriers, Micro-LED and Direct-view LED displays will change what consumers come to expect from foldable and high-performance display solutions.

Foldable Display Industry Regional Analysis

Asia Pacific is expected to account for the largest market share during the forecast period

The surging adoption of OLED foldable displays, including AMOLED and POLED, in a number of applications, along with an increasing demand for foldable displays in consumer electronics, is expected to strongly support regional market growth. Durable, reliable, and portable, with highly efficient foldable displays endorsed by advanced technologies, further propelled the market by introducing innovative foldable devices to meet modern consumer needs.

Foldable Display Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Top Foldable Display Companies - Key Market Players

The major players in the foldable display companies are

- Samsung Electronics Co., Ltd. (South Korea),

- BOE Technology Group Co., Ltd. (China),

- Visionox Company (China),

- Royole Corporation (China),

- TCL China Star Optoelectronics Co., Ltd. (China).

These companies have used both organic and inorganic growth strategies such as product launches, partnerships, collaborations, and expansions to strengthen their position in the market.

Foldable Display Market Report Scope

|

Report Metric |

Details |

|

Estimated Market Size |

USD 4.6 billion in 2024 |

|

Expected Market Size |

USD 13.2 billion by 2029 |

|

Growth Rate |

CAGR of 23.6% |

|

Market size available for years |

2020–2029 |

|

Base year considered |

2023 |

|

Forecast period |

2024–2029 |

|

Forecast units |

Value (USD Million or Billion), Volume (Million Units) |

|

Segments covered |

By Technology, Panel Size, Application, Material, Resolution, Type, and Region |

|

Geographies covered |

North America, Europe, Asia Pacific, and Rest of the World (RoW) |

|

Companies covered |

The major players in the foldable display market are are Samsung Electronics Co., Ltd. (South Korea), BOE Technology Group Co., Ltd. (China), Visionox Company (China), Royole Corporation (China), and TCL China Star Optoelectronics Co., Ltd. (China), AUO Corporation (Taiwan), Tianma (China), Huawei Technologies Co. Ltd. (China), Motorola Mobility LLC (US), and Honor Device Co., Ltd. (China). |

Foldable Display Market Highlights

The study segments the foldable display market share based on technology, panel size, application, material, resolution, type, and region at the regional and global level.

|

Segment |

Subsegment |

|

By Technology |

|

|

By Panel Size |

|

|

By Application |

|

|

By Material |

|

|

By Resolution |

|

|

By Type |

|

|

By Region |

|

Recent Developments in Foldable Display Industry

- In January 2023, the Samsung Electronics Co., Ltd. (South Korea) launched the Flex Hybrid model, with a foldable and slidable display for foldable smartphones in order to bring the small tablet experience that expands.

- In August 2021, the BOE Technology Group Co., Ltd. (China) partnered with Honor Device Co., Ltd. (China) to supply flexible full-screens for the newly launched Honor Magic 3 series of smartphones.

- In July 2023, Visionox Company (China) partnered with Honor Device Co., Ltd. of China to provide it with screens for foldable smartphones—Honor Magic V2 and Honor V Purse.

- In March 2020, Royole Corporation (China) launched a foldable smartphone with 5G network access, FlexPai 2.

- In May 2023, TCL China Star Optoelectronics Technology Co., Ltd. (China) unveiled a 65-inch 8K inkjet printing flexible OLED display. It realizes an excellent picture quality, flexibility, and durability, based on inkjet printing and IGZO TFT backplane technology.

Frequently Asked Questions (FAQs):

What is the current size of the global foldable display market?

The foldable display market is estimated to be worth USD 4.6 billion in 2024 and is projected to reach USD 13.2 billion by 2029, at a CAGR of 23.6% during the forecast period. The worldwide foldable display market is primarily driven by the growing need for foldable display panels in smartphone applications. Other key drivers include the rise in demand for multifunctional devices across various applications, such as laptops, tablets, large format displays, and digital signage, coupled with technological advancement.

Who are the winners in the global foldable display market size?

Companies such as are Samsung Electronics Co., Ltd. (South Korea), BOE Technology Group Co., Ltd. (China), Visionox Company (China), Royole Corporation (China), and TCL China Star Optoelectronics Co., Ltd. (China), fall under the winners category.

Which region is expected to hold the highest market share?

Asia Pacific is expected to dominate the foldable display market during forecast period. The presence of established several foldable display panels manufacturing companies such as Samsung Electronics Co., Ltd. (South Korea), BOE Technology Group Co., Ltd. (China), Visionox Company (China), Royole Corporation (China), and TCL China Star Optoelectronics Co., Ltd. (China), increasing integration of foldable displays in various applications, technological advancements, and huge consumer base are the major factors driving the market growth in Asia Pacific.

What are the major drivers and opportunities related to foldable display market size?

Rising demand for large screen in smartphones, impact of 5G rollout, increasing consumer interest in innovations and multifunctional devices, expansion of applications areas, emerging applications in foldable displays, and advancements in technology are some of the major drivers and opportunities for foldable display market.

What are the major strategies adopted by market players?

The key players have adopted product launches, partnerships, collaborations, and expansions to strengthen their position in the foldable display market.

We believe that gen AI/AI will impact the “Foldable Display Market” in the following use-cases. Can you please rate the level of impact on a scale of 1-10 (1 - least impacted, 10 - most impactful) ?

- AR and VR Capabilities

- Image Processing and Quality

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Consumer preference for smartphones with larger screens- Widespread rollout of 5G networks- High adoption of innovative and multifunctional devices by consumers- Revolutionizing industries by extending foldable displays beyond smartphonesRESTRAINTS- High production costs and poor yields- Longevity and reliability issuesOPPORTUNITIES- Growing demand for gaming, healthcare, and education applications- Enhancing quality through advanced technologiesCHALLENGES- Complexities associated with display designing and fabrication- Limited use of foldable displays

- 5.3 SUPPLY CHAIN ANALYSIS

-

5.4 ECOSYSTEM ANALYSIS

- 5.5 INVESTMENT AND FUNDING SCENARIO

-

5.6 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

-

5.7 TECHNOLOGY ANALYSISKEY TECHNOLOGIES- AMOLEDCOMPLEMENTARY TECHNOLOGIES- 5GADJACENT TECHNOLOGIES- Wearables

-

5.8 PRICING ANALYSISAVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY TECHNOLOGYAVERAGE SELLING PRICE TREND, BY REGION

-

5.9 PORTER'S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

-

5.10 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

-

5.11 CASE STUDY ANALYSISSAMSUNG'S CAMPAIGN TO REIGNITE SMARTPHONE SALES WITH GALAXY FOLD 5GUNIFIED INFOTECH STRATEGIES TO OVERCOME DESIGN AND FUNCTIONAL CHALLENGESOWENS REVOLUTIONIZES FLEXIBLE OLED DISPLAY PRODUCTION THROUGH INNOVATIVE ENGINEERING AND PARTNERSHIP

-

5.12 TRADE ANALYSISIMPORT SCENARIO (HS CODE 8524)EXPORT SCENARIO (HS CODE 8524)

-

5.13 PATENT ANALYSIS

-

5.14 REGULATORY LANDSCAPEREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONSSTANDARDSREGULATIONS

- 5.15 KEY CONFERENCES AND EVENTS, 2024–2025

- 5.16 IMPACT OF AI/GEN AI ON FOLDABLE DISPLAY MARKET

- 6.1 INTRODUCTION

- 6.2 GLASS

- 6.3 METAL

- 6.4 PLASTIC

- 6.5 OTHER MATERIALS

- 7.1 INTRODUCTION

- 7.2 LESS THAN HD

- 7.3 HD

- 7.4 MORE THAN HD

- 8.1 INTRODUCTION

- 8.2 CURVED DISPLAY

- 8.3 BENDABLE DISPLAY

- 8.4 ROLLABLE DISPLAY

- 9.1 INTRODUCTION

-

9.2 OLEDCONTINUOUS INVESTMENTS IN RESEARCH & DEVELOPMENT TO SUPPORT MARKET GROWTH

-

9.3 OTHER TECHNOLOGIESMICRO-LED- Overcoming manufacturing challenges and improving display durability to fuel marketDIRECT-VIEW LED- Increasing need for high-performance and large-format displays to spike demand

- 10.1 INTRODUCTION

-

10.2 UP TO 20 INCHESUP TO 8 INCHES- Improved functionality and user experience to foster market growth8 – 20 INCHES- Surging demand for bigger workspaces and devices with flexible screens to drive segmental growth

-

10.3 ABOVE 20 INCHESVERSATILE SOLUTIONS FOR OFFICES, PUBLIC SPACES, AND HOME ENTERTAINMENT TO SPUR DEMAND

- 11.1 INTRODUCTION

-

11.2 SMARTPHONESENHANCED VERSATILITY AND MULTITASKING TO FOSTER MARKET GROWTH

-

11.3 LAPTOPS AND TABLETSRISE OF REMOTE WORKING TRENDS, FLEXIBLE WORK ARRANGEMENTS, AND TELECOMMUTING TO SPUR DEMAND

-

11.4 DIGITAL SIGNAGE AND OTHER LARGE DISPLAY DEVICESDYNAMIC AND ADAPTABLE INSTALLATION OPTIONS TO FUEL MARKET GROWTH

- 12.1 INTRODUCTION

-

12.2 NORTH AMERICAMACROECONOMIC OUTLOOK FOR NORTH AMERICAUS- Increasing demand for video streaming services with rising number of online gamers to accelerate market growthCANADA- Digitally literate population and high standard of living to create growth opportunitiesMEXICO- Growing inclination of youth toward adoption of innovative technology to boost demand

-

12.3 EUROPEMACROECONOMIC OUTLOOK FOR EUROPEUK- Widespread availability of premium electronics due to strong retail infrastructure to support market growthGERMANY- Significant presence of manufacturers and suppliers of key components and materials to foster market growthFRANCE- Robust retail network to contribute to market growthREST OF EUROPE

-

12.4 ASIA PACIFICMACROECONOMIC OUTLOOK FOR ASIA PACIFICCHINA- Advanced manufacturing capabilities and supportive environment for innovation to accelerate marketJAPAN- Constant innovations in display technologies and robust consumer base to augment market growthSOUTH KOREA- Constant advancements in display technology by giant companies to create opportunitiesREST OF ASIA PACIFIC

-

12.5 ROWMACROECONOMIC OUTLOOK FOR ROWMIDDLE EAST & AFRICA- Increasing demand for versatile and advanced electronic devices from educational institutions to drive market- Gulf cooperation council (GCC)- Rest of Middle East & AfricaSOUTH AMERICA- Growing middle-class and tech-savvy youth to boost demand

- 13.1 OVERVIEW

- 13.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2019–2024

- 13.3 MARKET SHARE ANALYSIS, 2023

- 13.4 REVENUE ANALYSIS, 2019–2023

- 13.5 COMPANY VALUATION AND FINANCIAL METRICS

-

13.6 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023STARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTSCOMPANY FOOTPRINT: KEY PLAYERS, 2023- Company footprint- Technology footprint- Panel size footprint- Application footprint- Region footprint

-

13.7 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2023PROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKSCOMPETITIVE BENCHMARKING: STARTUPS/SMES, 2023- List of start-ups/SMEs- Competitive benchmarking of startups/SMEs

- 13.8 BRAND/PRODUCT COMPARISON

-

13.9 COMPETITIVE SCENARIOPRODUCT LAUNCHESDEALSOTHER DEVELOPMENTS

-

14.1 KEY PLAYERSSAMSUNG ELECTRONICS CO., LTD.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewBOE TECHNOLOGY GROUP CO., LTD.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewVISIONOX COMPANY- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewTCL CHINA STAR OPTOELECTRONICS TECHNOLOGY CO., LTD.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewTIANMA- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewROYOLE CORPORATION- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewAUO CORPORATION- Business overview- Products/Solutions/Services offered- Recent developmentsHUAWEI TECHNOLOGIES CO., LTD.- Business overview- Products/Solutions/Services offered- Recent developmentsMOTOROLA MOBILITY LLC- Business overview- Products/Solutions/Services offered- Recent developmentsHONOR DEVICE CO., LTD.- Business overview- Products/Solutions/Services offered- Recent developments

-

14.2 OTHER PLAYERSALPHABET, INC.LENOVOOPPOTECNO MOBILEVIVO MOBILE COMMUNICATION CO., LTD.XIAOMIVIEWSONIC CORPORATIONASUSTEK COMPUTER INC.E INK HOLDINGS INC.ONEPLUSCORNING INCORPORATEDONUMEN TECHNOLOGY CO., LTD.3MSCHOTT GROUPAPPLIED MATERIALS, INC.

- 15.1 INSIGHTS FROM INDUSTRY EXPERTS

- 15.2 DISCUSSION GUIDE

- 15.3 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 15.4 CUSTOMIZATION OPTIONS

- 15.5 RELATED REPORTS

- 15.6 AUTHOR DETAILS

- TABLE 1 FOLDABLE DISPLAY MARKET: FORECAST ASSUMPTIONS

- TABLE 2 MARKET: RESEARCH ASSUMPTIONS

- TABLE 3 MARKET: RISK ASSESSMENT

- TABLE 4 ROLE OF COMPANIES IN ECOSYSTEM

- TABLE 5 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY TECHNOLOGY, 2019–2023 (USD)

- TABLE 6 PORTER'S FIVE FORCES ANALYSIS

- TABLE 7 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY APPLICATION

- TABLE 8 KEY BUYING CRITERIA, BY APPLICATION

- TABLE 9 LIST OF PATENTS, 2020–2022

- TABLE 10 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 ROW: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 KEY CONFERENCES AND EVENTS, 2024–2025

- TABLE 15 MARKET, BY TECHNOLOGY, 2020–2023 (USD MILLION)

- TABLE 16 MARKET, BY TECHNOLOGY, 2024–2029 (USD MILLION)

- TABLE 17 OLED: MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 18 OLED: MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 19 OLED: MARKET, BY APPLICATION, 2020–2023 (USD MILLION)

- TABLE 20 OLED: MARKET, BY APPLICATION, 2024–2029 (USD MILLION)

- TABLE 21 OLED: MARKET IN ASIA PACIFIC, BY COUNTRY, 2020–2023 (USD MILLION)

- TABLE 22 OLED: FOLDABLE DISPLAY MARKET IN ASIA PACIFIC, BY COUNTRY, 2024–2029 (USD MILLION)

- TABLE 23 OLED: MARKET IN NORTH AMERICA, BY COUNTRY, 2020–2023 (USD MILLION)

- TABLE 24 OLED: MARKET IN NORTH AMERICA, BY COUNTRY, 2024–2029 (USD MILLION)

- TABLE 25 OLED: MARKET IN EUROPE, BY COUNTRY, 2020–2023 (USD MILLION)

- TABLE 26 OLED: MARKET IN EUROPE, BY COUNTRY, 2024–2029 (USD MILLION)

- TABLE 27 OLED: MARKET IN ROW, BY REGION, 2020–2023 (USD MILLION)

- TABLE 28 OLED: MARKET IN ROW, BY REGION, 2024–2029 (USD MILLION)

- TABLE 29 OLED: MARKET, BY APPLICATION, 2020–2023 (MILLION UNITS)

- TABLE 30 OLED: MARKET, BY APPLICATION, 2024–2029 (MILLION UNITS)

- TABLE 31 OLED: MARKET FOR SMARTPHONES, BY REGION, 2020–2023 (THOUSAND UNITS)

- TABLE 32 OLED: MARKET FOR SMARTPHONES, BY REGION, 2024–2029 (THOUSAND UNITS)

- TABLE 33 OLED: MARKET FOR LAPTOPS AND TABLETS, BY REGION, 2020–2023 (THOUSAND UNITS)

- TABLE 34 OLED: MARKET FOR LAPTOPS AND TABLETS, BY REGION, 2024–2029 (THOUSAND UNITS)

- TABLE 35 OTHER TECHNOLOGIES: MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 36 OTHER TECHNOLOGIES: MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 37 OTHER TECHNOLOGIES: MARKET, BY APPLICATION, 2020–2023 (USD MILLION)

- TABLE 38 OTHER TECHNOLOGIES: MARKET, BY APPLICATION, 2024–2029 (USD MILLION)

- TABLE 39 OTHER TECHNOLOGIES: MARKET, BY TECHNOLOGY TYPE, 2020–2023 (USD MILLION)

- TABLE 40 OTHER TECHNOLOGIES: MARKET, BY TECHNOLOGY TYPE, 2024–2029 (USD MILLION)

- TABLE 41 OTHER TECHNOLOGIES: MARKET, BY REGION, 2020–2023 (USD THOUSANDS)

- TABLE 42 OTHER TECHNOLOGIES: MARKET, BY REGION, 2024–2029 (USD THOUSAND)

- TABLE 43 OTHER TECHNOLOGIES: MARKET IN ASIA PACIFIC, BY COUNTRY, 2020–2023 (USD THOUSAND)

- TABLE 44 OTHER TECHNOLOGIES: MARKET IN ASIA PACIFIC, BY COUNTRY, 2024–2029 (USD THOUSAND)

- TABLE 45 OTHER TECHNOLOGIES: MARKET IN NORTH AMERICA, BY COUNTRY, 2020–2023 (USD THOUSAND)

- TABLE 46 OTHER TECHNOLOGIES: MARKET IN NORTH AMERICA, BY COUNTRY, 2024–2029 (USD THOUSAND)

- TABLE 47 OTHER TECHNOLOGIES: MARKET IN EUROPE, BY COUNTRY, 2020–2023 (USD THOUSAND)

- TABLE 48 OTHER TECHNOLOGIES: MARKET IN EUROPE, BY COUNTRY, 2024–2029 (USD THOUSAND)

- TABLE 49 OTHER TECHNOLOGIES: MARKET IN ROW, BY REGION, 2020–2023 (USD THOUSAND)

- TABLE 50 OTHER TECHNOLOGIES: MARKET IN ROW, BY REGION, 2024–2029 (USD THOUSAND)

- TABLE 51 MICRO-LED: MARKET, BY APPLICATION, 2020–2023 (USD MILLION)

- TABLE 52 MICRO-LED: MARKET, BY APPLICATION, 2024–2029 (USD MILLION)

- TABLE 53 FOLDABLE DISPLAY MARKET, BY PANEL SIZE, 2020–2023 (USD MILLION)

- TABLE 54 MARKET, BY PANEL SIZE, 2024–2029 (USD MILLION)

- TABLE 55 UP TO 20 INCHES: MARKET, BY APPLICATION, 2020–2023 (USD MILLION)

- TABLE 56 UP TO 20 INCHES: MARKET, BY APPLICATION, 2024–2029 (USD MILLION)

- TABLE 57 UP TO 20 INCHES: MARKET, BY TECHNOLOGY, 2020–2023 (USD MILLION)

- TABLE 58 UP TO 20 INCHES: MARKET, BY TECHNOLOGY, 2024–2029 (USD MILLION)

- TABLE 59 MARKET, BY APPLICATION, 2020–2023 (USD MILLION)

- TABLE 60 MARKET, BY APPLICATION, 2024–2029 (USD MILLION)

- TABLE 61 LAPTOPS AND TABLETS: MARKET, BY TECHNOLOGY, 2020–2023 (USD MILLION)

- TABLE 62 LAPTOPS AND TABLETS: MARKET, BY TECHNOLOGY, 2024–2029 (USD MILLION)

- TABLE 63 MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 64 MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 65 NORTH AMERICA: MARKET, BY COUNTRY, 2020–2023 (USD MILLION)

- TABLE 66 NORTH AMERICA: MARKET, BY COUNTRY, 2024–2029 (USD MILLION)

- TABLE 67 NORTH AMERICA: MARKET, BY TECHNOLOGY, 2020–2023 (USD MILLION)

- TABLE 68 NORTH AMERICA: MARKET, BY TECHNOLOGY, 2024–2029 (USD MILLION)

- TABLE 69 NORTH AMERICA: MARKET FOR OLED, BY APPLICATION, 2020–2023 (THOUSAND UNITS)

- TABLE 70 NORTH AMERICA: MARKET FOR OLED, BY APPLICATION, 2024–2029 (THOUSAND UNITS)

- TABLE 71 US: MARKET, BY TECHNOLOGY, 2020–2023 (USD MILLION)

- TABLE 72 US: MARKET, BY TECHNOLOGY, 2024–2029 (USD MILLION)

- TABLE 73 CANADA: MARKET, BY TECHNOLOGY, 2020–2023 (USD MILLION)

- TABLE 74 CANADA: MARKET, BY TECHNOLOGY, 2024–2029 (USD MILLION)

- TABLE 75 MEXICO: MARKET, BY TECHNOLOGY, 2020–2023 (USD THOUSAND)

- TABLE 76 MEXICO: MARKET, BY TECHNOLOGY, 2024–2029 (USD THOUSAND)

- TABLE 77 EUROPE: MARKET, BY COUNTRY, 2020–2023 (USD MILLION)

- TABLE 78 EUROPE: FOLDABLE DISPLAY MARKET, BY COUNTRY, 2024–2029 (USD MILLION)

- TABLE 79 EUROPE: MARKET, BY TECHNOLOGY, 2020–2023 (USD MILLION)

- TABLE 80 EUROPE: MARKET, BY TECHNOLOGY, 2024–2029 (USD MILLION)

- TABLE 81 EUROPE: MARKET FOR OLED, BY APPLICATION, 2020–2023 (THOUSAND UNITS)

- TABLE 82 EUROPE: MARKET FOR OLED, BY APPLICATION, 2024–2029 (THOUSAND UNITS)

- TABLE 83 UK: MARKET, BY TECHNOLOGY, 2020–2023 (USD MILLION)

- TABLE 84 UK: MARKET, BY TECHNOLOGY, 2024–2029 (USD MILLION)

- TABLE 85 GERMANY: MARKET, BY TECHNOLOGY, 2020–2023 (USD MILLION)

- TABLE 86 GERMANY: MARKET, BY TECHNOLOGY, 2024–2029 (USD MILLION)

- TABLE 87 FRANCE: MARKET, BY TECHNOLOGY, 2020–2023 (USD MILLION)

- TABLE 88 FRANCE: MARKET, BY TECHNOLOGY, 2024–2029 (USD MILLION)

- TABLE 89 REST OF EUROPE: MARKET, BY TECHNOLOGY, 2020–2023 (USD MILLION)

- TABLE 90 REST OF EUROPE: MARKET, BY TECHNOLOGY, 2024–2029 (USD MILLION)

- TABLE 91 ASIA PACIFIC: MARKET, BY COUNTRY, 2020–2023 (USD MILLION)

- TABLE 92 ASIA PACIFIC: MARKET, BY COUNTRY, 2024–2029 (USD MILLION)

- TABLE 93 ASIA PACIFIC: MARKET, BY TECHNOLOGY, 2020–2023 (USD MILLION)

- TABLE 94 ASIA PACIFIC: MARKET, BY TECHNOLOGY, 2024–2029 (USD MILLION)

- TABLE 95 ASIA PACIFIC: MARKET FOR OLED, BY APPLICATION, 2020–2023 (THOUSAND UNITS)

- TABLE 96 ASIA PACIFIC: MARKET FOR OLED, BY APPLICATION, 2024–2029 (THOUSAND UNITS)

- TABLE 97 CHINA: MARKET, BY TECHNOLOGY, 2020–2023 (USD MILLION)

- TABLE 98 CHINA: MARKET, BY TECHNOLOGY, 2024–2029 (USD MILLION)

- TABLE 99 JAPAN: MARKET, BY TECHNOLOGY, 2020–2023 (USD MILLION)

- TABLE 100 JAPAN: MARKET, BY TECHNOLOGY, 2024–2029 (USD MILLION)

- TABLE 101 SOUTH KOREA: MARKET, BY TECHNOLOGY, 2020–2023 (USD MILLION)

- TABLE 102 SOUTH KOREA: MARKET, BY TECHNOLOGY, 2024–2029 (USD MILLION)

- TABLE 103 REST OF ASIA PACIFIC: MARKET, BY TECHNOLOGY, 2020–2023 (USD MILLION)

- TABLE 104 REST OF ASIA PACIFIC: MARKET, BY TECHNOLOGY, 2024–2029 (USD MILLION)

- TABLE 105 ROW: FOLDABLE DISPLAY MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 106 ROW: MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 107 ROW: MARKET, BY TECHNOLOGY, 2020–2023 (USD MILLION)

- TABLE 108 ROW: MARKET, BY TECHNOLOGY, 2024–2029 (USD MILLION)

- TABLE 109 ROW: MARKET FOR OLED, BY APPLICATION, 2020–2023 (THOUSAND UNITS)

- TABLE 110 ROW: MARKET FOR OLED, BY APPLICATION, 2024–2029 (THOUSAND UNITS)

- TABLE 111 MIDDLE EAST & AFRICA: MARKET, BY TECHNOLOGY, 2020–2023 (USD MILLION)

- TABLE 112 MIDDLE EAST & AFRICA: MARKET, BY TECHNOLOGY, 2024–2029 (USD MILLION)

- TABLE 113 MIDDLE EAST & AFRICA: MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 114 MIDDLE EAST & AFRICA: MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 115 SOUTH AMERICA: MARKET, BY TECHNOLOGY, 2020–2023 (USD MILLION)

- TABLE 116 SOUTH AMERICA: MARKET, BY TECHNOLOGY, 2024–2029 (USD MILLION)

- TABLE 117 MARKET: KEY PLAYER STRATEGIES/RIGHT TO WIN, 2019–2024

- TABLE 118 MARKET: MARKET SHARE ANALYSIS OF TOP FIVE PLAYERS, 2023

- TABLE 119 MARKET: TECHNOLOGY FOOTPRINT

- TABLE 120 MARKET: PANEL SIZE FOOTPRINT

- TABLE 121 MARKET: APPLICATION FOOTPRINT

- TABLE 122 MARKET: REGION FOOTPRINT

- TABLE 123 FOLDABLE DISPLAY MARKET: LIST OF STARTUPS/SMES

- TABLE 124 MARKET: COMPETITIVE BENCHMARKING OF STARTUPS/SMES

- TABLE 125 MARKET: PRODUCT LAUNCHES, MAY 2019– JUNE 2024

- TABLE 126 MARKET: DEALS, MAY 2019–JUNE 2024

- TABLE 127 MARKET: OTHER DEVELOPMENTS, MAY 2019–JUNE 2024

- TABLE 128 SAMSUNG ELECTRONICS CO., LTD.: COMPANY OVERVIEW

- TABLE 129 SAMSUNG ELECTRONICS CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 130 SAMSUNG ELECTRONICS CO., LTD.: PRODUCT LAUNCHES

- TABLE 131 SAMSUNG ELECTRONICS CO., LTD.: DEALS

- TABLE 132 BOE TECHNOLOGY GROUP CO., LTD.: COMPANY OVERVIEW

- TABLE 133 BOE TECHNOLOGY GROUP CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 134 BOE TECHNOLOGY GROUP CO., LTD.: DEALS

- TABLE 135 VISIONOX COMPANY: COMPANY OVERVIEW

- TABLE 136 VISIONOX COMPANY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 137 VISIONOX COMPANY: DEALS

- TABLE 138 VISIONOX COMPANY: OTHER DEVELOPMENTS

- TABLE 139 TCL CHINA STAR OPTOELECTRONICS TECHNOLOGY CO., LTD.: COMPANY OVERVIEW

- TABLE 140 TCL CHINA STAR OPTOELECTRONICS TECHNOLOGY CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 141 TCL CHINA STAR OPTOELECTRONICS TECHNOLOGY CO., LTD.: PRODUCT LAUNCHES

- TABLE 142 TCL CHINA STAR OPTOELECTRONICS TECHNOLOGY CO., LTD.: DEALS

- TABLE 143 TIANMA: COMPANY OVERVIEW

- TABLE 144 TIANMA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 145 TIANMA: PRODUCT LAUNCHES

- TABLE 146 ROYOLE CORPORATION: COMPANY OVERVIEW

- TABLE 147 ROYOLE CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 148 ROYOLE CORPORATION: PRODUCT LAUNCHES

- TABLE 149 ROYOLE CORPORATION: DEALS

- TABLE 150 AUO CORPORATION: COMPANY OVERVIEW

- TABLE 151 AUO CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 152 AUO CORPORATION: PRODUCT LAUNCHES

- TABLE 153 HUAWEI TECHNOLOGIES CO., LTD.: COMPANY OVERVIEW

- TABLE 154 HUAWEI TECHNOLOGIES CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 155 HUAWEI TECHNOLOGIES CO., LTD.: PRODUCT LAUNCHES

- TABLE 156 MOTOROLA MOBILITY LLC: COMPANY OVERVIEW

- TABLE 157 MOTOROLA MOBILITY LLC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 158 MOTOROLA MOBILITY LLC: PRODUCT LAUNCHES

- TABLE 159 HONOR DEVICE CO., LTD.: COMPANY OVERVIEW

- TABLE 160 HONOR DEVICE CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 161 HONOR DEVICE CO., LTD.: PRODUCT LAUNCHES

- TABLE 162 ALPHABET, INC.: COMPANY OVERVIEW

- TABLE 163 LENOVO: COMPANY OVERVIEW

- TABLE 164 OPPO: COMPANY OVERVIEW

- TABLE 165 TECNO MOBILE: COMPANY OVERVIEW

- TABLE 166 VIVO MOBILE COMMUNICATION CO., LTD.: COMPANY OVERVIEW

- TABLE 167 XIAOMI: COMPANY OVERVIEW

- TABLE 168 VIEWSONIC CORPORATION: COMPANY OVERVIEW

- TABLE 169 ASUSTEK COMPUTER INC.: COMPANY OVERVIEW

- TABLE 170 E INK HOLDINGS INC.: COMPANY OVERVIEW

- TABLE 171 ONEPLUS: COMPANY OVERVIEW

- TABLE 172 CORNING INCORPORATED: COMPANY OVERVIEW

- TABLE 173 ONUMEN TECHNOLOGY CO., LTD.: COMPANY OVERVIEW

- TABLE 174 3M: COMPANY OVERVIEW

- TABLE 175 SCHOTT GROUP: COMPANY OVERVIEW

- TABLE 176 APPLIED MATERIALS, INC.: COMPANY OVERVIEW

- FIGURE 1 MARKET SEGMENTATION

- FIGURE 2 RESEARCH DESIGN

- FIGURE 3 BOTTOM-UP APPROACH

- FIGURE 4 TOP-DOWN APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION: DEMAND-SIDE ANALYSIS

- FIGURE 6 MARKET SIZE ESTIMATION: SUPPLY-SIDE ANALYSIS

- FIGURE 7 DATA TRIANGULATION

- FIGURE 8 GLOBAL FOLDABLE DISPLAY MARKET SNAPSHOT

- FIGURE 9 OLED SEGMENT TO SECURE LARGER MARKET SHARE IN 2024

- FIGURE 10 UP TO 20 INCHES SEGMENT TO HOLD LARGER MARKET SHARE DURING FORECAST PERIOD

- FIGURE 11 SMARTPHONES TO SECURE LARGEST MARKET SHARE IN 2029

- FIGURE 12 ASIA PACIFIC TO BE FASTEST-GROWING MARKET DURING FORECAST PERIOD

- FIGURE 13 RISING ADOPTION OF INNOVATIVE AND MULTIFUNCTIONAL DEVICES BY CONSUMERS TO DRIVE MARKET

- FIGURE 14 OLED SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 15 SMARTPHONES SEGMENT TO HOLD LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 16 FOLDABLE DISPLAYS UP TO 20 INCHES TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 17 ASIA PACIFIC TO BE LARGEST MARKET FOR FOLDABLE DISPLAYS BETWEEN 2024 AND 2029

- FIGURE 18 CHINA TO BE FASTEST-GROWING COUNTRY GLOBALLY DURING FORECAST PERIOD

- FIGURE 19 MARKET DYNAMICS

- FIGURE 20 GLOBAL 5G SUBSCRIPTIONS FOR SMARTPHONES, 2020–2029,

- FIGURE 21 IMPACT ANALYSIS OF DRIVERS ON MARKET

- FIGURE 22 IMPACT ANALYSIS OF RESTRAINTS ON MARKET

- FIGURE 23 IMPACT ANALYSIS OF OPPORTUNITIES ON FOLDABLE DISPLAY MARKET

- FIGURE 24 IMPACT ANALYSIS OF CHALLENGES ON MARKET

- FIGURE 25 SUPPLY CHAIN ANALYSIS

- FIGURE 26 ECOSYSTEM ANALYSIS

- FIGURE 27 DISPLAY ECOSYSTEM

- FIGURE 28 INVESTMENT AND FUNDING SCENARIO, 2018–2024

- FIGURE 29 TRENDS/DISRUPTIONS INFLUENCING CUSTOMER BUSINESS

- FIGURE 30 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY TECHNOLOGY, 2023

- FIGURE 31 AVERAGE SELLING PRICE TREND OF FOLDABLE DISPLAYS, BY REGION, 2019–2023

- FIGURE 32 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 33 IMPACT OF PORTER'S FIVE FORCES

- FIGURE 34 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY APPLICATION

- FIGURE 35 KEY BUYING CRITERIA, BY APPLICATION

- FIGURE 36 IMPORT DATA FOR HS CODE 8524-COMPLIANT PRODUCTS, BY COUNTRY, 2022–2023

- FIGURE 37 EXPORT DATA FOR HS CODE 8524-COMPLIANT PRODUCTS, BY COUNTRY, 2022–2023

- FIGURE 38 PATENT ANALYSIS

- FIGURE 39 IMPACT OF AI/GEN AI ON FOLDABLE DISPLAY MARKET

- FIGURE 40 OLED SEGMENT TO CAPTURE LARGER MARKET SHARE DURING FORECAST PERIOD

- FIGURE 41 ASIA PACIFIC TO BE FASTEST-GROWING MARKET FOR OLED TECHNOLOGY DURING FORECAST PERIOD

- FIGURE 42 ASIA PACIFIC TO LEAD MARKET FOR OTHER TECHNOLOGIES DURING FORECAST PERIOD

- FIGURE 43 ABOVE 20 INCHES SEGMENT TO EXHIBIT HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 44 SMARTPHONES SEGMENT TO CAPTURE LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 45 ASIA PACIFIC TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 46 NORTH AMERICA: MARKET SNAPSHOT

- FIGURE 47 EUROPE: MARKET SNAPSHOT

- FIGURE 48 ASIA PACIFIC: FOLDABLE DISPLAY MARKET SNAPSHOT

- FIGURE 49 MARKET: MARKET SHARE ANALYSIS, 2023

- FIGURE 50 MARKET: REVENUE ANALYSIS OF KEY PLAYERS, 2019–2023

- FIGURE 51 MARKET: COMPANY VALUATION, 2024

- FIGURE 52 MARKET: FINANCIAL METRICS, 2024

- FIGURE 53 MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2023

- FIGURE 54 MARKET: COMPANY FOOTPRINT

- FIGURE 55 MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2023

- FIGURE 56 FOLDABLE DISPLAY MARKET: BRAND/PRODUCT COMPARISON

- FIGURE 57 SAMSUNG ELECTRONICS CO., LTD.: COMPANY SNAPSHOT

- FIGURE 58 BOE TECHNOLOGY GROUP CO., LTD.: COMPANY SNAPSHOT

- FIGURE 59 VISIONOX COMPANY: COMPANY SNAPSHOT

- FIGURE 60 TCL CHINA STAR OPTOELECTRONICS TECHNOLOGY CO., LTD.: COMPANY SNAPSHOT

- FIGURE 61 TIANMA: COMPANY SNAPSHOT

- FIGURE 62 AUO CORPORATION: COMPANY SNAPSHOT

- FIGURE 63 HUAWEI TECHNOLOGIES CO., LTD.: COMPANY SNAPSHOT

The research study involved 4 major activities in estimating the size of the foldable display market. Exhaustive secondary research has been done to collect important information about the market and peer markets. The validation of these findings, assumptions, and sizing with the help of primary research with industry experts across the value chain has been the next step. Both top-down and bottom-up approaches have been used to estimate the market size. Post which the market breakdown and data triangulation have been adopted to estimate the market sizes of segments and sub-segments.

Secondary Research

In the secondary research process, various secondary sources have been referred to for identifying and collecting information required for this study. The secondary sources include annual reports, press releases, and investor presentations of companies, white papers, and articles from recognized authors. Secondary research has been mainly done to obtain key information about the market’s value chain, the pool of key market players, market segmentation according to industry trends, regional outlook, and developments from both market and technology perspectives.

Primary Research

In primary research, various primary sources from both supply and demand sides have been interviewed to obtain the qualitative and quantitative insights required for this report. Primary sources from the supply side include experts such as CEOs, vice presidents, marketing directors, manufacturers, technology and innovation directors, end users, and related executives from multiple key companies and organizations operating in the foldable display ecosystem.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the market engineering process, both top-down and bottom-up approaches have been used, along with data triangulation methods, to estimate and validate the size of the foldable display market and other dependent submarkets. The research methodology used to estimate the market sizes includes the following:

- Identifying stakeholders in the foldable display market that influence the entire market, along with participants across the value chain.

- Analyzing major manufacturers of foldable display panels and studying their product portfolios

- Analyzing trends related to the adoption of foldable displays

- Tracking the recent and upcoming developments in the market that include investments, R&D activities, product launches, partnerships, collaborations, and expansions as well as forecasting the market size based on these developments and other critical parameters

- Carrying out multiple discussions with key opinion leaders to identify the adoption trends of foldable display market

- Segmenting the overall market into various other market segments

- Validating the estimates at every level through discussions with key opinion leaders, such as chief executives (CXOs), directors, and operation managers, and finally with the domain experts at MarketsandMarkets

Market Size Estimation Methodology-Bottom-up Approach

Market Size Estimation Methodology-Top-Down Approach

Data Triangulation

After arriving at the overall market size by the market size estimation process explained in the earlier section, the overall foldable display market has been divided into several segments and subsegments. The data triangulation and market breakdown procedures have been used to complete the overall market engineering process and arrive at the exact statistics for all segments, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides. Along with data triangulation and market breakdown, the market has been validated by top-down and bottom-up approaches.

Market Definition

The foldable display market designs, manufactures, and distributes foldable display panels that can be folded or bent without losing their display capabilities. A foldable display principally comprises high-end materials like flexible AMOLED or pOLED panels with a thin substrate and protective layers. These are engineered displays that bend without losing resolution or color accuracy. They serve a wide variety of devices and applications that include smartphones, tablets, laptops, wearables, and even large-format displays. Foldable displays would be most fitting in compact devices requiring greater portability without the loss of screen size and come with some remarkable benefits such as advanced user experience, increased screen real estate in portable form, and innovative product design. The greatest advantages of foldable displays are to offer large, high-quality screens in compact form factors while increasing device usability and opening up new design possibilities that cannot be achieved with traditional rigid screens.

Stakeholders

- OEMs

- Electronics Retailers

- Foldable Display Panel Manufacturers

- Foldable Device Manufacturers

- Material and Component Suppliers

- Technology Solution Providers

- Software Developers

- Marketing and Advertising Firms

- Distributors and Resellers

- Service Providers

- Regulatory Bodies

- Research and Development Institutes

- End Users

The main objectives of this study are as follows:

- To define, describe, and forecast the size of the foldable display market, by technology, panel size, application, and region, in terms of value

- To forecast the size of the foldable display market, by technology, in terms of volume, at the regional level

- To forecast the size of various segments with respect to four regions, namely North America, Europe, Asia Pacific, and the Rest of the World

- To identify and analyze key drivers, restraints, opportunities, and challenges influencing the growth of the foldable display market

- To study the value chain and related industry segments of the foldable display market

- To strategically analyze the micromarkets1 with respect to individual growth trends, prospects, and contributions to the overall market

- To analyze trends and disruptions impacting customers’ businesses’ pricing trends, patents and innovations, trade data, regulatory landscape, Porter’s five forces, case studies, key stakeholders and buying criteria, technology trends, market ecosystem, and key conferences and events related to the foldable display market

- To analyze opportunities for various stakeholders by identifying the high-growth segments of the market

- To strategically profile the key players and comprehensively analyze their market position in terms of revenue, market share, and core competencies2, along with detailing the competitive landscape for the market leaders

- To analyze competitive developments such as product launches, partnerships, collaborations, expansions, and research and development (R&D) activities carried out by players in the foldable display market

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

- Country-wise Information:

- Analysis for additional countries (up to five)

Company Information:

- Detailed analysis and profiling of additional market players (up to five)

Growth opportunities and latent adjacency in Foldable Display Market