Fermentation Enabled Alternative Proteins & Supplements Market Report by Process (Precision, Biomass, Traditional), by Microbe (Yeast, Algae, Bacteria, Fungi), By Ingredient, End Use & Region - Global Forecast to 2029

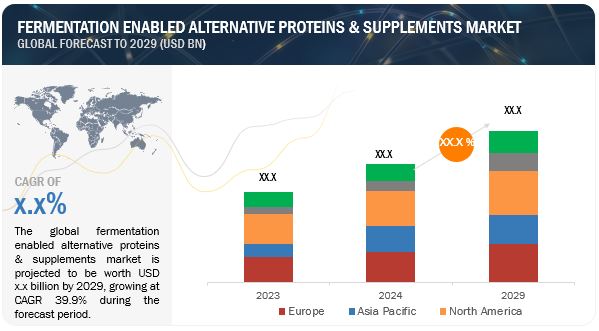

According to MarketsandMarkets, the fermentation enabled alternative proteins & supplements market is projected to reach USD XX billion by 2029 from USD XX billion by 2024, at a CAGR of 39.9% during the forecast period in terms of value. The fermentation-enabled alternative proteins and supplements market is driven by increasing demand for sustainable and ethical products, health and wellness trends, and rising vegetarian and vegan populations. Technological advancements in fermentation technology have revolutionized the production of high-quality proteins and supplements, making the process more efficient and cost-effective. One significant innovation is precision fermentation, which involves using microorganisms such as yeast, bacteria, and fungi to produce specific proteins with high precision. This technology allows for the targeted production of complex proteins, enzymes, and bioactive compounds that are difficult to obtain through traditional methods.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Market Dynamics

Driver:Increasing global population

Sanah Baig, Deputy Under Secretary at the USDA, highlighted the urgent need to double protein production by 2050 to feed our growing population, stressing that maintaining current production systems will not suffice. Global food systems must evolve to meet the demands of an expanding world, but this transformation requires substantial government investment. According to a report co-funded by the UK’s Foreign, Commonwealth & Development Office, a collective investment of $XX billion per year in alternative proteins is necessary to sustain the planet’s increasing population. As the global population rises, the market for fermentation-enabled alternative proteins and supplements is poised for significant growth, driven by the need for sustainable and efficient food production methods.

Restraint : High Production Cost

High production costs continue to be a major challenge for the fermentation-enabled alternative proteins market. Despite technological advancements that have increased efficiency, overall costs remain high due to several factors. Firstly, the raw materials required for fermentation, such as specific feedstocks and growth media, are often expensive. These materials must be of high purity and quality to ensure optimal growth conditions for the microorganisms, contributing to higher costs.

Opportunity :Precedent for economic viability and industrial-scale production.

Traditional and biomass fermentation processes present well-established opportunities for scalability and cost reduction, making them suitable for alternative protein applications. Continued innovation in these areas can further decrease costs, which is crucial for widespread adoption, particularly in low- and middle-income countries. The precedent for economic viability and industrial-scale production already exists with these methods. However, precision fermentation, which holds significant potential for the alternative protein industry, still requires additional efforts in scaling and cost reduction to fully realize its benefits.

Challenge: Regulatory Restrictions

Regulations concerning genome editing and engineering vary widely across jurisdictions, often imposing restrictions on specific ingredients. This variability poses significant challenges for the fermentation-enabled alternative proteins and supplements market, as certain ingredients may be outright restricted in some regions. However, ingredients classified as processing aids, such as enzymes (e.g., chymosin), generally receive more leniency across all regions, as many countries exempt them from genetic engineering restrictions. Past approvals in this field establish precedents and offer clear guidelines for gathering the necessary supporting evidence for future ingredients. Despite these guidelines, navigating the regulatory landscape remains complex and time-consuming, potentially hindering innovation and market access for fermentation-based alternative proteins and supplements.

Fermentation Enabled Alternative Proteins And Supplements Market Ecosystem

Key players within this market consist of reputable and financially robust fermentation enabled alternative proteins & supplements manufacturers. These entities boast extensive industry tenure, offering diversified product portfolios, advanced technologies, and robust global sales and marketing networks. Prominent companies in this market include Geltor (US), Perfect Day, Inc. (US), The EVERY Co. (US), Impossible Foods Inc. (US), Motif FoodWorks, Inc. (US), Imagindairy Ltd. (Israel), Shiru, Inc. (US), Formo (Germany), Eden Brew (Australia), New Culture (US), Helaina Inc (US), Mycorena (Sweden), Myco Technology (US), Fybraworks Foods (US) and Change Foods (US).

In process segment, precision process to hold largest market share in the global fermentation enabled alternative proteins & supplements market.

Precision fermentation holds the highest share in the fermentation-enabled alternative protein and supplement market for several compelling reasons. Firstly, it allows for the precise engineering of microorganisms to produce specific proteins with desired functionalities, such as bioavailability, texture, and taste, which are difficult to achieve through traditional methods. This customization capability enables the development of highly tailored products that meet diverse consumer preferences and nutritional needs, driving demand. Secondly, precision fermentation offers scalability advantages, allowing for consistent and efficient production at industrial scales without the limitations of agricultural cycles or animal-based production constraints. This scalability enhances supply chain resilience and reduces dependency on fluctuating agricultural yields.

By ingredients, enzymes to hold largest market share in the fermentation enabled alternative proteins & supplements market.

Enzymes dominate the fermentation-enabled alternative protein and supplement market for several reasons. They are essential as processing aids throughout fermentation and protein production, catalyzing biochemical reactions that efficiently convert raw materials into desired products, thereby enhancing process yields and lowering production costs. Additionally, enzymes exhibit versatile applications across various industries within the alternative protein sector, from breaking down complex substrates to improving texture and flavor profiles in final products, ensuring consistent quality. Their generally recognized safety status by regulatory authorities globally simplifies approval and adoption in food and beverage applications, ensuring compliance with safety standards and facilitating market access for enzyme-based products.

By end use , alternative proteins to hold largest market share in the fermentation enabled alternative proteins & supplements market.

Alternative proteins hold the highest share in the fermentation-enabled alternative proteins and supplement market for several compelling reasons. Firstly, there is a rising global demand for sustainable food sources driven by environmental concerns, animal welfare considerations, and health consciousness. Alternative proteins, produced through fermentation, offer a viable solution that reduces reliance on traditional animal agriculture, thereby addressing these consumer preferences. Fermentation-enabled alternative proteins and supplements are revolutionizing various end uses in the food industry. Initially seen in plant-based meat innovation by companies like Beyond Meat and Impossible Foods with minced and ground meat alternatives, fermentation technologies have expanded to enhance product quality and flavor. For instance, Impossible Foods and Mediterranean Food Lab utilize precision and traditional fermentation to develop functional ingredients that significantly improve the taste and texture of their products. Another promising application is in dairy products, where fermentation techniques are pivotal for creating plant-based cheeses with desirable flavors and textures, as demonstrated by companies like Treeline and Miyoko’s. Emerging companies such as New Culture, Change Foods, Cultivated, and LegenDairy are now leveraging fermentation to produce dairy proteins and fats, ushering in a new era of plant-based alternatives that are both nutritious and sustainable.

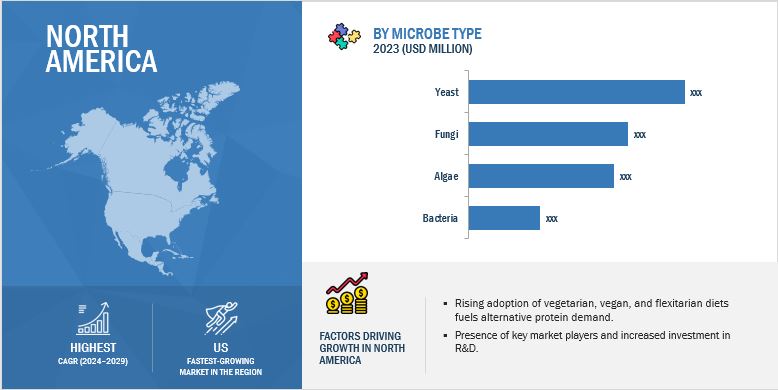

By microbe type, yeast segment to grow at highest rate in the given forecast period.

Precision fermentation ingredients utilize microbial hosts such as yeast or fungi as “cell factories” for creating a specific ingredient. It is particularly helpful for generating ingredients that need higher purity. Precision fermentation provides a better and more economical source of supply. For instance, a US-based startup, C16 Biosciences, has genetically modified microorganisms (yeast) to create palmitic acid, the key ingredient of palm oil. The company produced palmitic acid in batches, which is usually a time-consuming process. It utilized sugar from agricultural waste. This is possible because of precision fermentation, which eventually cuts the cost. Yeast microorganisms are vital in precision fermentation, especially for sustainable fat sources.

In application segment, dairy alternatives to grow at highest rate in the given forecast period.

Dairy alternatives hold a significant share in the fermentation-enabled alternative protein and supplement market for several compelling reasons. Firstly, there is a growing consumer demand for plant-based and lactose-free alternatives due to health and dietary preferences, including lactose intolerance and allergies. Dairy alternatives derived from fermentation offer similar taste, texture, and nutritional profiles to traditional dairy products, meeting these consumer needs effectively. Plant-based yogurt, ice cream, and milk products are major new functional dairy alternatives. These products are breakthrough solutions for lactose intolerance and milk allergies. They are also low in fat and calories and have a high nutrient content. These properties have increased the popularity of dairy alternatives worldwide as a majority of the population adopts a healthy and high-nutrient diet.

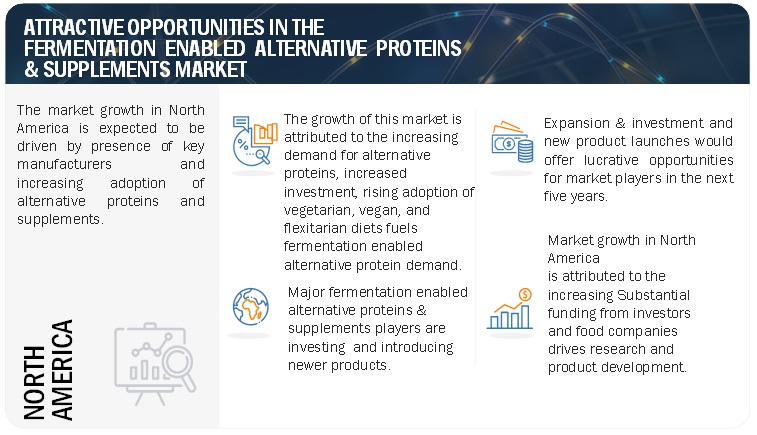

North America to dominate the fermentation enabled alternative proteins & supplements market during the forecast period.

North America leads the fermentation-enabled alternative protein and supplement market due to several key factors. Firstly, the region benefits from a strong consumer base increasingly opting for plant-based diets and sustainable food choices. This trend is supported by a robust infrastructure for food innovation and entrepreneurship, which fosters the development of fermentation technologies. Secondly, North America enjoys substantial investments in research and development, particularly in biotechnology and food science, driving ongoing advancements in alternative proteins. Thirdly, favorable regulatory environments and widespread consumer acceptance of innovative food technologies contribute to market expansion, facilitating the introduction and commercial success of fermentation-enabled protein products. Lastly, the presence of established companies and startups specializing in alternative proteins, alongside high demand for nutritious and eco-friendly food options, solidifies North America's dominance in this rapidly growing market segment.

Key Market Players

The key players in this market include Geltor (US), Perfect Day, Inc. (US), The EVERY Co. (US), Impossible Foods Inc. (US), Motif FoodWorks, Inc. (US), Imagindairy Ltd. (Israel), Shiru, Inc. (US), Formo (Germany), Eden Brew (Australia), New Culture (US), Helaina Inc (US), Mycorena (Sweden), Myco Technology (US), Fybraworks Foods (US) and Change Foods (US). These market participants are emphasizing the expansion of their footprint via agreements and partnerships. They maintain a robust presence in North America, Asia Pacific, South America, RoW, and Europe, and they are supported by manufacturing facilities and well-established distribution networks spanning these regions.

Recent Developments

- In February 2024, Nestlé launched its inaugural precision fermentation dairy protein powder, branded as Better Whey, a lactose-free and animal-free whey isolate product under the Orgain label.

- In February 2024, Cargill and food tech innovator ENOUGH, known for sustainable fermented protein production, announced an expanded partnership aimed at innovating nutritious and sustainable alternative meat and dairy solutions in high demand by consumers. Cargill's investment in ENOUGH's latest Series C growth funding round and the signing of a commercial agreement to utilize and promote its fermented protein underscore their commitment to advancing sustainable food technologies.

- In February 2022, Geltor announced the successful scale-up of its PrimaColl bioactive collagen production, achieved without animal inputs. This milestone highlights Geltor's rapid advancement in biodesigned protein manufacturing, significantly increasing production capacity to millions of liters within two years. These achievements solidify Geltor's leadership in fermentation technology and sustainable protein production, laying the groundwork for ongoing innovation and future expansion.

Frequently Asked Questions (FAQ):

Which are the major companies in the fermentation enabled alternative proteins & supplements market? What are their major strategies to strengthen their market presence?

The key players in this include Geltor (US), Perfect Day, Inc. (US), The EVERY Co. (US), Impossible Foods Inc. (US), Motif FoodWorks, Inc. (US), Imagindairy Ltd. (Israel), Shiru, Inc. (US), Formo (Germany), Eden Brew (Australia), New Culture (US), Helaina Inc (US), Mycorena (Sweden), Myco Technology (US), Fybraworks Foods (US) and Change Foods (US). These players in this market are focusing on increasing their presence through agreements and collaborations. These companies have a strong presence in North America, Asia Pacific, and Europe. They also have manufacturing facilities and strong distribution networks across these regions.

What are the drivers and opportunities for the fermentation enabled alternative proteins & supplements market?

The fermentation-enabled alternative protein and supplements market is driven by increasing consumer demand for sustainable and plant-based food options amid growing environmental awareness. This trend is bolstered by advancements in fermentation technology, which enhance production efficiency and product quality while reducing environmental impact compared to traditional animal farming. Opportunities abound in this market as technological innovations continue to improve scalability and cost-effectiveness, making alternative proteins more accessible and competitive. Additionally, regulatory support and investment in biotechnology further propel market growth, enabling companies to meet the rising global demand for nutritious, ethical, and environmentally friendly protein sources.

Which region is expected to hold the highest market share?

North America leads the fermentation-enabled alternative protein and supplements market due to several strategic advantages. Firstly, a growing consumer base is increasingly opting for plant-based diets and sustainable food choices, influenced by health considerations and environmental awareness. This trend is supported by a well-established infrastructure that fosters food innovation and entrepreneurial growth, creating an ideal environment for the development of fermentation technologies. Secondly, significant investments in research and development, particularly in biotechnology and food science, drive continuous innovation and product advancement in alternative proteins. Thirdly, favorable regulatory environments and widespread consumer acceptance of innovative food technologies facilitate market expansion and the introduction of fermentation-enabled protein products. Lastly, the presence of leading companies and startups specializing in alternative proteins, coupled with strong demand for nutritious and environmentally friendly food options, consolidates North America's dominant position in this rapidly growing market segment.

What are the key technology trends prevailing in the fermentation enabled alternative proteins & supplements market?

The adaptability of fermentation processes to various raw materials, such as feedstocks, offers significant opportunities for cost reduction and sustainability improvements. Many companies and researchers are leveraging this potential by engineering industrial-scale production systems that utilize side streams from other industries. This approach not only enhances economic viability by minimizing raw material costs but also promotes sustainability by converting waste products or agro-industrial byproducts into high-quality protein biomass. Examples include Nature’s Fynd, which utilizes extremophile fungi from Yellowstone National Park capable of metabolizing diverse feedstocks, and companies like 3F Bio and Mycorena in Sweden, known for their leadership in sustainable feedstock utilization. These technological innovations underscore a growing emphasis on maximizing resource efficiency and environmental stewardship in the fermentation-based production of alternative proteins and supplements.

What is the total CAGR expected to be recorded for the fermentation enabled alternative proteins & supplements market during 2024-2029?

The CAGR is expected to record as of 39.9% from 2024-2029. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Growth opportunities and latent adjacency in Fermentation Enabled Alternative Proteins & Supplements Market