Floor Grinding Tools Market by Application (Grinding, Honing, Polishing, Burnishing), Floor Type (Concrete, Wood, Marble), Polishing Type (Dry Polishing, Wet Polishing), Region( North America, Europe, APAC, MEA, RoW) - Global Forecast to 2027

Updated on : September 02, 2025

Floor Grinding Tools Market

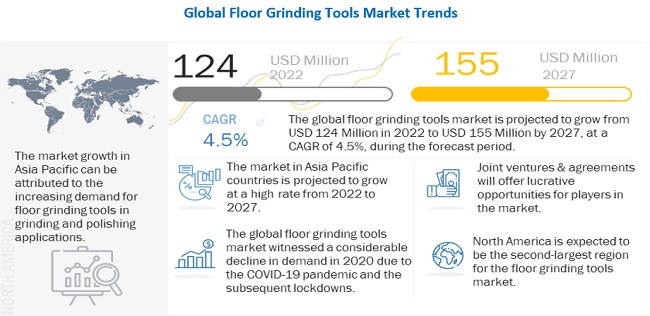

The global floor grinding tools market was valued at USD 124 million in 2022 and is projected to reach USD 155 million by 2027, growing at 4.5% cagr from 2022 to 2027. Growth in investments in the construction industry is boosting the floor grinding tools market. Increasing demand for green & energy-efficient buildings and acceleration in the construction of new residential & commercial spaces are likely to support the growth of the floor grinding tools market during the forecast period.

To know about the assumptions considered for the study, Request for Free Sample Report

Covid-19 Impact on Global Floor Grinding Tools Market

In 2020, the floor grinding tools market was significantly impacted by the COVID-19 pandemic, with a substantial decline in its CAGR. However, recovery was witnessed with a positive impact on the floor grinding tools market because of demand in the construction sector in 2021.

Floor Grinding Tools Market Dynamics

Driver: Rise in number of renovation and remodeling activities

Renovation and home remodeling activities are increasing globally. This is mainly driven by the rising focus on home decor and the improving lifestyles of consumers, and government support for such activities. In Europe, the National Energy Efficiency Action Plan (NEEAP) aims to foster investments in the renovation of residential and commercial buildings.

Increasing consumer income levels, changing lifestyles, and adopting different cultures in terms of interior decor have resulted in consumers' growing interest in the interior decoration of their houses and workspaces. Consumers are spending on the styling and interiors of living spaces, which leads them to spend on home furnishings such as carpets, rugs, and other floor coverings that add to the esthetic appeal of interiors. The use of different flooring materials due to the aforementioned factors leads to the demand for floor grinding tools for surface preparation and finishing.

Restraint: Disposal of concrete grinding residue

The concrete grinding residue (CGR), also known as sawing slurry, is generated during sawing and diamond grinding operations. The slurry is the byproduct created when a diamond blade’s cooling water mixes with concrete fines. Its proper disposal is a concern for flooring contractors. Often government regulations lay down the slurry disposal procedures without knowing what the material consists of. This can turn into a time-consuming task for construction workers. In the US, the Environmental Protection Agency (EPA) is responsible for protecting the environment and sets the rules for dealing with concrete slurry. To address the multifaceted issue of slurry disposal, the International Grooving & Grinding Association (IGGA) has issued the slurry Best Management Practices (BMP) guide to reduce the burden on contractors while ensuring that they act in an environmentally responsible manner. Slurry BPM includes slurry spreading disposal, slurry collection & pond decanting, slurry collection & plant processing, and a pH control plan.

Opportunity: Scaling non-residential and infrastructural construction activities

Infrastructure spending is a key driver of the global and regional economies. China, India, and other countries in the Asia Pacific, along with South Africa and Brazil, are investing considerably in infrastructural development. This investment is required for modernization and commercialization. According to the Organization for Economic Co-operation and Development, the total global investment in infrastructure is estimated to be around USD 50 trillion by 2030. Non-residential construction activities are expected to accelerate over the next decade. Matured markets such as the US, Argentina, Mexico, Eastern Europe, and the Middle Eastern countries are likely to be the high-potential markets for several leading contractors owing to attractive opportunities for long-term infrastructural investments.

The growth of the flooring market is highly dependent on the growth of the construction industry. Developing countries in the Asia Pacific have a large number of construction projects. The construction industry in mature markets such as the US and the UK is also growing owing to the demand for residential and non-residential spaces. These factors prove that the construction industry is witnessing healthy growth globally and is set to provide the growth impetus to market players in the coming years. Emerging economies have been focusing on rapid industrialization over the last few decades. Countries such as India, Indonesia, South Africa, Brazil, and Argentina are transforming their economies from being agricultural-based to being based on manufacturing. With the emergence of new industries, the need for industrial construction is also increasing, creating a potential for the floor grinding tools market's growth.

Challenge: Health risks associated floor grinding activity

Construction workers performing concrete grinding may breathe dust that contains respirable crystalline silica (RCS). Concrete cutting and concrete grinding generate a significant amount of dust, which might pose a health risk to masons. Masonry blocks, bricks, and concrete slabs comprise concentrated amounts of crystalline silica. Dry cutting these materials releases silica dust which enters the workers’ breathing zone. Continuous exposure to this dust can lead to the development of silicosis, which is a deadly and incurable lung disease. Construction workers face the risk of exposure to silica dust. Wet grinding has lesser exposure to silica dust for masons. Workers who work on dry cutting and grinding face the risk of inhaling the silica dust up to 10 times OSHA’s (Occupational Safety and Health Administration) defined permissible exposure limit (PEL).

Floor Grinding Tools Market Ecosystem

In the global floor grinding tools market grinding application had the largest share in 2021

Floor grinding is the process of smoothing rough floor surfaces. An abrasive tool with a diamond attachment smooths the rough surface during the grinding process. All coatings, stains, and surface cracks are removed along with the top layer of concrete. The floor grinding tools have applications in various types of floors installed in residential and commercial spaces. Floor grinding tools are used in new residential buildings, renovations, and restructuring projects to enhance the esthetic appeal and provide comfort. Floor grinding is an apt solution for residential flooring as grinding the concrete slabs reduce use of excess materials such as adhesives and concrete along with the byproducts which are used to create wood floors, carpets, and tiles.

Concrete floor to be the largest and fastest growing floor type in floor grinding tools market

Concrete is a widely used building material owing to its strength and versatility. Although durable, concrete is a natural material and will degrade with time. Many residential and non-residential spaces now opt for concrete due to decorative purposes. Concrete grinding refers to smoothening the floor surface using abrasive tools. Floor grinding machines are considered better than scarifiers or shot blasters as they do not create ridges on the floor surface. Further, they allow the creation of leveled joints and remove dirt, grease, spots, and industrial contaminants. Clearance of materials creates a uniform base for floor polishing, staining, and sealing of floor surfaces. Concrete grinding machines have horizontally rotating discs with multiple attachments, which differ by type and grit as per the application.

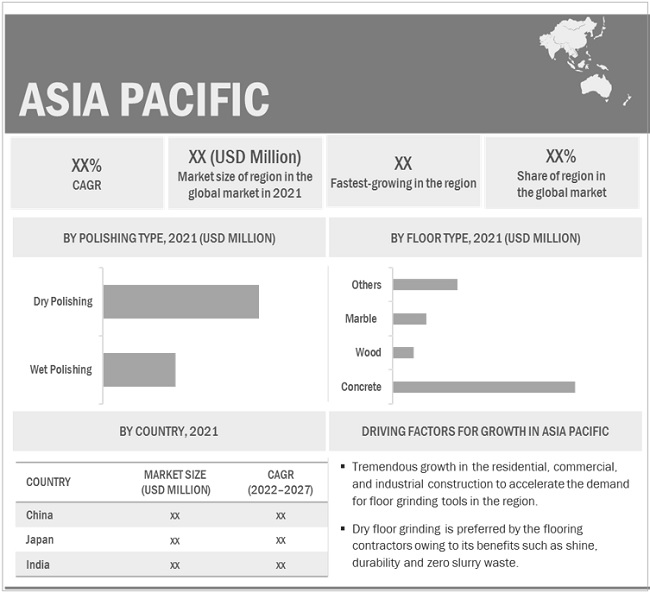

Dry polishing segment will lead the floor grinding tools market in 2021

The dry polishing segment is the larger and faster-growing segment than wet polishing in the floor grinding tools market. For the dry polishing method, the floor's surface is leveled (or grounded) with commercial-scale grinding and polishing machines. Each stage requires a different abrasive polishing disc, often incorporating diamond grit, with coarser textures for earlier stages and finer ones to get the final shine. Much of the dust is vacuumed up as it is ground; however, some dust is dispersed into the air. Companies aiming to impress customers with a high-gloss floor prefer the dry method as it provides shinier, classier, and a higher level of light reflecting floors than wet polishing.

APAC region to lead the global floor grinding tools market by 2027

Asia Pacific was the largest market for floor grinding tools, in terms of value, in 2021. Emerging economies in the region are expected to experience significant demand for floor grinding tools because of the expansion of residential, commercial, and industrial sectors due to rapid economic development and government initiatives toward economic development. In addition to this, the growing population in these countries represents a strong customer base.

Asia Pacific is the fastest-growing market for floor grinding tools globally, in terms of value and volume, during the forecast period. The increasing per capita expenditure on construction activities, huge consumer base, rising urban population, low labor costs, and easy availability of raw materials are attracting international manufacturers to shift their production facilities to the region. This escalates the demand for floor grinding tools in these industries.

To know about the assumptions considered for the study, download the pdf brochure

Floor Grinding Tools Market Players

The floor grinding tools market is dominated by a few globally established players, such as Husqvarna Group (Sweden), Shenzhen Idimas Holding Co., Ltd. (China), Tyrolit Group (Austria), Diamag (Netherlands), and Klindex (Italy).

Floor Grinding Tools Market Report Scope

|

Report Metric |

Details |

|

Market Size Value in 2022 |

USD 124 million |

|

Revenue Forecast in 2027 |

USD 155 million |

|

CAGR |

4.5% |

|

Market size available for years |

2020–2027 |

|

Base year considered |

2021 |

|

Forecast period |

2022–2027 |

|

Forecast units |

Value (USD Million) and Volume (Unit) |

|

Segments covered |

Application, Floor Type, Polishing Type and Region |

|

Geographies covered |

North America, Asia Pacific, Europe, Middle East & Africa, and South America |

|

Companies covered |

The major players include Husqvarna Group (Sweden), Shenzhen Idimas Holding Co., Ltd. (China), Tyrolit Group (Austria), Diamag (Netherlands), and Klindex (Italy). |

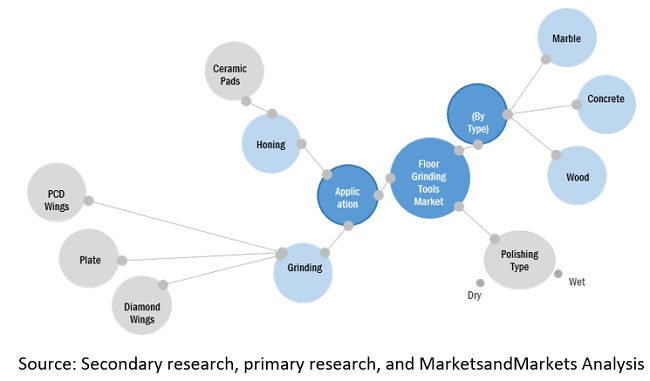

This research report categorizes the floor grinding tools based on application, floor type, polishing type and region.

On the basis of application:

-

Grinding

- Diamond Wings

- Plates

- PCD Wings

- Honing (Ceramic Pads)

- Polishing (Resin Pads)

- Burnishing (Non-woven Pads)

On the basis of floor type

- Concrete

- Wood

- Marble

- Others

On the basis of polishing type

- Dry Polishing

- Wet Polishing

On the basis of region:

- North America

- Europe

- Asia Pacific

- Middle East & Africa

- South America

Recent Developments

- In December 2020, the Husqvarna Group's Construction Division acquired Blastrac N.A., a leading provider of surface preparation technologies for the global construction and remediation industry. The acquired product range complements the Husqvarna Construction Division's offering within concrete surfaces and floors.

- In March 2017, the Construction Division of Husqvarna Group acquired HTC's floor grinding solutions division. They strengthened their ability to develop and offer customers total floor solutions for the construction segment through the acquisition.

Frequently Asked Questions (FAQ):

What is the current size of global floor grinding tools market?

The market size for floor grinding tools was USD 119 million in 2021 and is projected to reach USD 155 million by 2027.

How is the floor grinding tools market aligned?

The floor grinding tools market is competitive, and have number of manufacturer operating at the regional, and domestic level. The market will continue to be competitive and this competitiveness will increase over the forecast period.

Who are the key players in the global floor grinding tools market?

The key players operating in the floor grinding tools market, were Husqvarna Group (Sweden), Shenzhen Idimas Holding Co., Ltd. (China), Tyrolit Group (Austria), Diamag (Netherlands), and Klindex (Italy) in 2021.

What are the latest ongoing trends in the floor grinding tools market?

The latest ongoing trends in the floor grinding tools market are increasing consumer preference for polished floors in residential and non-residential buildings and technological advancement.

What are some of the mandates in the floor grinding tools market?

The OSHA (Occupational Safety and Health Administration) is part of the US Department of Labor. The floor grinding tools market aims at adapting and complying with all the standards, rules, and regulations provided by OSHA. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 20)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.3 INCLUSION & EXCLUSION

TABLE 1 INCLUSION & EXCLUSION

1.4 MARKET SCOPE

FIGURE 1 FLOOR GRINDING TOOLS MARKET SEGMENTATION

1.4.1 YEARS CONSIDERED

1.4.2 REGIONAL SCOPE

FIGURE 2 FLOOR GRINDING TOOLS MARKET, BY REGION

1.5 CURRENCY

1.6 UNIT CONSIDERED

1.7 STAKEHOLDERS

1.8 LIMITATIONS

2 RESEARCH METHODOLOGY (Page No. - 25)

2.1 RESEARCH DATA

FIGURE 3 FLOOR GRINDING TOOLS MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

FIGURE 4 LIST OF STAKEHOLDERS INVOLVED AND BREAKDOWN OF PRIMARY INTERVIEWS

2.2 MARKET SIZE ESTIMATION

FIGURE 5 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

FIGURE 6 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

FIGURE 7 MARKET SIZE ESTIMATION: SUPPLY-SIDE

2.3 DATA TRIANGULATION

FIGURE 8 FLOOR GRINDING TOOLS MARKET: DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS

2.5 LIMITATIONS

2.6 GROWTH RATE ASSUMPTIONS/GROWTH FORECAST

3 EXECUTIVE SUMMARY (Page No. - 32)

3.1 INTRODUCTION

FIGURE 9 CONCRETE FLOOR TO DOMINATE FLOOR GRINDING TOOLS MARKET

FIGURE 10 GRINDING SEGMENT TO DOMINATE FLOOR GRINDING TOOLS MARKET, 2022–2027

FIGURE 11 DRY POLISHING TO LEAD POLISHING SEGMENT IN FLOOR GRINDING TOOLS MARKET, 2022–2027

FIGURE 12 ASIA PACIFIC LED FLOOR GRINDING TOOLS MARKET IN 2021

4 PREMIUM INSIGHTS (Page No. - 36)

4.1 ASIA PACIFIC TO GROW AT SIGNIFICANT RATE DUE TO RAPID GROWTH OF CONSTRUCTION INDUSTRY

FIGURE 13 EMERGING ECONOMIES OFFER ATTRACTIVE OPPORTUNITIES IN FLOOR GRINDING TOOLS MARKET

4.2 ASIA PACIFIC: FLOOR GRINDING TOOLS MARKET, BY POLISHING TYPE AND COUNTRY

FIGURE 14 CHINA HELD LARGEST SHARE OF FLOOR GRINDING TOOLS MARKET IN 2021

4.3 FLOOR GRINDING TOOLS MARKET, BY APPLICATION

FIGURE 15 GRINDING SEGMENT TO LEAD FLOOR GRINDING TOOLS MARKET

4.4 FLOOR GRINDING TOOLS MARKET, BY FLOOR TYPE

FIGURE 16 CONCRETE SEGMENT TO LEAD FLOOR GRINDING TOOLS MARKET IN FORECAST PERIOD

4.5 FLOOR GRINDING TOOLS MARKET, BY POLISHING TYPE

FIGURE 17 DRY POLISHING TO LEAD MARKET FOR FLOOR GRINDING TOOLS

4.6 FLOOR GRINDING TOOLS MARKET, BY KEY COUNTRIES

FIGURE 18 CHINA TO WITNESS HIGHEST CAGR FROM 2022 TO 2027

5 MARKET OVERVIEW (Page No. - 40)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 19 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN FLOOR GRINDING TOOLS MARKET

5.2.1 DRIVERS

5.2.1.1 Rise in number of renovation and remodeling activities

5.2.1.2 E-commerce to boost floor grinding tools market

5.2.2 RESTRAINTS

5.2.2.1 Disposal of concrete grinding residue

5.2.2.2 Fluctuation in raw material prices

5.2.3 OPPORTUNITIES

5.2.3.1 Addressing housing crisis

5.2.3.2 Scaling non-residential and infrastructural construction activities

5.2.4 CHALLENGES

5.2.4.1 Health risks associated with floor grinding activity

6 INDUSTRY TRENDS (Page No. - 45)

6.1 PORTER’S FIVE FORCES ANALYSIS

FIGURE 20 PORTER’S FIVE FORCES ANALYSIS

TABLE 2 FLOOR GRINDING TOOLS MARKET: PORTER'S FIVE FORCE ANALYSIS

6.1.1 BARGAINING POWER OF SUPPLIERS

6.1.2 BARGAINING POWER OF BUYERS

6.1.3 THREAT OF NEW ENTRANTS

6.1.4 THREAT OF SUBSTITUTES

6.1.5 INTENSITY OF COMPETITIVE RIVALRY

6.2 SUPPLY CHAIN ANALYSIS

FIGURE 21 FLOOR GRINDING TOOLS SUPPLY CHAIN

6.3 ECOSYSTEM MAPPING

FIGURE 22 FLOOR GRINDING TOOLS MARKET: ECOSYSTEM MAP

6.4 TECHNOLOGY ANALYSIS

6.5 CASE STUDY ANALYSIS

6.6 TRADE ANALYSIS

TABLE 3 IMPORT TRADE DATA FOR INDUSTRIAL DIAMOND, 2020 (USD MILLION)

TABLE 4 EXPORT TRADE DATA FOR INDUSTRIAL DIAMOND, 2020 (USD MILLION)

6.7 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESS

FIGURE 23 FLOOR GRINDING TOOLS MARKET: TRENDS IMPACTING CUSTOMER'S BUSINESS

6.8 KEY CONFERENCES & EVENTS IN 2022–2023

TABLE 5 FLOOR GRINDING TOOLS MARKET: DETAILED LIST OF CONFERENCES & EVENTS

6.9 TARIFF AND REGULATIONS REGULATORY ANALYSIS

6.9.1 OSHA (OCCUPATIONAL SAFETY AND HEALTH ADMINISTRATION) STANDARDS

6.9.2 EUROPEAN UNION STANDARDS FOR SILICA DUST

6.9.3 EUROPEAN UNION STANDARDS FOR GRINDING TOOLS

6.9.4 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 6 LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

6.10 PATENT ANALYSIS

6.10.1 INTRODUCTION

6.10.2 METHODOLOGY

6.10.3 DOCUMENT TYPE

TABLE 7 TOTAL NUMBER OF PATENTS

FIGURE 24 TOTAL NUMBER OF PATENTS

6.10.4 PUBLICATION TRENDS - LAST 10 YEARS

FIGURE 25 NUMBER OF PATENTS YEAR-WISE, FROM 2011 TO 2021

6.10.5 INSIGHTS

6.10.6 LEGAL STATUS OF PATENTS

FIGURE 26 PATENT ANALYSIS, BY LEGAL STATUS

6.10.7 JURISDICTION ANALYSIS

FIGURE 27 TOP JURISDICTION – BY DOCUMENT

6.10.8 TOP COMPANIES/APPLICANTS

FIGURE 28 TOP 10 COMPANIES/APPLICANTS WITH HIGHEST NUMBER OF PATENTS

6.10.8.1 List of Patents

TABLE 8 LIST OF PATENTS

6.10.8.2 TOP 10 PATENT OWNERS (US) IN LAST 10 YEARS

TABLE 9 LIST OF PATENTS OWNERS

7 FLOOR GRINDING TOOLS MARKET, BY APPLICATION (Page No. - 62)

7.1 INTRODUCTION

FIGURE 29 GRINDING SEGMENT TO LEAD FLOOR GRINDING TOOLS MARKET

TABLE 10 FLOOR GRINDING TOOLS MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 11 FLOOR GRINDING TOOLS MARKET SIZE, BY APPLICATION, 2020–2027 (UNIT)

7.2 GRINDING

7.3 HONING

7.4 POLISHING

7.5 BURNISHING

8 FLOOR GRINDING TOOLS MARKET, BY FLOOR TYPE (Page No. - 67)

8.1 INTRODUCTION

FIGURE 30 CONCRETE FLOOR TYPE SEGMENT TO LEAD GLOBAL FLOOR GRINDING TOOLS MARKET

TABLE 12 FLOOR GRINDING TOOLS MARKET SIZE, BY FLOOR TYPE, 2020–2027 (USD MILLION)

TABLE 13 FLOOR GRINDING TOOLS MARKET SIZE, BY FLOOR TYPE, 2020–2027 (UNIT)

8.2 CONCRETE

8.3 WOOD

8.4 MARBLE

8.5 OTHERS

9 FLOOR GRINDING TOOLS MARKET, BY POLISHING TYPE (Page No. - 71)

9.1 INTRODUCTION

FIGURE 31 DRY POLISHING SEGMENT TO LEAD GLOBAL FLOOR GRINDING TOOLS MARKET

TABLE 14 FLOOR GRINDING TOOLS MARKET SIZE, BY POLISHING TYPE, 2020–2027 (USD MILLION)

TABLE 15 FLOOR GRINDING TOOLS MARKET SIZE, BY POLISHING TYPE, 2020–2027 (UNIT)

9.2 DRY POLISHING

9.3 WET POLISHING

10 FLOOR GRINDING TOOLS MARKET, BY REGION (Page No. - 75)

10.1 INTRODUCTION

FIGURE 32 REGIONAL SNAPSHOT: CHINA IS PROJECTED TO BE FASTEST-GROWING MARKET DURING FORECAST PERIOD

TABLE 16 FLOOR GRINDING TOOLS MARKET SIZE, BY REGION, 2020–2027 (USD MILLION)

TABLE 17 FLOOR GRINDING TOOLS MARKET SIZE, BY REGION, 2020–2027 (UNIT)

10.2 ASIA PACIFIC

FIGURE 33 ASIA PACIFIC: FLOOR GRINDING TOOLS MARKET SNAPSHOT

TABLE 18 ASIA PACIFIC: FLOOR GRINDING TOOLS MARKET SIZE, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 19 ASIA PACIFIC: FLOOR GRINDING TOOLS MARKET SIZE, BY COUNTRY, 2020–2027 (UNIT)

TABLE 20 ASIA PACIFIC: FLOOR GRINDING TOOLS MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 21 ASIA PACIFIC: FLOOR GRINDING TOOLS MARKET SIZE, BY APPLICATION, 2020–2027 (UNIT)

TABLE 22 ASIA PACIFIC: FLOOR GRINDING TOOLS MARKET SIZE, BY FLOOR TYPE, 2020–2027 (USD MILLION)

TABLE 23 ASIA PACIFIC: FLOOR GRINDING TOOLS MARKET SIZE, BY FLOOR TYPE, 2020–2027 (UNIT)

TABLE 24 ASIA PACIFIC: FLOOR GRINDING TOOLS MARKET SIZE, BY POLISHING TYPE, 2020–2027 (USD MILLION)

TABLE 25 ASIA PACIFIC: FLOOR GRINDING TOOLS MARKET SIZE, BY POLISHING TYPE, 2020–2027 (UNIT)

10.2.1 CHINA

10.2.1.1 Increasing demand for flooring in residential applications

TABLE 26 CHINA: FLOOR GRINDING TOOLS MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 27 CHINA: FLOOR GRINDING TOOLS MARKET SIZE, BY APPLICATION, 2020–2027 (UNIT)

TABLE 28 CHINA: FLOOR GRINDING TOOLS MARKET SIZE, BY FLOOR TYPE, 2020–2027 (USD MILLION)

TABLE 29 CHINA: FLOOR GRINDING TOOLS MARKET SIZE, BY FLOOR TYPE, 2020–2027 (UNIT)

TABLE 30 CHINA: FLOOR GRINDING TOOLS MARKET SIZE, BY POLISHING TYPE, 2020–2027 (USD MILLION)

TABLE 31 CHINA: FLOOR GRINDING TOOLS MARKET SIZE, BY POLISHING TYPE, 2020–2027 (UNIT)

10.2.2 JAPAN

10.2.2.1 Infrastructure and commercial building products to boost market

TABLE 32 JAPAN: FLOOR GRINDING TOOLS MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 33 JAPAN: FLOOR GRINDING TOOLS MARKET SIZE, BY APPLICATION, 2020–2027 (UNIT)

TABLE 34 JAPAN: FLOOR GRINDING TOOLS MARKET SIZE, BY FLOOR TYPE, 2020–2027 (USD MILLION)

TABLE 35 JAPAN: FLOOR GRINDING TOOLS MARKET SIZE, BY FLOOR TYPE, 2020–2027 (UNIT)

TABLE 36 JAPAN: FLOOR GRINDING TOOLS MARKET SIZE, BY POLISHING TYPE, 2020–2027 (USD MILLION)

TABLE 37 JAPAN: FLOOR GRINDING TOOLS MARKET SIZE, BY POLISHING TYPE, 2020–2027 (UNIT)

10.2.3 INDIA

10.2.3.1 Increasing government spending for infrastructure development to augment market growth

TABLE 38 INDIA: FLOOR GRINDING TOOLS MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 39 INDIA: FLOOR GRINDING TOOLS MARKET SIZE, BY APPLICATION, 2020–2027 (UNIT)

TABLE 40 INDIA: FLOOR GRINDING TOOLS MARKET SIZE, BY FLOOR TYPE, 2020–2027 (USD MILLION)

TABLE 41 INDIA: FLOOR GRINDING TOOLS MARKET SIZE, BY FLOOR TYPE, 2020–2027 (UNIT)

TABLE 42 INDIA: FLOOR GRINDING TOOLS MARKET SIZE, BY POLISHING TYPE, 2020–2027 (USD MILLION)

TABLE 43 INDIA: FLOOR GRINDING TOOLS MARKET SIZE, BY POLISHING TYPE, 2020–2027 (UNIT)

10.2.4 SOUTH KOREA

10.2.4.1 Commercial construction to propel market growth

TABLE 44 SOUTH KOREA: FLOOR GRINDING TOOLS MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 45 SOUTH KOREA: FLOOR GRINDING TOOLS MARKET SIZE, BY APPLICATION, 2020–2027 (UNIT)

TABLE 46 SOUTH KOREA: FLOOR GRINDING TOOLS MARKET SIZE, BY FLOOR TYPE, 2020–2027 (USD MILLION)

TABLE 47 SOUTH KOREA: FLOOR GRINDING TOOLS MARKET SIZE, BY FLOOR TYPE, 2020–2027 (UNIT)

TABLE 48 SOUTH KOREA: FLOOR GRINDING TOOLS MARKET SIZE, BY POLISHING TYPE, 2020–2027 (USD MILLION)

TABLE 49 SOUTH KOREA: FLOOR GRINDING TOOLS MARKET SIZE, BY POLISHING TYPE, 2020–2027 (UNIT)

10.2.5 REST OF ASIA PACIFIC

TABLE 50 REST OF ASIA PACIFIC: FLOOR GRINDING TOOLS MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 51 REST OF ASIA PACIFIC: FLOOR GRINDING TOOLS MARKET SIZE, BY APPLICATION, 2020–2027 (UNIT)

TABLE 52 REST OF ASIA PACIFIC: FLOOR GRINDING TOOLS MARKET SIZE, BY FLOOR TYPE, 2020–2027 (USD MILLION)

TABLE 53 REST OF ASIA PACIFIC: FLOOR GRINDING TOOLS MARKET SIZE, BY FLOOR TYPE, 2020–2027 (UNIT)

TABLE 54 REST OF ASIA PACIFIC: FLOOR GRINDING TOOLS MARKET SIZE, BY POLISHING TYPE, 2020–2027 (USD MILLION)

TABLE 55 REST OF ASIA PACIFIC: FLOOR GRINDING TOOLS MARKET SIZE, BY POLISHING TYPE, 2020–2027 (UNIT)

10.3 NORTH AMERICA

TABLE 56 NORTH AMERICA: FLOOR GRINDING TOOLS MARKET SIZE, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 57 NORTH AMERICA: FLOOR GRINDING TOOLS MARKET SIZE, BY COUNTRY, 2020–2027 (UNIT)

TABLE 58 NORTH AMERICA: FLOOR GRINDING TOOLS MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 59 NORTH AMERICA: FLOOR GRINDING TOOLS MARKET SIZE, BY APPLICATION, 2020–2027 (UNIT)

TABLE 60 NORTH AMERICA: FLOOR GRINDING TOOLS MARKET SIZE, BY FLOOR TYPE, 2020–2027 (USD MILLION)

TABLE 61 NORTH AMERICA: FLOOR GRINDING TOOLS MARKET SIZE, BY FLOOR TYPE, 2020–2027 (UNIT)

TABLE 62 NORTH AMERICA: FLOOR GRINDING TOOLS MARKET SIZE, BY POLISHING TYPE, 2020–2027 (USD MILLION)

TABLE 63 NORTH AMERICA: FLOOR GRINDING TOOLS MARKET SIZE, BY POLISHING TYPE, 2020–2027 (UNIT)

10.3.1 US

10.3.1.1 Growing residential and commercial projects to support demand growth

TABLE 64 US: FLOOR GRINDING TOOLS MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 65 US: FLOOR GRINDING TOOLS MARKET SIZE, BY APPLICATION, 2020–2027 (UNIT)

TABLE 66 US: FLOOR GRINDING TOOLS MARKET SIZE, BY FLOOR TYPE, 2020–2027 (USD MILLION)

TABLE 67 US: FLOOR GRINDING TOOLS MARKET SIZE, BY FLOOR TYPE, 2020–2027 (UNIT)

TABLE 68 US: FLOOR GRINDING TOOLS MARKET SIZE, BY POLISHING TYPE, 2020–2027 (USD MILLION)

TABLE 69 US: FLOOR GRINDING TOOLS MARKET SIZE, BY POLISHING TYPE, 2020–2027 (UNIT)

10.3.2 CANADA

10.3.2.1 Skyrocketing demand for floor grinding tools for renovation and remodeling projects

TABLE 70 CANADA: FLOOR GRINDING TOOLS MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 71 CANADA: FLOOR GRINDING TOOLS MARKET SIZE, BY APPLICATION, 2020–2027 (UNIT)

TABLE 72 CANADA: FLOOR GRINDING TOOLS MARKET SIZE, BY FLOOR TYPE, 2020–2027 (USD MILLION)

TABLE 73 CANADA: FLOOR GRINDING TOOLS MARKET SIZE, BY FLOOR TYPE, 2020–2027 (UNIT)

TABLE 74 CANADA: FLOOR GRINDING TOOLS MARKET SIZE, BY POLISHING TYPE, 2020–2027 (USD MILLION)

TABLE 75 CANADA: FLOOR GRINDING TOOLS MARKET SIZE, BY POLISHING TYPE, 2020–2027 (UNIT)

10.3.3 MEXICO

10.3.3.1 Significant growth opportunities for floor grinding tools manufacturers

TABLE 76 MEXICO: FLOOR GRINDING TOOLS MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 77 MEXICO: FLOOR GRINDING TOOLS MARKET SIZE, BY APPLICATION, 2020–2027 (UNIT)

TABLE 78 MEXICO: FLOOR GRINDING TOOLS MARKET SIZE, BY FLOOR TYPE, 2020–2027 (USD MILLION)

TABLE 79 MEXICO: FLOOR GRINDING TOOLS MARKET SIZE, BY FLOOR TYPE, 2020–2027 (UNIT)

TABLE 80 MEXICO: FLOOR GRINDING TOOLS MARKET SIZE, BY POLISHING TYPE, 2020–2027 (USD MILLION)

TABLE 81 MEXICO: FLOOR GRINDING TOOLS MARKET SIZE, BY POLISHING TYPE, 2020–2027 (UNIT)

10.4 EUROPE

TABLE 82 EUROPE: FLOOR GRINDING TOOLS MARKET SIZE, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 83 EUROPE: FLOOR GRINDING TOOLS MARKET SIZE, BY COUNTRY, 2020–2027 (UNIT)

TABLE 84 EUROPE: FLOOR GRINDING TOOLS MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 85 EUROPE: FLOOR GRINDING TOOLS MARKET SIZE, BY APPLICATION, 2020–2027 (UNIT)

TABLE 86 EUROPE: FLOOR GRINDING TOOLS MARKET SIZE, BY FLOOR TYPE, 2020–2027 (USD MILLION)

TABLE 87 EUROPE: FLOOR GRINDING TOOLS MARKET SIZE, BY FLOOR TYPE, 2020–2027 (UNIT)

TABLE 88 EUROPE: FLOOR GRINDING TOOLS MARKET SIZE, BY POLISHING TYPE, 2020–2027 (USD MILLION)

TABLE 89 EUROPE FLOOR GRINDING TOOLS MARKET SIZE, BY POLISHING TYPE, 2020–2027 (UNIT)

10.4.1 GERMANY

10.4.1.1 Ongoing development in construction industry to drive growth

TABLE 90 GERMANY: FLOOR GRINDING TOOLS MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 91 GERMANY: FLOOR GRINDING TOOLS MARKET SIZE, BY APPLICATION, 2020–2027 (UNIT)

TABLE 92 GERMANY: FLOOR GRINDING TOOLS MARKET SIZE, BY FLOOR TYPE, 2020–2027 (USD MILLION)

TABLE 93 GERMANY: FLOOR GRINDING TOOLS MARKET SIZE, BY FLOOR TYPE, 2020–2027 (UNIT)

TABLE 94 GERMANY: FLOOR GRINDING TOOLS MARKET SIZE, BY POLISHING TYPE, 2020–2027 (USD MILLION)

TABLE 95 GERMANY: FLOOR GRINDING TOOLS MARKET SIZE, BY POLISHING TYPE, 2020–2027 (UNIT)

10.4.2 ITALY

10.4.2.1 Increase in demand for new housing drives consumption of floor grinding tools

TABLE 96 ITALY: FLOOR GRINDING TOOLS MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 97 ITALY: FLOOR GRINDING TOOLS MARKET SIZE, BY APPLICATION, 2020–2027 (UNIT)

TABLE 98 ITALY: FLOOR GRINDING TOOLS MARKET SIZE, BY FLOOR TYPE, 2020–2027 (USD MILLION)

TABLE 99 ITALY: FLOOR GRINDING TOOLS MARKET SIZE, BY FLOOR TYPE, 2020–2027 (UNIT)

TABLE 100 ITALY: FLOOR GRINDING TOOLS MARKET SIZE, BY POLISHING TYPE, 2020–2027 (USD MILLION)

TABLE 101 ITALY: FLOOR GRINDING TOOLS MARKET SIZE, BY POLISHING TYPE, 2020–2027 (UNIT)

10.4.3 FRANCE

10.4.3.1 New non-residential projects to support market growth

TABLE 102 FRANCE: FLOOR GRINDING TOOLS MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 103 FRANCE: FLOOR GRINDING TOOLS MARKET SIZE, BY APPLICATION, 2020–2027 (UNIT)

TABLE 104 FRANCE: FLOOR GRINDING TOOLS MARKET SIZE, BY FLOOR TYPE, 2020–2027 (USD MILLION)

TABLE 105 FRANCE: FLOOR GRINDING TOOLS MARKET SIZE, BY FLOOR TYPE, 2020–2027 (UNIT)

TABLE 106 FRANCE: FLOOR GRINDING TOOLS MARKET SIZE, BY POLISHING TYPE, 2020–2027 (USD MILLION)

TABLE 107 FRANCE: FLOOR GRINDING TOOLS MARKET SIZE, BY POLISHING TYPE, 2020–2027 (UNIT)

10.4.4 SPAIN

10.4.4.1 Revival of construction sector driving demand for floor grinding tools

TABLE 108 SPAIN: FLOOR GRINDING TOOLS MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 109 SPAIN: FLOOR GRINDING TOOLS MARKET SIZE, BY APPLICATION, 2020–2027 (UNIT)

TABLE 110 SPAIN: FLOOR GRINDING TOOLS MARKET SIZE, BY FLOOR TYPE, 2020–2027 (USD MILLION)

TABLE 111 SPAIN: FLOOR GRINDING TOOLS MARKET SIZE, BY FLOOR TYPE, 2020–2027 (UNIT)

TABLE 112 SPAIN: FLOOR GRINDING TOOLS MARKET SIZE, BY POLISHING TYPE, 2020–2027 (USD MILLION)

TABLE 113 SPAIN: FLOOR GRINDING TOOLS MARKET SIZE, BY POLISHING TYPE, 2020–2027 (UNIT)

10.4.5 UK

10.4.5.1 Increasing construction and renovation activities to support growth

TABLE 114 UK: FLOOR GRINDING TOOLS MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 115 UK: FLOOR GRINDING TOOLS MARKET SIZE, BY APPLICATION, 2020–2027 (UNIT)

TABLE 116 UK: FLOOR GRINDING TOOLS MARKET SIZE, BY FLOOR TYPE, 2020–2027 (USD MILLION)

TABLE 117 UK: FLOOR GRINDING TOOLS MARKET SIZE, BY FLOOR TYPE, 2020–2027 (UNIT)

TABLE 118 UK: FLOOR GRINDING TOOLS MARKET SIZE, BY POLISHING TYPE, 2020–2027 (USD MILLION)

TABLE 119 UK: FLOOR GRINDING TOOLS MARKET SIZE, BY POLISHING TYPE, 2020–2027 (UNIT)

10.4.6 RUSSIA

10.4.6.1 Infrastructure development in country to drive market growth

TABLE 120 RUSSIA: FLOOR GRINDING TOOLS MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 121 RUSSIA: FLOOR GRINDING TOOLS MARKET SIZE, BY APPLICATION, 2020–2027 (UNIT)

TABLE 122 RUSSIA: FLOOR GRINDING TOOLS MARKET SIZE, BY FLOOR TYPE, 2020–2027 (USD MILLION)

TABLE 123 RUSSIA: FLOOR GRINDING TOOLS MARKET SIZE, BY FLOOR TYPE, 2020–2027 (UNIT)

TABLE 124 RUSSIA: FLOOR GRINDING TOOLS MARKET SIZE, BY POLISHING TYPE, 2020–2027 (USD MILLION)

TABLE 125 RUSSIA: FLOOR GRINDING TOOLS MARKET SIZE, BY POLISHING TYPE, 2020–2027 (UNIT)

10.4.7 REST OF EUROPE

TABLE 126 REST OF EUROPE: FLOOR GRINDING TOOLS MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 127 REST OF EUROPE: FLOOR GRINDING TOOLS MARKET SIZE, BY APPLICATION, 2020–2027 (UNIT)

TABLE 128 REST OF EUROPE: FLOOR GRINDING TOOLS MARKET SIZE, BY FLOOR TYPE, 2020–2027 (USD MILLION)

TABLE 129 REST OF EUROPE: FLOOR GRINDING TOOLS MARKET SIZE, BY FLOOR TYPE, 2020–2027 (UNIT)

TABLE 130 REST OF EUROPE: FLOOR GRINDING TOOLS MARKET SIZE, BY POLISHING TYPE, 2020–2027 (USD MILLION)

TABLE 131 REST OF EUROPE: FLOOR GRINDING TOOLS MARKET SIZE, BY POLISHING TYPE, 2020–2027 (UNIT)

10.5 MIDDLE EAST & AFRICA

TABLE 132 MIDDLE EAST & AFRICA: FLOOR GRINDING TOOLS MARKET SIZE, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 133 MIDDLE EAST & AFRICA: FLOOR GRINDING TOOLS MARKET SIZE, BY COUNTRY, 2020–2027 (UNIT)

TABLE 134 MIDDLE EAST & AFRICA: FLOOR GRINDING TOOLS MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 135 MIDDLE EAST & AFRICA: FLOOR GRINDING TOOLS MARKET SIZE, BY APPLICATION, 2020–2027 (UNIT)

TABLE 136 MIDDLE EAST & AFRICA: FLOOR GRINDING TOOLS MARKET SIZE, BY FLOOR TYPE, 2020–2027 (USD MILLION)

TABLE 137 MIDDLE EAST & AFRICA: FLOOR GRINDING TOOLS MARKET SIZE, BY FLOOR TYPE, 2020–2027 (UNIT)

TABLE 138 MIDDLE EAST & AFRICA: FLOOR GRINDING TOOLS MARKET SIZE, BY POLISHING TYPE, 2020–2027 (USD MILLION)

TABLE 139 MIDDLE EAST & AFRICA: FLOOR GRINDING TOOLS MARKET SIZE, BY POLISHING TYPE, 2020–2027 (UNIT)

10.5.1 SAUDI ARABIA

10.5.1.1 Heavy investment in development of commercial infrastructure to drive market

TABLE 140 SAUDI ARABIA: FLOOR GRINDING TOOLS MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 141 SAUDI ARABIA: FLOOR GRINDING TOOLS MARKET SIZE, BY APPLICATION, 2020–2027 (UNIT)

TABLE 142 SAUDI ARABIA: FLOOR GRINDING TOOLS MARKET SIZE, BY FLOOR TYPE, 2020–2027 (USD MILLION)

TABLE 143 SAUDI ARABIA: FLOOR GRINDING TOOLS MARKET SIZE, BY FLOOR TYPE, 2020–2027 (UNIT)

TABLE 144 SAUDI ARABIA: FLOOR GRINDING TOOLS MARKET SIZE, BY POLISHING TYPE, 2020–2027 (USD MILLION)

TABLE 145 SAUDI ARABIA: FLOOR GRINDING TOOLS MARKET SIZE, BY POLISHING TYPE, 2020–2027 (UNIT)

10.5.2 UAE

10.5.2.1 Government policy supporting growth of infrastructure projects to drive market

TABLE 146 UAE: FLOOR GRINDING TOOLS MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 147 UAE: FLOOR GRINDING TOOLS MARKET SIZE, BY APPLICATION, 2020–2027 (UNIT)

TABLE 148 UAE: FLOOR GRINDING TOOLS MARKET SIZE, BY FLOOR TYPE, 2020–2027 (USD MILLION)

TABLE 149 UAE: FLOOR GRINDING TOOLS MARKET SIZE, BY FLOOR TYPE, 2020–2027 (UNIT)

TABLE 150 UAE: FLOOR GRINDING TOOLS MARKET SIZE, BY POLISHING TYPE, 2020–2027 (USD MILLION)

TABLE 151 UAE: FLOOR GRINDING TOOLS MARKET SIZE, BY POLISHING TYPE, 2020–2027 (UNIT)

10.5.3 SOUTH AFRICA

10.5.3.1 Rapid urbanization and growing demand for sustainable buildings would support market growth

TABLE 152 SOUTH AFRICA: FLOOR GRINDING TOOLS MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 153 SOUTH AFRICA: FLOOR GRINDING TOOLS MARKET SIZE, BY APPLICATION, 2020–2027 (UNIT)

TABLE 154 SOUTH AFRICA: FLOOR GRINDING TOOLS MARKET SIZE, BY FLOOR TYPE, 2020–2027 (USD MILLION)

TABLE 155 SOUTH AFRICA: FLOOR GRINDING TOOLS MARKET SIZE, BY FLOOR TYPE, 2020–2027 (UNIT)

TABLE 156 SOUTH AFRICA: FLOOR GRINDING TOOLS MARKET SIZE, BY POLISHING TYPE, 2020–2027 (USD MILLION)

TABLE 157 SOUTH AFRICA: FLOOR GRINDING TOOLS MARKET SIZE, BY POLISHING TYPE, 2020–2027 (UNIT)

10.5.4 REST OF MIDDLE EAST & AFRICA

TABLE 158 REST OF MIDDLE EAST & AFRICA: FLOOR GRINDING TOOLS MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 159 REST OF MIDDLE EAST & AFRICA: FLOOR GRINDING TOOLS MARKET SIZE, BY APPLICATION, 2020–2027 (UNIT)

TABLE 160 REST OF MIDDLE EAST & AFRICA: FLOOR GRINDING TOOLS MARKET SIZE, BY FLOOR TYPE, 2020–2027 (USD MILLION)

TABLE 161 REST OF MIDDLE EAST & AFRICA: FLOOR GRINDING TOOLS MARKET SIZE, BY FLOOR TYPE, 2020–2027 (UNIT)

TABLE 162 REST OF MIDDLE EAST & AFRICA: FLOOR GRINDING TOOLS MARKET SIZE, BY POLISHING TYPE, 2020–2027 (USD MILLION)

TABLE 163 REST OF MIDDLE EAST & AFRICA: FLOOR GRINDING TOOLS MARKET SIZE, BY POLISHING TYPE, 2020–2027 (UNIT)

10.6 SOUTH AMERICA

TABLE 164 SOUTH AMERICA: FLOOR GRINDING TOOLS MARKET SIZE, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 165 SOUTH AMERICA: FLOOR GRINDING TOOLS MARKET SIZE, BY COUNTRY, 2020–2027 (UNIT)

TABLE 166 SOUTH AMERICA: FLOOR GRINDING TOOLS MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 167 SOUTH AMERICA: FLOOR GRINDING TOOLS MARKET SIZE, BY APPLICATION, 2020–2027 (UNIT)

TABLE 168 SOUTH AMERICA: FLOOR GRINDING TOOLS MARKET SIZE, BY FLOOR TYPE, 2020–2027 (USD MILLION)

TABLE 169 SOUTH AMERICA: FLOOR GRINDING TOOLS MARKET SIZE, BY FLOOR TYPE, 2020–2027 (UNIT)

TABLE 170 SOUTH AMERICA: FLOOR GRINDING TOOLS MARKET SIZE, BY POLISHING TYPE, 2020–2027 (USD MILLION)

TABLE 171 SOUTH AMERICA: FLOOR GRINDING TOOLS MARKET SIZE, BY POLISHING TYPE, 2020–2027 (UNIT)

10.6.1 BRAZIL

10.6.1.1 Brazil to dominate the floor grinding tools market in South America

TABLE 172 BRAZIL: FLOOR GRINDING TOOLS MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 173 BRAZIL: FLOOR GRINDING TOOLS MARKET SIZE, BY APPLICATION, 2020–2027 (UNIT)

TABLE 174 BRAZIL: FLOOR GRINDING TOOLS MARKET SIZE, BY FLOOR TYPE, 2020–2027 (USD MILLION)

TABLE 175 BRAZIL: FLOOR GRINDING TOOLS MARKET SIZE, BY FLOOR TYPE, 2020–2027 (UNIT)

TABLE 176 BRAZIL: FLOOR GRINDING TOOLS MARKET SIZE, BY POLISHING TYPE, 2020–2027 (USD MILLION)

TABLE 177 BRAZIL: FLOOR GRINDING TOOLS MARKET SIZE, BY POLISHING TYPE, 2020–2027 (UNIT)

10.6.2 ARGENTINA

10.6.2.1 Increase in funding for infrastructural development to drive market growth

TABLE 178 ARGENTINA: FLOOR GRINDING TOOLS MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 179 ARGENTINA: FLOOR GRINDING TOOLS MARKET SIZE, BY APPLICATION, 2020–2027 (UNIT)

TABLE 180 ARGENTINA: FLOOR GRINDING TOOLS MARKET SIZE, BY FLOOR TYPE, 2020–2027 (USD MILLION)

TABLE 181 ARGENTINA: FLOOR GRINDING TOOLS MARKET SIZE, BY FLOOR TYPE, 2020–2027 (UNIT)

TABLE 182 ARGENTINA: FLOOR GRINDING TOOLS MARKET SIZE, BY POLISHING TYPE, 2020–2027 (USD MILLION)

TABLE 183 ARGENTINA: FLOOR GRINDING TOOLS MARKET SIZE, BY POLISHING TYPE, 2020–2027 (UNIT)

10.6.3 REST OF SOUTH AMERICA

TABLE 184 REST OF SOUTH AMERICA: FLOOR GRINDING TOOLS MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 185 REST OF SOUTH AMERICA: FLOOR GRINDING TOOLS MARKET SIZE, BY APPLICATION, 2020–2027 (UNIT)

TABLE 186 REST OF SOUTH AMERICA: FLOOR GRINDING TOOLS MARKET SIZE, BY FLOOR TYPE, 2020–2027 (USD MILLION)

TABLE 187 REST OF SOUTH AMERICA: FLOOR GRINDING TOOLS MARKET SIZE, BY FLOOR TYPE, 2020–2027 (UNIT)

TABLE 188 REST OF SOUTH AMERICA: FLOOR GRINDING TOOLS MARKET SIZE, BY POLISHING TYPE, 2020–2027 (USD MILLION)

TABLE 189 REST OF SOUTH AMERICA: FLOOR GRINDING TOOLS MARKET SIZE, BY POLISHING TYPE, 2020–2027 (UNIT)

11 COMPETITIVE LANDSCAPE (Page No. - 150)

11.1 INTRODUCTION

11.2 STRATEGIES ADOPTED BY KEY PLAYERS

TABLE 190 OVERVIEW OF STRATEGIES ADOPTED BY FLOOR GRINDING TOOLS MANUFACTURERS

11.3 MARKET SHARE ANALYSIS

11.3.1 RANKING OF KEY MARKET PLAYERS

FIGURE 34 RANKING OF TOP FIVE PLAYERS IN FLOOR GRINDING TOOLS MARKET, 2021

11.3.2 MARKET SHARE OF KEY PLAYERS, 2021

TABLE 191 FLOOR GRINDING TOOLS MARKET: MARKET SHARE OF KEY PLAYERS

FIGURE 35 FLOOR GRINDING TOOLS MARKET: MARKET SHARE ANALYSIS

11.3.2.1 Husqvarna Group

11.3.2.2 Tyrolit Group

11.3.2.3 Diamag

11.3.2.4 Klindex

11.3.2.5 Shenzhen Idimas Holding Co., Ltd.

11.4 COMPANY EVALUATION QUADRANT (TIER 1)

11.4.1 STARS

11.4.2 PERVASIVE

11.4.3 EMERGING LEADERS

11.4.4 PARTICIPANTS

FIGURE 36 FLOOR GRINDING TOOLS MARKET: COMPANY EVALUATION QUADRANT, 2021

11.5 START-UP/SMALL AND MEDIUM-SIZED ENTERPRISES (SMES) EVALUATION QUADRANT

11.5.1 PROGRESSIVE COMPANIES

11.5.2 RESPONSIVE COMPANIES

11.5.3 STARTING BLOCKS

11.5.4 DYNAMIC COMPANIES

FIGURE 37 START-UP/SMES EVALUATION QUADRANT FOR FLOOR GRINDING TOOLS MARKET

11.6 COMPETITIVE BENCHMARKING

TABLE 192 FLOOR GRINDING TOOLS MARKET: DETAILED LIST OF KEY STARTUP/SMES

TABLE 193 FLOOR GRINDING TOOLS MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS [STARTUPS/SMES]

11.7 COMPETITIVE SITUATION AND TRENDS

11.7.1 DEALS

TABLE 194 FLOOR GRINDING TOOLS MARKET: DEALS (2018–2021)

12 COMPANY PROFILES (Page No. - 161)

(Business overview, Products/solutions/services offered, Recent Developments, SWOT analysis, MNM view)*

12.1 MAJOR PLAYERS

12.1.1 SHENZHEN IDIMAS HOLDING CO., LTD.

TABLE 195 SHENZHEN IDIMAS HOLDING CO., LTD.: COMPANY OVERVIEW

12.1.2 TYROLIT GROUP

TABLE 196 TYROLIT GROUP: COMPANY OVERVIEW

12.1.3 HUSQVARNA GROUP

TABLE 197 HUSQVARNA GROUP: COMPANY OVERVIEW

FIGURE 38 HUSQVARNA GROUP: COMPANY SNAPSHOT

TABLE 198 HUSQVARNA GROUP: DEALS

12.1.4 BLASTRAC

TABLE 199 BLASTRAC: COMPANY OVERVIEW

12.1.5 DIAMAG

TABLE 200 DIAMAG: COMPANY OVERVIEW

12.1.6 KLINDEX

TABLE 201 KLINDEX: COMPANY OVERVIEW

12.1.7 SCANMASKIN SVERIGE AB

TABLE 202 SCANMASKIN SVERIGE AB: COMPANY OVERVIEW

12.1.8 DRS FLOOR

TABLE 203 DRS FLOOR: COMPANY OVERVIEW

12.1.9 SUPERABRASIVE INC.

TABLE 204 SUPERABRASIVE INC.: COMPANY OVERVIEW

12.1.10 LINAX CO., LTD.

TABLE 205 LINAX CO., LTD.: COMPANY OVERVIEW

(Business overview, Products/solutions/services offered, Recent Developments, SWOT analysis, MNM view)*

12.2 OTHER PLAYERS

12.2.1 SASE COMPANY, LLC

TABLE 206 SASE COMPANY, LLC: COMPANY OVERVIEW

12.2.2 QUANZHOU JDK DIAMOND TOOLS CO., LTD

TABLE 207 QUANZHOU JDK DIAMOND TOOLS CO., LTD: COMPANY OVERVIEW

12.2.3 SUBSTRATE TECHNOLOGY, INC.

TABLE 208 SUBSTRATE TECHNOLOGY, INC.: COMPANY OVERVIEW

12.2.4 FUJIAN XINGYI POLISHING MACHINE CO., LTD

TABLE 209 FUJIAN XINGYI POLISHING MACHINE CO., LTD: COMPANY OVERVIEW

12.2.5 SCHWAMBORN GERA¨TEBAU GMBH

TABLE 210 SCHWAMBORN GERA¨TEBAU GMBH: COMPANY OVERVIEW

12.2.6 BARTELL GLOBAL

TABLE 211 BARTELL GLOBAL: COMPANY OVERVIEW

12.2.7 DR. SCHULZE GMBH

TABLE 212 DR. SCHULZE GMBH: BUSINESS OVERVIEW

12.2.8 HANGZHOU BYCON INDUSTRY CO., LTD.

TABLE 213 HANGZHOU BYCON INDUSTRY CO., LTD.: BUSINESS OVERVIEW

12.2.9 SHAANXI RONLON MACHINERY CO., LTD

TABLE 214 SHAANXI RONLON MACHINERY CO., LTD: COMPANY OVERVIEW

12.2.10 ONFLOOR TECHNOLOGIES

TABLE 215 ONFLOOR TECHNOLOGIES: BUSINESS OVERVIEW

12.2.11 PHX INDUSTRIES

TABLE 216 PHX INDUSTRIES: BUSINESS OVERVIEW

12.2.12 BIMACK S.R.L.

TABLE 217 BIMACK S.R.L.: BUSINESS OVERVIEW

12.2.13 WARRIOR EQUIPMENT

TABLE 218 WARRIOR EQUIPMENT: BUSINESS OVERVIEW

13 APPENDIX (Page No. - 184)

13.1 DISCUSSION GUIDE

13.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.3 AVAILABLE CUSTOMIZATIONS

13.4 RELATED REPORTS

13.5 AUTHOR DETAILS

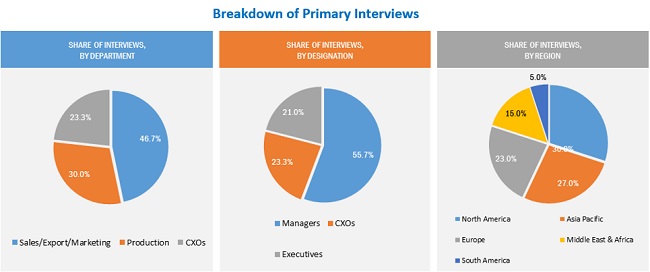

The study involved four major activities for estimating the current global size of the floor grinding tools. The exhaustive secondary research was carried out to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions and sizes with the industry experts across the value chain of floor grinding tools through primary research. The supply-side approach was employed to estimate the overall size of the floor grinding tools. Thereafter, market breakdown and data triangulation procedures were used to estimate the size of different segments and sub-segments of the market.

Secondary Research

In the secondary research process, various secondary sources such as Hoovers, Factiva, Bloomberg BusinessWeek, and Dun & Bradstreet were referred to, so as to identify and collect information for this study on the floor grinding tools. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, regulatory bodies, trade directories, and databases.

Primary Research

Various primary sources from both the supply and demand sides of the floor grinding tools were interviewed to obtain qualitative and quantitative information. The primary sources from the supply-side included industry experts, such as Chief Executive Officers (CEOs), vice presidents, marketing directors, sales professionals, and related key executives from various leading companies and organizations operating in the floor grinding tools industry. Primary sources from the demand side include experts and key personnel in various end-use industries.The breakdown of the profiles of primary respondents is as follows:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The bottom-up and top-down approaches have been used to estimate the floor grinding tools market by product type, end use, and region. The research methodology used to calculate the market size includes the following steps:

- The key players of each type in the floor grinding tools market have been identified through secondary research, and their revenues have been determined through primary and secondary research.

- The market size of the floor grinding tools market has been derived from the aggregation of the market shares of the leading players in each product, and the forecast is based on the analysis of market trends, such as pricing and consumption of floor grinding tools in various end-use industries.

- The market size of the floor grinding tool by region has been calculated by using the market sizes of each product in each end-use.

- The market size for floor grinding tools for each end-use, in terms of value, has been calculated by multiplying the average price of the product with their volumes.

All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Floor grinding tools Market: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Floor grinding tools Market: Top-Down Approach

Data Triangulation

After arriving at the overall market size, the overall market has been split into several segments. In order to complete the market engineering process and arrive at the exact statistics for all segments, the data triangulation and market breakdown procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market has been validated using both the top-down and bottom-up approaches. It has been then verified through primary interviews. Hence, for every data segment, there are three sources — the top-down approach, the bottom-up approach, and interviews with experts. The data is assumed correct only when the values arrived at from these three sources match.

Report Objectives

- To define, analyze, and project the size of the floor grinding tools in terms of value and volume based on application, floor type, polishing type, and region

- To project the size of the market and its segments in terms of value and volume, with respect to the five main regions, namely, North America, Europe, Asia Pacific, Middle East & Africa, and South America

- To provide detailed information about the key factors, such as drivers, restraints, opportunities, and challenges influencing the growth of the market

- To strategically analyze the micro markets with respect to individual growth trends, future prospects, and their contribution to the total market

- To analyze the opportunities in the market for stakeholders and provide a detailed competitive landscape of the market leaders

- To analyze the competitive developments, such as investments & expansions, and merger & acquisitions, in the floor grinding tools

- To strategically profile the key players operating in the market and comprehensively analyze their market shares and core competencies

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to client-specific needs.

The following customization options are available for the floor grinding tools report:

Product Analysis

- Product matrix, which offers a detailed comparison of the product portfolio of companies

Regional Analysis

- Further analysis of the floor grinding tools for additional countries

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Floor Grinding Tools Market