Fiducial Markers Market by Product (Metal Based Markers (Gold, Gold Combination) Polymer Markers), Cancer Type (Prostate, Lung, Breast), Modality (CT, CBCT, MRI, Ultrasound), End User (Hospitals, Outpatient Facilities) & Region - Global Forecast to 2025

Market Growth Outlook Summary

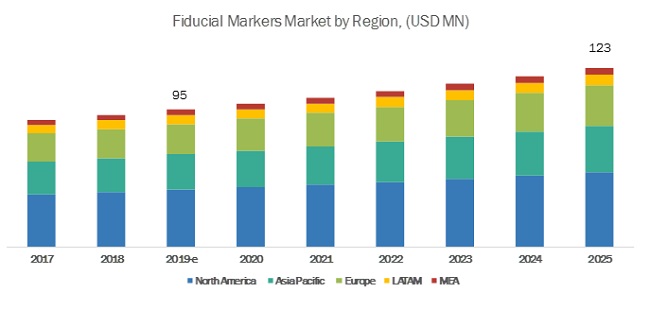

The global fiducial markers market growth forecasted to transform from $95 million in 2019 to $123 million by 2025, driven by a CAGR of 4.5%. Increasing investments, funds, and grants by public-private organizations for cancer research, technological advancements in the market, and the rising cancer burden globally will fuel market growth over the forecast period.

By product, the metal-based markers segment is expected to hold the largest share of the fiducial markers industry during the forecast period

Based on product, the fiducial markers market is segmented into metal-based, polymer-based, and other fiducial markers. The metal-based markers segment is further subsegmented into pure gold markers, gold combination markers, and other metal-based markers (tungsten, platinum, and nitinol, among others). The metal-based markers segment commanded the largest share of the market in 2018.

The ultrasound modality segment of the fiducial markers industry will register significant growth over the forecast period

On the basis of modality, the fiducial markers market is classified into CT/CBCT, MRI, ultrasound, and radiotherapy. Technological advancements and the rising preference for minimally invasive procedures have supported the high growth of the ultrasound modality segment.

Prostate cancer commanded the leading market share of the fiducial markers industry due to the rising preference for radiotherapy treatment

By cancer type, the fiducial markers market is segmented into prostate cancer, lung cancer, breast cancer, gastric cancer, and others. The prostate cancer segment is expected to dominate the market. The ongoing modernization and expansion of healthcare infrastructure, growing medical tourism, and improving research capabilities are expected to improve radiotherapy accessibility, further supporting market growth.

The hospitals & outpatient facilities end-user segment garnered the highest revenue in the fiducial markers industry

The end users of fiducial markers include hospitals & outpatient facilities, independent radiotherapy centers, and cancer research centers. As FM placement around tumors is generally a noncritical procedure, it is typically performed in outpatient settings seven days before radiotherapy. This has ensured a sustained demand for the services of such facilities. In addition, the growing adoption of EBRT procedures (that utilize FMs for tumor localization) and the development & modernization of healthcare facilities are supporting the growth of this segment.

The Asia Pacific region of the fiducial markers industry is expected to grow at the highest CAGR during the forecast period

The fiducial markers market is segmented into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. The Asia Pacific market is expected to be the fastest-growing region owing to improvements in healthcare infrastructure and supportive government initiatives. In addition, the growing incidence of cancer and the rising acceptance of radiotherapy procedures are propelling market growth. However, a dearth of skilled and experienced oncologists in developing countries and the slow adoption of advanced technologies are restraining the growth of the market.

The major players in the market include CIVCO Radiotherapy (US), IZI Medical Products (US), Boston Scientific Corporation (US), Naslund Medical AB (Sweden), and IBA (Belgium). Other players in the market are Best Medical International, Inc. (US), Nanovi A/S (Denmark), Carbon Medical Technologies (US), Eckert & Ziegler (Germany), Innovative Oncology Solutions (US), Medtronic (Ireland), QlRad Inc. (US), JJ-Medtech (Netherlands), and QFIX (US).

An analysis of market developments between 2016 and 2019 revealed that several growth strategies, such as product launches and enhancements, partnerships, and acquisitions, were adopted by market players to strengthen their portfolios and maintain a competitive position in the market. Partnerships and agreements were the most widely adopted growth strategies by market players.

CIVCO Radiotherapy (US): In 2018, CIVCO Radiotherapy (US) dominated the global fiducial markers market in 2019. Its strong product portfolio and high geographic penetration are the key factors contributing to the leading position of this company in the market. In order to maintain its dominant position, the company develops both metal-based as well as polymer-based fiducial markers, such as FusionCoil, PolyMark, FlexiCoil, Align, and PointCoil. The company is also focusing on increasing its presence in developing countries to leverage high-growth opportunities.

Scope of the Fiducial Markers Industry:

|

Report Metric |

Details |

|

Market Revenue Size in 2019 |

$95 million |

|

Projected Revenue Size by 2025 |

$123 million |

|

Industry Growth Rate |

Poised to grow at a CAGR of 4.5% |

|

Market Driver |

Growing incidence of cancer |

|

Market Opportunity |

Emerging economies |

The research report categorizes the market fiducial markers market to forecast revenue and analyze trends in each of the following submarkets:

By Product

-

Metal-based Markers

- Pure Gold

- Gold Alloys

- Other Metal-based Markers

- Polymer-based Markers

- Other Fiducial Markers

By Modality

- CT/CBCT

- MRI

- Ultrasound

- Radiotherapy

By Cancer Type

- Prostate Cancer

- Lung Cancer

- Breast Cancer

- Gastric Cancer

- Other Cancers

By End User

- Hospitals & Outpatient Facilities

- Independent Radiotherapy Centers

- Cancer Research Centers

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- France

- UK

- Spain

- Italy

- Rest of Europe

-

Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- Rest of APAC

-

Latin America

- Brazil

- Mexico

- RoLA

- Middle East & Africa

Recent Developments of Fiducial Markers Industry:

- In 2019, Stratpharma AG (Switzerland) expanded its agreement with CIVCO (US) to distribute CIVCO’s radiotherapy solutions globally

- In 2019, IZI Medical Products (US) acquired the RadioMed division of IBA (Belgium), which manufactures the VISICOIL implantable fiducial markers

- In 2018, Nanovi A/S (Denmark) secured USD 2.23 million from existing investors to expand its business and introduce BioXmark in the European market

Frequently Asked Questions (FAQ):

What is the projected market revenue value of the global fiducial markers market?

The global fiducial markers market boasts a total revenue value of $123 million by 2025.

What is the estimated growth rate (CAGR) of the global fiducial markers market?

The global fiducial markers market has an estimated compound annual growth rate (CAGR) of 4.5% and a revenue size in the region of $95 million in 2019.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 15)

1.1 Objectives of the Study

1.2 Market Definition

1.2.1 Markets Covered

1.2.2 Years Considered for the Study

1.3 Currency

1.4 Limitations

1.5 Stakeholders

2 Research Methodology (Page No. - 18)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Breakdown of Primaries

2.1.2.2 Key Data From Primary Sources

2.2 Market Size Estimation

2.2.1 Product-Based Market Estimation

2.2.2 End User-Based Market Size Estimation

2.2.3 Primary Research Validation

2.3 Market Breakdown & Data Triangulation

2.4 Assumptions for the Study

2.5 Research Limitations

3 Executive Summary (Page No. - 28)

4 Premium Insights (Page No. - 32)

4.1 Fiducial Markers: Market Overview

4.2 Fiducial Markers Market, By Product & Region, 2019

4.3 Fiducial Markers Industry, By Modality, 2019–2025

4.4 Fiducial Markers Industry, By Cancer Type, 2019 Vs. 2025

4.5 Market Share, By End User, 2019 Vs. 2025

4.6 Geographic Snapshot of the Fiducial Markers Industry, 2019

5 Market Overview (Page No. - 37)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Growing Incidence of Cancer

5.2.1.2 Improving Reimbursement Scenario

5.2.1.3 Rising Awareness on Radiotherapy

5.2.1.4 Rising Investments and Funding for Cancer Research

5.2.2 Restraints

5.2.2.1 Lack of Adequate Healthcare Infrastructure and Premium Pricing of Modalities

5.2.2.2 Alternative Therapies and High Marker Costs

5.2.3 Opportunities

5.2.3.1 Emerging Economies

5.2.4 Challenges

5.2.4.1 Complications Associated With the Placement of Fiducial Markers

5.2.4.2 Shortage of Trained Personnel

6 Market, By Product (Page No. - 43)

6.1 Introduction

6.2 Metal-Based Markers

6.2.1 Pure Gold Markers

6.2.1.1 Pure Gold Markers Hold the Largest Share of the Metal-Based Market

6.2.2 Gold Combination Markers

6.2.2.1 High-Precision Advantages and Versatility are Driving Demand for Gold Combination Markers

6.2.3 Other Metal-Based Markers

6.3 Polymer-Based Markers

6.3.1 Visibility Limitations Have Affected Demand for Polymer-Based Markers

6.4 Other Fiducial Markers

7 Market, By Modality (Page No. - 55)

7.1 Introduction

7.2 Ct/Cbct

7.2.1 Technological Advancements and Rising Adoption of Cbct are Expected to Fuel Market Growth

7.3 Ultrasound

7.3.1 Rising Preference for Minimally Invasive Procedures is Driving Demand for Ultrasound

7.4 MRI

7.4.1 High Adoption of Combined Ct-Mri Modalities for Fm Localization Will Drive Segmental Growth

7.5 Radiotherapy

7.5.1 High Success Rate of Sbrt Using Radiotherapy Systems Will Drive the Segment Growth

8 Market, By Cancer Type (Page No. - 61)

8.1 Introduction

8.2 Prostate Cancer

8.2.1 Prostate Cancer Holds the Largest Share of the Market, By Cancer Type

8.3 Lung Cancer

8.3.1 Technological Advancements and Product Approvals Will Drive Market Growth

8.4 Gastric Cancer

8.4.1 High Incidence of Gastric Cancer and Advancements in Treatment Support Market Growth

8.5 Breast Cancer

8.5.1 EffiCACy of Advanced Radiology Treatment for Breast Cancer Will Ensure the Growth of the Market

8.6 Other Cancers

9 Market, By End User (Page No. - 69)

9.1 Introduction

9.2 Hospitals & Outpatient Facilities

9.2.1 Hospitals & Outpatient Facilities Hold the Largest Share of the Market

9.3 Independent Radiotherapy Centers

9.3.1 Unfavorable Reimbursement Scenario Will Hamper Growth

9.4 Cancer Research Centers

9.4.1 Rising Investments and Funding Will Increase Research Activities and Support Market Growth

10 Market, By Region (Page No. - 74)

10.1 Introduction

10.2 North America

10.2.1 US

10.2.1.1 US Commanded the Largest Share of the Market in 2018

10.2.2 Canada

10.2.2.1 Public-Private Initiatives are Expected to Support the Adoption of Radiotherapy Procedures and Fiducial Markers

10.3 Europe

10.3.1 Germany

10.3.1.1 Favorable Reimbursement Scenario for Radiotherapy is Supporting Market Growth in Germany

10.3.2 UK

10.3.2.1 Rising Cancer Incidence and the Presence of Highly Developed Healthcare Infrastructure are Supporting Market Growth in the UK

10.3.3 France

10.3.3.1 Increasing Access to Radiotherapy Will Drive Market Growth

10.3.4 Spain

10.3.4.1 Shortage of Human Resources and Lack of Accessibility May Hinder Market Growth

10.3.5 Italy

10.3.5.1 Rising Research Activities Will Support Market Growth

10.3.6 Rest of Europe

10.4 Asia Pacific

10.4.1 Japan

10.4.1.1 Japan Dominates the APAC Market

10.4.2 China

10.4.2.1 China Will Register the Highest Growth in the APAC Market Due to the Growing Target Patient Population

10.4.3 India

10.4.3.1 Indian Market is Expected to be Driven By the Surge in Patient Population and Favorable Government Initiatives

10.4.4 South Korea

10.4.4.1 Growing Adoption of Advanced EBRT is Contributing to Market Growth in the Country

10.4.5 Australia

10.4.5.1 Favorable Reimbursement Scenario Will Support Market Growth

10.4.6 Rest of APAC

10.5 Latin America

10.5.1 Brazil

10.5.1.1 Brazil Held the Largest Share of the Latin American Market in 2018

10.5.2 Mexico

10.5.2.1 Initiatives are Being Undertaken to Spread Awareness and Boost Access to Radiotherapy

10.5.3 Rest of Latam

10.6 Middle East & Africa

10.6.1 Poor Healthcare Infrastructure and Reimbursement Scenario Restrain Market Growth

11 Competitive Landscape (Page No. - 108)

11.1 Overview

11.2 Market Share Analysis

11.3 Competitive Scenario

11.3.1 Key Product Launches and Enhancements

11.3.2 Key Agreements, Partnerships, and Collaborations

11.3.3 Key Acquisitions

11.3.4 Key Expansions

11.4 Competitive Leadership Mapping

11.4.1 Visionary Leaders

11.4.2 Innovators

11.4.3 Dynamic Differentiators

11.4.4 Emerging Companies

12 Company Profiles (Page No. - 114)

(Business Overview, Products Offered, Recent Developments, MnM View)*

12.1 CIVCO Radiotherapy

12.2 Boston Scientific Corporation

12.3 IZI Medical Products

12.4 IBA

12.5 Naslund Medical AB

12.6 Medtronic

12.7 Best Medical International, Inc.

12.8 Nanovi A/S

12.9 Carbon Medical Technologies

12.10 Eckert & Ziegler

12.11 Innovative Oncology Solutions

12.12 QlRad Inc.

12.13 Stellar Medical

12.14 JJ-Medtech

12.15 QFIX

12.16 Other Companies

12.16.1 Varian Medical Systems, Inc.

12.16.2 Beekley Corporation

12.16.3 Innomedicus Ag

12.16.4 Meditronix Corporation

12.16.5 Seedos Ltd

*Business Overview, Products Offered, Recent Developments, MnM View Might Not be Captured in Case of Unlisted Companies.

13 Appendix (Page No. - 138)

13.1 Discussion Guide

13.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

13.3 Available Customizations

13.4 Related Reports

13.5 Author Details

List of Tables (113 Tables)

Table 1 National Average Medicare Reimbursement: Outpatient Prospective Payment System (Opps) Estimated Per Course

Table 2 Reimbursement for IMRT in Germany, 2017

Table 3 Market, By Product, 2017–2025 (USD Million)

Table 4 Metal-Based Fiducial Markers Market, By Type, 2017–2025 (USD Million)

Table 5 Fiducial Markers Industry, By Region, 2017–2025 (USD Million)

Table 6 Market, By Modality, 2017–2025 (USD Million)

Table 7 Market, By Cancer Type, 2017–2025 (USD Million)

Table 8 Market, By End User, 2017–2025 (USD Million)

Table 9 Pure Gold Fiducial Markers Market, By Region, 2017–2025 (USD Million)

Table 10 Fiducial Markers Industry, By Modality, 2017–2025 (USD Million)

Table 11 Market, By Cancer Type, 2017–2025 (USD Million)

Table 12 Market, By End User, 2017–2025 (USD Million)

Table 13 Gold Combination Fiducial Markers Market, By Region, 2017–2025 (USD Million)

Table 14 Market, By Modality, 2017–2025 (USD Million)

Table 15 Fiducial Markers Industry, By Cancer Type, 2017–2025 (USD Million)

Table 16 Market, By End User, 2017–2025 (USD Million)

Table 17 Other Metal-Based Fiducial Markers Market, By Region, 2017–2025 (USD Million)

Table 18 Market, By Modality, 2017–2025 (USD Million)

Table 19 Market, By Cancer Type, 2017–2025 (USD Million)

Table 20 Fiducial Markers Industry, By End User, 2017–2025 (USD Million)

Table 21 Polymer-Based Fiducial Markers Market, By Region, 2017–2025 (USD Million)

Table 22 Market, By Modality, 2017–2025 (USD Million)

Table 23 Market, By Cancer Type, 2017–2025 (USD Million)

Table 24 Market, By End User, 2017–2025 (USD Million)

Table 25 Other Fiducial Markers Market, By Region, 2017–2025 (USD Million)

Table 26 Fiducial Markers Industry, By Modality, 2017–2025 (USD Million)

Table 27 Market, By Cancer Type, 2017–2025 (USD Million)

Table 28 Market, By End User, 2017–2025 (USD Million)

Table 29 Market, By Modality, 2017–2025 (USD Million)

Table 30 Market for CT/CBCT, By Region, 2017–2025 (USD Million)

Table 31 Fiducial Markers Industry for Ultrasound, By Region, 2017–2025 (USD Million)

Table 32 Market for Cancer Research Centers, By Region, 2017–2025 (USD Million)

Table 33 Conventional EBRT vs SBRT

Table 34 Market for Radiotherapy, By Region, 2017–2025 (USD Million)

Table 35 Market, By Cancer Type, 2017–2025 (USD Million)

Table 36 Newly Diagnosed Prostate Cancer Cases, By Key Country, 2018

Table 37 Fiducial Markers Industry for Prostate Cancer, By Region, 2017–2025 (USD Million)

Table 38 Market for Lung Cancer, By Region, 2017–2025 (USD Million)

Table 39 New Gastric Cancer Cases Diagnosed, By Country, 2018

Table 40 Market for Gastric Cancer, By Region, 2017–2025 (USD Million)

Table 41 New Breast Cancer Cases Diagnosed, By Country, 2018

Table 42 Fiducial Markers Industry for Breast Cancer, By Region, 2017–2025 (USD Million)

Table 43 Market for Other Cancers, By Region, 2017–2025 (USD Million)

Table 44 Market, By End User, 2017–2025 (USD Million)

Table 45 Market for Hospitals & Outpatient Facilities, By Region, 2017–2025 (USD Million)

Table 46 Market for Independent Radiotherapy Centers, By Region, 2017–2025 (USD Million)

Table 47 Fiducial Markers Industry for Cancer Research Centers, By Region, 2017–2025 (USD Million)

Table 48 Market, By Region, 2017–2025 (USD Million)

Table 49 North America: Market, By Country, 2017–2025 (USD Million)

Table 50 North America: Market, By Product, 2017–2025 (USD Million)

Table 51 North America: Metal-Based Market, By Type, 2017–2025 (USD Million)

Table 52 North America: Fiducial Markers Industry, By Modality, 2017–2025 (USD Million)

Table 53 North America: Market, By Cancer Type, 2017–2025 (USD Million)

Table 54 North America: Market, By End User, 2017–2025 (USD Million)

Table 55 National Average Medicare Reimbursement: Outpatient Prospective Payment System (Opps) Estimated Per Course

Table 56 NCI Funding, By Research Area, 2015–2017 (USD Million)

Table 57 US: Market, By Product, 2017–2025 (USD Million)

Table 58 US: Metal-Based Fiducial Markers Market, By Type, 2017–2025 (USD Million)

Table 59 Canada: Market, By Product, 2017–2025 (USD Million)

Table 60 Canada: Metal-Based Fiducial Markers Market, By Type, 2017–2025 (USD Million)

Table 61 Europe: Market, By Country, 2017–2025 (USD Million)

Table 62 Europe: Market, By Product, 2017–2025 (USD Million)

Table 63 Europe: Metal-Based Fiducial Markers Market, By Type, 2017–2025 (USD Million)

Table 64 Europe: Market, By Modality, 2017–2025 (USD Million)

Table 65 Europe: Market, By Cancer Type, 2017–2025 (USD Million)

Table 66 Europe: Fiducial Markers Industry, By End User, 2017–2025 (USD Million)

Table 67 Germany: Market, By Product, 2017–2025 (USD Million)

Table 68 Germany: Metal-Based Fiducial Markers Market, By Type, 2017–2025 (USD Million)

Table 69 UK: Market, By Product, 2017–2025 (USD Million)

Table 70 UK: Metal-Based Fiducial Markers Market, By Type, 2017–2025 (USD Million)

Table 71 France: Market, By Product, 2017–2025 (USD Million)

Table 72 France: Metal-Based Fiducial Markers Market, By Type, 2017–2025 (USD Million)

Table 73 Spain: Market, By Product, 2017–2025 (USD Million)

Table 74 Spain: Market, By Type, 2017–2025 (USD Million)

Table 75 Italy: Market, By Product, 2017–2025 (USD Million)

Table 76 Italy: Fiducial Markers Industry, By Type, 2017–2025 (USD Million)

Table 77 RoE: Market, By Product, 2017–2025 (USD Million)

Table 78 RoE: Metal-Based Fiducial Markers Market, By Type, 2017–2025 (USD Million)

Table 79 Asia Pacific: Market, By Country, 2017–2025 (USD Million)

Table 80 Asia Pacific: Market, By Product, 2017–2025 (USD Million)

Table 81 Asia Pacific: Metal-Based Fiducial Markers Market, By Type, 2017–2025 (USD Million)

Table 82 Asia Pacific: Market, By Modality, 2017–2025 (USD Million)

Table 83 Asia Pacific: Market, By Cancer Type, 2017–2025 (USD Million)

Table 84 Asia Pacific: Fiducial Markers Industry, By End User, 2017–2025 (USD Million)

Table 85 Japan: Market, By Product, 2017–2025 (USD Million)

Table 86 Japan: Metal-Based Fiducial Markers Market, By Type, 2017–2025 (USD Million)

Table 87 China: Market, By Product, 2017–2025 (USD Million)

Table 88 China: Metal-Based Fiducial Markers Market, By Type, 2017–2025 (USD Million)

Table 89 India: Market, By Product, 2017–2025 (USD Million)

Table 90 India: Metal-Based Fiducial Markers Market, By Type, 2017–2025 (USD Million)

Table 91 South Korea: Market, By Product, 2017–2025 (USD Million)

Table 92 South Korea: Metal-Based Fiducial Markers Market, By Type, 2017–2025 (USD Million)

Table 93 Australia: Market, By Product, 2017–2025 (USD Million)

Table 94 Australia: Metal-Based Fiducial Markers Market, By Type, 2017–2025 (USD Million)

Table 95 RoAPAC: Market, By Product, 2017–2025 (USD Million)

Table 96 RoAPAC: Metal-Based Fiducial Markers Market, By Type, 2017–2025 (USD Million)

Table 97 Latin America: Market, By Country, 2017–2025 (USD Million)

Table 98 Latin America: Market, By Product, 2017–2025 (USD Million)

Table 99 Latin America: Metal-Based Fiducial Markers Market, By Type, 2017–2025 (USD Million)

Table 100 Latin America: Market, By Modality, 2017–2025 (USD Million)

Table 101 Latin America: Market, By Cancer Type, 2017–2025 (USD Million)

Table 102 Latin America: Fiducial Markers Industry, By End User, 2017–2025 (USD Million)

Table 103 Brazil: Market, By Product, 2017–2025 (USD Million)

Table 104 Brazil: Metal-Based Fiducial Markers Market, By Type, 2017–2025 (USD Million)

Table 105 Mexico: Market, By Product, 2017–2025 (USD Million)

Table 106 Mexico: Metal-Based Fiducial Markers Market, By Type, 2017–2025 (USD Million)

Table 107 RoLA: Market, By Product, 2017–2025 (USD Million)

Table 108 RoLA: Metal-Based Fiducial Markers Market, By Type, 2017–2025 (USD Million)

Table 109 MEA: Market, By Product, 2017–2025 (USD Million)

Table 110 MEA: Metal-Based Fiducial Markers Market, By Type, 2017–2025 (USD Million)

Table 111 MEA: Market, By Modality, 2017–2025 (USD Million)

Table 112 MEA: Fiducial Markers Industry, By Cancer Type, 2017–2025 (USD Million)

Table 113 MEA: Market, By End User, 2017–2025 (USD Million)

List of Figures (28 Figures)

Figure 1 Fiducial Markers Market: Research Methodology Steps

Figure 2 Research Design

Figure 3 Breakdown of Primary Interviews: By Company Type, Designation, and Region

Figure 4 Research Methodology: Hypothesis Building

Figure 5 Market: Product-Based Estimation

Figure 6 Market: End User-Based Estimation

Figure 7 Fiducial Markers Industry: Data Triangulation

Figure 8 Market Share, By Product, 2019 Vs. 2025

Figure 9 Market Share, By Modality, 2019 Vs. 2025

Figure 10 Market, By Cancer Type, 2019–2025 (USD Million)

Figure 11 Market, By End User, 2019–2025 (USD Million)

Figure 12 Market, By Region: Geographical Snapshot

Figure 13 Growing Adoption of Image-Guided Radiotherapy Across the Globe is Supporting the Growth of the Market

Figure 14 Metal-Based Markers Command the Largest Market Share

Figure 15 CT/CBCT Segment Dominates the Global Market During the Forecast Period

Figure 16 Prostate Cancer Segment Will Hold the Major Share of the Market During the Forecast Period

Figure 17 Hospitals & Outpatient Facilities Segment Command the Largest Market Share

Figure 18 China to Register the Highest CAGR During the Forecast Period

Figure 19 Fiducial Markers Industry: Drivers, Restraints, Opportunities, and Challenges

Figure 20 Number of New Cancer Cases Diagnosed, By Country, 2018 (Thousand)

Figure 21 North America: Market Snapshot

Figure 22 Key Growth Strategies Adopted By Market Players From 2016 to 2019

Figure 23 CIVCO Radiotherapy Held the Leading Position in the Market, 2018

Figure 24 Market (Global) Competitive Leadership Mapping, 2019

Figure 25 Boston Scientific Corporation: Company Snapshot

Figure 26 IBA: Company Snapshot

Figure 27 Medtronic: Company Snapshot

Figure 28 Eckert & Ziegler: Company Snapshot

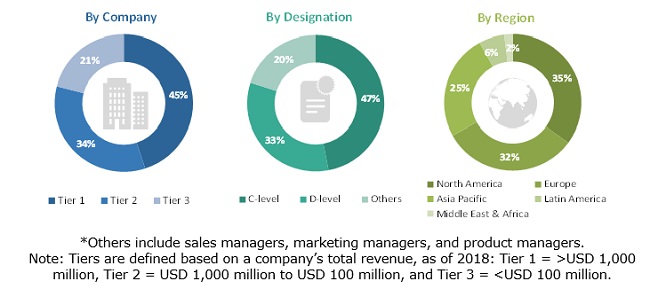

This study involved the extensive use of both primary and secondary sources. The research process involved the study of various factors affecting the industry to identify segmentation types, industry trends, key players, competitive landscape, key market dynamics, and key player strategies.

Secondary Research

The secondary research process involves the widespread use of secondary sources, directories, databases (such as Bloomberg Businessweek, Factiva, and D&B), white papers, annual reports, company house documents, investor presentations, and SEC filings of companies. Secondary research was used to identify and collect information useful for this extensive, technical, market-oriented, and commercial study of the fiducial markers market. A database of key industry leaders was also prepared using secondary research.

Primary Research

Extensive primary research was conducted after acquiring knowledge about the market scenario through secondary research. A significant number of primary interviews was conducted from both the demand (fiducial marker suppliers, vendors, and distributors, personnel from hospitals & clinics, cancer research laboratories, and radiology centers) and supply sides (presidents, CEOs, vice presidents, directors, general managers, heads of business segments, and senior managers). The primaries interviewed for this study include experts from the fiducial markers industry, such as CEOs, VPs, directors, sales heads, and marketing managers of tier 1, 2, and 3 companies engaged in offering fiducial markers across the globe; administrators and purchase managers; and academic research institutes.

A breakdown of primary respondents is provided below:

Market Size Estimation

Market size estimates and forecasts provided in this study are derived through a mix of the bottom-up approach (segmental analysis of major segments) and top-down approach (assessment of utilization/adoption/penetration trends, by product, cancer type, modality, end user, and region).

Data Triangulation

After arriving at the market size, the fiducial markers market was divided into several segments and subsegments. The data triangulation and market breakdown procedures were employed to complete the overall market engineering process and arrive at exact statistics for all segments & subsegments, wherever applicable.

Objectives of the Study

- To define, describe, and forecast the market on the basis of product, cancer type, modality, end user, and region

- To provide detailed information regarding the major factors influencing the market growth (drivers, restraints, opportunities, and challenges)

- To strategically analyze micromarkets with respect to individual growth trends, future prospects, and contributions to the total market

- To analyze opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To forecast the sizes of market segments with respect to five regions—North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa

- To profile key players and comprehensively analyze their market shares and core competencies

- To track and analyze competitive developments such as product launches, collaborations, mergers & acquisitions, and R&D activities in the market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product matrix that gives a detailed comparison of the product portfolios of the top five companies in the fiducial markers market

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Fiducial Markers Market