Fava Bean Protein Market by Product Type (Protein Isolate, Protein Concentrates, Flour), Nature Type (Organic, And Conventional), End-User (Food Processing, Infant Nutrition, Nutraceuticals, Animal Feed, and Others), and Region - Global Forecast to 2029

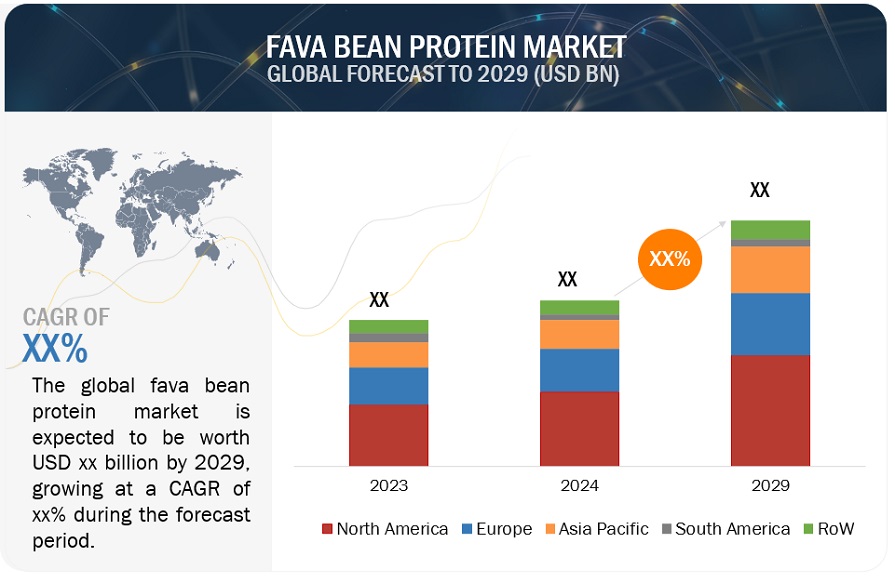

The global fava bean protein market growth is on a trajectory of significant expansion, with an estimated value projected to reach USD XX.X billion by 2029 from the 2024 valuation of USD XX.X billion, displaying a promising Compound Annual Growth Rate (CAGR) of X.X%. Fava bean protein is a plant-based protein derived from fava beans (also known as broad beans), a legume rich in nutrients. Fava bean protein is in immense demand. Owing to several primary factors, the fava bean protein market is growing in a fast pace. In addition, growing consumer interest in vegetarian and vegan diets made fava bean protein a convenient alternative. Moreover, with increased health consciousness among people, there is a growing need for high-protein, low-fat alternatives. These trends toward sustainability include some demands on fava beans that are less water-intensive and lower in carbon footprint than other animal proteins.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Market Dynamics

Drivers: The increasing interest of consumers in vegetarian and vegan diets favoring the market growth.

The surging adoption of plant-based diets among the consumers drives the fava bean protein market. As people are increasingly adopting a vegetarian and vegan lifestyle, there has been an increased demand for high-quality sources of plant-based proteins. Fava bean protein is one of the most nutritious options, rich with essential amino acids such as lysine that are often scarcest in other plant proteins. With all these features, it can be introduced to all types of food products-including meat alternatives, dairy alternates, or even snacks-from the mushrooming range of plant-based offerings.

Moreover, sustainability is also crucial factor because several people switch to a plant-based diet for ethical or environmental reasons. Fava beans are sustainable as they consume significantly less water and resources as compared to the farming industry of animals.

Restraints: Allergen Risks Associated with Fava Bean Protein

The allergen risks associated with fava bean protein can hinder the market significantly. As the bean's component has the potential to cause red blood cells, which carry oxygen throughout the body, to break down quickly. As a result, the organs do not receive adequate oxygen. Hemolytic anemia is the term for this breakdown of red blood cells, and symptoms include jaundice, exhaustion, and shortness of breath. In extreme circumstances, death may occur. All of this is caused by a deficiency in a particular enzyme known as glucose-6-phosphate dehydrogenase, or G6PD, in some individuals. The consumption of fava beans causes an accumulation of reactive oxygen species, a class of molecules that this enzyme helps deal with.

Opportunities: Innovative Product Development.

The major opportunities in the market for fava bean proteins include the development by manufacturers of a diversified food product portfolio that caters to the shift in consumer preference. This flexibility of application of fava bean protein enables its smooth onboarding into applications such as meat substitute, dairy substitutes, protein-enriched snacks, and baked goods. This flexibility alone caters to mounting demand for plant-based and healthy foods but further opens opportunities for the brands to continue innovating and diversifying their offering.

Customers are becoming increasingly health-conscious and environmentally aware, and this market actively seeks healthy and sustainable solutions in line with their diets. Therefore, with fava bean protein, manufacturers are well-positioned to tap into this trend, targeting a broad group of vegans, vegetarians, and flexitarians. In addition, functionality development will help in creating foods that have superior nutritional profiles like high-protein bars and fortified beverages. Strategic use of fava bean protein, in a competitive market, therefore, puts companies in a position to address a variety of consumer demands and build a strong footing in the very rapidly expanding plant-based food sector.

Challenges: Replicating meat and dairy textures challenges due to consumer expectations.

The lack of awareness regarding the fava beans protein can be a challenge for the market. The lack of awareness about the advantages of the fava bean such as versatile source of protein can affect marketing efforts, making it difficult for brands to effectively communicate the unique advantages of fava bean protein, ultimately slowing market growth and reducing opportunities for innovation. Therefore, the need to innovate would relate to education for the customer to pass over this hurdle and expand this market scope.

Market Ecosystem

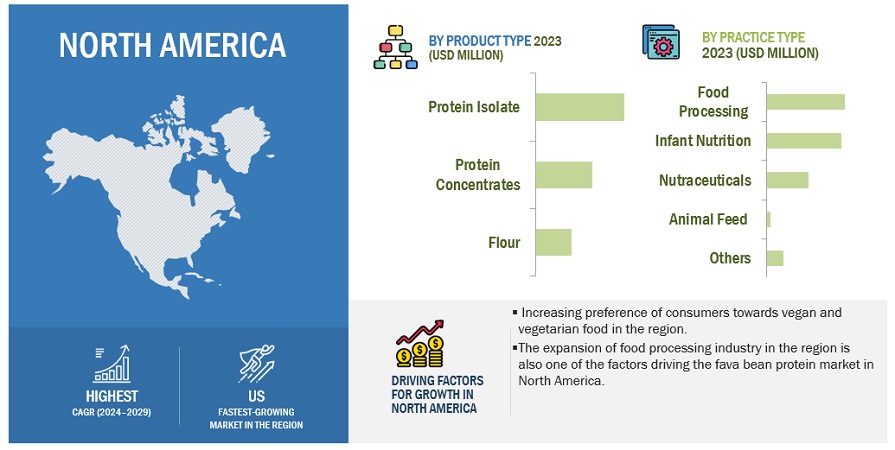

protein isolate segment accounted for A HIGHER market SHARE among Product Type SEGMENT in 2023.

Protein isolate accounts for a relatively larger part of the fava bean protein market than protein concentrates and flour. This is attributed to better bioavailability, an economical offering, and extensive historical research proving the product offers health advantages. Fava bean protein isolates has a high protein concentration compared to other bean refined forms. This makes them appealing to consumers with high demand for the potent protein sources specially in fitness and health-oriented products. The protein isolates can be used in broad range of applications including dairy alternatives, plant-based meats, protein powders. As consumers become increasingly environmentally conscious, the sustainability of fava beans further drives demand for plant-based protein isolates.

THE food processing SEGMENT IS PROJECTED TO BE THE dominant DURING THE FORECAST PERIOD IN BY end-user SEGMENT.

Food processing segment is considered the largest market share in the fava bean protein market. Fava bean is a promising source of proteins and has a potential in industrial food applications. Processing of fava ingredients modifies proteins and their functional properties. Due to the rise in consumer demand for proteins in processed food, processors are incorporating fava bean protein into a broad product portfolio, such as baked goods, buggers, nuggets, and ready-to-eat meals. This versatility makes it usable in many processed foods. From protein bars to dairy alternatives and meat substitutes, this flexibility allows the manufacturer to present varied and innovative offerings in the market. Clean labelling aligns well with consumer wishes for high levels of natural and minimally processed ingredients, which fava bean protein is very well-positioned for.

NORTH AMERICA REGION IS EXPECTED TO DOMINATE FOR FAVA BEAN PROTEIN MARKET AMONG THE REGIONS.

North America is the largest market for fava bean protein. This growth is driven by the significant increase in consumer demand for plant-based protein in the region. North America has a very strong, long-established food processing industry. There is a strong intent to identify new ingredients for immediate inclusion into the product line, especially in segments that are rapidly growing such as meat and dairy alternatives. Consumers generally place an emphasis on health and wellness, requiring high protein/nutrition content products, such as fava bean protein. The area also receives enormous investments in research and development that help to innovate and introduce new protein-based products of fava beans. In addition, increasing awareness and concern among consumers and manufacturers about sustainability also intensify the quest for environmentally friendly sources of protein, which further drives the market for fava bean protein.

Key Market Players

The key players in this market include Australian Plant Proteins (Australia), Ingredion (US), Roquette Frères (France), Prairie Fava (Canada), VESTKORN (Norway), AGT Food and Ingredients Inc (Canada), Puris (US), MartinBauer (Germany), Nuttee Bean Co. (US), GrainCorp (Australia), Deltagen Ltd (UK), Cargill Incorporated (US).

Recent Developments

- In June 2024, Phytokana Ingredients Inc., announced a breakthrough in plant-based ingredient innovation with the launch of its F70 LVC Faba Protein Concentrate. This concentrate is the culmination of combined crop science and automation and technology innovation to yield a high purity 70% protein concentrate, retaining native functionality with superior sensory attributes and addressing key anti-nutritional requirements for widespread use of faba ingredients in a diverse set of customer-validated human food applications ranging from alternative meat to non-dairy food and beverage applications.

- In May 2024, Roquette, one of the global leaders in plant-based ingredients, announced the launch of NUTRALYS Fava S900M fava bean protein isolates in Europe and North America – the latest addition and first protein isolate derived from fava bean in Roquette’s NUTRALYSplant protein range. Delivering 90% protein content across various applications, including meat substitutes, non-dairy alternatives, and baked goods, NUTRALYS Fava S900M also offers a clean taste, light color and functional excellence.

- In Feb 2023, Sensus launched fava protein ingredient using fava beans to provide high protein content in a highly soluble and easily emulsified format. Designed with plant-based dairy applications, the protein also seeks to alleviate the difficulty in replicating the creamy texture of animal dairy products.

Frequently Asked Questions (FAQ):

What is the current size of the fava bean protein market?

The fava bean protein market forecast is estimated at USD XX.X billion in 2024 and is projected to reach USD XX.X billion by 2029, at a CAGR of X.X% from 2024 to 2029.

Which are the key players in the market, and how intense is the competition?

Fava bean protein market players include Australian Plant Proteins (Australia), Ingredion (US), Roquette Frères (France), Prairie Fava (Canada), VESTKORN (Norway), AGT Food and Ingredients Inc (Canada), Puris (US), MartinBauer (Germany), Nuttee Bean Co. (US), GrainCorp (Australia), Deltagen Ltd (UK), Cargill Incorporated (US). These companies boast reliable fava bean protein facilities alongside robust distribution networks spanning crucial regions. They possess a well-established portfolio of esteemed services, commanding a sturdy market presence supported by sound business strategies. Additionally, they hold substantial market share, offer services with versatile applications, cater to a diverse geographical clientele, and maintain an extensive service range.

Which region is projected to account for the largest share of the fava bean protein market?

The North America holds a largest market share in fava bean protein as consumer awareness of health and rising demand for dietary supplements continue in the region.

What kind of information is provided in the company profile section?

The company profiles mentioned above offer valuable information such as a comprehensive business overview, including details on the company's various business segments, financial performance, geographical reach, revenue composition, and the breakdown of their business revenue. Additionally, these profiles offer insights into the company's product offerings, significant milestones, and expert analyst perspectives to further explain the company's potential.

What are the growth prospects for the fava bean protein market in the next five years?

As increasing number of consumers are turning towards vegan, vegetarian. In addition, fava beans are rich in protein, fiber, vitamins, and minerals. This factor is appealing to the health-conscious consumers seeking nutritious food options. Also, the growing demand for plant-based diet holds immense opportunities for the market. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Growth opportunities and latent adjacency in Fava Bean Protein Market