Field Activity Management Market by Component (Solution and Services (Consulting, Integration, and training and support)), Deployment Mode, Organization Size, Vertical (Telecom, Energy and Utilities, and Government) and Region - Global Forecast to 2026

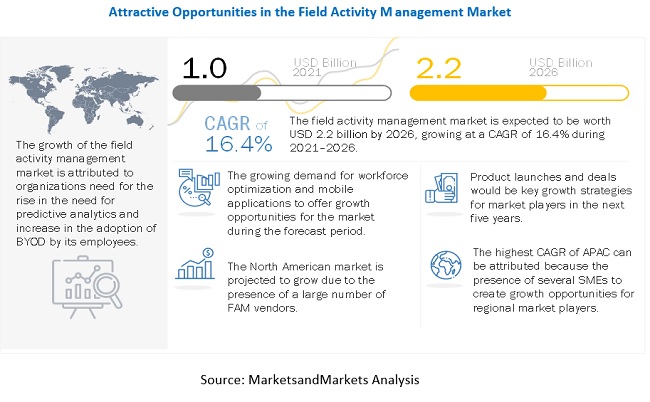

[198 Pages Report] MarketsandMarkets forecasts the global Field activity management Market size to grow from USD 1.0 billion in 2021 to USD 2.2 billion by 2026, at a Compound Annual Growth Rate (CAGR) of 16.4% during the forecast period. The presence of various key players in the ecosystem has led to competitive and diverse market. Field activity management is the practice of managing field activities, including physical assets, associated workforce, and equipment using software, workflows, and communication solutions. Field activity management solution consolidates and captures the data related to mapping and scheduling, location data, and time and expense tracking under one platform and helps in efficient utilization, visualization, tracking, and management of assets on the field.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 has impacted the global economy. It has had a significant economic impact on various financial and industrial sectors, such as energy, oil and gas, transportation and logistics, manufacturing, and aviation. It is predicted that the global economy will go into recession due to the loss of trillions of dollars. With the increasing number of countries imposing and extending lockdowns, economic activities are declining, which would impact the global economy. Every individual and government, irrespective of federal, state, central, local, and provinces, has been in constant touch with one other in the society to provide and get real-time information on COVID-19.

COVID-19 cases are growing day-by-day, as several infected cases have been on the rise. In line with individuals, COVID-19 has a massive impact on large enterprises and SMEs. Core industries, such as manufacturing, automotive, textile, transportation and logistics, travel and hospitality, and consumer goods, have been closed due to country-level lockdown across the globe. This would have a substantial impact on the global economy in terms of the decline in GDP. Since ages, SMEs are acting as the backbone of the economy. In the current situation, SMEs are the most affected due to the COVID-19 pandemic.

Market Dynamics

Driver: Increased adoption of cloud-based field activity management solutions

The cloud-based deployment of field activity management solutions has gained significant traction. As per the Cisco Global Cloud Index Forecast, the global cloud Internet Protocol (IP) traffic is expected to grow at a CAGR of 30% during 2015–2020. The cloud-based deployment model offers benefits, such as lucrativeness, easy and high speed of deployment, and more agile management and operation of field activity solutions. The cloud platform caters to the needs of geographically dispersed business units by providing one consolidated platform. To leverage the benefits of this technology, organizations are shifting from on-premises field activity management solutions to the field activity management solutions deployed in the cloud. Considering the demand for cloud solutions, field activity management vendors are increasingly focusing on providing SaaS-based solutions that help lower costs and achieve higher Return on Investments (RoI).

Restraint: Resistance from field workers to adopt automated solutions

Enterprises are rapidly moving toward digitalization by adopting emerging technologies to automate and accelerate their business processes efficiently. Field activity management solutions might enhance the efficiency of the field workforce, but the workforce at different levels often considers it as an interrupting policing tool. They often think switching from manual methods to automated applications would lose their independence. As employees assume they are being monitored 24x7, the upper management fears losing their potential field staff. With accelerated automation across industries, employees fear losing their jobs. According to Cambridge Econometrics 2017 analysis, direct employment losses because of automation in 2030 would be significantly high for high-growth markets, such as China, India, and the EU. This is another factor that restraints field workers of these regions to accept field activity management solutions.

Opportunity: Increasing need to make informed decision among enterprises

In the last 4–5 years, almost every business has transformed digitally. The tremendous growth in technologies leads to the generation of a large amount of data, and this increases the need for storing data and the speed of processing it. The development of field activity management solutions has evolved almost hand-in-hand with technological progress. Enterprises are utilizing the data generated from various field activity management solutions, such as time and attendance, leave and absence management, and workforce scheduling to make critical decisions. Initially, data analysis decisions were based on traditional practices, such as intuition, hunches, or opinions; however, with the use of field activity management solution, enterprises have realized that managing the workforce increases productivity, improves profitability, and can be used to make better strategic decisions.

Challenge: tracking the workforce in real-time

Customers expect timely delivery of products and services they pay for, and the companies rely on their employees to meet these expectations. Hence, it is important that field workers maintain their assigned schedules, even while away from the office, and it is always helpful to know technicians’ real-time location, their performance, and their adherence with assigned jobs and hours. Tracking the workforce while they are in the field also means that users can allocate work orders faster and manage task distribution daily. A field activity management application that lets workers coordinate with the back office using a service desk can solve this problem. The user can see their workers’ location, schedule and dispatch jobs, track hours, and monitor incoming customer requests with ease. According to research, using a field activity management solution for a mobile workforce can lead to a 47% increase in the rate of jobs completed each day and a 77% reduction in overtime.

The services to record a higher growth rate during the forecast period

In the field activity management market by component, the services is expected to record a higher growth rate during the forecast period. Services play a vital role in the deployment and integration of field activity management solutions. Services are considered an important part as they are instrumental in fulfilling the custom requirements of the clients. Based on services, the field activity management market has been segmented into consulting, implementation and integration, and training and support. These services help implement field activity management solutions in a cost-efficient manner to effectively accomplish business processes within the timeframe and budget.

To know about the assumptions considered for the study, download the pdf brochure

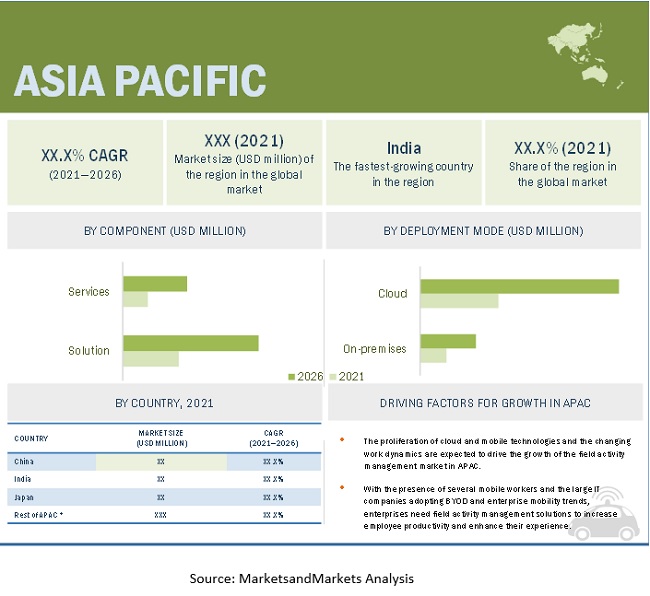

APAC to have a higher growth rate during the forecast period

By region, APAC is expected to grow at the highest CAGR during the forecast period. The field activity management market in APAC is expected to experience strong growth in the coming years, due to the constant economic growth, increasing the young workforce, and the usage of tablets and smartphones for business purposes will lead toward the adaptation of enterprise mobility solutions to meet the growing demand for securing and protecting critical data. The major reason for this high growth in APAC is the increasing digitalization among people and the rising infusion of automation at workplaces and government initiatives to promote technology adoption across the region.

Market Players

The report covers the competitive landscape and profiles major market players, as ESRI (US), SAP (Germany), Fielda (US), Fulcrum (US), ProntoForms (Canada), OnSource (US), SafetyCulture (Australia), Field Safe Solutions (Canada), GoCanvas (US), Repsly (US), Fieldwire (UK), FieldEZ (India), FastField (US), MobileLogix (US), Corrata (Ireland), Thundermaps (New Zealand), Logistrics Services (Canada), Bentley Systems (US), Webuild (Australia), Smart Service (US), Device Magic (US), Forms On Fire (US). These players have adopted several organic and inorganic growth strategies, including new product launches, partnerships and collaborations, and acquisitions, to expand their offerings and market shares in the global Field activity management market.

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

2020-2026 |

|

Base year considered |

2020 |

|

Forecast period |

2021-2026 |

|

Forecast units |

Value (USD Billion) |

|

Segments covered |

By Component, Deployment mode, Organisation Size, Vertical |

|

Regions covered |

North America, Europe, APAC, MEA, and Latin America |

|

Companies covered |

ESRI (US), SAP (Germany), Fielda (US), Fulcrum (US), ProntoForms (Canada), OnSource (US), SafetyCulture (Australia), Field Safe Solutions (Canada), GoCanvas (US), Repsly (US), Fieldwire (UK), FieldEZ (India), FastField (US), MobileLogix (US), Corrata (Ireland), Thundermaps (New Zealand), Logistrics Services (Canada), Bentley Systems (US), Webuild (Australia), Smart Service (US), Device Magic (US), Forms On Fire (US) |

This research report categorizes the field activity management to forecast revenue and analyze trends in each of the following submarkets:

Based on Component:

- Solution

- Services

- Consulting

- Integration and Implementation

- Training and Support

Based on Deployment Mode:

- On-premises

- Cloud

Based on Organisation Size:

- SMEs

- Large Enterprises

Based on Vertical:

- Telecom

- Energy and Utilities

- Construction and Real- Estate

- Manufacturing

- Agriculture

- Government

- Other Verticals

Based on regions:

- North America

- Europe

- APAC

- MEA

- Latin America

Recent Developments:

- In December 2021, ESRI and Microsoft partnered to deliver data related to imagery analysis captured by satellites in space. ArcGIS image technology offered by ESRI processes and analyzes image data hosted on Microsoft’s Azure Orbital.

- In November 2021, Bentley Systems acquired Power Line Systems, which is a global leader in software for power transmission engineering. It was founded in 1984 and is headquartered in Madison. Its concentrated focus from the outset has been ever-improving engineering tools for overhead power line structures, earning the supportive confidence of transmission engineers.

- In January 2021, Fulcrum’s no-code mobile application platform integrated with the location intelligent platform of ESRI to enable the field team to grasp the fulcrum location-based data on ESRI maps. This integration will enhance the efficiency of the QA team, safety, and device management inspectors.

Frequently Asked Questions (FAQ):

What is the projected market value of the global field activity management market?

The global Field activity management Market size is to grow from USD 1.0 Billion in 2021 to USD 2.2 Billion by 2026, at a Compound Annual Growth Rate (CAGR) of 16.4% during the forecast period.

Which region have the highest market share in the field activity management market?

North America is expected to hold the largest market size in the global field activity management market during the forecast period. This region has been extremely responsive toward adopting the latest technological advancements, including field activities, cloud computing, and IoT, within enterprises. The US is the major contributor across North America, as continuous innovation, as well as the introduction of new technologies, are the key factors driving the growth of the US market. With the increase in the use of field activities and BYOD preferences, there is an increase in the number of data breaches.

Which deployment type is expected to hold a higher growth rate during the forecast period?

In the Field activity management market by Deployment Type, cloud is expected to have a higher growth rate. Benefits include flexibility, scalability, affordability, operational efficiency, and low costs. This is due to the associated functionalities and core features. The additional benefits of cloud-based solutions include effectiveness while being used by various users, reduced upfront costs, easy rolling out of new projects, zero hardware investments, low maintenance costs, and minimized infrastructure costs.

Who are the major vendors in the Field activity management market?

Major vendors in the field activity management market are ESRI (US), SAP (Germany), Fielda (US), Fulcrum (US), ProntoForms (Canada), OnSource (US), SafetyCulture (Australia), Field Safe Solutions (Canada), GoCanvas (US), Repsly (US), Fieldwire (UK), FieldEZ (India), FastField (US), MobileLogix (US), Corrata (Ireland), Thundermaps (New Zealand), Logistrics Services (Canada), Bentley Systems (US), Webuild (Australia), Smart Service (US), Device Magic (US), Forms On Fire (US). .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 20)

1.1 INTRODUCTION TO COVID–19

1.2 COVID–19 HEALTH ASSESSMENT

FIGURE 1 COVID–19: GLOBAL PROPAGATION

FIGURE 2 COVID–19 PROPAGATION: SELECT COUNTRIES

1.3 COVID–19 ECONOMIC ASSESSMENT

FIGURE 3 REVISED GROSS DOMESTIC PRODUCT FORECASTS FOR SELECT G20 COUNTRIES IN 2020

1.3.1 COVID–19 ECONOMIC IMPACT—SCENARIO ASSESSMENT

FIGURE 4 CRITERIA IMPACTING GLOBAL ECONOMY

FIGURE 5 SCENARIOS IN TERMS OF RECOVERY OF GLOBAL ECONOMY

1.4 OBJECTIVES OF THE STUDY

1.5 MARKET DEFINITION

1.5.1 INCLUSIONS AND EXCLUSIONS

1.6 MARKET SCOPE

1.6.1 MARKET SEGMENTATION

1.6.2 REGIONS COVERED

1.6.3 YEARS CONSIDERED FOR THE STUDY

1.7 CURRENCY CONSIDERED

1.8 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 29)

2.1 RESEARCH DATA

FIGURE 6 FIELD ACTIVITY MANAGEMENT MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

2.1.2.1 Breakup of primary profiles

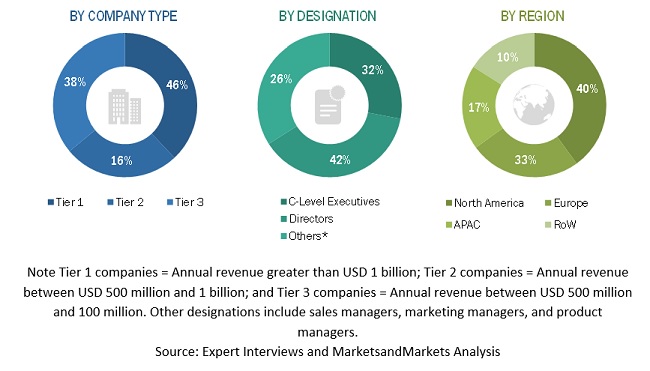

FIGURE 7 BREAKUP OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

2.1.2.2 Key industry insights

2.2 MARKET BREAKUP AND DATA TRIANGULATION

FIGURE 8 DATA TRIANGULATION

2.3 MARKET SIZE ESTIMATION

FIGURE 9 MARKET: TOP–DOWN AND BOTTOM–UP APPROACHES

FIGURE 10 MARKET SIZE ESTIMATION METHODOLOGY – APPROACH 1 (SUPPLY SIDE): REVENUE OF FAM FROM VENDORS

FIGURE 11 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM–UP APPROACH (SUPPLY SIDE): COLLECTIVE REVENUE OF FIELD ACTIVITY MANAGEMENT VENDORS

FIGURE 12 MARKET SIZE ESTIMATION METHODOLOGY –APPROACH 2 (DEMAND SIDE): FIELD ACTIVITY MANAGEMENT MARKET

2.4 MARKET FORECAST

TABLE 1 FACTOR ANALYSIS

2.5 ASSUMPTIONS FOR THE STUDY

2.6 LIMITATIONS OF THE STUDY

3 EXECUTIVE SUMMARY (Page No. - 39)

FIGURE 13 FIELD ACTIVITY MANAGEMENT MARKET SIZE, 2020–2026

FIGURE 14 LARGEST SEGMENTS IN THE MARKET, 2021

FIGURE 15 MARKET ANALYSIS

FIGURE 16 ASIA PACIFIC TO BE BEST MARKET FOR INVESTMENTS DURING THE FORECAST PERIOD

4 PREMIUM INSIGHTS (Page No. - 44)

4.1 ATTRACTIVE OPPORTUNITIES IN THE FIELD ACTIVITY MANAGEMENT MARKET

FIGURE 17 RISING DEMAND FOR MOBILE APPLICATIONS TO DRIVE MARKET GROWTH

4.2 DEPLOYMENT MODE: MARKET, 2021

FIGURE 18 CLOUD DEPLOYMENT MODE TO ACCOUNT FOR A LARGER MARKET SHARE IN 2021

4.3 NORTH AMERICAN MARKET, 2021

FIGURE 19 SOLUTION SEGMENT AND UNITED STATES TO ACCOUNT FOR LARGE MARKET SHARES IN NORTH AMERICA IN 2021

4.4 ASIA PACIFIC MARKET, 2021

FIGURE 20 SOLUTION SEGMENT AND CHINA TO ACCOUNT FOR LARGE MARKET SHARES IN ASIA PACIFIC IN 2021

4.5 MARKET, BY COUNTRY

FIGURE 21 INDIA TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

5 MARKET OVERVIEW AND INDUSTRY TRENDS (Page No. - 47)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 22 FIELD ACTIVITY MANAGEMENT MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Growing demand for workforce optimization and mobile applications

FIGURE 23 SMARTPHONE ADOPTION TREND BY 2025

5.2.1.2 Increasing adoption of cloud-based field activity management solutions

5.2.1.3 Increasing need for predictive analytics

5.2.1.4 Increase in adoption of BYOD

FIGURE 24 PERCENTAGE OF EMPLOYEES DESIGNATED MOBILE WORKERS VS. EMPLOYEES WHO USE MOBILE DEVICES FOR WORK

5.2.2 RESTRAINTS

5.2.2.1 Resistance from field workers to adopt automated solutions

5.2.2.2 Privacy and security concerns related to workforce data deployed on the cloud

5.2.3 OPPORTUNITIES

5.2.3.1 Increasing need to make informed decisions among enterprises

5.2.3.2 Rising adoption of field activity management solutions by SMEs

5.2.3.3 Emergence of technologies, such as augmented reality

5.2.3.4 Integration of IoT for improved experience

5.2.4 CHALLENGES

5.2.4.1 Tracking the workforce in real-time, especially when they are off-field, is a major challenge

5.2.4.2 Ensuring the safety and liability concerns for workers visiting hazardous locations is one of the most important issues for many organizations

5.3 INDUSTRY TRENDS

5.3.1 VALUE CHAIN ANALYSIS

FIGURE 25 FIELD ACTIVITY MANAGEMENT MARKET: VALUE CHAIN

5.3.2 ECOSYSTEM

TABLE 2 MARKET: ECOSYSTEM

5.3.3 PORTER’S FIVE FORCE MODEL

TABLE 3 IMPACT OF EACH FORCE ON THE MARKET

5.3.3.1 Threat of new entrants

5.3.3.2 Threat of substitutes

5.3.3.3 Bargaining power of suppliers

5.3.3.4 Bargaining power of buyers

5.3.3.5 Degree of competition

5.3.4 TECHNOLOGY ANALYSIS

5.3.4.1 Machine learning and artificial intelligence

5.3.4.2 Internet of things

5.3.4.3 Analytics

5.3.4.4 Cloud

5.3.5 PATENT ANALYSIS

FIGURE 26 TOP TEN COMPANIES WITH THE HIGHEST NUMBER OF PATENT APPLICATIONS

TABLE 4 TOP TWENTY PATENT OWNERS

FIGURE 27 NUMBER OF PATENTS GRANTED IN A YEAR OVER THE LAST TEN YEARS

5.3.6 AVERAGE SELLING PRICE ANALYSIS

TABLE 5 AVERAGE SELLING PRICE RANGES OF SUBSCRIPTION BASED FIELD ACTIVITY MANAGEMENT SYSTEMS

5.3.7 USE CASES

TABLE 6 USE CASE 1: FIELDA

TABLE 7 USE CASE 2: CORRATA

TABLE 8 USE CASE 3: FIELDEZ

TABLE 9 USE CASE 4: IFS

TABLE 10 USE CASE 5: FULCRUMAPP

5.4 COVID-19 PANDEMIC-DRIVEN MARKET DYNAMICS AND FACTOR ANALYSIS

5.4.1 OVERVIEW

5.4.2 DRIVERS AND OPPORTUNITIES

5.4.3 RESTRAINTS AND CHALLENGES

5.4.4 CUMULATIVE GROWTH ANALYSIS

TABLE 11 MARKET: CUMULATIVE GROWTH ANALYSIS

6 FIELD ACTIVITY MANAGEMENT MARKET, BY COMPONENT (Page No. - 67)

6.1 INTRODUCTION

FIGURE 28 SOLUTION TO DOMINATE THE MARKET DURING THE FORECAST PERIOD

TABLE 12 COMPONENTS: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

TABLE 13 MARKET SIZE, BY COMPONENT, 2020–2026 (USD MILLION)

6.2 SOLUTION

6.2.1 SOLUTION: MARKET DRIVERS

6.2.2 SOLUTION: COVID-19 IMPACT

TABLE 14 SOLUTION: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

6.3 SERVICES

6.3.1 SERVICES: MARKET DRIVERS

6.3.2 SERVICES: COVID-19 IMPACT

FIGURE 29 IMPLEMENTATION AND INTEGRATION SEGMENT TO HAVE THE LARGEST MARKET SHARE DURING THE FORECAST PERIOD

TABLE 15 SERVICES: FIELD ACTIVITY MANAGEMENT MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

TABLE 16 COMPONENTS: MARKET SIZE, BY SERVICE, 2020–2026 (USD MILLION)

6.3.3 CONSULTING

TABLE 17 CONSULTING: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

6.3.4 INTEGRATION AND IMPLEMENTATION

TABLE 18 INTEGRATION AND IMPLEMENTATION: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

6.3.5 TRAINING AND SUPPORT

TABLE 19 TRAINING AND SUPPORT: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

7 FIELD ACTIVITY MANAGEMENT MARKET, BY DEPLOYMENT MODE (Page No. - 75)

7.1 INTRODUCTION

FIGURE 30 CLOUD DEPLOYMENT MODE TO DOMINATE THE MARKET DURING THE FORECAST PERIOD

TABLE 20 MARKET SIZE, BY DEPLOYMENT MODE, 2020–2026 (USD MILLION)

7.2 CLOUD

7.2.1 CLOUD: MARKET DRIVERS

7.2.2 CLOUD: COVID-19 IMPACT

TABLE 21 CLOUD: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

7.3 ON-PREMISES

7.3.1 ON-PREMISES: MARKET DRIVERS

7.3.2 ON-PREMISES: COVID-19 IMPACT

TABLE 22 ON-PREMISES: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

8 FIELD ACTIVITY MANAGEMENT MARKET, BY ORGANIZATION SIZE (Page No. - 80)

8.1 INTRODUCTION

FIGURE 31 SMALL AND MEDIUM-SIZED ENTERPRISES SEGMENT TO REGISTER A HIGHER GROWTH RATE DURING THE FORECAST PERIOD

TABLE 23 MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

8.2 LARGE ENTERPRISES

8.2.1 LARGE ENTERPRISES: MARKET DRIVERS

8.2.2 LARGE ENTERPRISES: COVID-19 IMPACT

TABLE 24 LARGE ENTERPRISES: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

8.3 SMALL AND MEDIUM-SIZED ENTERPRISES

8.3.1 SMALL AND MEDIUM-SIZED ENTERPRISES: MARKET DRIVERS

8.3.2 SMALL AND MEDIUM-SIZED ENTERPRISES: COVID-19 IMPACT

TABLE 25 SMALL AND MEDIUM-SIZED ENTERPRISES: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

9 FIELD ACTIVITY MANAGEMENT MARKET, BY VERTICAL (Page No. - 85)

9.1 INTRODUCTION

FIGURE 32 CONSTRUCTION AND REAL ESTATE ENTERPRISES SEGMENT TO REGISTER THE HIGHEST GROWTH RATE DURING THE FORECAST PERIOD

TABLE 26 MARKET SIZE, BY VERTICAL, 2020–2026 (USD MILLION)

9.2 TELECOM

9.2.1 TELECOM: MARKET DRIVERS

9.2.2 TELECOM: COVID-19 IMPACT

TABLE 27 TELECOM: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

9.3 ENERGY AND UTILITIES

9.3.1 ENERGY AND UTILITIES: MARKET DRIVERS

9.3.2 ENERGY AND UTILITIES: COVID-19 IMPACT

TABLE 28 ENERGY AND UTILITIES: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

9.4 CONSTRUCTION AND REAL ESTATE

9.4.1 CONSTRUCTION AND REAL ESTATE: MARKET DRIVERS

9.4.2 CONSTRUCTION AND REAL ESTATE: COVID-19 IMPACT

TABLE 29 CONSTRUCTION AND REAL ESTATE: FIELD ACTIVITY MANAGEMENT MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

9.5 MANUFACTURING

9.5.1 MANUFACTURING: MARKET DRIVERS

9.5.2 MANUFACTURING: COVID-19 IMPACT

TABLE 30 MANUFACTURING: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

9.6 AGRICULTURE

9.6.1 AGRICULTURE: MARKET DRIVERS

9.6.2 AGRICULTURE: COVID-19 IMPACT

TABLE 31 AGRICULTURE: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

9.7 GOVERNMENT

9.7.1 GOVERNMENT: MARKET DRIVERS

9.7.2 GOVERNMENT: COVID-19 IMPACT

TABLE 32 GOVERNMENT: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

9.8 OTHER VERTICALS

TABLE 33 OTHER VERTICALS: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

10 FIELD ACTIVITY MANAGEMENT MARKET, BY REGION (Page No. - 96)

10.1 INTRODUCTION

FIGURE 33 NORTH AMERICA TO DOMINATE THE MARKET DURING THE FORECAST PERIOD

TABLE 34 \MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

FIGURE 34 ASIA PACIFIC TO BE THE FASTEST-GROWING \MARKET DURING THE FORECAST PERIOD

10.2 NORTH AMERICA

10.2.1 NORTH AMERICA: \MARKET DRIVERS

10.2.2 NORTH AMERICA: COVID–19 IMPACT

FIGURE 35 NORTH AMERICA: MARKET SNAPSHOT

TABLE 35 NORTH AMERICA: FIELD ACTIVITY MANAGEMENT MARKET SIZE, BY COMPONENT, 2020–2026 (USD MILLION)

TABLE 36 NORTH AMERICA: MARKET SIZE, BY SERVICE, 2020–2026 (USD MILLION)

TABLE 37 NORTH AMERICA: MARKET SIZE, BY DEPLOYMENT MODE, 2020–2026 (USD MILLION)

TABLE 38 NORTH AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

TABLE 39 NORTH AMERICA: MARKET SIZE, BY VERTICAL, 2020–2026 (USD MILLION)

TABLE 40 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

10.2.3 UNITED STATES

TABLE 41 UNITED STATES: FIELD ACTIVITY MANAGEMENT MARKET SIZE, BY COMPONENT, 2020–2026 (USD MILLION)

TABLE 42 UNITED STATES: MARKET SIZE, BY SERVICE, 2020–2026 (USD MILLION)

TABLE 43 UNITED STATES: MARKET SIZE, BY DEPLOYMENT MODE, 2020–2026 (USD MILLION)

TABLE 44 UNITED STATES: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

TABLE 45 UNITED STATES: MARKET SIZE, BY VERTICAL, 2020–2026 (USD MILLION)

10.2.4 CANADA

TABLE 46 CANADA: MARKET SIZE, BY COMPONENT, 2020–2026 (USD MILLION)

TABLE 47 CANADA: MARKET SIZE, BY SERVICE, 2020–2026 (USD MILLION)

TABLE 48 CANADA: MARKET SIZE, BY DEPLOYMENT MODE, 2020–2026 (USD MILLION)

TABLE 49 CANADA: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

TABLE 50 CANADA: MARKET SIZE, BY VERTICAL, 2020–2026 (USD MILLION)

10.3 EUROPE

10.3.1 EUROPE: MARKET DRIVERS

10.3.2 EUROPE: COVID–19 IMPACT

TABLE 51 EUROPE: FIELD ACTIVITY MANAGEMENT MARKET SIZE, BY COMPONENT, 2020–2026 (USD MILLION)

TABLE 52 EUROPE: MARKET SIZE, BY SERVICE, 2020–2026 (USD MILLION)

TABLE 53 EUROPE: MARKET SIZE, BY DEPLOYMENT MODE, 2020–2026 (USD MILLION)

TABLE 54 EUROPE: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

TABLE 55 EUROPE: MARKET SIZE, BY VERTICAL, 2020–2026 (USD MILLION)

TABLE 56 EUROPE: MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

10.3.3 UNITED KINGDOM

TABLE 57 UNITED KINGDOM: MARKET SIZE, BY COMPONENT, 2020–2026 (USD MILLION)

TABLE 58 UNITED KINGDOM: MARKET SIZE, BY SERVICE, 2020–2026 (USD MILLION)

TABLE 59 UNITED KINGDOM: MARKET SIZE, BY DEPLOYMENT MODE, 2020–2026 (USD MILLION)

TABLE 60 UNITED KINGDOM: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

TABLE 61 UNITED KINGDOM: MARKET SIZE, BY VERTICAL, 2020–2026 (USD MILLION)

10.4 ASIA PACIFIC

10.4.1 ASIA PACIFIC: MARKET DRIVERS

10.4.2 ASIA PACIFIC: COVID–19 IMPACT

FIGURE 36 ASIA PACIFIC: MARKET SNAPSHOT

TABLE 62 ASIA PACIFIC: FIELD ACTIVITY MANAGEMENT MARKET SIZE, BY COMPONENT, 2020–2026 (USD MILLION)

TABLE 63 ASIA PACIFIC: MARKET SIZE, BY SERVICE, 2020–2026 (USD MILLION)

TABLE 64 ASIA PACIFIC: MARKET SIZE, BY DEPLOYMENT MODE, 2020–2026 (USD MILLION)

TABLE 65 ASIA PACIFIC: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

TABLE 66 ASIA PACIFIC: MARKET SIZE, BY VERTICAL, 2020–2026 (USD MILLION)

TABLE 67 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

10.4.3 CHINA

TABLE 68 CHINA: MARKET SIZE, BY COMPONENT, 2020–2026 (USD MILLION)

TABLE 69 CHINA: MARKET SIZE, BY SERVICE, 2020–2026 (USD MILLION)

TABLE 70 CHINA: MARKET SIZE, BY DEPLOYMENT MODE, 2020–2026 (USD MILLION)

TABLE 71 CHINA: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

TABLE 72 CHINA: MARKET SIZE, BY VERTICAL, 2020–2026 (USD MILLION)

10.5 MIDDLE EAST AND AFRICA

10.5.1 MIDDLE EAST AND AFRICA: MARKET DRIVERS

10.5.2 MIDDLE EAST AND AFRICA: COVID–19 IMPACT

TABLE 73 MIDDLE EAST AND AFRICA: FIELD ACTIVITY MANAGEMENT MARKET SIZE, BY COMPONENT, 2020–2026 (USD MILLION)

TABLE 74 MIDDLE EAST AND AFRICA: MARKET SIZE, BY SERVICE, 2020–2026 (USD MILLION)

TABLE 75 MIDDLE EAST AND AFRICA: MARKET SIZE, BY DEPLOYMENT MODE, 2020–2026 (USD MILLION)

TABLE 76 MIDDLE EAST AND AFRICA: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

TABLE 77 MIDDLE EAST AND AFRICA: MARKET SIZE, BY VERTICAL, 2020–2026 (USD MILLION)

TABLE 78 MIDDLE EAST AND AFRICA: MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

10.6 LATIN AMERICA

10.6.1 LATIN AMERICA: MARKET DRIVERS

10.6.2 LATIN AMERICA: COVID–19 IMPACT

TABLE 79 LATIN AMERICA: FIELD ACTIVITY MANAGEMENT MARKET SIZE, BY COMPONENT, 2020–2026 (USD MILLION)

TABLE 80 LATIN AMERICA: MARKET SIZE, BY SERVICE, 2020–2026 (USD MILLION)

TABLE 81 LATIN AMERICA: MARKET SIZE, BY DEPLOYMENT MODE, 2020–2026 (USD MILLION)

TABLE 82 LATIN AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

TABLE 83 LATIN AMERICA: MARKET SIZE, BY VERTICAL, 2020–2026 (USD MILLION)

TABLE 84 LATIN AMERICA: MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

11 COMPETITIVE LANDSCAPE (Page No. - 125)

11.1 OVERVIEW

11.2 MARKET EVALUATION FRAMEWORK

FIGURE 37 MARKET EVALUATION FRAMEWORK, 2019–2021

11.3 KEY MARKET DEVELOPMENTS

11.3.1 PRODUCT LAUNCHES

TABLE 85 FIELD ACTIVITY MANAGEMENT MARKET: PRODUCT LAUNCHES, FEBRUARY 2021–NOVEMBER 2021

11.3.2 DEALS

TABLE 86 MARKET: DEALS, APRIL 2019–DECEMBER 2021

11.4 MARKET SHARE ANALYSIS OF TOP PLAYERS

TABLE 87 MARKET: DEGREE OF COMPETITION

FIGURE 38 MARKET SHARE ANALYSIS OF COMPANIES IN THE MARKET

11.5 COMPANY EVALUATION MATRIX OVERVIEW

11.6 COMPANY EVALUATION MATRIX METHODOLOGY AND DEFINITIONS

TABLE 88 PRODUCT FOOTPRINT WEIGHTAGE

11.6.1 STAR

11.6.2 EMERGING LEADERS

11.6.3 PERVASIVE

11.6.4 PARTICIPANTS

FIGURE 39 FIELD ACTIVITY MANAGEMENT MARKET, COMPANY EVALUATION MATRIX, 2021

11.7 COMPANY PRODUCT FOOTPRINT ANALYSIS

TABLE 89 COMPANY PRODUCT FOOTPRINT

TABLE 90 COMPANY APPLICATION FOOTPRINT

TABLE 91 COMPANY VERTICAL FOOTPRINT

TABLE 92 COMPANY REGION FOOTPRINT

11.8 COMPANY MARKET RANKING ANALYSIS

FIGURE 40 RANKING OF KEY PLAYERS IN THE MARKET, 2021

12 COMPANY PROFILES (Page No. - 137)

12.1 MAJOR PLAYERS

(Business Overview, Products, Recent Developments, MnM View)*

12.1.1 ESRI

TABLE 93 ESRI: BUSINESS OVERVIEW

TABLE 94 ESRI: FIELD ACTIVITY MANAGEMENT MARKET: PRODUCTS OFFERED

TABLE 95 ESRI: MARKET: PRODUCT LAUNCHES

TABLE 96 ESRI: MARKET: DEALS

12.1.2 SAP

TABLE 97 SAP: BUSINESS OVERVIEW

FIGURE 41 SAP: COMPANY SNAPSHOT

TABLE 98 SAP: MARKET: PRODUCTS OFFERED

TABLE 99 SAP: MARKET: DEALS

12.1.3 BENTLEY SYSTEMS

TABLE 100 BENTLEY SYSTEMS: BUSINESS OVERVIEW

FIGURE 42 BENTLEY SYSTEMS: COMPANY SNAPSHOT

TABLE 101 BENTLEY SYSTEMS: MARKET: PRODUCTS OFFERED

TABLE 102 BENTLEY SYSTEMS: MARKET: DEALS

12.1.4 FULCRUM

TABLE 103 FULCRUM: BUSINESS OVERVIEW

TABLE 104 FULCRUM: FIELD ACTIVITY MANAGEMENT MARKET: PRODUCTS OFFERED

TABLE 105 FULCRUM: MARKET: PRODUCT LAUNCHES

TABLE 106 FULCRUM: MARKET: DEALS

12.1.5 PRONTOFORMS

TABLE 107 PRONTOFORMS: BUSINESS OVERVIEW

TABLE 108 PRONTOFORMS: MARKET: PRODUCTS OFFERED

TABLE 109 PRONTOFORMS: MARKET: OTHERS

12.1.6 ONSOURCE

TABLE 110 ONSOURCE: BUSINESS OVERVIEW

FIGURE 43 GENPACT: COMPANY SNAPSHOT

TABLE 111 ONSOURCE: MARKET: PRODUCTS OFFERED

12.1.7 SAFETYCULTURE

TABLE 112 SAFETYCULTURE: BUSINESS OVERVIEW

TABLE 113 SAFETYCULTURE: MARKET: PRODUCTS OFFERED

TABLE 114 SAFETYCULTURE: MARKET: PRODUCT LAUNCHES

12.1.8 FIELD SAFE SOLUTIONS

TABLE 115 FIELD SAFE SOLUTIONS: BUSINESS OVERVIEW

TABLE 116 FIELD SAFE SOLUTIONS: FIELD ACTIVITY MANAGEMENT MARKET: PRODUCTS OFFERED

12.1.9 GOCANVAS

TABLE 117 GOCANVAS: BUSINESS OVERVIEW

TABLE 118 GOCANVAS: MARKET: PRODUCTS OFFERED

TABLE 119 GOCANVAS: MARKET: PRODUCT LAUNCHES

TABLE 120 GOCANVAS: MARKET: DEALS

12.1.10 REPSLY

TABLE 121 REPSLY: BUSINESS OVERVIEW

TABLE 122 REPSLY: MARKET: PRODUCTS OFFERED

TABLE 123 REPSLY: MARKET: PRODUCT LAUNCHES

12.1.11 FIELDA INC

TABLE 124 FIELDA INC: BUSINESS OVERVIEW

TABLE 125 FIELDA INC: MARKET: PRODUCTS OFFERED

TABLE 126 FIELDA INC: MARKET: PRODUCT LAUNCHES

12.1.12 FIELDWIRE

TABLE 127 FIELDWIRE: BUSINESS OVERVIEW

TABLE 128 FIELDWIRE: FIELD ACTIVITY MANAGEMENT MARKET: PRODUCTS OFFERED

TABLE 129 FIELDWIRE: MARKET: PRODUCT LAUNCHES

*Details on Business Overview, Recent Developments, MnM View might not be captured in case of unlisted companies.

12.2 OTHER VENDORS

12.2.1 FIELDEZ

12.2.2 FASTFIELD

12.2.3 MOBILELOGIX, INC.

12.2.4 CORRATA

12.2.5 THUNDERMAPS

12.2.6 LOGISTRICS SERVICES

12.2.7 WEBUILD

12.2.8 SMART SERVICE

12.2.9 DEVICE MAGIC

12.2.10 FORMS ON FIRE

13 ADJACENT/RELATED MARKET (Page No. - 177)

13.1 INTRODUCTION

13.1.1 LIMITATIONS

13.2 FIELD SERVICE MANAGEMENT MARKET WITH THE COVID-19 IMPACT ANALYSIS–GLOBAL FORECAST TO 2026

13.2.1 MARKET DEFINITION

13.2.2 MARKET OVERVIEW

13.2.2.1 Field service management market, by component

TABLE 130 FIELD SERVICE MANAGEMENT MARKET SIZE, BY COMPONENT, 2016–2020 (USD MILLION)

TABLE 131 FIELD SERVICE MANAGEMENT MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

13.2.2.2 Field service management market, by deployment mode

TABLE 132 FIELD SERVICE MANAGEMENT MARKET SIZE, BY DEPLOYMENT MODE, 2016–2020 (USD MILLION)

TABLE 133 FIELD SERVICE MANAGEMENT MARKET SIZE, BY DEPLOYMENT TYPE, 2021–2026 (USD MILLION)

13.2.2.3 Field service management market, by organization size

TABLE 134 FIELD SERVICE MANAGEMENT MARKET SIZE, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 135 FIELD SERVICE MANAGEMENT MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

13.2.2.4 Field service management market, by vertical

TABLE 136 FIELD SERVICE MANAGEMENT MARKET SIZE, BY VERTICAL, 2016–2020 (USD MILLION)

TABLE 137 FIELD SERVICE MANAGEMENT MARKET SIZE, BY VERTICAL, 2021–2026 (USD MILLION)

13.3 WORKFORCE MANAGEMENT MARKET – GLOBAL FORECAST 2025

13.3.1 MARKET DEFINITION

13.3.2 MARKET OVERVIEW

13.3.2.1 Workforce management market, by component

TABLE 138 WORKFORCE MANAGEMENT MARKET SIZE, BY COMPONENT, 2018–2025 (USD MILLION)

13.3.2.2 Workforce management market, by solution

TABLE 139 WORKFORCE MANAGEMENT MARKET SIZE, BY SOLUTION, 2018–2025 (USD MILLION)

13.3.2.3 Workforce management market, by service

TABLE 140 WORKFORCE MANAGEMENT MARKET SIZE, BY SERVICE, 2018–2025 (USD MILLION)

13.3.2.4 Workforce management market, by deployment mode

TABLE 141 WORKFORCE MANAGEMENT MARKET SIZE, BY DEPLOYMENT TYPE, 2018–2025 (USD MILLION)

13.3.2.5 Workforce management market, by organization size

TABLE 142 WORKFORCE MANAGEMENT MARKET SIZE, BY ORGANIZATION SIZE, 2018–2025 (USD MILLION)

13.3.2.6 Workforce management market, by vertical

TABLE 143 WORKFORCE MANAGEMENT MARKET SIZE, BY VERTICAL, 2018–2025 (USD MILLION)

13.3.2.7 Workforce management market, by region

TABLE 144 WORKFORCE MANAGEMENT MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

13.4 FIELD FORCE AUTOMATION MARKET — GLOBAL FORECAST 2024

13.4.1 MARKET DEFINITION

13.4.2 MARKET OVERVIEW

13.4.2.1 Field force automation market, by component

TABLE 145 FIELD FORCE AUTOMATION MARKET SIZE, BY COMPONENT, 2017–2024 (USD MILLION)

13.4.2.2 Field force automation market, by organization size

TABLE 146 FIELD FORCE AUTOMATION MARKET SIZE, BY ORGANIZATION SIZE, 2017–2024 (USD MILLION)

13.4.2.3 Field force automation market, by deployment type

TABLE 147 FIELD FORCE AUTOMATION MARKET SIZE, BY DEPLOYMENT TYPE, 2017–2024 (USD MILLION)

13.4.2.4 Field force automation market, by industry vertical

TABLE 148 FIELD FORCE AUTOMATION MARKET, BY INDUSTRY VERTICAL, 2017–2024 (USD MILLION)

13.4.2.5 Field force automation market, by region

TABLE 149 FIELD FORCE AUTOMATION MARKET SIZE, BY REGION, 2017–2024 (USD MILLION)

14 APPENDIX (Page No. - 192)

14.1 DISCUSSION GUIDE

14.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

14.3 AVAILABLE CUSTOMIZATIONS

14.4 RELATED REPORTS

14.5 AUTHOR DETAILS

This research study involved the use of extensive secondary sources, directories, and databases, such as D&B Hoovers, DiscoverOrg, Factiva, vendor data sheets, product demos, Cloud Computing Association (CCA), Vendor Surveys, Asia Cloud Computing Association, and The Software Alliance. All these sources were referred to, to identify and collect information useful for this technical, market-oriented, and commercial study of the FAM market. Primary sources were several industry experts from the core and related industries, preferred software providers, distributors, service providers, technology developers, alliances, and organizations related to all the segments of the industry’s value chain. In-depth interviews were conducted with various primary respondents, including key industry participants, subject-matter experts, C-level executives of key market players, and industry consultants, to obtain and verify critical qualitative and quantitative information and assess the market’s prospects.

Secondary Research

The market size of companies offering FAM was derived on the basis of the secondary data available through paid and unpaid sources by analyzing the product portfolios of major companies in the ecosystem and rating the companies based on their product capabilities and business strategies. In the secondary research process, various sources were referred to, for identifying and collecting information for the study. Secondary sources included annual reports, press releases, and investor presentations of companies and product data sheets; white papers; journals; certified publications; and articles from recognized authors, government websites, directories, and databases.

Secondary research was majorly used to obtain the key information related to the industry’s supply chain, the total pool of key players, market classification, and segmentation according to industry trends to the bottom-most level, regional markets, and key developments from both market-and technology-oriented perspectives; all of which were further validated by primary sources.

Primary Research

In the primary research process, various primary sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts, including Chief Experience Officers (CXOs); Vice Presidents (VPs); directors from business development, marketing, and product development/innovation teams; related key executives from FAM vendors, industry associations, and independent consultants; and key opinion leaders.

Primary interviews were conducted to gather insights, such as market statistics, latest trends disrupting the market, new use cases implemented, data of revenue collected from products and services, market breakups, market size estimations, market forecasts, and data triangulation. Primary research also helped in understanding various trends related to technology, component, deployment, and region. Demand-side stakeholders, such as Chief Information Officers (CIOs), Chief Technology Officers (CTOs), Chief Security Officers (CSOs), the installation teams of governments/end users using FAM, and digital initiatives project teams, were interviewed to understand the buyer’s perspective on suppliers, products, service providers, and their current use, which would affect the overall FAM market.

Given below is the breakup of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The top-down and bottom-up approaches were used to estimate and validate the size of the FAM market and various other dependent subsegments. The research methodology used to estimate the market size included the following: the key players in the market were identified through secondary research, and their revenue contributions in respective countries were determined through primary and secondary research, this entire procedure included the study of the annual and financial reports of top market players and extensive interviews for key insights from industry leaders, such as CEOs, VPs, directors, and marketing executives, all percentage splits and breakups were determined using secondary sources and verified through primary sources. All possible parameters affecting the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. This data is consolidated and added with detailed inputs and analysis from MarketsandMarkets. In the bottom-up approach, the adoption trend of FAM in key countries with respect to regions that contribute to most of the market share was identified. For cross-validation, the adoption trend of FAM, along with different use cases with respect to their business segments, was identified and extrapolated. Weightage was given to the use cases identified in different areas for the calculation. An exhaustive list of all vendors offering services in the FAM market was prepared. The revenue contribution of all vendors in the market was estimated through annual reports, press releases, funding, investor presentations, paid databases, and primary interviews. Vendors with FAM offerings were considered for the evaluation of the market size. Each vendor was evaluated based on its offerings across verticals. The aggregate of all companies’ revenue was extrapolated to reach the overall market size. Each subsegment was studied and analyzed for its market size and regional penetration. Based on these numbers, the region split was determined by primary and secondary sources.

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and sub segments. The data triangulation and market breakup procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics of each market segment and sub segment. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To describe and forecast the global field activity management (FAM) market based on components (solution and services), deployment mode, organization size, verticals, and regions

- To forecast the market size of regional segments: North America, Europe, Asia Pacific (APAC), Middle East and Africa (MEA), and Latin America

- To strategically analyze the market’s subsegments with respect to individual growth trends, prospects, and contributions to the total market

- To provide detailed information related to major factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market

- To analyze opportunities in the market for stakeholders and provide details of the competitive landscape for major players

- To comprehensively analyze the core competencies of key players

- To track and analyze COVID–19 and competitive developments, such as mergers and acquisitions, new product developments, and partnerships and collaborations, in the market.

Available customizations

Along with the market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Company information

- Detailed analysis and profiling of additional market players (Up to 5)

Geographic Analysis

- Further breakdown of the European Field activity management Market

- Further breakdown of the APAC Market

- Further breakdown of the MEA Market

- Further breakdown of the Latin American Market

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Field Activity Management Market