Feed Ingredients Market by Livestock (Poultry, Ruminant, Swine, Aquaculture, Equine, & Pets), Ingredient Type (Soybean Meal, Canola, and Rendered Meal), Product type (Compound feed, Fodder, Forage, Oilseed meals, Animal by-product meals) and Key Region - Global Forecast to 2027

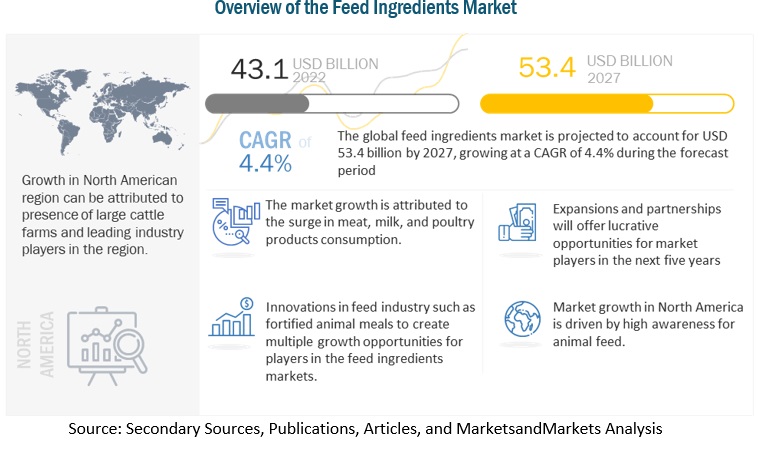

According to MarketsandMarkets, the global feed ingredients market is estimated to be valued at USD 43.1 billion in 2022 and is projected to reach USD 53.4 billion by 2027. The market is expected to grow with a CAGR of 4.4%, in terms of value between 2022 and 2027. According to the FDA, animal food (feed) ingredient is a component part, constituent, or any combination added to and comprising the animal food.

Feed Ingredients Market Dynamics

Drivers: Global rise in the demand for nutritional meat

This rise in demand for high-value nutritional meat is expected to drive the global market for feed ingredients. With lifestyle changes, a behavioural shift in consumers has been observed in meat consumption. Thus, demand for high-value nutritional meat is propelling globally, subsequently fuelling the growth of feed ingredients market.

Restraints: Rising food safety concerns and awareness on red meat to hinder the growth to an extent

Rising consumer awareness regarding processed and red meat which have been associated with chronic health conditions such as heart strokes, infections, Alzheimer’s, diabetes, and liver diseases has persuaded people to look for plant-based safe and healthy alternatives, which is predicted to impact the feed ingredients market negatively.

Opportunities: Rise in demand for animal-based products such as milk to create huge opportunity for feed ingredients

Due to rise in demand for milk and poultry-based products, commercialization and cattle farms have increased globally. Thus, it had become crucial for cattle breeders, to take good care of the livestock to ensure profitable outputs. This rise in demand for animal-based products and cattle farms, has posed a huge opportunity for feed ingredients market that support the overall health of cattle.

Challenges: Rising cost of feed is a big challenge for feed ingredients market

According to Alltech, one of the leading players in the feed ingredients market, is the rising cost of feed, which is estimated to account up to 70% of total production expenses. Moreover, up to 25% of the available nutrients in the feed are not fully utilized by the animal due to anti nutritional factors in the feed. Thus, cattle and livestock farmers particularly in the developing and underdeveloped markets restrain to purchase feed, thus affecting the sales and production of feed ingredient manufacturers.

By livestock, poultry segment is expected to dominate the global feed ingredients market

Presence of large number of global poultry farms, has led the poultry farmers across the globe to procure healthy feed to have good commercial output. Moreover, growing consumer preference for specific yolk color and meat has increased the demand for poultry feed, subsequently poultry feed ingredients.

By ingredient, soybean meal segment is likely to be the fastest growing ingredient

Soybean is drastically gaining popularity due to its wide scale production and availability. The production of soybean is on a rise every year and is now being used popularly in the livestock industry. Moreover, the ingredient is cost effective and is high on nutrition. Thus, it is expected to showcase high growth during the forecast period.

North American region is expected to dominate the feed ingredients market. Factors such as high awareness, presence of large cattle farms and presence of key industry players is expected to drive the demand for feed and feed ingredients in the region.

Key Market Players:

Key players in this market include ADM (US), Cargill, Inc. (US), Mosaic Company (US), BASF (Germany), Adisseo (China), DSM (The Netherlands), and Alltech (US).

Table Of Contents

1 Introduction

1.1 Key-Take Aways

1.2 Report Description

1.3 Markets Covered

1.4 Research Methodology

1.4.1 Market Size

1.4.2 Market Share

1.4.3 Key Data Points from Secondary Sources

1.4.4 Key Data Points from Primary Sources

1.4.5 Assumptions

1.5 Stakeholders

2 ExecutiveSummary

3 Market Overview

3.1 Introduction

3.2 Evolution

3.3 Market Segmentation

3.4 Market Dynamics

3.4.1 Drivers

3.4.2 Restraints

3.4.3 Opportunities

3.5 Winning Imperatives

3.6 Burning Issues

3.7 Value Chain Analysis

3.8 End User Analysis

3.9 Market Share Analysis

3.10 Industry Benchmarking

4 Market by Products (Up to Level 5 Segmentation if possible)

5 Market by Applications

6 Market by Technology

7 Geographic Analysis

7.1 Americas/North America

7.2 Europe

7.3 Asia/APAC

7.4 RoW (Rest of the World)

8 Competitive Landscape

8.1 Mergers & Acquisitions

8.2 Agreements & Collaborations

8.3 New Product Developments

9 Company Profiles

9.1 Company A

9.1.1 Overview

9.1.2 Financials

9.1.3 Products & Services

9.1.4 Strategy

9.1.5 Developments

Growth opportunities and latent adjacency in Feed Ingredients Market