Flexible Plastic Pouches Market by Material (PE, PP), Type (Flat Pouches, Stand-up Pouches), Application (Food, Beverage), and Region (APAC, North America, Europe, South America, and Middle East & Africa) - Global Forecasts to 2026

Updated on : September 03, 2025

Flexible Plastic Pouches Market

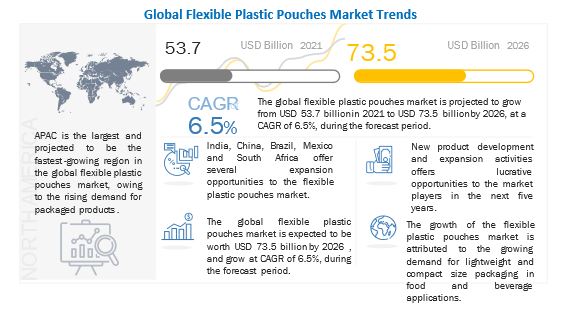

The flexible plastic pouches market was valued at USD 53.7 billion in 2021 and is projected to reach USD 73.5 billion by 2026, growing at 6.5% cagr from 2021 to 2026. The market is witnessing high growth owing to the increase in demand for lightweight, convenient, and cost-effective packaging products & solutions for food and beverage applications. The aesthetic appeal, increased shelf life of product, rising demand from end-use sectors, and increasing e-commerce sales are key factors driving the demand for flexible plastic pouches during the forecast period.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 impact on the Global Flexible Plastic Pouches Market

The demand for various flexible plastic pouch types has increased during the lockdown and created more demand for the future. The pandemic has also increased the use of single-use plastics in terms of pouches; this has created more demand for the market. Consumer behavior has changed owing to the safety concerns due to the pandemic. Consumers, right now, prefer to buy packed food & beverage rather than going to restaurants. E-commerce has also witnessed a positive impact due to the pandemic. Consumers are opting for online shopping for products instead of buying from brick & mortar stores, which is preferred for the purchase of a small number of products or rapid fulfillment of the same. Moreover, consumers are buying one-time usable plastic pouches owing to hygiene issues. An increase in demand for FMCG products due to the pandemic is attributed to the growth of flexible plastic pouches.

Flexible Plastic Pouches Market Dynamics

Driver: Rising demand for packaged food and beverages

Increasing health awareness and growing per capita income has resulted in the rise in demand for packaged food and beverages, which, in turn, drives the demand for pouches. According to ASSOCHAM (The Associated Chambers of Commerce & Industry of India), an annual increase of 22.5% has been witnessed from 2010 to 2015 in the packaged food annual spending in India. The Growing westernization, along with an increase in the standard of living and preference for convenience food products, contributes toward the rise in demand for packaged food products. The rise in demand for packaged food subsequently drives the demand for pouches.

Restraint: Stringent government regulations

Pouches are one of the fastest-growing segments of the flexible packaging industry. However, stringent regulations imposed regarding flexible plastic packaging may pose a restraint to the market. Compliance with regulations is necessary as the smallest defect in packaging may contaminate the product; it may also affect the manufacturers’ profit. Packaging for food & beverage, personal care, and healthcare products requires properties such as moisture resistance, barrier against light, and ease of transport. Regulatory bodies for flexible plastic packaging include the Food and Drug Administration (FDA), the European Commission, and the US Environmental Protection Agency (EPA).

Opportunity: Growing popularity of pouches in alcohol packaging

Alcohol packaging in pouches has recently started to gain popularity. Pouches are flexible, compact, lightweight, and cost-effective; they also contribute to aesthetic appeal and have the ability to preserve flavor & quality, which contribute to their increasing adoption in alcohol packaging. Furthermore, they also have oxygen & contamination barrier properties, which play a vital role in extending the freshness of the product. Currently, pouches are increasingly used for the packaging of wine, spirits, and beer. This packaging format for alcohol is largely used in the US, Australia, and South Africa.

Challenges: Availability of substitutes

The substitutes for pouches in the packaging industry include rigid containers and poly bags. Rigid containers include bottles, jars, cans, and containers and find wide application in the food & beverages, personal care, and pharmaceutical industries. The impact strength, high robustness, and barrier properties of rigid containers have contributed to its popularity across industries. Rigid containers are the most widely used and popular form of packaging in the food & beverages industry.

Polyethylene is the largest material segment of the flexible plastic pouches market

The flexible plastic pouches market is segmented on the basis of material into polyethylene, polypropylene, and others. The polyethylene material segment accounted for a larger market share. This is attributed to its unique flow properties such as propensity to stretch when strained, low production costs, high clarity, heat seal-ability, high elongation, and softness make it suitable for pouch packaging. Polypropylene is projected to be the fastest-growing material segment. This is attributed to its good resistance to almost all types of chemicals, including strong acids, alkalis, and most organic materials, and its high melting point makes it a superior material for boilable packages and sterilizable products.

Flat pouches is the largest type segment of the flexible plastic pouches market

The flexible plastic pouches market is segmented on the basis of type into flat pouches and stand-up pouches. The flat pouches segment led the market in terms of both value and volume. Its cost-effectiveness and aesthetic display in stores contribute toward its leading share in the flexible plastic pouches market.

Food is the largest application segment of the flexible plastic pouches market

The flexible plastic pouches market is segmented on the basis of application into food, beverage, and others. Food application segment accounts for the largest market share in the market. Its malleability and low weight, along with the protection that it offers against contaminants make pouches an ideal packaging solution for food packaging products, leading to its large market share.

APAC is the largest market for flexible plastic pouches market

The APAC region is projected to be the largest market and to grow at the highest CAGR during the forecast period. Growth in APAC is backed by the increase in disposable income of people in countries such as China and India, growing middle-class population, rise in demand for packaged food, and the growth of the food & beverage industry. Moreover, the growth of the flexible plastic pouches market in the APAC region is attributed to the higher consumer spending and manufacturing of packaging materials in developing economies, such as China and India. China is projected to be the fastest-growing market across the globe during the forecast period. This is attributed to the population growth in the country, along with the high availability of packaging material coupled with technological development. This directly affects the growth of the flexible plastic pouches market in the APAC region.

Berry Global Inc. (US), Mondi (UK), Huhtamaki (Finland), Sealed Air Corp. (US), Sonoco Products Company (US), Smurfit Kappa (Ireland), Amcor Plc (Switzerland), Gogllio SpA (Italy), Constantia Flexibles (Austria), and ProAmpac (US) are key players in flexible plastic pouches market.

Flexible Plastic Pouches Market Interconnections

Flexible Plastic Pouches Market Players

Berry Global Inc. (US), Mondi (UK), Huhtamaki (Finland), Sealed Air Corp. (US), Sonoco Products Company (US), Smurfit Kappa (Ireland), Amcor Plc (Switzerland), Gogllio SpA (Italy), Constantia Flexibles (Austria), and ProAmpac (US) are key players in flexible plastic pouches market.

These companies have adopted several growth strategies to strengthen their position in the market. Expansion, new product development, merger & acquisition, and collaboration are the key growth strategies adopted by these players to enhance their product offering & regional presence to meet the growing demand for o flexible plastic pouches from emerging economies.

Flexible Plastic Pouches Market Report Scope

|

Report Metric |

Details |

|

Market size available for years |

2019–2026 |

|

Base year |

2020 |

|

Forecast period |

2021–2026 |

|

Units considered |

Value (USD Million) |

|

Segments |

Material, Type, Application, and Region |

|

Regions |

APAC, Europe, North America, South America, and Middle East & Africa |

|

Companies |

Berry Global Inc. (US), Mondi (UK), Huhtamaki (Finland), Sealed Air Corp. (US), Sonoco Products Company (US), Smurfit Kappa (Ireland), Amcor Plc (Switzerland), Gogllio SpA (Italy), Constantia Flexibles (Austria), and ProAmpac (US) |

This research report categorizes the flexible plastic pouches market based on material, type, application, and region.

Flexible Plastic Pouches Market By Material:

- Polyethylene

- Polypropylene

- Others (PVC, EVOH, and polyamide)

Flexible Plastic Pouches Market, By Type:

- Flat Pouches

- Stand-up Pouches

Flexible Plastic Pouches Market, By Application:

- Food

- Beverage

- Others (personal care & homecare, healthcare, oil & lubricants, auto glass wipes, agricultural products, lawn & garden products, and paints)

Flexible Plastic Pouches Market, By Region:

- APAC

- Europe

- North America

- South America

- Middle East & Africa

Recent Developments

- In August 2020, Sealed Air Corp. announced that it had signed a collaboration agreement with Plastic Energy, an industry-leading company in advanced recycling technology. Additionally, Sealed Air has made an equity investment in Plastic Energy Global, the parent company of Plastic Energy.

- In July 2020. Mondi partnered with Austrian meat producer Hütthaler to produce a fully recyclable thermoforming film made from a mono-material for their meat and sausage products. The film is made of a mono-material solution that can be fully recycled and provides a barrier to protect the food and extend its shelf life. The independent cyclos-HTP Institute for Recyclability and Product Responsibility has awarded this film the highest classification "AAA" for recyclability.

- In July 2020, Mondi invested in its flexible packaging plants, in Aramil and Pereslavl in Russia, to provide customers with improved flexibility and a broader portfolio, including sustainable packaging solutions.

- In May 2020, Berry Global Inc. announced its collaboration with the longtime customer, Mondelçz International, to supply packaging containing recycled plastic for Philadelphia, the world’s most popular cream cheese. The package contains plastic material recovered using advanced recycling technology from Berry’s partnership with SABIC, announced earlier this year.

- In May 2020, Huhtamaki and the international charity WasteAid announced a €900,000 (USD 1,011,330) partnership to drive community-level circular economy innovation in Vietnam, India, and South Africa for a two-year period. To mark its 100-year anniversary, Huhtamaki is donating €3 million (USD 3.4 million) to global sustainability initiatives.

- In January 2020, Sealed Air Corp. launched a new version of its bubble wrap brand packaging made with at least 90% recycled content. The recycled content used to make this version of bubble wrap brand packaging is sourced from post-industrial materials that would otherwise end up in landfills.

- In January 2020, Huhtamaki completed the acquisition of Mohan Mutha Polytech Private Limited (India), a privately owned flexible packaging manufacturer. The transaction was complete for approximately USD 11 million.

- In September 2019, Mondi, in a four-year effort with a customer Werner & Mertz GmbH (Germany), developed a fully recyclable, flexible, stand-up pouch for W&M’s Frosch-brand laundry detergent. The product is called StripPouch and has earned certifications from two independent bodies for being 100% recyclable.

- In September 2019, Sonoco announced the introduction of EnviroFlex PE, which is a recyclable polyethylene flexible packaging. EnviroFlex PE can be dropped off at local retail stores for recycling with grocery bags as it is eligible to use the How2Recycle Store Drop-Off label. EnviroFlex PE is suitable for a variety of products, including cookies and crackers, confections, dry/dehydrated foods, sweet and savory snacks, pet food and treats, and personal care items.

- In August 2019, Sonoco announced the completion of its acquisition of Corenso Holdings America, Inc. (US) from a company owned by investment funds advised by Madison Dearborn Partners, LLC, and management for USD 110 million in cash.

- In July 2019, Berry Global Inc. completed the acquisition of RPC Group Plc (UK) for a purchase price of USD 6.5 billion. The combination of Berry and RPC creates a leading global supplier of value-added protective solutions and one of the largest plastic packaging companies.

- In April 2019, Huhtamaki launched Blueloop, a new range of recyclable flexible packaging made of mono-material PP, PE, and paper. Huhtamaki Blueloop solutions involve innovative polyolefin structures to pack coffee, snacks, dry food, personal care, and other fast-moving consumer products. The range also includes paper-based solutions to replace plastic packaging.

- In April 2019, Huhtamaki started a new manufacturing plant for flexible packaging in Egypt, with an aim to enter into Africa’s flexible packaging market. The manufactured flexible packaging solutions are expected to serve the market in Egypt and will be exported to the African & European markets.

- In March 2019, Sealed Air Corp. invested in increasing capacity at its Simpsonville, S.C. facility to produce plant-based food packaging. The facility will produce materials from Plantic plant-based resin and post-consumer plastic and is the first such facility in North America.

- In February 2019, Sealed Air Corp. acquired MGM Blendwell Corporation's (Philippines) flexible packaging business. The acquired company specializes in printing and laminating and offers flexible food packaging materials in Southeast Asia for the consumer-packaged goods market. This strategic initiative will help Sealed Air to leverage MGM’s expertise in lamination and printing capabilities.

- In June 2017, Sonoco (US) expanded its ClearGuard flexible packaging portfolio to include pouches for viscous and liquid products. The added feature holds the ability to withstand retort cooking processes and rigors of the hot fill.

- In December 2016, Berry Global Inc. launched a new line of pouch packaging named ‘Entour.’ This product line includes non-laminated stand-up pouches for catering to the packaging needs of baking mixes, snacks, rice, pasta, granola, confections, and dry contents. This strategic initiative strengthened the company’s stand-up pouch product line.

Frequently Asked Questions (FAQ):

What are the upcoming hot bets for the flexible plastic pouches market?

Rise in demand for flexible plastic pouches from emerging economies and growing popularity of pouches in alcohol packaging are hot bets for the market.

What are the market dynamics for the different type of flexible plastic pouches?

On the basis of type, the market is segment into flat pouches and stand-up pouches. The flat pouches segment led the market in terms of both value and volume. Its cost-effectiveness and aesthetic display in stores contribute toward its leading share in the flexible plastic pouches market.

What are the market dynamics for the different applications of flexible plastic pouches?

The food segment accounted for the largest market share during the forecast period. Pouches are widely used in the food segments as these pouches are made with high-grade materials that protect the contents from contaminants and have lower shipping costs as they are lightweight and compact. These factors are fueling the growth of the flexible plastic pouches market in the food applications.

Who are the major manufacturers of flexible plastic pouches market?

Berry Global Inc. (US), Mondi (UK), Huhtamaki (Finland), Sealed Air Corp. (US), Sonoco Products Company (US), Smurfit Kappa (Ireland), Amcor Plc (Switzerland), Gogllio SpA (Italy), Constantia Flexibles (Austria), and ProAmpac (US) are the key players operating in the flexible plastic pouches market.

What are the major factors which will impact market growth during the forecast period?

Stringent government regulations will be a restraint to the growth of the market during the forecast period. Compliance with regulations is necessary as the smallest defect in packaging may contaminate the product; it may also affect the manufacturers’ profit. Packaging waste harms the ecosystem as it takes decades to decompose. Governments worldwide are addressing this issue by imposing strict laws, which results in the flexible plastic pouches market being subjected to governance.

What are the effects of COVID-19 on flexible plastic pouches market?

The pandemic has resulted in increased use of single-use plastics in terms of pouches; this has created more demand for the market. Consumer behavior has changed owing to the safety concerns due to the pandemic. Consumers, right now, prefer to buy packed food & beverage rather than going to restaurants. E-commerce has also witnessed a positive impact due to the pandemic. Consumers are opting for online shopping for products instead of buying from brick & mortar stores, which is preferred for the purchase of a small number of products or rapid fulfillment of the same. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 29)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

FIGURE 1 FLEXIBLE PLASTIC POUCHES MARKET: MARKET DEFINITION

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 MARKET SCOPE

1.3.1 MARKET SEGMENTATION

1.3.2 REGIONS COVERED

1.3.3 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY

1.5 UNIT CONSIDERED

1.6 LIMITATIONS

1.7 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 34)

2.1 RESEARCH DATA

FIGURE 2 FLEXIBLE PLASTIC POUCHES MARKET: RESEARCH DESIGN

2.2 DATA TRIANGULATION

2.2.1 SECONDARY DATA

2.2.2 PRIMARY DATA

FIGURE 3 DATA TRIANGULATION

2.3 KEY INDUSTRY INSIGHTS

FIGURE 4 DATA VALIDATION FROM PRIMARY EXPERTS

TABLE 1 LIST OF STAKEHOLDERS INVOLVED

FIGURE 5 BREAKDOWN OF PRIMARY INTERVIEWS

2.4 BASE NUMBER CALCULATION

2.4.1 SUPPLY-SIDE APPROACH – 1

FIGURE 6 FLEXIBLE PLASTIC POUCHES: SUPPLY-SIDE APPROACH – 1

2.4.2 SUPPLY-SIDE APPROACH – 2

FIGURE 7 FLEXIBLE PLASTIC POUCHES MARKET: SUPPLY-SIDE APPROACH - 2

2.4.3 SUPPLY-SIDE APPROACH – 3

FIGURE 8 FLEXIBLE PLASTIC POUCHES MARKET: SUPPLY-SIDE APPROACH – 3

2.4.4 DEMAND-SIDE APPROACH – 1

FIGURE 9 FLEXIBLE PLASTIC POUCHES MARKET: DEMAND-SIDE APPROACH - 1

2.5 MARKET SIZE ESTIMATION

2.5.1 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.5.2 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.5.3 ASSUMPTIONS

2.5.4 RISK ASSESSMENT

TABLE 2 LIMITATIONS & ASSOCIATED RISKS

2.6 GROWTH RATE ASSUMPTIONS/GROWTH FORECAST

FIGURE 10 MARKET GROWTH PROJECTIONS FROM GROWTH DRIVERS AND OPPORTUNITIES

2.7 FACTOR ANALYSIS

2.7.1 INTRODUCTION

2.7.2 DEMAND-SIDE ANALYSIS

2.7.3 SUPPLY-SIDE ANALYSIS

FIGURE 11 FACTOR ANALYSIS

3 EXECUTIVE SUMMARY (Page No. - 46)

FIGURE 12 POLYETHYLENE TO LEAD THE MARKET DURING THE FORECAST PERIOD

FIGURE 13 FLAT POUCHES TO ACCOUNT FOR LARGER MARKET SHARE DURING THE FORECAST PERIOD

FIGURE 14 FOOD APPLICATION TO LEAD THE MARKET DURING THE FORECAST PERIOD

FIGURE 15 FLEXIBLE PLASTIC POUCHES MARKET IN APAC TO REGISTER THE FASTEST GROWTH DURING THE FORECAST PERIOD

FIGURE 16 APAC LED THE FLEXIBLE PLASTIC POUCHES MARKET IN 2020

4 PREMIUM INSIGHTS (Page No. - 50)

4.1 ATTRACTIVE MARKET OPPORTUNITIES IN THE FLEXIBLE PLASTIC POUCHES MARKET

FIGURE 17 FLEXIBLE PLASTIC POUCHES MARKET IN APAC TO OFFER ATTRACTIVE OPPORTUNITIES DURING THE FORECAST PERIOD

4.2 FLEXIBLE PLASTIC POUCHES MARKET, BY REGION

FIGURE 18 APAC TO BE THE FASTEST-GROWING MARKET DURING THE FORECAST PERIOD

4.3 FLEXIBLE PLASTIC POUCHES MARKET, BY MATERIAL

FIGURE 19 POLYETHYLENE TO BE THE LARGEST SEGMENT DURING THE FORECAST PERIOD

4.4 FLEXIBLE PLASTIC POUCHES MARKET, BY TYPE

FIGURE 20 FLAT POUCHES TO ACCOUNT FOR LARGER MARKET SHARE DURING THE FORECAST PERIOD

4.5 FLEXIBLE PLASTIC POUCHES MARKET, BY APPLICATION

FIGURE 21 BEVERAGE IS THE FASTEST-GROWING APPLICATION SEGMENT OF THE MARKET

4.6 FLEXIBLE PLASTIC POUCHES MARKET: EMERGING VS. MATURE MARKETS

FIGURE 22 US TO EMERGE AS THE MOST LUCRATIVE MARKET BETWEEN 2021 AND 2026

4.7 FLEXIBLE PLASTIC POUCHES MARKET IN APAC, 2020, BY COUNTRY AND APPLICATION

FIGURE 23 CHINA AND THE FOOD SEGMENT ACCOUNTED FOR THE LARGEST SHARES

4.8 FLEXIBLE PLASTIC POUCHES MARKET: REGIONAL SNAPSHOT

FIGURE 24 CHINA TO GROW AT THE HIGHEST RATE FROM 2021 TO 2026

5 MARKET OVERVIEW (Page No. - 54)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 25 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN THE FLEXIBLE PLASTIC POUCHES MARKET

5.2.1 DRIVERS

5.2.1.1 Rising demand for packaged food and beverages

5.2.1.2 Cost-effectiveness of flexible plastic pouches

5.2.1.3 Rise in demand from end-use industries

5.2.1.4 Aesthetic appeal of flexible plastic pouches

TABLE 3 CUSTOMIZABLE FEATURES OF FLEXIBLE PLASTIC POUCHES

5.2.2 RESTRAINTS

5.2.2.1 Stringent government regulations

5.2.3 OPPORTUNITIES

5.2.3.1 Rise in demand from emerging economies

5.2.3.2 Growing popularity of pouches in alcohol packaging

5.2.4 CHALLENGES

5.2.4.1 Availability of substitutes

5.2.4.2 Recycling of multi-layer structure

6 INDUSTRY TRENDS (Page No. - 59)

6.1 INTRODUCTION

6.2 VALUE CHAIN ANALYSIS

FIGURE 26 VALUE CHAIN ANALYSIS

6.3 PORTER’S FIVE FORCES ANALYSIS

FIGURE 27 PORTER’S FIVE FORCES ANALYSIS OF THE FLEXIBLE PLASTIC POUCHES MARKET

TABLE 4 FLEXIBLE PLASTIC POUCHES MARKET: PORTER’S FIVE FORCES ANALYSIS

6.3.1 THREAT OF NEW ENTRANTS

6.3.1.1 Presence of large-scale players

6.3.1.2 High investments

6.3.2 THREAT OF SUBSTITUTES

6.3.2.1 Abundance of substitutes

6.3.2.2 Low switching costs

6.3.3 BARGAINING POWER OF SUPPLIERS

6.3.3.1 Easy availability of raw materials

6.3.4 BARGAINING POWER OF BUYERS

6.3.4.1 High-volume buyers hold a high degree of bargaining power

6.3.4.2 Availability of numerous substitutes

6.3.5 INTENSITY OF COMPETITIVE RIVALRY

6.3.5.1 High degree of market fragmentation

6.3.5.2 Low customer loyalty

6.4 YC & YCC SHIFT

FIGURE 28 FLEXIBLE PLASTIC POUCHES FUTURE REVENUE MIX

6.5 SCENARIO ANALYSIS

6.6 RANGE SCENARIOS OF THE FLEXIBLE PLASTIC POUCHES MARKET

6.6.1 OPTIMISTIC SCENARIO

6.6.2 PESSIMISTIC SCENARIO

6.6.3 REALISTIC SCENARIO

6.7 PATENT ANALYSIS

6.7.1 METHODOLOGY

6.7.2 DOCUMENT TYPE

TABLE 5 FLEXIBLE PLASTICS POUCHES MARKET: REGISTERED PATENTS

FIGURE 29 FLEXIBLE PLASTICS POUCHES MARKET: REGISTERED PATENTS

6.7.3 PATENT PUBLICATION TRENDS

FIGURE 30 FLEXIBLE PLASTICS POUCHES MARKET: PATENT PUBLICATION TRENDS, 2010-2020

6.7.4 INSIGHT

6.7.5 JURISDICTION ANALYSIS

FIGURE 31 FLEXIBLE PLASTICS POUCHES MARKET: JURISDICTION ANALYSIS

6.7.6 TOP PATENT APPLICANTS

FIGURE 32 FLEXIBLE PLASTICS POUCHES MARKET: TOP PATENT APPLICANTS

TABLE 6 FLEXIBLE PLASTIC POUCHES MARKET SIZE: LIST OF PATENTS, BY FRITO-LAY NORTH AMERICA INC.

TABLE 7 FLEXIBLE PLASTIC POUCHES MARKET SIZE: LIST OF PATENTS, BY REYNOLDS PRESTO PRODUCTS INC.

TABLE 8 FLEXIBLE PLASTIC POUCHES MARKET SIZE: LIST OF PATENTS, BY TOPPAN PRINTING CO. LTD.

TABLE 9 FLEXIBLE PLASTIC POUCHES MARKET SIZE: LIST OF PATENTS, BY DOW GLOBAL TECHNOLOGIES LLC

TABLE 10 FLEXIBLE PLASTIC POUCHES MARKET SIZE: LIST OF PATENTS, BY MEDTRONIC XOMED INC.

TABLE 11 FLEXIBLE PLASTIC POUCHES MARKET SIZE: LIST OF PATENTS, BY TOYO SEIKAN KAISHA LTD.

6.7.7 TOP PATENT OWNERS (US) IN LAST 10 YEARS

TABLE 12 FLEXIBLE PLASTIC POUCHES MARKET: LIST OF 20 PATENT OWNERS (US) IN LAST 10 YEARS

6.8 REGULATORY ANALYSIS

6.8.1 FDA

6.8.2 EUROPEAN UNION

6.8.3 RECENT LAWS AND REGULATIONS REGARDING USE AND RECYCLING OF PLASTIC

6.9 PRICING ANALYSIS

FIGURE 33 AVERAGE SELLING PRICE (2020-2026)

6.10 TECHNOLOGY ANALYSIS

6.10.1 FILM-FORMING PROCESS

6.10.2 PROCESS

6.10.2.1 Extrusion-Cast film

6.10.2.2 Extrusion-Blown film

6.10.2.3 Extrusion Coating

6.11 ECOSYSTEM/MARKET MAP

FIGURE 34 FLEXIBLE PLASTIC POUCHES MARKET: ECOSYSTEM/MARKET MAP

6.12 TRADE ANALYSIS

6.12.1 IMPORT EXPORT SCENARIO OF FLEXIBLE PLASTIC POUCHES MARKET

6.12.2 EXPORT SCENARIO OF FLEXIBLE PLASTIC POUCHES

FIGURE 35 FLEXIBLE PLASTIC POUCHES MARKET: EXPORTING COUNTRIES

6.12.3 IMPORT SCENARIO OF FLEXIBLE PLASTIC POUCHES

FIGURE 36 FLEXIBLE PLASTIC POUCHES MARKET: IMPORTING COUNTRIES

6.13 CASE STUDY ANALYSIS

6.13.1 BUSH BOYS BEEHIVES SWITCH TO SPOUTED STAND-UP POUCHES FORM TRADITIONAL BOTTLE PACKS FOR HONEY PRODUCTS

6.13.1.1 Objective

6.13.1.2 Solution statement

6.13.1.3 Benefits

6.14 MACROECONOMIC INDICATORS

6.14.1 GDP TRENDS AND FORECAST OF MAJOR ECONOMIES

TABLE 13 TRENDS AND FORECASTS OF GDP, 2019–2026 (GROWTH RATE)

7 FLEXIBLE PLASTIC POUCHES MARKET, BY MATERIAL (Page No. - 82)

7.1 INTRODUCTION

FIGURE 37 POLYETHYLENE TO ACCOUNT FOR THE LARGEST MARKET SHARE

TABLE 14 FLEXIBLE PLASTIC POUCHES MARKET SIZE, BY MATERIAL, 2019–2026 (USD MILLION)

TABLE 15 FLEXIBLE PLASTIC POUCHES MARKET SIZE, BY MATERIAL, 2019–2026 (MILLION KG)

7.2 POLYETHYLENE (PE)

7.2.1 HIGH-DENSITY POLYETHYLENE (HDPE)

7.2.1.1 Ease of processing and low cost of production makes it a preferred packaging polymer

7.2.2 LOW-DENSITY POLYETHYLENE (LDPE)

7.2.2.1 Properties such as high elongation, heat seal-ability, and softness to increase its demand

7.2.3 LINEAR LOW-DENSITY POLYETHYLENE (LLDPE)

7.2.3.1 Preferred for its heat seal-ability and impact & tensile strength

7.3 POLYPROPYLENE (PP)

7.3.1 BIAXIALLY ORIENTED POLYPROPYLENE (BOPP)

7.3.1.1 High barrier properties and durability to drive its demand

7.3.2 CAST POLYPROPYLENE (CPP)

7.3.2.1 Primarily used for confectionary and baked goods packaging

7.4 OTHERS

7.4.1 POLY VINYL CHLORIDE (PVC)

7.4.2 ETHYLENE VINYL ALCOHOL (EVOH)

7.4.3 POLYAMIDE

8 FLEXIBLE PLASTIC POUCHES MARKET, BY TYPE (Page No. - 88)

8.1 INTRODUCTION

FIGURE 38 STAND-UP POUCHES TO GROW AT A HIGHER RATE

TABLE 16 FLEXIBLE PLASTIC POUCHES MARKET SIZE, BY TYPE,2019–2026 (USD MILLION)

TABLE 17 FLEXIBLE PLASTIC POUCHES MARKET SIZE, BY TYPE, 2019–2026 (MILLION KG)

8.2 FLAT POUCHES

8.2.1 INCREASING DEMAND FOR FOUR-SIDE-SEAL POUCHES TO DRIVE THE DEMAND FOR FLAT POUCHES

TABLE 18 FLAT POUCHES: FLEXIBLE PLASTIC POUCHES MARKET SIZE, 2019–2026 (USD MILLION)

TABLE 19 FLAT POUCHES: FLEXIBLE PLASTIC POUCHES MARKET SIZE, 2019–2026 (MILLION KG)

8.3 STAND-UP POUCHES

8.3.1 GROWING DEMAND FOR SPOUT POUCHES TO BOOST THE MARKET FOR STAND-UP POUCHES

TABLE 20 STAND-UP POUCHES: FLEXIBLE PLASTIC POUCHES MARKET SIZE, 2019–2026 (USD MILLION)

TABLE 21 STAND-UP POUCHES: FLEXIBLE PLASTIC POUCHES MARKET SIZE, 2019–2026 (MILLION KG)

9 FLEXIBLE PLASTIC POUCHES MARKET, BY APPLICATION (Page No. - 94)

9.1 INTRODUCTION

FIGURE 39 FOOD APPLICATION TO DOMINATE THE MARKET DURING THE FORECAST PERIOD

TABLE 22 FLEXIBLE PLASTIC POUCHES MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 23 FLEXIBLE PLASTIC POUCHES MARKET SIZE, BY APPLICATION, 2019–2026 (MILLION KG)

9.2 FOOD

9.2.1 GROWTH IN DEMAND FOR COMPACT & LIGHTWEIGHT PACKAGING TO PROPEL THE MARKET IN THE THIS SEGMENT

9.3 BEVERAGES

9.3.1 TO GROW AT THE FASTEST RATE DURING THE FORECAST PERIOD

9.4 OTHERS

10 FLEXIBLE PLASTIC POUCHES MARKET, BY REGION (Page No. - 98)

10.1 INTRODUCTION

FIGURE 40 CHINA TO BE THE FASTEST-GROWING FLEXIBLE PLASTIC POUCHES MARKET, 2021–2026

TABLE 24 FLEXIBLE PLASTIC FLEXIBLE PLASTIC POUCHES MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

TABLE 25 FLEXIBLE PLASTIC FLEXIBLE PLASTIC POUCHES MARKET SIZE, BY REGION, 2019–2026 (MILLION KG)

TABLE 26 FLEXIBLE PLASTIC FLEXIBLE PLASTIC POUCHES MARKET SIZE, BY MATERIAL, 2019–2026 (USD MILLION)

TABLE 27 FLEXIBLE PLASTIC FLEXIBLE PLASTIC POUCHES MARKET SIZE, BY MATERIAL, 2019–2026 (MILLION KG)

TABLE 28 FLEXIBLE PLASTIC FLEXIBLE PLASTIC POUCHES MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 29 FLEXIBLE PLASTIC FLEXIBLE PLASTIC POUCHES MARKET SIZE, BY TYPE, 2019–2026 (MILLION KG)

TABLE 30 FLEXIBLE PLASTIC POUCHES MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 31 FLEXIBLE PLASTIC POUCHES MARKET SIZE, BY APPLICATION, 2019–2026 (MILLION KG)

10.2 APAC

FIGURE 41 APAC: FLEXIBLE PLASTIC POUCHES MARKET SNAPSHOT

TABLE 32 APAC: FLEXIBLE PLASTIC POUCHES MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 33 APAC: FLEXIBLE PLASTIC POUCHES MARKET SIZE, BY COUNTRY, 2019–2026 (MILLION KG)

TABLE 34 APAC: FLEXIBLE PLASTIC POUCHES MARKET SIZE, BY MATERIAL, 2019–2026 (USD MILLION)

TABLE 35 APAC: FLEXIBLE PLASTIC POUCHES MARKET SIZE, BY MATERIAL, 2019–2026 (MILLION KG)

TABLE 36 APAC: FLEXIBLE PLASTIC POUCHES MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 37 APAC: FLEXIBLE PLASTIC POUCHES MARKET SIZE, BY TYPE, 2019–2026 (MILLION KG)

TABLE 38 APAC: FLEXIBLE PLASTIC POUCHES MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 39 APAC: FLEXIBLE PLASTIC POUCHES MARKET SIZE, BY APPLICATION, 2019–2026 (MILLION KG)

10.2.1 CHINA

10.2.1.1 China to lead the APAC flexible plastic pouches market

TABLE 40 CHINA: FLEXIBLE PLASTIC POUCHES MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 41 CHINA: FLEXIBLE PLASTIC POUCHES MARKET SIZE, BY APPLICATION, 2019–2026 (MILLION KG)

10.2.2 JAPAN

10.2.2.1 High demand from the food and beverage segment to drive the market

TABLE 42 JAPAN: FLEXIBLE PLASTIC POUCHES MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 43 JAPAN: FLEXIBLE PLASTIC POUCHES MARKET SIZE, BY APPLICATION, 2019–2026 (MILLION KG)

10.2.3 INDIA

10.2.3.1 India to be the second-fastest-growing market for pouches in APAC

TABLE 44 INDIA: FLEXIBLE PLASTIC POUCHES MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 45 INDIA: FLEXIBLE PLASTIC POUCHES MARKET SIZE, BY APPLICATION, 2019–2026 (MILLION KG)

10.2.4 AUSTRALIA

10.2.4.1 High disposable income, rise in the consumption of packaged food, and changes in lifestyle to drive the market

TABLE 46 AUSTRALIA: FLEXIBLE PLASTIC POUCHES MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 47 AUSTRALIA: FLEXIBLE PLASTIC POUCHES MARKET SIZE, BY APPLICATION, 2019–2026 (MILLION KG)

10.2.5 SOUTH KOREA

10.2.5.1 Demand for convenience packaging to impact the market

TABLE 48 SOUTH KOREA: FLEXIBLE PLASTIC POUCHES MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 49 SOUTH KOREA: FLEXIBLE PLASTIC POUCHES MARKET SIZE, BY APPLICATION, 2019–2026 (MILLION KG)

10.2.6 REST OF APAC

TABLE 50 REST OF APAC: FLEXIBLE PLASTIC POUCHES MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 51 REST OF APAC: FLEXIBLE PLASTIC POUCHES MARKET SIZE, BY APPLICATION, 2019–2026 (MILLION KG)

10.3 NORTH AMERICA

FIGURE 42 NORTH AMERICA: FLEXIBLE PLASTIC POUCHES MARKET SNAPSHOT

TABLE 52 NORTH AMERICA: FLEXIBLE PLASTIC POUCHES MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 53 NORTH AMERICA: FLEXIBLE PLASTIC POUCHES MARKET SIZE, BY COUNTRY, 2019–2026 (MILLION KG)

TABLE 54 NORTH AMERICA: FLEXIBLE PLASTIC POUCHES MARKET SIZE, BY MATERIAL, 2019–2026 (USD MILLION)

TABLE 55 NORTH AMERICA: FLEXIBLE PLASTIC POUCHES MARKET SIZE, BY MATERIAL, 2019–2026 (MILLION KG)

TABLE 56 NORTH AMERICA: FLEXIBLE PLASTIC POUCHES MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 57 NORTH AMERICA: FLEXIBLE PLASTIC POUCHES MARKET SIZE, BY TYPE, 2019–2026 (MILLION KG)

TABLE 58 NORTH AMERICA: FLEXIBLE PLASTIC POUCHES MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 59 NORTH AMERICA: FLEXIBLE PLASTIC POUCHES MARKET SIZE, BY APPLICATION, 2019–2026 (MILLION KG)

10.3.1 US

10.3.1.1 The US to lead the regional market

TABLE 60 US: FLEXIBLE PLASTIC POUCHES MARKET SIZE, BY APPLICATION,2019–2026 (USD MILLION)

TABLE 61 US: FLEXIBLE PLASTIC POUCHES MARKET SIZE, BY APPLICATION, 2019–2026 (MILLION KG)

10.3.2 CANADA

10.3.2.1 Increase in exports of packaged food to drive the country’s flexible plastic pouches market

TABLE 62 CANADA: FLEXIBLE PLASTIC POUCHES MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 63 CANADA: FLEXIBLE PLASTIC POUCHES MARKET SIZE, BY APPLICATION, 2019–2026 (MILLION KG)

10.3.3 MEXICO

10.3.3.1 Increase in the demand for frozen, ready-to-eat, and processed food to be the market drivers

TABLE 64 MEXICO: FLEXIBLE PLASTIC POUCHES MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 65 MEXICO: FLEXIBLE PLASTIC POUCHES MARKET SIZE, BY APPLICATION, 2019–2026 (MILLION KG)

10.4 EUROPE

FIGURE 43 EUROPE: FLEXIBLE PLASTIC POUCHES MARKET SNAPSHOT

TABLE 66 EUROPE: FLEXIBLE PLASTIC POUCHES MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 67 EUROPE: FLEXIBLE PLASTIC POUCHES MARKET SIZE, BY COUNTRY, 2019–2026 (MILLION KG)

TABLE 68 EUROPE: FLEXIBLE PLASTIC POUCHES MARKET SIZE, BY MATERIAL, 2019–2026 (USD MILLION)

TABLE 69 EUROPE: FLEXIBLE PLASTIC POUCHES MARKET SIZE, BY MATERIAL, 2019–2026 (MILLION KG)

TABLE 70 EUROPE: FLEXIBLE PLASTIC POUCHES MARKET SIZE, TYPE, 2019–2026 (USD MILLION)

TABLE 71 EUROPE: FLEXIBLE PLASTIC POUCHES MARKET SIZE, TYPE, 2019–2026 (MILLION KG)

TABLE 72 EUROPE: FLEXIBLE PLASTIC POUCHES MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 73 EUROPE: FLEXIBLE PLASTIC POUCHES MARKET SIZE, BY APPLICATION, 2019–2026 (MILLION KG)

10.4.1 GERMANY

10.4.1.1 Germany to lead the flexible plastic pouches market in Europe

TABLE 74 GERMANY: FLEXIBLE PLASTIC POUCHES MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 75 GERMANY: FLEXIBLE PLASTIC POUCHES MARKET SIZE, BY APPLICATION, 2019–2026 (MILLION KG)

10.4.2 UK

10.4.2.1 Increase in expenditure on food and beverages to drive the demand for flexible plastic pouches

TABLE 76 UK: FLEXIBLE PLASTIC POUCHES MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 77 UK: FLEXIBLE PLASTIC POUCHES MARKET SIZE, BY APPLICATION, 2019–2026 (MILLION KG)

10.4.3 FRANCE

10.4.3.1 Stand-up pouches segment to lead the flexible plastic pouches market

TABLE 78 FRANCE: FLEXIBLE PLASTIC POUCHES MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 79 FRANCE: FLEXIBLE PLASTIC POUCHES MARKET SIZE, BY APPLICATION, 2019–2026 (MILLION KG)

10.4.4 SPAIN

10.4.4.1 Rise in demand for convenient packaging to support the growth of the market

TABLE 80 SPAIN: FLEXIBLE PLASTIC POUCHES MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 81 SPAIN: FLEXIBLE PLASTIC POUCHES MARKET SIZE, BY APPLICATION, 2019–2026 (MILLION KG)

10.4.5 RUSSIA

10.4.5.1 Growing demand for ready-to-eat and packaged food to drive the market

TABLE 82 RUSSIA: FLEXIBLE PLASTIC POUCHES MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 83 RUSSIA: FLEXIBLE PLASTIC POUCHES MARKET SIZE, BY APPLICATION, 2019–2026 (MILLION KG)

10.4.6 ITALY

10.4.6.1 Flat pouches to lead the flexible plastic pouches market

TABLE 84 ITALY: FLEXIBLE PLASTIC POUCHES MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 85 ITALY: FLEXIBLE PLASTIC POUCHES MARKET SIZE, BY APPLICATION, 2019–2026 (MILLION KG)

10.4.7 POLAND

10.4.7.1 Pet care industry to drive the demand

TABLE 86 POLAND: FLEXIBLE PLASTIC POUCHES MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 87 POLAND: FLEXIBLE PLASTIC POUCHES MARKET SIZE, BY APPLICATION, 2019–2026 (MILLION KG)

10.4.8 REST OF EUROPE

TABLE 88 REST OF EUROPE: FLEXIBLE PLASTIC POUCHES MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 89 REST OF EUROPE: FLEXIBLE PLASTIC POUCHES MARKET SIZE, BY APPLICATION, 2019–2026 (MILLION KG)

10.5 SOUTH AMERICA

FIGURE 44 SOUTH AMERICA: FLEXIBLE PLASTIC POUCHES MARKET SNAPSHOT

TABLE 90 SOUTH AMERICA: FLEXIBLE PLASTIC POUCHES MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 91 SOUTH AMERICA: FLEXIBLE PLASTIC POUCHES MARKET SIZE, BY COUNTRY, 2019–2026 (MILLION KG)

TABLE 92 SOUTH AMERICA: FLEXIBLE PLASTIC POUCHES MARKET SIZE, BY MATERIAL, 2019–2026 (USD MILLION)

TABLE 93 SOUTH AMERICA: FLEXIBLE PLASTIC POUCHES MARKET SIZE, BY MATERIAL, 2019–2026 (MILLION KG)

TABLE 94 SOUTH AMERICA: FLEXIBLE PLASTIC POUCHES MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 95 SOUTH AMERICA: FLEXIBLE PLASTIC POUCHES MARKET SIZE, BY TYPE, 2019–2026 (MILLION KG)

TABLE 96 SOUTH AMERICA: FLEXIBLE PLASTIC POUCHES MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 97 SOUTH AMERICA: FLEXIBLE PLASTIC POUCHES MARKET SIZE, BY APPLICATION, 2019–2026 (MILLION KG)

10.5.1 BRAZIL

10.5.1.1 Growth in food exports to boost the market in the country

TABLE 98 BRAZIL: FLEXIBLE PLASTIC POUCHES MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 99 BRAZIL: FLEXIBLE PLASTIC POUCHES MARKET SIZE, BY APPLICATION, 2019–2026 (MILLION KG)

10.5.2 ARGENTINA

10.5.2.1 Rise in demand for meat products, coupled with the increasing food exports, to drive the demand for flexible plastic pouches

TABLE 100 ARGENTINA: FLEXIBLE PLASTIC POUCHES MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 101 ARGENTINA: FLEXIBLE PLASTIC POUCHES MARKET SIZE, BY APPLICATION, 2019–2026 (MILLION KG)

10.5.3 REST OF SOUTH AMERICA

TABLE 102 REST OF SOUTH AMERICA: FLEXIBLE PLASTIC POUCHES MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 103 REST OF SOUTH AMERICA: FLEXIBLE PLASTIC POUCHES MARKET SIZE, BY APPLICATION, 2019–2026 (MILLION KG)

10.6 MIDDLE EAST & AFRICA

FIGURE 45 MIDDLE EAST & AFRICA: FLEXIBLE PLASTIC POUCHES MARKET SNAPSHOT

TABLE 104 MIDDLE EAST & AFRICA: FLEXIBLE PLASTIC POUCHES MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 105 MIDDLE EAST & AFRICA: FLEXIBLE PLASTIC POUCHES MARKET SIZE, BY COUNTRY, 2019–2026 (MILLION KG)

TABLE 106 MIDDLE EAST & AFRICA: FLEXIBLE PLASTIC POUCHES MARKET SIZE, BY MATERIAL, 2019–2026 (USD MILLION)

TABLE 107 MIDDLE EAST & AFRICA: FLEXIBLE PLASTIC POUCHES MARKET SIZE, BY MATERIAL, 2019–2026 (MILLION KG)

TABLE 108 MIDDLE EAST & AFRICA: FLEXIBLE PLASTIC POUCHES MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 109 MIDDLE EAST & AFRICA: FLEXIBLE PLASTIC POUCHES MARKET SIZE, BY TYPE, 2019–2026 (MILLION KG)

TABLE 110 MIDDLE EAST & AFRICA: FLEXIBLE PLASTIC POUCHES MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 111 MIDDLE EAST & AFRICA: FLEXIBLE PLASTIC POUCHES MARKET SIZE, BY APPLICATION, 2019–2026 (MILLION KG)

10.6.1 TURKEY

10.6.1.1 Turkey to lead the flexible plastic pouches market in the Middle East & Africa

TABLE 112 TURKEY: FLEXIBLE PLASTIC POUCHES MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 113 TURKEY: FLEXIBLE PLASTIC POUCHES MARKET SIZE, BY APPLICATION, 2019–2026 (MILLION KG)

10.6.2 SOUTH AFRICA

10.6.2.1 Growth in the packaging industry to drive the demand

TABLE 114 SOUTH AFRICA: FLEXIBLE PLASTIC POUCHES MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 115 SOUTH AFRICA: FLEXIBLE PLASTIC POUCHES MARKET SIZE, BY APPLICATION, 2019–2026 (MILLION KG)

10.6.3 SAUDI ARABIA

10.6.3.1 Increasing need for convenience packaging in various applications driving the flexible plastic pouches market in the country

TABLE 116 SAUDI ARABIA: FLEXIBLE PLASTIC POUCHES MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 117 SAUDI ARABIA: FLEXIBLE PLASTIC POUCHES MARKET SIZE, BY APPLICATION, 2019–2026 (MILLION KG)

10.6.4 REST OF MIDDLE EAST & AFRICA

TABLE 118 REST OF MIDDLE EAST & AFRICA: FLEXIBLE PLASTIC POUCHES MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 119 REST OF MIDDLE EAST & AFRICA: FLEXIBLE PLASTIC POUCHES MARKET SIZE, BY APPLICATION, 2019–2026 (MILLION KG)

11 IMPACT OF COVID-19 ON FLEXIBLE PLASTIC POUCHES MARKET (Page No. - 143)

11.1 INTRODUCTION

11.1.1 COVID-19 IMPACT ON FLEXIBLE PLASTIC POUCHES MATERIAL SUPPLY

11.1.2 COVID-19 IMPACT ON FLEXIBLE PLASTIC POUCH APPLICATIONS

11.1.3 UPDATE ON OPERATIONS BY MANUFACTURERS IN RESPONSE TO COVID-19

11.1.4 NEW OPPORTUNITIES AMID COVID-19

12 COMPETITIVE LANDSCAPE (Page No. - 147)

12.1 OVERVIEW

12.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

FIGURE 46 COMPANIES ADOPTED MERGER & ACQUISITION AS THE KEY GROWTH STRATEGY BETWEEN 2016–2021

12.3 MARKET SHARE ANALYSIS OF TOP 5 PLAYERS

FIGURE 47 SHARE OF KEY PLAYERS IN FLEXIBLE PLASTIC POUCHES MARKET, 2020

TABLE 120 FLEXIBLE PLASTIC POUCHES MARKET: DEGREE OF COMPETITION

FIGURE 48 FLEXIBLE PLASTIC POUCHES MARKET SHARE ANALYSIS, 2020

12.4 MARKET EVALUATION FRAMEWORK

TABLE 121 MARKET EVALUATION FRAMEWORK

12.5 REVENUE ANALYSIS OF TOP 5 MARKET PLAYERS

FIGURE 49 MARKET IS FRAGMENTED WITH TOP FIVE PLAYERS HOLDING 10-12% MARKET SHARE

12.6 COMPETITIVE LEADERSHIP MAPPING

12.6.1 STAR

12.6.2 EMERGING LEADERS

12.6.3 PERVASIVE

12.6.4 EMERGING COMPANIES

FIGURE 50 FLEXIBLE PLASTIC PACKAGING MARKET: COMPETITIVE LEADERSHIP MAPPING, 2020

12.6.5 STRENGTH OF PRODUCT PORTFOLIO

FIGURE 51 PRODUCT PORTFOLIO ANALYSIS OF TOP PLAYERS IN FLEXIBLE PLASTIC POUCHES MARKET

12.6.6 BUSINESS STRATEGY EXCELLENCE

FIGURE 52 BUSINESS STRATEGY EXCELLENCE OF TOP PLAYERS IN FLEXIBLE PLASTIC POUCHES MARKET

TABLE 122 COMPANY PRODUCT FOOTPRINT

TABLE 123 COMPANY APPLICATION FOOTPRINT

TABLE 124 COMPANY REGION FOOTPRINT

12.7 COMPETITIVE LEADERSHIP MAPPING (START-UP/SMES), 2020

12.7.1 PROGRESSIVE COMPANIES

12.7.2 RESPONSIVE COMPANIES

12.7.3 STARTING BLOCKS

12.7.4 DYNAMIC COMPANIES

FIGURE 53 FLEXIBLE PLASTIC PACKAGING MARKET: (START-UP/SMSE) COMPETITIVE LEADERSHIP MAPPING, 2020

12.8 COMPETITIVE SCENARIO

TABLE 125 FLEXIBLE PLASTIC POUCHES MARKET: PRODUCT LAUNCHES, 2016–2021

TABLE 126 FLEXIBLE PLASTIC POUCHES MARKET: DEALS, 2016- 2021

TABLE 127 FLEXIBLE PLASTIC POUCHES MARKET: OTHERS, 2016–2021

13 COMPANY PROFILES (Page No. - 167)

13.1 MAJOR PLAYERS

(Business overview, Products/solutions/services offered, Recent developments, MnM view, Key strengths/right to win, Strategic choices made, and Weaknesses and competitive threats)*

13.1.1 BERRY GLOBAL INC.

TABLE 128 BERRY GLOBAL INC.: BUSINESS OVERVIEW

FIGURE 54 BERRY GLOBAL INC.: COMPANY SNAPSHOT

13.1.2 MONDI GROUP

TABLE 129 MONDI GROUP: BUSINESS OVERVIEW

FIGURE 55 MONDI GROUP: COMPANY SNAPSHOT

13.1.3 HUHTAMAKI

TABLE 130 HUHTAMAKI: BUSINESS OVERVIEW

FIGURE 56 HUHTAMAKI: COMPANY SNAPSHOT

13.1.4 SEALED AIR CORP.

TABLE 131 SEALED AIR CORP.: BUSINESS OVERVIEW

FIGURE 57 SEALED AIR CORP.: COMPANY SNAPSHOT

13.1.5 SONOCO PRODUCTS COMPANY

TABLE 132 SONOCO PRODUCTS COMPANY: BUSINESS OVERVIEW

FIGURE 58 SONOCO PRODUCTS COMPANY: COMPANY SNAPSHOT

13.1.6 SMURFIT KAPPA

TABLE 133 SMURFIT KAPPA: BUSINESS OVERVIEW

FIGURE 59 SMURFIT KAPPA: COMPANY SNAPSHOT

13.1.7 AMCOR PLC

TABLE 134 AMCOR PLC: COMPANY OVERVIEW

FIGURE 60 AMCOR PLC: COMPANY SNAPSHOT

13.1.8 GOGLIO SPA

TABLE 135 GOGLIO SPA: BUSINESS OVERVIEW

FIGURE 61 GOGLIO SPA: COMPANY SNAPSHOT

13.1.9 CONSTANTIA FLEXIBLES INC.

TABLE 136 CONSTANTIA FLEXIBLES INC.: BUSINESS OVERVIEW

13.1.10 PROAMPAC

TABLE 137 PROAMPAC: BUSINESS OVERVIEW

13.1.11 UFLEX LIMITED

TABLE 138 UFLEX LIMITED: BUSINESS OVERVIEW

FIGURE 62 UFLEX LIMITED: COMPANY SNAPSHOT

13.1.12 KOROZO AMBALAJ SAN. VE TIC. A.S.

TABLE 139 KOROZO AMBALAJ SAN. VE TIC. A.S.: BUSINESS OVERVIEW

13.1.13 CLONDALKIN GROUP

TABLE 140 CLONDALKIN GROUP: BUSINESS OVERVIEW

13.1.14 COVERIS

TABLE 141 COVERIS: BUSINESS OVERVIEW

13.1.15 GUALAPACK S.P.A.

TABLE 142 GUALAPACK S.P.A.: BUSINESS OVERVIEW

13.1.16 WIPF HOLDING AG

TABLE 143 WIPF HOLDING AG: BUSINESS OVERVIEW

13.1.17 NOVOLEX

13.1.18 GLENROY, INC.

13.1.19 DAKLAPACK EUROPE B.V.

13.1.20 PRINTPACK

13.1.21 SIGMA PLASTICS GROUP

13.1.22 SWISS PAC

13.1.23 WIHURI OYJ

13.1.24 TRANSCONTINENTAL INC

13.1.25 SHAKO FLEXIPACK PRIVATE LIMITED

*Details on Business overview, Products/solutions/services offered, Recent developments, MnM view, Key strengths/right to win, Strategic choices made, and Weaknesses and competitive threats might not be captured in case of unlisted companies.

14 ADJACENT MARKETS (Page No. - 221)

14.1 FLEXIBLE PLASTIC PACKAGING MARKET

14.1.1 INTRODUCTION

14.1.2 FLEXIBLE PLASTIC PACKAGING MARKET, BY TYPE

TABLE 144 FLEXIBLE PLASTIC PACKAGING MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 145 FLEXIBLE PLASTIC PACKAGING MARKET SIZE, BY TYPE, 2018–2025 (MILLION KG)

14.1.3 FLEXIBLE PLASTIC PACKAGING MARKET, BY MATERIAL

TABLE 146 FLEXIBLE PLASTIC PACKAGING MARKET SIZE, BY MATERIAL, 2018–2025 (USD MILLION)

14.1.4 FLEXIBLE PLASTIC PACKAGING MARKET, BY APPLICATION

TABLE 147 FLEXIBLE PLASTIC PACKAGING MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 148 FLEXIBLE PLASTIC PACKAGING MARKET SIZE, BY APPLICATION, 2018–2025 (MILLION KG)

14.1.5 FLEXIBLE PLASTIC PACKAGING MARKET, BY REGION

TABLE 149 FLEXIBLE PLASTIC PACKAGING MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 150 FLEXIBLE PLASTIC PACKAGING MARKET SIZE, BY REGION, 2018–2025 (MILLION KG)

14.2 STAND-UP POUCHES MARKET

14.2.1 INTRODUCTION

14.2.2 STAND-UP POUCHES MARKET SIZE, BY FORM

TABLE 151 STAND-UP POUCHES MARKET SIZE, BY FORM, 2016–2023 (USD MILLION)

TABLE 152 STAND-UP POUCHES MARKET SIZE, BY FORM, 2016–2023 (MILLION UNIT)

14.2.3 STAND-UP POUCHES MARKET, BY TYPE

TABLE 153 STAND-UP POUCHES MARKET SIZE, BY TYPE, 2016–2023 (USD MILLION)

TABLE 154 STAND-UP POUCHES MARKET SIZE, BY TYPE, 2016–2023 (MILLION UNIT)

14.2.4 STAND-UP POUCHES MARKET, BY CLOSURE TYPE

TABLE 155 STAND-UP POUCHES MARKET SIZE, BY CLOSURE TYPE, 2016–2023 (USD MILLION)

TABLE 156 STAND-UP POUCHES MARKET SIZE, BY CLOSURE TYPE, 2016–2023 (MILLION UNIT)

14.2.5 STAND-UP POUCHES MARKET, BY APPLICATION

TABLE 157 STAND-UP POUCHES MARKET SIZE, BY APPLICATION, 2016–2023 (USD MILLION)

TABLE 158 STAND-UP POUCHES MARKET SIZE, BY APPLICATION, 2016–2023 (MILLION UNIT)

14.2.6 STAND-UP POUCHES MARKET, BY REGION

TABLE 159 STAND-UP POUCHES MARKET SIZE, BY REGION, 2016–2023 (USD MILLION)

TABLE 160 STAND-UP POUCHES MARKET, BY REGION, 2016–2023 (MILLION UNIT)

14.3 POUCHES MARKET

14.3.1 INTRODUCTION

14.3.2 POUCHES MARKET, BY TYPE

TABLE 161 POUCHES MARKET SIZE, BY TYPE, 2017–2024 (USD MILLION)

TABLE 162 POUCHES MARKET SIZE, BY TYPE, 2017–2024 (MILLION UNIT)

14.3.3 POUCHES MARKET, BY MATERIAL

TABLE 163 POUCHES MARKET SIZE, BY MATERIAL, 2017–2024 (USD MILLION)

TABLE 164 POUCHES MARKET SIZE, BY MATERIAL, 2017–2024 (MILLION UNIT)

14.3.4 POUCHES MARKET, BY APPLICATION

TABLE 165 POUCHES MARKET SIZE, BY APPLICATION, 2017–2024 (USD MILLION)

TABLE 166 POUCHES MARKET SIZE, BY APPLICATION, 2017–2024 (MILLION UNIT)

14.3.5 POUCHES MARKET, BY TREATMENT TYPE

TABLE 167 POUCHES MARKET SIZE, BY TREATMENT TYPE, 2017–2024 (USD MILLION)

TABLE 168 POUCHES MARKET SIZE, BY TREATMENT TYPE, 2017–2024 (MILLION UNIT)

14.3.6 POUCHES MARKET, BY REGION

TABLE 169 POUCHES MARKET SIZE, BY REGION, 2017–2024 (USD MILLION)

TABLE 170 POUCHES MARKET SIZE, BY REGION, 2017–2024 (MILLION UNIT)

15 APPENDIX (Page No. - 232)

15.1 DISCUSSION GUIDE

15.2 KNOWLEDGE STORE: MARKETSANDMARKETS SUBSCRIPTION PORTAL

15.3 AVAILABLE CUSTOMIZATIONS

15.4 RELATED REPORTS

15.5 AUTHOR DETAILS

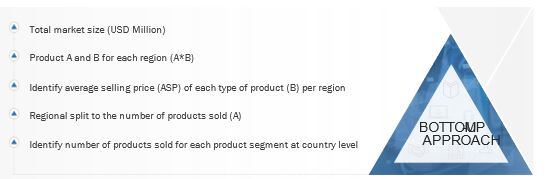

The study involved four major activities in estimating the current market size for the flexible plastic pouches market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, the market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources, such as Hoovers and Bloomberg BusinessWeek, were referred to for identifying and collecting information for this study. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold standard & silver standard websites, food safety organizations, regulatory bodies, and databases.

Primary Research

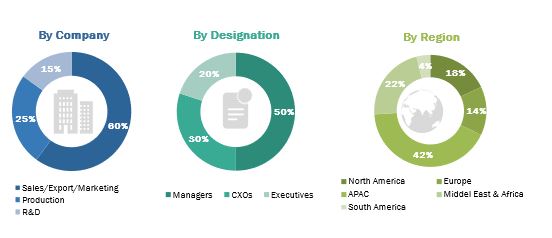

The flexible plastic pouches comprises of several stakeholders, such as raw material suppliers, end-product manufacturers, and regulatory organizations in the supply chain. The key growth drivers of the flexible plastic pouches market are rising demand from food and beverage applications, aesthetic appeal, cost-effectiveness & increased shelf life of product, rising demand from end-use sectors, and increasing e-commerce sales. Growth in the market is also backed by the growing consumer preference on packed & processed food, rising per-capita income, and development of end-use industries. The supply side is characterized by market consolidation activities undertaken by raw material suppliers. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following is the breakdown of primary respondents

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Top-down and bottom-up approaches were used to estimate and validate the total size of the flexible plastic pouches market. These methods were also used extensively to estimate the size of the various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value and volume, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Global Fllexible Plastic Pouches Market Size: Bottom-UP Approach

Data Triangulation

After arriving at the overall market size-using the market size estimation processes as explained above-the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives:

- To define, describe, and forecast the global flexible plastic pouches market size, in terms of value and volume

- To provide detailed information regarding the key drivers, restraints, challenges, and opportunities influencing the market growth

- To analyze and forecast the flexible plastic pouches market based on material, type, and application

- To analyze and forecast the market size, based on five key regions, namely, Asia Pacific (APAC), Europe, North America, South America, and Middle East & Africa along with their key countries

- To analyze opportunities in the market for stakeholders and provide a competitive landscape for market leaders

- To analyze competitive developments, such as expansions, merger & acquisition, collaboration, and new product developments in the market

- To strategically identify and profile the key market players and analyze their core competencies in the market

Available Customizations:

- MarketsandMarkets offers customizations according to the specific requirements of companies with the given market data.

- The following customization options are available for the report

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Flexible Plastic Pouches Market