Flow Computer Market in Oil & Gas by Offering (Hardware, Software, Support Services), by Operation (Upstream, Midstream and Downstream), Application (Custody Transfer, Pipeline Flow Monitoring, Wellhead Monitoring) and Region - Global Forecast to 2028

Updated on : July 11, 2025

Flow Computer Market Summary

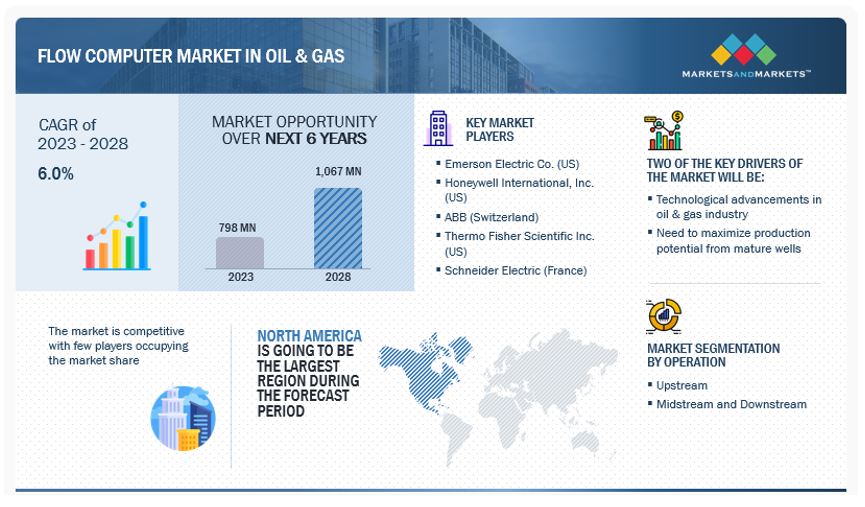

[183 Pages Report] The Flow Computer Market in oil & gas is projected to grow from USD 798 Million in 2023 to USD 1,067 Million in 2028; it is expected to grow at a CAGR of 6.0% from 2023 to 2028.

Flow Computer Market Key Takeaways

-

By 2023–2028, the flow computer market is expected to grow from USD 798 million by 2023 to USD 1,067 million by 2028, registering a growing CAGR of 6.0%.

-

By dynamics – the oil & gas industry is driving demand, as flow computers are essential for accurate measurement and control in processes like custody transfer, boosting operational efficiency.

-

By dynamics – real-time data matters, and flow computers play a key role in streamlining processes across upstream, midstream, and downstream operations by monitoring and recording critical flow information.

-

By opportunity – upstream operations are seeing strong adoption, with more companies relying on flow computers for wellhead monitoring and enhanced control in oil exploration.

-

By type – hardware-based flow computers lead the market, especially field-mounted units that offer durability and reliability in harsh environments.

-

By component – software and services are gaining traction, as companies seek integrated systems for data analysis, visualization, and remote management.

-

By challenge – integration remains a hurdle, with compatibility issues between older legacy systems and newer digital flow computing platforms.

-

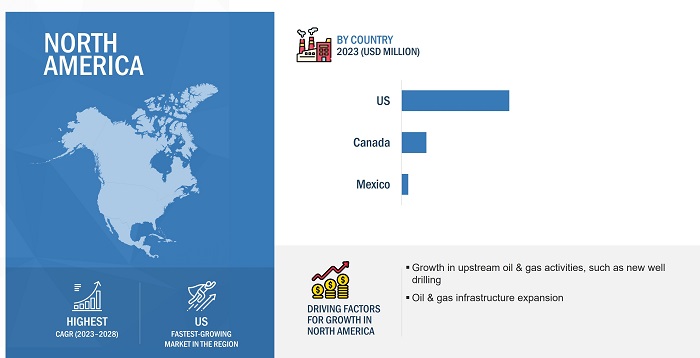

By region – North America remains the dominant player, backed by a robust oil & gas sector, strong infrastructure, and early adoption of digital flow monitoring technologies.

Market Size & Forecast Report

-

2023 Market Size: USD 798 million

-

2028 Projected Market Size: USD 1,067 million

-

CAGR (2023-2028): 6.0%

-

North America : Grow at the highest CAGR

The market growth is driven by factors including the technological advancements in oil & gas industry and suitability in many functions of the oil & gas industry and increasing adoption of process automation providing opportunities for flow computer industry in oil & gas. However, interoperability of multiple components from different solution providers are challenging the market growth

Flow Computer Market Size and Forecast to 2028

To know about the assumptions considered for the study, Request for Free Sample Report

Flow Computer Market Trends and Dynamics

DRIVERS: Technological advancements in oil & gas industry

Digital transformation and automation are emerging trends in the oil & gas industry, which is experiencing rapid digitalization with smarter operations, thus giving rise to the digital economy. Digital transformation or automation enables deployment of a minimum workforce in remote onshore & offshore exploration sites. The demand for operational digital oilfield solutions is increasing due to limited oil or fuel supply to the growing number of vehicles in the market, which compels the oil industry to adopt new and improved technologies. The implementation of systems such as DCS, PLC, smart well, and SCADA in the upstream segment helps automate the control process and offers real-time data.

RESTRAINT: High cost of flow computer and regular maintenance

Flow computers are known for providing accurate and reliable flow measurements in the oil & gas industry. They require specialized components and manufacturing processes to achieve a high level of accuracy and reliable flow measurement. New-age components provide add-on features and functionality, such as the measurement of multiple fluid parameters simultaneously and diagnostic and calibration features, which give advantages over other flow measurement devices. These add-on features and functionality increase the cost of the device and maintenance costs. If the add-on features may not be justifiable for pipeline operators and cannot return on investments in terms of improved efficiency, accuracy, and reduced operating cost, then flow computer becomes a non-viable option for the operators. Hence, high product and maintenance costs become restraints for operators looking to minimize their cost of ownership.

OPPORTUNITIES: Growing demand for offshore/ultra-deep discoveries.

The oil & gas industry is going through a phase of technological advancements in exploration technology for deepwater exploration and production activities and the commercial viability of the projects. Current advances allow oil companies to improve recovery and accelerate production.

Offshore wells may have a different level of automation, ranging from simple one-way monitoring to complex subsurface controls with intelligent completions. Petrobras (Brazil) has created a corporate program dedicated to studying, developing, and implementing digital integrated field management (GeDIg) among its production assets. Petrobras selected the Carapeba field as a pilot project. It is a mature field composed of three wells located in the northeastern part of the Campos Basin, which has installed automated subsurface sensors in the wells.

CHALLENGES: Interoperability of multiple components from different solution providers.

Companies in the upstream segment often buy and assemble components from different vendors depending on customer requirements. This makes the Flow Computer Market size highly consumer-dominated, so no standard or generalized product can be developed by a single player. In that case, interoperability with other systems and components is a challenge for upstream operators. Adding any alternative system, hardware, or software that is not compatible with some of the digital oilfield systems, such as the flow computer, becomes a constraint as it has to integrate with the existing system for optimum results seamlessly. Developments for integrating various services with each other are expected to overcome this challenge faced by oilfield operators.

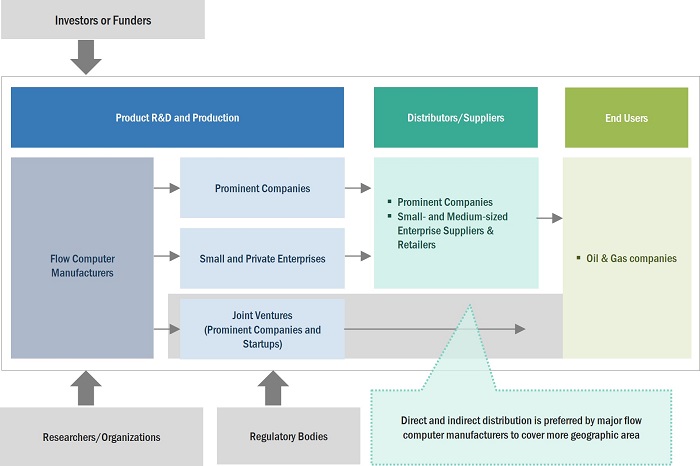

Flow Computer Market in Oil & Gas Ecosystem

Prominent companies in this market include well-established, financially stable manufacturers and providers of flow computers. These companies have been operating in the flow computer market size for several years and possess a diversified product portfolio, state-of-the-art technologies, and strong global sales and marketing networks. Prominent companies in this market include Emerson Electric Co. (US), Honeywell International, Inc. (US), ABB (Switzerland), Thermo Fisher Scientific Inc. (US), and Schneider Electric (France).

Market By Operation Insights:

Midstream & Downstream segment is expected to register higher market share during the forecast period

The crude oil and natural gas are distributed through midstream pipelines and tankers. Since these pipelines carry important and pricey materials, they require continuous monitoring. The flow computers perform metering, meter proving, ticketing, valve control, batching, and product interfacing.

In the midstream application, positive displacement, ultrasonic, Coriolis, and turbine flow meters are majorly used and connected to flow computers. These flow computers can also be utilized in leak detection and pipeline control. Similarly, in downstream, flow computers are used for the distribution of oil & gas from one source to multiple sources. They are also used for flow indication and control.

Apart from billing, the flow computers are also used for flow measurement at ship, rail, and road loading. As a result, the market size of flow computers in midstream and downstream operations is larger than upstream operations.

Offering Insights:

Hardware segment is expected to register higher market share during the forecast period

In the hardware component, the market for flow computer devices is considered. The flow computers are used in upstream, midstream, and downstream oil and gas operations. These flow computer devices perform significant tasks of accurate flow calculations and therefore are employed at multiple operation points.

Flow computer devices are of two major types: field-mounted devices and panel-mounted devices. Field-mounted devices are mounted or installed onsite, whereas the panel-mounted flow computers are installed at a workstation or centralized station from where the flow monitoring and controlling are done. The field-mounted flow computers are installed on the site, such as wellheads, production sites, pipeline mounted, and sometimes at remote places. Therefore, field-mounted flow computers are required to be sturdy and resistant to hazardous climate conditions.

Application Insights:

Flow computers in the oil and gas industry are used for specific applications that vary based on their role in the value chain:

- Custody Transfer: One of the most critical applications for flow computers, custody transfer involves the accurate measurement of oil and gas during commercial transactions. Flow computers ensure compliance with international measurement standards, minimize disputes, and support accurate billing.

- Pipeline Monitoring: Flow computers monitor the flow of oil and gas in pipelines, helping to ensure efficiency, detect leaks, and maintain safety standards. They provide real-time data on pressure, flow rates, and volume to optimize transportation.

- Wellhead Monitoring: In upstream operations, flow computers are used to monitor well production and optimize the extraction process. They provide critical data for decision-making regarding production rates and reservoir management.

- Refining and Distribution: In downstream operations, flow computers monitor the flow of refined products during the refining process and ensure precise measurements in fuel distribution networks.

Regional Insights

North America to grow at the highest CAGR during the forecast period

North America has the largest number of oil & gas rigs with top flow computer manufacturers and providers such as Emerson Electric Co. (US), Honeywell (US), Thermo Fisher Scientific (US), and OMNI Flow Computers (US).

Furthermore, Oil & gas companies in US are investing a fair amount in automating their processes and converting components to digital. The integration of IIoT and SCADA systems is increasing the scope of flow computers for oil & gas. Similarly, Canada is the fifth-largest producer of natural gas and the sixth-largest producer of crude oil worldwide.

Its expanding production enables the adoption of flow computers in oil and natural gas plants. The oil & gas reserves in the Mexican Gulf are expected to be high in resources; therefore, many companies worldwide are investing heavily in this region

Flow Computer Market by Region

To know about the assumptions considered for the study, download the pdf brochure

By End-user:

The flow computer market size is segmented by the type of end-user organizations in the oil and gas industry:

- National Oil Companies (NOCs): These are state-owned companies that dominate the oil and gas industry in regions like the Middle East, Africa, and parts of Asia. Flow computers are integral to their large-scale operations.

- International Oil Companies (IOCs): Global energy companies like ExxonMobil, BP, Shell, and Chevron that operate across multiple countries. These companies are key consumers of flow computers, as they focus on maximizing production efficiency, safety, and regulatory compliance.

- Independent Oil & Gas Companies: Smaller firms engaged in upstream exploration and production activities, especially in regions like North America. These companies tend to adopt advanced flow computer solutions to improve operational efficiency and cost-effectiveness.

Top Flow Computer Companies - Key Market Players:

The Flow Computer Companies is dominated by players such as :

- Emerson Electric Co. (US),

- Honeywell International, Inc. (US),

- ABB (Switzerland),

- Thermo Fisher Scientific Inc. (US),

- Schneider Electric (France),

- Krohne Messtechnik GmbH (Germany),

- Yokogawa Electric Corporation (Japan),

- TechnipFMC plc (US),

- OMNI Flow Computers, Inc. (US),

- Dynamic Flow Computers, Inc. (US),

- Contrec Limited (UK),

- Kessler-Ellis Products (KEP) Co, Inc. (US),

- Sensia (US),

- Prosoft Technology, Inc.(US),

- Flowmetric, Inc.(US)

Flow Computer Market Report Scope:

|

Report Metric |

Details |

|

Estimated Market Size in 2023 |

USD 798 Million in 2023 |

|

Projected Market Size in 2028 |

USD 1,067 Million in 2028 |

|

Growth Rate |

CAGR of 6.0% |

|

Flow Computer Market Size Available for Years |

2019–2028 |

|

Base Year |

2022 |

|

Forecast Period |

2023–2028 |

|

Units |

Value (USD Billion/Million) |

|

Segments Covered |

Component, Operation |

|

Geographic Regions Covered |

North America, Europe, Asia Pacific and RoW |

|

Companies Covered |

Major Players: Emerson Electric Co. (US), Honeywell International, Inc. (US), ABB (Switzerland), Thermo Fisher Scientific Inc. (US), Schneider Electric (France), Krohne Messtechnik GmbH (Germany), Yokogawa Electric Corporation (Japan), TechnipFMC plc (US), OMNI Flow Computers, Inc. (US), Dynamic Flow Computers, Inc. (US), Contrec Limited (UK), Kessler-Ellis Products (KEP) Co, Inc. (US), Sensia (US),Spirax Sarco Limited (UK), SICK AG (Germany), Badger Meter, Inc.(US), Quorum Business Solution, Inc.(US), Endress+Hauser AG (Switzerland), PLUM Sp. Zo. O (Poland), Fluidwell BV (Netherlands), Oval Corporation (Japan), Seneca srl (Italy), and Hoffer Flow Controls, Inc. (US). and Others- total 25 players have been covered |

Flow Computer Market Highlights

This research report categorizes the flow computer market in oil & gas by component, operation, and region.

|

Segment |

Subsegment |

|

By Component: |

|

|

By Operation: |

|

|

By Region: |

|

Recent Developments in Flow Computer Market

- Schneider Electric’s Realflo 7.0 Flow Computer Software, which focuses on enhancing the functionality of flow computers used in the oil and gas industry, particularly for measurement accuracy and digital integration.

- In January 2023, Emerson Electric Co. launched a new generation of single and dual meter run gas flow computers. They are field-mounted and explosion-proof flow computers, which offer a more practical option for remote oil & gas production sites.

- In June 2022, ABB and Wison Offshore & Marine Limited (WOM), a technology and solution provider focusing on clean energy, collaborated to develop and implement floating liquefied natural gas (FLNG) facilities worldwide. This would enable the delivery of standardized electrification and safety system to improve production efficiency.

- In September 2021, Thermo Fisher Scientific Inc. introduced the Thermo Scientific AutoFLEX EFM, the newest addition to the Auto SERIES flow computer portfolio, utilized to measure flow and process control in the oil and gas industry

Frequently Asked Questions (FAQ):

What is the total CAGR expected to be recorded for the flow computer market in oil & gas during 2023-2028?

The global flow computer market in oil & gas is expected to record a CAGR of 6.0% from 2023–2028.

What are the driving factors for the flow computer market in oil & gas?

Technological advancements in oil & gas industry and suitability in many functions of the oil and gas industry.

Which operational area in oil & gas is likely to create high growth opportunities for flow computer?

Upstream operations are expected to create considerable growth opportunities for the flow computer market.

What are the applications of flow computer that drives the adoption of flow computer in oil & gas?

Some common applications of flow computers in oil and gas include custody transfer, pipeline flow monitoring, and wellhead monitoring. Custody transfer is the transfer of ownership of crude oil, natural gas, or other fluids from one party to another. Flow computers are used to measure the volume and flow rate during the transfer to ensure accurate and fair transactions. Flow computers are used to monitor the flow rate and pressure of oil and gas through pipelines to ensure safe and efficient operations. They can detect changes in viscosity, temperature, and density of the fluids being transported. Flow computers monitor the flow rate and pressure of oil & gas from individual wells to optimize production and ensure safe operations.

Which region will lead the flow computer market in oil & gas in the future?

North America is expected to lead the flow computer market in oil & gas during the forecast period.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Technological advancements in oil & gas industry- Need to maximize production potential from mature wells- Suitability in oil & gas industryRESTRAINTS- Cybersecurity threats- High cost of flow computer and regular maintenanceOPPORTUNITIES- Growing demand for offshore/ultra-deep discoveries- Increasing adoption of process automationCHALLENGES- Interoperability of multiple components from different solution providers

- 5.3 VALUE CHAIN ANALYSIS

-

5.4 ECOSYSTEM ANALYSIS

-

5.5 PRICING ANALYSISAVERAGE SELLING PRICE OF FLOW COMPUTERS OFFERED BY KEY PLAYERS

-

5.6 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

-

5.7 TECHNOLOGY ANALYSISIMPACT OF IIOT ON FLOW COMPUTER MARKET IN OIL & GASINTEGRATION OF ARTIFICIAL INTELLIGENCE INTO FLOW COMPUTERS

- 5.8 PORTER’S FIVE FORCES ANALYSIS

-

5.9 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

-

5.10 CASE STUDIES

- 5.11 TRADE ANALYSIS

-

5.12 PATENT ANALYSIS

- 5.13 KEY CONFERENCES AND EVENTS, 2023–2024

-

5.14 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONSSTANDARDS

- 6.1 INTRODUCTION

- 6.2 CUSTODY TRANSFER

- 6.3 PIPELINE FLOW MONITORING

- 6.4 WELLHEAD MONITORING

- 7.1 INTRODUCTION

-

7.2 HARDWAREUSED IN WELLHEAD MEASUREMENT, CUSTODY TRANSFER, AND FUEL MONITORINGPROCESSORMEMORYINPUT/OUTPUT (I/O) MODULEPOWER SUPPLYCOMMUNICATION INTERFACEENCLOSUREDISPLAY

-

7.3 SOFTWAREENABLES ACCURATE MEASUREMENT, MONITORING, AND FLOW OF MEDIUM

-

7.4 SUPPORT SERVICESMINIMIZES ECONOMIC LOSSES AND TECHNICAL ISSUES POST INSTALLATIONSYSTEM INTEGRATIONCUSTOMIZATIONFIELD SERVICESCONSULTING SERVICES

- 8.1 INTRODUCTION

-

8.2 UPSTREAMENGAGES IN EXPLORATION, DRILLING, AND PRODUCTION

-

8.3 MIDSTREAM AND DOWNSTREAMAPPLICATIONS IN CUSTODY TRANSFER, PIPELINE FLOW MONITORING, ALLOCATION, BLENDING, AND BATCHING

- 9.1 INTRODUCTION

-

9.2 NORTH AMERICAUS- Contributes highest market share in regionCANADA- Significant oil reserves and expanding productionMEXICO- Moderate market growth

-

9.3 EUROPENORWAY- Growing investments in oil & gas projectsKAZAKHSTAN- Exports 80% of oil producedUK- Presence of several technology providersREST OF EUROPE

-

9.4 MIDDLE EASTSAUDI ARABIA- Continuous oil exploration and development by Saudi AramcoIRAN- Increased production activitiesQATAR- Depleting oil productionREST OF MIDDLE EAST

-

9.5 ASIA PACIFICCHINA- Expected to dominate market in Asia PacificINDIA- Redevelopment of legacy oilfields and government initiativesINDONESIA- Government plans to boost oil & gas productionREST OF ASIA PACIFIC

-

9.6 REST OF THE WORLDSOUTH AMERICA- Digitalization in oilfieldsAFRICA- Governments plans to expand energy segment

- 10.1 INTRODUCTION

- 10.2 TOP 5 COMPANY REVENUE ANALYSIS

- 10.3 MARKET SHARE ANALYSIS OF TOP FIVE PLAYERS, 2022

-

10.4 COMPANY EVALUATION QUADRANT, 2022STARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

- 10.5 FLOW COMPUTER MARKET IN OIL & GAS: PRODUCT FOOTPRINT

-

10.6 SMALL AND MEDIUM-SIZED ENTERPRISES (SME) EVALUATION MATRIX, 2022PROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKSSTARTUPS/SMES EVALUATION MATRIX

-

10.7 COMPETITIVE SITUATIONS AND TRENDSMARKET IN OIL & GAS: PRODUCT LAUNCHES, SEPTEMBER 2021–JANUARY 2023MARKET IN OIL & GAS: DEALS, JUNE 2022MARKET IN OIL & GAS: OTHERS, FEBRUARY 2021

-

11.1 KEY PLAYERSEMERSON ELECTRIC CO.- Business overview- Products offered- Recent developments- MnM viewHONEYWELL INTERNATIONAL, INC.- Business overview- Products offered- MnM viewABB- Business overview- Products offered- Recent developments- MnM viewTHERMO FISHER SCIENTIFIC INC.- Business overview- Products offered- Recent developments- MnM viewSCHNEIDER ELECTRIC- Business overview- Products offered- MnM viewKROHNE MESSTECHNIK GMBH- Business overview- Products offeredYOKOGAWA ELECTRIC CORPORATION- Business overview- Products offeredTECHNIPFMC PLC- Business overview- Products offeredOMNI FLOW COMPUTERS, INC.- Business overview- Products offeredDYNAMIC FLOW COMPUTERS, INC.- Business overview- Products offeredCONTREC LIMITED- Business overview- Products offeredKESSLER-ELLIS PRODUCTS (KEP) CO, INC.- Business overview- Products offeredSENSIA- Business overview- Products offered

-

11.2 OTHER KEY PLAYERSPROSOFT TECHNOLOGY, INC.FLOWMETRICS, INC.SPIRAX SARCO LIMITEDSICK AGBADGER METER, INC.QUORUM BUSINESS SOLUTIONS, INC.ENDRESS+HAUSER AGPLUM SP. Z O.OFLUIDWELL BVOVAL CORPORATIONSENECA SRLHOFFER FLOW CONTROLS, INC.

- 12.1 INTRODUCTION

- 12.2 STUDY LIMITATIONS

-

12.3 PROCESS AUTOMATION AND INSTRUMENTATION MARKET, BY INSTRUMENTFIELD INSTRUMENTS- Level Transmitters- Pressure Transmitters- Temperature Transmitters- Others- Vibration level switchesPROCESS ANALYZERS- High demand from pharmaceutical industry

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS

- TABLE 1 FLOW COMPUTER MARKET IN OIL & GAS: ECOSYSTEM

- TABLE 2 INDICATIVE PRICES OF FLOW COMPUTER

- TABLE 3 AVERAGE SELLING PRICES OF FLOW COMPUTERS OFFERED BY KEY PLAYERS (USD)

- TABLE 4 AVERAGE SELLING PRICES OF FLOW COMPUTER BY REGION (USD)

- TABLE 5 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 COMPONENTS (%)

- TABLE 6 KEY BUYING CRITERIA FOR TOP 3 COMPONENTS

- TABLE 7 TURKSTREAM GAS PIPELINE USED CONTREC’S 515 GAS FLOW COMPUTERS FOR FLOW MEASUREMENT SOLUTION

- TABLE 8 INSTALLATION OF E-CHART FLOW COMPUTERS FOR ACCURATE MONITOR MEASUREMENTS FOR GAS LIFT OPERATION

- TABLE 9 HUSKY ENERGY UPGRADED ITS LIMA REFINERY WITH MICRO MVL FLOW COMPUTER FOR RELIABLE MEASUREMENT

- TABLE 10 INSTALLATION OF EMERSON’S FB1200 FLOW COMPUTER BY WATERBRIDGE TO ACHIEVE ACCURATE AND LOW MAINTENANCE METER PERFORMANCE

- TABLE 11 TOP 20 PATENT OWNERS IN US IN LAST 10 YEARS

- TABLE 12 LIST OF FEW PATENTS IN MARKET IN OIL & GAS, 2020–2023

- TABLE 13 FLOW COMPUTER MARKET IN OIL & GAS: DETAILED LIST OF CONFERENCES AND EVENTS

- TABLE 14 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 REST OF THE WORLD: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 STANDARDS FOR MARKET IN OIL & GAS

- TABLE 19 MARKET IN OIL & GAS, BY OFFERING, 2019–2022 (USD MILLION)

- TABLE 20 MARKET IN OIL & GAS, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 21 MARKET IN OIL & GAS, BY OPERATION, 2019–2022 (USD MILLION)

- TABLE 22 MARKET IN OIL & GAS, BY OPERATION, 2023–2028 (USD MILLION)

- TABLE 23 UPSTREAM MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 24 UPSTREAM MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 25 NORTH AMERICA: UPSTREAM FLOW COMPUTER MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 26 NORTH AMERICA: UPSTREAM MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 27 EUROPE: UPSTREAM MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 28 EUROPE: UPSTREAM MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 29 MIDDLE EAST: UPSTREAM MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 30 MIDDLE EAST: UPSTREAM MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 31 ASIA PACIFIC: UPSTREAM MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 32 ASIA PACIFIC: UPSTREAM MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 33 REST OF THE WORLD: UPSTREAM MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 34 REST OF THE WORLD: UPSTREAM MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 35 MIDSTREAM AND DOWNSTREAM MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 36 MIDSTREAM AND DOWNSTREAM MARKET, BY REGION , BY REGION, 2023–2028 (USD MILLION)

- TABLE 37 NORTH AMERICA: MIDSTREAM AND UPSTREAM FLOW COMPUTER MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 38 NORTH AMERICA: MIDSTREAM AND UPSTREAM MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 39 EUROPE: MIDSTREAM AND UPSTREAM MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 40 EUROPE: MIDSTREAM AND UPSTREAM MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 41 MIDDLE EAST: MIDSTREAM AND UPSTREAM MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 42 MIDDLE EAST: MIDSTREAM AND UPSTREAM MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 43 ASIA PACIFIC: MIDSTREAM AND UPSTREAM MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 44 ASIA PACIFIC: MIDSTREAM AND UPSTREAM MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 45 REST OF THE WORLD: MIDSTREAM AND UPSTREAM MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 46 REST OF THE WORLD: MIDSTREAM AND UPSTREAM MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 47 FLOW COMPUTER MARKET IN OIL & GAS, BY REGION, 2019–2022 (USD MILLION)

- TABLE 48 MARKET IN OIL & GAS, BY REGION, 2023–2028 (USD MILLION)

- TABLE 49 NORTH AMERICA: MARKET IN OIL & GAS, BY COUNTRY, 2019–2022(USD MILLION)

- TABLE 50 NORTH AMERICA: MARKET IN OIL & GAS, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 51 NORTH AMERICA: MARKET IN OIL & GAS, BY OPERATION, 2019–2022 (USD MILLION)

- TABLE 52 NORTH AMERICA: MARKET IN OIL & GAS, BY OPERATION, 2023–2028 (USD MILLION)

- TABLE 53 US: MARKET IN OIL & GAS, BY OPERATION, 2019–2022 (USD MILLION)

- TABLE 54 US: MARKET IN OIL & GAS, BY OPERATION, 2023–2028 (USD MILLION)

- TABLE 55 CANADA: MARKET IN OIL & GAS, BY OPERATION, 2019–2022 (USD MILLION)

- TABLE 56 CANADA: MARKET IN OIL & GAS, BY OPERATION, 2023–2028 (USD MILLION)

- TABLE 57 MEXICO: MARKET IN OIL & GAS, BY OPERATION, 2019–2022 (USD MILLION)

- TABLE 58 MEXICO: MARKET IN OIL & GAS, BY OPERATION, 2023–2028 (USD MILLION)

- TABLE 59 EUROPE: MARKET IN OIL & GAS, BY COUNTRY, 2019–2022(USD MILLION)

- TABLE 60 EUROPE: MARKET IN OIL & GAS, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 61 EUROPE: MARKET IN OIL & GAS, BY OPERATION, 2019–2022 (USD MILLION)

- TABLE 62 EUROPE: MARKET IN OIL & GAS, BY OPERATION, 2023–2028 (USD MILLION)

- TABLE 63 NORWAY: MARKET IN OIL & GAS, BY OPERATION, 2019–2022 (USD MILLION)

- TABLE 64 NORWAY: MARKET IN OIL & GAS, BY OPERATION, 2023–2028 (USD MILLION)

- TABLE 65 KAZAKHSTAN: MARKET IN OIL & GAS, BY OPERATION, 2019–2022 (USD MILLION)

- TABLE 66 KAZAKHSTAN: MARKET IN OIL & GAS, BY OPERATION, 2023–2028 (USD MILLION)

- TABLE 67 UK: FLOW COMPUTER MARKET IN OIL & GAS, BY OPERATION, 2019–2022 (USD MILLION)

- TABLE 68 UK: MARKET IN OIL & GAS, BY OPERATION, 2023–2028 (USD MILLION)

- TABLE 69 REST OF EUROPE: MARKET IN OIL & GAS, BY OPERATION, 2019–2022 (USD MILLION)

- TABLE 70 REST OF EUROPE: MARKET IN OIL & GAS, BY OPERATION, 2023–2028 (USD MILLION)

- TABLE 71 MIDDLE EAST: MARKET IN OIL & GAS, BY COUNTRY, 2019–2022(USD MILLION)

- TABLE 72 MIDDLE EAST: MARKET IN OIL & GAS, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 73 MIDDLE EAST: MARKET IN OIL & GAS, BY OPERATION, 2019–2022 (USD MILLION)

- TABLE 74 MIDDLE EAST: MARKET IN OIL & GAS, BY OPERATION, 2023–2028 (USD MILLION)

- TABLE 75 SAUDI ARABIA: MARKET IN OIL & GAS, BY OPERATION, 2019–2022 (USD MILLION)

- TABLE 76 SAUDI ARABIA: MARKET IN OIL & GAS, BY OPERATION, 2023–2028 (USD MILLION)

- TABLE 77 IRAN: MARKET IN OIL & GAS, BY OPERATION, 2019–2022 (USD MILLION)

- TABLE 78 IRAN: MARKET IN OIL & GAS, BY OPERATION, 2023–2028 (USD MILLION)

- TABLE 79 QATAR: MARKET IN OIL & GAS, BY OPERATION, 2019–2022 (USD MILLION)

- TABLE 80 QATAR: MARKET IN OIL & GAS, BY OPERATION, 2023–2028 (USD MILLION)

- TABLE 81 REST OF MIDDLE EAST: FLOW COMPUTER MARKET IN OIL & GAS, BY OPERATION, 2019–2022 (USD MILLION)

- TABLE 82 REST OF MIDDLE EAST: MARKET IN OIL & GAS, BY OPERATION, 2023–2028 (USD MILLION)

- TABLE 83 ASIA PACIFIC: MARKET IN OIL & GAS, BY COUNTRY, 2019–2022(USD MILLION)

- TABLE 84 ASIA PACIFIC: MARKET IN OIL & GAS, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 85 ASIA PACIFIC: MARKET IN OIL & GAS, BY OPERATION, 2019–2022 (USD MILLION)

- TABLE 86 ASIA PACIFIC: MARKET IN OIL & GAS, BY OPERATION, 2023–2028 (USD MILLION)

- TABLE 87 CHINA: MARKET IN OIL & GAS, BY OPERATION, 2019–2022 (USD MILLION)

- TABLE 88 CHINA: MARKET IN OIL & GAS, BY OPERATION, 2023–2028 (USD MILLION)

- TABLE 89 INDIA: MARKET IN OIL & GAS, BY OPERATION, 2019–2022 (USD MILLION)

- TABLE 90 INDIA: MARKET IN OIL & GAS, BY OPERATION, 2023–2028 (USD MILLION)

- TABLE 91 INDONESIA: MARKET IN OIL & GAS, BY OPERATION, 2019–2022 (USD MILLION)

- TABLE 92 INDONESIA: MARKET IN OIL & GAS, BY OPERATION, 2023–2028 (USD MILLION)

- TABLE 93 REST OF ASIA PACIFIC: MARKET IN OIL & GAS, BY OPERATION, 2019–2022 (USD MILLION)

- TABLE 94 REST OF ASIA PACIFIC: MARKET IN OIL & GAS, BY OPERATION, 2023–2028 (USD MILLION)

- TABLE 95 REST OF THE WORLD: FLOW COMPUTER MARKET IN OIL & GAS, BY REGION, 2019–2022(USD MILLION)

- TABLE 96 REST OF THE WORLD: MARKET IN OIL & GAS, BY REGION, 2023–2028 (USD MILLION)

- TABLE 97 REST OF THE WORLD: MARKET IN OIL & GAS, BY OPERATION, 2019–2022 (USD MILLION)

- TABLE 98 REST OF THE WORLD: MARKET IN OIL & GAS, BY OPERATION, 2023–2028 (USD MILLION)

- TABLE 99 SOUTH AMERICA: MARKET IN OIL & GAS, BY OPERATION, 2019–2022 (USD MILLION)

- TABLE 100 SOUTH AMERICA: MARKET IN OIL & GAS, BY OPERATION, 2023–2028 (USD MILLION)

- TABLE 101 AFRICA: MARKET IN OIL & GAS, BY OPERATION, 2019–2022 (USD MILLION)

- TABLE 102 AFRICA: MARKET IN OIL & GAS, BY OPERATION, 2023–2028 (USD MILLION)

- TABLE 103 MARKET SHARE OF TOP FIVE PLAYERS IN MARKET IN OIL & GAS, 2022

- TABLE 104 COMPANY FOOTPRINT

- TABLE 105 PRODUCT TYPE FOOTPRINT OF COMPANIES

- TABLE 106 OPERATION FOOTPRINT OF COMPANIES

- TABLE 107 REGIONAL FOOTPRINT OF COMPANIES

- TABLE 108 MARKET IN OIL & GAS: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 109 MARKET IN OIL & GAS: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 110 MARKET IN OIL & GAS: PRODUCT LAUNCHES, SEPTEMBER 2021–JANUARY 2023

- TABLE 111 MARKET IN OIL & GAS: DEALS, JUNE 2022

- TABLE 112 MARKET IN OIL & GAS: OTHERS, FEBRUARY 2021

- TABLE 113 EMERSON ELECTRIC CO.: COMPANY OVERVIEW

- TABLE 114 EMERSON ELECTRIC CO.: PRODUCTS OFFERED

- TABLE 115 EMERSON ELECTRIC CO.: PRODUCT LAUNCHES

- TABLE 116 HONEYWELL INTERNATIONAL, INC.: COMPANY OVERVIEW

- TABLE 117 HONEYWELL INTERNATIONAL, INC.: PRODUCTS OFFERED

- TABLE 118 ABB: COMPANY OVERVIEW

- TABLE 119 ABB: PRODUCTS OFFERED

- TABLE 120 ABB: DEALS

- TABLE 121 ABB: OTHERS

- TABLE 122 THERMO FISHER SCIENTIFIC INC.: COMPANY OVERVIEW

- TABLE 123 THERMO FISHER SCIENTIFIC INC.: PRODUCTS OFFERED

- TABLE 124 THERMO FISHER SCIENTIFIC INC.: PRODUCT LAUNCHES

- TABLE 125 SCHNEIDER ELECTRIC: COMPANY OVERVIEW

- TABLE 126 SCHNEIDER ELECTRIC: PRODUCTS OFFERED

- TABLE 127 KROHNE MESSTECHNIK GMBH: COMPANY OVERVIEW

- TABLE 128 KROHNE MESSTECHNIK GMBH: PRODUCTS OFFERED

- TABLE 129 YOKOGAWA ELECTRIC CORPORATION: COMPANY OVERVIEW

- TABLE 130 YOKOGAWA ELECTRIC CORPORATION: PRODUCTS OFFERED

- TABLE 131 TECHNIPFMC PLC: COMPANY OVERVIEW

- TABLE 132 TECHNIPFMC PLC: PRODUCTS OFFERED

- TABLE 133 OMNI FLOW COMPUTERS, INC.: COMPANY OVERVIEW

- TABLE 134 OMNI FLOW COMPUTERS, INC.: PRODUCTS OFFERED

- TABLE 135 DYNAMIC FLOW COMPUTERS, INC.: COMPANY OVERVIEW

- TABLE 136 DYNAMIC FLOW COMPUTERS, INC.: PRODUCTS OFFERED

- TABLE 137 CONTREC LIMITED: COMPANY OVERVIEW

- TABLE 138 CONTREC LIMITED: PRODUCTS OFFERED

- TABLE 139 KESSLER-ELLIS PRODUCTS CO, INC.: COMPANY OVERVIEW

- TABLE 140 KESSLER-ELLIS PRODUCTS CO, INC.: PRODUCTS OFFERED

- TABLE 141 SENSIA: COMPANY OVERVIEW

- TABLE 142 SENSIA: PRODUCTS OFFERED

- TABLE 143 PROCESS AUTOMATION AND INSTRUMENTATION MARKET, BY TYPE, 2018–2021 (USD MILLION)

- TABLE 144 PROCESS AUTOMATION AND INSTRUMENTATION MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 145 PROCESS AUTOMATION AND INSTRUMENTATION MARKET, BY INSTRUMENT, 2018–2021 (USD MILLION)

- TABLE 146 PROCESS AUTOMATION AND INSTRUMENTATION MARKET, BY INSTRUMENT, 2022–2027 (USD MILLION)

- FIGURE 1 SEGMENTATION OF FLOW COMPUTER MARKET IN OIL & GAS

- FIGURE 2 MARKET IN OIL & GAS: RESEARCH DESIGN

- FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: SUPPLY-SIDE APPROACH

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 6 DATA TRIANGULATION

- FIGURE 7 RESEARCH STUDY ASSUMPTIONS

- FIGURE 8 HARDWARE SEGMENT TO ACCOUNT FOR LARGEST SHARE OF MARKET IN OIL & GAS IN 2028

- FIGURE 9 UPSTREAM OPERATIONS TO CREATE HIGH-GROWTH OPPORTUNITIES FOR MARKET DURING FORECAST PERIOD

- FIGURE 10 NORTH AMERICA ACCOUNTED FOR LARGEST MARKET SHARE IN 2022

- FIGURE 11 GDP GROWTH PROJECTION TILL 2023 FOR MAJOR ECONOMIES (PERCENTAGE CHANGE)

- FIGURE 12 ADOPTION OF PROCESS AUTOMATION IN OIL & GAS INDUSTRY TO PROVIDE OPPORTUNITIES FOR MARKET PLAYERS

- FIGURE 13 SOFTWARE SEGMENT TO REGISTER HIGHEST CAGR IN MARKET IN OIL & GAS BETWEEN 2023 AND 2028

- FIGURE 14 US AND MIDSTREAM AND DOWNSTREAM TO ACCOUNT FOR LARGEST SHARE OF MARKET IN OIL & GAS IN NORTH AMERICA IN 2028

- FIGURE 15 NORTH AMERICA TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 16 FLOW COMPUTER MARKET IN OIL & GAS: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 17 MARKET IN OIL & GAS: IMPACT ANALYSIS OF DRIVERS

- FIGURE 18 MARKET IN OIL & GAS: IMPACT ANALYSIS OF RESTRAINTS

- FIGURE 19 MARKET IN OIL & GAS: IMPACT ANALYSIS OF OPPORTUNITIES

- FIGURE 20 MARKET IN OIL & GAS: IMPACT ANALYSIS OF CHALLENGES

- FIGURE 21 VALUE CHAIN ANALYSIS: MAJOR VALUE ADDITION DURING MANUFACTURING AND SYSTEM INTEGRATION PHASE

- FIGURE 22 MARKET IN OIL & GAS: ECOSYSTEM ANALYSIS

- FIGURE 23 AVERAGE SELLING PRICE TREND OF FLOW COMPUTER

- FIGURE 24 AVERAGE SELLING PRICES OF FLOW COMPUTERS OFFERED BY KEY PLAYERS

- FIGURE 25 REVENUE SHIFT AND NEW REVENUE POCKETS FOR PLAYERS IN MARKET IN OIL & GAS

- FIGURE 26 MARKET IN OIL & GAS: PORTER’S FIVE FORCES ANALYSIS

- FIGURE 27 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 COMPONENTS

- FIGURE 28 KEY BUYING CRITERIA FOR TOP 3 COMPONENTS

- FIGURE 29 IMPORT DATA, BY COUNTRY, 2017–2021 (USD MILLION)

- FIGURE 30 EXPORT DATA, BY COUNTRY, 2017–2021 (USD MILLION)

- FIGURE 31 TOP 10 COMPANIES WITH HIGHEST NUMBER OF PATENT APPLICATIONS IN LAST 10 YEARS

- FIGURE 32 NUMBER OF PATENTS GRANTED FROM 2013 TO 2022

- FIGURE 33 HARDWARE SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 34 MIDSTREAM AND UPSTREAM OPERATION TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 35 US TO EXHIBIT HIGHEST CAGR IN MARKET IN OIL & GAS DURING FORECAST PERIOD

- FIGURE 36 NORTH AMERICA: SNAPSHOT OF MARKET IN OIL & GAS

- FIGURE 37 EUROPE: SNAPSHOT OF MARKET IN OIL & GAS

- FIGURE 38 ASIA PACIFIC: SNAPSHOT OF MARKET IN OIL & GAS

- FIGURE 39 MARKET IN OIL & GAS: REVENUE ANALYSIS OF FIVE KEY PLAYERS, 2018–2022

- FIGURE 40 SHARE OF MAJOR PLAYERS IN MARKET IN OIL & GAS, 2022

- FIGURE 41 MARKET IN OIL & GAS: COMPANY EVALUATION QUADRANT, 2022

- FIGURE 42 FLOW COMPUTER MARKET IN OIL & GAS, SME EVALUATION QUADRANT, 2022

- FIGURE 43 EMERSON ELECTRIC CO.: COMPANY SNAPSHOT

- FIGURE 44 HONEYWELL INTERNATIONAL, INC.: COMPANY SNAPSHOT

- FIGURE 45 ABB: COMPANY SNAPSHOT

- FIGURE 46 THERMO FISHER SCIENTIFIC INC.: COMPANY SNAPSHOT

- FIGURE 47 SCHNEIDER ELECTRIC: COMPANY SNAPSHOT

- FIGURE 48 YOKOGAWA ELECTRIC CORPORATION: COMPANY SNAPSHOT

- FIGURE 49 TECHNIPFMC PLC: COMPANY SNAPSHOT

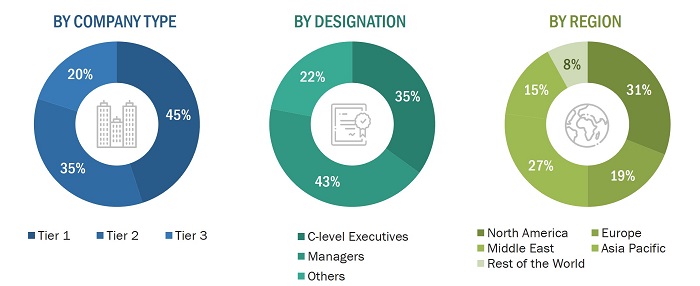

The study involved four major activities in estimating the size of the flow computer market in oil & gas. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across value chains through primary research. The bottom-up and top-down approaches were employed to estimate the overall market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various sources were referred to for identifying and collecting information important for this study. Secondary sources include corporate filings (such as annual reports, investor presentations, and financial statements, press releases); trade, business, and professional associations; white papers, flow computer-related journals, and certified publications; articles by recognized authors; gold and silver standard websites; and directories.

Secondary research was mainly conducted to obtain key information about the market value chain, the industry supply chain, the total pool of key players, market classification and segmentation according to industry trends to the bottom-most level, and key developments from both markets- and technology-oriented perspectives. Data from secondary research was collected and analyzed to arrive at the overall market size, which was further validated by primary research.

Primary Research

Extensive primary research has been conducted after understanding and analyzing the flow computer market through secondary research. Several primary telephonic interviews have been conducted with key opinion leaders from the demand- and supply-side vendors across four major regions—North America, Europe, Asia Pacific, and the Rest of the World (RoW). Moreover, questionnaires and emails were also used to collect the data.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In this report, for the complete market engineering process, both top-down and bottom-up approaches were used, along with several data triangulation methods, to estimate, forecast, and validate the size of the market and its segments and subsegments listed in the report. Extensive qualitative and quantitative analyses were carried out to list the key information/insights pertaining to the flow computer market size in oil & gas.

Major players in the flow computer market size in oil & gas have been identified through secondary research, and their market shares in the respective regions have been determined through primary and secondary research. The entire research methodology included the study of annual and financial reports of top players and interviews with experts (such as CEOs, VPs, directors, and marketing executives) for key insights (quantitative and qualitative). All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources. This data was consolidated and enhanced with detailed inputs and analysis from MarketsandMarkets and presented in this report.

Flow Computer Market in Oil & Gas: Bottom-Up Approach

- Identifying various applications in upstream, midstream, and downstream operations using or expected to adopt flow computers in the oil & gas industry

- Analyzing each operation, along with major related companies and their system integrators, and identifying service providers for implementing flow computers in operations

- Understanding the demand generated by these operations for flow computers in the oil & gas industry

- Estimating the size of the flow computer market size for each country and each region

- Tracking the ongoing and upcoming implementation of technology projects by various companies for each operation and region and forecasting the market size based on these developments and other critical parameters, such as investments in R&D

Flow Computer Market in Oil & Gas: Top-Down Approach

- Focusing on top-line investments and spending in the ecosystem of the oil & gas industry; Tracking further split by new installations, modification of solutions, and developments in key market areas

- Building and developing the information related to market revenues offered by key hardware, software, and service providers

- Carrying out multiple on-field discussions with key opinion leaders across each major company involved in the development of hardware and software and offering services pertaining to flow computers in oil & gas

- Estimating the geographic split using secondary sources based on factors such as oil & gas production, refining capacity, consumption, and adoption of technologies in the oil & gas operations

Data Triangulation

After arriving at the overall size of the flow computer market in oil & gas through the process explained above, the total market has been split into several segments. The market breakdown and data triangulation procedures have been employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all segments. The data has been triangulated by studying various factors and trends from the demand and supply sides. The market has also been validated using top-down and bottom-up approaches.

Market Definition

A flow computer is a microprocessor-based device that measures, monitors, and controls the flow of liquid, gas, and in some cases, steam. The flow computer receives signal inputs from flow meters: temperature, pressure, and other flow measurement transmitters. It calculates and records the data from the interfaced devices, important events, and alarms and then transfers it to external computers or workstations for inspecting, management, and accounting. It operates as the central point of the control system, collating and interpreting the raw data collected from monitoring equipment, which is then used to provide appropriate control over the system that it supervises.

Key Stakeholders

- Original Technology Designers and Suppliers

- Technical Universities

- Electronic Hardware Equipment Manufacturers

- Intellectual Property Vendors

- Market Research and Consulting Firms

- Intellectual Property Vendors

- Network Service Providers

- Software Service Providers

- Component Providers for Flow Computer Solutions and Software Integrators

- Subcomponent Manufacturers

- Government Organizations

- Technology Providers

- Software Solution Providers

- Venture Capitalists, Private Equity Firms, and Startups

Report Objectives

- To define, analyze, and forecast the flow computer market size in oil & gas, in terms of value, by offering, operation, and region

- To forecast the market size for various segments with respect to five main regions: North America, Europe, Middle East, Asia Pacific, and Rest of the World (RoW)

- To provide detailed information regarding drivers, restraints, opportunities, and challenges influencing market growth

- To strategically analyze the micromarkets1 with respect to individual growth trends, prospects, and contributions to the total market

- To provide a detailed overview of the value chain in the flow computer market in oil & gas and analyze the market trends

- To analyze opportunities in the market for various stakeholders by identifying the high growth segments of the flow computer market in oil & gas

- To strategically profile the key players and comprehensively analyze their market position in terms of ranking and core competencies2, along with detailing the competitive landscape for the market leaders

- To benchmark players within the market using competitive leadership mapping, which analyzes market players on various parameters within the broad categories of business and product strategies

- To map the competitive intelligence based on company profiles, key player strategies, and game-changing developments, such as product launches and partnerships

- To analyze the probable impact of the recession on the market in the near future

Available Customizations

Based on the given market data, MarketsandMarkets offers customizations in the reports according to the client’s specific requirements. The available customization options are as follows:

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Flow Computer Market