Feed Yeast Market by Type (Yeast Derivatives, Probiotic Yeast, Brewer’s Yeast, and Specialty Yeast), Livestock (Ruminants, Swine, Poultry, Aquatic Animals, Pets and Equine), Genus , and Region - Global Forecast to 2025

[325 Pages Report] The global feed yeast market size was valued at USD 1.8 billion in 2020 and is projected to reach USD 2.3 billion by 2025, recording a CAGR of 5.1% during the forecast period. The feed yeast market is driven by factors such as ban on the use of antibiotics in feed as a growth promoter and increasing use of yeast as a nutritional supplement for livestock. Also, rising concern regarding animal health and feed quality has been driving the growth of this market.

To know about the assumptions considered for the study, Request for Free Sample Report

Market Dynamics

Driver: Increasing nutritional benefits from yeast-based feed products

Ample quantity of yeast is present in the environment. Some yeasts are isolated from natural products such as honey, fruits, soil, water, flowers, leaves, and stems. Feed ingredients such as grains, silage, and hay also have yeasts present in them. Most of the yeast species have no impact on animals and humans, while some have negative or positive effects. It has been observed that yeasts such as Saccharomyces cerevisiae, Kluyveromyces marxianus, and Candida utilis have a positive impact on animal health; they provide nutrition to animals and thus are used as feed additives. Besides application in animal feed, there are many commercial applications of different yeast genera in various industries such as brewing, bakery, food and flavoring, pharmaceutical, and bioethanol fuel production.

Restraint: Competition for basic raw materials

The global supply of raw materials for yeast production can have a significant impact on the production of feed yeast and its extracts. The important source of yeast production is based on a sugar by-product, molasses. The shortage of molasses is a major concern for the global yeast market due to the high competition for these raw materials from different industries such as food, pharmaceutical, feed, and others. Such a shortage has arisen due to many reasons—poor sugarcane and sugar beet yield being the major one. Therefore, this is expected to limit its supply in the production of yeast ingredients. With high demand for brewer’s yeast used in bakery and alcohol industries, much more deficit in the availability of raw materials for the manufacturing of feed yeast can further affect the final product price. This would eventually affect the demand for yeast products among feed manufacturers and livestock growers.

Opportunity: Innovations in the animal feed industry

Technological innovations in the animal feed sector had created significant opportunities for the manufacturers to come up with new products in the animal nutrition and feed additives segments. For instance, Canadian Bio-Systems Inc (Canada) launched a new category of feed technology with broad advantages for the livestock industry. This technology, which is a yeast-based innovation, was developed for the use of yeast as a feed additive in the diets of swine, ruminants, and poultry. This is one of the best replacements for antibiotic use to improve animal health and performance. As the use of antibiotics is banned in the animal feed sector, such yeast-based bioactive technology can serve as a suitable alternative for livestock producers in the coming years. As a bio-based feed ingredient, yeast can be mixed with the feed and can be fed at farm sites. Apart from the above-stated innovation, various other innovations are patented in terms of feed yeast; these include developments for the production of multifunctional probiotics that include Bacillus and Saccharomyces yeast strains, which can provide combined essential benefits of these multiple strains. The innovation is said to improve antibacterial properties as well as increase enzyme activity in the final feed products.

Challenge: Commercialization of duplicate and low-quality products

Lack of transparency in patent protection laws and regulatory compliance in various countries have led to the duplication of products. Low-quality products are also introduced in the market by regional or local manufacturers to reap the benefits of the growing demand for feed yeast. Duplicate and low-quality products can create health issues in the livestock and are a big concern for the producers. There are many small players in the developing markets of Asia Pacific that offer yeast-based feed ingredients without any brand name, and somehow increase their profits by selling unauthorized duplicate products. These local manufacturers attract the feed producers as well by offering lower prices for their low-quality feed yeast ingredients.

To know about the assumptions considered for the study, download the pdf brochure

On the basis of genus, the Saccharomyces Spp. segment is projected to be the fastest-growing segment during the forecast period.

Saccharomyces cerevisiae has been the most widely adopted yeast for various applications, including feed. Majority of the key players such as Associated British Foods plc. (UK), Cargill (US), and Lesaffre (France) have been providing feed yeast with Saccharomyces formulation. According to the FAO, besides Saccharomyces spp., Candida spp. (a part of which was formerly known as Torula) has been gaining traction as a probiotic yeast in feed application in North America. Of the various probiotic strains registered with the FAO in 2018 for animal nutrition, only Saccharomyces and Candida are approved for probiotic application in the feed industry.

The increasing awareness of health benefits associated with probiotic yeast has widened the scope of growth for the feed yeast market.

The use of probiotic yeast in ruminant feed resulted in improved health and higher milk production. Similarly, in pigs, yeast triggers an immune response to reduce the entry of pathogens in the body and also reduces the occurrence of post-weaning diarrhea. With the increasing use of probiotics for animal nutrition, growth promotion, and gut health development, the probiotic yeast segment is projected to record the fastest growth, on the basis of type, during the forecast period.

On the basis of livestock, the aquatic animals segment is projected to witness the highest growth in the market.

A rise in fish farming practices in the developing countries of the Asia Pacific due to the increased profits through farmed fish cultivation over the past 10 years. In addition, the increasing fish consumption in regions such as Europe and South America encourages fish farming, which would further drive the market in the aquafeed segment. Supplementing feed yeast in right quantities to aquatic animals leads to an optimal supply of essential nutrients.

The current scenario of COVID-19 is projected to slightly impact the market growth for feed yeast. The increase in consumption of animal-based products and the rise in concerns pertaining to animal health are factors that are projected to drive the demand for feed yeast. However, the shortage in labor, international trade restrictions and reduced consumption of livestock products are factors that are projected to have a short-term impact on the production and supply of feed yeast. According to Animal HealthCare Centre, USDA report, the companies are focusing on increasing their production capacity post-COVID-19 lockdown to meet supply gaps created in the domestic and international markets due to supply chain hindrances. This encourages various international governments to develop proper sanitary guidelines for feed additive production. Thus, the decline in 2020 in the feed yeast market growth is mainly due to the impact of COVID-19 pandemic. Thereafter, as the restrictions of the government measures are likely to relax gradually, the market is likely to experience a rise in the coming years till 2025 as many feed additive producers have started seeking alternatives to antibiotics. There would be a strong consumer preference for meat products raised on natural feed additives and products, such as probiotic yeast, that also help reduce environmental impact.

Increasing concerns about the COVID-19 spread on livestock and the rising awareness among consumers about consuming such livestock products have led manufacturers in the feed industry to opt for various natural and organic alternatives such as live feed yeast. Feed yeast being natural additives will witness an increase in its usage as more people are opting for organic and healthy products as compared to synthetic products. These growing concerns of consumers will require breeders to adapt natural additives, such as feed yeasts.

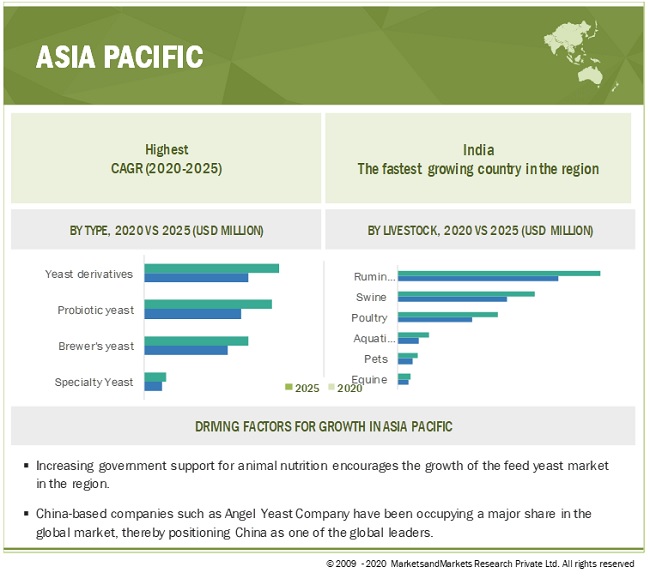

Asia Pacific is projected to be the fastest and largest-growing region in the feed yeast market.

As per the FAO figures of 2019, the consumption rate of meat products in East Asia had witnessed rapid growth. The consumption rate reached 50 kg per person in 2015 from nearly 9 kg per capita in the 1960s. However, the ban on the use of antibiotics as a growth promoter in the livestock sector across the European and North American countries has indirectly impacted the Asia Pacific countries. This has encouraged key companies of feed additives to develop natural growth promoters and health supplements. Since the ban, the livestock producers had identified innovative ways to promote animal production through products with similar benefits by replacing antibiotic growth promoters with microbial-based feed additives, which possess antibiotic properties. Many key players such as Lallemand Inc. (Canada) and Angel Yeast (China) are focusing on tapping the Asia Pacific market by setting up their feed additive manufacturing units.

Key Market Players

Many domestic and global players provide feed yeast to improve animal health and performance. Major manufacturers have their presence in the European and Asian countries. The key companies in the global market are Associated British Foods PLC. (UK), Archer Daniels Midland (US), Alltech Inc. (US), Cargill, Incorporated (US), Angel Yeast Co. Ltd. (China), Chr. Hansen (Denmark), and Lesaffre (France), Various strategies, such as expansions, mergers & acquisitions, and new product launches, were adopted by the key companies to remain competitive in the market.

Scope of the report

|

Report Metric |

Details |

|

Market size estimation |

2016–2025 |

|

Base year considered |

2019 |

|

Forecast period considered |

2020–2025 |

|

Units considered |

Value (USD) & Volume (KT) |

|

Segments covered |

Type, Livestock, Genus, and Region |

|

Regions covered |

North America, Asia Pacific, Europe, South America, and RoW |

|

Companies studied |

Associated British Foods Inc. (UK), Archer Daniels Midland Company (US), Alltech Inc. (US), Cargill (US), Angel Yeast Company (China), Chr. Hansen (Denmark), Lesaffre (France), Nutreco N.V. (Netherlands), Lallemand Inc. (Canada), Novus International (US), Zilor (Biorigin) (Brazil), Kerry Group (Ireland), and Kemin (US) (Total 25 companies) |

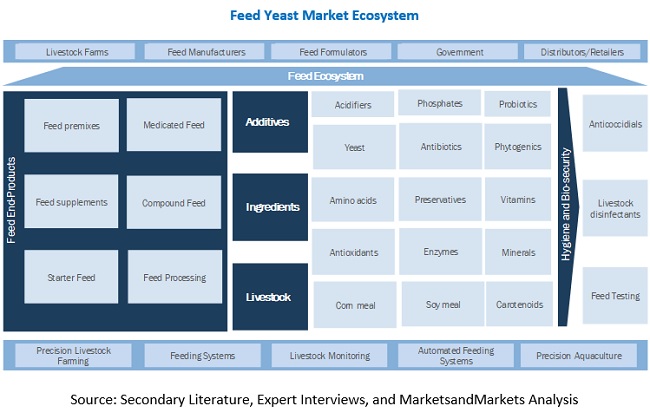

This research report categorizes the feed yeast market based on type, livestock, genus, and region.

On the basis of type, the market has been segmented as follows:

- Probiotic yeast

- Brewer’s yeast

- Specialty yeast

- Yeast derivatives

On the basis of livestock, the market has been segmented as follows:

- Ruminants

- Poultry

- Swine

- Aquatic animals

- Pets

- Equine

On the basis of genus, the market has been segmented as follows:

- Saccharomyces spp.

- Kluyveromyces spp.

- Others (Torula spp. and Pichia spp.)

On the basis of region, the market has been segmented as follows:

- North America

- Europe

- Asia Pacific

- South America

- RoW (Africa and the Middle East)

Recent Developments

- In January 2019, Ohly (UK) and Lallemand (Canada), entered into a strategic partnership for the divestment of Ohly’s Hutchinson Torula Yeast facility and associated Torula whole cell business in the US. The long-term supply partnership between these companies aims at benefitting Ohly by ensuring sustainable security of the Hutchinson site.

- In January 2019, ADM acquired Neovia (Chicago) which is a a global leader in value-added products and solutions for both production and companion animals. This acquisition would add new products such as premixes, complete feed, ingredients, pet care solutions, aquaculture, additives, feed yeast, and amino acids to the existing portfolio.

Frequently Asked Questions (FAQ):

Which region is projected to account for the largest share in the feed yeast market?

Asia Pacific accounted for the largest share of the feed yeast market in 2019, owing to the high production of brewer’s and probiotic yeast in countries such as China, Japan and South Korea. Expansion of production facilities for feed yeast in China and India, and the growing awareness among livestock growers about the benefits of feed yeast are expected to provide scope for market expansion in Asia Pacific. Government policies adopted by Asian countries toward a ban on the usage of antibiotics in animal feed have also been a major factor contributing to the growth of this market in the region. Moreover, ongoing R&D activities for better and efficient application of yeast in animal and pet food nutrition could also render scope for market growth.

What is the current size of the global feed yeast market?

The global feed yeast market is estimated to be USD 1.84 billion in 2020 and projected to reach USD 2.36 billion by 2025, at a CAGR of 5.1%.

How would COVID-19 impact the fluctuations in raw material prices?

Based on inputs from industry experts, the prices of different types of feed yeasts such as probiotic yeasts, yeast derivatives, brewer’s yeast and specialty yeasts were considered to be lower than their regular ranges due to the COVID-19 impact on the feed additives market. Industry experts believe that COVID-19 could affect feed yeast production by 14-15% globally in 2020.

Which are the key players in the market, and how intense is the competition?

The key market players include Associated British Foods Inc. (UK), Archer Daniels Midland (US), Alltech Inc. (US), Cargill (US), Angel Yeast Co. Ltd. (China), Chr. Hansen (Denmark) and Lesaffre (France). These companies cater to the requirements of the livestock industry by providing customized feed yeast products. Moreover, these companies have effective global manufacturing operations and supply chain strategies. Such advantages give these companies an edge over other companies.

What is the COVID-19 impact on feed yeast manufacturers?

Feed yeast suppliers have their manufacturing facilities spread across various countries across Asia Pacific, Europe, North America, South America, and RoW. Though COVID-19 has impacted their businesses as well, there is no significant impact on the global operations and supply chain of their feed yeast. Multiple manufacturing facilities of players are still in operation. The international trade barriers, closure of restaurants, hotels, and live animal markets, supply chain hindrances, consumption patterns of livestock-based products were considered to be mildly significant, which has disrupted the market for feed yeast. However, during this pandemic situation, livestock farmers and animal breeders are facing minimal challenges in this market as yeast are found abundantly everywhere; on cereal grains, grain by-products, silages, hays and are even present in the soil and water and can be cultured rapidly and easily. So even if the processing plants or laboratories are closed, livestock farmers and animal breeders who source feed yeast from different manufacturers, can themselves practice live yeast culture. Thus, the decline in 2020 in the feed yeast market growth is mainly due to the major impact of COVID-19 pandemic. Gradually, as the restrictions of the government measures are likely to relax, the market for feed yeast would witness a slight increment in the upcoming years till 2025. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 39)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 STUDY SCOPE

FIGURE 1 MARKET SEGMENTATION

1.4 REGIONAL SEGMENTATION

1.5 PERIODIZATION CONSIDERED

1.6 CURRENCY CONSIDERED

TABLE 1 USD EXCHANGE RATE, 2014–2017

1.7 UNIT CONSIDERED

1.8 STAKEHOLDERS

1.9 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 45)

2.1 RESEARCH DATA

FIGURE 2 RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

2.1.2.1 Key industry insights

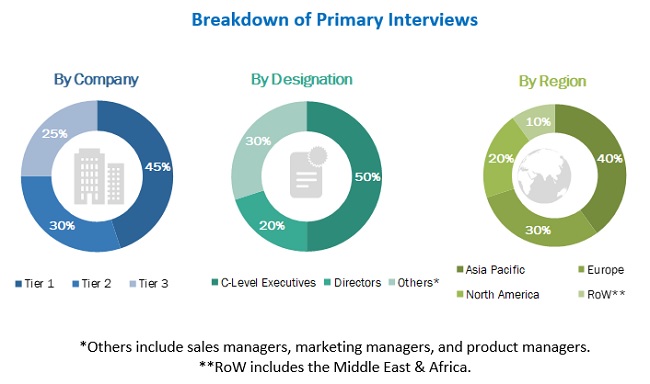

2.1.2.2 Breakdown of primary interviews

FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

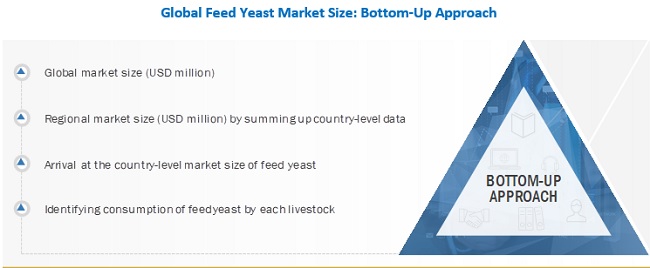

2.2 MARKET SIZE ESTIMATION

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.3 DATA TRIANGULATION

FIGURE 6 DATA TRIANGULATION METHODOLOGY

2.4 RESEARCH ASSUMPTIONS

2.5 LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 53)

FIGURE 7 FEED YEAST MARKET SIZE, BY GENUS, 2020 VS. 2025 (USD MILLION)

FIGURE 8 MARKET SIZE, BY TYPE, 2020 VS. 2025 (USD MILLION)

FIGURE 9 MARKET SHARE (VOLUME), BY LIVESTOCK, 2020

FIGURE 10 FEED YEAST MARKET: REGIONAL SNAPSHOT, 2020

4 PREMIUM INSIGHTS (Page No. - 58)

4.1 OPPORTUNITIES IN THE MARKET

FIGURE 11 THE BAN ON FEED ANTIBIOTICS IN ASIA PACIFIC IS PROJECTED TO MAINTAIN A STEADY MARKET GROWTH FOR FEED YEAST

4.2 FEED YEAST MARKET, BY TYPE & REGION, 2020

FIGURE 12 ASIA PACIFIC ESTIMATED TO WITNESS THE HIGHEST DEMAND FOR THE YEAST DERIVATIVES AND BREWER’S YEAST SEGMENTS IN 2020, IN TERMS OF VALUE

4.3 ASIA PACIFIC: FEED YEAST MARKET, BY KEY LIVESTOCK & COUNTRY, 2020

FIGURE 13 ASIA PACIFIC: CHINA ESTIMATED TO BE ONE OF THE MAJOR YEAST PRODUCERS AND CONSUMERS ACROSS THE GLOBE IN 2020

4.4 FEED YEAST MARKET, BY GENUS, 2020

FIGURE 14 SACCHAROMYCES SPP. ESTIMATED TO BE THE MOST HIGHLY VALUED FEED YEAST GENUS IN 2020

4.5 FEED YEAST MARKET, BY KEY COUNTRY, 2020

FIGURE 15 ASIAN COUNTRIES PROJECTED TO WITNESS HIGH GROWTH DURING THE FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 62)

5.1 INTRODUCTION

5.2 MACROECONOMIC INDICATORS

5.2.1 INCREASING GROWTH IN THE COMPOUND FEED INDUSTRY

5.2.1.1 Increasing compound feed production

FIGURE 16 COMPOUND FEED PRODUCTION TRENDS IN EU, 2011-2017

5.2.2 INCREASE IN LIVESTOCK POPULATION

FIGURE 17 GLOBAL LIVESTOCK PRODUCTION TRENDS, 2011–2017

5.3 MARKET DYNAMICS

FIGURE 18 FEED YEAST MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.3.1 DRIVERS

5.3.1.1 Increasing nutritional benefits from yeast-based feed products

TABLE 2 NUTRITIONAL COMPOSITION OF BREWER’S YEAST IN COMPARISON WITH DEHULLED SOYBEAN MEAL

5.3.1.2 Increasing concerns related to animal health

5.3.1.2.1 Ban on the use of antibiotic growth promoters in feed

5.3.2 RESTRAINTS

5.3.2.1 Competition for basic raw materials

5.3.2.2 Willingness of livestock growers to use antibiotics for animal feed

5.3.3 OPPORTUNITIES

5.3.3.1 Innovations in the animal feed industry

5.3.3.2 Increase in demand for pet food nutrition

5.3.3.3 Yeast as the promising protein source

TABLE 3 AMINO ACID COMPARISON CHART FOR YEAST AND SOY MEAL-BASED LIVESTOCK DIET

5.3.4 CHALLENGES

5.3.4.1 Commercialization of duplicate and low-quality products

5.3.5 COVID-19 PANDEMIC IMPACT

FIGURE 19 PRE & POST COVID-19 SCENARIO IN THE FEED YEAST MARKET

5.4 PATENT ANALYSIS

FIGURE 20 NUMBER OF PATENTS APPROVED FOR FEED YEAST, BY KEY COMPANY, 2014–2018

FIGURE 21 GEOGRAPHICAL ANALYSIS: PATENT APPROVAL FOR FEED YEAST, 2014–2018

TABLE 4 LIST OF IMPORTANT PATENTS FOR FEED YEAST, 2014–2018

5.5 REGULATORY FRAMEWORK

5.5.1 NORTH AMERICA

5.5.1.1 US

5.5.1.2 Canada

5.5.2 EUROPE

5.5.3 ASIA PACIFIC

5.5.3.1 Australia

5.5.3.2 China

6 FEED YEAST MARKET, BY TYPE (Page No. - 89)

6.1 INTRODUCTION

TABLE 5 POSITIVE EFFECTS OF DIETARY YEAST SUPPLEMENTATION ON ANIMAL HEALTH

FIGURE 22 MARKET SIZE FOR FEED YEAST, BY TYPE, 2020 VS. 2025 (USD MILLION)

TABLE 6 MARKET SIZE FOR FEED YEAST, BY TYPE, 2016–2019 (USD MILLION)

TABLE 7 MARKET SIZE FOR FEED YEAST, BY TYPE, 2020–2025 (USD MILLION)

TABLE 8 MARKET SIZE FOR FEED YEAST, BY TYPE, 2016–2019 (KT)

TABLE 9 MARKET SIZE FOR FEED YEAST, BY TYPE, 2020–2025 (KT)

6.2 YEAST DERIVATIVES

TABLE 10 YEAST DERIVATIVES: FEED YEAST MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 11 YEAST DERIVATIVES: MARKET SIZE FOR FEED YEAST, BY REGION, 2020–2025 (USD MILLION)

TABLE 12 YEAST DERIVATIVES: MARKET SIZE FOR FEED YEAST, BY REGION, 2016–2019 (KT)

TABLE 13 YEAST DERIVATIVES: MARKET SIZE FOR FEED YEAST, BY REGION, 2020–2025 (KT)

6.2.1 BETA-GLUCANS

6.2.1.1 Immunostimulating properties of beta-glucans is a key factor for its premium price value

6.2.2 NUCLEOTIDES

6.2.2.1 Nucleotide-based yeasts are used at early stages of the animal’s life

6.2.3 MANNOOLIGOSACCHARIDES

6.2.3.1 Pathogen binding capacity of mannooligosaccharides is projected to be a major feed functionality in the coming years

6.3 PROBIOTIC YEAST

6.3.1 PROBIOTIC YEAST IS CONSIDERED TO BE A SUITABLE REPLACEMENT FOR FEED ANTIBIOTICS

TABLE 14 PROBIOTIC YEAST: FEED YEAST MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 15 PROBIOTIC YEAST: MARKET SIZE FOR FEED YEAST, BY REGION, 2020–2025 (USD MILLION)

TABLE 16 PROBIOTIC YEAST: MARKET SIZE FOR FEED YEAST, BY REGION, 2016–2019 (TON)

TABLE 17 PROBIOTIC YEAST: MARKET SIZE FOR FEED YEAST, BY REGION, 2020–2025 (KT)

6.4 BREWER’S YEAST

6.4.1 BREWER’S YEAST IS CONSIDERED AS A RICH SOURCE OF PROTEIN SUPPLEMENT AND ALTERNATIVE FOR FEED

TABLE 18 BREWER’S YEAST: MARKET SIZE FOR FEED YEAST, BY REGION, 2016–2019 (USD MILLION)

TABLE 19 BREWER’S YEAST: FEED YEAST MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

TABLE 20 BREWER’S YEAST: MARKET SIZE FOR FEED YEAST, BY REGION, 2016–2019 (KT)

TABLE 21 BREWER’S YEAST: MARKET SIZE FOR FEED YEAST, BY REGION, 2020–2025 (KT)

6.5 SPECIALTY YEAST

TABLE 22 SPECIALTY YEAST: MARKET SIZE FOR FEED YEAST, BY REGION, 2016–2019 (USD MILLION)

TABLE 23 SPECIALTY YEAST: MARKET SIZE FOR FEED YEAST, BY REGION, 2020–2025 (USD THOUSAND)

TABLE 24 SPECIALTY YEAST: MARKET SIZE FOR FEED YEAST, BY REGION, 2016–2019 (TON)

TABLE 25 SPECIALTY YEAST: MARKET SIZE FOR FEED YEAST, BY REGION, 2020–2025 (TON)

6.5.1 SELENIUM YEAST

6.5.1.1 The health benefits of selenium-enriched yeast are projected to strengthen its demand

6.5.2 CHROMIUM YEAST

6.5.2.1 Chromium yeast act as a stress reliever for animals

7 FEED YEAST MARKET, BY LIVESTOCK (Page No. - 104)

7.1 INTRODUCTION

7.2 OPERATIONAL DRIVERS

7.2.1 INCREASE IN DEMAND AND CONSUMPTION OF LIVESTOCK-BASED PRODUCTS

FIGURE 23 MAJOR MEAT PRODUCING REGIONS/COUNTRIES (THOUSAND TONNES)

FIGURE 24 MAJOR BOVINE MEAT PRODUCING REGIONS/COUNTRIES (THOUSAND TONNES)

FIGURE 25 MAJOR SWINE MEAT PRODUCING REGIONS/COUNTRIES (THOUSAND TONNES)

FIGURE 26 MAJOR POULTRY MEAT PRODUCING REGIONS/COUNTRIES (THOUSAND TONNES)

FIGURE 27 LIVESTOCK-BASED PRODUCT CONSUMPTION, BY COMMODITY, 1967–2030 (MILLION TONS)

7.2.2 GROWTH IN FEED PRODUCTION

FIGURE 28 FEED PRODUCTION TREND, 2014–2018 (MILLION TONS)

FIGURE 29 REGIONAL FEED PRODUCTION SNAPSHOT, 2019 (MILLION TONS)

FIGURE 30 LEADING FEED PRODUCING COUNTRIES, 2017 (MILLION TONS)

FIGURE 31 MARKET SIZE FOR FEED YEAST, BY LIVESTOCK, 2020 VS. 2025 (USD MILLION)

TABLE 26 MARKET SIZE FOR FEED YEAST, BY LIVESTOCK, 2016–2019 (USD MILLION)

TABLE 27 MARKET SIZE FOR FEED YEAST, BY LIVESTOCK, 2020-2025 (USD MILLION)

TABLE 28 MARKET SIZE FOR FEED YEAST, BY LIVESTOCK, 2016–2019 (KT)

TABLE 29 MARKET SIZE FOR FEED YEAST, BY LIVESTOCK, 2020-2025 (KT)

7.3 RUMINANTS

7.3.1 RISE IN RUMINANTS’ PRODUCTION TO DRIVE CONSUMPTION OF FEED YEAST ACROSS ALL REGIONS

TABLE 30 RUMINANTS: FEED YEAST MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 31 RUMINANTS: MARKET SIZE FOR FEED YEAST, BY REGION, 2020–2025 (USD MILLION)

TABLE 32 RUMINANTS: MARKET SIZE FOR FEED YEAST, BY REGION, 2016–2019 (KT)

TABLE 33 RUMINANTS: MARKET SIZE FOR FEED YEAST, BY REGION, 2020–2025 (KT)

7.4 SWINE

7.4.1 ASIA PACIFIC IS ESTIMATED TO DOMINATE THE SWINE FEED YEAST MARKET

TABLE 34 SWINE: FEED YEAST MARKET SIZE, BY REGION, 2016–2019 (USD THOUSAND)

TABLE 35 SWINE: MARKET SIZE FOR FEED YEAST, BY REGION, 2020–2025 (USD THOUSAND)

TABLE 36 SWINE: MARKET SIZE FOR FEED YEAST, BY REGION, 2016–2019 (TON)

TABLE 37 SWINE: MARKET SIZE FOR FEED YEAST, BY REGION, 2020–2025 (TON)

7.5 POULTRY

7.5.1 REDUCTION IN USAGE OF ANTIBIOTICS COULD BOOST THE DEMAND FOR YEAST-BASED POULTRY DIETS

TABLE 38 POULTRY: MARKET SIZE FOR FEED YEAST, BY REGION, 2016–2019 (USD MILLION)

TABLE 39 POULTRY: MARKET SIZE FOR FEED YEAST, BY REGION, 2020–2025 (USD MILLION)

TABLE 40 POULTRY: MARKET SIZE FOR FEED YEAST, BY REGION, 2016–2019 (KT)

TABLE 41 POULTRY: MARKET SIZE FOR FEED YEAST, BY REGION, 2020–2025 (KT)

7.6 AQUATIC ANIMALS

7.6.1 DEMAND FOR YEAST-FORTIFIED AQUA FEED IS EXPECTED TO GROW SIGNIFICANTLY IN FARMED FISH CULTIVATION

TABLE 42 AQUATIC ANIMALS: FEED YEAST MARKET SIZE, BY REGION, 2016–2019 (USD THOUSAND)

TABLE 43 AQUATIC ANIMALS: MARKET SIZE FOR FEED YEAST, BY REGION, 2020–2025 (USD THOUSAND)

TABLE 44 AQUATIC ANIMALS: MARKET SIZE FOR FEED YEAST, BY REGION, 2016–2019 (TON)

TABLE 45 AQUATIC ANIMALS: MARKET SIZE FOR FEED YEAST, BY REGION, 2020–2025 (TON)

7.7 PETS

7.7.1 THE TREND OF FEEDING COMPLETE DIET TO PETS IS GROWING WITH THE GROWTH IN URBANIZATION

TABLE 46 PETS: FEED YEAST MARKET SIZE, BY REGION, 2016–2019 (USD THOUSAND)

TABLE 47 PETS: MARKET SIZE FOR FEED YEAST, BY REGION, 2020–2025 (USD THOUSAND)

TABLE 48 PETS: MARKET SIZE FOR FEED YEAST, BY REGION, 2016–2019 (TON)

TABLE 49 PETS: MARKET SIZE FOR FEED YEAST, BY REGION, 2020–2025 (TON)

7.8 EQUINE

TABLE 50 EQUINE: MARKET SIZE FOR FEED YEAST, BY REGION, 2016–2019 (USD THOUSAND)

TABLE 51 EQUINE: MARKET SIZE FOR FEED YEAST, BY REGION, 2020–2025 (USD THOUSAND)

TABLE 52 EQUINE: MARKET SIZE FOR FEED YEAST, BY REGION, 2016–2019 (TON)

TABLE 53 EQUINE: MARKET SIZE FOR FEED YEAST, BY REGION, 2020–2025 (TON)

7.9 IMPACT OF COVID-19 ON LIVESTOCK APPLICATION

7.9.1 HIGHLY IMPACTED LIVESTOCK INDUSTRIES – RUMINANTS AND SWINE

7.9.2 LEAST IMPACTED LIVESTOCK INDUSTRIES – POULTRY AND OTHERS

8 FEED YEAST MARKET, BY GENUS (Page No. - 129)

8.1 INTRODUCTION

FIGURE 32 FEED YEAST MARKET SIZE, BY GENUS, 2020 VS. 2025 (USD MILLION)

TABLE 54 MARKET SIZE FOR FEED YEAST, BY GENUS, 2016–2019 (USD MILLION)

TABLE 55 MARKET SIZE FOR FEED YEAST, BY GENUS, 2020–2025 (USD MILLION)

8.2 SACCHAROMYCES SPP.

8.2.1 HIGHER USAGE IN ANIMAL FEED DUE TO ITS BENEFICIAL EFFECTS ON ANIMAL HEALTH AND GROWTH PERFORMANCE

TABLE 56 SACCHAROMYCES SPP.: FEED YEAST MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 57 SACCHAROMYCES SPP.: MARKET SIZE FOR FEED YEAST, BY REGION, 2020–2025 (USD MILLION)

8.3 KLUYVEROMYCES SPP.

8.3.1 ACCORDING TO COFALEC, KLUYVEROMYCES MARXIANUS WAS THE SECOND MOST COMMON STRAIN USED FOR FEED ADDITIVE

TABLE 58 KLUYVEROMYCES SPP.: MARKET SIZE FOR FEED YEAST, BY REGION, 2016–2019 (USD MILLION)

TABLE 59 KLUYVEROMYCES SPP.: MARKET SIZE FOR FEED YEAST, BY REGION, 2020-2025 (USD MILLION)

8.4 OTHERS

TABLE 60 OTHERS: MARKET SIZE FOR FEED YEAST, BY REGION, 2016–2019 (USD THOUSAND)

TABLE 61 OTHERS: MARKET SIZE FOR FEED YEAST, BY REGION, 2020-2025 (USD THOUSAND)

9 FEED YEAST MARKET, BY REGION (Page No. - 136)

9.1 INTRODUCTION

FIGURE 33 THE US WAS THE DOMINANT MARKET FOR FEED YEAST IN 2019

TABLE 62 FEED YEAST MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 63 MARKET SIZE FOR FEED YEAST, BY REGION, 2020-2025 (USD MILLION)

TABLE 64 MARKET SIZE FOR FEED YEAST, BY REGION, 2016–2019 (KT)

TABLE 65 MARKET SIZE FOR FEED YEAST, BY REGION, 2020-2025 (KT)

9.2 REGIONAL OPERATIONAL DRIVERS

9.2.1 BAN ON CHEMICAL-BASED FEED PRODUCTS FOR ANIMAL NUTRITION GLOBALLY

TABLE 66 LIST OF BANNED CHEMICAL COMPOUNDS DUE TO THEIR TOXIC EFFECTS

9.2.2 INCREASING AWARENESS ABOUT THE BENEFITS OF YEAST-DERIVED FEED AMONG LIVESTOCK OWNERS

9.3 IMPACT OF COVID-19 ON FEED YEAST ACROSS REGIONS

9.3.1 HIGH IMPACT REGIONS — NORTH AMERICA, ASIA PACIFIC & EUROPE

9.3.2 LOW IMPACT REGIONS – SOUTH AMERICA

9.4 ASIA PACIFIC

FIGURE 34 ASIA PACIFIC: REGIONAL SNAPSHOT

TABLE 67 ASIA PACIFIC: FEED YEAST MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 68 ASIA PACIFIC: MARKET SIZE FOR FEED YEAST, BY COUNTRY, 2020-2025 (USD MILLION)

TABLE 69 ASIA PACIFIC: MARKET SIZE FOR FEED YEAST, BY LIVESTOCK, 2016–2019 (USD MILLION)

TABLE 70 ASIA PACIFIC: MARKET SIZE FOR FEED YEAST, BY LIVESTOCK, 2020-2025 (USD MILLION)

TABLE 71 ASIA PACIFIC: MARKET SIZE FOR FEED YEAST, BY LIVESTOCK, 2016–2019 (KT)

TABLE 72 ASIA PACIFIC: MARKET SIZE FOR FEED YEAST, BY LIVESTOCK, 2020-2025 (KT)

TABLE 73 ASIA PACIFIC: MARKET SIZE FOR FEED YEAST, BY TYPE, 2016–2019 (USD MILLION)

TABLE 74 ASIA PACIFIC: MARKET SIZE FOR FEED YEAST, BY TYPE, 2020-2025 (USD MILLION)

TABLE 75 ASIA PACIFIC: MARKET SIZE FOR FEED YEAST, BY TYPE, 2016–20219 (KT)

TABLE 76 ASIA PACIFIC: MARKET SIZE FOR FEED YEAST, BY TYPE, 2020-2025 (KT)

TABLE 77 ASIA PACIFIC: MARKET SIZE FOR FEED YEAST, BY GENUS, 2016–2019 (USD MILLION)

TABLE 78 ASIA PACIFIC: MARKET SIZE FOR FEED YEAST, BY GENUS, 2020-2025 (USD MILLION)

9.4.1 CHINA

9.4.1.1 China surpassed the US in terms of feed production in 2019

TABLE 79 CHINA: FEED YEAST MARKET SIZE, BY LIVESTOCK, 2016–2019 (USD MILLION)

TABLE 80 CHINA: MARKET SIZE FOR FEED YEAST, BY LIVESTOCK, 2020-2025 (USD MILLION)

TABLE 81 CHINA: MARKET SIZE FOR FEED YEAST, BY LIVESTOCK, 2016–2019 (TON)

TABLE 82 CHINA: MARKET SIZE FOR FEED YEAST, BY LIVESTOCK, 2020-2025 (TON)

TABLE 83 CHINA: MARKET SIZE FOR FEED YEAST, BY TYPE, 2016–2019 (USD MILLION)

TABLE 84 CHINA: MARKET SIZE FOR FEED YEAST, BY TYPE, 2020-2025 (USD MILLION)

TABLE 85 CHINA: MARKET SIZE FOR FEED YEAST, BY TYPE, 2016–2019 (KT)

TABLE 86 CHINA: MARKET SIZE FOR FEED YEAST, BY TYPE, 2020-2025 (KT)

9.4.2 JAPAN

9.4.2.1 Decline in antibiotic feed additives led to the development of microbial-based feed additive products in Japan

TABLE 87 JAPAN: FEED YEAST MARKET SIZE, BY LIVESTOCK, 2016–2019 (USD THOUSAND)

TABLE 88 JAPAN: MARKET SIZE FOR FEED YEAST, BY LIVESTOCK, 2020-2025 (USD THOUSAND)

TABLE 89 JAPAN: MARKET SIZE FOR FEED YEAST, BY LIVESTOCK, 2016–2019 (TON)

TABLE 90 JAPAN: MARKET SIZE FOR FEED YEAST, BY LIVESTOCK, 2020-2025 (TON)

TABLE 91 JAPAN: MARKET SIZE FOR FEED YEAST, BY TYPE, 2016–2019 (USD MILLION)

TABLE 92 JAPAN: FEED YEAST MARKET SIZE, BY TYPE, 2020-2025 (USD THOUSAND)

TABLE 93 JAPAN: MARKET SIZE FOR FEED YEAST, BY TYPE, 2016–2019 (TON)

TABLE 94 JAPAN: MARKET SIZE FOR FEED YEAST, BY TYPE, 2020-2025 (TON)

9.4.3 INDIA

9.4.3.1 Increase in demand for milk and milk products in India drives the feed yeast market in the country

TABLE 95 INDIA: FEED YEAST MARKET SIZE, BY LIVESTOCK, 2016–2019 (USD THOUSAND)

TABLE 96 INDIA: MARKET SIZE FOR FEED YEAST, BY LIVESTOCK, 2020-2025 (USD THOUSAND)

TABLE 97 INDIA: MARKET SIZE FOR FEED YEAST, BY LIVESTOCK, 2016–2019 (TON)

TABLE 98 INDIA: MARKET SIZE FOR FEED YEAST, BY LIVESTOCK, 2020-2025 (TON)

TABLE 99 INDIA: MARKET SIZE FOR FEED YEAST, BY TYPE, 2016–2019 (USD THOUSAND)

TABLE 100 INDIA: MARKET SIZE FOR FEED YEAST, BY TYPE, 2020-2025 (USD THOUSAND)

TABLE 101 INDIA: FEED YEAST MARKET SIZE, BY TYPE, 2016–2019 (TON)

TABLE 102 INDIA: FEED YEAST MARKET SIZE, BY TYPE, 2020-2025 (TON)

9.4.4 SOUTH KOREA

9.4.4.1 Demand for beef products has been boosting the demand for premium nutrition products in Korea

TABLE 103 SOUTH KOREA: FEED YEAST MARKET SIZE, BY LIVESTOCK, 2016–2019 (USD THOUSAND)

TABLE 104 SOUTH KOREA: MARKET SIZE FOR FEED YEAST, BY LIVESTOCK, 2020-2025 (USD THOUSAND)

TABLE 105 SOUTH KOREA: MARKET SIZE FOR FEED YEAST, BY LIVESTOCK, 2016–2019 (TON)

TABLE 106 SOUTH KOREA: MARKET SIZE FOR FEED YEAST, BY LIVESTOCK, 2020-2025 (TON)

TABLE 107 SOUTH KOREA: MARKET SIZE FOR FEED YEAST, BY TYPE, 2016–2019 (USD THOUSAND)

TABLE 108 SOUTH KOREA: MARKET SIZE FOR FEED YEAST, BY TYPE, 2020-2025 (USD THOUSAND)

TABLE 109 SOUTH KOREA: MARKET SIZE FOR FEED YEAST, BY TYPE, 2016–2019 (TON)

TABLE 110 SOUTH KOREA: MARKET SIZE FOR FEED YEAST, BY TYPE, 2020-2025 (TON)

9.4.5 AUSTRALIA

9.4.5.1 Livestock farming has been an essential part of the Australian economy, thereby broadening the growth scope for yeast market

TABLE 111 AUSTRALIA: FEED YEAST MARKET SIZE, BY LIVESTOCK, 2016–2019 (USD THOUSAND)

TABLE 112 AUSTRALIA: MARKET SIZE FOR FEED YEAST, BY LIVESTOCK, 2020-2025 (USD THOUSAND)

TABLE 113 AUSTRALIA: MARKET SIZE FOR FEED YEAST, BY LIVESTOCK, 2016–2019 (TON)

TABLE 114 AUSTRALIA: MARKET SIZE FOR FEED YEAST, BY LIVESTOCK, 2020-2025 (TON)

TABLE 115 AUSTRALIA: MARKET SIZE FOR FEED YEAST, BY TYPE, 2016–2019 (USD THOUSAND)

TABLE 116 AUSTRALIA: MARKET SIZE FOR FEED YEAST, BY TYPE, 2020-2025 (USD THOUSAND)

TABLE 117 AUSTRALIA: MARKET SIZE FOR FEED YEAST, BY TYPE, 2016–2019 (TON)

TABLE 118 AUSTRALIA: MARKET SIZE FOR FEED YEAST, BY TYPE, 2020-2025 (TON)

9.4.6 THAILAND

9.4.6.1 The developing economic conditions in Thailand has spurred growth opportunity for feed yeast market

TABLE 119 THAILAND: FEED YEAST MARKET SIZE, BY LIVESTOCK, 2016–2019 (USD THOUSAND)

TABLE 120 THAILAND: MARKET SIZE, BY LIVESTOCK, 2020-2025 (USD THOUSAND)

TABLE 121 THAILAND: MARKET SIZE, BY LIVESTOCK, 2016–2019 (TON)

TABLE 122 THAILAND: MARKET SIZE, BY LIVESTOCK, 2020-2025 (TON)

TABLE 123 THAILAND: MARKET SIZE, BY TYPE, 2016–2019 (USD THOUSAND)

TABLE 124 THAILAND: MARKET SIZE, BY TYPE, 2020-2025 (USD THOUSAND)

TABLE 125 THAILAND: MARKET SIZE, BY TYPE, 2016–2019 (TON)

TABLE 126 THAILAND: MARKET SIZE, BY TYPE, 2020-2025 (TON)

9.4.7 REST OF ASIA PACIFIC

TABLE 127 REST OF ASIA PACIFIC: FEED YEAST MARKET SIZE, BY LIVESTOCK, 2016–2019 (USD THOUSAND)

TABLE 128 REST OF ASIA PACIFIC: MARKET SIZE, BY LIVESTOCK, 2020-2025 (USD THOUSAND)

TABLE 129 REST OF ASIA PACIFIC: MARKET SIZE, BY LIVESTOCK, 2016–2019 (TON)

TABLE 130 REST OF ASIA PACIFIC: MARKET SIZE, BY LIVESTOCK, 2020-2025 (TON)

TABLE 131 REST OF ASIA PACIFIC: MARKET SIZE, BY TYPE, 2016–2019 (USD THOUSAND)

TABLE 132 REST OF ASIA PACIFIC: MARKET SIZE, BY TYPE, 2020-2025 (USD THOUSAND)

TABLE 133 REST OF ASIA PACIFIC: MARKET SIZE, BY TYPE, 2016–2019 (TON)

TABLE 134 REST OF ASIA PACIFIC: MARKET SIZE, BY TYPE, 2020-2025 (TON)

9.5 EUROPE

TABLE 135 EUROPE: FEED YEAST MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 136 EUROPE: MARKET SIZE, BY COUNTRY, 2020-2025 (USD MILLION)

TABLE 137 EUROPE: MARKET SIZE, BY LIVESTOCK, 2016–2019 (USD MILLION)

TABLE 138 EUROPE: MARKET SIZE, BY LIVESTOCK, 2020-2025 (USD MILLION)

TABLE 139 EUROPE: MARKET SIZE, BY LIVESTOCK, 2016–2019 (TON)

TABLE 140 EUROPE: MARKET SIZE, BY LIVESTOCK, 2020-2025 (TON)

TABLE 141 EUROPE: MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 142 EUROPE: MARKET SIZE, BY TYPE, 2020-2025 (USD MILLION)

TABLE 143 EUROPE: MARKET SIZE, BY TYPE, 2016–20219 (KT)

TABLE 144 EUROPE: MARKET SIZE, BY TYPE, 2020-2025 (KT)

TABLE 145 EUROPE: MARKET SIZE, BY GENUS, 2016–2019 (USD MILLION)

TABLE 146 EUROPE: MARKET SIZE, BY GENUS, 2020-2025 (USD MILLION)

9.5.1 NETHERLANDS

9.5.1.1 High livestock production drives the market for feed yeast in the Netherlands

TABLE 147 NETHERLANDS: FEED YEAST MARKET SIZE, BY LIVESTOCK, 2016–2019 (USD THOUSAND)

TABLE 148 NETHERLANDS: FEED YEAST MARKET SIZE, BY LIVESTOCK, 2020-2025 (USD THOUSAND)

TABLE 149 NETHERLANDS: FEED YEAST MARKET SIZE, BY LIVESTOCK, 2016–2019 (TON)

TABLE 150 NETHERLANDS: FEED YEAST MARKET SIZE, BY LIVESTOCK, 2020-2025 (TON)

TABLE 151 NETHERLANDS: FEED YEAST MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 152 NETHERLANDS: FEED YEAST MARKET SIZE, BY TYPE, 2020-2025 (USD MILLION)

TABLE 153 NETHERLANDS: FEED YEAST MARKET SIZE, BY TYPE, 2016–2019 (TON)

TABLE 154 NETHERLANDS: FEED YEAST MARKET SIZE, BY TYPE, 2020-2025 (TON)

9.5.2 GERMANY

9.5.2.1 High availability of spent grains as raw materials for the production of yeast in Germany drives the feed yeast market growth

TABLE 155 GERMANY: FEED YEAST MARKET SIZE, BY LIVESTOCK, 2016–2019 (USD THOUSAND)

TABLE 156 GERMANY: MARKET SIZE, BY LIVESTOCK, 2020-2025 (USD THOUSAND)

TABLE 157 GERMANY: MARKET SIZE, BY LIVESTOCK, 2016–2019 (TON)

TABLE 158 GERMANY: MARKET SIZE, BY LIVESTOCK, 2020-2025 (TON)

TABLE 159 GERMANY: MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 160 GERMANY: MARKET SIZE, BY TYPE, 2020-2025 (USD MILLION)

TABLE 161 GERMANY: MARKET SIZE, BY TYPE, 2016–2019 (TON)

TABLE 162 GERMANY: MARKET SIZE, BY TYPE, 2020-2025 (TON)

9.5.3 UK

9.5.3.1 The UK witnessed a significant drop in antibiotic sales for feed in the last few years

TABLE 163 UK: FEED YEAST MARKET SIZE, BY LIVESTOCK, 2016–2019 (USD THOUSAND)

TABLE 164 UK: MARKET SIZE, BY LIVESTOCK, 2020-2025 (USD THOUSAND)

TABLE 165 UK: MARKET SIZE, BY LIVESTOCK, 2016–2019 (TON)

TABLE 166 UK: MARKET SIZE, BY LIVESTOCK, 2020-2025 (TON)

TABLE 167 UK: MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 168 UK: MARKET SIZE, BY TYPE, 2020-2025 (USD MILLION)

TABLE 169 UK: MARKET SIZE, BY TYPE, 2016–2019 (TON)

TABLE 170 UK: MARKET SIZE, BY TYPE, 2020-2025 (TON)

9.5.4 FRANCE

9.5.4.1 High livestock production in France drives the feed yeast market in the country

TABLE 171 FRANCE: FEED YEAST MARKET SIZE, BY LIVESTOCK, 2016–2019 (USD THOUSAND)

TABLE 172 FRANCE: MARKET SIZE, BY LIVESTOCK, 2020-2025 (USD THOUSAND)

TABLE 173 FRANCE: MARKET SIZE, BY LIVESTOCK, 2016–2019 (TON)

TABLE 174 FRANCE: MARKET SIZE, BY LIVESTOCK, 2020-2025 (TON)

TABLE 175 FRANCE: MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 176 FRANCE: MARKET SIZE, BY TYPE, 2020-2025 (USD THOUSAND)

TABLE 177 FRANCE: MARKET SIZE, BY TYPE, 2016–2019 (TON)

TABLE 178 FRANCE: MARKET SIZE, BY TYPE, 2020-2025 (TON)

9.5.5 RUSSIA

9.5.5.1 Less stringent regulations on the use of antibiotics for feed in Russia may restrict the growth for the feed yeast market

TABLE 179 RUSSIA: FEED YEAST MARKET SIZE, BY LIVESTOCK, 2016–2019 (USD THOUSAND)

TABLE 180 RUSSIA: MARKET SIZE, BY LIVESTOCK, 2020-2025 (USD THOUSAND)

TABLE 181 RUSSIA: MARKET SIZE, BY LIVESTOCK, 2016–2019 (TON)

TABLE 182 RUSSIA: MARKET SIZE, BY LIVESTOCK, 2020-2025 (TON)

TABLE 183 RUSSIA: MARKET SIZE, BY TYPE, 2016–2019 (USD THOUSAND)

TABLE 184 RUSSIA: MARKET SIZE, BY TYPE, 2020-2025 (USD THOUSAND)

TABLE 185 RUSSIA: MARKET SIZE, BY TYPE, 2016–2019 (TON)

TABLE 186 RUSSIA: MARKET SIZE, BY TYPE, 2020-2025 (TON)

9.5.6 REST OF EUROPE

TABLE 187 REST OF EUROPE: FEED YEAST MARKET SIZE, BY LIVESTOCK, 2016–2019 (USD THOUSAND)

TABLE 188 REST OF EUROPE: MARKET SIZE, BY LIVESTOCK, 2020-2025 (USD THOUSAND)

TABLE 189 REST OF EUROPE: MARKET SIZE, BY LIVESTOCK, 2016–2019 (TON)

TABLE 190 REST OF EUROPE: MARKET SIZE, BY LIVESTOCK, 2020-2025 (TON)

TABLE 191 REST OF EUROPE: MARKET SIZE, BY TYPE, 2016–2019 (USD THOUSAND)

TABLE 192 REST OF EUROPE: MARKET SIZE, BY TYPE, 2020-2025 (USD THOUSAND)

TABLE 193 REST OF EUROPE: MARKET SIZE, BY TYPE, 2016–2019 (TON)

TABLE 194 REST OF EUROPE: MARKET SIZE, BY TYPE, 2020-2025 (TON)

9.6 NORTH AMERICA

TABLE 195 NORTH AMERICA: FEED YEAST MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 196 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2020-2025 (USD MILLION)

TABLE 197 NORTH AMERICA: MARKET SIZE, BY LIVESTOCK, 2016–2019 (USD MILLION)

TABLE 198 NORTH AMERICA: MARKET SIZE, BY LIVESTOCK, 2020-2025 (USD MILLION)

TABLE 199 NORTH AMERICA: MARKET SIZE, BY LIVESTOCK, 2016–2019 (TON)

TABLE 200 NORTH AMERICA: MARKET SIZE, BY LIVESTOCK, 2020-2025 (TON)

TABLE 201 NORTH AMERICA: MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 202 NORTH AMERICA: MARKET SIZE, BY TYPE, 2020-2025 (USD MILLION)

TABLE 203 NORTH AMERICA: MARKET SIZE, BY TYPE, 2016–20219 (KT)

TABLE 204 NORTH AMERICA: MARKET SIZE, BY TYPE, 2020-2025 (KT)

TABLE 205 NORTH AMERICA: MARKET SIZE, BY GENUS, 2016–2019 (USD MILLION)

TABLE 206 NORTH AMERICA: MARKET SIZE, BY GENUS, 2020-2025 (USD MILLION)

9.6.1 US

9.6.1.1 Being the second-largest producer of feed in the world, the country has the largest market in the region

TABLE 207 US: FEED YEAST MARKET SIZE, BY LIVESTOCK, 2016–2019 (USD MILLION)

TABLE 208 US: MARKET SIZE, BY LIVESTOCK, 2020-2025 (USD MILLION)

TABLE 209 US: MARKET SIZE, BY LIVESTOCK, 2016–2019 (TON)

TABLE 210 US: MARKET SIZE, BY LIVESTOCK, 2020-2025 (TON)

TABLE 211 US: MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 212 US: MARKET SIZE, BY TYPE, 2020-2025 (USD MILLION)

TABLE 213 US: MARKET SIZE, BY TYPE, 2016–2019 (KT)

TABLE 214 US: MARKET SIZE, BY TYPE, 2020-2025 (KT)

9.6.2 CANADA

9.6.2.1 Increasing exports of animal food products support the growth of the Canadian feed industry

TABLE 215 CANADA: FEED YEAST MARKET SIZE, BY LIVESTOCK, 2016–2019 (USD MILLION)

TABLE 216 CANADA: MARKET SIZE, BY LIVESTOCK, 2020-2025 (USD MILLION)

TABLE 217 CANADA: MARKET SIZE, BY LIVESTOCK, 2016–2019 (TON)

TABLE 218 CANADA: MARKET SIZE, BY LIVESTOCK, 2020-2025 (TON)

TABLE 219 CANADA: MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 220 CANADA: MARKET SIZE, BY TYPE, 2020-2025 (USD MILLION)

TABLE 221 CANADA: MARKET SIZE, BY TYPE, 2016–2019 (TON)

TABLE 222 CANADA: MARKET SIZE, BY TYPE, 2020-2025 (TON)

9.6.3 MEXICO

9.6.3.1 Government incentives supporting the Mexican feed industry

TABLE 223 MEXICO: FEED YEAST MARKET SIZE, BY LIVESTOCK, 2016–2019 (USD THOUSAND)

TABLE 224 MEXICO: MARKET SIZE, BY LIVESTOCK, 2020-2025 (USD THOUSAND)

TABLE 225 MEXICO: MARKET SIZE, BY LIVESTOCK, 2016–2019 (TON)

TABLE 226 MEXICO: MARKET SIZE, BY LIVESTOCK, 2020-2025 (TON)

TABLE 227 MEXICO: MARKET SIZE, BY TYPE, 2016–2019 (USD THOUSAND)

TABLE 228 MEXICO: MARKET SIZE, BY TYPE, 2020-2025 (USD THOUSAND)

TABLE 229 MEXICO: MARKET SIZE, BY TYPE, 2016–2019 (TON)

TABLE 230 MEXICO: MARKET SIZE, BY TYPE, 2020-2025 (TON)

9.7 SOUTH AMERICA

TABLE 231 SOUTH AMERICA: FEED YEAST MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 232 SOUTH AMERICA: MARKET SIZE, BY COUNTRY, 2020-2025 (USD MILLION)

TABLE 233 SOUTH AMERICA: MARKET SIZE, BY LIVESTOCK, 2016–2019 (USD MILLION)

TABLE 234 SOUTH AMERICA: MARKET SIZE, BY LIVESTOCK, 2020-2025 (USD MILLION)

TABLE 235 SOUTH AMERICA: MARKET SIZE, BY LIVESTOCK, 2016–2019 (TON)

TABLE 236 SOUTH AMERICA: MARKET SIZE, BY LIVESTOCK, 2020-2025 (TON)

TABLE 237 SOUTH AMERICA: MARKET SIZE, BY TYPE, 2016–20219 (USD MILLION)

TABLE 238 SOUTH AMERICA: MARKET SIZE, BY TYPE, 2020-2025 (USD MILLION)

TABLE 239 SOUTH AMERICA: MARKET SIZE, BY TYPE, 2016–20219 (T0N)

TABLE 240 SOUTH AMERICA: MARKET SIZE, BY TYPE, 2020-2025 (TON)

TABLE 241 SOUTH AMERICA: MARKET SIZE, BY GENUS, 2016–2019 (USD MILLION)

TABLE 242 SOUTH AMERICA: MARKET SIZE, BY GENUS, 2020-2025 (USD MILLION)

9.7.1 BRAZIL

9.7.1.1 Brazil occupied over 60% of South American feed production

TABLE 243 BRAZIL: FEED YEAST MARKET SIZE, BY LIVESTOCK, 2016–2019 (USD THOUSAND)

TABLE 244 BRAZIL: MARKET SIZE, BY LIVESTOCK, 2020-2025 (USD THOUSAND)

TABLE 245 BRAZIL: MARKET SIZE, BY LIVESTOCK, 2016–2019 (TON)

TABLE 246 BRAZIL: MARKET SIZE, BY LIVESTOCK, 2020-2025 (TON)

TABLE 247 BRAZIL: MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 248 BRAZIL: MARKET SIZE, BY TYPE, 2020-2025 (USD MILLION)

TABLE 249 BRAZIL: MARKET SIZE, BY TYPE, 2016–2019 (TON)

TABLE 250 BRAZIL: MARKET SIZE, BY TYPE, 2020-2025 (TON)

9.7.2 ARGENTINA

9.7.2.1 Growth scope for feed additives, including feed yeast, is expected to be spurred after the removal of export taxes

TABLE 251 ARGENTINA: FEED YEAST MARKET SIZE, BY LIVESTOCK, 2016–2019 (USD THOUSAND)

TABLE 252 ARGENTINA: MARKET SIZE, BY LIVESTOCK, 2020-2025 (USD THOUSAND)

TABLE 253 ARGENTINA: MARKET SIZE, BY LIVESTOCK, 2016–2019 (TON)

TABLE 254 ARGENTINA: MARKET SIZE, BY LIVESTOCK, 2020-2025 (TON)

TABLE 255 ARGENTINA: MARKET SIZE, BY TYPE, 2016–2019 (USD THOUSAND)

TABLE 256 ARGENTINA: MARKET SIZE, BY TYPE, 2020-2025 (USD THOUSAND)

TABLE 257 ARGENTINA: MARKET SIZE, BY TYPE, 2016–2019 (TON)

TABLE 258 ARGENTINA: MARKET SIZE, BY TYPE, 2020-2025 (TON)

9.7.3 REST OF SOUTH AMERICA

TABLE 259 REST OF SOUTH AMERICA: FEED YEAST MARKET SIZE, BY LIVESTOCK, 2016–2019 (USD THOUSAND)

TABLE 260 REST OF SOUTH AMERICA: MARKET SIZE, BY LIVESTOCK, 2020-2025 (USD THOUSAND)

TABLE 261 REST OF SOUTH AMERICA: MARKET SIZE, BY LIVESTOCK, 2016–2019 (TON)

TABLE 262 REST OF SOUTH AMERICA: MARKET SIZE, BY LIVESTOCK, 2020-2025 (TON)

TABLE 263 REST OF SOUTH AMERICA: MARKET SIZE, BY TYPE, 2016–2019 (USD THOUSAND)

TABLE 264 REST OF SOUTH AMERICA: MARKET SIZE, BY TYPE, 2020-2025 (USD THOUSAND)

TABLE 265 REST OF SOUTH AMERICA: MARKET SIZE, BY TYPE, 2016–2019 (TON)

TABLE 266 REST OF SOUTH AMERICA: MARKET SIZE, BY TYPE, 2020-2025 (TON)

9.8 REST OF THE WORLD (ROW)

TABLE 267 REST OF THE WORLD: FEED YEAST MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 268 REST OF THE WORLD: MARKET SIZE, BY REGION, 2020-2025 (USD MILLION)

TABLE 269 REST OF THE WORLD: MARKET SIZE, BY LIVESTOCK, 2016–2019 (USD THOUSAND)

TABLE 270 REST OF THE WORLD: MARKET SIZE, BY LIVESTOCK, 2020-2025 (USD THOUSAND)

TABLE 271 REST OF THE WORLD: MARKET SIZE, BY LIVESTOCK, 2016–2019 (TON)

TABLE 272 REST OF THE WORLD: MARKET SIZE, BY LIVESTOCK, 2020-2025 (TON)

TABLE 273 REST OF THE WORLD: MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 274 REST OF THE WORLD: MARKET SIZE, BY TYPE, 2020-2025 (USD THOUSAND)

TABLE 275 REST OF THE WORLD: MARKET SIZE, BY TYPE, 2016–20219 (TON)

TABLE 276 REST OF THE WORLD: MARKET SIZE, BY TYPE, 2020-2025 (TON)

TABLE 277 REST OF THE WORLD: MARKET SIZE, BY GENUS, 2016–2019 (USD THOUSAND)

TABLE 278 REST OF THE WORLD: MARKET SIZE, BY GENUS, 2020-2025 (USD THOUSAND)

9.8.1 MIDDLE EAST

9.8.1.1 Growing industrialization of the feed industry in the region

TABLE 279 MIDDLE EAST: FEED YEAST MARKET SIZE, BY LIVESTOCK, 2016–2019 (USD THOUSAND)

TABLE 280 MIDDLE EAST: MARKET SIZE, BY LIVESTOCK, 2020-2025 (USD THOUSAND)

TABLE 281 MIDDLE EAST: MARKET SIZE, BY LIVESTOCK, 2016–2019 (TON)

TABLE 282 MIDDLE EAST: MARKET SIZE, BY LIVESTOCK, 2020-2025 (TON)

TABLE 283 MIDDLE EAST: MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 284 MIDDLE EAST: MARKET SIZE, BY TYPE, 2020-2025 (USD MILLION)

TABLE 285 MIDDLE EAST: MARKET SIZE, BY TYPE, 2016–2019 (TON)

TABLE 286 MIDDLE EAST: MARKET SIZE, BY TYPE, 2020-2025 (TON)

9.8.2 AFRICA

9.8.2.1 The growing poultry and cattle feed demand in Africa to have a long-term impact on the feed yeast market growth

TABLE 287 AFRICA: FEED YEAST MARKET SIZE, BY LIVESTOCK, 2016–2019 (USD THOUSAND)

TABLE 288 AFRICA: MARKET SIZE, BY LIVESTOCK, 2020-2025 (USD THOUSAND)

TABLE 289 AFRICA: MARKET SIZE, BY LIVESTOCK, 2016–2019 (TON)

TABLE 290 AFRICA: MARKET SIZE, BY LIVESTOCK, 2020-2025 (TON)

TABLE 291 AFRICA: MARKET SIZE, BY TYPE, 2016–2019 (USD THOUSAND)

TABLE 292 AFRICA: MARKET SIZE, BY TYPE, 2020-2025 (USD THOUSAND)

TABLE 293 AFRICA: MARKET SIZE, BY TYPE, 2016–2019 (TON)

TABLE 294 AFRICA: MARKET SIZE, BY TYPE, 2020-2025 (TON)

10 COMPETITIVE LANDSCAPE (Page No. - 254)

10.1 OVERVIEW

10.2 COMPETITIVE LEADERSHIP MAPPING

10.2.1 DYNAMIC CAPITALIZERS

10.2.2 INNOVATORS

10.2.3 VISIONARY LEADERS

10.2.4 EMERGING COMPANIES

FIGURE 35 FEED YEAST MARKET: COMPETITIVE LEADERSHIP MAPPING, 2019

FIGURE 36 KEY DEVELOPMENTS OF THE LEADING PLAYERS IN THE FEED YEAST MARKET, 2015–2020

10.3 SHARE ANALYSIS, 2019

FIGURE 37 ABF, CARGILL, ALLTECH, AND LESAFFRE OCCUPIED A DOMINANT SHARE IN THE GLOBAL AS WELL REGIONAL MARKETS

10.4 COMPETITIVE LEADERSHIP MAPPING (FOR START-UPS/SME’S)

10.4.1 PROGRESSIVE COMPANIES

10.4.2 STARTING BLOCKS

10.4.3 RESPONSIVE COMPANIES

10.4.4 DYNAMIC COMPANIES

FIGURE 38 FEED YEAST MARKET: COMPETITIVE LEADERSHIP MAPPING FOR START-UPS, 2019

10.5 COMPETITIVE SCENARIO

10.5.1 NEW PRODUCT LAUNCHES

TABLE 295 NEW PRODUCT LAUNCHES, 2015 –2018

10.5.2 EXPANSIONS & INVESTMENTS

TABLE 296 EXPANSIONS & INVESTMENTS, 2018

10.5.3 ACQUISITIONS

TABLE 297 ACQUISITIONS, 2016 –2020

10.5.4 PARTNERSHIPS, JOINT VENTURES, AND AGREEMENTS

TABLE 298 PARTNERSHIPS, JOINT VENTURES, AND AGREEMENTS, 2018–2019

11 COMPANY PROFILES (Page No. - 263)

11.1 ASSOCIATED BRITISH FOODS PLC.

FIGURE 39 ASSOCIATED BRITISH FOODS: COMPANY SNAPSHOT

FIGURE 40 ASSOCIATED BRITISH FOODS: SWOT ANALYSIS

11.2 ARCHER DANIELS MIDLAND COMPANY

FIGURE 41 ARCHER DANIELS MIDLAND COMPANY: COMPANY SNAPSHOT

FIGURE 42 ARCHER DANIELS MIDLAND COMPANY: SWOT ANALYSIS

11.3 ALLTECH INC.

11.4 CARGILL

FIGURE 43 CARGILL: COMPANY SNAPSHOT

FIGURE 44 CARGILL: SWOT ANALYSIS

11.5 NUTRECO N.V.

11.6 LESAFFRE GROUP

FIGURE 45 LESAFFRE: SWOT ANALYSIS

11.7 LALLEMAND INC.

FIGURE 46 LALLEMAND: SWOT ANALYSIS

11.8 NOVUS INTERNATIONAL

11.9 ANGEL YEAST CO LTD.

11.10 CHR. HANSEN

FIGURE 47 CHR. HANSEN: COMPANY SNAPSHOT

11.11 ZILOR (BIORIGIN)

11.12 KERRY GROUP

FIGURE 48 KERRY: COMPANY SNAPSHOT

11.13 KEMIN INDUSTRIES

11.14 TITAN BIOTECH LTD.

11.15 BARENTZ B.V

11.16 BIOFEED TECHNOLOGY INC.

11.17 PROSOL S.P.A

11.18 F.L. EMMERT

11.19 BIOMIN HOLDING GMBH

11.20 LEIBER GMBH

11.21 DEVENISH NUTRITION

11.22 SPECIALTY BIOTECH CO. LTD.

11.23 SIVER AGRO LLC

11.24 SHANGHAI GENON BIOTECH CO. LTD

11.25 SHENYANG FADA CO. LTD.

12 ADJACENT & RELATED MARKETS (Page No. - 300)

12.1 INTRODUCTION

12.2 LIMITATIONS

12.3 FEED ENZYMES MARKET

12.3.1 MARKET DEFINITION

12.3.2 MARKET OVERVIEW

FIGURE 49 FEED ENZYME MARKET IS ESTIMATED TO HAVE A HIGH GROWTH DURING THE FORECAST PERIOD

12.4 FEED ENZYME MARKET, BY LIVESTOCK

12.4.1 INTRODUCTION

TABLE 299 FEED ENZYMES MARKET SIZE, BY LIVESTOCK, 2016-2019 (USD MILLION)

TABLE 300 FEED ENZYMES MARKET SIZE, BY LIVESTOCK, 2020-2025 (USD MILLION)

12.5 FEED ENZYME MARKET, BY REGION

12.5.1 NORTH AMERICA

TABLE 301 NORTH AMERICA: FEED ENZYMES MARKET SIZE, BY LIVESTOCK, 2016-2019 (USD MILLION)

TABLE 302 NORTH AMERICA: FEED ENZYMES MARKET SIZE, BY LIVESTOCK, 2020–2025 (USD MILLION)

12.5.2 EUROPE

TABLE 303 EUROPE: FEED ENZYMES MARKET SIZE, BY LIVESTOCK, 2016-2019 (USD MILLION)

TABLE 304 EUROPE: FEED ENZYMES MARKET SIZE, BY LIVESTOCK, 2020–2025 (USD MILLION)

12.5.3 ASIA PACIFIC

TABLE 305 ASIA PACIFIC: FEED ENZYMES MARKET SIZE, BY LIVESTOCK, 2016-2019 (USD MILLION)

TABLE 306 ASIA PACIFIC: FEED ENZYMES MARKET SIZE, BY LIVESTOCK, 2020–2025 (USD MILLION)

12.5.4 SOUTH AMERICA

TABLE 307 SOUTH AMERICA: FEED ENZYMES MARKET SIZE, BY LIVESTOCK, 2016-2019 (USD MILLION)

TABLE 308 SOUTH AMERICA: FEED ENZYMES MARKET SIZE, BY LIVESTOCK, 2020–2025 (USD MILLION)

12.5.5 REST OF THE WORLD (ROW)

TABLE 309 ROW: FEED ENZYMES MARKET SIZE, BY LIVESTOCK, 2016-2019 (USD THOUSAND)

TABLE 310 ROW: FEED ENZYMES MARKET SIZE, BY LIVESTOCK, 2020–2025 (USD THOUSAND)

12.6 PROBIOTICS IN ANIMAL FEED MARKET

12.6.1 LIMITATIONS

12.6.2 MARKET DEFINITION

12.6.3 MARKET OVERVIEW

FIGURE 50 PROBIOTICS IN ANIMAL FEED MARKET PROJECTED TO ACHIEVE HIGH GROWTH DURING THE FORECAST PERIOD

12.6.4 PROBIOTICS IN ANIMAL FEED MARKET SIZE, BY SOURCE

TABLE 311 PROBIOTICS IN ANIMAL FEED MARKET SIZE, BY SOURCE, 2017–2025 (USD MILLION)

12.6.5 PROBIOTICS IN ANIMAL FEED MARKET, BY REGION

TABLE 312 PROBIOTICS IN ANIMAL FEED MARKET SIZE, BY REGION, 2017–2025 (USD MILLION)

12.6.5.1 North America

TABLE 313 NORTH AMERICA: PROBIOTICS IN ANIMAL FEED MARKET SIZE, BY SOURCE, 2017–2025 (USD MILLION)

12.6.5.2 Europe

TABLE 314 EUROPE: PROBIOTICS IN ANIMAL FEED MARKET SIZE, BY SOURCE, 2017–2025 (USD MILLION)

12.6.5.3 Asia Pacific

TABLE 315 ASIA PACIFIC: PROBIOTICS IN ANIMAL FEED MARKET SIZE, BY SOURCE, 2017–2025 (USD MILLION)

12.6.5.4 Rest of The World (ROW)

TABLE 316 ROW: PROBIOTICS IN ANIMAL FEED MARKET SIZE, BY SOURCE, 2017–2025 (USD MILLION)

13 APPENDIX (Page No. - 318)

13.1 DISCUSSION GUIDE

13.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.3 AVAILABLE CUSTOMIZATIONS

13.4 RELATED REPORTS

13.5 AUTHOR DETAILS

The study includes four major activities to estimate the current market size for feed yeast. Exhaustive secondary research was done to collect information on the overall market and the peer market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were used to estimate the complete market size. Thereafter, data triangulation was used, and the market breakdown was done to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources were referred to, to identify and collect information for this study. The secondary sources included annual reports, press releases and investor presentations of companies, white papers, certified publications, articles from recognized authors, gold & silver standard websites, regulatory bodies, trade directories, and databases. Secondary research was mainly used to obtain important information about the industry’s supply chain, the market’s value chain, key players, and the market classification and segmentation according to the industry trends to the bottom-most level, and geographical markets. It was also used to obtain information on key developments from a market-oriented perspective.

Primary Research

The market comprises several stakeholders, which include yeast manufacturers, formulators, suppliers, and feed and feed additive manufacturers in the supply chain. Various primary sources from both the supply and demand sides of yeast manufacturers and feed manufacturers were interviewed to obtain qualitative and quantitative information. The primary interviewees from the demand side include research institutions, feed premix and supplement formulators and suppliers, government agencies, livestock, and the feed industry associations, and farm cooperative societies. The primary sources from the supply side include yeast starter culture providers, corn distillers and bioethanol manufacturers, raw material and fermenter equipment suppliers, and key opinion leaders.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the feed yeast market. These methods were also used extensively to estimate the size of various sub-segments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets were identified through extensive secondary research.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research included the study of reports, reviews, and newsletters of top market players, along with extensive interviews for opinions from leaders such as CEOs, directors, and marketing executives.

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market was split into several segments and subsegments. In order to arrive at the exact statistics for all the segments and subsegments, the data triangulation and market breakdown procedures were employed wherever applicable. After the market was validated using both the top-down and bottom-up approaches, the data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- Determining and projecting the size of the market with respect to type, livestock, genus, and region over a five-year period from 2020 to 2025

- Identifying attractive opportunities in the market by determining the largest and fastest-growing segments across regions

- Analyzing the demand-side factors on the basis of the following:

- Impact of macro- and microeconomic factors on the market

- Shifts in demand patterns across different subsegments and regions

- Identifying and profiling key market players in the feed yeast market on the basis of the following:

- Product/service offering

- Business strategies

- Strengths, weaknesses, opportunities, and threats

- Key financials

- Understanding the competitive landscape for a comparative analysis of market leaders and identifying the key market shareholders across the industry.

- Analyzing regulatory frameworks across regions and their impact on prominent market players

- Providing insights on key investments in technology innovations

Availabe Customizations

With the given market data, MarketsandMarkets offers customizations according to the company’s specific scientific needs.

The following customization options are available for the report:

Product Analysis

- Product Matrix, which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

- Further breakdown of the Rest of Europe market into Italy, Spain, Belgium, and Denmark

- Further breakdown of the Rest of Asia Pacific market into the Philippines, Vietnam, Indonesia, Pakistan, and New Zealand

- Further breakdown of the Rest of South America market into Chile, Colombia, and Venezuela

Company Information

- Detailed analyses and profiling of additional market players (up to five)

Growth opportunities and latent adjacency in Feed Yeast Market

Does this report cover on specific details for Europe feed yeast like competitor sales revenues and average selling price of products?

Does this report provide market size for countries in MENA region such as Saudi Arabia, Egypt and UAE ?

Which are key application area for the Feed yeast and fastest growing market in this report study ?

What are the countries that your report has considered under Rest of Europe in Feed Yeast Market?