Fire Stopping Materials Market by Type (Sealants, Mortar, Boards, Putty &Putty Pads, Cast-in Devices), by Application (Electrical, Mechanical, Plumbing), End-Use (Commercial, Industrial & Residential), and Region - Global Forecast to 2026

Fire Stopping Materials Market

The global fire stopping materials market size was valued at USD 1.4 billion in 2021 and is projected to reach USD 2.4 billion by 2026, growing at 11.6% cagr during the forecast period. The market is mainly driven by the rising demand for fire stopping materials in applications such as electrical, mechanical, plumbing and others. Increasing fire safety regulations & stringent building code , and the rising number of fire accidents are driving the market. North America is the key market for fire stopping materials, globally, in terms of value. APAC is the fastest-growing region in the fire stopping materials market.

To know about the assumptions considered for the study, Request for Free Sample Report

Impact of COVID-19 on Fire Stopping Materials Market

The global pandemic has affected almost every sector in the world. The fire stopping materials market has shown a negative growth as it was affected due to disruptions in the global supply chain and fluctuation in the raw material prices. This situation arised due to fall in demand from the construction sector. The market is highly dependent on the commercial, industrial and residential industries. North America is the largest region in terms of value for the fire stopping materials market.

North America has always been a strong market for fire stopping materials. Globally, North America has been one of the leaders in demand and product innovation, in terms of quality and application development. Key countries in the North American market are the US (the most dominant market, accounting for a significant regional market share), Canada, and Mexico. The fire stopping materials market is experiencing significant growth due to the increasing demand for advanced materials in the construction industry. The North American market is highly regulated, with several associations playing a key role in the monitoring and commercialization of fire stopping materials.

Fire stopping materials market is highly influenced by the strict regulations in this region. Various regulatory bodies including FPA, NFPA and CFPA are observing the building codes in the region. The builders and contractors adhere to these standards. North America is also a highly industrialized region, which plays an important role in the growth of this market. The growth of commercial and industrial infrastructure plays a key role in this market.

Fire Stopping Materials Market Dynamics

Driver: Increasing fire safety regulations

The fire stopping materials market is strongly influenced by the stringent legal framework and industry standards/regulations, especially in Europe and North America regions. These regulations are leading to the development of innovative fire stopping materials. They are varied across different regions, depending on the corresponding national regulations for health and environmental security.

The stringent fire regulations defined by the regulatory agencies of different countries, such as NFPA (U.S), VFDB (Germany), FPA (UK), and FPAA (Australia) is driving the demand for fire stopping materials such as cast-in devices, collars, and sleeves consistently in the construction materials.

All these factors collectively are driving the demand for fire stopping materials in the various end-use industries.

Restraints: Price sensitivity in the emerging regions

APAC, Africa, and South America are price-sensitive markets. Pricing plays a huge role in product placement and marketing in APAC. Hilti Corporation and 3M are the leading global market players. However, in the Indian subcontinent regional players are leading the market, as per industry experts, the reason behind this is the cost-effective products provided by these companies. Various residential projects tend to evade few fire compliances to reduce the cost of the project as the fire stopping materials are provided at a high cost. This has a negative impact on the market for fire stopping material despite the strict fire safety regulations. It has also been observed that contractors tend to avoid or do not comply with building codes to reduce the cost of construction.

Opportunities: Development of innovative fire-stopping systems

In order to boost the performance of fire stopping materials, global companies are innovating new technologies to enhance its protecting properties. Due to the stringent rules towards fire protection by government, the demand for fire stopping materials is rising. Companies are coming up with innovative solutions which adhere to the country codes and standards. Moreover, they are focusing on solutions that are easy to install, user friendly and require low maintenance. Global companies like 3M and Specified Technologies Inc. are focusing on developing innovative fire protection systems to effectively stop the spread of fire, smoke, and gases. Recently Specified Technologies Inc launched E-Wrap Systems FP-3 and FP-4, specifically for the protection of fuel oil pipe. The system is in accordance with UL 1489 (Standard for fire tests of fire-resistant pipe protection systems carrying combustible liquids). 3M has developed fire barrier dryer ventilation wrap particularly for enclosure of ventilation ductwork that runs through wood frame construction. It has been tested to ASTM E2816 Condition B. Companies are becoming aware of various standards and developing fire-stopping solutions adhering to these regulations.

Challenges: Non-compliance to the regulations in the emerging markets

Developing economies have recently begun the use of fire stopping materials in construction projects. These economies include China, India, Brazil, and the countries in Eastern Europe and Africa. Fire stopping materials is still a new technology in these countries, where active fire protection techniques are used. Many potential end users are not aware of the benefits of using fire stopping materials in various applications. Contractors tend to avoid building codes or do not comply with the mandatory fire safety regulations due to high prices and lack of a regulatory body or proper inspection procedures. This is mostly the case in emerging economies.

Putty and putty pads is estimated to be the fastest-growing type in the fire stopping materials market between 2021 and 2026.

Putty is a material with high plasticity, similar in texture to clay or dough, typically used to seal gaps during construction. Firestop putty are mainly used for electrical outlet boxes, sealing pipe and cable insulation, construction joints, solid ceilings, and lightweight partitions to increase their fire-resistance. It is an intumescent elastomer, which expands at least three times when exposed to fire or high temperature. These are flexible and can be molded by hand for quick installation. It provides full protection against the spreading of smoke and fire during a fire accident. It also provides excellent adhesion to construction substrates and penetrants including gypsum, metal and plastic. These properties are expected to drive the demand of putty and putty pads during the forecast period.

Electrical was the largest application for fire stopping materials market in 2020

The rise in the construction industry is a key factor in the growth of this application. Development of high-rise apartments is increasing, these infrastructures require sophisticated electrical systems including switch boards, cables, conduit and outlets. Due to strict regulations, it is necessary to install fire stopping systems within these facilities. Mortar, sealants and putty are the most commonly used fire stopping materials to fireproof electric cables and boxes. These materials are easy to apply and are effective against fire hazards.

Commercial construction was the largest end-use for fire stopping materials market in 2020

Commercial construction is the largest application of fire stopping materials. It is also known as institutional construction. It comprises healthcare facilities (hospitals and laboratories), banks, hotels, education institutions (schools and colleges), and government-owned offices. Commercial construction is increasing in developed and developing countries. In developed countries, the construction of grocery stores, drugstore, and quick service restaurants are increasing, while in developing countries, the construction of hospitals, schools and colleges, and retail stores is driving the commercial construction segment.

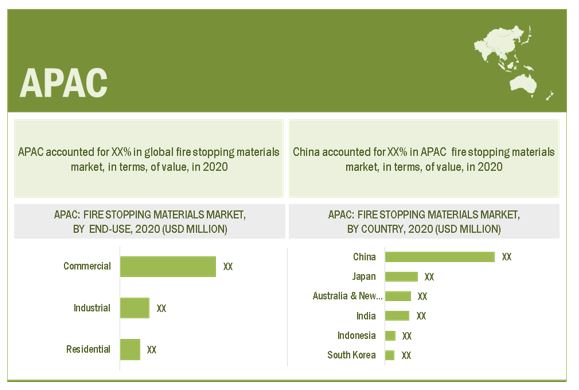

APAC is estimated to be the fastest-growing region in fire stopping materials market in the forecast period

APAC consists of major developing nations such as China and India. Hence, there is wide scope for development for most of the industries in these emerging countries. The fire stopping materials industry is a significantly growing industry, and it offers high growth opportunities for manufacturers. The increasing population in the region, accompanied by the development of new technologies and products are projected to make this region an ideal destination for the growth of fire stopping materials. Improved lifestyle and increasing income also help the market to flourish in developing economies of the region. However, setting up new plants, implementing new technologies, creating a supply chain between raw material providers and manufacturing industries in the developing regions of APAC would be a challenge for the industry players as urbanization and industrialization rate is slower in few countries. On the other hand, the industry experts expects to see a boost in APAC’s infrastructural developments as many foreign players are investing in the APAC construction industry. This gives a huge lift to ongoing developments. Thus, the market for fire stopping material is expected to register very high growth.

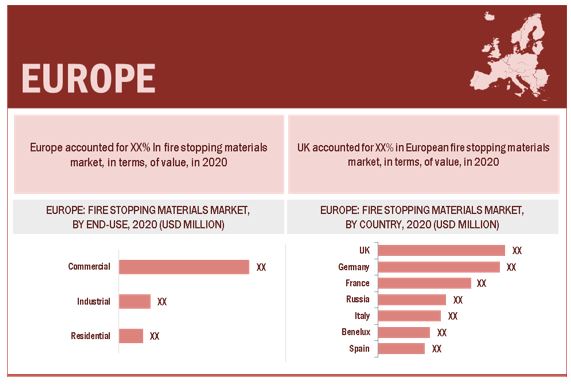

Europe was estimated to be the second-largest fire stopping market in 2020.

Europe is one of the largest markets for fire stopping materials in the world. In 2020, the region accounted for the second-largest region for the global fire stopping materials market. Key countries in the region include Germany, France, the UK, Italy, Spain, Benelux, and Russia. After North America, Europe is the largest consumer of fire-stopping materials. Stringent regulations and codes for building and construction in the region drive the demand of the market. Various regulatory bodies like CFPA-Europe and EAPFP monitor the fire safety guidelines for commercial and residential buildings. Moreover, the increased awareness regarding fire safety is driving the market in the construction and industrial sector. Concerns regarding loss of inventory due to fire related hazards is rising leading to the construction of fire-safe infrastructures.

Fire Stopping Materials Market Players

The key market players profiled in the report include Hilti Corporation (Liechtenstein), 3M (US), Etex Group (Belgium), Knauf Insulation (US), Specified Technologies Inc (US), Sika AG(Switzerland), RectorSeal Corporation (US), BASF SE(Germany), RPM International Inc.(US), Morgan Advanced Materials (UK), Rolf Kuhn GmbH (Germany), Tenmat Ltd. (UK), Encon Insulation Ltd. (UK), Fischerwerke GmbH & Co. KG (Germany), Saint-Gobain Group (France), Rockwool International AS (UK), Supremex Equipments (India), Walraven (The Netherlands), Everkem Diversified Products (US), Abesco Fire Ltd. (UK), Lloyd Insulations (India), Den Braven (The Netherlands), HoldRite (US), Unique fire stop products Inc. (US), and Fire Seals Direct (UK).

Fire Stopping Materials Market Report Scope

|

Report Metric |

Details |

|

Market Size Value in 2021 |

USD 1.4 billion |

|

Revenue Forecast in 2026 |

USD 2.4 billion |

|

CAGR |

11.6% |

|

Years considered for the study |

2016-2026 |

|

Base Year |

2021 |

|

Forecast period |

2021–2026 |

|

Units considered |

Value (USD Million) |

|

Segments |

Type, Application, End-Use and Region |

|

Regions |

APAC, North America, Europe, Middle East & Africa, and South America |

|

Companies |

Hilti Corporation (Liechtenstein), 3M (US), Etex Group (Belgium), Knauf Insulation (US), Specified Technologies Inc (US), Sika AG(Switzerland), RectorSeal Corporation (US), BASF SE(Germany), RPM International Inc.(US), Morgan Advanced Materials (UK), Rolf Kuhn GmbH (Germany), Tenmat Ltd. (UK), Encon Insulation Ltd. (UK), Fischerwerke GmbH & Co. KG (Germany), Saint-Gobain Group (France), Rockwool International AS (UK), Supremex Equipments (India), Walraven (The Netherlands), Everkem Diversified Products (US), Abesco Fire Ltd. (UK), Lloyd Insulations (India), Den Braven (The Netherlands), HoldRite (US), Unique fire stop products Inc. (US), and Fire Seals Direct (UK). |

This report categorizes the global fire stopping materials market based on type, application, end-use and region.

Fire Stopping Materials Market by Type

On the basis of type, the fire stopping materials market has been segmented as follows:

- Mortars

- Sealants

- Cast-in devices

- Boards

- Putty and Putty Pads

- Collars

- Wraps/strips

- Others

Fire Stopping Materials Market by Application

On the basis of application, the fire stopping materials market has been segmented as follows:

- Electrical

- Mechanical

- Plumbing

- Others

Fire Stopping Materials Market by End-Use

On the basis of end-use, the fire stopping materials market has been segmented as follows:

- Commercial

- Industrial

- Residential

Fire Stopping Materials Market by Region

On the basis of region, the fire stopping materials market has been segmented as follows:

- APAC

- North America

- Europe

- Middle East & Arica

- South America

Recent Developments

- In January 2020, Specified Technologies Inc launched 2 new fuel pipe protection E-Wrap systems: FP-3 and FP-4. These systems are available for protection of fuel oil pipe.

- In September 2020, Etex Group has acquired FSI Ltd, British company specialized in passive protection solutions to strengthen its fire stopping business unit.

Frequently Asked Questions (FAQ):

What are applications & End-Use of fire stopping materials market?

By Application (Electrical, Mechanical, Plumbing) & By End-Use (Commercial, Industrial & Residential)

What is total market value of fire stopping materials market?

The fire stopping materials market is projected to reach USD 2.4 billion by 2026, at a CAGR of 11.6% from USD 1.4 billion in 2021.

What type of structure are fire stops most useful for?

Sealants, Mortar, Borrds, Putty & Putty Pads, Cast-in Devices

What are the factors influencing the growth of fire stopping materials?

Increasing fire safety regulations in the developed regions and growing number of fire incidents are driving this market.

What are different type of major types of fire stopping materials?

It is classified into eight categories- mortars, sealants, cast-in devices, boards, putty and putty pads, collars, wraps/strips, and others.

What is the biggest restraint for fire stopping materials?

Price sensitivity in the emerging regions is a major restraint of the market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 31)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.2.1 FIRE STOPPING MATERIALS MARKET: INCLUSIONS AND EXCLUSIONS

1.2.2 MARKET: DEFINITION AND INCLUSION, BY TYPE

1.2.3 MARKET: DEFINITION AND INCLUSIONS, BY APPLICATION

1.2.4 MARKET: DEFINITION AND INCLUSIONS, BY END–USE

1.3 MARKET SCOPE

1.3.1 FIRE STOPPING MATERIALS MARKET SEGMENTATION

1.3.2 REGIONS COVERED

1.3.3 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY

1.5 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 36)

2.1 RESEARCH DATA

FIGURE 1 FIRE STOPPING MATERIALS MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

2.1.2.1 Primary interviews – demand and supply sides

2.1.2.2 Key industry insights

2.1.2.3 Breakdown of primary interviews

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM–UP APPROACH

FIGURE 2 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1 (SUPPLY SIDE): REVENUE OF PRODUCTS

FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1 BOTTOM–UP (SUPPLY–SIDE): COLLECTIVE REVENUE OF ALL PRODUCTS

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 2 – BOTTOM–UP (DEMAND SIDE): APPLICATIONS SERVED AND THEIR AVERAGE SELLING PRICES

2.2.2 TOP–DOWN APPROACH

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 3 – TOP–DOWN

2.3 DATA TRIANGULATION

FIGURE 6 FIRE STOPPING MATERIALS MARKET: DATA TRIANGULATION

2.4 GROWTH RATE ASSUMPTIONS/GROWTH FORECAST

2.4.1 SUPPLY–SIDE

FIGURE 7 MARKET CAGR PROJECTIONS FROM THE SUPPLY SIDE

2.4.2 DEMAND–SIDE

FIGURE 8 MARKET GROWTH PROJECTIONS FROM DEMAND–SIDE DRIVERS AND OPPORTUNITIES

2.5 FACTOR ANALYSIS

2.6 ASSUMPTIONS

2.7 LIMITATIONS

2.8 RISK ASSESSMENT

TABLE 1 FIRE STOPPING MATERIALS MARKET: RISK ASSESSMENT

3 EXECUTIVE SUMMARY (Page No. - 48)

FIGURE 9 BY END–USE, COMMERCIAL SEGMENT TO LEAD FIRE STOPPING MATERIALS MARKET DURING FORECAST PERIOD

FIGURE 10 BY TYPE, SEALANTS SEGMENT TO LEAD FIRE STOPPING MATERIALS MARKET DURING FORECAST PERIOD

FIGURE 11 NORTH AMERICA ACCOUNTED FOR LARGEST SHARE OF FIRE STOPPING MATERIALS MARKET IN 2020

4 PREMIUM INSIGHTS (Page No. - 51)

4.1 ATTRACTIVE MARKET OPPORTUNITIES FOR FIRE STOPPING MATERIAL MANUFACTURERS

FIGURE 12 GROWING GLOBAL CONSTRUCTION ACTIVITIES PROPELLING MARKET FOR FIRE STOPPING MATERIALS

4.2 FIRE STOPPING MATERIALS MARKET, BY REGION

FIGURE 13 NORTH AMERICA ESTIMATED TO LEAD FIRE STOPPING MATERIALS MARKET BETWEEN 2021 AND 2026

4.3 FIRE STOPPING MATERIALS MARKET SHARE, BY REGION & END–USE

FIGURE 14 COMMERCIAL END–USE DOMINATED FIRE STOPPING MATERIALS MARKET IN ALL REGIONS IN 2020

4.4 NORTH AMERICA: FIRE STOPPING MATERIALS MARKET, BY TYPE AND COUNTRY

FIGURE 15 US ACCOUNTED FOR LARGEST SHARE OF FIRE STOPPING MATERIALS MARKET IN NORTH AMERICA IN 2020

4.5 FIRE STOPPING MATERIALS MARKET ATTRACTIVENESS

FIGURE 16 FIRE STOPPING MATERIALS MARKET IN ARGENTINA TO WITNESS HIGHEST CAGR BETWEEN 2021 AND 2026

5 MARKET OVERVIEW AND INDUSTRY TRENDS (Page No. - 54)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 17 FIRE STOPPING MATERIALS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Increasing fire safety regulations

5.2.1.2 Rising number of fire incidents

FIGURE 18 NUMBER OF STRUCTURAL FIRE INCIDENTS IN KEY COUNTRIES IN 2018

5.2.1.3 Adoption of fire stopping materials in emerging markets

5.2.2 RESTRAINTS

5.2.2.1 Economic slowdown and COVID–19 impact on construction industry

TABLE 2 COVID–19 IMPACT ON RESIDENTIAL CONSTRUCTION MARKET SIZE, BY REGION, 2018–2021 (USD BILLION)

TABLE 3 COVID–19 IMPACT ON NON–RESIDENTIAL CONSTRUCTION MARKET SIZE, BY REGION, 2018–2021 (USD BILLION)

TABLE 4 COVID–19 IMPACT ON HEAVY & CIVIL ENGINEERING CONSTRUCTION MARKET SIZE, BY REGION, 2018–2021 (USD BILLION)

5.2.2.2 Price sensitivity in emerging regions

5.2.3 OPPORTUNITIES

5.2.3.1 Development of innovative fire stopping systems

5.2.3.2 Increasing demand for passive fire protection systems

5.2.4 CHALLENGES

5.2.4.1 Non–compliance with regulations in emerging markets

5.2.4.2 Technical complexity in installing fire stopping systems

5.3 PORTER’S FIVE FORCES ANALYSIS

FIGURE 19 PORTER’S FIVE FORCES ANALYSIS OF FIRE STOPPING MATERIALS MARKET

TABLE 5 FIRE STOPPING MATERIALS MARKET: PORTER’S FIVE FORCES ANALYSIS

5.3.1 THREAT OF NEW ENTRANTS

5.3.2 THREAT OF SUBSTITUTES

5.3.3 BARGAINING POWER OF SUPPLIERS

5.3.4 BARGAINING POWER OF BUYERS

5.3.5 INTENSITY OF COMPETITIVE RIVALRY

5.4 SUPPLY CHAIN ANALYSIS

FIGURE 20 FIRE STOPPING MATERIALS MARKET: SUPPLY CHAIN

5.4.1 RAW MATERIAL

5.4.2 MANUFACTURING OF FIRE STOPPING MATERIALS

5.4.3 DISTRIBUTION TO END–USERS

5.5 TECHNOLOGY ANALYSIS

5.6 TRENDS/DISRUPTIONS IMPACTING CUSTOMER’S BUSINESS

5.6.1 REVENUE SHIFTS & REVENUE POCKETS FOR FIRE STOPPING MATERIALS MANUFACTURERS

FIGURE 21 REVENUE SHIFT FOR FIRE STOPPING MATERIALS MARKET

5.7 ECOSYSTEM/ MARKET MAP

FIGURE 22 FIRE STOPPING MATERIALS MARKET: ECOSYSTEM

TABLE 6 FIRE STOPPING MATERIALS MARKET: ECOSYSTEM

5.8 CASE STUDIES

5.8.1 A CASE STUDY ON FIRE PROTECTION TEST BY GERCO–FAS

5.8.2 A CASE STUDY ON PITT–CHAR XP BY PPG INDUSTRIES

5.9 TARIFF AND REGULATORY LANDSCAPE

5.9.1 US

5.9.2 EUROPE

5.9.3 CHINA

5.10 MACROECONOMIC INDICATOR

5.10.1 GDP TRENDS AND FORECASTS OF MAJOR ECONOMIES

TABLE 7 GDP TRENDS AND FORECAST BY MAJOR ECONOMY, 2018 – 2026 (USD BILLION)

5.11 FIRE STOPPING MATERIALS: REALISTIC, PESSIMISTIC, OPTIMISTIC, AND NON–COVID–19 SCENARIO

FIGURE 23 MARKET SIZE UNDER REALISTIC, PESSIMISTIC, OPTIMISTIC, AND NON–COVID–19 SCENARIO

TABLE 8 FIRE STOPPING MATERIALS MARKET: MARKET FORECAST SCENARIOS, 2019–2026 (USD MILLION)

5.11.1 NON–COVID–19 SCENARIO

5.11.2 OPTIMISTIC SCENARIO

5.11.3 PESSIMISTIC SCENARIO

5.11.4 REALISTIC SCENARIO

5.12 PATENT ANALYSIS

5.12.1 INTRODUCTION

5.12.2 APPROACH

5.12.3 DOCUMENT TYPE

TABLE 9 THE GRANTED PATENTS ARE 16% OF THE TOTAL COUNT BETWEEN 2010 AND 2020

FIGURE 24 PATENTS REGISTERED FOR FIRE STOPPING MATERIALS, 2010–2020

FIGURE 25 PATENT PUBLICATION TRENDS FOR FIRE STOPPING MATERIALS, 2010–2020

5.12.4 INSIGHTS

5.12.5 JURISDICTION ANALYSIS

FIGURE 26 MAXIMUM PATENTS FILED BY COMPANIES IN US

5.12.6 TOP APPLICANTS

FIGURE 27 PROMAT AUSTRALIA PTY LTD REGISTERED HIGHEST NUMBER OF PATENTS BETWEEN 2010 AND 2020

TABLE 10 TOP TEN PATENT OWNERS IN THE US, 2010–2020

5.13 TRADE DATA

5.13.1 IMPORT SCENARIO OF FIRE STOPPING MATERIALS

FIGURE 28 FIRE STOPPING MATERIAL IMPORTS, BY KEY COUNTRIES, 2017–2020

TABLE 11 FIRE STOPPING MATERIAL IMPORTS, BY REGION, 2017–2020 (USD MILLION)

5.13.2 EXPORT SCENARIO OF FIRE STOPPING MATERIALS

FIGURE 29 FIRE STOPPING MATERIAL EXPORTS, BY KEY COUNTRIES, 2017–2020

TABLE 12 FIRE STOPPING MATERIAL EXPORTS, BY REGION, 2017–2020 (USD MILLION)

5.14 COVID–19 IMPACT

5.14.1 INTRODUCTION

5.14.2 COVID–19 HEALTH ASSESSMENT

FIGURE 30 COUNTRY–WISE SPREAD OF COVID–19

5.14.3 COVID–19 ECONOMIC ASSESSMENT

FIGURE 31 REVISED GDP FORECASTS FOR SELECT G20 COUNTRIES IN 2021

5.14.3.1 COVID–19 Impact on Economy—Scenario Assessment

FIGURE 32 FACTORS IMPACTING GLOBAL ECONOMY

FIGURE 33 SCENARIOS OF COVID–19 IMPACT

6 FIRE STOPPING MATERIALS MARKET, BY TYPE (Page No. - 82)

6.1 INTRODUCTION

FIGURE 34 BY TYPE, SEALANTS TO DOMINATE FIRE STOPPING MATERIALS MARKET DURING FORECAST PERIOD

TABLE 13 MARKET, BY TYPE, 2016–2019 (USD MILLION)

TABLE 14 MARKET, BY TYPE, 2020–2026 (USD MILLION)

6.2 MORTARS

6.2.1 LOW COST SIGNIFICANTLY DRIVING CONSUMPTION OF MORTARS

TABLE 15 MORTARS: FIRE STOPPING MATERIALS MARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 16 MORTARS: MARKET, BY REGION, 2020–2026 (USD MILLION)

6.3 SEALANTS

6.3.1 HIGH VERSATILITY AND COMPATIBILITY WITH VARIOUS BASE MATERIALS BOOSTING DEMAND FOR SEALANTS

TABLE 17 SEALANTS: FIRE STOPPING MATERIALS MARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 18 SEALANTS: MARKET, BY REGION, 2020–2026 (USD MILLION)

6.4 CAST–IN DEVICES

6.4.1 EASY INSTALLATION SPURRING DEMAND FOR CAST–IN DEVICES

TABLE 19 CAST–IN DEVICES: FIRE STOPPING MATERIALS MARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 20 CAST–IN DEVICES: MARKET, BY REGION, 2020–2026 (USD MILLION)

6.5 BOARDS

6.5.1 GROWTH OF HVAC INDUSTRY AND NEED FOR EFFICIENT VENTILATION POSITIVELY INFLUENCING BOARDS DEMAND

TABLE 21 BOARDS: FIRE STOPPING MATERIALS MARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 22 BOARDS: MARKET, BY REGION, 2020–2026 (USD MILLION)

6.6 PUTTY AND PUTTY PADS

6.6.1 DEMAND FOR PUTTY & PUTTY PADS INFLUENCED BY GROWTH OF COMPLEX ELECTRIC BOARDS IN COMMERCIAL AND RESIDENTIAL CONSTRUCTION

TABLE 23 PUTTY AND PUTTY PADS: FIRE STOPPING MATERIALS MARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 24 PUTTY AND PUTTY PADS: MARKET, BY REGION, 2020–2026 (USD MILLION)

6.7 COLLARS

6.7.1 EUROPE IS SECOND–LARGEST MARKET FOR FIRE STOPPING COLLARS

TABLE 25 COLLARS: FIRE STOPPING MATERIALS MARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 26 COLLARS: MARKET, BY REGION, 2020–2026 (USD MILLION)

6.8 WRAPS/STRIPS

6.8.1 PROPERTY OF BLOCKING HEAT AND TOXIC BY–PRODUCTS DRIVING DEMAND FOR WRAPS/STRIPS

TABLE 27 WRAPS/STRIPS: FIRE STOPPING MATERIALS MARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 28 WRAPS/STRIPS: MARKET, BY REGION, 2020–2026 (USD MILLION)

6.9 OTHERS

TABLE 29 OTHERS: FIRE STOPPING MATERIALS MARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 30 OTHERS: MARKET, BY REGION, 2020–2026 (USD MILLION)

6.9.1 PILLOWS

6.9.2 SLEEVES

6.9.3 DISCS

6.9.4 COMPOSITE SHEETS

7 FIRE STOPPING MATERIALS MARKET, BY APPLICATION (Page No. - 94)

7.1 INTRODUCTION

FIGURE 35 BY APPLICATION, ELECTRICAL SEGMENT TO LEAD FIRE STOPPING MATERIALS MARKET DURING FORECAST PERIOD

TABLE 31 FIRE STOPPING MATERIALS MARKET, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 32 MARKET, BY APPLICATION, 2020–2026 (USD MILLION)

7.2 ELECTRICAL

7.3 MECHANICAL

7.4 PLUMBING

7.5 OTHERS

8 FIRE STOPPING MATERIALS MARKET, BY END–USE (Page No. - 97)

8.1 INTRODUCTION

FIGURE 36 BY END–USE, COMMERCIAL SEGMENT TO LEAD FIRE STOPPING MATERIALS MARKET DURING FORECAST PERIOD

TABLE 33 FIRE STOPPING MATERIALS MARKET, BY END–USE, 2016–2019 (USD MILLION)

TABLE 34 MARKET, BY END–USE, 2020–2026 (USD MILLION)

8.2 COMMERCIAL

8.2.1 HIGH GROWTH IN COMMERCIAL CONSTRUCTION DRIVING FIRE STOPPING MATERIALS MARKET

TABLE 35 FIRE STOPPING MATERIALS MARKET IN COMMERCIAL END–USE, BY REGION, 2016–2019 (USD MILLION)

TABLE 36 MARKET IN COMMERCIAL END–USE, BY REGION, 2020–2026 (USD MILLION)

8.3 INDUSTRIAL

8.3.1 INDUSTRIAL EXPANSION IN EMERGING ECONOMIES

TABLE 37 FIRE STOPPING MATERIALS MARKET IN INDUSTRIAL END–USE, BY REGION, 2016–2019 (USD MILLION)

TABLE 38 MARKET IN INDUSTRIAL END–USE, BY REGION, 2020–2026 (USD MILLION)

8.4 RESIDENTIAL

8.4.1 GROWING GDP AND RISE IN RESIDUAL INCOME DRIVING RESIDENTIAL END–USE INDUSTRY

TABLE 39 FIRE STOPPING MATERIALS MARKET IN RESIDENTIAL END–USE, BY REGION, 2016–2019 (USD MILLION)

TABLE 40 MARKET IN RESIDENTIAL END–USE, BY REGION, 2020–2026 (USD MILLION)

9 FIRE STOPPING MATERIALS MARKET, BY REGION (Page No. - 103)

9.1 INTRODUCTION

FIGURE 37 APAC LED IN NUMBER OF 300 METER OR TALLER BUILDINGS COMPLETED IN 2019

FIGURE 38 NORTH AMERICA TO BE LARGEST FIRE STOPPING MATERIALS MARKET DURING FORECAST PERIOD

TABLE 41 FIRE STOPPING MATERIALS MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 42 MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

9.2 NORTH AMERICA

FIGURE 39 NORTH AMERICA: FIRE STOPPING MATERIALS MARKET SNAPSHOT

9.2.1 NORTH AMERICA MARKET, BY TYPE

TABLE 43 NORTH AMERICA: FIRE STOPPING MATERIALS MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 44 NORTH AMERICA: MARKET SIZE, BY TYPE, 2020–2026 (USD MILLION)

9.2.2 NORTH AMERICA FIRE STOPPING MATERIALS MARKET, BY END–USE

TABLE 45 NORTH AMERICA: MARKET SIZE, BY END–USE, 2016–2019 (USD MILLION)

TABLE 46 NORTH AMERICA: MARKET SIZE, BY END–USE, 2020–2026 (USD MILLION)

9.2.3 NORTH AMERICA FIRE STOPPING MATERIALS MARKET, BY COUNTRY

FIGURE 40 US TO BE LARGEST MARKET FOR FIRE STOPPING MATERIALS IN NORTH AMERICA

TABLE 47 NORTH AMERICA: FIRE STOPPING MATERIALS MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 48 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

9.2.3.1 US

9.2.3.1.1 Increased emphasis on passive fire protection and certified fire protection experts driving US market

TABLE 49 US: FIRE STOPPING MATERIALS MARKET SIZE, BY END–USE, 2016–2019 (USD MILLION)

TABLE 50 US: MARKET SIZE, BY END–USE, 2020–2026 (USD MILLION)

9.2.3.2 Canada

9.2.3.2.1 Growth in each end–use segment positively influencing market in Canada

TABLE 51 CANADA: FIRE STOPPING MATERIALS MARKET SIZE, BY END–USE, 2016–2019 (USD MILLION)

TABLE 52 CANADA: MARKET SIZE, BY END–USE, 2020–2026 (USD MILLION)

9.2.3.3 Mexico

9.2.3.3.1 Increased government investment in industrial and commercial infrastructure to drive market

TABLE 53 MEXICO: FIRE STOPPING MATERIALS MARKET SIZE, BY END–USE, 2016–2019 (USD MILLION)

TABLE 54 MEXICO: MARKET SIZE, BY END–USE, 2020–2026 (USD MILLION)

9.3 EUROPE

FIGURE 41 EUROPE: FIRE STOPPING MATERIALS MARKET SNAPSHOT

9.3.1 EUROPE MARKET, BY TYPE

TABLE 55 EUROPE: FIRE STOPPING MATERIALS MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 56 EUROPE: MARKET SIZE, BY TYPE, 2020–2026 (USD MILLION)

9.3.2 EUROPE FIRE STOPPING MATERIALS MARKET, BY END–USE

TABLE 57 EUROPE: MARKET SIZE, BY END–USE, 2016–2019 (USD MILLION)

TABLE 58 EUROPE: FIRE STOPPING MATERIALS MARKET SIZE, BY END–USE, 2020–2026 (USD MILLION)

9.3.3 EUROPE MARKET, BY COUNTRY

FIGURE 42 UK ESTIMATED TO LEAD FIRE STOPPING MATERIALS MARKET IN EUROPE DURING FORECAST PERIOD

TABLE 59 EUROPE: MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 60 EUROPE: FIRE STOPPING MATERIALS MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

9.3.3.1 Germany

9.3.3.1.1 Presence of many global leaders and stringent building codes favor market growth

TABLE 61 GERMANY: FIRE STOPPING MATERIALS MARKET SIZE, BY END–USE, 2016–2019 (USD MILLION)

TABLE 62 GERMANY: MARKET SIZE, BY END–USE, 2020–2026 (USD MILLION)

9.3.3.2 UK

9.3.3.2.1 Increased construction activities and fire–safety awareness to drive demand

TABLE 63 UK: FIRE STOPPING MATERIALS MARKET SIZE, BY END–USE, 2016–2019 (USD MILLION)

TABLE 64 UK: MARKET SIZE, BY END–USE, 2020–2026 (USD MILLION)

9.3.3.3 France

9.3.3.3.1 Rapid economic growth to increase construction activities

TABLE 65 FRANCE: FIRE STOPPING MATERIALS MARKET SIZE, BY END–USE, 2016–2019 (USD MILLION)

TABLE 66 FRANCE: MARKET SIZE, BY END–USE, 2020–2026 (USD MILLION)

9.3.3.4 Italy

9.3.3.4.1 Growth in tourism industry and commercial construction to drive demand in Italy

TABLE 67 ITALY: FIRE STOPPING MATERIALS MARKET SIZE, BY END–USE, 2016–2019 (USD MILLION)

TABLE 68 ITALY: MARKET SIZE, BY END–USE, 2020–2026 (USD MILLION)

9.3.3.5 Russia

9.3.3.5.1 Nationwide growth in infrastructure driving market in Russia

TABLE 69 RUSSIA: FIRE STOPPING MATERIALS MARKET SIZE, BY END–USE, 2016–2019 (USD MILLION)

TABLE 70 RUSSIA: MARKET SIZE, BY END–USE, 2020–2026 (USD MILLION)

9.3.3.6 Spain

9.3.3.6.1 Increased demand from residential end–use industry to positively impact market in Spain

TABLE 71 SPAIN: FIRE STOPPING MATERIALS MARKET SIZE, BY END–USE, 2016–2019 (USD MILLION)

TABLE 72 SPAIN: MARKET SIZE, BY END–USE, 2020–2026 (USD MILLION)

9.3.3.7 Benelux

9.3.3.7.1 Increased investments in construction industry and growing tourism industry to boost demand for fire stopping materials

TABLE 73 BENELUX: FIRE STOPPING MATERIALS MARKET SIZE, BY END–USE, 2016–2019 (USD MILLION)

TABLE 74 BENELUX: MARKET SIZE, BY END–USE, 2020–2026 (USD MILLION)

9.3.3.8 Rest of Europe

TABLE 75 REST OF EUROPE: FIRE STOPPING MATERIALS MARKET SIZE, BY END–USE, 2016–2019 (USD MILLION)

TABLE 76 REST OF EUROPE: MARKET SIZE, BY END–USE, 2020–2026 (USD MILLION)

9.4 APAC

FIGURE 43 APAC: FIRE STOPPING MATERIALS MARKET SNAPSHOT

9.4.1 APAC MARKET, BY TYPE

TABLE 77 APAC: FIRE STOPPING MATERIALS MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 78 APAC: MARKET SIZE, BY TYPE, 2020–2026 (USD MILLION)

9.4.2 APAC FIRE STOPPING MATERIALS MARKET, BY END–USE

TABLE 79 APAC: MARKET SIZE, BY END–USE, 2016–2019 (USD MILLION)

TABLE 80 APAC: FIRE STOPPING MATERIALS MARKET SIZE, BY END–USE, 2020–2026 (USD MILLION)

9.4.3 APAC MARKET, BY COUNTRY

FIGURE 44 CHINA ESTIMATED TO LEAD FIRE STOPPING MATERIALS MARKET IN APAC DURING FORECAST PERIOD

TABLE 81 APAC: FIRE STOPPING MATERIALS MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 82 APAC: MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

9.4.3.1 China

9.4.3.1.1 Growing economy and ongoing infrastructural boom resulting in high market growth in China

FIGURE 45 CHINA LED IN NUMBER OF 300 METER OR TALLER BUILDINGS COMPLETED IN 2019

TABLE 83 CHINA: FIRE STOPPING MATERIALS MARKET SIZE, BY END–USE, 2016–2019 (USD MILLION)

TABLE 84 CHINA: MARKET SIZE, BY END–USE, 2020–2026 (USD MILLION)

9.4.3.2 Japan

9.4.3.2.1 Stringent fire safety rules positively impacting demand for fire stopping materials

TABLE 85 JAPAN: FIRE STOPPING MATERIALS MARKET SIZE, BY END–USE, 2016–2019 (USD MILLION)

TABLE 86 JAPAN: MARKET SIZE, BY END–USE, 2020–2026 (USD MILLION)

9.4.3.3 India

9.4.3.3.1 Increased emphasis on stringent fire safety codes spurring demand for fire stopping materials in India

TABLE 87 INDIA: FIRE STOPPING MATERIALS MARKET SIZE, BY END–USE, 2016–2019 (USD MILLION)

TABLE 88 INDIA: MARKET SIZE, BY END–USE, 2020–2026 (USD MILLION)

9.4.3.4 South Korea

9.4.3.4.1 Ongoing growth in construction industry acts as major market driver

TABLE 89 SOUTH KOREA: FIRE STOPPING MATERIALS MARKET SIZE, BY END–USE, 2016–2019 (USD MILLION)

TABLE 90 SOUTH KOREA: MARKET SIZE, BY END–USE, 2020–2026 (USD MILLION)

9.4.3.5 Indonesia

9.4.3.5.1 Increased spending on better building materials drive market in Indonesia

TABLE 91 INDONESIA: FIRE STOPPING MATERIALS MARKET SIZE, BY END–USE, 2016–2019 (USD MILLION)

TABLE 92 INDONESIA: MARKET SIZE, BY END–USE, 2020–2026 (USD MILLION)

9.4.3.6 Australia & New Zealand

9.4.3.6.1 Increased infrastructure projects to drive the fire stopping materials market

TABLE 93 AUSTRALIA & NEW ZEALAND: FIRE STOPPING MATERIALS MARKET SIZE, BY END–USE, 2016–2019 (USD MILLION)

TABLE 94 AUSTRALIA & NEW ZEALAND: MARKET SIZE, BY END–USE, 2020–2026 (USD MILLION)

9.4.3.7 Rest of APAC

9.4.3.7.1 Increased tourism drive market in Rest of APAC

TABLE 95 REST OF APAC: FIRE STOPPING MATERIALS MARKET SIZE, BY END–USE, 2016–2019 (USD MILLION)

TABLE 96 REST OF APAC: MARKET SIZE, BY END–USE, 2020–2026 (USD MILLION)

9.5 MIDDLE EAST & AFRICA

9.5.1 MIDDLE EAST & AFRICA FIRE STOPPING MATERIALS MARKET, BY TYPE

TABLE 97 MIDDLE EAST & AFRICA: MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 98 MIDDLE EAST & AFRICA: FIRE STOPPING MATERIALS MARKET SIZE, BY TYPE, 2020–2026 (USD MILLION)

9.5.2 MIDDLE EAST & AFRICA FIRE STOPPING MATERIALS MARKET, BY END–USE

TABLE 99 MIDDLE EAST & AFRICA: MARKET SIZE, BY END–USE, 2016–2019 (USD MILLION)

TABLE 100 MIDDLE EAST & AFRICA: FIRE STOPPING MATERIALS MARKET SIZE, BY END–USE, 2020–2026 (USD MILLION)

9.5.3 MIDDLE EAST & AFRICA MARKET, BY COUNTRY

TABLE 101 MIDDLE EAST & AFRICA: FIRE STOPPING MATERIALS MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 102 MIDDLE EAST & AFRICA: MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

9.5.3.1 South Africa

9.5.3.1.1 Economic growth after decades of political turmoil largely boosting market growth

TABLE 103 SOUTH AFRICA: FIRE STOPPING MATERIALS MARKET SIZE, BY END–USE, 2016–2019 (USD MILLION)

TABLE 104 SOUTH AFRICA: MARKET SIZE, BY END–USE, 2020–2026 (USD MILLION)

9.5.3.2 Rest of Middle East & Africa

9.5.3.2.1 Demand from industrial and commercial construction actives positively influencing market growth

TABLE 105 REST OF MIDDLE EAST & AFRICA: FIRE STOPPING MATERIALS MARKET SIZE, BY END–USE, 2016–2019 (USD MILLION)

TABLE 106 REST OF MIDDLE EAST & AFRICA: MARKET SIZE, BY END–USE, 2020–2026 (USD MILLION)

9.6 SOUTH AMERICA

9.6.1 SOUTH AMERICA FIRE STOPPING MATERIALS MARKET, BY TYPE

TABLE 107 SOUTH AMERICA: MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 108 SOUTH AMERICA: FIRE STOPPING MATERIALS MARKET SIZE, BY TYPE, 2020–2026 (USD MILLION)

9.6.2 SOUTH AMERICA MARKET, BY END–USE

TABLE 109 SOUTH AMERICA: FIRE STOPPING MATERIALS MARKET SIZE, BY END–USE, 2016–2019 (USD MILLION)

TABLE 110 SOUTH AMERICA: MARKET SIZE, BY END–USE, 2020–2026 (USD MILLION)

9.6.3 SOUTH AMERICA FIRE STOPPING MATERIALS MARKET, BY COUNTRY

TABLE 111 SOUTH AMERICA: MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 112 SOUTH AMERICA: FIRE STOPPING MATERIALS MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

9.6.3.1 Brazil

9.6.3.1.1 Significant increase in government spending on national infrastructure expected to drive market in Brazil

TABLE 113 BRAZIL: FIRE STOPPING MATERIALS MARKET SIZE, BY END–USE, 2016–2019 (USD MILLION)

TABLE 114 BRAZIL: MARKET SIZE, BY END–USE, 2020–2026 (USD MILLION)

9.6.3.2 Argentina

9.6.3.2.1 High demand for new constructions to act as market driver in Argentina

TABLE 115 ARGENTINA: FIRE STOPPING MATERIALS MARKET SIZE, BY END–USE, 2016–2019 (USD MILLION)

TABLE 116 ARGENTINA: MARKET SIZE, BY END–USE, 2020–2026 (USD MILLION)

9.6.3.3 Rest of South America

9.6.3.3.1 Economic growth to develop construction sector

TABLE 117 REST OF SOUTH AMERICA: FIRE STOPPING MATERIALS MARKET SIZE, BY END–USE, 2016–2019 (USD MILLION)

TABLE 118 REST OF SOUTH AMERICA: MARKET SIZE, BY END–USE, 2020–2026 (USD MILLION)

10 COMPETITIVE LANDSCAPE (Page No. - 147)

10.1 INTRODUCTION

10.2 STRATEGIES ADOPTED BY KEY PLAYERS

10.2.1 OVERVIEW OF STRATEGIES ADOPTED BY FIRE STOPPING MATERIAL MANUFACTURERS

10.3 MARKET SHARE ANALYSIS

10.3.1 RANKING OF KEY MARKET PLAYERS

FIGURE 46 RANKING OF TOP FIVE PLAYERS IN FIRE STOPPING MATERIALS MARKET, 2020

10.3.2 MARKET SHARE OF KEY PLAYERS, 2020

TABLE 119 FIRE STOPPING MATERIALS MARKET: DEGREE OF COMPETITION

FIGURE 47 FIRE STOPPING MATERIALS MARKET SHARE, BY COMPANY, 2020

10.3.2.1 Hilti Corporation

10.3.2.2 3M

10.3.2.3 Etex Group

10.3.2.4 Knauf Insulation GmbH

10.3.2.5 Specified Technologies Inc.

10.3.3 REVENUE ANALYSIS OF KEY MARKET PLAYERS, 2016–2020

FIGURE 48 REVENUE ANALYSIS OF KEY COMPANIES FOR PAST FIVE YEARS

10.4 COMPANY PRODUCT FOOTPRINT ANALYSIS

FIGURE 49 FIRE STOPPING MATERIALS MARKET: COMPANY PRODUCT FOOTPRINT

TABLE 120 MARKET: TYPE FOOTPRINT

TABLE 121 MARKET: END–USE FOOTPRINT

TABLE 122 MARKET: COMPANY REGION FOOTPRINT

10.5 COMPANY EVALUATION MATRIX (TIER 1)

10.5.1 STAR

10.5.2 EMERGING LEADER

10.5.3 PARTICIPANTS

FIGURE 50 FIRE STOPPING MATERIALS MARKET: COMPANY EVALUATION MATRIX, 2020

10.6 START–UP/SMALL AND MEDIUM–SIZED ENTERPRISES (SMES) EVALUATION MATRIX

10.6.1 RESPONSIVE COMPANIES

10.6.2 STARTING BLOCKS

FIGURE 51 START–UP/SMES EVALUATION MATRIX FOR FIRE STOPPING MATERIALS MARKET

10.7 COMPETITIVE SITUATIONS AND TRENDS

10.7.1 NEW PRODUCT LAUNCHES

TABLE 123 FIR STOPPING MATERIALS MARKET: NEW PRODUCT LAUNCHES, JANUARY 2019 TO DECEMBER 2020

10.7.2 DEALS

TABLE 124 FIRE STOPPING MATERIALS MARKET: DEALS, JANUARY 2020 TO DECEMBER 2020

11 COMPANY PROFILES (Page No. - 160)

11.1 MAJOR PLAYERS

(Business Overview, Products Offered, Winning imperatives, MnM view, Key strengths/right to win, Strategic choices made, Weakness/competitive threats)*

11.1.1 HILTI CORPORATION

FIGURE 52 HILTI CORPORATION: COMPANY SNAPSHOT

TABLE 125 HILTI CORPORATION: BUSINESS OVERVIEW

FIGURE 53 HILTI CORPORATION: WINNING IMPERATIVES

11.1.2 3M

FIGURE 54 3M: COMPANY SNAPSHOT

TABLE 126 3M: BUSINESS OVERVIEW

FIGURE 55 3M: WINNING IMPERATIVES

11.1.3 MORGAN ADVANCED MATERIALS

FIGURE 56 MORGAN ADVANCED MATERIALS: COMPANY SNAPSHOT

TABLE 127 MORGAN ADVANCED MATERIALS: BUSINESS OVERVIEW

FIGURE 57 MORGAN ADVANCED MATERIALS: WINNING IMPERATIVES

11.1.4 SPECIFIED TECHNOLOGIES INC.

TABLE 128 SPECIFIED TECHNOLOGIES INC.: BUSINESS OVERVIEW

FIGURE 58 SPECIFIED TECHNOLOGIES INC.: WINNING IMPERATIVES

11.1.5 ETEX GROUP

FIGURE 59 ETEX GROUP: COMPANY SNAPSHOT

TABLE 129 ETEX GROUP: BUSINESS OVERVIEW

FIGURE 60 ETEX GROUP: WINNING IMPERATIVES

11.1.6 RPM INTERNATIONAL INC.

FIGURE 61 RPM INTERNATIONAL INC.: COMPANY SNAPSHOT

TABLE 130 RPM INTERNATIONAL INC.: BUSINESS OVERVIEW

FIGURE 62 RPM INTERNATIONAL INC.: WINNING IMPERATIVES

11.1.7 BASF SE

FIGURE 63 BASF SE: COMPANY SNAPSHOT

TABLE 131 BASF SE: BUSINESS OVERVIEW

FIGURE 64 BASF SE: WINNING IMPERATIVES

11.1.8 KNAUF INSULATION GMBH

TABLE 132 KNAUF INSULATION GMBH: BUSINESS OVERVIEW

11.1.9 SIKA AG

FIGURE 65 SIKA AG: COMPANY SNAPSHOT

TABLE 133 SIKA AG: BUSINESS OVERVIEW

11.1.10 RECTORSEAL CORPORATION

TABLE 134 RECTORSEAL CORPORATION: BUSINESS OVERVIEW

11.2 OTHER KEY MARKET PLAYERS

11.2.1 ROLF KUHN GMBH (GERMANY)

TABLE 135 ROLF KUHN GMBH: BUSINESS OVERVIEW

11.2.2 SUPREMEX EQUIPMENTS

TABLE 136 SUPREMEX EQUIPMENTS: BUSINESS OVERVIEW

11.2.3 WALRAVEN

TABLE 137 WALRAVEN: BUSINESS OVERVIEW

11.2.4 TENMAT LTD.

TABLE 138 TENMAT LTD.: BUSINESS OVERVIEW

11.2.5 EVERKEM DIVERSIFIED PRODUCTS

TABLE 139 EVERKEM DIVERSIFIED PRODUCTS: BUSINESS OVERVIEW

11.2.6 ENCON INSULATION LTD.

TABLE 140 ENCON INSULATION LTD.: BUSINESS OVERVIEW

11.2.7 ABESCO FIRE LTD.

TABLE 141 ABESCO FIRE LTD.: BUSINESS OVERVIEW

11.2.8 LLOYD INSULATIONS (INDIA) LTD.

TABLE 142 LLOYD INSULATIONS (INDIA) LTD.: BUSINESS OVERVIEW

11.2.9 SAINT–GOBAIN GROUP

TABLE 143 SAINT–GOBAIN GROUP: BUSINESS OVERVIEW

11.2.10 DEN BRAVEN

TABLE 144 DEN BRAVEN: BUSINESS OVERVIEW

11.2.11 HOLDRITE

TABLE 145 HOLDRITE: BUSINESS OVERVIEW

11.2.12 UNIQUE FIRE STOP PRODUCTS INC.

TABLE 146 UNIQUE FIRE STOP PRODUCTS INC.: BUSINESS OVERVIEW

11.2.13 FIRESEALS DIRECT

TABLE 147 FIRESEALS DIRECT: BUSINESS OVERVIEW

11.2.14 FISCHERWERKE GMBH & CO. KG

TABLE 148 FISCHERWERKE GMBH & CO. KG: BUSINESS OVERVIEW

11.2.15 ROCKWOOL INTERNATIONAL AS

TABLE 149 ROCKWOOL INTERNATIONAL AS: BUSINESS OVERVIEW

*Details on Business Overview, Products Offered, Winning imperatives, MnM view, Key strengths/right to win, Strategic choices made, Weakness/competitive threats might not be captured in case of unlisted companies.

12 ADJACENT & RELATED MARKETS (Page No. - 194)

12.1 INTRODUCTION

12.2 LIMITATION

12.3 CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET

12.3.1 MARKET DEFINITION

12.3.2 MARKET OVERVIEW

12.4 CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS, BY REGION

TABLE 150 CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET SIZE, BY REGION, 2018–2025 (THOUSAND LITER)

TABLE 151 CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

12.4.1 NORTH AMERICA

12.4.1.1 By country

TABLE 152 NORTH AMERICA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY COUNTRY, 2018–2025 (THOUSAND LITER)

TABLE 153 NORTH AMERICA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

12.4.1.2 By type

TABLE 154 NORTH AMERICA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2018–2025 (THOUSAND LITER)

TABLE 155 NORTH AMERICA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2018–2025 (USD MILLION)

12.4.1.3 By End–use

TABLE 156 NORTH AMERICA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY END–USE, 2018–2025 (THOUSAND LITER)

TABLE 157 NORTH AMERICA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY END–USE, 2018–2025 (USD MILLION)

12.4.2 EUROPE

12.4.2.1 By country

TABLE 158 EUROPE: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY COUNTRY, 2018–2025 (THOUSAND LITER)

TABLE 159 EUROPE: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

12.4.2.2 By type

TABLE 160 EUROPE: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2018–2025 (THOUSAND LITER)

TABLE 161 EUROPE: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2018–2025 (USD MILLION)

12.4.2.3 By End–use

TABLE 162 EUROPE: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY END–USE, 2018–2025 (THOUSAND LITER)

TABLE 163 EUROPE: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY END–USE, 2018–2025 (USD MILLION)

12.4.3 APAC

12.4.3.1 By country

TABLE 164 APAC: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY COUNTRY, 2018–2025 (THOUSAND LITER)

TABLE 165 APAC: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

12.4.3.2 By type

TABLE 166 APAC: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2018–2025 (THOUSAND LITER)

TABLE 167 APAC: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2018–2025 (USD MILLION)

12.4.3.3 By End–use

TABLE 168 APAC: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY END–USE, 2018–2025 (THOUSAND LITER)

TABLE 169 APAC: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY END–USE, 2018–2025 (USD MILLION)

12.4.4 MIDDLE EAST & AFRICA

12.4.4.1 By country

TABLE 170 MIDDLE EAST & AFRICA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY COUNTRY, 2018–2025 (THOUSAND LITER)

TABLE 171 MIDDLE EAST & AFRICA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

12.4.4.2 By type

TABLE 172 MIDDLE EAST & AFRICA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2018–2025 (THOUSAND LITER)

TABLE 173 MIDDLE EAST & AFRICA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2018–2025 (USD MILLION)

12.4.4.3 By End–use

TABLE 174 MIDDLE EAST & AFRICA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY END–USE, 2018–2025 (THOUSAND LITER)

TABLE 175 MIDDLE EAST & AFRICA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY END–USE, 2018–2025 (USD MILLION)

12.4.5 SOUTH AMERICA

12.4.5.1 By country

TABLE 176 SOUTH AMERICA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY COUNTRY, 2018–2025 (THOUSAND LITER)

TABLE 177 SOUTH AMERICA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

12.4.5.2 By type

TABLE 178 SOUTH AMERICA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2018–2025 (THOUSAND LITER)

TABLE 179 SOUTH AMERICA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2018–2025 (USD MILLION)

12.4.5.3 By End–use

TABLE 180 SOUTH AMERICA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY END–USE, 2018–2025 (THOUSAND LITER)

TABLE 181 SOUTH AMERICA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY END–USE, 2018–2025 (USD MILLION)

13 APPENDIX (Page No. - 208)

13.1 DISCUSSION GUIDE

13.2 KNOWLEDGE STORE: MARKETSANDMARKETS SUBSCRIPTION PORTAL

13.3 AVAILABLE CUSTOMIZATIONS

13.4 RELATED REPORTS

13.5 AUTHOR DETAILS

The study involved four major activities to estimate the market size for fire stopping materials. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, the market breakdown and data triangulation procedures were used to estimate the market size of the segments and subsegments.

Fire Stopping Materials Market Secondary Research

Secondary sources used in this study included annual reports, press releases, and investor presentations of companies; white papers; certified publications; articles from recognized authors; and gold standard & silver standard websites such as Factiva, ICIS, Bloomberg, and others. Findings of this study were verified through primary research by conducting extensive interviews with key officials such as CEOs, VPs, directors, and other executives.

Fire Stopping Materials Market Primary Research

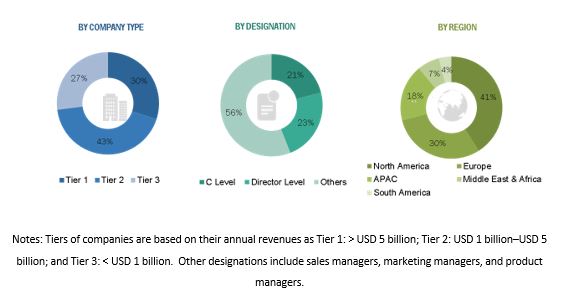

The fire stopping materials market comprises several stakeholders such as raw material suppliers, manufacturers, and regulatory organizations in the supply chain. The demand side of this market is characterized by the development in end-use industries such as automotive, power generation, construction, and others. The supply side is characterized by advancements in technology and diverse application industries. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. The breakdown of profiles of the primary interviewees is illustrated in the figure below:

To know about the assumptions considered for the study, download the pdf brochure

Fire Stopping Materials Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the fire stopping materials market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

The key players in the industry have been identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size-using the market size estimation processes as explained above-the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Fire Stopping Materials Market Report Objectives

- To analyze and forecast the size of the fire stopping materials market, in terms of value

- To provide detailed information regarding key factors, such as drivers, restraints, and opportunities influencing the growth of the market

- To define, describe, and segment the fire stopping materials market on the basis of type and application

- To forecast the size of the market segments for regions such as APAC, North America, Europe, South America, and the Middle East & Africa

- To strategically analyze the segmented markets with respect to individual growth trends, prospects, and contribution to the overall market

- To identify and analyze opportunities for stakeholders in the market

- To analyze competitive developments such as new product launch, merger & acquisition in the fire stopping materials market

- To strategically profile key players and comprehensively analyze their core competencies

Fire Stopping Materials Market Report Available Customizations

Along with the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Fire Stopping Materials Market Regional Analysis

- Further breakdown of a region with respect to a particular country or additional application

Fire Stopping Materials Market Company Information

- Detailed analysis and profiles of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Fire Stopping Materials Market