Flexographic Printing Market Size, Share & Industry Trends Growth Analysis Report by Offering (Flexographic Printing Machine, Flexographic Printing Ink) Application (Corrugated Packaging, Flexible Packaging, Labels & Tags), Automation Type( Automatic, Semi-automatic) Region - Global Forecast to 2028

Updated on : Oct 22, 2024

Flexographic Printing Market Size & Share

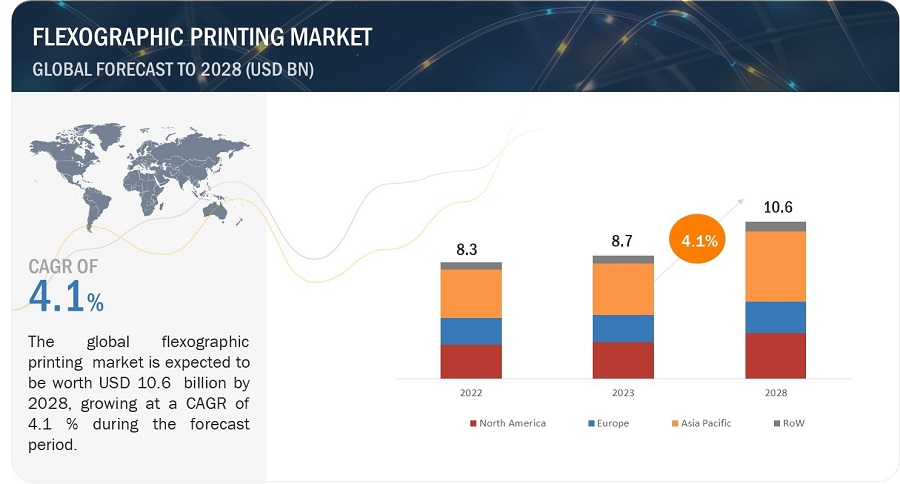

The Flexographic Printing Market Size is expected to be valued at USD 8.7 Billion in 2023 and reach USD 10.6 Billion by 2028, growing at a CAGR of 4.1% during the forecast period 2023 to 2028.

The growth of the consumer goods industry is one of the major industrial growths to support the printing and packaging industries. Increased consumer spending power and demand for various consumer products extend the demand for packaging, labels, and other printed materials, creating opportunities for flexographic printing industry to cater to these needs. The objective of the report is to define, describe, and forecast the flexographic printing market based on offering, application, and region.

Flexographic Printing Market Forecast to 2028

To know about the assumptions considered for the study, Request for Free Sample Report

Flexographic Printing Market Trends

Drivers: Growth of the packaging industry

The packaging industry is driven by increasing consumer demand for packaged goods, contributing significantly to flexographic printing demand as flexographic printing is widely used for packaging materials such as labels, cartons, bags, and flexible packaging.

The packaging industry is continually evolving with growing trends such as booming E-commerce and online shopping, due to which there has been a surge in demand for packaging material to protect and deliver the products. Increased awareness towards sustainability of the environment and demand for eco-friendly packaging solutions by the companies have added to the growth of this industry.

Labor cost and skilled workforce

The operation of flexographic printing equipment requires knowledgeable and experienced operators who can efficiently manage the printing process and perform maintenance. Labor costs and the availability of a skilled workforce can indeed be a restraint for the flexographic printing market.

Flexographic printing involves complex machinery, plate-making processes, ink mixing, and color management. skilled operators are essential to ensure the printing process runs smoothly, efficiently, and produces high-quality output. Proper investments in workforce training are essential for the printing process. Hence, the availability of a skilled workforce and the associated labor costs can impact the flexographic printing market's efficiency, quality, and competitiveness.

Opportunity: Customization and personalization packaging

Flexographic printing allows businesses to create custom designs and branding that stands out in the market. This uniqueness helps brands differentiate themselves and establish a strong identity in consumers' minds.

The versatility provided by the flexographic printing market growth are well-suited for producing tailored packaging solutions rendering the demand of customization by the consumers based on target demographics, events, or seasons. Flexographic printing can integrate variable data printing, enabling the incorporation of individualized text, images, and QR codes. This capability is particularly valuable for promotions, personalized messages, and serialized labels. Moreover, its printing efficiency makes producing small batches of customized products feasible, catering to niche markets and micro-targeted audiences.

Challenge: Shift in market demand

Changing Consumer Preferences for packaging design, materials, and sustainability practices increases demand for flexographic printers to offer solutions that align with these shifting demands.

The rise of e-commerce has led to unique packaging requirements, such as shipping-friendly designs and unboxing experiences. Flexographic printers must cater to these specialized needs to serve e-commerce businesses effectively. The trend towards shorter print runs and on-demand printing requires flexographic printers to optimize their processes to efficiently cater to these smaller production quantities. In addition to that brands also become more price-sensitive due to economic fluctuations. Flexographic printers must balance cost-effective solutions while delivering high-quality, visually appealing printed materials.

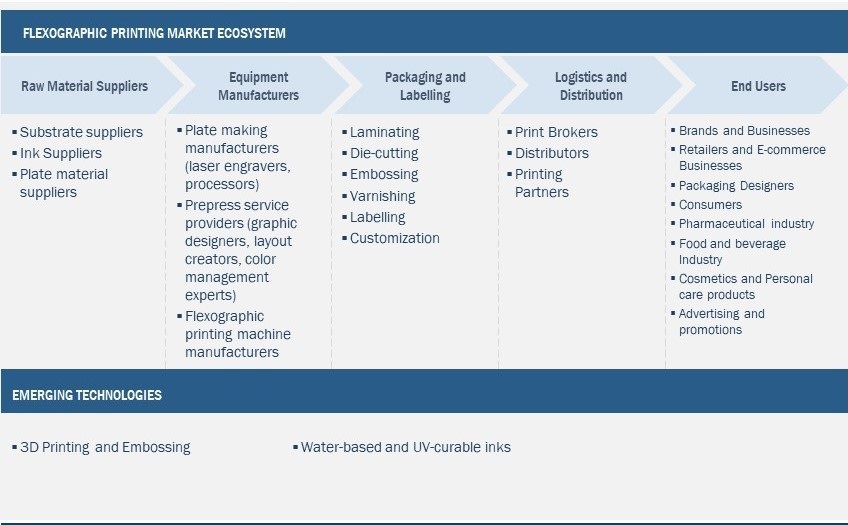

Flexographic printing Map/Ecosystem:

Flexographic Printing Market Segment

Market for corrugated packaging is expected to have largest market share during the forecast period.

In 2022, corrugated packaging held the largest share of the flexographic printing market, and a similar trend is likely to be observed in the coming years. Corrugated packaging plays a significant role in the flexographic printing market as it is widely used in printing methods for packaging materials, including corrugated boxes.

These types of packaging are commonly used for shipping and storing products. Applying flexographic printing to these boxes allows manufacturers and retailers to directly print branding elements, product information, logos, barcodes, and other relevant details onto the packaging. Bobst (Switzerland), Heidelberger Druckmaschinen AG (Germany), and Nilpeter A/S (US) are a few of the key players offering corrugated packaging.

Market for the wide web flexographic printing machine to have largest market size during the forecast period.

Wide web in flexographic printing involves using flexographic technology to print on substrates of significant width. This segment of the market is known for its capability to produce large-scale packaging materials and printed products efficiently.

Wide web printing is chosen for its ability to produce a significant amount of printed material in a relatively short amount of time, making it ideal for industrial-scale applications such as producing packaging materials for bulk items (grains, cement, and other industrial goods). It is cost-effective for large print runs, where the benefits of scale contribute to lower costs per unit. Moreover, it can also be integrated with digital printing technologies for variable data and customization.

Flexible packaging application segment is expected to hold the highest growth rate in the flexographic printing market during the forecast period

Flexible packaging application segment is expected to hold the highest growth rate in the flexographic printing market during the forecast period. Flexible packaging is a type of packaging that is made from flexible materials that can be easily molded, folded, or bent.

This packaging type offers various benefits in terms of convenience, preservation, and sustainability. Flexible packaging serves a wide range of industries and sectors such as food, beverages, personal care items, and pharmaceuticals among others. The materials used in flexible packaging are plastic films, aluminum foil, paper, and laminates, which combined to create structures that provide barrier properties to protect the contents from moisture, oxygen, light, and other external factors.

Flexographic Printing Market Regional Analysis

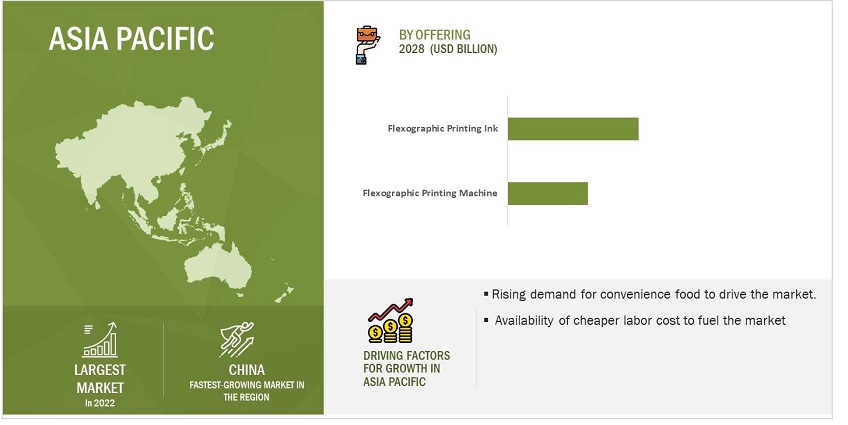

Flexographic printing market in the Asia Pacific estimated to grow at the fastest rate during the forecast period.

The flexographic printing market in the Asia Pacific has been studied for China, Japan, South Korea, India, and the Rest of Asia Pacific. The growth of the flexographic printing market in the Asia Pacific is attributed to the growing demand for quality, efficiency, and innovation which the packaging industry demands.

The availability of cheap and abundant labor, along with low prices of energy and relaxed environmental norms, has aided the growth of packaging printing companies.

Flexographic Printing Market Statistics by Region

To know about the assumptions considered for the study, download the pdf brochure

Top Flexographic Printing Companies - Key Market Players

Major vendors in the flexographic printing companies include

- Bobst (Switzerland),

- Mark Andy Inc. (US),

- Nilpeter A/S (US),

- Amcor Plc (Australia),

- Windmöller & Hölscher (Germany),

- Heidelberger Druckmaschinen AG (Germany);

- MPS Systems B.V. (Netherlands).

Flexographic Printing Market Report Scope

|

Report Metric |

Details |

|

Estimated Market Size |

USD 8.7 Billion in 2023 |

|

Projected Market Size |

USD 10.6 Billion by 2028 |

|

Growth Rate |

CAGR of 4.1% |

|

Market size available for years |

2019—2028 |

|

Base year |

2022 |

|

Forecast period |

2023—2028 |

|

Forecast Units |

USD Millions/USD Billions and Million Units |

|

Segments Covered |

Offering, Application, and Region |

|

Geographic regions covered |

North America, Europe, Asia Pacific, and RoW |

|

Companies covered |

Bobst (Switzerland), Mark Andy Inc. (US), Windmöller & Hölscher (Germany), Heidelberger Druckmaschinen AG (Germany), MPS Systems B.V. (Netherlands), NilpeterA/S (US), Amcor Plc (Australia), Aim Machinetechnik Pvt. Ltd (India), Rotatek (Germany), Koenig & Bauer AG (Germany), Comexi (Spain), Uteco (Italy), Codimag (France), Gaullus (Switzerland), Tresu Group (Denmark), Komori Corporation (Japan), Nuova Gidue (Italy), Omet Group (Italy), Flint Group (Luxembourg), Allstein GmbH (Germany), Soma Engineering (Czech Republic), Edale (Italy), Barry Wehmiller (US), Westrock (US), Andreson & Vreeland (US). |

Flexographic Printing Market Highlights

This research report categorizes the flexographic printing market based on offering, application and region.

|

Segment |

Subsegment |

|

By Offering |

|

|

By Type |

|

|

By Method |

|

|

By Type |

|

|

By Automation Type |

|

|

By Application |

|

|

By Region |

|

Recent Developments in Flexographic Printing Industry

- For instance, In February 2021, Mark Andy, Inc. (US) announced the launch of its latest production inkjet press, Digital Series iQ. Built on Mark Andy Inc. evolution series of flexographic platform for providing flexibility in various applications, the press uses a Domino N610i UV inkjet module for high-quality production-class printing. Moreover the press has a high-quality print resolution achieving speeds up to 230 fpm (70 mpm) in rapid production mode

- In August 2022, Windmöller & Hölscher (W&H) has launched the VISTAFLEX II, which is CI flexographic press with wide-web press that could run jobs 24/7 with a speed of up to 800 m/min (2,620 ft/min) with quick and easy job changeovers. Moreover, this version is launched with technical upgradation and modern look.

Critical questions answered by this report:

What are the key strategies adopted by key companies in the flexographic printing market?

Product launches, acquisitions, and collaborations have been and continue to be some of the major strategies adopted by the key players to grow in the flexographic printing market.

What region dominates the flexographic printing market?

The Asia Pacific region will dominate the flexographic printing market.

What application dominates the flexographic printing market?

The corrugated packaging segment is expected to dominate the flexographic printing market.

Which printing machine type dominates the flexographic printing machine market?

The wide web flexographic printing machine is expected to have the largest market size during the forecast period.

Who are the major companies in the flexographic printing market?

The major players in the flexographic printing market include Bobst (Switzerland), Mark Andy Inc. (US), Heidelberger Druckmaschinen AG (Germany), MPS Systems B.V. (Netherlands), Windmöller & Hölscher (Germany).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- High demand for printed packaging in e-commerce industry- Growing demand for cost-effective printing solutions- Increasing packaging demand from emerging countries in Asia Pacific- Development of innovative printing methodsRESTRAINTS- Suitability of digital printing over traditional flexographic printing for smaller businesses- High cost of hiring skilled workforceOPPORTUNITIES- Increasing trend of customization and personalized packaging- Growing adoption of sustainable printing solutions- Advancements in flexographic printing technologyCHALLENGES- Need to adapt to evolving printing requirements- Need to ensure compliance with packaging and printing regulations

- 5.3 SUPPLY CHAIN ANALYSIS

-

5.4 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSESREVENUE SHIFTS AND NEW REVENUE POCKETS FOR MARKET PLAYERS

-

5.5 ECOSYSTEM MAPPING

-

5.6 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

-

5.7 KEY STAKEHOLDERS AND BUYING CRITERIABUYING CRITERIA

-

5.8 CASE STUDY ANALYSISLUMINITES ANILOX CYLINDER ELIMINATES BRIDGING AND FILLING-IN DEFECTS IN PRINTINGLEAN AND AI TECHNIQUES IMPROVE ENERGY PERFORMANCE IN FLEXOGRAPHIC PRINTING PROCESS

-

5.9 TECHNOLOGY ANALYSISKEY TECHNOLOGIES- 3D printing and embossing- Water-based and UV-curable inks

-

5.10 TRADE ANALYSISIMPORT SCENARIOEXPORT SCENARIO

- 5.11 TARIFF ANALYSIS

-

5.12 PATENT ANALYSIS

-

5.13 REGULATORY ANALYSISREGULATORY COMPLIANCE- Regulations- StandardsREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.14 KEY CONFERENCES AND EVENTS, 2023–2024

-

5.15 PRICING ANALYSISAVERAGE SELLING PRICE OF WIDE WEB FLEXOGRAPHIC PRINTING MACHINES OFFERED BY TOP 3 PLAYERSAVERAGE SELLING PRICE TREND

- 6.1 INTRODUCTION

-

6.2 FLEXOGRAPHIC PRINTING MACHINEUSED TO PRODUCE LABELS, PACKAGING MATERIALS, AND VARIOUS PRINTED PRODUCTS

-

6.3 FLEXOGRAPHIC PRINTING INKFEATURES EXCELLENT ADHESION, FAST DRYING TIME, AND DURABILITY

- 7.1 INTRODUCTION

-

7.2 WATER-BASED INKCONTAINS LESS VOLATILE ORGANIC COMPOUNDS (VOCS)

-

7.3 SOLVENT-BASED INKEXHIBITS FAST DRYING TIME AND EXCELLENT ADHESION

-

7.4 ENERGY-CURABLE INKOFFERS HIGH DURABILITY AND RESISTANCE TO FADING, ABRASION, AND CHEMICALS

- 8.1 INTRODUCTION

- 8.2 INLINE-TYPE PRESS

- 8.3 CENTRAL IMPRESSION (CI) PRESS

- 8.4 STACK-TYPE PRESS

- 9.1 INTRODUCTION

-

9.2 NARROW WEBHIGHLY SUITABLE FOR SHORT OR MEDIUM PRINT RUNS

-

9.3 MEDIUM WEBIDEAL FOR MEDIUM TO LARGE PRINT RUNS

-

9.4 WIDE WEBUSED TO PRINT ON LARGE-SCALE PACKAGING MATERIALS

- 10.1 INTRODUCTION

- 10.2 AUTOMATIC

- 10.3 SEMI-AUTOMATIC

- 11.1 INTRODUCTION

-

11.2 CORRUGATED PACKAGINGFACILITATES EFFICIENT TRACKING AND IDENTIFICATION OF PRODUCTS

-

11.3 FLEXIBLE PACKAGINGOFFERS CONVENIENCE, PRESERVATION, AND SUSTAINABILITY FEATURES AND GENERATES LESS WASTE THAN TRADITIONAL RIGID PACKAGING

-

11.4 CARTONCOMMONLY USED IN RETAIL INDUSTRY ATTRIBUTED TO VERSATILITY, COST-EFFECTIVENESS, AND ABILITY TO HANDLE HIGH-VOLUME PRINTING

-

11.5 LABELS AND TAGSCAPABLE TO WORK WITH WATER-BASED AND UV-CURABLE INKS

-

11.6 OTHERSBAGS AND SACKSNEWSPAPERSENVELOPESSANITARY/KITCHENWARE

- 12.1 INTRODUCTION

-

12.2 NORTH AMERICANORTH AMERICA: RECESSION IMPACTUS- Rising trend for retail shoppingCANADA- Rising demand for printed packaging materials in food & beverage and home & personal care industriesMEXICO- Rising consumption of convenience foods

-

12.3 EUROPEEUROPE: RECESSION IMPACTUK- Growing demand for foods and beveragesGERMANY- Presence of major food & beverage companiesFRANCE- Growing textile industryITALY- Increased demand for package printing in retail, food & beverage, and healthcare industriesREST OF EUROPE

-

12.4 ASIA PACIFICASIA PACIFIC: RECESSION IMPACTCHINA- Availability of low-cost laborJAPAN- Rising demand for convenience foodsSOUTH KOREA- Increasing urbanization and demand for packaged foodsINDIA- Government-led investments in manufacturing sectorREST OF ASIA PACIFIC

-

12.5 ROWROW: RECESSION IMPACTSOUTH AMERICA- Changing lifestyles with increase in per capita incomeMIDDLE EAST & AFRICA- Technological advancements in printing and packaging systems

- 13.1 OVERVIEW

- 13.2 KEY STRATEGIES ADOPTED BY MAJOR PLAYERS

- 13.3 MARKET SHARE ANALYSIS, 2022

-

13.4 KEY COMPANIES EVALUATION MATRIX, 2022STARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

-

13.5 STARTUPS/SMALL AND MEDIUM-SIZED ENTERPRISES (SMES) EVALUATION MATRIX, 2022PROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKS

- 13.6 COMPETITIVE BENCHMARKING

- 13.7 COMPANY FOOTPRINT

-

13.8 COMPETITIVE SCENARIOS AND TRENDSPRODUCT LAUNCHESDEALSOTHERS

-

14.1 KEY PLAYERSBOBST- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewMARK ANDY INC.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewHEIDELBERGER DRUCKMASCHINEN AG- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewWINDMÖLLER & HÖLSCHER- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewMPS SYSTEMS B.V.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewNILPETER A/S- Business overview- Products/Solutions/Services offered- Recent developmentsAMCOR PLC- Business overview- Products/Solutions/Services offered- Recent developmentsAIM MACHINTECHNIK PRIVATE LIMITED- Business overview- Products/Solutions/Services offeredROTATEK- Business overview- Products/Solutions/Services offeredKOENIG & BAUER AG- Business overview- Products/Solutions/Services offeredCOMEXI- Business overview- Products/Solutions/Services offered- Recent developments

-

14.2 OTHER PLAYERSUTECOCODIMAGGALLUSTRESUKOMORI CORPORATIONSTAR FLEX INTERNATIONALOMETFLINT GROUPALLSTEIN GMBHSOMAEDALEBARRY-WEHMILLER COMPANIESWESTROCK COMPANYANDERSON AND VREELAND, INC.

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 15.3 CUSTOMIZATION OPTIONS

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS

- TABLE 1 COMPANIES AND THEIR ROLE IN FLEXOGRAPHIC PRINTING ECOSYSTEM

- TABLE 2 FLEXOGRAPHIC PRINTING MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 3 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 APPLICATIONS

- TABLE 4 KEY BUYING CRITERIA FOR TOP 3 APPLICATIONS

- TABLE 5 IMPORT DATA, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 6 EXPORT DATA, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 7 TARIFF FOR FLEXOGRAPHIC PRINTING MACHINERY EXPORTED BY GERMANY

- TABLE 8 TARIFF FOR FLEXOGRAPHIC PRINTING MACHINERY EXPORTED BY CHINA

- TABLE 9 TARIFF FOR FLEXOGRAPHIC PRINTING MACHINERY EXPORTED BY US

- TABLE 10 MARKET: PATENT REGISTRATIONS

- TABLE 11 NUMBER OF PATENTS REGISTERED, 2012–2022

- TABLE 12 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 MARKET: LIST OF CONFERENCES AND EVENTS

- TABLE 14 AVERAGE SELLING PRICE OF FLEXOGRAPHIC PRINTING MACHINES OFFERED BY TOP 3 COMPANIES

- TABLE 15 MARKET, BY OFFERING, 2019–2022 (USD MILLION)

- TABLE 16 FLEXOGRAPHIC PRINTING MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 17 FLEXOGRAPHIC PRINTING MACHINE: MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 18 FLEXOGRAPHIC PRINTING MACHINE: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 19 FLEXOGRAPHIC PRINTING MACHINE: MARKET FOR CORRUGATED PACKAGING, BY REGION, 2019–2022 (USD MILLION)

- TABLE 20 FLEXOGRAPHIC PRINTING MACHINE: MARKET FOR CORRUGATED PACKAGING, BY REGION, 2023–2028 (USD MILLION)

- TABLE 21 FLEXOGRAPHIC PRINTING MACHINE: MARKET FOR FLEXIBLE PACKAGING, BY REGION, 2019–2022 (USD MILLION)

- TABLE 22 FLEXOGRAPHIC PRINTING MACHINE: MARKET FOR FLEXIBLE PACKAGING, BY REGION, 2023–2028 (USD MILLION)

- TABLE 23 FLEXOGRAPHIC PRINTING MACHINE: MARKET FOR CARTON, BY REGION, 2019–2022 (USD MILLION)

- TABLE 24 FLEXOGRAPHIC PRINTING MACHINE: MARKET FOR CARTON, BY REGION, 2023–2028 (USD MILLION)

- TABLE 25 FLEXOGRAPHIC PRINTING MACHINE: MARKET FOR LABELS AND TAGS, BY REGION, 2019–2022 (USD MILLION)

- TABLE 26 FLEXOGRAPHIC PRINTING MACHINE: MARKET FOR LABELS AND TAGS, BY REGION, 2023–2028 (USD MILLION)

- TABLE 27 FLEXOGRAPHIC PRINTING MACHINE: MARKET FOR OTHERS, BY REGION, 2019–2022 (USD MILLION)

- TABLE 28 FLEXOGRAPHIC PRINTING MACHINE: MARKET FOR OTHERS, BY REGION, 2023–2028 (USD MILLION)

- TABLE 29 FLEXOGRAPHIC PRINTING MACHINE: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 30 FLEXOGRAPHIC PRINTING MACHINE: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 31 FLEXOGRAPHIC PRINTING INK: FLEXOGRAPHIC PRINTING MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 32 FLEXOGRAPHIC PRINTING INK: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 33 FLEXOGRAPHIC PRINTING INK: MARKET FOR CORRUGATED PACKAGING, BY REGION, 2019–2022 (USD MILLION)

- TABLE 34 FLEXOGRAPHIC PRINTING INK: MARKET FOR CORRUGATED PACKAGING, BY REGION, 2023–2028 (USD MILLION)

- TABLE 35 FLEXOGRAPHIC PRINTING INK: MARKET FOR FLEXIBLE PACKAGING, BY REGION, 2019–2022 (USD MILLION)

- TABLE 36 FLEXOGRAPHIC PRINTING INK: MARKET FOR FLEXIBLE PACKAGING, BY REGION, 2023–2028 (USD MILLION)

- TABLE 37 FLEXOGRAPHIC PRINTING INK: MARKET FOR CARTON, BY REGION, 2019–2022 (USD MILLION)

- TABLE 38 FLEXOGRAPHIC PRINTING INK: MARKET FOR CARTON, BY REGION, 2023–2028 (USD MILLION)

- TABLE 39 FLEXOGRAPHIC PRINTING INK: MARKET FOR LABELS AND TAGS, BY REGION, 2019–2022 (USD MILLION)

- TABLE 40 FLEXOGRAPHIC PRINTING INK: MARKET FOR LABELS AND TAGS, BY REGION, 2023–2028 (USD MILLION)

- TABLE 41 FLEXOGRAPHIC PRINTING INK: MARKET FOR OTHERS, BY REGION, 2019–2022 (USD MILLION)

- TABLE 42 FLEXOGRAPHIC PRINTING INK: MARKET FOR OTHERS, BY REGION, 2023–2028 (USD MILLION)

- TABLE 43 FLEXOGRAPHIC PRINTING INK: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 44 FLEXOGRAPHIC PRINTING INK: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 45 FLEXOGRAPHIC PRINTING INK MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 46 FLEXOGRAPHIC PRINTING INK MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 47 FLEXOGRAPHIC PRINTING INK MARKET, BY TYPE, 2019–2022 (KT)

- TABLE 48 FLEXOGRAPHIC PRINTING INK MARKET, BY TYPE, 2023–2028 (KT)

- TABLE 49 FLEXOGRAPHIC PRINTING MACHINE MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 50 FLEXOGRAPHIC PRINTING MACHINE MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 51 FLEXOGRAPHIC PRINTING MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 52 MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 53 CORRUGATED PACKAGING: MARKET, BY OFFERING, 2019–2022 (USD MILLION)

- TABLE 54 CORRUGATED PACKAGING: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 55 CORRUGATED PACKAGING: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 56 CORRUGATED PACKAGING: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 57 FLEXIBLE PACKAGING: MARKET, BY OFFERING, 2019–2022 (USD MILLION)

- TABLE 58 FLEXIBLE PACKAGING: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 59 FLEXIBLE PACKAGING: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 60 FLEXIBLE PACKAGING: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 61 CARTON: MARKET, BY OFFERING, 2019–2022 (USD MILLION)

- TABLE 62 CARTON: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 63 CARTON: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 64 CARTON: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 65 LABELS AND TAGS: MARKET, BY OFFERING, 2019–2022 (USD MILLION)

- TABLE 66 LABELS AND TAGS: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 67 LABELS AND TAGS: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 68 LABELS AND TAGS: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 69 OTHERS: MARKET, BY OFFERING, 2019–2022 (USD MILLION)

- TABLE 70 OTHERS: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 71 OTHERS: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 72 OTHERS: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 73 FLEXOGRAPHIC PRINTING MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 74 MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 75 NORTH AMERICA: MARKET, BY OFFERING, 2019–2022 (USD MILLION)

- TABLE 76 NORTH AMERICA: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 77 NORTH AMERICA: MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 78 NORTH AMERICA: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 79 NORTH AMERICA: MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 80 NORTH AMERICA: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 81 US: MARKET, BY OFFERING, 2019–2022 (USD MILLION)

- TABLE 82 US: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 83 CANADA: MARKET, BY OFFERING, 2019–2022 (USD MILLION)

- TABLE 84 CANADA: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 85 MEXICO: MARKET, BY OFFERING, 2019–2022 (USD MILLION)

- TABLE 86 MEXICO: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 87 EUROPE: MARKET, BY OFFERING, 2019–2022 (USD MILLION)

- TABLE 88 EUROPE: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 89 EUROPE: MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 90 EUROPE: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 91 EUROPE: MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 92 EUROPE: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 93 UK: FLEXOGRAPHIC PRINTING MARKET, BY OFFERING, 2019–2022 (USD MILLION)

- TABLE 94 UK: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 95 GERMANY: MARKET, BY OFFERING, 2019–2022 (USD MILLION)

- TABLE 96 GERMANY: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 97 FRANCE: MARKET, BY OFFERING, 2019–2022 (USD MILLION)

- TABLE 98 FRANCE: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 99 ITALY: MARKET, BY OFFERING, 2019–2022 (USD MILLION)

- TABLE 100 ITALY: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 101 REST OF EUROPE: MARKET, BY OFFERING, 2019–2022 (USD MILLION)

- TABLE 102 REST OF EUROPE: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 103 ASIA PACIFIC: MARKET, BY OFFERING, 2019–2022 (USD MILLION)

- TABLE 104 ASIA PACIFIC: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 105 ASIA PACIFIC: MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 106 ASIA PACIFIC: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 107 ASIA PACIFIC: MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 108 ASIA PACIFIC: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 109 CHINA: MARKET, BY OFFERING, 2019–2022 (USD MILLION)

- TABLE 110 CHINA: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 111 JAPAN: MARKET, BY OFFERING, 2019–2022 (USD MILLION)

- TABLE 112 JAPAN: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 113 SOUTH KOREA: MARKET, BY OFFERING, 2019–2022 (USD MILLION)

- TABLE 114 SOUTH KOREA: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 115 INDIA: FLEXOGRAPHIC PRINTING MARKET, BY OFFERING, 2019–2022 (USD MILLION)

- TABLE 116 INDIA: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 117 REST OF ASIA PACIFIC: MARKET, BY OFFERING, 2019–2022 (USD MILLION)

- TABLE 118 REST OF ASIA PACIFIC: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 119 ROW: MARKET, BY OFFERING, 2019–2022 (USD MILLION)

- TABLE 120 ROW: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 121 ROW: MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 122 ROW: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 123 ROW: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 124 ROW: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 125 SOUTH AMERICA: MARKET, BY OFFERING, 2019–2022 (USD MILLION)

- TABLE 126 SOUTH AMERICA: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 127 MIDDLE EAST & AFRICA: MARKET, BY OFFERING, 2019–2022 (USD MILLION)

- TABLE 128 MIDDLE EAST & AFRICA: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 129 MARKET: KEY STRATEGIES ADOPTED BY MAJOR PLAYERS, 2019–2023

- TABLE 130 FLEXOGRAPHIC PRINTING MACHINE MARKET: DEGREE OF COMPETITION

- TABLE 131 MARKET: KEY STARTUPS/SMES

- TABLE 132 MARKET: LIST OF KEY STARTUPS/SMES

- TABLE 133 MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 134 COMPANY FOOTPRINT

- TABLE 135 TYPE: COMPANY FOOTPRINT

- TABLE 136 APPLICATION: COMPANY FOOTPRINT

- TABLE 137 REGION: COMPANY FOOTPRINT

- TABLE 138 MARKET: PRODUCT LAUNCHES, 2020–2023

- TABLE 139 MARKET: DEALS, 2020–2023

- TABLE 140 MARKET: OTHERS, 2020–2023

- TABLE 141 BOBST: COMPANY OVERVIEW

- TABLE 142 BOBST: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 143 BOBST: PRODUCT LAUNCHES

- TABLE 144 BOBST: DEALS

- TABLE 145 MARK ANDY INC.: COMPANY OVERVIEW

- TABLE 146 MARK ANDY INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 147 MARK ANDY INC.: PRODUCT LAUNCHES

- TABLE 148 MARK ANDY INC.: DEALS

- TABLE 149 HEIDELBERGER DRUCKMASCHINEN AG: COMPANY OVERVIEW

- TABLE 150 HEIDELBERGER DRUCKMASCHINEN AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 151 HEIDELBERG DRUCKMASCHINEN AG: DEALS

- TABLE 152 WINDMÖLLER & HÖLSCHER: COMPANY OVERVIEW

- TABLE 153 WINDMÖLLER & HÖLSCHER: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 154 WINDMÖLLER & HÖLSCHER: DEALS

- TABLE 155 MPS SYSTEMS B.V.: COMPANY OVERVIEW

- TABLE 156 MPS SYSTEMS B.V.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 157 MPS SYSTEMS B.V.: DEALS

- TABLE 158 NILPETER A/S: COMPANY OVERVIEW

- TABLE 159 NILPETER A/S: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 160 NILPETER A/S: DEALS

- TABLE 161 AMCOR PLC: COMPANY OVERVIEW

- TABLE 162 AMCOR PLC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 163 AMCOR PLC: DEALS

- TABLE 164 AMCOR PLC: OTHERS

- TABLE 165 AIM MACHINTECHNIK PRIVATE LIMITED: COMPANY OVERVIEW

- TABLE 166 AIM MACHINTECHNIK PRIVATE LIMITED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 167 ROTATEK: COMPANY OVERVIEW

- TABLE 168 ROTATEK: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 169 KOENIG & BAUER AG: COMPANY OVERVIEW

- TABLE 170 KOENIG & BAUER AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 171 KOENIG & BAUER AG: DEALS

- TABLE 172 COMEXI: COMPANY OVERVIEW

- TABLE 173 COMEXI: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 174 COMEXI: PRODUCT LAUNCHES

- FIGURE 1 FLEXOGRAPHIC PRINTING MARKET SEGMENTATION

- FIGURE 2 MARKET: RESEARCH DESIGN

- FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY (SUPPLY SIDE): REVENUE GENERATED THROUGH SALE OF PRODUCTS IN FLEXOGRAPHIC PRINTING MACHINE MARKET

- FIGURE 4 MARKET: BOTTOM-UP APPROACH

- FIGURE 5 FLEXOGRAPHIC PRINTING MACHINE: TOP-DOWN APPROACH

- FIGURE 6 DATA TRIANGULATION

- FIGURE 7 FLEXOGRAPHIC PRINTING MACHINE SEGMENT TO RECORD HIGHER CAGR FROM 2023 TO 2028

- FIGURE 8 WIDE WEB SEGMENT TO HOLD LARGEST MARKET SHARE IN 2028

- FIGURE 9 WATER-BASED INK SEGMENT TO HOLD LARGEST MARKET SHARE IN 2028

- FIGURE 10 FLEXIBLE PACKAGING SEGMENT TO REGISTER HIGHEST CAGR BETWEEN 2023 AND 2028

- FIGURE 11 ASIA PACIFIC HELD LARGEST SHARE OF MARKET IN 2022

- FIGURE 12 INCREASING APPLICATIONS OF FLEXOGRAPHIC PRINTING IN FLEXIBLE PACKAGING

- FIGURE 13 NARROW WEB SEGMENT TO REGISTER HIGHEST CAGR FROM 2023 TO 2028

- FIGURE 14 CORRUGATED PACKAGING SEGMENT TO HOLD LARGEST SHARE OF MARKET IN 2028

- FIGURE 15 WATER-BASED INK SEGMENT TO HOLD LARGEST SHARE OF FLEXOGRAPHIC PRINTING INK MARKET IN 2028

- FIGURE 16 CORRUGATED PACKAGING SEGMENT AND US HELD LARGEST SHARES OF NORTH AMERICAN MARKET IN 2022

- FIGURE 17 INDIA TO REGISTER HIGHEST CAGR IN MARKET DURING FORECAST PERIOD

- FIGURE 18 FLEXOGRAPHIC PRINTING MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 19 ANALYSIS OF IMPACT OF DRIVERS ON MARKET

- FIGURE 20 ANALYSIS OF IMPACT OF RESTRAINTS ON MARKET

- FIGURE 21 ANALYSIS OF IMPACT OF OPPORTUNITIES ON MARKET

- FIGURE 22 ANALYSIS OF IMPACT OF CHALLENGES ON MARKET

- FIGURE 23 MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 24 REVENUE SHIFTS AND NEW REVENUE POCKETS FOR MARKET PLAYERS

- FIGURE 25 MARKET: ECOSYSTEM MAPPING

- FIGURE 26 MARKET: PORTER’S FIVE FORCES ANALYSIS

- FIGURE 27 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 28 KEY BUYING CRITERIA FOR TOP 3 APPLICATIONS

- FIGURE 29 IMPORT DATA FOR PRODUCTS COVERED UNDER HS CODE 844316, BY COUNTRY, 2018–2022 (USD MILLION)

- FIGURE 30 EXPORT DATA FOR PRODUCTS COVERED UNDER HS CODE 844316, BY COUNTRY, 2018–2022 (USD MILLION)

- FIGURE 31 PATENTS PUBLISHED IN MARKET, 2012–2022

- FIGURE 32 TOP 10 COMPANIES WITH HIGHEST NUMBER OF PATENT APPLICATIONS, 2012–2022

- FIGURE 33 AVERAGE SELLING PRICE OF WIDE WEB FLEXOGRAPHIC PRINTING MACHINES OFFERED BY TOP 3 PLAYERS

- FIGURE 34 AVERAGE SELLING PRICE OF FLEXOGRAPHIC PRINTING INK

- FIGURE 35 FLEXOGRAPHIC PRINTING MACHINE SEGMENT TO EXHIBIT HIGHER CAGR IN MARKET DURING FORECAST PERIOD

- FIGURE 36 CORRUGATED PACKAGING SEGMENT TO HOLD LARGEST SHARE OF MARKET FOR FLEXOGRAPHIC PRINTING INK IN 2028

- FIGURE 37 WATER-BASED INK SEGMENT TO DOMINATE FLEXOGRAPHIC INK MARKET DURING FORECAST PERIOD

- FIGURE 38 NARROW WEB SEGMENT TO EXHIBIT HIGHEST CAGR IN FLEXOGRAPHIC PRINTING MACHINE MARKET DURING FORECAST PERIOD

- FIGURE 39 LABELS AND TAGS SEGMENT TO EXHIBIT HIGHEST CAGR IN MARKET FROM 2023 TO 2028

- FIGURE 40 FLEXOGRAPHIC PRINTING MACHINE SEGMENT TO EXHIBIT HIGHER CAGR IN MARKET FOR FLEXIBLE PACKAGING BETWEEN 2023 AND 2028

- FIGURE 41 FLEXOGRAPHIC PRINTING INK SEGMENT TO REGISTER HIGHER GROWTH IN MARKET FOR CARTON DURING FORECAST PERIOD

- FIGURE 42 ASIA PACIFIC TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 43 NORTH AMERICA: MARKET SNAPSHOT

- FIGURE 44 EUROPE: MARKET SNAPSHOT

- FIGURE 45 ASIA PACIFIC: MARKET SNAPSHOT

- FIGURE 46 FLEXOGRAPHIC PRINTING MACHINE MARKET SHARE ANALYSIS, 2022

- FIGURE 47 MARKET: KEY COMPANIES EVALUATION MATRIX, 2022

- FIGURE 48 MARKET: STARTUPS/SMES EVALUATION MATRIX, 2022

- FIGURE 49 HEIDELBERGER DRUCKMASCHINEN AG: COMPANY SNAPSHOT

- FIGURE 50 AMCOR PLC: COMPANY SNAPSHOT

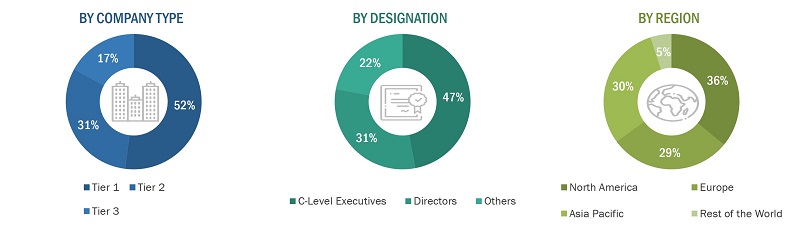

The research process for this study included systematic gathering, recording, and analysis of data about customers and companies operating in the flexographic printing market. This process involved the extensive use of secondary sources, directories, and databases (Factiva, Oanda, and OneSource) for identifying and collecting valuable information for the comprehensive, technical, market-oriented, and commercial study of the flexographic printing market. In-depth interviews were conducted with primary respondents, including experts from core and related industries and preferred manufacturers, to obtain and verify critical qualitative and quantitative information as well as to assess growth prospects. Key players in the flexographic printing market were identified through secondary research, and their market rankings were determined through primary and secondary research. This research included studying annual reports of top players and interviewing key industry experts such as CEOs, directors, and marketing executives.

Secondary Research

In the secondary research process, various sources were used to identify and collect information important for this study. These include annual reports, press releases & investor presentations of companies, white papers, technology journals, certified publications, articles by recognized authors, directories, and databases.

Secondary research was mainly used to obtain key information about the industry's supply chain, the total pool of market players, the classification of the market according to industry trends to the bottom-most level, regional markets, and key developments from the market and technology-oriented perspectives.

Primary Research

Primary research was also conducted to identify the segmentation types, key players, competitive landscape, and key market dynamics, such as drivers, restraints, opportunities, challenges, and industry trends, along with key strategies adopted by players operating in the flexographic printing market. Extensive qualitative and quantitative analyses were performed on the complete market engineering process to list key information and insights throughout the report.

Extensive primary research has been conducted after acquiring knowledge about the flexographic printing market scenario through secondary research. Several primary interviews have been conducted with experts from both demand (end users) and supply side (flexographic printing machine and supplies /service providers) across four major geographic regions: North America, Europe, Asia Pacific, and RoW. Approximately 80% and 20% of the primary interviews have been conducted from the supply and demand side, respectively. These primary data have been collected through questionnaires, emails, and telephonic interviews.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the complete market engineering process, both top-down and bottom-up approaches were implemented, along with several data triangulation methods, to estimate and validate the size of the flexographic printing market and various other dependent submarkets. Key players in the market were identified through secondary research, and their market share in the respective regions was determined through primary and secondary research. This entire research methodology included the study of annual and financial reports of the top players, as well as interviews with experts (such as CEOs, VPs, directors, and marketing executives) for key insights (quantitative and qualitative).

All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources. All the possible parameters that affect the markets covered in this research study were accounted for, viewed in detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data was consolidated and supplemented with detailed inputs and analysis from MarketsandMarkets and presented in this report.

Flexographic Printing Market: Bottom-Up Approach

Flexographic printing Market: Top-down Approach

Data Triangulation

After arriving at the overall market size from the market size estimation process, as explained above, the total market has been split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, market breakdown and data triangulation procedures have been employed, wherever applicable. The data have been triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market has been validated using top-down and bottom-up approaches.

Market Definition

The flexographic printing technology plates made of flexible materials such as plastics, rubbers, and UV-sensitive polymers are used. This printing technology is widely used for packaging printing due to wide range of benefits, such as high-quality printed images and high production speed. It is used to print corrugated containers, folding cartons, labels and tags, paper sacks, plastic bags among others. The key offerings of the market include flexographic printing machines and flexographic printing inks.

Key Stakeholders

- Manufacturers of flexographic printing machines

- Suppliers of flexographic printing inks

- Consumables and accessories providers

- Packaging and label manufacturers

- Retailers and consumer goods producers

- Printers and printing service providers

Report Objectives

- To describe, segment, and forecast the flexographic printing market based on offering and application in terms of value.

- To describe and forecast the flexographic printing machine market by type and automation type in terms of value.

- To describe and forecast the flexographic printing ink market by type in terms of value.

- To describe and forecast the market for four key regions: North America, Europe, Asia Pacific, and the Rest of the World (RoW), in terms of value.

- To describe elements with varied types and application modes of the flexographic printing market.

- To provide detailed information regarding drivers, restraints, opportunities, and challenges influencing the growth of the flexographic printing market

- To provide a detailed overview of the supply chain and ecosystem pertaining to the flexographic printing market, along with the average selling prices of flexographic printing machines.

- To strategically analyze the ecosystem, tariffs and regulations, patent landscape, trade landscape, and case studies pertaining to the market under study

- To strategically analyze micro markets with regard to individual growth trends, prospects, and contributions to the overall market

- To analyze opportunities in the market for stakeholders and provide a competitive landscape of the market

- To analyze competitive developments such as product launches and developments, expansions, partnerships, collaborations, contracts, and mergers and acquisitions in the flexographic printing market

- To strategically profile the key players in the flexographic printing market and comprehensively analyze their market ranking and core competencies

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in Flexographic Printing Market