Fermented Plant-based Protein Market

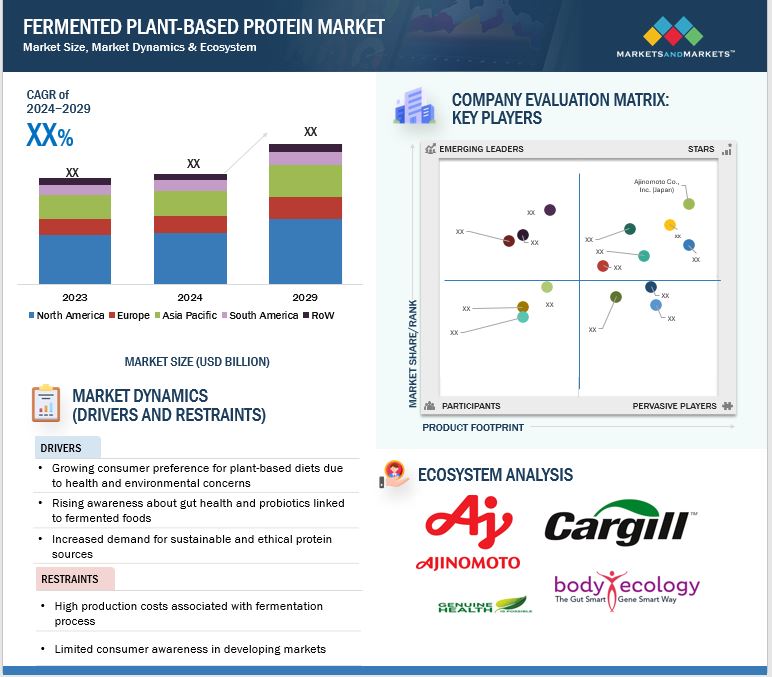

The market for fermented plant-based protein is estimated at USD XX billion in 2024; it is projected to grow at a CAGR of XX% to reach USD XX billion by 2029. The growth of the fermented plant-based protein market is driven by several factors rooted in advancements in both fermentation technologies and consumer demand for healthier, sustainable food options. One key factor is the enrichment of plant ingredients with high-quality proteins, which are used to create fermented plant protein-based analogues and products. Fermentation not only improves the digestibility and bioavailability of these proteins but also enhances their functional properties. Bioactive peptides, produced during fermentation, contribute to the preservation of food by inhibiting the growth of pathogenic bacteria, extending shelf life, and preventing lipid oxidation, which has positive implications for both food safety and quality.

Furthermore, fermentation helps reduce anti-nutritional factors like phytic acid and tannins, which can interfere with protein absorption and nutrient bioavailability. It also promotes the degradation of allergenic components in plant proteins, making these products safer and more accessible to a broader range of consumers. Studies have highlighted the benefits of fermentation in improving the nutritional value of products like soya milk and meat analogues, ensuring they meet the growing demand for healthier and more sustainable food options. The continued growth of the fermented plant-based protein market is fueled by technological innovations in fermentation, which enhance the nutritional and sensory qualities of plant proteins. As consumer preferences shift towards plant-based and functional foods, the market is well positioned to thrive, offering cleaner, healthier alternatives without compromising on taste or texture.

Global Fermented Plant-Based Protein Market Trends

Market Dynamics

Drivers:

Growing consumer preference for plant-based diets due to health and environmental concerns

The growing consumer preference for plant-based diets is being driven by increasing health and environmental concerns, which have significantly influenced dietary choices in recent years. As more people become aware of the detrimental effects of excessive meat consumption on health and the planet, plant-based diets are emerging as a preferred alternative.

From a health perspective, studies have consistently shown that plant-based diets are linked to a reduced risk of chronic diseases such as heart disease, type 2 diabetes, and certain cancers. Plant-based diets, rich in fruits, vegetables, whole grains, legumes, and nuts, are often high in fiber, antioxidants, and essential nutrients while being lower in saturated fats. This makes them appealing to health-conscious consumers. For instance, 2022 research published by the National Institute of Health (NIH) found that individuals following plant-based diets tend to have lower blood pressure, reduced cholesterol levels, and a healthier weight compared to those who consume meat regularly, the rise of flexitarian diets, where individuals reduce meat consumption without eliminating it, reflects the growing interest in plant-based foods due to the perceived health benefits.

Environmental concerns also play a major role in the growing demand for plant-based foods. The livestock industry is a significant contributor to greenhouse gas emissions, deforestation, and water usage, which are all major environmental issues. A 2021 report by the United Nations Food and Agriculture Organization (FAO) highlighted that livestock farming accounts for nearly 15% of global greenhouse gas emissions, a proportion comparable to that of all the world’s cars, planes, and trains combined. Therefore, many are turning to plant-based diets to reduce their carbon footprint. Brands like Beyond Meat and Impossible Foods have capitalized on this trend by offering plant-based meat alternatives that replicate the taste and texture of animal products while being far more sustainable in terms of production.

Restraints:

High production costs associated with fermentation processes

High production costs associated with fermentation processes are a significant challenge for industries using this technology, particularly in the context of plant-based protein production. Fermentation, while offering numerous benefits such as improving protein quality, digestibility, and bioactivity, is a resource-intensive process that involves several expensive steps, which can increase the overall cost of production.

Fermentation can be energy-intensive, especially when maintaining the right environmental conditions for microbial growth. In large-scale operations, the demand for electricity, heating, and cooling systems can significantly increase the cost of production. In some cases, energy costs can account for up to 40% of the total production costs in fermentation processes used for food manufacturing.

Moreover, fermentation processes typically have lower yields compared to conventional methods of protein extraction, meaning that more raw materials and longer fermentation times are needed to achieve the desired output. This can further raise costs by increasing labor, energy, and material costs per unit of product produced.

Opportunities:

Expanding the use of fermented proteins in diverse applications, including meat and dairy alternatives

As consumers seek healthier and more sustainable options, the demand for plant-based proteins that mimic the taste, texture, and nutritional profile of traditional animal products has led to increased innovation in fermentation-based technologies.

Fermented proteins offer unique benefits over conventional plant proteins. Through fermentation, plant-based ingredients such as soy, peas, and other legumes undergo transformations that enhance their nutritional profile, digestibility, and flavor. For instance, fermented proteins can break down anti-nutritional factors like phytic acid, which can inhibit mineral absorption, improving bioavailability. Furthermore, the fermentation process produces bioactive peptides, which not only enhance flavor but also contribute to health benefits like immune system support and reduced inflammation.

Challenges:

Regulatory hurdles in labeling and approvals for fermented products.

Fermentation, while an ancient practice, is increasingly being used to produce novel ingredients and functional foods, which often do not fall neatly into established regulatory categories. As a result, companies need to navigate complex approval processes that can vary by country and region. The key regulatory challenge in the fermented products market is determining the correct labeling for new or novel ingredients derived from fermentation. Regulatory bodies like the U.S. Food and Drug Administration (FDA) and the European Food Safety Authority (EFSA) have specific rules about how new food products and ingredients should be labeled, especially when they involve genetically modified organisms (GMOs) or novel production methods like fermentation.

Fermented Plant-Based Protein Market Ecosystem

Prominent companies in this market include well-established, financially stable manufacturers of fermented plant-based protein. These companies have been operating in the market for several years and possess a diversified product portfolio, state-of-the-art technologies, and strong global sales and marketing networks. Prominent companies in this market include Ajinomoto Co., Inc. (Japan), Cargill, Incorporated (US), Genuine Health (Canada), European Protein A/S (Denmark), and Body Ecology (US) among others.

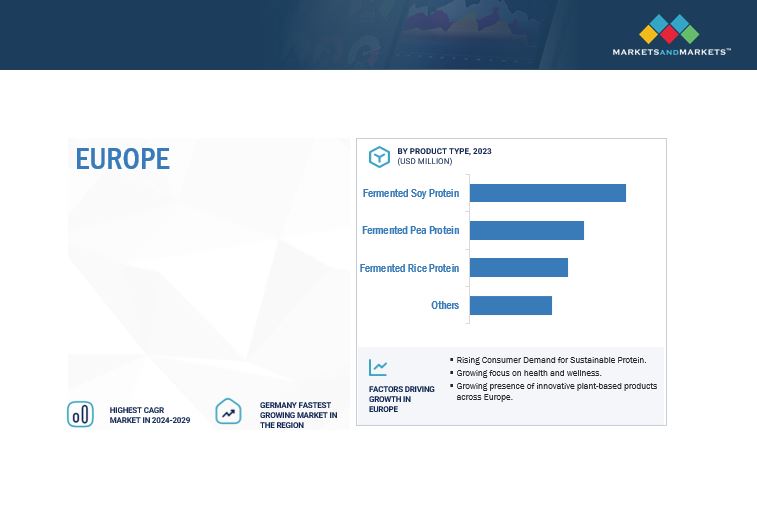

Based on product type, the fermented soy protein segment is projected to be the dominant segment in the market.

In fermentation, soy proteins undergo biochemical changes that enhance their digestibility, bioavailability, and nutritional value, addressing common concerns about plant-based proteins, such as amino acid imbalance and anti-nutritional factors like phytates and trypsin inhibitors. For instance, fermentation not only improves protein digestibility but also boosts the presence of bioactive peptides that contribute to better gut health and immune function.

Companies are leveraging fermentation technologies to enhance the functional properties of soy protein, particularly in food applications like meat analogues, dairy alternatives, and protein-fortified beverages. Moreover, fermented soy protein is seen as a key ingredient in the rapidly growing segment of plant-based meat alternatives, with companies like Impossible Foods (US), and Beyond Meat (US) incorporating soy-derived proteins into their products to replicate the texture and nutritional profile of traditional meat. As demand for these products increases, the fermented soy protein segment is expected to continue its dominance.

The food & beverage application segment in the fermented plant-based protein market is projected to have a significant share.

Fermented plant-based proteins are increasingly being used in a variety of food categories, including meat and dairy alternatives, protein snacks, beverages, and functional foods, as they offer enhanced flavor profiles, improved texture, and superior nutritional benefits.

Fermentation is particularly important in the production of plant-based meat alternatives, where it is used to improve the texture, taste, and mouthfeel of products made from soy, peas, and other plant proteins. The use of fermented proteins is also enhancing the sensory qualities of plant-based dairy products such as yogurt, cheese, and milk. For instance, Oatly (Sweden), a leading brand in the plant-based dairy market, employs fermentation to enhance the taste and texture of its oat-based products, making them more appealing to consumers who are looking for plant-based alternatives to traditional dairy. Similarly, fermentation is increasingly used to improve the flavor profiles and nutritional qualities of protein-enriched beverages, such as protein shakes and functional drinks, that cater to the health-conscious consumer.

Europe is the fastest growing region in the fermented plant-based protein market.

The European market has seen significant growth in demand for plant-based foods, with countries like the UK, Germany, and the Netherlands at the forefront of this shift. Consumers in these regions are increasingly adopting plant-based diets for health reasons, such as reducing cholesterol and improving cardiovascular health, as well as environmental concerns regarding the carbon footprint of animal agriculture.

In addition to health-conscious consumers, there is a growing demand from food manufacturers for innovative, clean-label ingredients. Fermented plant-based proteins align perfectly with these trends, as they offer superior nutritional profiles and improved functionality without relying on artificial additives. 2021 Research by ProVeg International found that Europe’s plant-based food market has been expanding at an impressive rate, particularly in the dairy alternative and plant-based meat sectors. Companies like European Protein (Denmark), one of the leading players in fermentation-based plant protein production, are investing heavily in production facilities to meet the rising demand in the region. Furthermore, the European Union's strong regulatory framework for food safety, sustainability, and labeling has created an environment conducive to the growth of plant-based and fermented food products.

Key Market Players

- Ajinomoto Co., Inc. (Japan)

- Cargill, Incorporated (US)

- Genuine Health (Canada)

- European Protein A/S (Denmark)

- Body Ecology (US)

These market players are focusing on increasing their presence through agreements and collaborations. These companies have a strong presence in North America, Asia Pacific, Europe, South America, and the Rest of the World. They also have manufacturing facilities along with strong distribution networks across these regions.

Recent Developments

- In September 2024, European Protein, a Danish biotechnology company, entered into a strategic partnership with Yenher Holdings Berhad, a leading Malaysian feed producer, to establish two new fermentation plants in Southeast Asia. The announcement was made during the official signing ceremony at the Agricultural Fair, MAHA 2024. This joint venture will utilize European Protein's patented solid-state lacto-fermentation process, which transforms plant proteins and byproducts into high-value feed ingredients. The fermentation process, which uses less water and energy while generating significantly less waste compared to traditional methods, offers a more sustainable alternative to soy protein refinement. This technology has the potential to reduce environmental impact by up to 63%.

- In August 2024, Ajinomoto Health & Nutrition partnered with Shiru, a protein discovery company, to explore and commercialize sweet proteins, which are increasingly seen as a viable sugar alternative in food and beverage products. This collaboration marks Ajinomoto's first entry into the sweet protein sector, where natural proteins derived from fruits can replace sugar without affecting blood sugar levels. Ajinomoto will leverage Shiru’s AI-driven Flourish platform, which uses advanced digital technology to discover functional ingredients. The partnership combines Shiru's expertise in AI-based protein discovery with Ajinomoto’s fermentation technology to create stable and effective sweet proteins that could provide up to 5,000 times the sweetness of sugar, replacing up to 70–90% of the sweetness in food products.

Frequently Asked Questions (FAQ):

What is the current size of the fermented plant-based protein market?

The fermented plant-based protein market is estimated at USD XX billion in 2024 and is projected to reach USD XX billion by 2029, at a CAGR of XX% during the same period.

Which are the key players in the market, and how intense is the competition?

Ajinomoto Co., Inc. (Japan), Cargill, Incorporated (US), Genuine Health (Canada), European Protein A/S (Denmark), and Body Ecology (US). The market for fermented plant-based protein is expanding rapidly, with more mergers, acquisitions, and product launches. Companies in this sector are also heavily investing in research and development.

Which region is projected to account for the largest share of the fermented plant-based protein market?

The North American market is expected to dominate during the forecast period due to its high consumer awareness about plant-based and functional foods, growing vegan and flexitarian population, and significant investments in food innovation and technology. Additionally, robust distribution networks, the strong presence of key players, and the demand for sustainable and clean-label food products further bolster its leadership in this market.

What kind of information is provided in the company profiles section?

The provided company profiles deliver crucial details, including a thorough business summary that covers different segments, financial results, geographic presence, revenue distribution, and business revenue breakdown. They also offer insights into product lines, key achievements, and expert analyst opinions to better illustrate the company's potential.

What are the factors driving the fermented plant-based protein market?

The fermented plant-based protein market is driven by increasing consumer awareness of health benefits, particularly improved digestion and enhanced protein bioavailability due to fermentation. The growing popularity of plant-based diets, driven by environmental concerns and ethical considerations, also fuels demand. Advances in fermentation technologies, which improve taste, texture, and functional properties, alongside rising demand for clean-label and sustainable food products, contribute to market expansion. Additionally, the incorporation of fermented proteins into diverse applications such as meat substitutes, dairy alternatives, and dietary supplements strengthens growth potential.

Growth opportunities and latent adjacency in Fermented Plant-based Protein Market