File Integrity Monitoring Market by Component (Software and Services), Installation Mode (Agent-based and Agentless), Deployment Mode (Cloud and On-premises), Organization Size (SMEs and Large Enterprises), Vertical, and Region - Global Forecast to 2022

[119 Pages Report] The file integrity monitoring market size is expected to grow from USD 470.1 Million in 2016 to USD 986.1 Million by 2022, at a Compound Annual Growth Rate (CAGR) of 13.86% during the forecast period (20172022). The base year for the study is 2016 and the forecast period is 2017 to 2022. The objective of the study is to define, describe, and forecast the FIM market on the basis of software, services, installation modes, deployment modes, organization sizes, verticals, and regions. It also analyzes recent developments, such as partnerships, strategic alliances, mergers and acquisitions, business expansions, new product developments, and research and development (R&D) in the global FIM market.

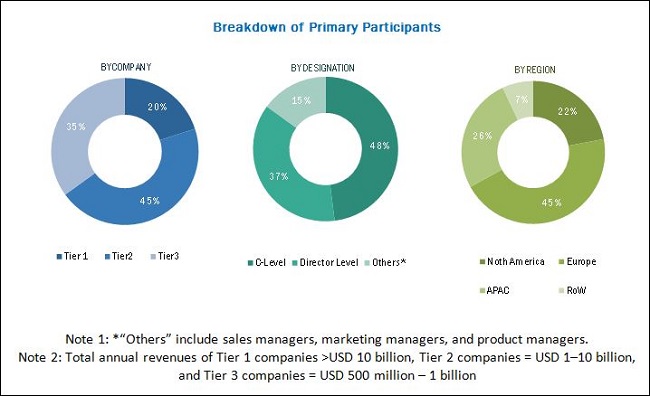

The research methodology used to estimate and forecast the file integrity monitoring market begins with the collection and analysis of data on key vendor revenues through secondary sources such as company websites, press releases, annual reports, TechTarget reports, Cloud Security Alliance reports, SC magazine, and SANS Institute studies. The vendor offerings have also been taken into consideration to determine the market segmentation. The bottom-up procedure was employed to arrive at the total market size of the global file integrity monitoring market from the revenues of the key players. After arriving at the overall market size, the total market was split into several segments and subsegments, which were then verified through primary research by conducting extensive interviews with key people, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), directors, and executives. The data triangulation and market breakdown procedures were employed to complete the overall market engineering process and to arrive at the exact statistics for all the segments and subsegments. The breakdown of profiles of the primary is depicted in the figure below:

To know about the assumptions considered for the study, download the pdf brochure

The file integrity monitoring market comprises key vendors, such as SolarWinds (US), AlienVault (US), LogRhythm (US), Trustwave(US), ManageEngine (US), Trend Micro (Japan), New Net Technologies (US), Netwrix (US), McAfee (US), Tripwire (US), Cimcor (US), and Qualys (US). These vendors provide FIM solutions and services to end-users to cater to their unique business requirements and compliance and security needs. These File Integrity Monitoring Software Vendors are rated and listed by us on the basis of product quality, reliability, and their business strategy. Please visit 360Quadrants to see the vendor listing of File Integrity Monitoring Software.

Key Target Audience

- FIM Software providers

- Government agencies

- IT security agencies

- System integrators

- Cloud service providers

- Security solution providers

- Software vendors

Study answers several questions for the stakeholders, primarily which market segments to focus over the next 25 years for prioritizing the efforts and investments.

Scope of the Report

The research report segments the file integrity monitoring market into the following submarkets:

By Component:

- Software

- Services

By Installation Mode:

- Agent-based

- Agentless

By Deployment Mode:

- On-premises

- Cloud

By Organization Size:

- Small and Medium-sized Enterprises

- Large Enterprises

By Vertical:

- Banking, Financial Services, and Insurance (BFSI)

- Government

- Healthcare and Lifesciences

- Education

- Media and Entertainment

- Retail and eCommerce

- Manufacturing and Automotive

- Others (Utilities and Logistics, and Telecom and IT)

By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Middle East and Africa (MEA)

- Latin America

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the companys specific needs. The following customization options are available for the report:

Product Analysis

- Product matrix which gives a detailed comparison of product portfolio of each company

Geographic Analysis

- Further breakdown of the North America file integrity monitoring market

- Further breakdown of the Europe FIM market

- Further breakdown of the APAC FIM market

- Further breakdown of the MEA FIM market

- Further breakdown of the Latin America FIM market

Company Information

- Detailed analysis and profiling of additional market players

MarketsandMarkets expects the global file integrity monitoring market size to grow from USD 515.3 Million in 2017 to USD 986.1 Million by 2022, at a Compound Annual Growth Rate (CAGR) of 13.86%. The constant pressure of managing sensitive data of consumers, along with the need to manage stringent compliances, has led enterprises of all sizes to adopt FIM solutions for critical information protection. Moreover, cloud-based deployment is gaining high traction in the market, as it requires less capital investment, and helps decrease the operational and maintenance costs, and reduce the managements efforts. Cloud FIM solutions are available according to customers demand, wherein a customer can start or stop any service, at will. FIM solutions help organizations protect their sensitive data, applications, and comply with stringent regulations.

FIM solutions are available with agent-based and agentless installation modes. The agentless installation mode is expected to dominate the file integrity monitoring market and is estimated to contribute a larger market share in 2017. The agent-based installation mode is expected to play a key role in changing the FIM market landscape and grow at the highest CAGR during the forecast period, as global organizations are highly proactive toward protecting the sensitive information.

The cloud deployment mode is a faster-growing mode in the file integrity monitoring market, as it benefits organizations with increased scalability, speed, 24/7 services, and enhanced management capabilities. Small and Medium-sized Enterprises (SMEs) continue to opt for the cloud deployment, as it can help them to avoid costs pertaining to hardware, software, storage, and technical staff.

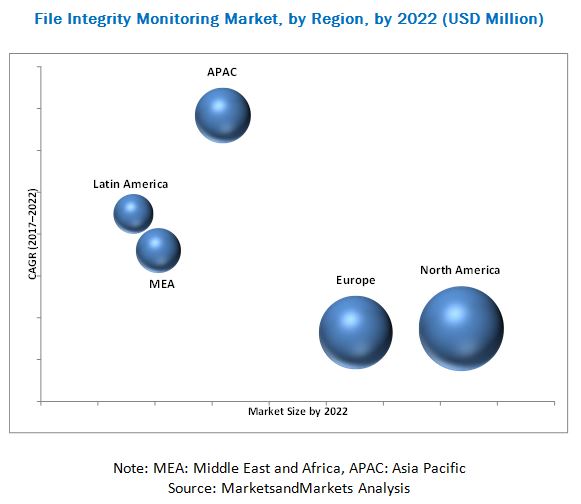

North America is estimated to hold the largest market size in 2017. Increasing penetration of internet and incidents of attacks on enterprise IT infrastructure driving the needs for FIM solutions. Furthermore, rapid economic growth in the developing countries, along with improving regulatory reforms and economic stability is driving the file integrity monitoring market growth in APAC. In Latin America, SMEs as well as large enterprises belonging to a range of verticals, such as Banking, Financial Services, and Insurance (BFSI), government, and healthcare and life sciences, are expected to increase their investments in FIM solutions and services.

High development cost for cutting-edge FIM solution is becoming a major restraint for the growth of the market. The Research and Development (R&D) expenses to develop advanced FIM solutions are very high, which lead to high pricing of the security solutions. As the frequency of security breaches has increased over the past 5 years, organizations have increased their IT security investments to protect against advanced threats. However, for many enterprises, including SMEs, these investment costs are a matter of concern. Furthermore, for strong and advanced security, the cost of innovation is still high, and many organizations view budgetary constraints as a barrier to growth in the file integrity monitoring market.

The need for securing the growing volumes of data in organizations is expected to provide significant growth opportunities to the FIM solution vendors. There are several established players in this market, such as SolarWinds (US), AlienVault (US), LogRhythm (US), Trustwave(US), ManageEngine (US), Trend Micro (Japan), New Net Technologies (US), Netwrix (US), McAfee (US), Tripwire (US), Cimcor (US), and Qualys (US).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 13)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.4 Years Considered for the Study

1.5 Currency

1.6 Stakeholders

2 Research Methodology (Page No. - 17)

2.1 Research Data

2.2 Research Data

2.2.1 Secondary Data

2.2.2 Primary Data

2.2.2.1 Breakdown of Primaries

2.2.2.2 Key Industry Insights

2.3 Market Size Estimation

2.3.1 Bottom-Up Approach

2.3.2 Top-Down Approach

2.4 Microquadrant Research Methodology

2.4.1 Vendor Inclusion Criteria

2.5 Research Assumptions and Limitations

2.5.1 Limitations

3 Executive Summary (Page No. - 24)

4 Premium Insights (Page No. - 27)

4.1 Attractive Market Opportunities in the File Integrity Monitoring Market

4.2 File Integrity Monitoring Market, By Region, 20172022

4.3 File Integrity Monitoring Market, By Vertical, 20172022

5 Market Overview and Industry Trends (Page No. - 29)

5.1 Introduction

5.2 Regulatory Implications

5.2.1 Payment Card Industry Data Security Standard (PCIDSS)

5.2.2 Health Insurance Portability and Accountability Act (HIPAA)

5.2.3 Gramm-Leach-Bliley Act (GLBA)

5.2.4 Sarbanes-Oxley Act (SOX)

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Stringent Regulatory Compliance Requirements

5.3.1.2 Increasing Threats to Data Security

5.3.1.3 Increasing Need to Control Organization Data and Spot Human Errors

5.3.2 Restraints

5.3.2.1 Financial Constraints and High Innovation Costs

5.3.3 Opportunities

5.3.3.1 Rapidly Increasing Organization Data and the Need to Secure It

5.3.3.2 Increasing Demand for Cloud-Based Solutions

5.3.4 Challenges

5.3.4.1 Growing Complexity and Size of Organization It Infrastructures

6 File Integrity Monitoring Market Analysis, By Component (Page No. - 34)

6.1 Introduction

6.2 Software

6.3 Services

6.3.1 Professional Services

6.3.2 Managed Services

7 File Integrity Monitoring Market Analysis, By Installation Mode (Page No. - 39)

7.1 Introduction

7.2 Agent-Based

7.3 Agentless

8 File Integrity Monitoring Market Analysis, By Deployment Type (Page No. - 43)

8.1 Introduction

8.2 Cloud

8.3 On-Premises

9 File Integrity Monitoring Market Analysis, By Organization Size (Page No. - 47)

9.1 Introduction

9.2 Small and Medium-Sized Enterprises (SMES)

9.3 Large Enterprises

10 File Integrity Monitoring Market Analysis, By Vertical (Page No. - 51)

10.1 Introduction

10.2 Banking, Financial Services, and Insurance

10.2.1 Use Case

10.3 Government

10.3.1 Use Case

10.4 Healthcare and Life Sciences

10.4.1 Use Case

10.5 Education

10.6 Media and Entertainment

10.7 Retail and Ecommerce

10.8 Manufacturing

10.9 Others

11 Geographic Analysis (Page No. - 61)

11.1 Introduction

11.2 North America

11.3 Europe

11.4 Asia Pacific

11.5 Middle East and Africa

11.6 Latin America

12 Company Profiles (Page No. - 80)

Overview, Strength of Product Portfolio, Business Strategy Excellence, Recent Developments

12.1 SolarWinds

12.2 AlienVault

12.3 LogRhythm

12.4 Trustwave

12.5 ManageEngine

12.6 Trend Micro

12.7 New Net Technologies

12.8 Netwrix

12.9 McAfee

12.10 Tripwire

12.11 Cimcor

12.12 Qualys

*Details Might Not Be Captured in Case of Unlisted Companies.

13 Appendix (Page No. - 111)

13.1 Discussion Guide

13.2 Knowledge Store: Marketsandmarkets Subscription Portal

13.3 Introducing RT: Real-Time Market Intelligence

13.4 Available Customization

13.5 Related Reports

13.6 Author Details

List of Tables (62 Tables)

Table 1 USD Exchange Rate, 20142016

Table 2 Evaluation Criteria

Table 3 Global File Integrity Monitoring Market Size and Growth, 20152022 (USD Million, Y-O-Y %)

Table 4 File Integrity Monitoring Market Size, By Component, 20152022 (USD Million)

Table 5 Software: File Integrity Monitoring Market Size, By Region, 20152022 (USD Million)

Table 6 Services: File Integrity Monitoring Market Size, By Region, 20152022 (USD Million)

Table 7 Professional Services Market Size, By Region, 20152022 (USD Million)

Table 8 Managed Services Market Size, By Region, 20152022 (USD Million)

Table 9 File Integrity Monitoring Market Size, By Installation Mode, 20152022 (USD Million)

Table 10 Agent-Based: File Integrity Monitoring Market Size, By Region, 20152022 (USD Million)

Table 11 Agentless: File Integrity Monitoring Market Size, By Region, 20152022 (USD Million)

Table 12 File Integrity Monitoring Market Size, By Deployment Type, 20152022 (USD Million)

Table 13 Cloud: File Integrity Monitoring Market Size, By Region, 20152022 (USD Million)

Table 14 On-Premises: File Integrity Monitoring Market Size, By Region, 20152022 (USD Million)

Table 15 File Integrity Monitoring Market Size, By Organization Size, 20152022 (USD Million)

Table 16 SMES: File Integrity Monitoring Market Size, By Region, 20152022 (USD Million)

Table 17 Large Enterprises: File Integrity Monitoring Market Size, By Region, 20152022 (USD Million)

Table 18 File Integrity Monitoring Market Size, By Vertical, 20152022 (USD Million)

Table 19 Banking, Financial Services, and Insurance: File Integrity Monitoring Market Size, By Region, 20152022 (USD Million)

Table 20 Government: File Integrity Monitoring Market Size, By Region, 20152022 (USD Million)

Table 21 Healthcare and Life Sciences: File Integrity Monitoring Market Size, By Region, 20152022 (USD Million)

Table 22 Education: File Integrity Monitoring Market Size, By Region, 20152022 (USD Million)

Table 23 Media and Entertainment: File Integrity Monitoring Market Size, By Region, 20152022 (USD Million)

Table 24 Retail and Ecommerce: File Integrity Monitoring Market Size, By Region, 20152022 (USD Million)

Table 25 Manufacturing: File Integrity Monitoring Market Size, By Region, 20152022 (USD Million)

Table 26 Others: File Integrity Monitoring Market Size, By Region, 20152022 (USD Million)

Table 27 File Integrity Monitoring Market Size, By Region, 20172022 (USD Million)

Table 28 North America: File Integrity Monitoring Market Size, By Country, 20152022 (USD Million)

Table 29 North America: File Integrity Monitoring Market Size, By Component, 20152022 (USD Million)

Table 30 North America: File Integrity Monitoring Market Size, By Installation Mode, 20152022(USD Million)

Table 31 North America: File Integrity Monitoring Market Size, By Deployment Type, 20152022 (USD Million)

Table 32 North America: File Integrity Monitoring Market Size, By Service, 20152022 (USD Million)

Table 33 North America: File Integrity Monitoring Market Size, By Organization Size, 20152022 (USD Million)

Table 34 North America: File Integrity Monitoring Market Size, By Vertical, 20152022 (USD Million)

Table 35 Europe: File Integrity Monitoring Market Size, By Country, 20152022 (USD Million)

Table 36 Europe: File Integrity Monitoring Market Size, By Component, 20152022 (USD Million)

Table 37 Europe: File Integrity Monitoring Market Size, By Installation Mode, 20152022 (USD Million)

Table 38 Europe: File Integrity Monitoring Market Size, By Deployment Type, 20152022 (USD Million)

Table 39 Europe: File Integrity Monitoring Market Size, By Service, 20152022 (USD Million)

Table 40 Europe: File Integrity Monitoring Market Size, By Organization Size, 20152022 (USD Million)

Table 41 Europe: File Integrity Monitoring Market Size, By Vertical, 20152022 (USD Million)

Table 42 Asia Pacific: File Integrity Monitoring Market Size, By Country, 20152022 (USD Million)

Table 43 Asia Pacific: File Integrity Monitoring Market Size, By Component, 20152022 (USD Million)

Table 44 Asia Pacific: File Integrity Monitoring Market Size, By Installation Mode, 20152022 (USD Million)

Table 45 Asia Pacific: File Integrity Monitoring Market Size, By Deployment Type, 20152022 (USD Million)

Table 46 Asia Pacific: File Integrity Monitoring Market Size, By Service, 20152022 (USD Million)

Table 47 Asia Pacific: File Integrity Monitoring Market Size, By Organization Size, 20152022 (USD Million)

Table 48 Asia Pacific: File Integrity Monitoring Market Size, By Vertical, 20152022 (USD Million)

Table 49 Middle East and Africa: File Integrity Monitoring Market Size, By Sub-Region, 20152022 (USD Million)

Table 50 Middle East and Africa: File Integrity Monitoring Market Size, By Component, 20152022 (USD Million)

Table 51 Middle East and Africa: File Integrity Monitoring Market Size, By Installation Mode, 20152022 (USD Million)

Table 52 Middle East and Africa: File Integrity Monitoring Market Size, By Deployment Type, 20152022 (USD Million)

Table 53 Middle East and Africa: File Integrity Monitoring Market Size, By Service, 20152022 (USD Million)

Table 54 Middle East and Africa: File Integrity Monitoring Market Size, By Organization Size, 20152022 (USD Million)

Table 55 Middle East and Africa: File Integrity Monitoring Market Size, By Vertical, 20152022 (USD Million)

Table 56 Latin America: File Integrity Monitoring Market Size, By Country, 20152022 (USD Million)

Table 57 Latin America: File Integrity Monitoring Market Size, By Component, 20152022 (USD Million)

Table 58 Latin America: File Integrity Monitoring Market Size, By Installation Mode, 20152022 (USD Million)

Table 59 Latin America: File Integrity Monitoring Market Size, By Deployment Type, 20152022 (USD Million)

Table 60 Latin America: File Integrity Monitoring Market Size, By Service, 20152022 (USD Million)

Table 61 Latin America: File Integrity Monitoring Market Size, By Organization Size, 20152022 (USD Million)

Table 62 Latin America: File Integrity Monitoring Market Size, By Vertical, 20152022 (USD Million)

List of Figures (25 Figures)

Figure 1 Global File Integrity Monitoring Market: Market Segmentation

Figure 2 Regional Scope

Figure 3 Global File Integrity Monitoring Market: Research Design

Figure 4 Data Triangulation

Figure 5 Market Size Estimation Methodology: Bottom-Up Approach

Figure 6 Market Size Estimation Methodology: Top-Down Approach

Figure 7 Services Component is Expected to Grow at A Higher CAGR During the Forecast Period

Figure 8 Agent-Based Installation Mode is Expected to Grow at A Higher CAGR During the Forecast Period

Figure 9 Cloud Deployment is Expected to Grow at A Higher CAGR During the Forecast Period

Figure 10 North America is Estimated to Hold the Largest Market Share in 2017

Figure 11 Stringent Regulations Spurring Demand for File Integrity Solutions is Expected to Drive the Overall Market Growth During the Forecast Period

Figure 12 Asia Pacific is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 13 Government Sector is Expected to Grow at the Highest CAGR in the File Integrity Monitoring Market During the Forecast Period

Figure 14 Market Investment Scenario: Asia Pacific is Expected to Provide the Best Opportunities for Investment Over the Next Five Years

Figure 15 File Integrity Monitoring Market: Drivers, Restraints, Opportunities, and Challenges

Figure 16 Services Component is Expected to Exhibit the Higher CAGR During the Forecast Period

Figure 17 Agent-Based Installation Mode is Expected to Exhibit A Higher CAGR During the Forecast Period

Figure 18 Cloud Deployment is Expected to Exhibit the Higher CAGR During the Forecast Period

Figure 19 SMES is Expected to Exhibit A Higher CAGR During the Forecast Period

Figure 20 Government Vertical is Expected to Have the Highest CAGR During the Forecast Period

Figure 21 Asia Pacific is Expected to Exhibit the Highest CAGR During the Forecast Period

Figure 22 North America: Market Snapshot

Figure 23 Asia Pacific: Market Snapshot

Figure 24 Trend Micro: Company Snapshot

Figure 25 Qualys: Company Snapshot

Growth opportunities and latent adjacency in File Integrity Monitoring Market