Fermentation Enzymes Market - Global Forecast to 2029

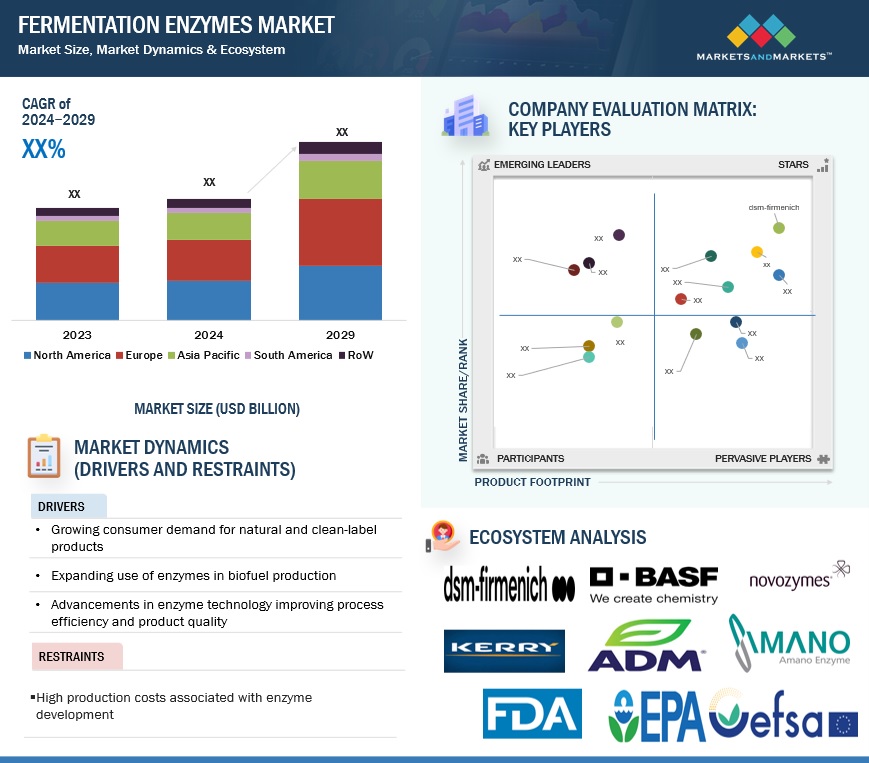

The market for fermentation enzymes is estimated at USD xx billion in 2024; it is projected to grow at a CAGR of xx% to reach USD xx billion by 2029. The applications of fermentation enzymes in the food & beverage sector have been frequently linked with higher consumer demand for natural clean-label products and functional foods. The adoption of these enzymes for product enhancement and processing efficiency has also increased. Increased demand for better nutrition in livestock and improved feed conversion efficiency are driving the use of enzymes in animal feed. Advances in biotechnology and increasing demand for enzyme-based production and formulations in pharmaceuticals further propel growth in the market.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Drivers: Rising demand for natural and clean-label food products

As health-conscious consumers become aware of the adverse health issues associated with artificial additives and preservatives used in food products, it gives them a push to find products containing known, uncomplicated ingredients. Fermentation enzymes provide functional benefits as they enhance food quality without deterring health. For example, enzymatic processing not only enhances digestibility and increases nutrient availability but also naturally strengthens flavors in organic and functional food. Furthermore, the global trend toward sustainability encourages manufacturers to adopt fermentation processes that will help reduce reliance on chemical additives as much as possible, thus minimizing their environmental impact. Food and beverage companies are investing in R&D processes to find new applications for enzymes to produce clean-label products for health-conscious consumers. As a result, this emerging interest in natural, clean-label food products is boosting the fermentative enzyme market with greater innovation.

Restraints: High production & extraction costs

High production and extraction costs of fermentation enzymes affect both the manufacturers and consumers. The production process for such enzymes is quite complicated, involving sophisticated biotechnological methods that include the culture of selected microorganisms within controlled conditions. The process involves the optimization of many factors, such as temperature, pH, and nutrient availability, for the highest possible yield of the enzymes, which increases the operational cost. Further, specialized tools and plants are required so that small producers gain a niche in the market where they can compete with dominant players. Other processes that require more labor and energy consumption are the extraction and purification of enzymes from fermentation broths, which require sophisticated technologies to obtain high purity and activity grades.

The high costs of enzyme production can result in elevated prices for end products, making it difficult for manufacturers to maintain competitive pricing in a market that often favors cost-effectiveness. To overcome these challenges, there is a need for research and innovation aimed at developing more cost-effective production methods. This could include helping advance enzyme engineering, optimizing fermentation processes, and exploring alternative raw materials.

Opportunities: Expansion of the plant-based products

The rising popularity of plant-based diets is significantly driving demand for fermentation enzymes, particularly in the development of meat alternatives. As consumers increasingly prioritize health, sustainability, and ethical considerations in their food choices, the market for plant-based products, such as veggie burgers, sausages, and dairy substitutes, is expanding rapidly. Fermentation enzymes play a crucial role in this transformation by enhancing the texture and mouthfeel of plant-based proteins, making them more appealing to consumers who seek alternatives that closely mimic the sensory experience of traditional meat products. These enzymes facilitate the breakdown of complex carbohydrates and proteins, improving digestibility and enabling manufacturers to create products with a more desirable texture and flavor profile.

Enzymes can also enhance the fermentation process itself, resulting in the development of unique flavors that resonate with consumers seeking authenticity and complexity in their food choices. As the plant-based food market continues to grow, manufacturers are investing in research and development to explore innovative enzyme applications that can further improve the quality and appeal of their offerings. This trend not only supports the fermentation enzymes market but also aligns with broader dietary shifts toward healthier and more sustainable food options

Challenges:Inconsistency in the quality of enzymes

Consistency and reliability of enzyme performance are the prime concerns in terms of the quality of enzymes applied in the food and beverages industry. Fluctuations in enzyme activity can be due to differences in the source organisms, production methods, and conditions of processing. For example, efficacy and the activities of enzymes sourced from one different microbial strain differ from those of other strains and may culminate into varying outcomes in food processing. The inconsistencies of these enzymes can affect the texture, flavor, and overall quality of the final product, and all batches may not be uniform from production. Enzymes are sensitive to environmental conditions as the temperature, pH, and moisture can influence the activity and shelf life of an enzyme. Thus, stability and effectiveness at every stage of the process, as well as the shelf life of the final product, are indispensable. Degradation or loss of enzyme activity can bring about off-flavors, undesirable textures, or a reduction in nutritional value, and as such, manufacturers must invest rigorously in quality control as well as research to produce more stable enzyme formulations and how best to store them to ensure consistent performances and quality.

FERMENTATION ENZYMES MARKET ECOSYSTEM

Prominent companies in this market include well-established, financially stable manufacturers of fermentation enzymes. These companies have been operating in the market for several years and possess a diversified product portfolio, state-of-the-art technologies, and strong global sales and marketing networks. Prominent companies in this market include BASF SE (Germany), dsm-firmenich (Netherlands), Kerry Group plc (Ireland), International Flavors & Fragrances Inc (US), Dyadic International Inc (US), and Novozymes A/S (Denmark).

Based on type, the carbohydrase segment dominates the fermentation enzymes market.

Carbohydrase hold the highest share in the fermentation enzymes market due to its wide application across all industries, including food and beverage. These enzymes have established themselves as a must for breaking down the complex carbohydrate content into simpler sugars in baked goods, beverages, and dairy products for better texture, flavor, and nutritional value. There is also increased demand for natural and clean-label food products, which fuels the market penetration for carbohydrase. By making the digestion of ingredients easier and raising the bioavailability of nutrients, carbohydrates allow the production of functional foods.

Carbohydrase plays a vital role in enhancing the quality of end products. In the food industry, they aid in texture modification, flavor enhancement, and the production of low-calorie sweeteners. In the textile industry, carbohydrates assist in the removal of impurities and the improvement of fabric properties. Carbohydrase offers cost-effectiveness attributed to their high catalytic activity and efficiency. They can be produced on a large scale using microbial fermentation processes, making them economically advantageous for both industrial enzyme manufacturers and end-users.

The food & beverages segment holds the highest market share in the fermentation enzymes market

The food and beverages segment has the maximum market share in terms of the application segment of the fermentation enzymes market mainly because of the essential role that these play in improving quality and efficiency across many food processing methods. Among the few common applications, amylases, proteases, and carbohydrase are widely used in baking, brewing, dairy, and juice production. For instance, starches in baking are converted into fermentable sugars by amylases to improve dough texture and fermentation rates. Then, proteases will improve the strength of gluten for better quality breads. Lipase is an enzyme that has recently been found to be applicable to bakery products. Although protease is a better enzyme for the dough mixing process and the processing time, lipase is preferable as it increases the shelf life of bakery products. Similarly, brewery enzymes facilitate the breakdown of starches and proteins, optimize their fermentation processes, and result in the optimization of flavor profiles; these play a very important role in beverage production, especially high-quality ones.

The Asia Pacific region is anticipated to experience rapid growth between 2024 and 2029.

In the Asia Pacific region, high growth is anticipated in the fermentation enzymes market on account of applications in diverse sectors, including food and beverages, animal feed, pharmaceuticals, and biofuels. The demand for natural and functional products has increased, thus providing scope for applications as a means of improving flavor, texture, and nutritional profiles. At the same time, growth in the animal industry is leading to increased usage of enzymes in animal feed with the purpose of improving digestion and nutrient uptake by the livestock. Additionally, governments in the region are offering incentives, grants, and funding programs to support the growth of the fermentation enzymes market. For example, China has introduced several policies and measures to promote the industrial biotechnology sector, including enzymes. Such enzymes help in converting biomass into renewable biofuels and energy within the region that support the sustainability goals. Overall, these factors place the Asia Pacific at the centre of fermentation enzyme innovation and application and fuel high growth in the market across industries.

WuXi STA (China) expanded its biocatalysis capabilities in October 2024 through the launch of a new enzyme fermentation plant located in Changshu, China. The facility will increase the company's total enzyme fermentation capacity to 22,850 liters, better positioning it to meet the varied demands of multiple projects. The expansion will allow WuXi STA to provide greater scalability, speed, and efficiency in enzyme production, which allows the company to better serve its clients while trying to keep up with the growing demand for high-quality fermentation enzymes.

Key Market Players

- BASF SE (Germany)

- Novozymes A/S (Denmark)

- Kerry Group plc (Ireland)

- International Flavors & Fragrances Inc (US)

- Chr. Hansen A/S (Denmark)

- dsm-firmenich (Denmark)

- AB Enzymes (Germany)

- Amano Enzyme Inc (Japan)

- Dyadic International Inc (US)

- Advanced Enzyme Technologies (India)

- Biocatalysts Ltd. (UK)

- Nagase & Co., Ltd. (Japan)

- Aumgene Biosciences (India)

- Megazyme Ltd. (US)

- Associated British Foods plc (UK)

- Perfect Day, Inc (US)

- Creative Enzymes (US)

- Infinita Biotech Private Limited (India)

- Sunson Industry Group Co., Ltd. (China)

- Lonza (Switzerland)

- Novus International, Inc. (UK)

- Specialty Enzymes & Probiotics (US)

- SternEnzym GmbH & Co. KG (Germany)

- Bio-Vet (US)

- Lonct Enzymes (China)

These market players are focusing on increasing their presence through agreements and collaborations. These companies have a strong presence in North America, Asia Pacific, and Europe. They also have manufacturing facilities along with strong distribution networks across these regions.

Recent Developments

- In July 2024, Lallemand Bio-Ingredients invested in Turkish enzyme manufacturer Livzym Biotechnologies, expanding its portfolio of industrial enzymes used in various industries such as food, textiles, and biofuels. The collaboration is aimed at enhancing enzyme production using precision fermentation and promoting sustainability?

- In March 2024, Biocatalysts (UK), the leading company in the discovery, development, and fermentation of enzymes for the Food, Beverage, and Life Science industries, increased its production capacity. It has established a new large-scale freeze-drying capability center at its Cardiff manufacturing site. This investment increased the company’s onsite freeze-drying capacity, enabling greater customization of enzyme formulations tailored to specific customer and industry needs.

- In January 2023, Advanced Enzyme Technologies (India) acquired a 50% stake in Saiganesh Enzytech Solutions Private Limited (India). With this acquisition, Advanced Enzyme Technologies increased its product portfolio by utilizing the resources from Saiganesh Enzytech Solutions.

- In February 2022, Kerry Group plc. (Ireland) acquired C-LEcta (Germany) and Enmex (Mexico) to expand their knowledge, technology, and manufacturing capabilities. c-LEcta has successfully commercialized a number of biotechnology products, including enzymes that facilitate the synthesis of a plant-based sweetener, enzymes that make pharmaceutical bioprocess production more efficient and sustainable, and other cutting-edge enzymes utilized in food applications

Frequently Asked Questions (FAQ):

What is the current size of the fermentation enzymes market?

The fermentation enzymes market is estimated at USD xx billion in 2024 and is projected to reach USD xx billion by 2029, at a CAGR of xx% during the same period.

Which are the key players in the market, and how intense is the competition?

BASF SE (Germany), dsm-firmenich (Netherlands), Kerry Group plc (Ireland), International Flavors & Fragrances Inc (US), and Dyadic International Inc (US). The market for fermentation enzymes is expanding rapidly, with more mergers, acquisitions, and product launches. Companies in this sector are also heavily investing in research and development.

Which region is projected to account for the largest share of the fermentation enzymes market?

The Asia Pacific market is expected to dominate during the forecast period. The region is currently growing at the highest rate, boasting dominance fueled by a convergence of factors, including robust research and development initiatives and the presence of major key players with advanced manufacturing capabilities.

What kind of information is provided in the company profiles section?

The provided company profiles deliver crucial details, including a thorough business summary that covers different segments, financial results, geographic presence, revenue distribution, and business revenue breakdown. They also offer insights into product lines, key achievements, and expert analyst opinions to better illustrate the company's potential.

What are the factors driving the fermentation enzymes market?

Advancement in biotechnology, rising demand for clean-label products, and support from the government in manufacturing fermentation enzymes.

Growth opportunities and latent adjacency in Fermentation Enzymes Market