Flexible Epoxy Resin Market by Type (Urethane Modified, Rubber Modified, Dimer Acid), Application (Paints & Coatings, Composites, Adhesives), and Region - Global Forecast to 2022

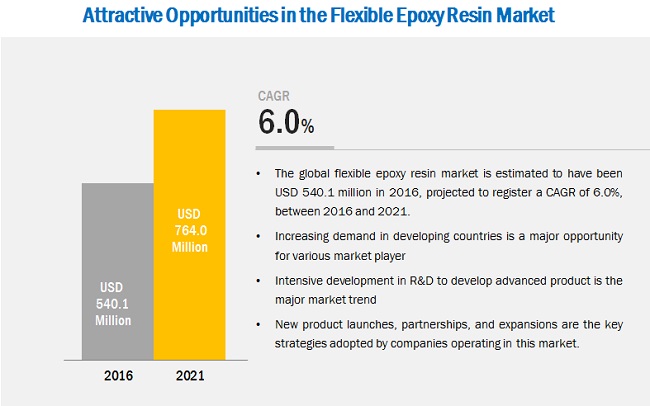

[108 Pages Report] The flexible epoxy resin (FER) market was estimated at USD 540.1 million in 2016 and projected to reach USD 764.0 million by 2022, at a CAGR of 6.0% during the forecast period. In this study, 2016 has been considered as the base year, while the forecast period has been considered from 2017 to 2022.

Market Dynamics

Drivers

- Increasing demand from building & construction and automotive industries

- Increasing use of composites

Restraints

- Complicated processing and health hazards associated with the manufacturing of flexible epoxy resins

Opportunities

- Rise in use of composites and rapid urbanization in emerging economies

Challenges

- Stringent regulatory consents and saturated use in developed economies

Increasing demand from building & construction and automotive industries

Flexible epoxy resins are used to manufacture adhesives, sealants, coatings, composites, and flooring products, which are important parts of the building & construction industry. The epoxy resin-based adhesives are used for making laminated woods for decks, walls, roofs and other building applications as well as in other products that require strong bonds to a variety of substrates such as concrete or wood. These adhesives are more resistive to heat and chemicals than normal glues. In coatings, these provide high gloss, durability, and protection to the applied surface. In floorings, flexible epoxy resins are used in high performance and decorative floorings, such as terrazzo flooring and chip flooring. In the automotive industry, flexible epoxy resins are used in coatings, adhesives, and composites. In composites, flexible epoxy resins are used in the manufacturing of lightweight components to be used in structural, exterior, and under-the-hood applications. Superior chemical properties of flexible epoxy resins, such as mechanical strength, adhesion to metals, and heat resistance enable optimum use in the coating application in the automotive industry. These properties facilitate protective actions, such as corrosion resistance scratch resistance, and increasing the lifespan of the vehicle. High adhesion strength and improved properties also enable their use in the adhesive applications in the automotive industry.

Objectives of the Study:

- To estimate and forecast the size of the flexible epoxy resin market, in terms of value and volume

- To provide detailed information about the key factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market

- To define, describe, and forecast the flexible epoxy resin market, by type application, and region

- To forecast the size of the market based on five regions, namely, Asia-Pacific, Europe, North America, Middle East & Africa, and South America along with country-level data

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and their contribution to the market

- To track and analyze recent developments such as new product launches, expansions, and partnerships in the market

- To analyze the opportunities for stakeholders in the market and provide a competitive landscape for the market leaders

- To strategically profile the key players and comprehensively analyze their market share and core competencies2

Note1: Micromarkets are the subsegments of the FER market included in the report

Note2: Core competencies of companies are determined in terms of their key developments, SWOT analysis, and key strategies adopted by them to sustain in the market

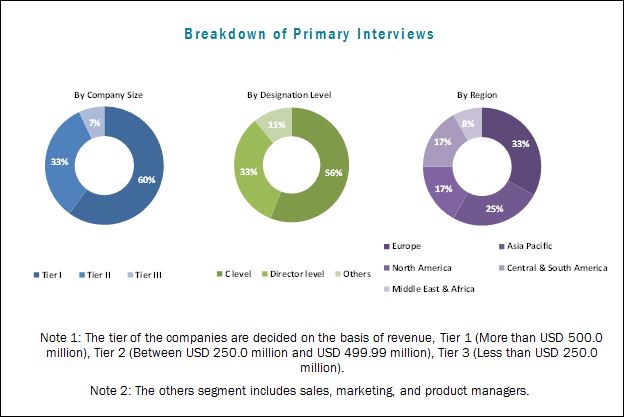

In this report, the market sizes have been derived from various research methodologies. In the secondary research process, different sources have been referred to, to identify and collect information for this study on the FER market. These secondary sources include annual reports, press releases, and investor presentations of companies, associations such as Epoxy Resin Committee (ERC), American Coatings Association, The World Paint & Coatings Industry Association, and others; and white papers, certified publications, and articles from recognized authors. In the primary research process, sources from both supply and demand sides have been interviewed to obtain qualitative and quantitative information for this report. The bottom-up approach has been used to estimate the market size, in terms of value. The top-down approach has been implemented to validate the market size, in terms of value. With the data triangulation procedure and validation of data through primaries, exact values of the sizes of the overall parent market and individual markets have been determined and confirmed in this study.

The figure below illustrates the breakdown of profiles of primary interview participants.

To know about the assumptions considered for the study, download the pdf brochure

The FER market includes raw material suppliers, manufacturers, and end-users of FER. Olin Corporation (U.S.), Hexion (U.S.), Kukdo Chemical (South Korea), Aditya Birla Chemicals (Thailand), Huntsman Corporation (U.S.), and DIC Corporation (Japan) are the leading players operating in the FER market.

Key Target Audience:

- FER Manufacturers

- FER Traders, Distributors, and Suppliers

- Raw Material Suppliers

- Governments and Research Organizations

- Associations and Industrial Bodies

- R&D Institutions

- Environment Support Agencies

Scope of the Report

The report forecasts revenue growth and provides an analysis of trends in each of the subsegments of the FER market. This research report categorizes the market based on the following:

FER Market, By Type:

- Urethane Modified

- Rubber Modified

- Dimer Acid

FER Market, By Application:

- Paints & Coatings

- Composites

- Adhesives

- Others (tooling, electrical castings, electrical laminates, and fibers)

FER Market, By Region:

- North America

- Asia-Pacific

- Europe

- Middle East & Africa

- South America

Each region has been further segmented into the key countries in that region.

Critical questions which the report answers

- What are the upcoming trends for FER market?

- Which are the key players in the market and how intense is the competition?

Available Customizations:

The following customization options are available for the report:

Country Information

- FER market analysis for additional countries

Company Information

- Detailed analysis and profiles of additional market players (up to five)

The flexible epoxy resin (FER) market is estimated at USD 570.9 million in 2017 and is projected to reach USD 764.0 million by 2022, at a CAGR of 6.0% between 2017 and 2022. The growth is driven by the increasing demand for FERs from the end-use industries such as automotive and building & construction. These end-use industries have a high consumption of paints & coatings, composites, and adhesives, which in turn increases the demand for FERs. In addition, rising GDP, growing disposable income, increasing use of composites instead of conventional materials, and increasing number of expansions and other development activities also drive the FER market, globally.

The urethane-modified type is projected to be the largest and fastest-growing segment of the market during the forecast period, in terms of both value and volume. The growth in the use of FER is due to its wide use in composites, which in turn is used in automotive and aerospace end-use industries. This growth is also expected to increase in future due to the growth in infrastructural activities in emerging economies.

The paints & coatings segment is projected to be the largest application of FERs during the forecast period, in terms of both value and volume, owing to the rapid urbanization and growing population. This is also mainly due to the number of projects being commissioned and tendered in various emerging countries. Major restraint for the FER market includes its complex processing and harmful effects on human health. The main reason for the complicated process for manufacturing epoxy resins is the highly exothermic reaction between the epoxy resin and the curing agent. In human beings, adverse effects include irritation in lungs, asthma, skin irritation, headaches, eye damage, nausea, dizziness, slurred speech, confusion, and loss of consciousness on improper or non-standard use of these chemicals.

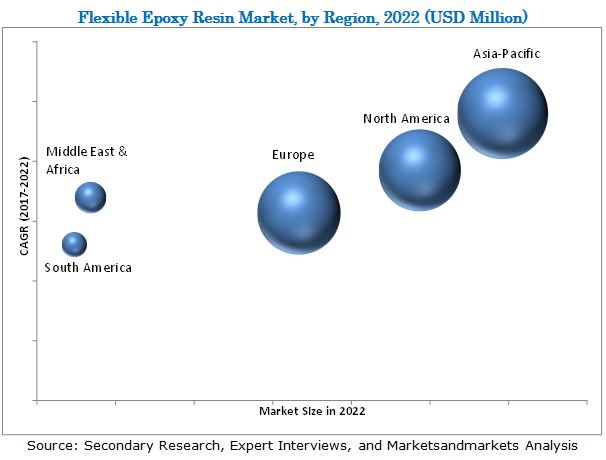

Asia-Pacific is projected to be the largest market for FER during the forecast period. The demand for FERs is high in the region due to the large industrial base and high living standard of the population. In addition to this, the increasing use of FERs in the automotive industry and related growth in emerging economies such as India, China, and South Korea also drives the FER market growth in the region. The FER market in Asia-Pacific is also projected to witness the highest growth during the forecast period, owing to the rising standard of living, which is expected to boost the demand for automobiles in the region during the forecast period. In addition, government initiatives and policies to attract investments from various international companies will boost the growth of the various end-use industries of FER and support the growth of the market in the region.

Membrane separation technology is used in various applications such as water & wastewater treatment, industrial processing, medical & pharmaceutical, and food & beverage.

Paints & coatings

Paints & coatings is the largest application of flexible epoxy resin. Epoxy resins used in the coatings application are more expensive than the other substitutes such as phenolic resin. However, epoxy resins still have a large demand in the coatings application owing to their superior properties, such as low viscosity, chemical resistance, and superior mechanical and electrical properties. Flexible epoxy resins are used in paints & coatings, which are in turn used in the construction industry. These resins are commonly used in floor coating, primer, undercoating, tank lining, waterproof coating in civil construction, and binder coating.

Adhesives & sealants

Adhesives & sealants are one of the most important applications of flexible epoxy resin. Flexible epoxy resin-based adhesives can easily bond many substrates and sometimes be modified to achieve widely varying properties. Flexible epoxy resins are used to produce high-strength epoxy adhesives, which are the most extensively used structural adhesives. These adhesives have high demand owing to their strong bonding capabilities and high chemical and heat resistance. They are extensively used in industries, such as aerospace, automotive, wind power, and electrical & electronics. Ease of application of epoxy adhesives has encouraged their commercialization, thereby driving the market. These adhesives are developed to cater to a wide range of applications and operating conditions and are commonly used as either one-component or two-component systems.

Composites

A composite material is made from two or more materials with different physical or chemical properties that, when combined, forms a new material in which the characteristics of the individual materials are retained. The new material is stronger, lighter, and less expensive than the individual constituent material. Flexible epoxy composite materials are used in the construction of buildings, bridges, and structures, such as boat hulls, swimming pool panels, race car bodies, shower stalls, bathtubs, storage tanks, imitation granite, and cultured marble sinks and countertops.

Critical questions the report answers:

- What are the upcoming hot bets for FER market?

- How market dynamics is changing for different types in different applications?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

The key players, such as Olin Corporation (U.S.), Hexion (US), Kukdo Chemical (South Korea), Aditya Birla Chemicals (Thailand), Huntsman Corporation (U.S.), and DIC Corporation (Japan), operating in the FER market, adopted both organic as well as inorganic growth strategies between 2013 and 2017 to strengthen their position in the market. New product launches was the major growth strategy adopted by the market players to enhance their regional presence and meet the growing demand for FER in the emerging economies.

Table of Contents

1 Introduction (Page No. - 13)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Years Considered for the Study

1.4 Currency

1.5 Units Considered

1.6 Stakeholders

2 Research Methodology (Page No. - 16)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primary Interviews

2.2 Market Size Estimation

2.3 Data Triangulation

2.4 Assumptions

2.5 Limitations

3 Executive Summary (Page No. - 24)

4 Premium Insights (Page No. - 27)

4.1 Significant Opportunities in Flexible Epoxy Resin Market

4.2 Flexible Epoxy Resin Market, By Application

4.3 Flexible Epoxy Resin Market, By Type

4.4 Asia-Pacific Flexible Epoxy Resin Market, By Application and Country

4.5 Flexible Epoxy Resin Market Share, By Region

5 Market Overview (Page No. - 30)

5.1 Introduction

5.1.1 Drivers

5.1.1.1 Increasing Demand From Building & Construction and Automotive Industries

5.1.1.2 Increasing Use of Composites

5.1.2 Restraints

5.1.2.1 Complicated Processing and Health Hazards Associated With the Manufacturing of Flexible Epoxy Resins

5.1.3 Opportunities

5.1.3.1 Rise in Use of Composites and Rapid Urbanization in Emerging Economies

5.1.4 Challenges

5.1.4.1 Stringent Regulatory Consents and Saturated Use in Developed Economies

5.2 Porters Five Forces Analysis

5.2.1 Bargaining Power of Buyers

5.2.2 Bargaining Power of Suppliers

5.2.3 Threat of New Entrants

5.2.4 Threat of Substitutes

5.2.5 Intensity of Competitive Rivalry

5.3 Macroeconomic Indicators

5.3.1 GDP Growth Rate Forecast of Major Economies

5.3.2 Automotive Industry

5.3.3 Construction Industry

5.3.4 Trends and Forecast of Construction Industry in North America

5.3.5 Trends and Forecast of Construction Industry in Europe

5.3.6 Trends and Forecast of Construction Industry in Asia-Pacific

6 Flexible Epoxy Resin Market, By Type (Page No. - 38)

6.1 Introduction

6.2 Urethane-Modified FER

6.3 Rubber-Modified FER

6.4 Dimer Acid-Modified FER

7 Flexible Epoxy Resin Market, By Application (Page No. - 41)

7.1 Introduction

7.2 Paints & Coatings

7.3 Adhesives & Sealants

7.4 Composites

7.5 Others

8 Flexible Epoxy Resin Market, By Region (Page No. - 45)

8.1 Introduction

8.2 Asia-Pacific

8.2.1 China

8.2.2 Japan

8.2.3 South Korea

8.2.4 India

8.2.5 Rest of Asia-Pacific

8.3 North America

8.3.1 U.S.

8.3.2 Canada

8.3.3 Mexico

8.4 Europe

8.4.1 Germany

8.4.2 France

8.4.3 U.K.

8.4.4 Russia

8.4.5 Italy

8.4.6 Rest of Europe

8.5 Middle East & Africa

8.5.1 Saudi Arabia

8.5.2 UAE

8.5.3 South Africa

8.5.4 Rest of Middle East & Africa

8.6 South America

8.6.1 Brazil

8.6.2 Argentina

8.6.3 Rest of South America

9 Competitive Landscape (Page No. - 78)

9.1 Introduction

9.2 Market Ranking

9.3 Competitive Scenario

9.3.1 New Product Launches

9.3.2 Partnerships

9.3.3 Expansions

10 Company Profiles (Page No. - 82)

(Overview, Financial*, Products & Services, Strategy, and Developments)

10.1 Olin Corporation

10.2 Hexion Inc.

10.3 Kukdo Chemicals

10.4 Aditya Birla Chemicals

10.5 Huntsman Corporation

10.6 DIC Corporation

10.7 Emerald Performance Material

10.8 Epoxonic GmbH

10.9 Nan Ya Plastic Corporation

10.10 Spolchemie

10.11 Other Players

10.11.1 Atul Chemicals

10.11.2 Cardolite Corporation

10.11.3 Conren Limited

10.11.4 Easy Composites Ltd.

10.11.5 Fong Yong Chemical Co., Ltd.

10.11.6 Intertronics

10.11.7 Jiangsu Sanmu Group Corporation

10.11.8 Leuna-Harze GmbH

10.11.9 Loxeal Srl

10.11.10 Lymtal International Inc.

10.11.11 Mereco Technologies Inc.

10.11.12 Resintech Limited

10.11.13 Resoltech

10.11.14 Sicomin Epoxy Systems

10.11.15 The DOW Chemical Company

*Details Might Not Be Captured in Case of Unlisted Companies

11 Appendix (Page No. - 100)

11.1 Insights From Industry Experts

11.2 Discussion Guide

11.3 Knowledge Store: Marketsandmarkets Subscription Portal

11.4 Introducing RT: Real-Time Market Intelligence

11.5 Available Customizations

11.6 Related Reports

11.7 Author Details

List of Tables (76 Tables)

Table 1 Trends and Forecast of GDP Growth Rates, 20162021

Table 2 Motor Vehicle Production, 20152016

Table 3 Contribution of Construction Industry to GDP of North America, 20142016 (USD Billion)

Table 4 Contribution of Construction Industry to GDP of Europe, 20142016 (USD Billion)

Table 5 Contribution of Construction Industry to GDP of Asia-Pacific, 20142016 (USD Billion)

Table 6 Flexible Epoxy Resin Market Size, By Type, 20152022 (Kiloton)

Table 7 Flexible Epoxy Resin Market Size, By Type, 20152022 (USD Million)

Table 8 Flexible Epoxy Resin Market Size, By Application, 20152022 (Kiloton)

Table 9 Flexible Epoxy Resin Market Size, By Application, 20152022 (USD Million)

Table 10 Flexible Epoxy Resin Market Size, By Region, 20152022 (Kiloton)

Table 11 Flexible Epoxy Resin Market Size, By Region, 20152022 (USD Million)

Table 12 Asia-Pacific: Flexible Epoxy Resin Market Size, By Country, 20152022 (Kiloton)

Table 13 Asia-Pacific: Flexible Epoxy Resin Market Size, By Country, 20152022 (USD Million)

Table 14 Asia-Pacific: Flexible Epoxy Resin Market Size, By Application, 20152022 (Kiloton)

Table 15 Asia-Pacific: By Market Size, By Application, 20152022 (USD Million)

Table 16 China: Flexible Epoxy Resin Market Size, By Application, 20152022 (Kiloton)

Table 17 China: Flexible Epoxy Resin Market Size, By Application, 20152022 (USD Million)

Table 18 Japan: Flexible Epoxy Resin Market Size, By Application, 20152022 (Kiloton)

Table 19 Japan: Flexible Epoxy Resin Market Size, By Application, 20152022 (USD Million)

Table 20 South Korea: Flexible Epoxy Resin Market Size, By Application, 20152022 (Kiloton)

Table 21 South Korea: Flexible Epoxy Resin Market Size, By Application, 20152022 (USD Million)

Table 22 India: Flexible Epoxy Resin Market Size, By Application, 20152022 (Kiloton)

Table 23 India: Flexible Epoxy Resin Market Size, By Application, 20152022 (USD Million)

Table 24 Rest of Asia-Pacific: Flexible Epoxy Resin Market Size, By Application, 20152022 (Kiloton)

Table 25 Rest of Asia-Pacific: By Market Size, By Application, 20152022 (USD Million)

Table 26 North America: Flexible Epoxy Resin Market Size, By Country, 20152022 (Kiloton)

Table 27 North America: Flexible Epoxy Resin Market Size, By Country, 20152022 (USD Million)

Table 28 North America: Flexible Epoxy Resin Market Size, By Application, 20152022 (Kiloton)

Table 29 North America: By Market Size, By Application, 20152022 (USD Million)

Table 30 U.S.: Flexible Epoxy Resin Market Size, By Application, 20152022 (Kiloton)

Table 31 U.S.: By Market Size, By Application, 20152022 (USD Million)

Table 32 Canada: Flexible Epoxy Resin Market Size, By Application, 20152022 (Kiloton)

Table 33 Canada: By Market Size, By Application, 20152022 (USD Million)

Table 34 Mexico: Flexible Epoxy Resin Market Size, By Application, 20152022 (Kiloton)

Table 35 Mexico: By Market Size, By Application, 20152022 (USD Million)

Table 36 Europe: Flexible Epoxy Resin Market Size, By Country, 20152022 (Kiloton)

Table 37 Europe: By Market Size, By Country, 20152022 (USD Million)

Table 38 Europe: By Market Size, By Application, 20152022 (Kiloton)

Table 39 Europe: By Market Size, By Application, 20152022 (USD Million)

Table 40 Germany: Flexible Epoxy Resin Market Size, By Application, 20152022 (Kiloton)

Table 41 Germany: By Market Size, By Application, 20152022 (USD Million)

Table 42 France: Flexible Epoxy Resin Market Size, By Application, 20152022 (Kiloton)

Table 43 France: By Market Size, By Application, 20152022 (USD Million)

Table 44 U.K.: Flexible Epoxy Resin Market Size, By Application, 20152022 (Kiloton)

Table 45 U.K.: By Market Size, By Application, 20152022 (USD Million)

Table 46 Russia: Flexible Epoxy Resin Market Size, By Application, 20152022 (Kiloton)

Table 47 Russia: By sin Market Size, By Application, 20152022 (USD Million)

Table 48 Italy: Flexible Epoxy Resin Market Size, By Application, 20152022 (Kiloton)

Table 49 Italy: By Market Size, By Application, 20152022 (USD Million)

Table 50 Rest of Europe: Flexible Epoxy Resin Market Size, By Application, 20152022 (Kiloton)

Table 51 Rest of Europe: By Market Size, By Application, 20152022 (USD Million)

Table 52 Middle East & Africa: Flexible Epoxy Resin Market Size, By Country, 20152022 (Kiloton)

Table 53 Middle East & Africa: Market Size, By Country, 20152022 (USD Million)

Table 54 Middle East & Africa: Market Size, By Application, 20152022 (Kiloton)

Table 55 Middle East & Africa: Market Size, By Application, 20152022 (USD Million)

Table 56 Saudi Arabia: Flexible Epoxy Resin Market Size, By Application, 20152022 (Kiloton)

Table 57 Saudi Arabia: Market Size, By Application, 20152022 (USD Million)

Table 58 UAE: Flexible Epoxy Resin Market Size, By Application, 20152022 (Kiloton)

Table 59 UAE: Market Size, By Application, 20152022 (USD Million)

Table 60 South Africa: Flexible Epoxy Resin Market Size, By Application, 20152022 (Kiloton)

Table 61 South Africa: Market Size, By Application, 20152022 (USD Million)

Table 62 Rest of Middle East & Africa: Flexible Epoxy Resin Market Size, By Application, 20152022 (Kiloton)

Table 63 Rest of Middle East & Africa: Market Size, By Application, 20152022 (USD Million)

Table 64 South America: Flexible Epoxy Resin Market Size, By Country, 20152022 (Kiloton)

Table 65 South America: Market Size, By Country, 20152022 (USD Million)

Table 66 South America: Market Size, By Application, 20152022 (Kiloton)

Table 67 South America: Market Size, By Application, 20152022 (USD Million)

Table 68 Brazil: Flexible Epoxy Resin Market Size, By Application, 20152022 (Kiloton)

Table 69 Brazil: Market Size, By Application, 20152022 (USD Million)

Table 70 Argentina: Flexible Epoxy Resin Market Size, By Application, 20152022 (Kiloton)

Table 71 Argentina: Market Size, By Application, 20152022 (USD Million)

Table 72 Rest of South America: Flexible Epoxy Resin Market Size, By Application, 20152022 (Kiloton)

Table 73 Rest of South America: Market Size, By Application, 20152022 (USD Million)

Table 74 New Product Launches, 20142017

Table 75 Partnerships, 20142017

Table 76 Expansions, 20142017

List of Figures (30 Figures)

Figure 1 Flexible Epoxy Resin Market: Research Methodology

Figure 2 Market Size Estimation: Bottom-Up Approach

Figure 3 Market Size Estimation: Top-Down Approach

Figure 4 Flexible Epoxy Resin Market: Data Triangulation

Figure 5 Paints & Coatings Application to Lead the Flexible Epoxy Resin Market Between 2017 and 2022

Figure 6 Urethane-Modified FER to Lead the Flexible Epoxy Resin Market Between 2017 and 2022

Figure 7 Asia-Pacific to Be the Fastest-Growing Market During the Forecast Period

Figure 8 Attractive Opportunities in the Flexible Epoxy Resin Market Between 2017 and 2022

Figure 9 Composites to Be the Second Largest Application of Flexible Epoxy Resin Between 2017 and 2022

Figure 10 Urethane-Modified FER to Lead the Market Between 2017 and 2022

Figure 11 China Was the Largest Market in Asia-Pacific, in 2016

Figure 12 Asia-Pacific Accounted for the Largest Market Share in 2016

Figure 13 Drivers, Restraints, Opportunities, and Challenges in Flexible Epoxy Resin Market

Figure 14 Flexible Epoxy Resin Market: Porters Five Forces Analysis

Figure 15 UrethaneModified FER to Be the Largest Type During the Forecast Period

Figure 16 Paints & Coatings to Be the Largest Application During the Forecast Period

Figure 17 Regional Snapshot: India to Witness the Highest Growth Rate Between 2017 and 2022

Figure 18 Asia-Pacific Market Snapshot: Paints & Coatings Application to Drive the Flexible Epoxy Resin Market

Figure 19 North America Market Snapshot: Paints & Coatings to Be the Largest Application of Flexible Epoxy Resin

Figure 20 Germany to Lead Flexible Epoxy Resin Market in Europe During the Forecast Period

Figure 21 Companies Adopted New Product Launches as the Key Growth Strategy, 20142017

Figure 22 Olin Corporation Dominated the Flexible Epoxy Resin Market in 2016

Figure 23 Olin Corporation: Company Snapshot

Figure 24 SWOT Analysis: Olin Corporation

Figure 25 Hexion Inc.: Company Snapshot

Figure 26 SWOT Analysis: Hexion Inc.

Figure 27 Huntsman Corporation: Company Snapshot

Figure 28 SWOT Analysis: Huntsman Corporation

Figure 29 DIC Corporation: Company Snapshot

Figure 30 Nan Ya Plastic Corporation: Company Snapshot

Growth opportunities and latent adjacency in Flexible Epoxy Resin Market