Fiberglass Pipes Market by Type (GRP, GRE), Fiber (E-Glass, T-glass), Application (Oil & Gas, Chemicals, Sewage, Irrigation), and Region - Global Forecast to 2021

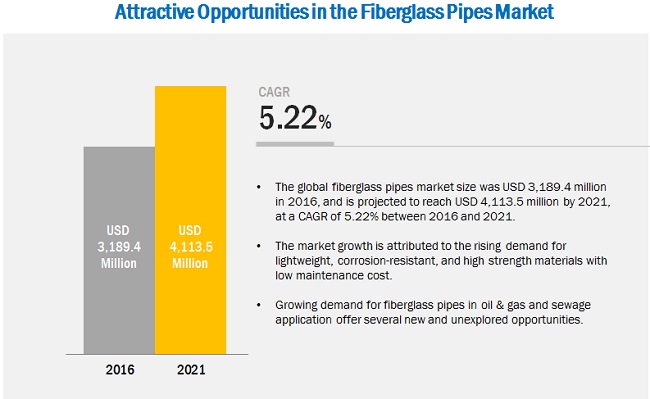

[139 Pages Report] In terms of value, the Fiberglass Pipes Market was valued at USD 3.04 Billion in 2015, and is projected to reach USD 4.11 Billion by 2021, at a CAGR of 5.22% from 2016 to 2021. Fiberglass pipes are becoming crucial in chemicals, oil & gas, and sewage applications due to the superior properties, low maintenance, and long product life. In this study, the years considered to estimate the market size of fiberglass pipes are:

- Base Year 2015

- Estimated Year 2016

- Projected Year 2021

- Forecast Period 2016 to 2021

2015 has been considered as the base year for company profiles. Whenever information was unavailable for the base year, the prior year has been considered.

Objectives of the Study

- To define, describe, and forecast the fiberglass pipes market size, in terms of value

- To identify and measure the fiberglass pipes market by type, fiber, application, and region

- To analyze significant region-specific market trends in North America, Europe, Asia-Pacific, and RoW and country-specific trends in the U.S., Canada, Mexico, Germany, France, the U.K., Russia, China, India, Japan, South Korea, and others

- To provide detailed information regarding the major factors influencing the growth of the fiberglass pipes market (drivers, restraints, opportunities, and challenges)

- To strategically profile the key market players and analyze their core competencies

- To analyze recent market developments such as agreements, acquisitions, new product launches, and expansions in the fiberglass pipes market

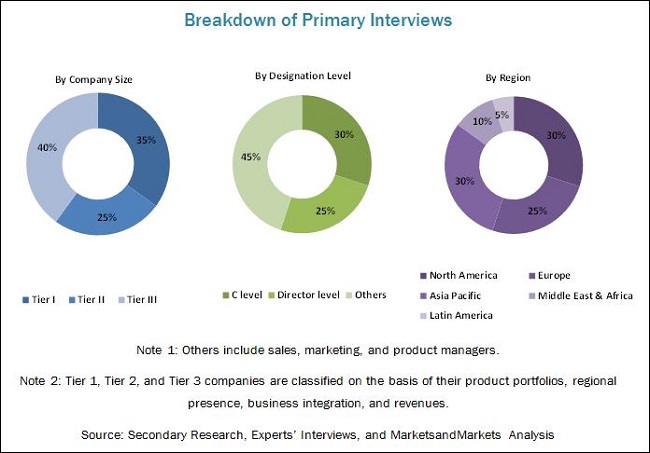

Various secondary sources such as company websites, encyclopedias, directories, and databases such as Composite World, Factiva, American Composites Manufacturers Association, and others have been used to understand and gain insights into the fiberglass pipes market. Experts from top fiberglass pipes companies have been interviewed to verify and collect critical information and to assess the trends in the fiberglass pipes market for the forecast period. The top-down, bottom-up, and data triangulation approaches have been implemented to calculate the exact values of the overall parent and individual market sizes.

To know about the assumptions considered for the study, download the pdf brochure

The fiberglass pipes market has a diversified ecosystem, including downstream stakeholders such as manufacturers, vendors, end users, and government organizations. Some of the major raw material suppliers are Arkema (France), Mitsubishi Plastics, Inc. (Japan), Formosa Plastics Corporation (Taiwan), SGL Group (Germany), SABIC (Saudi Arabia), Huntsman Corporation (U.S), and others.

The fiberglass pipes market value chain includes resin manufacturers such as Arkema (France), Mitsubishi Plastics, Inc. (Japan), Huntsman Corporation (U.S), and others. Glass fiber manufacturers include PPG Industries, Inc. (U.S.), Taishan Fiberglass Inc. (China), and others. Further, the manufacturers of fiberglass pipes supply their products to various entities in the oil & gas, chemicals, sewage, irrigation, and other applications.

This study focuses on the top investment pockets, which would help stakeholders understand and analyze the emerging trends in the fiberglass pipes market. These stakeholders include:

- Fiberglass Pipes Manufacturers

- Raw Material Suppliers

- Distributors and Suppliers

- End-use Industries

- Industry Associations

- R&D Institutions

- Environment Support Agencies

Scope of the Report:

This research report categorizes the fiberglass pipes market based on product type, application, and region. It forecasts revenue growth and analyzes trends in each of the submarkets till 2021.

Based on Type

- GRP

- GRE

- Others

Based on Fiber

- E-Glass

- T-Glass

- Others

Based on Application

- Oil & Gas

- Chemicals

- Sewage

- Irrigation

- Others

Based on Region

- North America

- Europe

- Asia-Pacific

- RoW

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the specific needs of the companies. The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of the North American fiberglass pipes market

- Further breakdown of the European fiberglass pipes market

- Further breakdown of the Asia-Pacific region fiberglass pipes market

- Further breakdown of the RoW fiberglass pipes market

Company Information

- Detailed analysis and profiles of additional market players

The global fiberglass pipes market is projected to reach USD 4.11 Billion by 2021, at a CAGR of 5.22% from 2016 to 2021. Superior mechanical properties leading to a long product life with low maintenance costs and the increasing demand for fiberglass pipes in sewage and water management applications are the key factors responsible for the growth of the fiberglass pipes market.

The fiberglass pipes market, by type, is further segmented into GRP and GRE. The GRE pipes segment accounts for the major market share owing to their high strength, high resistance to corrosion, and ease of installation. Due to these properties, GRE pipes are used in applications including oil & gas, chemicals, and sewage.

The major applications of the fiberglass pipes market include oil & gas, chemicals, sewage, and irrigation. The chemicals application is the fastest-growing application segment in the fiberglass pipes market. Fiberglass pipes offer various features including light weight, dimensional stability, resistance to corrosion, and ease of installation in comparison to traditional materials such as concrete and metallic pipes, due to which the usage of fiberglass pipes in the chemicals, oil & gas, and sewage applications is growing at a high rate.

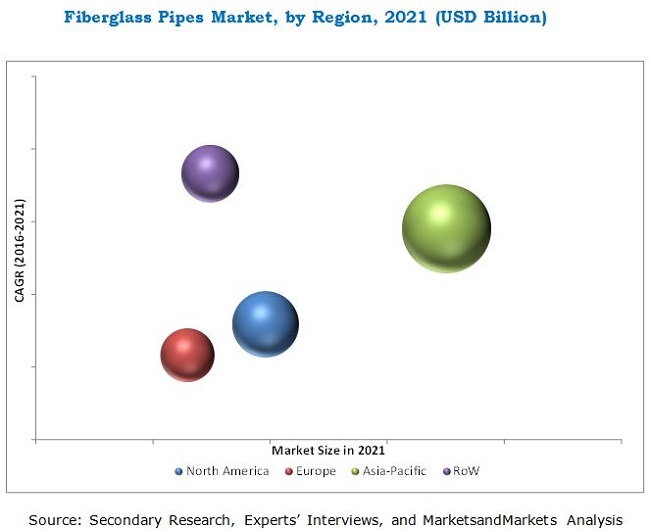

Asia-Pacific holds the largest share of the fiberglass pipes market owing to the presence of large chemical industry and government spending on water & waste management in countries such as China, India, and Indonesia. The RoW region is expected to be the fastest-growing regional market for fiberglass pipes during the next five years. The main factors that are leading to its growth are the increasing demand from the oil & gas and chemicals industries. The properties exhibited by fiberglass pipes enhance the flow characteristics, thus leading to low maintenance and long product span.

The global fiberglass pipes market is growing rapidly, in terms of value. However, the high raw material cost is a major restraint for the growth of the global fiberglass pipes market.

Companies such as Future Pipe Industries (UAE), Balaji Fiber Reinforced Plastics Ltd. (India), Chemical Process Piping Pvt. Ltd. (India), Graphite India Limited (India), Hobas (Austria), Saudi Arabian Amiantit Co. (Saudi Arabia), National Oilwell Varco (U.S.), ZCL Composites Inc. (Canada), Abu Dhabi Pipe Factory (UAE), Enduro Composites Inc. (U.S.), and others are the leading players in the global fiberglass pipes market. They have been adopting various organic and inorganic growth strategies such as agreements, new product launches, acquisitions, and expansions to enhance their shares in the global fiberglass pipes market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 15)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Scope of the Study

1.3.1 Years Considered for the Study

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 18)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.1 Breakdown of Primary Interviews

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.2.3 Data Triangulation

2.3 Research Assumptions

3 Executive Summary (Page No. - 26)

4 Premium Insights (Page No. - 30)

4.1 Significant Opportunities in Fiberglass Pipes Market

4.2 Fiberglass Pipes Market, By Type

4.3 Fiberglass Pipes Market, By Application, and Region

4.4 Fiberglass Pipes Market Share, By Country

5 Market Overview (Page No. - 33)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Increased Production and Exploration of Oil & Gas

5.2.1.2 Increasing Demand for Fiberglass Pipes in Sewage and Water Management

5.2.2 Restraints

5.2.2.1 High Raw Material Cost

5.2.3 Opportunities

5.2.3.1 High Demand for Fiberglass Pipes in Emerging Economies

5.2.4 Challenges

5.2.4.1 Need for Low-Cost Technologies

5.3 Porters Five Forces Analysis

5.3.1 Threat of New Entrants

5.3.2 Threat of Substitutes

5.3.3 Bargaining Power of Buyers

5.3.4 Bargaining Power of Suppliers

5.3.5 Intensity of Competitive Rivalry

6 Macroeconomic Overview and Key Trends (Page No. - 39)

6.1 Introduction

6.2 Trends and Forecast of GDP

6.3 Per Capita GDP vs Per Capita Fiberglass Pipes Demand

6.4 Trends of Oil & Gas Production

7 Fiberglass Pipes Market, By Type (Page No. - 45)

7.1 Introduction

7.2 GRE Pipes

7.3 GRP Pipes

7.4 Other Pipes

8 Fiberglass Pipes Market, By Fiber Type (Page No. - 51)

8.1 Introduction

8.2 E-Glass

8.3 T-Glass/S-Glass/R-Glass

8.4 Others

9 Fiberglass Pipes Market, By Application (Page No. - 54)

9.1 Introduction

9.2 Oil & Gas

9.2.1 Pipelines for Oil & Gas Production

9.2.2 Downhole Tubing

9.2.3 Refinery Piping

9.2.4 Marine Piping on Vessels

9.2.5 Pipe System for Fuel Handling and Storage

9.2.6 Offshore Platform Piping

9.2.7 Floats and Dredging

9.3 Chemicals

9.4 Sewage Pipes

9.5 Irrigation

9.6 Other Applications

9.6.1 Fire & Safety

9.6.2 Paper & Pulp

9.7 GRP Pipe Market, By Application

9.7.1 Oil & Gas

9.7.2 Chemicals

9.7.3 Sewage

9.7.4 Irrigation

9.7.5 Other Applications

9.8 GRE Pipes Market, By Application

9.8.1 Oil & Gas

9.8.2 Chemicals

9.8.3 Sewage Pipes

9.8.4 Irrigation

9.8.5 Other Applications

10 Regional Analysis (Page No. - 71)

10.1 Introduction

10.2 North America

10.2.1 Fiberglass Pipes Market Size in North America, By Application

10.2.2 Fiberglass Pipes Market Size in North America, By Country

10.2.2.1 U.S.

10.2.2.1.1 By Market Size in the U.S, By Application

10.2.2.2 Canada

10.2.2.2.1 By Market Size in Canada, By Application

10.2.2.3 Mexico

10.2.2.3.1 By Market Size in Mexico, By Application

10.3 Europe

10.3.1 Fiberglass Pipes Market Size in Europe, By Application

10.3.2 Fiberglass Pipes Market Size in Europe, By Country

10.3.2.1 Germany

10.3.2.1.1 By Market Size in Germany, By Application

10.3.2.2 France

10.3.2.2.1 By Market Size in France, By Application

10.3.2.3 U.K.

10.3.2.3.1 By Market Size in the U.K., By Application

10.3.2.4 Russia

10.3.2.4.1 By Market Size in Russia, By Application

10.3.2.5 Rest of Europe

10.4 Asia-Pacific

10.4.1 Fiberglass Pipes Market Size in Asia-Pacific, By Application

10.4.2 Fiberglass Pipes Market Size in Asia-Pacific, By Country

10.4.2.1 China

10.4.2.1.1 By Market Size in China, By Application

10.4.2.2 Japan

10.4.2.2.1 By Market Size in Japan, By Application

10.4.2.3 India

10.4.2.3.1 By Market Size in India, By Application

10.4.2.4 South Korea

10.4.2.4.1 Fiberglass Pipes Market Size in South Korea, By Application

10.4.2.5 Rest of Asia-Pacific

10.5 Rest of the World (RoW)

10.5.1 Fiberglass Pipes Market Size in RoW, By Application

10.5.2 Fiberglass Pipes Market Size in RoW, By Country

10.5.2.1 Brazil

10.5.2.1.1 By Market Size in Brazil, By Application

10.5.2.2 South Africa

10.5.2.2.1 By Market Size in South Africa, By Application

10.5.2.3 Other Countries of RoW

10.6 GRP Pipes Market By Region

10.6.1 GRP Pipes Market Size in North America, By Application

10.6.2 GRP Pipes Market Size in Europe

10.6.3 GRP Pipes Market Size in Asia-Pacific

10.6.4 GRP Pipes Market Size in RoW

10.7 GRE Pipes Market By Region

10.7.1 GRE Pipes Market Size in North America

10.7.2 GRE Pipes Market Size in Europe

10.7.3 GRE Pipes Market Size in Asia-Pacific

10.7.4 GRE Pipes Market Size in RoW

11 Competitive Landscape (Page No. - 101)

11.1 Overview

11.2 Competitive Situation and Trends

11.3 Market Ranking of Key Players

11.3.1 Ranking of Top 5 Players in the Fiberglass Pipes Market, 2015

11.4 Recent Developments

11.4.1 Agreements

11.4.2 Acquisitions

11.4.3 New Product Launches

11.4.4 Expansions

12 Company Profiles (Page No. - 108)

(Overview, Products and Services, Financials, Strategy & Development)*

12.1 Abu Dhabi Pipe Factory

12.2 Balaji Fiber Reinforced Pvt. Ltd.

12.3 Chemical Process Piping Pvt. Ltd.

12.4 Future Pipe Industries

12.5 Graphite India Limited

12.6 HOBAS

12.7 Hengrun Group Co., Ltd.

12.8 Enduro Composites, Inc.

12.9 Lianyungang Zhongfu Lianzhong Composites Group Co., Ltd.

12.10 National Oilwell Varco

12.11 Saudi Arabian Amiantit Co.

12.12 ZCL Composites Inc.

*Details on Overview, Products and Services, Financials, Strategy & Development Might Not Be Captured in Case of Unlisted Companies

13 Appendix (Page No. - 131)

13.1 Insights From Industry Experts

13.2 Discussion Guide

13.3 Knowledge Store: Marketsandmarkets Subscription Portal

13.4 Introducing RT: Real-Time Market Intelligence

13.5 Available Customizations

13.6 Related Reports

13.7 Author Details

List of Tables (110 Tables)

Table 1 Trends and Forecast of Gdp, 20152021 (USD Billion)

Table 2 Per Capita GDP vs Per Capita Fiberglass Pipes Demand, 2015

Table 3 Trend of Oil Production, By Country (Thousand Barrels Per Day)

Table 4 Trend of Gas Production, By Country (Billion Cubic Meters)

Table 5 Fiberglass Pipes Market Size, By Type, 20142021 (Kiloton)

Table 6 Fiberglass Pipes Market Size, By Type, 20142021 (USD Million)

Table 7 Fiberglass Pipes Market Size, By Application, 20142021 (Kiloton)

Table 8 Fiberglass Pipes Market Size, By Application, 20142021 (USD Million)

Table 9 Fiberglass Pipes Market Size, By Application, 20142021 (Kiloton)

Table 10 Fiberglass Pipes Market Size, By Application, 20142021 (USD Million)

Table 11 Other Fiberglass Pipes Market Size, By Application, 20142021 (Kiloton)

Table 12 Other Fiberglass Pipes Market Size, By Application, 20142021 (USD Million)

Table 13 Fiberglass Pipes Market Size, By Fiber Type, 20142021 (Kiloton)

Table 14 Fiberglass Pipes Market Size, By Type, 20142021 (USD Million)

Table 15 Fiberglass Pipes Market Size, By Application, 20142021 (Kiloton)

Table 16 Fiberglass Pipes Market Size, By Application, 20142021 (USD Million)

Table 17 Fiberglass Pipes Market Size in Oil & Gas Application, By Region, 20142021 (Kiloton)

Table 18 Fiberglass Pipes Market Size in Oil & Gas Application, By Region, 20142021 (USD Million)

Table 19 Fiberglass Pipes Market Size in Chemicals Application, By Region, 20142021 (Kiloton)

Table 20 Fiberglass Pipes Market Size in Chemicals Application, By Region, 20142021 (USD Million)

Table 21 Fiberglass Pipes Market Size in Sewage Pipes Application, By Region, 20142021 (Kiloton)

Table 22 Fiberglass Pipes Market Size in Sewage Pipes Application, By Region, 20142021 (USD Million)

Table 23 Fiberglass Pipes Market Size in Irrigation Application, By Region, 20142021 (Kiloton)

Table 24 Fiberglass Pipes Market Size in Irrigation Application, By Region, 20142021 (USD Million)

Table 25 Fiberglass Pipes Market Size in Other Applications, By Region, 20142021 (Kiloton)

Table 26 Fiberglass Pipes Market Size in Other Applications, By Region, 20142021 (USD Million)

Table 27 Fiberglass Pipes Market Size in Oil & Gas Application, By Region, 20142021 (Kiloton)

Table 28 Fiberglass Pipes Market Size in Oil & Gas Application, By Region, 20142021 (USD Million)

Table 29 Fiberglass Pipes Market Size in Chemicals Application, By Region, 20142021 (Kiloton)

Table 30 Fiberglass Pipes Market Size in Chemicals Application, By Region, 20142021 (USD Million)

Table 31 By Market Size in Sewage Pipes Application, By Region, 20142021 (Kiloton)

Table 32 By Market Size in Sewage Pipes Application, By Region, 20142021 (USD Million)

Table 33 By Market Size in Irrigation Application, By Region, 20142021 (Kiloton)

Table 34 By Market Size in Irrigation Application, By Region, 20142021 (USD Million)

Table 35 By Market Size in Other Applications, By Region, 20142021 (Kiloton)

Table 36 By Market Size in Other Applications, By Region, 20142021 (USD Million)

Table 37 By Market Size in Oil & Gas Application, By Region, 20142021 (Kiloton)

Table 38 By Market Size in Oil & Gas Application, By Region, 20142021 (USD Million)

Table 39 By Market Size in Chemicals Application, By Region, 20142021 (Kiloton)

Table 40 By Market Size in Chemicals Application, By Region, 20142021 (USD Million)

Table 41 By Market Size in Sewage Pipes Application, By Region, 20142021 (Kiloton)

Table 42 By Market Size in Sewage Pipes Application, By Region, 20142021 (USD Million)

Table 43 By Market Size in Irrigation Application, By Region, 20142021 (Kiloton)

Table 44 By Market Size in Irrigation Application, By Region, 20142021 (USD Million)

Table 45 By Market Size in Other Applications, By Region, 20142021 (Kiloton)

Table 46 By Market Size in Other Applications, By Region, 20142021 (USD Million)

Table 47 By Market Size, By Region, 20142021 (Kiloton)

Table 48 By Market Size, By Region, 20142021 (USD Million)

Table 49 North America: By Market Size, By Application, 20142021 (Kiloton)

Table 50 North America: By Market Size, By Application, 20142021 (USD Million)

Table 51 North America: By Market Size, By Country, 20142021 (Kiloton)

Table 52 North America: By Market Size, By Country, 20142021 (USD Million)

Table 53 U.S.: By Market Size, By Application, 20142021 (Kiloton)

Table 54 U.S.: By Market Size, By Application, 20142021 (USD Million)

Table 55 Canada: By Market Size, By Application, 20142021 (Kiloton)

Table 56 Canada: By Market Size, By Application, 20142021 (USD Million)

Table 57 Mexico: By Market Size, By Application, 20142021 (Kiloton)

Table 58 Mexico: By Market Size, By Application, 20142021 (USD Million)

Table 59 Europe: By Market Size, By Application, 20142021 (Kiloton)

Table 60 Europe: By Market Size, By Application, 20142021 (USD Million)

Table 61 Europe: By Market Size, By Country, 20142021 (Kiloton)

Table 62 Europe: By Market Size, By Country, 20142021 (USD Million)

Table 63 Germany: By Market Size, By Application, 20142021 (Kiloton)

Table 64 Germany: By Market Size, By Application, 20142021 (USD Million)

Table 65 France: By Market Size, By Application, 20142021 (Kiloton)

Table 66 France: By Market Size, By Application, 20142021 (USD Million)

Table 67 U.K.: By Market Size, By Application, 20142021 (Kiloton)

Table 68 U.K.: By Market Size, By Application, 20142021 (USD Million)

Table 69 Russia: By Market Size, By Application, 20142021 (Kiloton)

Table 70 Russia: By Market Size, By Application, 20142021 (USD Million)

Table 71 Asia-Pacific: Fiberglass Pipes Market Size, By Application, 20142021 (Kiloton)

Table 72 Asia-Pacific: By s Market Size, By Application, 20142021 (USD Million)

Table 73 Asia-Pacific: By Market Size, By Country, 20142021 (Kiloton)

Table 74 Asia-Pacific: By Market Size, By Country, 20142021 (USD Million)

Table 75 China: By Market Size, By Application, 20142021 (Kiloton)

Table 76 China: By Market Size, By Application, 20142021 (USD Million)

Table 77 Japan: By Market Size, By Application, 20142021 (Kiloton)

Table 78 Japan: By Market Size, By Application, 20142021 (USD Million)

Table 79 India: By Market Size, By Application, 20142021 (Kiloton)

Table 80 India: By Market Size, By Application, 20142021 (USD Million)

Table 81 South Korea: Fiberglass Pipes Market Size, By Application, 20142021 (Kiloton)

Table 82 South Korea: By Market Size, By Application, 20142021 (USD Million)

Table 83 RoW: Fiberglass Pipes Market Size, By Application, 20142021 (Kiloton)

Table 84 RoW: Fiberglass Pipes Market Size, By Application, 20142021 (USD Million)

Table 85 RoW: Fiberglass Pipes Market Size, By Country, 20142021 (Kiloton)

Table 86 RoW: Fiberglass Pipes Market Size, By Country, 20142021 (USD Million)

Table 87 Brazil: Fiberglass Pipes Market Size, By Application, 20142021 (Kiloton)

Table 88 Brazil: Fiberglass Pipes Market Size, By Application, 20142021 (USD Million)

Table 89 South Africa: Fiberglass Pipes Market Size, By Application, 20142021 (Kiloton)

Table 90 South Africa: Fiberglass Pipes Market Size, By Application, 20142021 (USD Million)

Table 91 North America: GRP Pipes Market Size, By Application, 20142021 (Kiloton)

Table 92 North America: GRP Pipes Market Size, By Application, 20142021 (USD Million)

Table 93 Europe: GRP Pipes Market Size, By Application, 20142021 (Kiloton)

Table 94 Europe: GRP Pipes Market Size, By Application, 20142021 (USD Million)

Table 95 Asia-Pacific: GRP Pipes Market Size, By Application, 20142021 (Kiloton)

Table 96 Asia-Pacific: GRP Pipes Market Size, By Application, 20142021 (USD Million)

Table 97 RoW: GRP Pipes Market Size, By Application, 20142021 (Kiloton)

Table 98 RoW: GRP Pipes Market Size, By Application, 20142021 (USD Million)

Table 99 North America: GRE Pipes Market Size, By Application, 20142021 (Kiloton)

Table 100 North America: GRE Pipes Market Size, By Application, 20142021 (USD Million)

Table 101 Europe: GRE Pipes Market Size, By Application, 20142021 (Kiloton)

Table 102 Europe: GRE Pipes Market Size, By Application, 20142021 (USD Million)

Table 103 Asia-Pacific: GRE Pipes Market Size, By Application, 20142021 (Kiloton)

Table 104 Asia-Pacific: GRE Pipes Market Size, By Application, 20142021 (USD Million)

Table 105 RoW: GRE Pipes Market Size, By Application, 20142021 (Kiloton)

Table 106 RoW: GRE Pipes Market Size, By Application, 20142021 (USD Million)

Table 107 Agreements, 20112016

Table 108 Acquisitions, 20112016

Table 109 New Product Launches, 20112016

Table 110 Expansions, 20112016

List of Figures (44 Figures)

Figure 1 Fiberglass Pipes: Market Segmentation

Figure 2 Fiberglass Pipes Market: Research Design

Figure 3 Market Size Estimation: Bottom-Up Approach

Figure 4 Market Size Estimation: Top-Down Approach

Figure 5 Fiberglass Pipes Market: Data Triangulation

Figure 6 Sewage Application to Drive Fiberglass Pipes Market Between 2016 and 2021

Figure 7 E-Glass Fiber-Based Fiberglass Pipes to Register Highest CAGR (2016 vs 2021)

Figure 8 GRE Pipes to Drive Fiberglass Pipes Market Between 2016 and 2021

Figure 9 Asia-Pacific Was Largest Fiberglass Pipes Market in 2015

Figure 10 Attractive Opportunities in Fiberglass Pipes Market, Between 2016 and 2021

Figure 11 GRE Pipes to Dominate Fiberglass Pipes Market

Figure 12 Asia-Pacific Dominated Fiberglass Pipes Market in 2015

Figure 13 India is Projected to Register Highest CAGR in Fiberglass Pipes Market in 2015

Figure 14 Drivers, Restraints, Opportunities, and Challenges of Fiberglass Pipes Market

Figure 15 Porters Five Forces Analysis of Fiberglass Pipes Market

Figure 16 Relative GDP Growth Scenario of Key Economies (2015-2021)

Figure 17 Per Capita GDP vs Per Capita Fiberglass Pipes Demand (2015)

Figure 18 U.S. is Largest Country in Terms of Oil Production, 2015

Figure 19 U.S. is Largest Country in Terms of Gas Production, 2015

Figure 20 GRE Pipes to Dominate the Fiberglass Pipes Market Between 2016 and 2021

Figure 21 Chemical Application to Lead the GRE Pipes Market During the Forecast Period

Figure 22 Sewage Application to Lead the GRP Pipes Market During the Forecast Period

Figure 23 E-Glass Fiber Dominate the Fiberglass Pipes Market

Figure 24 Sewage Pipes Application to Lead the Fiberglass Pipes Market

Figure 25 North America to Dominate the Fiberglass Pipes Market in Oil & Gas Application

Figure 26 Asia-Pacific to Dominate Fiberglass Pipes Market in Chemicals Application

Figure 27 Asia-Pacific to Dominate Fiberglass Pipes Market in Sewage Pipes Application

Figure 28 India and South Korea to Be the Fastest-Growing Fiberglass Pipes Market

Figure 29 North America Fiberglass Pipes Market Snapshot: the U.S. is the Most Lucrative Market

Figure 30 Europe Fiberglass Pipes Market Snapshot: Germany is the Most Lucrative Market

Figure 31 Asia-Pacific Fiberglass Pipes Market Snapshot: China is the Largest Market

Figure 32 Brazil is the Most Lucrative Fiberglass Pipes Market

Figure 33 Companies Adopted Agreements as the Key Growth Strategy Between 2011 and 2016

Figure 34 Agreements Was the Most Preferred Strategy Adopted Between 2011 and 2016

Figure 35 Market Evaluation Framework: Significant Number of Agreements Have Fueled Growth and Innovation, 20112016

Figure 36 Future Pipe Industries: SWOT Analysis

Figure 37 Graphite India Limited: Company Snapshot

Figure 38 HOBAS: SWOT Analysis

Figure 39 National Oilwell Varco: Company Snapshot

Figure 40 National Oilwell Varco: SWOT Analysis

Figure 41 Saudi Arabian Amiantit Co.: Company Snapshot

Figure 42 Saudi Arabian Amiantit Co.: SWOT Analysis

Figure 43 ZCL Composites Inc.: Company Snapshot

Figure 44 ZCL Composites Inc.: SWOT Analysis

Growth opportunities and latent adjacency in Fiberglass Pipes Market