Fire Protection System Testing, Inspection, and Certification (TIC) Market by Service Type (Testing, Inspection, Certification), System Type (Fire Alarm Devices, Fire Detection Systems, Sprinkler Systems), Application and Region - Global Forecast to 2028

Updated on : October 23, 2024

Fire Protection System Testing, Inspection, and Certification (TIC) Market Size & Growth

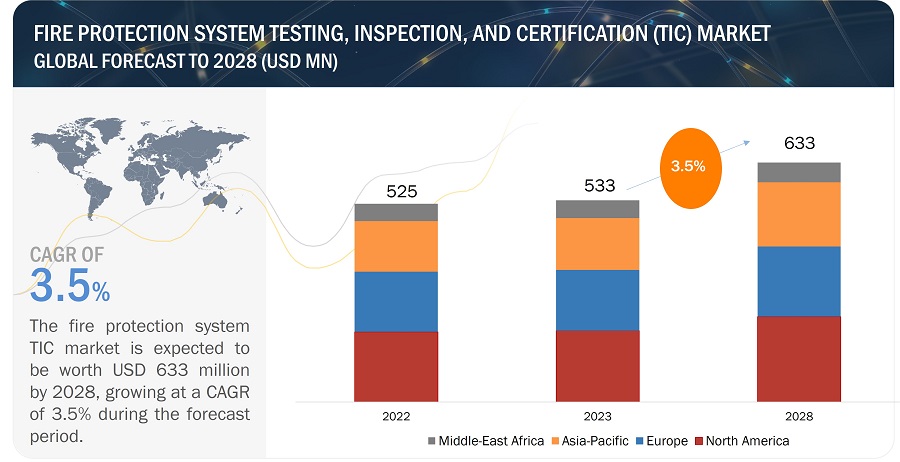

The global fire protection system testing, inspection, and certification (TIC) market size was valued at USD 533 million in 2023 and is projected to reach USD 633 million by 2028; growing at a CAGR of 3.5% during the forecast period from 2023 to 2029.

Growing urbanization driving the growth of the construction industry, growing human life and property loss owing to fire breakouts, strict government regulations pertaining to fire protection are among the key factors driving the growth of fire protection system TIC market.

Fire Protection System Testing, Inspection, and Certification (TIC) Market Size Forecast to 2028

To know about the assumptions considered for the study, Request for Free Sample Report

Fire Protection System Testing, Inspection, and Certification (TIC) Market Trends and Dynamics:

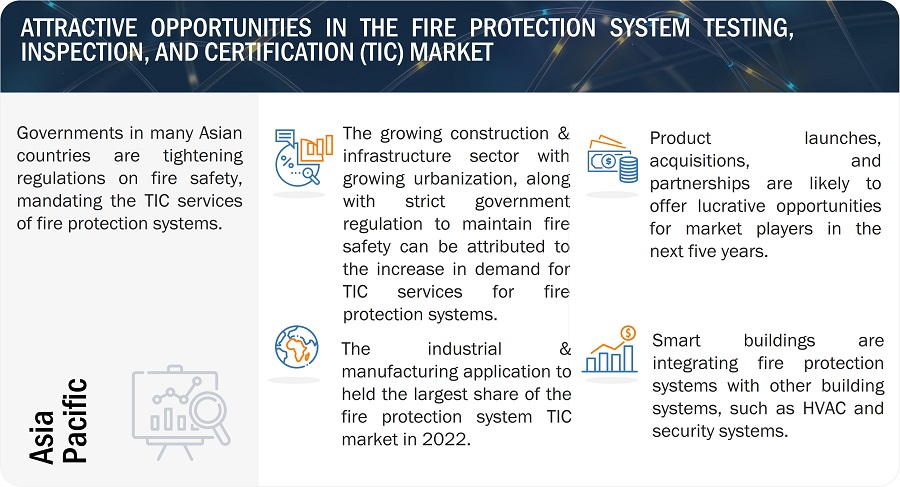

Driver: Growing urbanization will drive the growth of the construction industry

The construction industry is becoming larger and complex. According to the Global Construction Perspective, the global construction market is expected to grow to USD 8 trillion by 2030. This growth will be driven by the US, China, and India. Growth in construction industry in the US is attributed to the high demand for housing and commercial places. The construction industry in APAC and Europe is expected to grow significantly over the next few years, driven by the increasing infrastructure spending in both regions despite the challenges in the financial market. Rising urbanization in emerging markets such as China, India, Indonesia, and Nigeria is anticipated to accelerate infrastructure spending for vital infrastructure sectors, including transportation, water & wastewater treatment, and power. This, in turn, will urge infrastructure financing toward consumer sectors, including manufacturing and transportation, which facilitate producing and distributing raw materials for consumer goods. Growth in new and retrofit infrastructure has heavily boosted the construction industry in developing countries. With new development plans and projects, the use of construction equipment is also growing. In the construction industry, there have been tremendous advancements in facility management in developing nations over the past several years, especially in the area of building automation. Installation of fire protection systems in buildings has become common, as these systems are useful in detecting, containing, and extinguishing fires at an early stage. Advanced technologies have been developed for communicating during fires, which enables quick deployment of response teams to the affected site.

Further, the construction industry is now focusing on connected construction technology, it is defined as an ecosystem of connected job sites, workers and machines that promotes operational effectiveness and safety of related assets, property, and workplace workers. In this connected construction technology, the sensors and tags link with job sites, machines, and workers, helps to provide the real-time visibility and analytical capabilities to the manager. Hence, as the technological development are rising in this industry and owing to the growth, the demand for fire protection systems will also increase.

Restraint: Lack of global testing, inspection, and certification standards and relaxation of certification norms offered to SMEs by some government authorities

Testing, inspection, and certification standards for end-use applications and end-user industries differ from country to country. Thus, the lack of global standards affects market growth. Different countries are known for the export and import of different items. For instance, the textile industry in India has higher exports and imports than other countries; therefore, India is witnessing a surging demand for testing, inspection, and certification services for textile applications in the country. The testing, inspection, and certification (TIC) market growth is driven by companies who strictly want to adhere to defined standards, and the growth is hampered when the country has relaxed norms pertaining to import and export. Small to medium-sized testing, inspection, and certification companies face challenges in terms of receiving accreditation due to the requirement for huge capital. Additionally, each country has different certification standards. For instance, the US and China have more certification standards for electronics, while Europe has a high number of certification standards for the automotive sector. Also, the Middle East and Europe have a high number of certification standards for oil & gas industries. Many times, this creates conflict between local and international standards, thereby hindering the market growth.

Opportunity: Adoption of foam-based fire detection systems owing to less negative impact on the environment

The foam-based fire protection system is an aggregate of air-filled bubbles, which is formed from aqueous solutions, and has the lower density than the other flammable liquids. This foam-based system is mainly used to design a coherent floating blanket on flammable and combustible liquids to prevent the fires by excluding air and cooling the fuel. Further, this system also helps to prevent the re-ignition by suppressing the formation of flammable vapours, and it sticks to the surfaces, providing protection from adjacent fires. Foam based fir detection system can be used as fire control, prevention, or extinguishing agent for processing industrial areas like refineries, oil & gas, and commercial area.

The benefits of foam-based fire detection systems include they are quite efficient and effective when used correctly. They have very minimum negative impact on environmental. Moreover, the foaming agent in this system can be readily biodegradable in natural environments and sewage treatment facilities. Foam based fire suppression systems can cover larger areas, filling a huge warehouse for example, in mere seconds. These systems are considered as an ideal if we need an extinguishing agent to dump and expand to cover a huge area fast. In addition, foam-based suppression systems are considered as more cost effective from both an installation and maintenance point of view. Hence, their demand is growing so rapidly in the testing, inspection, and certification (TIC) market.

Challenge: Low adoption rate of innovative technologies in fire protection system TIC services

The sluggish adoption of innovative technologies in fire protection system Testing, Inspection, and Certification (TIC) services can be attributed to cost concerns, as these advanced solutions can require significant upfront investments. Additionally, the industry's conservative nature and stringent safety regulations and standards create a reluctance to change well-established practices. Limited awareness and understanding of the benefits of emerging technologies also hinder adoption. To address this, stakeholders should be educated about the advantages, including improved efficiency, accuracy, and safety, that these innovations can bring to fire protection systems, ultimately encouraging their wider integration into TIC services.

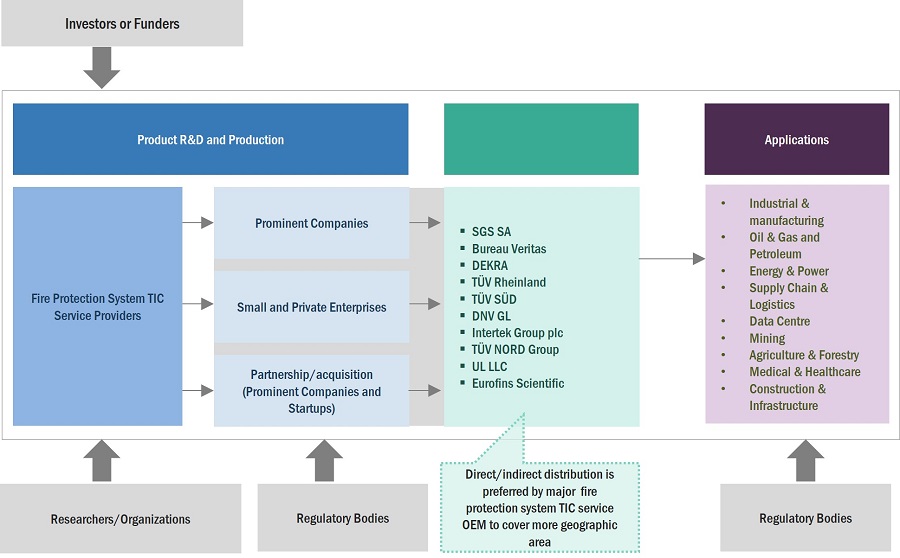

Fire protection system testing, inspection, and certification (TIC) Market Ecosystem

Prominent companies in the fire protection system testing, inspection, and certification (TIC) market include well-established, financially stable providers of fire protection system testing, inspection, and certification (TIC) services. These companies have been operating in the market for several years and possess a diversified product portfolio, state-of-the-art technologies, and strong global sales and marketing networks. Prominent companies in this market include SGS SA (Switzerland), Bureau Veritas (France), DEKRA (Germany), TÜV SÜD (Germany), TÜV Rheinland (Germany), DNV GL (Norway), Intertek Group plc (UK), TÜV NORD Group (Germany), UL LLC (US), Eurofins Scientific (Luxembourg), Kiwa (Netherlands), and APi National Service Group (APi NSG) (US).

Fire Protection System Testing, Inspection, and Certification (TIC) Market Segmentation

By services, the testing segment is expected to have the largest market share from 2023 to 2028

During the forecast period, testing services within the Fire Protection System Testing, Inspection, and Certification (TIC) market are anticipated to secure the largest testing, inspection, and certification (TIC) market share. This prominence is driven by several factors, including the increasing emphasis on proactive fire safety measures, stringent regulatory requirements, and growing awareness among industries and facility owners about the critical need to ensure their fire protection systems' proper functioning and reliability. Testing services play a pivotal role in assessing the performance of fire safety equipment, identifying potential issues, and verifying compliance with safety codes and standards. As a result, businesses and organizations are likely to prioritize regular testing to maintain the integrity of their fire protection systems, thus driving the demand for testing services and contributing to their dominant market share within the Fire Protection System TIC sector.

By Application, the oil & gas and petroleum segment is likely to grow at the highest CAGR between 2023 and 2028.

In Fire Protection System Testing, Inspection, and Certification (TIC) environment, the oil & gas and petroleum industry is poised to experience the highest Compound Annual Growth Rate (CAGR) during the forecast period. This ascent is driven by the industry's strict regulatory environment, characterized by the imperative need to adhere to rigorous safety standards and regulations to avert potentially catastrophic fire-related incidents. Given the inherently high-risk nature of oil refineries, drilling platforms, petrochemical plants, and storage facilities, comprehensive fire protection systems are indispensable for safeguarding lives, assets, and the environment. As these facilities house invaluable assets and operate in environments prone to fire hazards, a commitment to regular TIC services becomes paramount to ensure compliance and fortify asset protection and foster a culture of safety investment within the industry.

Fire Protection System Testing, Inspection, and Certification (TIC) Industry Regional Analysis

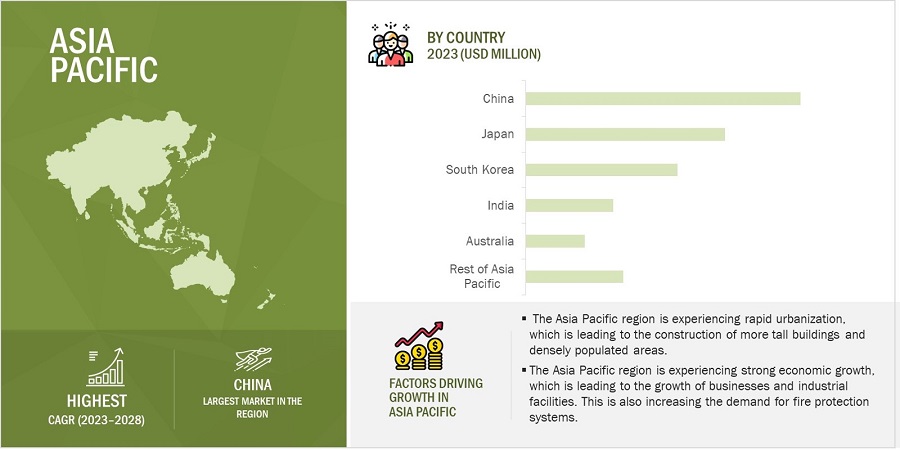

Asia Pacific region is likely to experience the highest growth in the overall fire protection system testing, inspection, and certification (TIC) market during the forecast period

Fire Protection System Testing, Inspection, and Certification (TIC) Market by Region

To know about the assumptions considered for the study, download the pdf brochure

During the forecast period, the Asia Pacific region is expected to experience the highest testing, inspection, and certification (TIC) market growth rate in the Fire Protection System Testing, Inspection, and Certification (TIC) industry. This growth can be attributed to several factors, including rapid urbanization, increased construction activities, and heightened awareness of fire safety regulations in countries across the region. As more buildings and infrastructure projects are developed, there is a growing demand for comprehensive fire protection services to ensure compliance with safety standards. Additionally, efforts to modernize and upgrade existing fire protection systems in established urban areas further contribute to the increasing demand for TIC services. The Asia Pacific's economic growth and emphasis on safety measures are expected to drive the expansion of the fire protection system testing, inspection, and certification (TIC) market in the region, making it a key growth area within the global fire protection industry.

Top Fire Protection System Testing, Inspection, and Certification (TIC) Companies - Key Market Players

- SGS SA (Switzerland),

- Bureau Veritas (France),

- DEKRA (Germany),

- TÜV SÜD (Germany),

- TÜV Rheinland (Germany),

- DNV GL (Norway),

- Intertek Group plc (UK),

- TÜV NORD Group (Germany),

- UL LLC (US) are some of the key players in the fire protection system testing, inspection, and certification (TIC) companies.

Fire Protection System Testing, Inspection, and Certification (TIC) Market Report Scope

|

Report Metric |

Details |

|

Estimated Market Size |

USD 533 million in 2023 |

|

Expected Market Size |

USD 633 million by 2028 |

|

Growth Rate |

CAGR of 3.5% |

|

Market Size Availability for Years |

2019–2028 |

|

Base Year |

2022 |

|

Forecast Period |

2023–2028 |

|

Forecast Units |

Value (USD Million) |

|

Segments Covered |

By service type, system type, application, and region |

|

Geographies Covered |

North America, Europe, Asia Pacific, and Rest of the World |

|

Companies Covered |

SGS SA (Switzerland), Bureau Veritas (France), DEKRA (Germany), TÜV SÜD (Germany), and TÜV Rheinland (Germany) More than 25 companies profiled |

Fire Protection System Testing, Inspection, and Certification (TIC) Market Highlights

This research report categorizes the fire protection system testing, inspection, and certification (TIC) market share based on service type, system type, application, and region.

|

Segment |

Subsegment |

|

By Service Type: |

|

|

By System Type: |

|

|

By Application: |

|

|

By Region: |

|

Recent Developments in Fire Protection System Testing, Inspection, and Certification (TIC) Industry

- In June 2023, DEKRA launched its inaugural suite of Artificial Intelligence (AI) Testing and Certification services, aimed at aiding clients in safeguarding the safety and security of their AI-driven products and services. The burgeoning AI field is demonstrating significant potential, swift growth prospects, and market feasibility.

- In January 2023, TÜV Rheinland acquired ABB’s UK technical engineering consultancy, a part of ABB’s Energy Industries division. This component will be incorporated into TÜV Rheinland's UK Industrial Services & Cybersecurity division.

- In December 2022, Intertek Group plc launched the Intertek Green R&D, a cutting-edge integrated solution that guarantees a product's sustainability, quality, and safety qualities.

- In November 2022, Using state-of-the-art technologies, SGS SA’s Harfleur laboratory in France offers world-class hydrogen testing capabilities to guarantee hydrogen (H2) purity compliance. These services will help companies manage industrial risks and hydrogen quality.

- In April 2022, ioMosaic (US), a leading provider of process safety solutions (PSS), collaborated with TÜV SÜD for risk management and process safety services. Under this collaboration, the clients of these organizations will receive a larger bundle of services, digital applications, expanded laboratory capacity & training options, and enhanced training expertise.

Frequently Asked Questions (FAQs):

Which are the major companies in the fire protection system testing, inspection, and certification (TIC) market? What are their major strategies to strengthen their market presence?

The major companies in the fire protection system testing, inspection, and certification (TIC) market are – SGS SA (Switzerland), Bureau Veritas (France), DEKRA (Germany), TÜV SÜD (Germany), and TÜV Rheinland (Germany), DNV GL (Norway), Intertek Group plc (UK), TÜV NORD Group (Germany), UL LLC (US), Eurofins Scientific (Luxembourg), Kiwa (Netherlands), APi National Service Group (APi NSG) (US), Applus+ (Spain), Element Materials Technology (UK), and SAI Global Australia PTY Ltd (Australia). The major strategies adopted by these players are product launches and developments.

What are the new opportunities for emerging players in the fire protection system testing, inspection, and certification (TIC) market?

New opportunities in the fire protection system testing, inspection, and certification (TIC) market include leveraging emerging technologies like IoT and AI for predictive maintenance, addressing sustainability with eco-friendly fire protection solutions, enhancing cybersecurity for interconnected systems, offering remote inspection services, emphasizing energy efficiency, ensuring compliance with evolving regulations, utilizing data analytics for system optimization, providing education and training programs, exploring specialized niches, and expanding into emerging markets. These opportunities arise from the growing complexity of fire protection systems, the need for innovation, and the industry's changing landscape of regulations and technologies. Companies embracing these trends can position themselves for growth and success in the evolving TIC market.

Which Application is likely to drive the fire protection system testing, inspection, and certification (TIC) market growth in the next five years?

The demand for fire protection system testing, inspection, and certification (TIC) services is expected to be significantly driven by the oil & gas and petroleum industry applications. This sector relies heavily on complex and critical fire safety systems to mitigate the risk of fire-related incidents, protect assets, and ensure the safety of personnel. Stringent regulations and safety standards in the oil & gas sector necessitate regular TIC services to verify the integrity and compliance of fire protection systems, including fire detection, suppression, and emergency response mechanisms. As the oil & gas industry continues to expand globally, particularly in regions like Asia and the Middle East, the need for TIC services to ensure the reliability and effectiveness of fire protection systems in this sector is poised to remain robust, contributing to the market's growth.

Which region will likely offer lucrative growth for the fire protection system testing, inspection, and certification (TIC) market by 2030?

Asia Pacific is widely recognized as one of the most promising and potential markets for the fire protection system testing, inspection, and certification (TIC) industry. Several factors contribute to this assessment, including rapid urbanization, increased construction activities, and a growing emphasis on regional fire safety regulations. As more infrastructure projects and urban developments emerge, there is a heightened demand for comprehensive TIC services to ensure compliance with safety standards. Moreover, the region's economic growth, expanding middle-class population, and rising awareness of fire safety issues create a fertile ground for the TIC market's growth. These factors collectively position Asia Pacific as a key global fire protection (TIC) market growth area.

Which factors are expected to boost fire protection system TIC market in the next 5-6 years?

Over the next 5-6 years, the fire protection system testing, inspection, and certification (TIC) market is anticipated to experience growth due to the enforcement of stricter fire safety regulations, increased urbanization driving demand for certified fire protection systems in construction, and expanding industrial sectors requiring reliable fire safety measures, all of which will fuel the need for TIC services in ensuring compliance and safety standards.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Stringent government regulations to ensure product safety and environmental protection- Rising need for interoperability testing due to IoT deployment- Increasing trade in counterfeit & defective pharmaceutical products- Growing focus on manufacturing high-quality productsRESTRAINTS- Complexities associated with government authorities for global standards- High cost of TIC services due to geographical diversityOPPORTUNITIES- Rising focus on digitalization to improve customer experience- Increasing importance of food safety & hygiene- Growing adoption of AI and ML worldwideCHALLENGES- Low adoption rate of innovative technologies

- 5.3 VALUE CHAIN ANALYSIS

-

5.4 TESTING, INSPECTION, AND CERTIFICATION MARKET ECOSYSTEM

-

5.5 PRICING ANALYSIS: AVERAGE SELLING PRICE TRENDAVERAGE SELLING PRICE OF CERTIFICATION SERVICES OFFERED BY KEY PLAYERS

-

5.6 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

-

5.7 TECHNOLOGY ANALYSISSUBSTITUTE TECHNOLOGYAUTOMATION TESTING TECHNOLOGY

-

5.8 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSCOMPETITIVE RIVALRY

-

5.9 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

-

5.10 CASE STUDY ANALYSISTESTING, INSPECTION, AND CERTIFICATION SERVICES FOR A FOOD MANUFACTURING COMPANYTESTING, INSPECTION, AND CERTIFICATION SERVICES FOR A CLEANING AND DISINFECTION SERVICE PROVIDERTESTING, INSPECTION, AND CERTIFICATION SERVICES FOR ENERGY INDUSTRYTESTING, INSPECTION, AND CERTIFICATION SERVICES FOR OFFSHORE WIND ENERGY SYSTEM

- 5.11 TRADE ANALYSIS

-

5.12 PATENT ANALYSIS

- 5.13 KEY CONFERENCES AND EVENTS (2023–2025)

-

5.14 REGULATORY LANDSCAPEREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.1 INTRODUCTION

-

6.2 TESTINGRISING REQUIREMENT FOR MEDICAL DEVICE TESTING TO FUEL MARKET

-

6.3 INSPECTIONSURGE IN DEMAND FOR ESSENTIAL COMMODITIES TO DRIVE FIRE PROTECTION TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET

-

6.4 CERTIFICATIONRISING NEED FOR PRODUCT MARKETABILITY TO SUPPORT MARKET

- 6.5 OTHERS

- 7.1 INTRODUCTION

-

7.2 IN-HOUSE SERVICESHIGH UTILIZATION IN MINING AND LIFE SCIENCE APPLICATIONS TO DRIVE MARKET

-

7.3 OUTSOURCED SERVICESHIGH-QUALITY ASSURANCE AND COST-EFFICIENCY TO FUEL MARKET

- 8.1 INTRODUCTION

-

8.2 CONSUMER GOODS AND RETAILPERSONAL CARE AND BEAUTY PRODUCTS- Increased manufacturing of beauty products to drive uptake of TIC servicesHARD GOODS- Advanced technological developments in household appliances to fuel uptake of inspection servicesSOFTLINES AND ACCESSORIES- Rising focus on consumer satisfaction with provision of high-quality products to drive marketTOYS AND JUVENILE PRODUCTS- Adoption of toxicological evaluation testing for product marketability in toys to drive marketELECTRICAL AND ELECTRONICS- Implementation of new hazard-based standards to drive uptake of TIC servicesOTHERS

-

8.3 AGRICULTURE AND FOODSEEDS AND CROPS- Adoption of seed-borne disease testing and viable testing for crop quality assessment to support market growthFERTILIZERS- Advent of digitalized fertilizer services to support market growthFOOD- Increasing demand for certified food products to fuel uptake of testing servicesMEAT- Rising cases of adulterating meat to fuel uptake of testing servicesFORESTRY- Stringent regulatory standards for sustainability and environmental protection to drive marketCOMMODITIES- Focus on agro-commodities testing to support market growthOTHERS

-

8.4 CHEMICALSASSET INTEGRITY MANAGEMENT SERVICES- Rising need for risk management services to drive marketPROJECT LIFECYCLE SERVICES- Demand for pre-shipment inspection services to support market growthFINISHED PRODUCT SERVICES- Utilization of raw material testing in products to support market growthCHEMICAL FEEDSTOCK SERVICES- Adoption of acid & alkaline tests in chemical products to drive marketOTHERS

-

8.5 CONSTRUCTION AND INFRASTRUCTUREPROJECT MANAGEMENT SERVICES- Digital transformation for new infrastructure to fuel uptake of inspection servicesMATERIAL SERVICES- Adoption of material testing for quality standards to drive marketCONSTRUCTION MACHINERY AND EQUIPMENT SERVICES- Rising focus on safety and efficiency of construction machinery & equipment to drive marketFACILITIES MANAGEMENT AND INSPECTION SERVICES- Implementation of maintenance & inspection systems for infrastructure safety to drive marketOTHERS

-

8.6 ENERGY AND POWERENERGY SOURCES- Increasing government incentives on renewable energy projects to drive market- Nuclear- Wind- Solar- Alternative fuels- Fuel oil & gases- CoalPOWER GENERATION- Growing focus on achieving optimal energy management to support market growthPOWER DISTRIBUTION- Rising need for reliable power distribution to fuel uptake of inspection servicesASSET INTEGRITY MANAGEMENT SERVICES- Assurance of technical integrity of assets to fuel uptake of inspection servicesPROJECT LIFECYCLE SERVICES- Ability to provide sustainable products with adherence to international quality standards to drive marketOTHERS

-

8.7 INDUSTRIAL AND MANUFACTURINGSUPPLIER-RELATED SERVICES- Rising need for high-utility performance of machinery & equipment to drive marketPRODUCTION AND PRODUCT-RELATED SERVICES- Growing focus on efficient product manufacturing to support market growthPROJECT-RELATED SERVICES- Rising demand for risk management services to drive marketOTHERS

-

8.8 MEDICAL AND LIFE SCIENCESMEDICAL DEVICES- Increasing development of innovative medical devices to drive demand for TIC servicesHEALTH, BEAUTY, AND WELLNESS- Strict regulations and standards for wellness and beauty products owing to public safety to fuel marketCLINICAL SERVICES- Adoption of biosimilar testing services for clinical trial management to support market growthLABORATORY SERVICES- Mandates by regulatory bodies for stringent testing of biopharmaceutical products & vaccines to fuel marketBIOPHARMACEUTICAL & PHARMACEUTICAL SERVICES- Increasing need for GVP measures following EU mandates to drive marketOTHERS

-

8.9 MININGINSPECTION & SAMPLING SERVICES- Strict trade regulations imposed by various countries to support market growthEXPLORATION SERVICES- Increasing exploration activities for sustainable development to support market growthMETALLURGY AND PROCESS DESIGN SERVICES- Demand for risk management services during metallurgy assessments to support market growthPRODUCTION AND PLANT SERVICES- Utilization of equipment optimization services for efficient operations to drive marketANALYTICAL SERVICES- Wide applications in mining industry to fuel uptake of testing servicesSITE OPERATION AND CLOSURE SERVICES- Sustainable process designing services for compliance with social & environmental standards to drive marketPROJECT RISK ASSESSMENT AND MITIGATION SERVICES- Adoption of operational monitoring services to support market growthOTHERS

-

8.10 OIL & GAS AND PETROLEUMUPSTREAM SERVICES- Increasing field and reservoir safety norms to fuel uptakeDOWNSTREAM SERVICES- Increasing safety norms for oil & gas and petroleum products to support market growthBIOFUELS AND FEEDSTOCK- Adoption of biomass fuel testing to support market growthPETROCHEMICALS- Testing of petrochemicals for purity levels to fuel marketASSET INTEGRITY MANAGEMENT- Climate change and environmental concerns to drive marketPROJECT LIFECYCLE SERVICES- Adoption of building maintenance services to support market growthOTHERS

-

8.11 PUBLIC SECTORPRODUCT CONFORMITY ASSESSMENT SERVICES- Increasing regulations and standards for product testing to support market growthMONITORING SERVICES- Growing importance of maintaining efficient legal frameworks to drive marketVALUATION SERVICES- Rising government regulations and trade policies to drive demand for TIC servicesOTHERS

-

8.12 AUTOMOTIVEELECTRICAL SYSTEMS AND COMPONENTS- Presence of regulatory standards for safety & quality assurance of electronic components to drive marketELECTRIC VEHICLES, HYBRID ELECTRIC VEHICLES, AND BATTERY SYSTEMS- Rising investments in electric vehicles and automotive technology to drive marketTELEMATICS- Advent of connective technologies in automotive applications to fuel uptake of TIC servicesFUELS, FLUIDS, AND EMOLLIENTS- Concerns associated with safety & efficiency of fuel-based engines to drive marketINTERIOR & EXTERIOR MATERIALS AND COMPONENTS- Adoption of mandatory interior testing in automobiles to fuel uptake of testing servicesVEHICLE INSPECTION SERVICES (VIS)- Comprehensive inspection of complete vehicle to support market growthHOMOLOGATION TESTING- Implementation of requirements by statutory regulatory bodies to drive marketOTHERS

-

8.13 AEROSPACESERVICES FOR AIRPORTSSERVICES FOR AVIATIONSERVICES FOR AEROSPACEAEROSPACE MANUFACTURING SERVICES- Implementation of testing and certification services for smooth airplane operations to drive marketAVIATION MANAGEMENT SERVICES- High demand for risk & quality management to drive marketOTHERS

-

8.14 MARINEMARINE FUEL SYSTEM AND COMPONENT SERVICES- Rising demand for fuel line testing services to drive marketSHIP CLASSIFICATION SERVICES- Strict regulations and certification requirements for international trade to support market growthMARINE MATERIAL AND EQUIPMENT SERVICES- Requirement of multiple certification processes to drive marketOTHERS

-

8.15 RAILWAYRAIL CONSTRUCTION AND PRODUCTION MONITORING- Adoption of drone technology for inspection of construction and production to fuel uptake of testing servicesINFRASTRUCTURE MANAGEMENT- Rising investments in railway infrastructure worldwide to drive marketOTHERS

-

8.16 SUPPLY CHAIN AND LOGISTICSPACKAGING AND HANDLING- Implementation of GDP certification to ensure adoption of TIC servicesRISK MANAGEMENT- Identification, assessment, and mitigation of risks to drive marketOTHERS

-

8.17 IT AND TELECOMMUNICATIONTELECOMMUNICATION AND IT INFRASTRUCTURE EQUIPMENT- Stringent product launch standards in various countries to drive marketMODULES AND DEVICES- Regulatory requirements for commercialization of products to support market growth

-

8.18 SPORTS AND ENTERTAINMENTSPORTS VENUES AND FACILITIES- Mandatory safety testing of turfs to drive marketSPORTING GOODS AND PROTECTIVE EQUIPMENT- Rising focus on product authenticity to fuel uptake of testing and inspection services

- 9.1 INTRODUCTION

-

9.2 NORTH AMERICANORTH AMERICA: RECESSION IMPACTUS- Increasing investments in innovative next-generation technologies to fuel uptake of testing servicesCANADA- High demand for TIC services in IT & telecommunication applications to drive marketMEXICO- Rising requirement for TIC services in automotive & aerospace to fuel market

-

9.3 EUROPEEUROPE: RECESSION IMPACTGERMANY- Implementation of Industry 4.0 in automotive sector to drive uptake of TIC servicesUK- Rising demand for accessibility testing in retail and food & beverage sectors to fuel marketFRANCE- Growing pharmaceutical industry to fuel demand for TIC servicesITALY- Rising government efforts for adherence to regulations to support market growthSPAIN- Privatization of aerospace industry to fuel uptake of TIC servicesBELGIUM- Presence of manufacturing facilities for food & beverage applications to support market growthRUSSIA- Growth in agricultural production to drive demand for TIC servicesNETHERLANDS- Surge in production of EVs and related components to drive marketSWITZERLAND- Rising import of goods and adherence to special regulations for environmental safety to drive marketHUNGARY- Rising expansion of e-commerce industry to support market growthPOLAND- Utilization of technologies such as IoT, cloud computing, and cybersecurity to drive marketBULGARIA- Import of machinery and manufacturing equipment to support market growthSWEDEN- Rising focus on introducing ICT-based technologies in automotive industry to support market growthNORWAY- Export of crude oil and petroleum gas to drive demand for TIC servicesROMANIA- Rising demand for TIC services in IT and telecommunication applications to drive marketAUSTRIA- Advancements in logistics and telecommunications sectors to drive adoption of TIC servicesTURKEY- Rising investments in development of robotics and AI to drive marketCROATIA- Expanding tourism and sports sectors to drive demand for TIC servicesIRELAND- Introduction of industrial robots to support market growthGREECE- Adoption of inspection services for fishing, mining, and shipping industries to support market growthCZECH REPUBLIC- Strong focus on automotive manufacturing capabilities to drive demand for TIC servicesLATVIA- Growth in food processing and textile industries to support market growthDENMARK- Rising focus of regulatory bodies on providing high-quality agricultural equipment to drive marketLITHUANIA- Adoption of testing services in food processing industry to drive marketESTONIA- Strict norms and import regulations to drive marketPORTUGAL- Expansion of manufacturing facilities to drive uptake for TIC servicesFINLAND- Rising R&D activities in automotive and chemical industries to support market growthREST OF EUROPE

-

9.4 ASIA PACIFICASIA PACIFIC: RECESSION IMPACTCHINA- Rising demand for TIC services in healthcare sector to support market growthJAPAN- Stringent regulatory norms in F&B industry to fuel uptake of testing and inspection servicesINDIA- Rising demand for certification services in healthcare and pharmaceuticals to drive marketSOUTH KOREA- Highly established market for export of electronics and medical devices to fuel uptake of TIC servicesAUSTRALIA- Stringent regulations in healthcare and mining industries to increase uptake of TIC servicesSINGAPORE- Adoption of innovative technologies for consumer electronics and electrical applications to support market growthTHAILAND- High growth in telecommunications and aviation industries to fuel uptakeINDONESIA- Stringent regulatory mandates in testing electronic products to drive marketMALAYSIA- High production of electronic equipment and manufacturing applications to drive marketVIETNAM- Heavy regulations for cosmetic and beauty product testing to support market growthTAIWAN- Thriving automotive and telecommunications applications to support market growthHONG KONG- Government regulations for safety mandates to fuel uptake of inspection servicesBANGLADESH- Booming textile industry and stringent rules to ensure manufacturing of high-quality consumer goods to fuel marketPHILIPPINES- Rising ICT sector and availability of online product certification to support market growthREST OF ASIA PACIFIC

-

9.5 REST OF THE WORLDREST OF THE WORLD: RECESSION IMPACTBRAZIL- Stringent government regulations for healthcare and energy applications to drive marketARGENTINA- Mutual agreements for import & export of products to drive demand for TIC servicesSAUDI ARABIA- Adoption of testing in oil reserves to drive marketUNITED ARAB EMIRATES- Growing manufacturing sector to fuel uptake of TIC servicesPERU- Growth in construction & infrastructure sectors to support market growthMOROCCO- Presence of strict regulations for entry and exit of industrial products to drive market growthCHILE- Mandatory certification of consumer electronics to support market growthCOLOMBIA- Growing medical and pharmaceutical markets to fuel uptakeVENEZUELA- Growth in oil & gas and petroleum industries to drive marketIRAN- Stringent regulations for imported products to fuel uptake of testing servicesIRAQ- Growth in consumer goods and retail industries to drive marketQATAR- Oil & gas sector to fuel uptake of TIC servicesOMAN- Growth opportunities in telecommunications and agriculture applications to support market growthBAHRAIN- Stringent certification and inspection policies in medical & life sciences sectors to fuel uptakeEGYPT- Renewable energy and logistics sectors to drive demand for certification servicesSOUTH AFRICA- Energy & power applications to drive marketREST OF SOUTH AMERICA, MIDDLE EAST, AND AFRICA

- 10.1 INTRODUCTION

- 10.2 STRATEGIES ADOPTED BY KEY PLAYERS

- 10.3 FIRE PROTECTION TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET SHARE ANALYSIS

- 10.4 REVENUE ANALYSIS

-

10.5 COMPANY EVALUATION QUADRANTSTARSPERVASIVE PLAYERSEMERGING LEADERSPARTICIPANTSCOMPANY FOOTPRINT

-

10.6 FIRE PROTECTION TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET: EVALUATION MATRIX FOR SMESPROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKS

-

10.7 COMPETITIVE SCENARIO AND TRENDSFIRE PROTECTION TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET- Product/Service launches- Deals- Other developments

-

11.1 KEY PLAYERSSGS S.A.- Business overview- Products/Services offered- Recent developments- MnM viewBUREAU VERITAS- Business overview- Products/Services offered- Recent developments- MnM viewINTERTEK GROUP PLC- Business overview- Products/Services offered- Recent developments- MnM viewTÜV SÜD- Business overview- Products/Services offered- Recent developments- MnM viewDNV GL- Business overview- Products/Services offered- Recent developments- MnM viewTÜV RHEINLAND- Business overview- Products/Services offered- Recent developments- MnM viewDEKRA SE- Business overview- Products/Services offered- Recent developmentsEUROFINS SCIENTIFIC- Business overview- Products/Services offered- Recent developmentsAPPLUS+- Business overview- Products/Services offered- Recent developmentsALS- Business overview- Products/Services offered- Recent developmentsTÜV NORD GROUP- Business overview- Products /Services offered- Recent developmentsLLOYD’S REGISTER GROUP SERVICES LIMITED- Business overview- Products/Services offered- Recent developmentsMISTRAS- Business overview- Products/Services offered- Recent developmentsELEMENT MATERIALS TECHNOLOGY- Business overview- Products/Services offered- Recent developmentsUL LLC- Business overview- Products/Services offered- Recent developments

-

11.2 OTHER PLAYERSAPAVE INTERNATIONALIRCLASSNORMEC QSTHOMAS BELL-WRIGHT INTERNATIONAL CONSULTANTSTIC-SERA LTD.HOHENSTEINASTMVDE TESTING AND CERTIFICATION INSTITUTEKEYSTONE COMPLIANCEWASHINGTON LABORATORIES, LTD.FORCE TECHNOLOGYKIWA INSPECTARINA S.P.A.TECHNICKÁ INŠPEKCIATÜRK LOYDUSAFETY ASSESSMENT FEDERATION (SAFED)PRIME GROUPHV TECHNOLOGIES, INC.CORE LABORATORIESNATIONAL COMMODITIES MANAGEMENT SERVICES LIMITED (NCML)AMSPEC, LLCASUREQUALITYMEDISTRI SAAVOMEEN ANALYTICAL SERVICESINOTIV, INC.GATEWAY ANALYTICALGULF INSPECTION INTERNATIONAL CO.NIPPON KAIJI KENTEI KYOKAI (NKKK)HUMBER INSPECTION INTERNATIONAL INDIA PRIVATE LIMITEDNQAQSRBALTIC CONTROLBRITISH STANDARDS INSTITUTION (BSI)OPUS GROUP ABTEAM, INC.FAVARETO SALENOR GROUPCOTECNA INSPECTION SA

- 12.1 INSIGHTS OF INDUSTRY EXPERTS

- 12.2 QUESTIONNAIRE FOR FIRE PROTECTION TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET

- 12.3 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 12.4 CUSTOMIZATION OPTIONS

- 12.5 RELATED REPORTS

- 12.6 AUTHOR DETAILS

- TABLE 1 RISK FACTOR ANALYSIS

- TABLE 2 FIRE PROTECTION TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET: IMPACT OF RECESSION ON END-USER VERTICALS

- TABLE 3 MARKET: ECOSYSTEM

- TABLE 4 AVERAGE SELLING PRICES OF KEY PLAYERS FOR CERTIFICATION SERVICES (USD)

- TABLE 5 ESTIMATION OF EMC TESTING COSTS AT STAGES

- TABLE 6 MARKET: KEY TRENDS

- TABLE 7 MARKET: IMPACT OF PORTER’S FIVE FORCES ANALYSIS

- TABLE 8 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 APPLICATIONS (%)

- TABLE 9 KEY BUYING CRITERIA FOR TOP 3 APPLICATIONS

- TABLE 10 TÜV SÜD PROVIDES CERTIFICATION AND AUDITING SERVICES FOR MEIJI CO. LTD.

- TABLE 11 TÜV SÜD PROVIDES CERTIFICATION SERVICES TO PRIMECH HOLDINGS LIMITED

- TABLE 12 APPLUS+ RTD IMPROVES FIELD SERVICE DELIVERY FOR ENERGY & POWER WITH LAUNCH OF A MOBILE REACH PLATFORM

- TABLE 13 LLOYD’S REGISTER AS AN INDEPENDENT THIRD-PARTY CERTIFYING AUTHORITY FOR SAFE INSTALLATION OF TENNET’S BORWIN GAMMA PLATFORM

- TABLE 14 IMPORT DATA FOR COMPLIANT PRODUCTS, HS CODE: 9018, BY COUNTRY, 2017–2021 (USD MILLION)

- TABLE 15 EXPORT DATA FOR COMPLIANT PRODUCTS, HS CODE: 9018, BY COUNTRY, 2017–2021 (USD MILLION)

- TABLE 16 FIRE PROTECTION TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET: LIST OF KEY PATENTS (2020–2022)

- TABLE 17 MARKET: DETAILED LIST OF CONFERENCES AND EVENTS

- TABLE 18 MARKET: REGULATORY LANDSCAPE

- TABLE 19 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 20 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 21 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 22 REST OF THE WORLD: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 23 FIRE PROTECTION TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET, BY SERVICE TYPE, 2019–2022 (USD MILLION)

- TABLE 24 MARKET, BY SERVICE TYPE, 2023–2028 (USD MILLION)

- TABLE 25 MARKET, BY SOURCING TYPE, 2019–2022 (USD MILLION)

- TABLE 26 MARKET, BY SOURCING TYPE, 2023–2028 (USD MILLION)

- TABLE 27 MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 28 MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 29 FIRE PROTECTION TIC MARKET FOR CONSUMER GOODS AND RETAIL, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 30 MARKET FOR CONSUMER GOODS & RETAIL, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 31 MARKET FOR AGRICULTURE AND FOOD, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 32 MARKET FOR AGRICULTURE & FOOD, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 33 MARKET FOR CHEMICALS, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 34 MARKET FOR CHEMICALS, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 35 FIRE PROTECTION TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET FOR CONSTRUCTION AND INFRASTRUCTURE, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 36 MARKET FOR CONSTRUCTION AND INFRASTRUCTURE, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 37 MARKET FOR ENERGY AND POWER, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 38 MARKET FOR ENERGY AND POWER, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 39 MARKET FOR INDUSTRIAL AND MANUFACTURING, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 40 MARKET FOR INDUSTRIAL AND MANUFACTURING, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 41 FIRE PROTECTION TIC MARKET FOR MEDICAL AND LIFE SCIENCES, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 42 MARKET FOR MEDICAL AND LIFE SCIENCES, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 43 MARKET FOR MINING, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 44 MARKET FOR MINING, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 45 MARKET FOR OIL & GAS AND PETROLEUM, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 46 MARKET FOR OIL & GAS AND PETROLEUM, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 47 FIRE PROTECTION TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET FOR PUBLIC SECTOR, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 48 MARKET FOR PUBLIC SECTOR, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 49 MARKET FOR AUTOMOTIVE, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 50 MARKET FOR AUTOMOTIVE, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 51 MARKET FOR AEROSPACE, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 52 FIRE PROTECTION TIC MARKET FOR AEROSPACE, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 53 FIRE PROTECTION TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET FOR MARINE, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 54 MARKET FOR MARINE, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 55 MARKET FOR RAILWAY, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 56 MARKET FOR RAILWAY, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 57 MARKET FOR SUPPLY CHAIN AND LOGISTICS, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 58 MARKET FOR SUPPLY CHAIN AND LOGISTICS, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 59 FIRE PROTECTION TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET FOR IT AND TELECOMMUNICATION, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 60 FIRE PROTECTION TIC MARKET FOR IT AND TELECOMMUNICATION, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 61 MARKET FOR SPORTS AND ENTERTAINMENT, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 62 MARKET FOR SPORTS AND ENTERTAINMENT, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 63 MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 64 MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 65 NORTH AMERICA: FIRE PROTECTION TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 66 NORTH AMERICA: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 67 NORTH AMERICA: MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 68 NORTH AMERICA: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 69 NORTH AMERICA: MARKET, BY SERVICE TYPE, 2019–2022 (USD MILLION)

- TABLE 70 NORTH AMERICA: MARKET, BY SERVICE TYPE, 2023–2028 (USD MILLION)

- TABLE 71 NORTH AMERICA: MARKET, BY SOURCING TYPE, 2019–2022 (USD MILLION)

- TABLE 72 NORTH AMERICA: FIRE PROTECTION TIC MARKET, BY SOURCING TYPE, 2023–2028 (USD MILLION)

- TABLE 73 US: FIRE PROTECTION TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 74 US: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 75 US: MARKET, BY SERVICE TYPE, 2019–2022 (USD MILLION)

- TABLE 76 US: MARKET, BY SERVICE TYPE, 2023–2028 (USD MILLION)

- TABLE 77 US: MARKET, BY SOURCING TYPE, 2019–2022 (USD MILLION)

- TABLE 78 US: FIRE PROTECTION TIC MARKET, BY SOURCING TYPE, 2023–2028 (USD MILLION)

- TABLE 79 CANADA: MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 80 CANADA: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 81 CANADA: MARKET, BY SERVICE TYPE, 2019–2022 (USD MILLION)

- TABLE 82 CANADA: MARKET, BY SERVICE TYPE, 2023–2028 (USD MILLION)

- TABLE 83 CANADA: MARKET, BY SOURCING TYPE, 2019–2022 (USD MILLION)

- TABLE 84 CANADA: FIRE PROTECTION TIC MARKET, BY SOURCING TYPE, 2023–2028 (USD MILLION)

- TABLE 85 MEXICO: FIRE PROTECTION TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 86 MEXICO: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 87 MEXICO: MARKET, BY SERVICE TYPE, 2019–2022 (USD MILLION)

- TABLE 88 MEXICO: MARKET, BY SERVICE TYPE, 2023–2028 (USD MILLION)

- TABLE 89 MEXICO: MARKET, BY SOURCING TYPE, 2019–2022 (USD MILLION)

- TABLE 90 MEXICO: FIRE PROTECTION TIC MARKET, BY SOURCING TYPE, 2023–2028 (USD MILLION)

- TABLE 91 EUROPE: FIRE PROTECTION TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 92 EUROPE: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 93 EUROPE: TESTING, INSPECTION, AND CERTIFICATION MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 94 EUROPE: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 95 EUROPE: MARKET, BY SERVICE TYPE, 2019–2022 (USD MILLION)

- TABLE 96 EUROPE: MARKET, BY SERVICE TYPE, 2023–2028 (USD MILLION)

- TABLE 97 EUROPE: MARKET, BY SOURCING TYPE, 2019–2022 (USD MILLION)

- TABLE 98 EUROPE: FIRE PROTECTION TIC MARKET, BY SOURCING TYPE, 2023–2028 (USD MILLION)

- TABLE 99 GERMANY: FIRE PROTECTION TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 100 GERMANY: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 101 GERMANY: MARKET, BY SERVICE TYPE, 2019–2022 (USD MILLION)

- TABLE 102 GERMANY: MARKET, BY SERVICE TYPE, 2023–2028 (USD MILLION)

- TABLE 103 GERMANY: MARKET, BY SOURCING TYPE, 2019–2022 (USD MILLION)

- TABLE 104 GERMANY: FIRE PROTECTION TIC MARKET, BY SOURCING TYPE, 2023–2028 (USD MILLION)

- TABLE 105 UK: FIRE PROTECTION TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 106 UK: TESTING, INSPECTION, AND CERTIFICATION MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 107 UK: MARKET, BY SERVICE TYPE, 2019–2022 (USD MILLION)

- TABLE 108 UK: MARKET, BY SERVICE TYPE, 2023–2028 (USD MILLION)

- TABLE 109 UK: MARKET, BY SOURCING TYPE, 2019–2022 (USD MILLION)

- TABLE 110 UK: FIRE PROTECTION TIC MARKET, BY SOURCING TYPE, 2023–2028 (USD MILLION)

- TABLE 111 FRANCE: FIRE PROTECTION TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 112 FRANCE: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 113 FRANCE: MARKET, BY SERVICE TYPE, 2019–2022 (USD MILLION)

- TABLE 114 FRANCE: MARKET, BY SERVICE TYPE, 2023–2028 (USD MILLION)

- TABLE 115 FRANCE: MARKET, BY SOURCING TYPE, 2019–2022 (USD MILLION)

- TABLE 116 FRANCE: FIRE PROTECTION TIC MARKET, BY SOURCING TYPE, 2023–2028 (USD MILLION)

- TABLE 117 ITALY: FIRE PROTECTION TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 118 ITALY: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 119 ITALY: MARKET, BY SERVICE TYPE, 2019–2022 (USD MILLION)

- TABLE 120 ITALY: MARKET, BY SERVICE TYPE, 2023–2028 (USD MILLION)

- TABLE 121 ITALY: MARKET, BY SOURCING TYPE, 2019–2022 (USD MILLION)

- TABLE 122 ITALY: FIRE PROTECTION TIC MARKET, BY SOURCING TYPE, 2023–2028 (USD MILLION)

- TABLE 123 SPAIN: FIRE PROTECTION TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 124 SPAIN: TESTING, INSPECTION, AND CERTIFICATION MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 125 SPAIN: MARKET, BY SERVICE TYPE, 2019–2022 (USD MILLION)

- TABLE 126 SPAIN: MARKET, BY SERVICE TYPE, 2023–2028 (USD MILLION)

- TABLE 127 SPAIN: MARKET, BY SOURCING TYPE, 2019–2022 (USD MILLION)

- TABLE 128 SPAIN: FIRE PROTECTION TIC MARKET, BY SOURCING TYPE, 2023–2028 (USD MILLION)

- TABLE 129 BELGIUM: FIRE PROTECTION TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 130 BELGIUM: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 131 BELGIUM: MARKET, BY SERVICE TYPE, 2019–2022 (USD MILLION)

- TABLE 132 BELGIUM: MARKET, BY SERVICE TYPE, 2023–2028 (USD MILLION)

- TABLE 133 BELGIUM: MARKET, BY SOURCING TYPE, 2019–2022 (USD MILLION)

- TABLE 134 BELGIUM: FIRE PROTECTION TIC MARKET, BY SOURCING TYPE, 2023–2028 (USD MILLION)

- TABLE 135 RUSSIA: FIRE PROTECTION TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 136 RUSSIA: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 137 RUSSIA: MARKET, BY SERVICE TYPE, 2019–2022 (USD MILLION)

- TABLE 138 RUSSIA: MARKET, BY SERVICE TYPE, 2023–2028 (USD MILLION)

- TABLE 139 RUSSIA: MARKET, BY SOURCING TYPE, 2019–2022 (USD MILLION)

- TABLE 140 RUSSIA: FIRE PROTECTION TIC MARKET, BY SOURCING TYPE, 2023–2028 (USD MILLION)

- TABLE 141 NETHERLANDS: FIRE PROTECTION TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 142 NETHERLANDS: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 143 NETHERLANDS: MARKET, BY SERVICE TYPE, 2019–2022 (USD MILLION)

- TABLE 144 NETHERLANDS: MARKET, BY SERVICE TYPE, 2023–2028 (USD MILLION)

- TABLE 145 NETHERLANDS: MARKET, BY SOURCING TYPE, 2019–2022 (USD MILLION)

- TABLE 146 NETHERLANDS: FIRE PROTECTION TIC MARKET, BY SOURCING TYPE, 2023–2028 (USD MILLION)

- TABLE 147 SWITZERLAND: FIRE PROTECTION TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 148 SWITZERLAND: TESTING, INSPECTION, AND CERTIFICATION MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 149 SWITZERLAND: MARKET, BY SERVICE TYPE, 2019–2022 (USD MILLION)

- TABLE 150 SWITZERLAND: MARKET, BY SERVICE TYPE, 2023–2028 (USD MILLION)

- TABLE 151 SWITZERLAND: MARKET, BY SOURCING TYPE, 2019–2022 (USD MILLION)

- TABLE 152 SWITZERLAND: FIRE PROTECTION TIC MARKET, BY SOURCING TYPE, 2023–2028 (USD MILLION)

- TABLE 153 ASIA PACIFIC: FIRE PROTECTION TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 154 ASIA PACIFIC: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 155 ASIA PACIFIC: MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 156 ASIA PACIFIC: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 157 ASIA PACIFIC: MARKET, BY SERVICE TYPE, 2019–2022 (USD MILLION)

- TABLE 158 ASIA PACIFIC: MARKET, BY SERVICE TYPE, 2023–2028 (USD MILLION)

- TABLE 159 ASIA PACIFIC: MARKET, BY SOURCING TYPE, 2019–2022 (USD MILLION)

- TABLE 160 ASIA PACIFIC: FIRE PROTECTION TIC MARKET, BY SOURCING TYPE, 2023–2028 (USD MILLION)

- TABLE 161 CHINA: FIRE PROTECTION TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 162 CHINA: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 163 CHINA: TESTING, INSPECTION, AND CERTIFICATION MARKET, BY SERVICE TYPE, 2019–2022 (USD MILLION)

- TABLE 164 CHINA: MARKET, BY SERVICE TYPE, 2023–2028 (USD MILLION)

- TABLE 165 CHINA: MARKET, BY SOURCING TYPE, 2019–2022 (USD MILLION)

- TABLE 166 CHINA: FIRE PROTECTION TIC MARKET, BY SOURCING TYPE, 2023–2028 (USD MILLION)

- TABLE 167 JAPAN: FIRE PROTECTION TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 168 JAPAN: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 169 JAPAN: TESTING, INSPECTION, AND CERTIFICATION MARKET, BY SERVICE TYPE, 2019–2022 (USD MILLION)

- TABLE 170 JAPAN: MARKET, BY SERVICE TYPE, 2023–2028 (USD MILLION)

- TABLE 171 JAPAN: MARKET, BY SOURCING TYPE, 2019–2022 (USD MILLION)

- TABLE 172 JAPAN: FIRE PROTECTION TIC MARKET, BY SOURCING TYPE, 2023–2028 (USD MILLION)

- TABLE 173 INDIA: TESTING, INSPECTION, AND CERTIFICATION MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 174 INDIA: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 175 INDIA: MARKET, BY SERVICE TYPE, 2019–2022 (USD MILLION)

- TABLE 176 INDIA: MARKET, BY SERVICE TYPE, 2023–2028 (USD MILLION)

- TABLE 177 INDIA: MARKET, BY SOURCING TYPE, 2019–2022 (USD MILLION)

- TABLE 178 INDIA: MARKET, BY SOURCING TYPE, 2023–2028 (USD MILLION)

- TABLE 179 SOUTH KOREA: FIRE PROTECTION TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 180 SOUTH KOREA: TIC MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 181 SOUTH KOREA: MARKET, BY SERVICE TYPE, 2019–2022 (USD MILLION)

- TABLE 182 SOUTH KOREA: MARKET, BY SERVICE TYPE, 2023–2028 (USD MILLION)

- TABLE 183 SOUTH KOREA: MARKET, BY SOURCING TYPE, 2019–2022 (USD MILLION)

- TABLE 184 SOUTH KOREA: MARKET, BY SOURCING TYPE, 2023–2028 (USD MILLION)

- TABLE 185 AUSTRALIA: FIRE PROTECTION TIC MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 186 AUSTRALIA: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 187 AUSTRALIA: MARKET, BY SERVICE TYPE, 2019–2022 (USD MILLION)

- TABLE 188 AUSTRALIA: TESTING, INSPECTION, AND CERTIFICATION MARKET, BY SERVICE TYPE, 2023–2028 (USD MILLION)

- TABLE 189 AUSTRALIA: MARKET, BY SOURCING TYPE, 2019–2022 (USD MILLION)

- TABLE 190 AUSTRALIA: MARKET, BY SOURCING TYPE, 2023–2028 (USD MILLION)

- TABLE 191 SINGAPORE: FIRE PROTECTION TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 192 SINGAPORE: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 193 SINGAPORE: MARKET, BY SERVICE TYPE, 2019–2022 (USD MILLION)

- TABLE 194 SINGAPORE: MARKET, BY SERVICE TYPE, 2023–2028 (USD MILLION)

- TABLE 195 SINGAPORE: MARKET, BY SOURCING TYPE, 2019–2022 (USD MILLION)

- TABLE 196 SINGAPORE: FIRE PROTECTION TIC MARKET, BY SOURCING TYPE, 2023–2028 (USD MILLION)

- TABLE 197 THAILAND: FIRE PROTECTION TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 198 THAILAND: TIC MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 199 THAILAND: MARKET, BY SERVICE TYPE, 2019–2022 (USD MILLION)

- TABLE 200 THAILAND: MARKET, BY SERVICE TYPE, 2023–2028 (USD MILLION)

- TABLE 201 THAILAND: MARKET, BY SOURCING TYPE, 2019–2022 (USD MILLION)

- TABLE 202 THAILAND: MARKET, BY SOURCING TYPE, 2023–2028 (USD MILLION)

- TABLE 203 INDONESIA: FIRE PROTECTION TIC MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 204 INDONESIA: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 205 INDONESIA: MARKET, BY SERVICE TYPE, 2019–2022 (USD MILLION)

- TABLE 206 INDONESIA: MARKET, BY SERVICE TYPE, 2023–2028 (USD MILLION)

- TABLE 207 INDONESIA: MARKET, BY SOURCING TYPE, 2019–2022 (USD MILLION)

- TABLE 208 INDONESIA: MARKET, BY SOURCING TYPE, 2023–2028 (USD MILLION)

- TABLE 209 MALAYSIA: FIRE PROTECTION TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 210 MALAYSIA: TESTING, INSPECTION, AND CERTIFICATION MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 211 MALAYSIA: MARKET, BY SERVICE TYPE, 2019–2022 (USD MILLION)

- TABLE 212 MALAYSIA: MARKET, BY SERVICE TYPE, 2023–2028 (USD MILLION)

- TABLE 213 MALAYSIA: MARKET, BY SOURCING TYPE, 2019–2022 (USD MILLION)

- TABLE 214 MALAYSIA: MARKET, BY SOURCING TYPE, 2023–2028 (USD MILLION)

- TABLE 215 VIETNAM: FIRE PROTECTION TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 216 VIETNAM: FIRE PROTECTION TIC MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 217 VIETNAM: MARKET, BY SERVICE TYPE, 2019–2022 (USD MILLION)

- TABLE 218 VIETNAM: MARKET, BY SERVICE TYPE, 2023–2028 (USD MILLION)

- TABLE 219 VIETNAM: MARKET, BY SOURCING TYPE, 2019–2022 (USD MILLION)

- TABLE 220 VIETNAM: MARKET, BY SOURCING TYPE, 2023–2028 (USD MILLION)

- TABLE 221 TAIWAN: FIRE PROTECTION TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 222 TAIWAN: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 223 TAIWAN: MARKET, BY SERVICE TYPE, 2019–2022 (USD MILLION)

- TABLE 224 TAIWAN: MARKET, BY SERVICE TYPE, 2023–2028 (USD MILLION)

- TABLE 225 TAIWAN: MARKET, BY SOURCING TYPE, 2019–2022 (USD MILLION)

- TABLE 226 TAIWAN: MARKET, BY SOURCING TYPE, 2023–2028 (USD MILLION)

- TABLE 227 HONG KONG: TESTING, INSPECTION, AND CERTIFICATION MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 228 HONG KONG: FIRE PROTECTION TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 229 HONG KONG: TIC MARKET, BY SERVICE TYPE, 2019–2022 (USD MILLION)

- TABLE 230 HONG KONG: MARKET, BY SERVICE TYPE, 2023–2028 (USD MILLION)

- TABLE 231 HONG KONG: MARKET, BY SOURCING TYPE, 2019–2022 (USD MILLION)

- TABLE 232 HONG KONG: MARKET, BY SOURCING TYPE, 2023–2028 (USD MILLION)

- TABLE 233 BANGLADESH: FIRE PROTECTION TIC MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 234 BANGLADESH: FIRE PROTECTION TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 235 BANGLADESH: MARKET, BY SERVICE TYPE, 2019–2022 (USD MILLION)

- TABLE 236 BANGLADESH: MARKET, BY SERVICE TYPE, 2023–2028 (USD MILLION)

- TABLE 237 BANGLADESH: MARKET, BY SOURCING TYPE, 2019–2022 (USD MILLION)

- TABLE 238 BANGLADESH: MARKET, BY SOURCING TYPE, 2023–2028 (USD MILLION)

- TABLE 239 PHILIPPINES: TESTING, INSPECTION, AND CERTIFICATION MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 240 PHILIPPINES: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 241 PHILIPPINES: MARKET, BY SERVICE TYPE, 2019–2022 (USD MILLION)

- TABLE 242 PHILIPPINES: MARKET, BY SERVICE TYPE, 2023–2028 (USD MILLION)

- TABLE 243 PHILIPPINES: FIRE PROTECTION TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET, BY SOURCING TYPE, 2019–2022 (USD MILLION)

- TABLE 244 PHILIPPINES: MARKET, BY SOURCING TYPE, 2023–2028 (USD MILLION)

- TABLE 245 REST OF ASIA PACIFIC: FIRE PROTECTION TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 246 REST OF ASIA PACIFIC: TIC MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 247 REST OF ASIA PACIFIC: MARKET, BY SERVICE TYPE, 2019–2022 (USD MILLION)

- TABLE 248 REST OF ASIA PACIFIC: MARKET, BY SERVICE TYPE, 2023–2028 (USD MILLION)

- TABLE 249 REST OF ASIA PACIFIC: MARKET, BY SOURCING TYPE, 2019–2022 (USD MILLION)

- TABLE 250 REST OF ASIA PACIFIC: MARKET, BY SOURCING TYPE, 2023–2028 (USD MILLION)

- TABLE 251 REST OF THE WORLD: TESTING, INSPECTION, AND CERTIFICATION MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 252 REST OF THE WORLD: FIRE PROTECTION TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 253 REST OF THE WORLD: MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 254 REST OF THE WORLD: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 255 REST OF THE WORLD: MARKET, BY SERVICE TYPE, 2019–2022 (USD MILLION)

- TABLE 256 REST OF THE WORLD: MARKET, BY SERVICE TYPE, 2023–2028 (USD MILLION)

- TABLE 257 REST OF THE WORLD: MARKET, BY SOURCING TYPE, 2019–2022 (USD MILLION)

- TABLE 258 REST OF THE WORLD: FIRE PROTECTION TIC MARKET, BY SOURCING TYPE, 2023–2028 (USD MILLION)

- TABLE 259 BRAZIL: FIRE PROTECTION TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 260 BRAZIL: TIC MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 261 BRAZIL: MARKET, BY SERVICE TYPE, 2019–2022 (USD MILLION)

- TABLE 262 BRAZIL: MARKET, BY SERVICE TYPE, 2023–2028 (USD MILLION)

- TABLE 263 BRAZIL: MARKET, BY SOURCING TYPE, 2019–2022 (USD MILLION)

- TABLE 264 BRAZIL: TESTING, INSPECTION, AND CERTIFICATION MARKET, BY SOURCING TYPE, 2023–2028 (USD MILLION)

- TABLE 265 ARGENTINA: FIRE PROTECTION TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 266 ARGENTINA: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 267 ARGENTINA: MARKET, BY SERVICE TYPE, 2019–2022 (USD MILLION)

- TABLE 268 ARGENTINA: MARKET, BY SERVICE TYPE, 2023–2028 (USD MILLION)

- TABLE 269 ARGENTINA: MARKET, BY SOURCING TYPE, 2019–2022 (USD MILLION)

- TABLE 270 ARGENTINA: FIRE PROTECTION TIC MARKET, BY SOURCING TYPE, 2023–2028 (USD MILLION)

- TABLE 271 SAUDI ARABIA: FIRE PROTECTION TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 272 SAUDI ARABIA: TESTING, INSPECTION, AND CERTIFICATION MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 273 SAUDI ARABIA: MARKET, BY SERVICE TYPE, 2019–2022 (USD MILLION)

- TABLE 274 SAUDI ARABIA: MARKET, BY SERVICE TYPE, 2023–2028 (USD MILLION)

- TABLE 275 SAUDI ARABIA: MARKET, BY SOURCING TYPE, 2019–2022 (USD MILLION)

- TABLE 276 SAUDI ARABIA: FIRE PROTECTION TIC MARKET, BY SOURCING TYPE, 2023–2028 (USD MILLION)

- TABLE 277 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS

- TABLE 278 TESTING, INSPECTION, AND CERTIFICATION MARKET: INTENSITY OF COMPETITIVE RIVALRY

- TABLE 279 COMPANY FOOTPRINT

- TABLE 280 COMPANY FOOTPRINT, BY APPLICATION

- TABLE 281 COMPANY FOOTPRINT, BY REGION

- TABLE 282 FIRE PROTECTION TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 283 MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 284 MARKET: PRODUCT/SERVICE LAUNCHES (JUNE 2018– DECEMBER 2022)

- TABLE 285 FIRE PROTECTION TIC MARKET: DEALS (JULY 2019–JANUARY 2023)

- TABLE 286 OTHER DEVELOPMENTS (JULY 2019–DECEMBER 2022)

- TABLE 287 SGS S.A.: COMPANY SNAPSHOT

- TABLE 288 SGS: PRODUCTS/SERVICES OFFERED

- TABLE 289 SGS: PRODUCT/SERVICE LAUNCHES

- TABLE 290 SGS: DEALS

- TABLE 291 SGS: OTHER DEVELOPMENTS

- TABLE 292 BUREAU VERITAS: BUSINESS OVERVIEW

- TABLE 293 BUREAU VERITAS: PRODUCTS/SERVICES OFFERED

- TABLE 294 BUREAU VERITAS: PRODUCT/SERVICE LAUNCHES

- TABLE 295 BUREAU VERITAS: DEALS

- TABLE 296 BUREAU VERITAS: OTHER DEVELOPMENTS

- TABLE 297 INTERTEK GROUP PLC: BUSINESS OVERVIEW

- TABLE 298 INTERTEK GROUP PLC: PRODUCTS/SERVICES OFFERED

- TABLE 299 INTERTEK GROUP PLC: PRODUCT/SERVICE LAUNCHES

- TABLE 300 INTERTEK: DEALS

- TABLE 301 INTERTEK: OTHER DEVELOPMENTS

- TABLE 302 TÜV SÜD: BUSINESS OVERVIEW

- TABLE 303 TÜV SÜD: PRODUCTS/SERVICES OFFERED

- TABLE 304 TÜV SÜD: PRODUCT/SERVICE LAUNCHES

- TABLE 305 TÜV SÜD: DEALS

- TABLE 306 TÜV SÜD: OTHER DEVELOPMENTS

- TABLE 307 DNV GL: BUSINESS OVERVIEW

- TABLE 308 DNV GL: PRODUCTS/SERVICES OFFERED

- TABLE 309 DNV GL: PRODUCT/SERVICE LAUNCHES

- TABLE 310 DNV GL: DEALS

- TABLE 311 DNV GL: OTHER DEVELOPMENTS

- TABLE 312 TÜV RHEINLAND: BUSINESS OVERVIEW

- TABLE 313 TÜV RHEINLAND: PRODUCTS/SERVICES OFFERED

- TABLE 314 TÜV RHEINLAND: PRODUCT/SERVICE LAUNCHES

- TABLE 315 TÜV RHEINLAND: DEALS

- TABLE 316 TÜV RHEINLAND: OTHER DEVELOPMENTS

- TABLE 317 DEKRA SE: BUSINESS OVERVIEW

- TABLE 318 DEKRA SE: PRODUCTS/SERVICES OFFERED

- TABLE 319 DEKRA SE: PRODUCT/SERVICE LAUNCHES

- TABLE 320 DEKRA SE: DEALS

- TABLE 321 DEKRA SE: OTHER DEVELOPMENTS

- TABLE 322 EUROFINS SCIENTIFIC: BUSINESS OVERVIEW

- TABLE 323 EUROFINS SCIENTIFIC: PRODUCTS/SERVICES OFFERED

- TABLE 324 EUROFINS SCIENTIFIC: PRODUCT/SERVICE LAUNCHES

- TABLE 325 EUROFINS SCIENTIFIC: DEALS

- TABLE 326 APPLUS+: BUSINESS OVERVIEW

- TABLE 327 APPLUS+: PRODUCTS/SERVICES OFFERED

- TABLE 328 APPLUS+: PRODUCT/SERVICE LAUNCHES

- TABLE 329 APPLUS+: DEALS

- TABLE 330 APPLUS+: OTHER DEVELOPMENTS

- TABLE 331 ALS: BUSINESS OVERVIEW

- TABLE 332 ALS: PRODUCTS/SERVICES OFFERED

- TABLE 333 ALS LIMITED: PRODUCT/SERVICE LAUNCHES

- TABLE 334 ALS: DEALS

- TABLE 335 TÜV NORD GROUP: BUSINESS OVERVIEW

- TABLE 336 TÜV NORD GROUP: PRODUCTS/SERVICES OFFERED

- TABLE 337 TÜV NORD GROUP: PRODUCT/SERVICE LAUNCHES

- TABLE 338 TÜV NORD GROUP: DEALS

- TABLE 339 LLOYD’S REGISTER GROUP SERVICES LIMITED: BUSINESS OVERVIEW

- TABLE 340 LLOYD’S REGISTER GROUP SERVICES LIMITED: PRODUCTS/SERVICES OFFERED

- TABLE 341 LLOYD’S REGISTER GROUP SERVICES LIMITED: PRODUCT/SERVICE LAUNCHES

- TABLE 342 LLOYD’S REGISTER GROUP SERVICES LIMITED: DEALS

- TABLE 343 LLOYD’S REGISTER GROUP SERVICES LIMITED: OTHER DEVELOPMENTS

- TABLE 344 MISTRAS: BUSINESS OVERVIEW

- TABLE 345 MISTRAS: PRODUCTS/SERVICES OFFERED

- TABLE 346 MISTRAS: PRODUCT/SERVICES LAUNCHES

- TABLE 347 MISTRAS: DEALS

- TABLE 348 ELEMENT MATERIALS TECHNOLOGY: BUSINESS OVERVIEW

- TABLE 349 ELEMENT MATERIALS TECHNOLOGY: PRODUCTS/SERVICES OFFERED

- TABLE 350 ELEMENT MATERIALS TECHNOLOGY: PRODUCT/SERVICE LAUNCHES

- TABLE 351 ELEMENT MATERIALS TECHNOLOGY: DEALS

- TABLE 352 ELEMENT MATERIALS TECHNOLOGY: OTHER DEVELOPMENTS

- TABLE 353 UL SOLUTIONS: BUSINESS OVERVIEW

- TABLE 354 UL SOLUTIONS: PRODUCTS/SERVICES OFFERED

- TABLE 355 UL SOLUTIONS: PRODUCT/SERVICE LAUNCHES

- TABLE 356 UL SOLUTIONS: DEALS

- TABLE 357 UL SOLUTIONS: OTHER DEVELOPMENTS

- FIGURE 1 FIRE PROTECTION TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET SEGMENTATION

- FIGURE 2 TESTING, INSPECTION, AND CERTIFICATION MARKET: RESEARCH DESIGN

- FIGURE 3 MARKET: MARKET SIZE ESTIMATION

- FIGURE 4 MARKET: BOTTOM-UP APPROACH

- FIGURE 5 FIRE PROTECTION TIC MARKET: TOP-DOWN APPROACH

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY (DEMAND-SIDE): BOTTOM-UP ESTIMATION, BY APPLICATION AND REGION

- FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY (SUPPLY-SIDE): ILLUSTRATION OF REVENUE ESTIMATION OF KEY MARKET PLAYERS, BY REGION

- FIGURE 8 DATA TRIANGULATION

- FIGURE 9 FIRE PROTECTION TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET: PRE- AND POST-RECESSION SCENARIO ANALYSIS, 2019–2028 (USD MILLION)

- FIGURE 10 TESTING SERVICES SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE DURING THE FORECAST PERIOD

- FIGURE 11 CONSUMER GOODS AND RETAIL APPLICATION SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 12 IN-HOUSE SOURCING SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 13 ASIA PACIFIC TO REGISTER HIGHEST GROWTH RATE DURING FORECAST PERIOD

- FIGURE 14 ASIA PACIFIC REGION TO EMERGE AS A LUCRATIVE GROWTH AVENUE FOR TIC SERVICES

- FIGURE 15 ELECTRICAL AND ELECTRONICS SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 16 IN-HOUSE SOURCING SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 17 TESTING SERVICES TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 18 ASIA PACIFIC TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 19 FIRE PROTECTION TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 20 TIC MARKET: DRIVERS

- FIGURE 21 MARKET: RESTRAINTS

- FIGURE 22 MARKET: OPPORTUNITIES

- FIGURE 23 MARKET: CHALLENGES

- FIGURE 24 MARKET: VALUE CHAIN ANALYSIS

- FIGURE 25 TIC MARKET: KEY PLAYERS IN ECOSYSTEM

- FIGURE 26 AVERAGE SELLING PRICE (ASP) OF SERVICE TYPES

- FIGURE 27 AVERAGE SELLING PRICE OF KEY PLAYERS FOR CERTIFICATION SERVICES

- FIGURE 28 FIRE PROTECTION TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET: REVENUE SHIFT

- FIGURE 29 FIRE PROTECTION TIC MARKET: PORTER’S FIVE FORCES ANALYSIS

- FIGURE 30 PORTER’S FIVE FORCES ANALYSIS

- FIGURE 31 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 APPLICATIONS

- FIGURE 32 KEY BUYING CRITERIA FOR TOP 3 APPLICATIONS

- FIGURE 33 COMPLIANT PRODUCTS AND IMPORT VALUES FOR MAJOR COUNTRIES (2017–2021)

- FIGURE 34 COMPLIANT PRODUCTS AND EXPORT VALUES FOR MAJOR COUNTRIES (2017–2021)

- FIGURE 35 FIRE PROTECTION TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET: NUMBER OF PATENTS GRANTED (2013–2022)

- FIGURE 36 TESTING, INSPECTION, AND CERTIFICATION MARKET: REGIONAL ANALYSIS OF PATENTS GRANTED (2013–2022)

- FIGURE 37 TIC MARKET: SERVICE TYPE

- FIGURE 38 TESTING SERVICES SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 39 FIRE PROTECTION TIC MARKET: BY SOURCING TYPE

- FIGURE 40 IN-HOUSE SOURCING SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 41 CONSUMER GOODS AND RETAIL SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 42 ELECTRICAL & ELECTRONICS SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE OF CONSUMER GOODS & RETAIL DURING FORECAST PERIOD

- FIGURE 43 EXPLORATION SERVICES SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE OF MINING APPLICATION DURING FORECAST PERIOD

- FIGURE 44 FIRE PROTECTION TIC MARKET: BY REGION

- FIGURE 45 INDIA EXPECTED TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 46 ASIA PACIFIC REGION PROJECTED TO WITNESS HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 47 NORTH AMERICA: IMPACT OF RECESSION

- FIGURE 48 FIRE PROTECTION TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET: NORTH AMERICA MARKET SNAPSHOT

- FIGURE 49 EUROPE: IMPACT OF RECESSION

- FIGURE 50 TESTING, INSPECTION, AND CERTIFICATION MARKET: EUROPE MARKET SNAPSHOT

- FIGURE 51 ASIA PACIFIC: IMPACT OF RECESSION

- FIGURE 52 TESTING, INSPECTION, AND CERTIFICATION MARKET: ASIA PACIFIC MARKET SNAPSHOT

- FIGURE 53 REST OF THE WORLD: IMPACT OF RECESSION

- FIGURE 54 SNAPSHOT OF TESTING, INSPECTION, AND CERTIFICATION MARKET IN ROW

- FIGURE 55 FIRE PROTECTION TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET: MARKET SHARE ANALYSIS (2022)

- FIGURE 56 TIC MARKET: REVENUE SHARE ANALYSIS OF TOP 5 PLAYERS (2018–2022)

- FIGURE 57 MARKET (GLOBAL): COMPANY EVALUATION QUADRANT (2022)

- FIGURE 58 FIRE PROTECTION TIC MARKET: EVALUATION QUADRANT FOR STARTUPS/SME (2022)

- FIGURE 59 SGS S.A.: COMPANY SNAPSHOT

- FIGURE 60 BUREAU VERITAS: COMPANY SNAPSHOT

- FIGURE 61 INTERTEK GROUP PLC: COMPANY SNAPSHOT

- FIGURE 62 TÜV SÜD: COMPANY SNAPSHOT

- FIGURE 63 DNV GL: COMPANY SNAPSHOT

- FIGURE 64 TÜV RHEINLAND: COMPANY SNAPSHOT

- FIGURE 65 DEKRA SE: COMPANY SNAPSHOT

- FIGURE 66 EUROFINS SCIENTIFIC: COMPANY SNAPSHOT

- FIGURE 67 APPLUS+: COMPANY SNAPSHOT

- FIGURE 68 ALS: COMPANY SNAPSHOT

- FIGURE 69 TÜV NORD GROUP: COMPANY SNAPSHOT

- FIGURE 70 MISTRAS: COMPANY SNAPSHOT

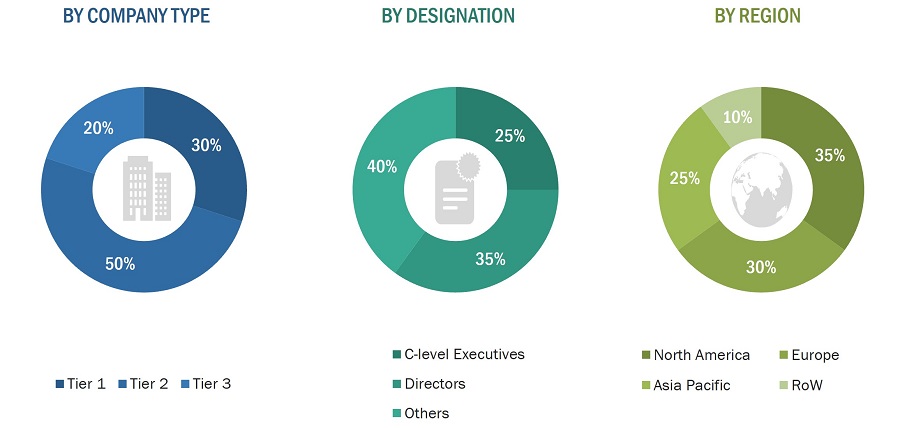

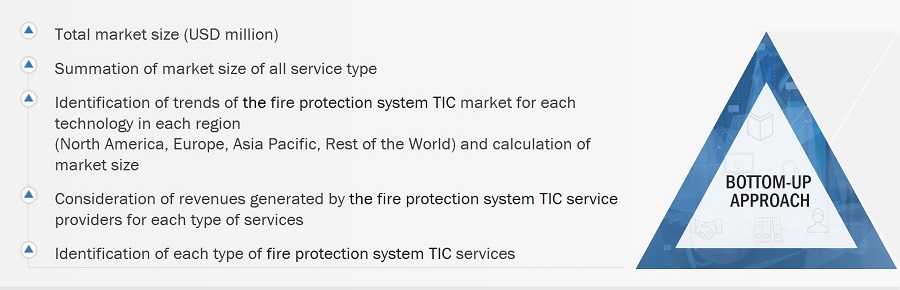

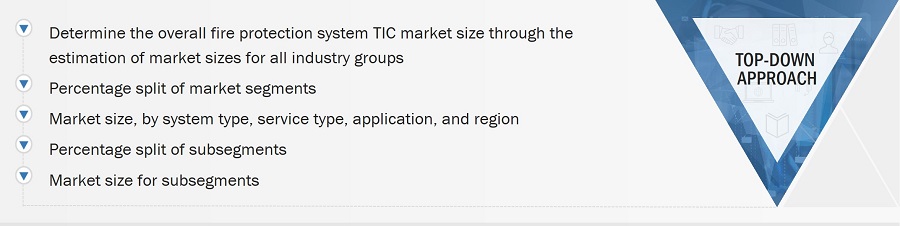

The study involved four major activities in estimating the fire protection system testing, inspection, and certification (TIC) market size. Exhaustive secondary research has been carried out to collect information on the market, the peer markets, and the parent market. Both top-down and bottom-up approaches have been employed to estimate the total market size. Market breakdown and data triangulation methods have also been used to estimate the market for segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources have been referred to for identifying and collecting information relevant to this study on the fire protection system testing, inspection, and certification (TIC) s market. The secondary sources included annual reports, press releases, and investor presentations of companies; white papers, certified publications, and articles by recognized authors; directories; and databases.

The global size of the fire protection system testing, inspection, and certification (TIC) market has been obtained from the secondary data available through paid and unpaid sources. It has also been determined by analyzing the product portfolios of the leading companies and rating them based on the quality of their offerings.

Secondary research has been used to gather key information about the industry's supply chain, the market’s monetary chain, the total number of key players, and market segmentation according to the industry trends to the bottom-most level, geographic markets, and key developments from both the market- and technology-oriented perspectives. It has also been conducted to identify and analyze the industry trends and key developments undertaken from both the market- and technology perspectives.

Primary Research

In the primary research process, various primary sources have been interviewed to obtain qualitative and quantitative information about the market across four main regions—Asia Pacific, North America, Europe, and the Rest of the World (the Middle East & Africa, and South America). Primary sources from the supply side include industry experts such as CEOs, vice presidents, marketing directors, technology directors, and other related key executives from major companies and organizations operating in the fire protection system testing, inspection, and certification (TIC) market or related markets.

After completing market engineering, primary research was conducted to gather information and verify and validate critical numbers from other sources. Primary research has also been conducted to identify various market segments; industry trends; key players; competitive landscape; and key market dynamics, such as drivers, restraints, opportunities, and challenges, along with key strategies adopted by market players. Most primary interviews have been conducted with the market's supply side. This primary data has been collected through questionnaires, emails, and telephonic interviews.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the complete engineering process, both top-down and bottom-up approaches and several data triangulation methods have been used to estimate and validate the size of the overall fire protection system testing, inspection, and certification (TIC) s market and other dependent submarkets. Key players in the market have been identified through secondary research, and their market positions in the respective geographies have been determined through both primary and secondary research. This entire procedure includes studying top market players' annual and financial reports and extensive interviews with industry leaders such as CEOs, VPs, directors, and marketing executives for key insights (qualitative and quantitative).

All percentage shares and breakdowns have been determined using secondary sources and verified through primary sources. All the possible parameters that affect the markets covered in this research study have been accounted for, viewed in detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data has been consolidated and supplemented with detailed inputs and analysis from MarketsandMarkets and presented in this report.

Global Fire Protection System Testing, Inspection, And Certification (TIC) Market Size: Bottom-Up Approach

Global Fire Protection System Testing, Inspection, And Certification (TIC) Market Size: Top-Down Approach

Data Triangulation

After arriving at the overall market size from the market size estimation process explained above, the total market has been split into several segments and subsegments. Data triangulation has been employed to complete the market engineering process and arrive at the exact statistics for all segments and subsegments. The data has been triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market has been validated using both the top-down and bottom-up approaches.

Market Definition