Fault Detection and Classification (FDC) Market Size, Share, Trends, Statistics and Industry Growth Analysis Report by offering type (Software, hardware, services), Application (Manufacturing, Packaging), end use (Automotive, Electronics & Semiconductor, Metal & Machinery) and Region - Global Forecast to 2028

Updated on : November 22, 2024

Fault Detection and Classification (FDC) Market Size & Growth

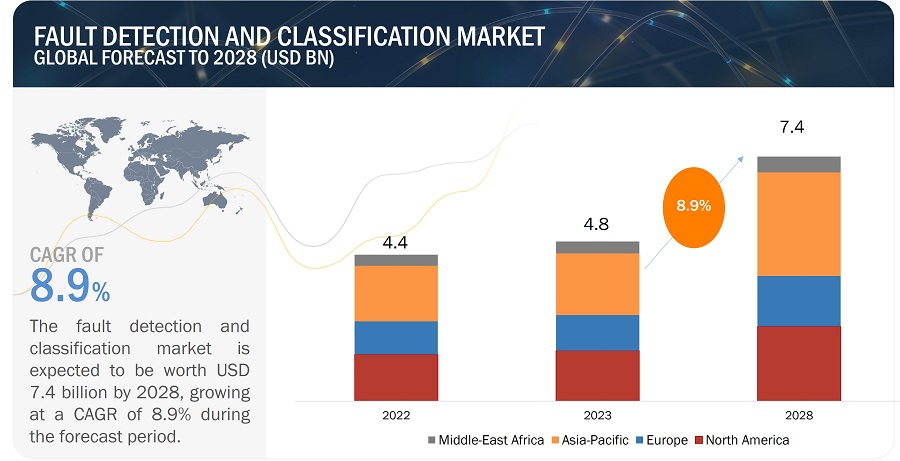

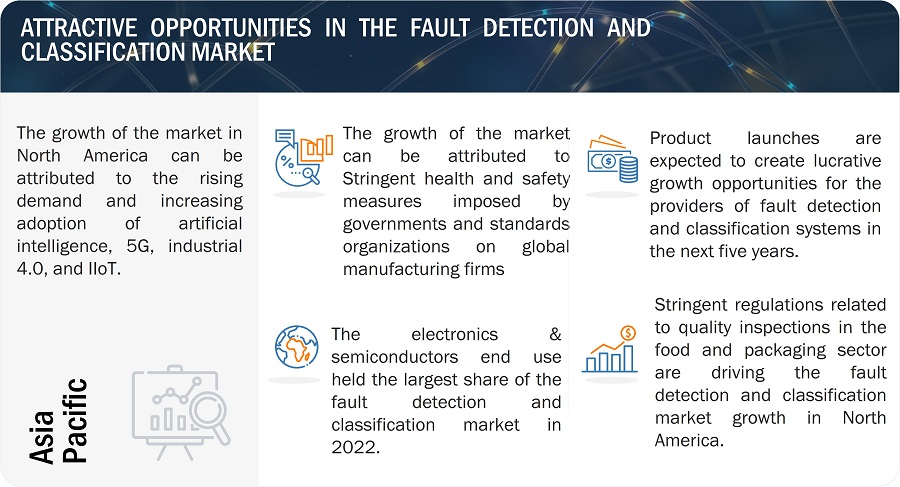

[257 Pages Report] The global fault detection and classification market size was valued at USD 4.4 billion in 2022 and is projected to reach USD 7.4 billion by 2028; growing at a CAGR of 8.9% during the forecast period 2022 to 2028 Stringent health and safety measures imposed by governments and standards organizations on global manufacturing firms and Strong focus of manufacturers on automating quality control and quality assurance processes are among the factors driving the growth of fault detection and classification industry .

Fault Detection and Classification (FDC) Market Statistics Forecast to 2028

To know about the assumptions considered for the study, Request for Free Sample Report

Fault Detection and Classification (FDC) Market Trends:

Driver: The increased complexity of systems

The rapid advancement of technology has led to increasingly complex systems across various industries. This complexity presents both opportunities and challenges, particularly in maintaining system reliability and efficiency. With increased complexity comes heightened challenges. Traditional manual monitoring and diagnosis no longer suffice, as the intricacies of these systems surpass human capacity. As systems become more intricate, the need for effective fault detection and classification (FDC) becomes paramount. FDC systems typically use a combination of sensors, data analytics, and machine learning algorithms to detect and classify faults. The sensors collect data from the system, which is then analyzed by the data analytics algorithms to identify any deviations from normal operating conditions. By continuously assessing data, these systems establish baselines for normal operation and identify deviations. Upon detecting anomalies, they employ classification algorithms to categorize faults, enabling swift responses.

The relentless rise in the complexity of modern systems necessitates innovative approaches to ensure their seamless functioning. Fault detection and classification systems stand as beacons of technological advancement, offering real-time monitoring, rapid fault identification, and informed decision-making. As industries embrace these solutions, they enhance their operational efficiency, safeguard their personnel and assets, and position themselves at the forefront of a future where complexity is not a challenge but an opportunity. In a world of intricate interconnections, FDC emerges as a cornerstone for sustained progress.

Restraint: Dearth of skilled professionals in manufacturing factories

In the manufacturing industry, there is a tremendous reliance on human experience and human senses. However, recently, the shortage of skilled professionals has become a more critical issue; therefore, automation of manufacturing, assembly, product testing and inspection, and transportation processes that depend on people has become an urgent task for businesses. On account of this, companies across industries embrace industrial automation with the growing use of fault detection and classification systems, machine vision systems, etc., to improve operational efficiency and performance, reduce waste and conserve natural resources, and reach new markets and audiences, but factories embracing machine vision technology would require more complex skill sets, and it could be difficult for lower/semi-skilled, less-educated workers to access opportunities.

Machine vision systems deployed to eliminate the defects require skilled professionals capable of deciphering machine signals on a dashboard and work together with collaborative robots on which machine vision systems are mounted.

Furthermore, economic growth largely depends on the productivity of the workforce. The current challenge is to promote lifelong learning, particularly among the elderly and economically active people. For example, China and Japan will face rapid population aging in the coming decades, necessitating the maintenance, and upgrading of a growing pool of mature and older workers, in addition to making further progress in formal education. Secondly, the growing younger generation will continue to strain both education and training capacities and job creation rates as more young people enter the job market. Young people with low skill levels are having difficulty finding work everywhere. In nearly every industry, there are now more open jobs than people looking for work. There are 1.06 job openings for every unemployed worker in the manufacturing industry. On average, 25% of workers in the manufacturing sector worldwide are underqualified.

Fault detection and classification systems with high-end and frequently changing features necessitate highly skilled individuals. An unskilled worker may be unable to carry out the operations and may impede the operation of the fault detection and classification system, resulting in false detection or a defect going undetected by the system. The shortage of skilled professionals can cause companies in various industries to shy away from fault detection and classification systems, proving a market restraint.

Opportunity: Increasing adoption of artificial intelligence (AI) technology

Quality control is one of the most important factors in manufacturing. Inspecting each product manually is costly, in terms of time and effort, creating bottlenecks caused by delayed production. In many cases, defects can be easily missed by the human eye or even by industry experts, resulting in decreased quality of an individual component or a defective final product that must be scrapped. Defect rates can often increase with more complex manufacturing systems. Recently, manufacturers have been focused on adopting advanced technologies, such as AI and deep learning, on transforming production processes and faster inspection of products and prompt detection of defects. The combination of software, use of deep learning technology, the power of parallel processing, and easy-to-use tools are core parameters of this transformation.

AI-based FDC tools/systems are superior to manual inspection in tracking products on the assembly lines, delivering significantly higher precision rates, enhanced product quality, increased productivity, higher throughput, and lower production costs. AI-based fault detection and classification systems used for quality control utilize machine learning technology so that defect prediction models can autonomously learn and make inferences from the manufacturer’s data. These models can shortlist important features and create new implicit rules to determine which combinations of features impact the overall product quality. Autonomous fault detection and classification systems deliver improved efficiency and accuracy, which constantly adjust to detect new types of defects across industries and verticals. Production yield and customer satisfaction largely depend on AI-based quality control for wide application areas ranging from nanometric semiconductors to huge engine parts of a commercial airplane. Traditional fault detection and classification systems cannot evaluate complex objects or products with high variations as easily as human operators; however, an AI-based fault detection and classification system can effortlessly find and compare defects with high variability.

AI-based fault detection and classification systems provide significant benefits to manufacturers:

- Early error detection, preventing defective parts from moving down the production line

- Increased production volume without sacrificing quality

- Tracking historical data to pinpoint issues and improve future production processes

- Optimized incoming material inspection

- Reaching, and often surpassing, human-level accuracy

These technologies enable the development of sophisticated algorithms capable of learning from historical data and adapting to changing conditions. This leads to higher accuracy in fault detection and classification and reduces false positives.

Furthermore, various companies are heavily investing in R&D activities to offer innovative and technologically advanced products and solutions in the fault detection and classification market. For instance, in July 203, Microsoft collaborated with Birlasoft to Establish Generative AI Centre of Excellence, Shares Rebound After Announcement. Birlasoft will utilize Azure OpenAI Service features for product design, process optimization, quality and defect detection, predictive maintenance, and digital twins for the manufacturing sector

Challenge: Complexity in implementation of fault detection and classification solution and technologies

Increasing competition, growing instability in the business arena, and ongoing technological advancements necessitate to change the way manufacturing enterprises operate and expand their business. To achieve the aforementioned objectives, organizations need to accomplish seamless production. Fault detection and classification systems are used in a variety of applications, including manufacturing, healthcare, and packaging. Each application has its own quirks, and technological advancements add complexity to manufacturing processes on a daily basis. Fault detection and classification systems face the challenge of meeting the diverse and ever-changing needs of various applications. Whether it is a camera, an optics, software, or a frame grabber, versatile solutions can be quickly developed to tackle a wide range of tasks by using multipurpose components. The need of the hour is to simplify the integration process with regard to different components of fault detection and classification systems and the production lines at application sites. With increasing efforts being put into boosting the convenience of installing and handling all technical systems, players in the fault detection and classification market must look to address these requirements by coming up with plug-and-play solutions.

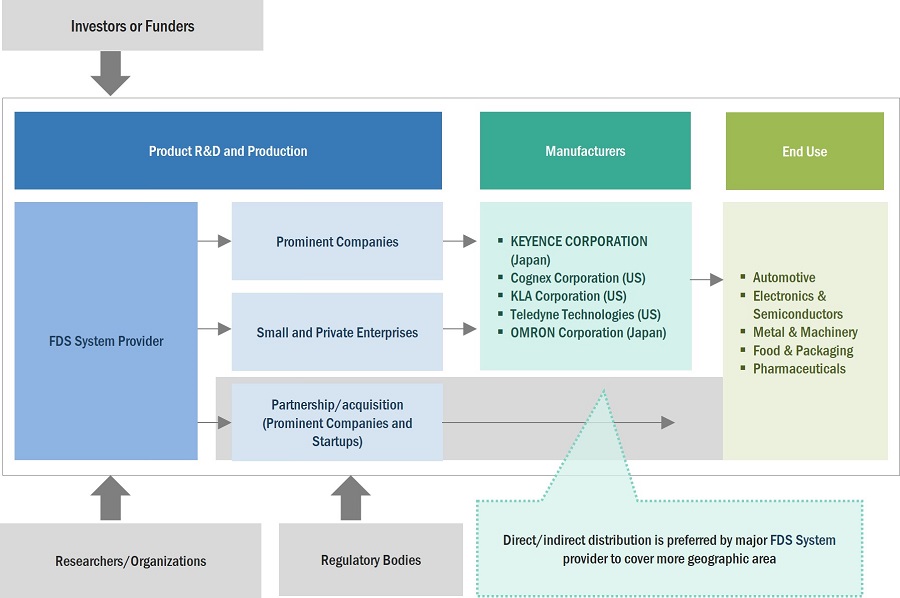

Fault Detection And Classification Market Ecosystem

Prominent companies in this market include well-established, financially stable providers of fault detection and classification systems. These companies have been operating in the market for several years and possess a diversified product portfolio, state-of-the-art technologies, and strong global sales and marketing networks. Prominent companies in this market include Keyence Corporation (Japan), Cognex Corporation (US), KLA Corporation (US), Teledyne Technologies (US), OMRON Corporation (Japan), Microsoft (US), Tokyo Electron Limited (Japan), Siemens (Germany), Amazon Web Services, Inc. (US), Synopsys, Inc. (US)

By end use, the automotive segment is expected to grow with the highest CAGR from 2023 to 2028

The fault detection and classification market for automotive end use is expected to grow at the highest CAGR from 2023 to 2028. The growth of the segment is attributed to the the increasing complexity of vehicles, stringent safety regulations, demand for improved fuel efficiency, need to reduce downtime, and advances in technology. Also, Automotive manufacturers are under immense pressure to meet safety standards and deliver vehicles with low defect rates. FDC systems provide a proactive approach to identifying issues early in the manufacturing process, reducing the likelihood of recalls and safety-related defects. This not only saves manufacturers from costly recalls but also enhances their reputation for producing safe and reliable vehicles.

By offering, the software segment is expected to grow with a highest CAGR in 2028.

Software offering is expected to exhibit a highest CAGR in the fault detection and classification market in 2028. The growth can be attributed as fault detection and classification software offers greater flexibility and adaptability compared to hardware-based solutions. It can be easily updated, modified, or reconfigured to accommodate changes in processes, equipment, or data sources. This flexibility is crucial in industries with rapidly evolving technologies or dynamic operational environments, as it allows organizations to stay agile and responsive to new challenges. Also, Software-based FDC solutions can scale easily to accommodate growing data volumes and expanding operations. As businesses expand, they can simply upgrade their software infrastructure to handle increased data sources and analytical demands.

By hardware, camera segment is expected to grow with a highest CAGR during the forecast period.

Cameras is expected to exhibit a highest CAGR in the fault detection and classification market during the forecast period. The growth of fault detection and classification cameras is driven by their advanced imaging technology, real-time monitoring capabilities, cost efficiency, applicability across industries, regulatory compliance, data analytics potential, and alignment with Industry 4.0 trends. As industries strive for higher product quality, efficiency, and competitiveness, FDC cameras continue to play a pivotal role in meeting these objectives.

FDC in Semiconductor Manufacturing

Fault Detection and Classification (FDC) Market Regional Analysis

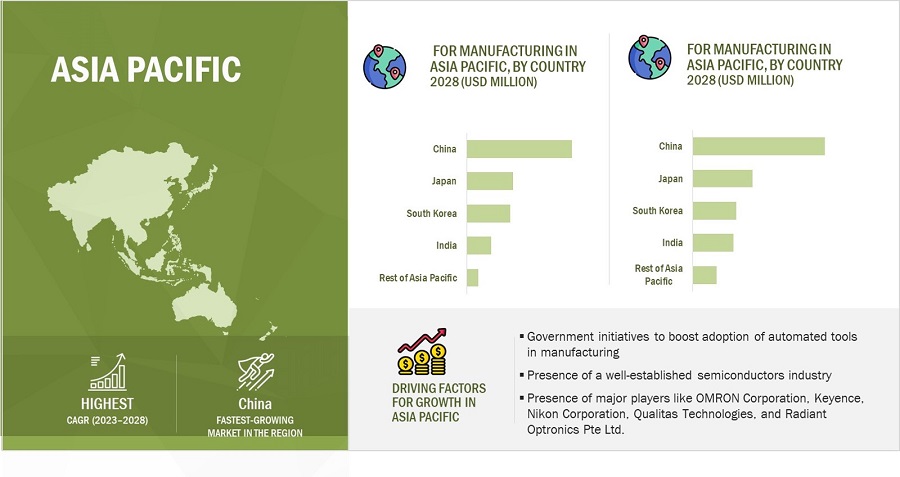

In 2028, Asia Pacific is projected to hold the highest CAGR of the overall fault detection and classification market

Fault Detection and Classification (FDC) Market Statistics by Region

To know about the assumptions considered for the study, download the pdf brochure

In 2028, Asia Pacific is projected to account for the largest share of the fault detection and classification market. Asia pacific has witnessed substantial industrial expansion, particularly in manufacturing, automotive, electronics, and semiconductor industries. As these sectors continue to grow, the need for FDC becomes paramount to maintain product quality, optimize production processes, and ensure operational efficiency.

Top Fault Detection and Classification (FDC) Companies - Key Market Players:

- Keyence Corporation (Japan),

- Cognex Corporation (US),

- KLA Corporation (US),

- Teledyne Technologies (US),

- OMRON Corporation (Japan),

- Microsoft (US),

- Tokyo Electron Limited (Japan),

- Siemens (Germany),

- Amazon Web Services, Inc. (US),

- Synopsys, Inc. (US) are some of the key players in the fault detection and classification companies.

Fault Detection and Classification (FDC) Market Report Scope :

|

Report Metric |

Details |

| Estimated Market Size | USD 4.4 Billion |

| Projected Market Size | USD 7.4 Billion |

| Growth Rate | CAGR of 8.9 % |

|

Fault Detection and Classification (FDC) Market Size Availability for Years |

2019–2028 |

|

Base Year |

2022 |

|

Forecast Period |

2023–2028 |

|

Forecast Units |

Value (USD) |

|

Segments Covered |

By Fault types, technology, offering, application, end-use, and region |

|

Geographies Covered |

North America, Europe, Asia Pacific, and RoW |

|

Companies Covered |

Keyence Corporation (Japan), Cognex Corporation (US), KLA Corporation (US), Teledyne Technologies (US), OMRON Corporation (Japan), Microsoft (US), Tokyo Electron Limited (Japan), Siemens (Germany), Amazon Web Services, Inc. (US), Synopsys, Inc. (US) are some of the key players in the fault detection and classification market. |

Fault Detection and Classification (FDC) Market Highlights

This research report categorizes the fault detection and classification market based on by fault types, technology, offering, application, end-use, and region.

|

Segment |

Subsegment |

|

By Fault Type |

|

|

Fault Detection and Classification (FDC) Market Share By Technique/Technology |

|

|

By Offering |

|

|

By Application |

|

|

By End Use |

|

|

By Geography |

|

Recent Developments in Fault Detection and Classification (FDC) Industry

- In August 2023, Synopsys, Inc. launched Synopsys Software Risk Manager, a powerful new application security posture management (ASPM) solution. Software Risk Manager enables security and development teams to simplify, align and streamline their application security testing across projects, teams and application security testing (AST) tools.

- In August 2022, Synopsys, Inc. collaborated with NowSecure (US), experts in mobile security and privacy, and Secure Code Warrior, provider of the leading agile learning platform for developer-driven security, to expand its Software Integrity Group's industry-leading portfolio of application security testing (AST) solutions.

- In July 2022, Microsoft collaborated with Birlasoft to Establish Generative AI Centre of Excellence, Shares Rebound After Announcement. Birlasoft will utilize Azure OpenAI Service features for product design, process optimization, quality and defect detection, predictive maintenance, and digital twins for the manufacturing sector.

- In may 2023, KLA Corporation partnered with imec (Belgium), a nanoelectronics research center. The partnership is to establish the Semiconductor Talent and Automotive Research (STAR) initiative, which is focused developing the talent base and infrastructure necessary to accelerate advanced semiconductor applications for electrification and autonomous mobility and move the automotive industry forward.

- In April 2023, The company launched In-Sight 3800 vision system. designed for high-speed production lines, In-Sight 3800 offers an extensive vision toolset, powerful imaging capabilities, and flexible software to deliver a fully integrated solution for a wide range of inspection applications.

Key Questions Addressed by the Report

Which are the major companies in the fault detection and classification market? What are their major strategies to strengthen their market presence?

The major companies in the fault detection and classification market are – Keyence Corporation (Japan), Cognex Corporation (US), KLA Corporation (US), Teledyne Technologies (US), OMRON Corporation (Japan), Microsoft (US), Tokyo Electron Limited (Japan), Siemens (Germany), Amazon Web Services, Inc. (US), Synopsys, Inc. (US) The major strategies adopted by these players are product launches and developments.

What is the potential market for fault detection and classification in terms of the region?

Asia Pacific region is expected to dominate the fault detection and classification market owing to the presence of countries such as China, Japan, South Korea, India. Rising adoption innovative technologies in industries in China, South Korea, Japan and India also facilitate growth to the market

Who are the winners in the global fault detection and classification market?

Companies such as Keyence Corporation (Japan), Cognex Corporation (US), KLA Corporation (US), Teledyne Technologies (US), OMRON Corporation (Japan), fall under the winner’s category. These companies cater to the requirements of their customers by providing fault detection and classification systems. Moreover, these companies are highly adopting organic growth strategies to strengthen their global market position and customer base.

What are the drivers and opportunities for the fault detection and classification market?

Strong focus of manufacturers on automating quality control and quality assurance processes is the driver and Increasing adoption of artificial intelligence (AI) technology is the opportunity in the fault detection and classification market

What are the restraints and challenges for the fault detection and classification market?

Increasing adoption of artificial intelligence (AI) technology and Complexity in implementation of fault detection and classification solution and technologies are restraints and challenges in the fault detection and classification market

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Effective detection and management of complex systems in modern technological landscape- Improved plant-efficiency and reduced costs with quality control processes in manufacturing- Increasing focus on deployment of automated tools in manufacturing sector- High demand for application-specific integrated circuitsRESTRAINTS- Shortage of skilled professionalsOPPORTUNITIES- Improved production processes using AI-based fault detection and classification instruments- Government-led initiatives to boost adoption of automation and data acquisition systemsCHALLENGES- Growing complexities in manufacturing processes attributed to technological innovations

-

5.3 VALUE CHAIN ANALYSISRESEARCH & DEVELOPMENT ENGINEERSRAW MATERIAL SUPPLIERSMANUFACTURERSSYSTEM INTEGRATORSSUPPLIERS AND DISTRIBUTORS

-

5.4 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

-

5.5 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

-

5.6 ECOSYSTEM MAPPING

-

5.7 PRICING ANALYSISAVERAGE SELLING PRICE OF HARDWARE OFFERED BY KEY PLAYERS

-

5.8 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

-

5.9 PATENT ANALYSIS

-

5.10 TECHNOLOGY ANALYSISLIQUID LENSROBOTIC VISIONDEEP LEARNING

-

5.11 TRADE ANALYSISIMPORT SCENARIOEXPORT SCENARIO

-

5.12 CASE STUDY ANALYSISMICROSOFT PROVIDES END-TO-END FAULT DETECTION SYSTEM TO DETECT AND LOCALIZE FAULTS IN SOLAR PANELS BASED ON THEIR ELECTROLUMINESCENCE (EL) IMAGINGAPPLIED MATERIALS, INC. OFFERS COST-EFFECTIVE APPROACH TO PROPAGATE FRONT-END FD PRACTICES INTO BACK-END ATP PROCESSES

- 5.13 KEY CONFERENCES AND EVENTS, 2023–2024

-

5.14 REGULATORY LANDSCAPEREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONSSTANDARDS

- 5.15 TARIFF ANALYSIS

- 6.1 INTRODUCTION

-

6.2 DIMENSIONAL FAULTINCREASING USE TO MINIMIZE DIMENSIONAL FAULTS LEADING TO HIGH COSTS AND DOWNTIME

-

6.3 SURFACE DEFECTSIRREGULARITIES DUE TO ELECTRICAL SHORTS AND DEVICE FAILURES

-

6.4 CONTAMINATION FAULTSINTERFERENCE IN PRECISE ETCHING AND DEPOSITION PROCESS DUE TO CONTAMINATION ISSUES

-

6.5 PROCESS VARIABILITYFLUCTUATION IN CLEANROOM ENVIRONMENT IMPACTING PROCESS STABILITY

- 6.6 OTHER FAULT TYPES

- 7.1 INTRODUCTION

-

7.2 SENSOR DATA ANALYSISGROWING NEED FOR ANALYSIS OF LARGE VOLUMES OF SENSOR DATA IN REAL-TIME TO DRIVE DEMAND

-

7.3 STATISTICAL METHODSABILITY TO TRANSFORM RAW DATA INTO ACTIONABLE INSIGHTS TO FOSTER SEGMENTAL GROWTH

-

7.4 MACHINE LEARNING ALGORITHMSEARLY ISSUE DETECTION AND PREDICTIVE MAINTENANCE TO SPUR DEMAND

- 7.5 OTHER TECHNOLOGIES

- 8.1 INTRODUCTION

-

8.2 SOFTWARERISING CRITICALITY OF INFRASTRUCTURE SYSTEMS TO FOSTER SEGMENTAL GROWTH

-

8.3 HARDWARECAMERAS- Cameras, by format- Cameras, by frame rateSENSORS- CCD sensors- CMOS sensorsFRAME GRABBERS- Ability to capture high-resolution digital still images to boost demandOPTICS- Need to regulate flaws in raw materials, components, and finished products to boost demandPROCESSORS- High-resolution and real-time video analytics in vision algorithms to propel market

-

8.4 SERVICESGROWING ADOPTION OF AI AND DEEP LEARNING TECHNOLOGIES TO BOOST DEMAND

- 9.1 INTRODUCTION

-

9.2 MANUFACTURINGASSEMBLY VERIFICATION- AI- and deep learning-based fault detection and classification systems to offer growth opportunitiesFLAW DETECTION- Measurement- Surface anomalies- Fabrication inspection

-

9.3 PACKAGINGGRADING- Introduction of application-specific products and solutions to boost marketLABEL VALIDATION- Product information- BarcodesCONTAINER/PACKAGING INSPECTION- Packaging integrity

- 10.1 INTRODUCTION

-

10.2 AUTOMOTIVERISING PRODUCTION OF HYBRID AND ELECTRIC VEHICLES TO BOOST MARKET

-

10.3 ELECTRONICS & SEMICONDUCTORSABILITY TO DETECT COMPLEX AND MACRO DEFECTS TO BOOST DEMAND

-

10.4 METALS & MACHINERYDEPLOYMENT OF INDUSTRY 4.0 AND IIOT IN METALS & MACHINERY TO DRIVE MARKET

-

10.5 FOOD & PACKAGINGIMPLEMENTATION OF AI AND DEEP LEARNING SOFTWARE IN FOOD & PACKAGING TO DRIVE MARKET

-

10.6 PHARMACEUTICALSABILITY TO INSPECT LARGE NUMBER OF TABLETS ACCURATELY TO BOOST DEMAND

- 11.1 INTRODUCTION

-

11.2 NORTH AMERICAUS- Presence of established players to foster market growthCANADA- Thriving automotive and aerospace sectors to contribute to market growthMEXICO- Growing FDIs in manufacturing to boost market growthNORTH AMERICA: RECESSION IMPACT

-

11.3 EUROPEGERMANY- Increasing demand for robots in automotive and electronics industries to foster market growthUK- Pharmaceutical industry to create significant demand for fault detection and classification systemsFRANCE- Rising automobile production to boost demandREST OF EUROPEEUROPE: RECESSION IMPACT

-

11.4 ASIA PACIFICCHINA- Established manufacturing hub for consumer electronics and automobiles to propel market growthJAPAN- Healthy growth of consumer electronics industry to boost demandSOUTH KOREA- Expanding consumer electronics industry and manufacturing sector to boost market growthINDIA- Government-led campaigns for boosting domestic manufacturing sector to drive marketREST OF ASIA PACIFICASIA PACIFIC: RECESSION IMPACT

-

11.5 ROWMIDDLE EAST & AFRICA- Booming energy & power industry to fuel demandSOUTH AMERICA- Rising need for high-quality automated inspections to drive demandROW: RECESSION IMPACT

- 12.1 OVERVIEW

-

12.2 KEY STRATEGIES ADOPTED BY MAJOR PLAYERSPRODUCT PORTFOLIOREGIONAL FOCUSMANUFACTURING FOOTPRINTORGANIC/INORGANIC STRATEGIES

- 12.3 MARKET SHARE ANALYSIS, 2022

- 12.4 REVENUE ANALYSIS, 2018–2022

-

12.5 EVALUATION MATRIX OF KEY COMPANIES, 2022STARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

-

12.6 EVALUATION MATRIX OF STARTUPS/SMES, 2022PROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKS

- 12.7 COMPANY FOOTPRINT

-

12.8 COMPETITIVE SCENARIOS AND TRENDSPRODUCT LAUNCHESDEALSOTHERS

-

13.1 KEY PLAYERSKEYENCE CORPORATION- Business overview- Products/Solutions/Services offered- Recent developments- Product launches- MnM viewCOGNEX CORPORATION- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewOMRON CORPORATION- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewTELEDYNE TECHNOLOGIES INCORPORATED- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewKLA CORPORATION- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewSIEMENS- Business overview- Products/Solutions/Services offered- Recent developmentsMICROSOFT- Business overview- Products/Solutions/Services offered- Recent developmentsAMAZON WEB SERVICES, INC.- Business overview- Products/Solutions/Services offered- Recent developmentsTOKYO ELECTRON LIMITED- Business overview- Products/Solutions/Services offeredSYNOPSYS, INC.- Business overview- Products/Solutions/Services offered- Recent developmentsAPPLIED MATERIALS, INC.- Business overview- Products/Solutions/Services offered- Recent developments

-

13.2 OTHER PLAYERSEINNOSYS TECHNOLOGIES INC.DATALOGIC S.P.A.PDF SOLUTIONSNIKON CORPORATIONINFICONQUALITAS TECHNOLOGIESBEYONDMINDSELUNIC AGCHOOCH INTELLIGENCE TECHNOLOGIESKILI TECHNOLOGYMOBIDEVDWFRITZ AUTOMATION, LLCRADIANT OPTRONICS PTE LTDVISIONIFY.AI

-

13.3 SOUTH KOREA – OTHER PLAYERSSAMSUNG SDSLS ELECTRIC CO., LTD.DOOSAN CORPORATION (DOOSAN ŠKODA POWER)HYUNDAI HEAVY INDUSTRIES

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS

- TABLE 1 MARKET GROWTH ASSUMPTIONS

- TABLE 2 KEY ASSUMPTIONS: MACRO-AND MICRO-ECONOMIC ENVIRONMENT

- TABLE 3 RISK ASSESSMENT

- TABLE 4 FAULT DETECTION AND CLASSIFICATION MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 5 AVERAGE SELLING PRICE OF HARDWARE OFFERED BY KEY PLAYERS

- TABLE 6 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP VERTICALS

- TABLE 7 KEY BUYING CRITERIA FOR TOP THREE VERTICALS

- TABLE 8 FAULT DETECTION AND CLASSIFICATION MARKET: INNOVATIONS AND PATENT REGISTRATIONS, 2021–2023

- TABLE 9 IMPORT DATA FOR FAULT DETECTION AND CLASSIFICATION INSTRUMENTS, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 10 EXPORT DATA FOR FAULT DETECTION AND CLASSIFICATION INSTRUMENTS, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 11 FAULT DETECTION AND CLASSIFICATION MARKET: LIST OF CONFERENCES AND EVENTS

- TABLE 12 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 ROW: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 TARIFF FOR HS CODE 903033-COMPLIANT PRODUCTS EXPORTED BY GERMANY

- TABLE 17 TARIFF FOR HS CODE 903033-COMPLIANT PRODUCTS EXPORTED BY CHINA, 2022

- TABLE 18 FAULT DETECTION AND CLASSIFICATION MARKET, BY OFFERING, 2019–2022 (USD MILLION)

- TABLE 19 FAULT DETECTION AND CLASSIFICATION MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 20 HARDWARE: FAULT DETECTION AND CLASSIFICATION MARKET, 2019–2022 (USD MILLION)

- TABLE 21 HARDWARE: FAULT DETECTION AND CLASSIFICATION MARKET, 2023–2028 (USD MILLION)

- TABLE 22 HARDWARE: FAULT DETECTION AND CLASSIFICATION MARKET, 2019–2022 (MILLION UNITS)

- TABLE 23 HARDWARE: FAULT DETECTION AND CLASSIFICATION MARKET, 2023–2028 (MILLION UNITS)

- TABLE 24 FAULT DETECTION AND CLASSIFICATION MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 25 FAULT DETECTION AND CLASSIFICATION MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 26 MANUFACTURING: FAULT DETECTION AND CLASSIFICATION MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 27 MANUFACTURING: FAULT DETECTION AND CLASSIFICATION MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 28 MANUFACTURING: FAULT DETECTION AND CLASSIFICATION MARKET, BY VERTICAL, 2019–2022 (USD MILLION)

- TABLE 29 MANUFACTURING: FAULT DETECTION AND CLASSIFICATION MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 30 MANUFACTURING: FAULT DETECTION AND CLASSIFICATION MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 31 MANUFACTURING: FAULT DETECTION AND CLASSIFICATION MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 32 MANUFACTURING: FAULT DETECTION AND CLASSIFICATION MARKET IN NORTH AMERICA, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 33 MANUFACTURING: FAULT DETECTION AND CLASSIFICATION MARKET IN NORTH AMERICA, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 34 MANUFACTURING: FAULT DETECTION AND CLASSIFICATION MARKET IN EUROPE, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 35 MANUFACTURING: FAULT DETECTION AND CLASSIFICATION MARKET IN EUROPE, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 36 MANUFACTURING: FAULT DETECTION AND CLASSIFICATION MARKET IN ASIA PACIFIC, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 37 MANUFACTURING: FAULT DETECTION AND CLASSIFICATION MARKET IN ASIA PACIFIC, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 38 MANUFACTURING: FAULT DETECTION AND CLASSIFICATION MARKET IN ROW, BY REGION, 2019–2022 (USD MILLION)

- TABLE 39 MANUFACTURING: FAULT DETECTION AND CLASSIFICATION MARKET IN ROW, BY REGION, 2023–2028 (USD MILLION)

- TABLE 40 PACKAGING: FAULT DETECTION AND CLASSIFICATION MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 41 PACKAGING: FAULT DETECTION AND CLASSIFICATION MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 42 PACKAGING: FAULT DETECTION AND CLASSIFICATION MARKET, BY VERTICAL, 2019–2022 (USD MILLION)

- TABLE 43 PACKAGING: FAULT DETECTION AND CLASSIFICATION MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 44 PACKAGING: FAULT DETECTION AND CLASSIFICATION MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 45 PACKAGING: FAULT DETECTION AND CLASSIFICATION MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 46 PACKAGING: FAULT DETECTION AND CLASSIFICATION MARKET IN NORTH AMERICA, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 47 PACKAGING: FAULT DETECTION AND CLASSIFICATION MARKET IN NORTH AMERICA, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 48 PACKAGING: FAULT DETECTION AND CLASSIFICATION MARKET IN EUROPE, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 49 PACKAGING: FAULT DETECTION AND CLASSIFICATION MARKET IN EUROPE, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 50 PACKAGING: FAULT DETECTION AND CLASSIFICATION MARKET IN ASIA PACIFIC, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 51 PACKAGING: FAULT DETECTION AND CLASSIFICATION MARKET IN ASIA PACIFIC, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 52 PACKAGING: FAULT DETECTION AND CLASSIFICATION MARKET IN ROW, BY REGION, 2019–2022 (USD MILLION)

- TABLE 53 PACKAGING: FAULT DETECTION AND CLASSIFICATION MARKET IN ROW, BY REGION, 2023–2028 (USD MILLION)

- TABLE 54 FAULT DETECTION AND CLASSIFICATION MARKET, BY VERTICAL, 2019–2022 (USD MILLION)

- TABLE 55 FAULT DETECTION AND CLASSIFICATION MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 56 AUTOMOTIVE: FAULT DETECTION AND CLASSIFICATION MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 57 AUTOMOTIVE: FAULT DETECTION AND CLASSIFICATION MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 58 AUTOMOTIVE: FAULT DETECTION AND CLASSIFICATION MARKET, BY MANUFACTURING APPLICATION, 2019–2022 (USD MILLION)

- TABLE 59 AUTOMOTIVE: FAULT DETECTION AND CLASSIFICATION MARKET, BY MANUFACTURING APPLICATION, 2023–2028 (USD MILLION)

- TABLE 60 AUTOMOTIVE: FAULT DETECTION AND CLASSIFICATION MARKET, BY PACKAGING APPLICATION, 2019–2022 (USD MILLION)

- TABLE 61 AUTOMOTIVE: FAULT DETECTION AND CLASSIFICATION MARKET, BY PACKAGING APPLICATION, 2023–2028 (USD MILLION)

- TABLE 62 ELECTRONICS & SEMICONDUCTORS: FAULT DETECTION AND CLASSIFICATION MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 63 ELECTRONICS & SEMICONDUCTORS: FAULT DETECTION AND CLASSIFICATION MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 64 ELECTRONICS & SEMICONDUCTORS: FAULT DETECTION AND CLASSIFICATION MARKET, BY MANUFACTURING APPLICATION, 2019–2022 (USD MILLION)

- TABLE 65 ELECTRONICS & SEMICONDUCTORS: FAULT DETECTION AND CLASSIFICATION MARKET, BY MANUFACTURING APPLICATION, 2023–2028 (USD MILLION)

- TABLE 66 ELECTRONICS & SEMICONDUCTORS: FAULT DETECTION AND CLASSIFICATION MARKET, BY PACKAGING APPLICATION, 2019–2022 (USD MILLION)

- TABLE 67 ELECTRONICS & SEMICONDUCTORS: FAULT DETECTION AND CLASSIFICATION MARKET, BY PACKAGING APPLICATION, 2023–2028 (USD MILLION)

- TABLE 68 METALS & MACHINERY: FAULT DETECTION AND CLASSIFICATION MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 69 METALS & MACHINERY: FAULT DETECTION AND CLASSIFICATION MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 70 METALS & MACHINERY: FAULT DETECTION AND CLASSIFICATION MARKET, BY MANUFACTURING APPLICATION, 2019–2022 (USD MILLION)

- TABLE 71 METALS & MACHINERY: FAULT DETECTION AND CLASSIFICATION MARKET, BY MANUFACTURING APPLICATION, 2023–2028 (USD MILLION)

- TABLE 72 METALS & MACHINERY: FAULT DETECTION AND CLASSIFICATION MARKET, BY PACKAGING APPLICATION, 2019–2022 (USD MILLION)

- TABLE 73 METALS & MACHINERY: FAULT DETECTION AND CLASSIFICATION MARKET, BY PACKAGING APPLICATION, 2023–2028 (USD MILLION)

- TABLE 74 FOOD & PACKAGING: FAULT DETECTION AND CLASSIFICATION MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 75 FOOD & PACKAGING: FAULT DETECTION AND CLASSIFICATION MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 76 FOOD & PACKAGING: FAULT DETECTION AND CLASSIFICATION MARKET, BY MANUFACTURING APPLICATION, 2019–2022 (USD MILLION)

- TABLE 77 FOOD & PACKAGING: FAULT DETECTION AND CLASSIFICATION MARKET, BY MANUFACTURING APPLICATION, 2023–2028 (USD MILLION)

- TABLE 78 FOOD & PACKAGING: FAULT DETECTION AND CLASSIFICATION MARKET, BY PACKAGING APPLICATION, 2019–2022 (USD MILLION)

- TABLE 79 FOOD & PACKAGING: FAULT DETECTION AND CLASSIFICATION MARKET, BY PACKAGING APPLICATION, 2023–2028 (USD MILLION)

- TABLE 80 PHARMACEUTICALS: FAULT DETECTION AND CLASSIFICATION MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 81 PHARMACEUTICALS: FAULT DETECTION AND CLASSIFICATION MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 82 PHARMACEUTICALS: FAULT DETECTION AND CLASSIFICATION MARKET, BY MANUFACTURING APPLICATION, 2019–2022 (USD MILLION)

- TABLE 83 PHARMACEUTICALS: FAULT DETECTION AND CLASSIFICATION MARKET, BY MANUFACTURING APPLICATION, 2023–2028 (USD MILLION)

- TABLE 84 PHARMACEUTICALS: FAULT DETECTION AND CLASSIFICATION MARKET, BY PACKAGING APPLICATION, 2019–2022 (USD MILLION)

- TABLE 85 PHARMACEUTICALS: FAULT DETECTION AND CLASSIFICATION MARKET, BY PACKAGING APPLICATION, 2023–2028 (USD MILLION)

- TABLE 86 FAULT DETECTION AND CLASSIFICATION MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 87 FAULT DETECTION AND CLASSIFICATION MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 88 NORTH AMERICA: FAULT DETECTION AND CLASSIFICATION MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 89 NORTH AMERICA: FAULT DETECTION AND CLASSIFICATION MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 90 US: FAULT DETECTION AND CLASSIFICATION MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 91 US: FAULT DETECTION AND CLASSIFICATION MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 92 CANADA: FAULT DETECTION AND CLASSIFICATION MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 93 CANADA: FAULT DETECTION AND CLASSIFICATION MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 94 MEXICO: FAULT DETECTION AND CLASSIFICATION MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 95 MEXICO: FAULT DETECTION AND CLASSIFICATION MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 96 EUROPE: FAULT DETECTION AND CLASSIFICATION MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 97 EUROPE: FAULT DETECTION AND CLASSIFICATION MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 98 GERMANY: FAULT DETECTION AND CLASSIFICATION MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 99 GERMANY: FAULT DETECTION AND CLASSIFICATION MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 100 UK: FAULT DETECTION AND CLASSIFICATION MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 101 UK: FAULT DETECTION AND CLASSIFICATION MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 102 FRANCE: FAULT DETECTION AND CLASSIFICATION MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 103 FRANCE: FAULT DETECTION AND CLASSIFICATION MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 104 REST OF EUROPE: FAULT DETECTION AND CLASSIFICATION MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 105 REST OF EUROPE: FAULT DETECTION AND CLASSIFICATION MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 106 ASIA PACIFIC: FAULT DETECTION AND CLASSIFICATION MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 107 ASIA PACIFIC: FAULT DETECTION AND CLASSIFICATION MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 108 CHINA: FAULT DETECTION AND CLASSIFICATION MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 109 CHINA: FAULT DETECTION AND CLASSIFICATION MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 110 JAPAN: FAULT DETECTION AND CLASSIFICATION MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 111 JAPAN: FAULT DETECTION AND CLASSIFICATION MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 112 SOUTH KOREA: FAULT DETECTION AND CLASSIFICATION MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 113 SOUTH KOREA: FAULT DETECTION AND CLASSIFICATION MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 114 INDIA: FAULT DETECTION AND CLASSIFICATION MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 115 INDIA: FAULT DETECTION AND CLASSIFICATION MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 116 REST OF ASIA PACIFIC: FAULT DETECTION AND CLASSIFICATION MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 117 REST OF ASIA PACIFIC: FAULT DETECTION AND CLASSIFICATION MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 118 ROW: FAULT DETECTION AND CLASSIFICATION MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 119 ROW: FAULT DETECTION AND CLASSIFICATION MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 120 MEA: FAULT DETECTION AND CLASSIFICATION MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 121 MEA: FAULT DETECTION AND CLASSIFICATION MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 122 SOUTH AMERICA: FAULT DETECTION AND CLASSIFICATION MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 123 SOUTH AMERICA: FAULT DETECTION AND CLASSIFICATION MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 124 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS

- TABLE 125 FAULT DETECTION AND CLASSIFICATION MARKET SHARE ANALYSIS, 2022

- TABLE 126 FAULT DETECTION AND CLASSIFICATION MARKET: LIST OF KEY STARTUPS/SMES

- TABLE 127 FAULT DETECTION AND CLASSIFICATION MARKET: STARTUPS/SMES COMPANY PROFILE

- TABLE 128 FAULT DETECTION AND CLASSIFICATION MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES (OFFERING)

- TABLE 129 FAULT DETECTION AND CLASSIFICATION MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES (VERTICAL FOOTPRINT)

- TABLE 130 FAULT DETECTION AND CLASSIFICATION MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES (REGION FOOTPRINT)

- TABLE 131 FAULT DETECTION AND CLASSIFICATION MARKET: COMPANY FOOTPRINT

- TABLE 132 VERTICAL: COMPANY FOOTPRINT

- TABLE 133 OFFERING: COMPANY FOOTPRINT

- TABLE 134 REGION: COMPANY FOOTPRINT

- TABLE 135 FAULT DETECTION AND CLASSIFICATION MARKET: PRODUCT LAUNCHES, 2019–2023

- TABLE 136 FAULT DETECTION AND CLASSIFICATION MARKET: DEALS, 2019–2023

- TABLE 137 FAULT DETECTION AND CLASSIFICATION MARKET: OTHERS, 2019–2023

- TABLE 138 KEYENCE CORPORATION: COMPANY OVERVIEW

- TABLE 139 KEYENCE CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 140 KEYENCE CORPORATION: PRODUCT LAUNCHES

- TABLE 141 COGNEX CORPORATION: COMPANY OVERVIEW

- TABLE 142 COGNEX CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 143 COGNEX CORPORATION: PRODUCT LAUNCHES

- TABLE 144 COGNEX CORPORATION: DEALS

- TABLE 145 OMRON CORPORATION: COMPANY OVERVIEW

- TABLE 146 OMRON CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 147 OMRON CORPORATION: PRODUCT LAUNCHES

- TABLE 148 OMRON CORPORATION: DEALS

- TABLE 149 OMRON CORPORATION: OTHERS

- TABLE 150 TELEDYNE TECHNOLOGIES INCORPORATED: COMPANY OVERVIEW

- TABLE 151 TELEDYNE TECHNOLOGIES INCORPORATED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 152 TELEDYNE TECHNOLOGIES INCORPORATED: PRODUCT LAUNCHES

- TABLE 153 TELEDYNE TECHNOLOGIES INCORPORATED: DEALS

- TABLE 154 KLA CORPORATION: COMPANY OVERVIEW

- TABLE 155 KLA CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 156 KLA CORPORATION: PRODUCT LAUNCHES

- TABLE 157 KLA CORPORATION: DEALS

- TABLE 158 KLA CORPORATION: OTHERS

- TABLE 159 SIEMENS: COMPANY OVERVIEW

- TABLE 160 SIEMENS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 161 SIEMENS: DEALS

- TABLE 162 MICROSOFT: COMPANY OVERVIEW

- TABLE 163 MICROSOFT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 164 MICROSOFT: PRODUCT LAUNCHES

- TABLE 165 MICROSOFT: DEALS

- TABLE 166 AMAZON WEB SERVICES, INC.: COMPANY OVERVIEW

- TABLE 167 AMAZON WEB SERVICES, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 168 AMAZON WEB SERVICES, INC.: PRODUCT LAUNCHES

- TABLE 169 AMAZON WEB SERVICES, INC.: DEALS

- TABLE 170 AMAZON WEB SERVICES, INC.: OTHERS

- TABLE 171 TOKYO ELECTRON LIMITED: COMPANY OVERVIEW

- TABLE 172 TOKYO ELECTRON LIMITED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 173 SYNOPSYS, INC.: COMPANY OVERVIEW

- TABLE 174 SYNOPSYS, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 175 SYNOPSYS, INC.: PRODUCT LAUNCHES

- TABLE 176 SYNOPSYS, INC.: DEALS

- TABLE 177 APPLIED MATERIALS, INC.: COMPANY OVERVIEW

- TABLE 178 APPLIED MATERIALS, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 179 APPLIED MATERIALS, INC.: PRODUCT LAUNCHES

- FIGURE 1 MARKET SEGMENTATION

- FIGURE 2 FAULT DETECTION AND CLASSIFICATION MARKET: RESEARCH DESIGN

- FIGURE 3 FAULT DETECTION AND CLASSIFICATION MARKET: RESEARCH APPROACH

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: SUPPLY-SIDE ANALYSIS

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN SUPPLY-SIDE ANALYSIS

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: SUPPLY-SIDE ANALYSIS

- FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 8 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 9 DATA TRIANGULATION

- FIGURE 10 AUTOMOTIVE SEGMENT TO WITNESS HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 11 SOFTWARE SEGMENT TO EXHIBIT HIGHEST CAGR IN MARKET DURING FORECAST PERIOD

- FIGURE 12 CAMERA SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 13 ASIA PACIFIC TO ACCOUNT FOR LARGEST MARKET SHARE THROUGHOUT FORECAST PERIOD

- FIGURE 14 PRE- AND POST-RECESSION IMPACT ON FAULT DETECTION AND CLASSIFICATION MARKET, 2019–2028

- FIGURE 15 HIGH DEMAND FOR APPLICATION-SPECIFIC INTEGRATED CIRCUITS TO DRIVE MARKET

- FIGURE 16 MANUFACTURING SEGMENT LEAD MARKET DURING FORECAST PERIOD

- FIGURE 17 ASSEMBLY VERIFICATION SEGMENT TO EXHIBIT HIGHEST CAGR FROM 2023 TO 2028

- FIGURE 18 LABEL VALIDATION SEGMENT TO CLAIM HIGHEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 19 ASIA PACIFIC TO HOLD LARGEST MARKET SHARE IN 2028, BY VALUE

- FIGURE 20 CHINA TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 21 FAULT DETECTION AND CLASSIFICATION MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 22 FAULT DETECTION AND CLASSIFICATION MARKET: IMPACT ANALYSIS OF DRIVERS

- FIGURE 23 FAULT DETECTION AND CLASSIFICATION MARKET: IMPACT ANALYSIS OF RESTRAINTS

- FIGURE 24 FAULT DETECTION AND CLASSIFICATION MARKET: IMPACT ANALYSIS OF OPPORTUNITIES

- FIGURE 25 FAULT DETECTION AND CLASSIFICATION MARKET: IMPACT ANALYSIS OF CHALLENGES

- FIGURE 26 FAULT DETECTION AND CLASSIFICATION MARKET: VALUE CHAIN ANALYSIS

- FIGURE 27 FAULT DETECTION AND CLASSIFICATION MARKET: PORTER’S FIVE FORCES ANALYSIS

- FIGURE 28 REVENUE SHIFT AND NEW REVENUE POCKETS FOR PLAYERS IN FAULT DETECTION AND CLASSIFICATION MARKET

- FIGURE 29 FAULT DETECTION AND CLASSIFICATION MARKET: ECOSYSTEM MAPPING

- FIGURE 30 AVERAGE SELLING PRICE OF HARDWARE, 2019–2028

- FIGURE 31 AVERAGE SELLING PRICE OF HARDWARE, BY KEY PLAYERS

- FIGURE 32 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE VERTICALS

- FIGURE 33 KEY BUYING CRITERIA FOR TOP THREE VERTICALS

- FIGURE 34 TOP 10 COMPANIES WITH HIGHEST NUMBER OF PATENT APPLICATIONS DURING LAST 10 YEARS

- FIGURE 35 REGIONAL ANALYSIS OF PATENTS GRANTED FOR FAULT DETECTION AND CLASSIFICATION DEVICES, 2022

- FIGURE 36 HARDWARE SEGMENT TO CAPTURE LARGEST MARKET SHARE THROUGHOUT FORECAST PERIOD

- FIGURE 37 BY HARDWARE OFFERING, CAMERA SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 38 MANUFACTURING SEGMENT TO CAPTURE LARGEST MARKET SHARE THROUGHOUT FORECAST PERIOD

- FIGURE 39 ASSEMBLY VERIFICATION SEGMENT TO CAPTURE LARGEST MARKET SHARE FOR MANUFACTURING APPLICATIONS THROUGHOUT FORECAST PERIOD

- FIGURE 40 LABEL VALIDATION SEGMENT TO CAPTURE LARGEST MARKET SHARE THROUGHOUT FORECAST PERIOD

- FIGURE 41 ELECTRONICS & SEMICONDUCTORS TO LEAD MARKET THROUGHOUT FORECAST PERIOD

- FIGURE 42 ASSEMBLY VERIFICATION TO LEAD MARKET THROUGHOUT FORECAST PERIOD

- FIGURE 43 BY MANUFACTURING APPLICATION, FABRIC INSPECTION TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 44 ASSEMBLY VERIFICATION SEGMENT TO EXHIBIT HIGHEST CAGR IN FAULT DETECTION AND CLASSIFICATION MARKET FOR MANUFACTURING APPLICATIONS DURING FORECAST PERIOD

- FIGURE 45 ASSEMBLY VERIFICATION SEGMENT TO DISPLAY HIGHEST CAGR IN FAULT DETECTION AND CLASSIFICATION MARKET FOR MANUFACTURING APPLICATIONS THROUGHOUT FORECAST PERIOD

- FIGURE 46 ASSEMBLY VERIFICATION TO DISPLAY HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 47 ASIA PACIFIC TO EXHIBIT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 48 NORTH AMERICA: FAULT DETECTION AND CLASSIFICATION MARKET SNAPSHOT

- FIGURE 49 EUROPE: FAULT DETECTION AND CLASSIFICATION MARKET SNAPSHOT

- FIGURE 50 ASIA PACIFIC: FAULT DETECTION AND CLASSIFICATION MARKET SNAPSHOT

- FIGURE 51 FAULT DETECTION AND CLASSIFICATION SYSTEMS: REVENUE ANALYSIS OF FIVE KEY PLAYERS, 2018–2022

- FIGURE 52 FAULT DETECTION AND CLASSIFICATION SYSTEMS: EVALUATION MATRIX OF KEY COMPANIES, 2022

- FIGURE 53 FAULT DETECTION AND CLASSIFICATION MARKET: EVALUATION MATRIX OF STARTUPS/SME, 2022

- FIGURE 54 KEYENCE CORPORATION: COMPANY SNAPSHOT

- FIGURE 55 COGNEX CORPORATION: COMPANY SNAPSHOT

- FIGURE 56 OMRON CORPORATION: COMPANY SNAPSHOT

- FIGURE 57 TELEDYNE TECHNOLOGIES INCORPORATED: COMPANY SNAPSHOT

- FIGURE 58 KLA CORPORATION: COMPANY SNAPSHOT

- FIGURE 59 SIEMENS: COMPANY SNAPSHOT

- FIGURE 60 MICROSOFT: COMPANY SNAPSHOT

- FIGURE 61 AMAZON WEB SERVICES, INC.: COMPANY SNAPSHOT

- FIGURE 62 TOKYO ELECTRON LIMITED: COMPANY SNAPSHOT

- FIGURE 63 SYNOPSYS, INC.: COMPANY SNAPSHOT

- FIGURE 64 APPLIED MATERIALS, INC.: COMPANY SNAPSHOT

The study involved four major activities in estimating the size of fault detection and classification market. Exhaustive secondary research has been carried out to collect information on the market, the peer markets, and the parent market. Both top-down and bottom-up approaches have been employed to estimate the total market size. Market breakdown and data triangulation methods have also been used to estimate the market for segments and subsegments.

Secondary Research

Revenues of companies offering fault detection and classification systems have been obtained from the secondary data available through paid and unpaid sources. The revenues have also been derived by analyzing the product portfolio of key companies, and these companies have been rated according to the performance and quality of their products.

In the secondary research process, various sources have been referred to for identifying and collecting information for this study on the fault detection and classification market. Secondary sources considered for this research study include government sources; corporate filings; and trade, business, and professional associations. Secondary data has been collected and analyzed to arrive at the overall market size, which has been further validated through primary research.

Secondary research has been mainly used to obtain key information about the supply chain of fault detection and classification systems to identify key players based on their products and prevailing industry trends in the fault detection and classification market by by fault types, technology, offering, application, end-use, and region. Secondary research also helped obtain market information- and technology-oriented key developments undertaken by market players to expand their presence and increase their market share.

Primary Research

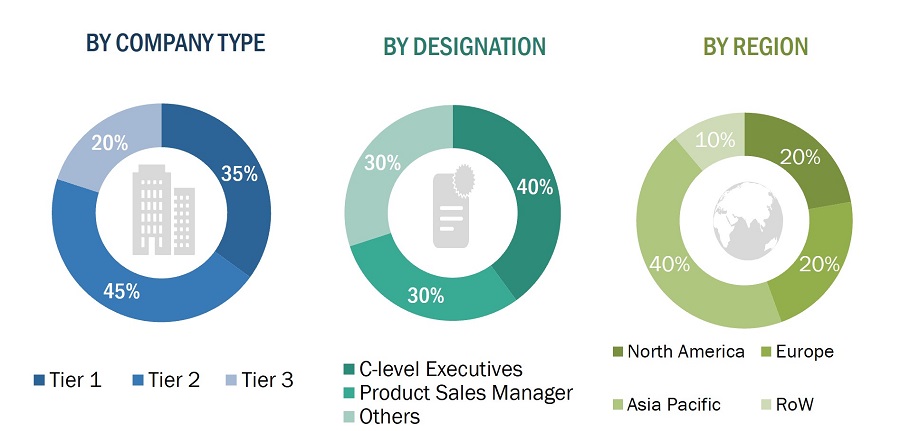

Extensive primary research has been conducted after understanding and analyzing the current scenario of fault detection and classification market through secondary research. Several primary interviews have been conducted with the key opinion leaders from the demand and supply sides across four main regions—North America, Europe, Asia Pacific, and the Rest of Europe. Approximately 25% of the primary interviews were conducted with the demand-side respondents, while approximately 75% have been conducted with the supply-side respondents. The primary data has been collected through questionnaires, emails, and telephonic interviews.

After interacting with industry experts, brief sessions were conducted with highly experienced independent consultants to reinforce the findings from our primary. This, along with the in-house subject matter experts’ opinions, has led us to the findings as described in the remainder of this report. The breakdown of primary respondents is as follows:

To know about the assumptions considered for the study, download the pdf brochure

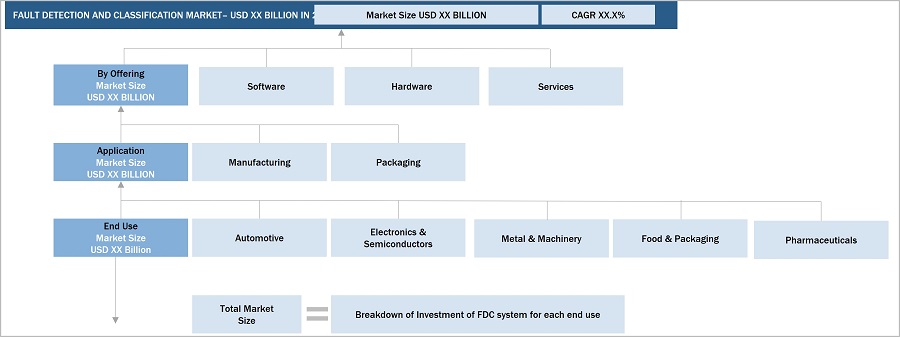

Market Size Estimation

The bottom-up procedure has been employed to arrive at the overall size of the fault detection and classification market.

- Analyzing the average selling price of fault detection and classification systems based on different technologies used in different products.

- Arriving at the market estimates by analyzing the revenue of companies and then combining these figures to arrive at the market size.

- Studying various paid and unpaid sources, such as annual reports, press releases, white papers, and databases, to gather the required information.

- Tracking the ongoing developments and identifying the upcoming ones in the market that include investments, research and development activities, product launches, collaborations, and partnerships undertaken, as well as forecasting the market based on these developments and other critical parameters.

- Carrying out multiple discussions with the key opinion leaders to understand the fault detection and classification technologies and related raw materials, as well as products designed and developed to analyze the break-up of the scope of work carried out by the key companies manufacturing panels.

- Verifying and cross-checking the estimate at every level through discussions with key opinion leaders such as chief executives (CXOs), directors, and operation managers, and finally with the domain experts in MarketsandMarkets

The top-down approach has been used to estimate and validate the total size of the fault detection and classification market.

- Focusing on top-line investments and expenditures being made in the ecosystems of various end users.

- Calculating the market size considering revenues generated by major players through the cost of the fault detection and classification systems.

- Segmenting each application of fault detection and classification in each region and deriving the global market size based on region.

- Acquiring and analyzing information related to revenues generated by players through their key product offerings.

- Conducting multiple on-field discussions with key opinion leaders involved in the development of various fault detection and classification offerings.

- Estimating the geographic split using secondary sources based on various factors, such as the number of players in a specific country and region and the types of fault detection and classification technology used in automotive, electronics and semiconductor, metals & machinery, food & packaging and pharmaceuticals

Data Triangulation

After arriving at the overall market size-using the market size estimation processes as explained above-the market has been split into several segments and subsegments. To complete the entire market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation and market breakdown procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from the demand and supply sides in the fault detection and classification market.

Market Definition

Fault detection and classification is an important part of the manufacturing process. The initial detection of faults or defects and the removal of the aspects that may produce them are essential to improve product quality and reduce the economic impact caused by defective products. Modern-day fault detection and classification systems use sensor data analysis, machine learning algorithm and statistical methods for instant identification of defective or anomalous defects on complex surfaces, which helps manufacturers reduce costs and meet consumer quality expectations.

Key Stakeholders

- Brand Product Manufacturers/Original Equipment Manufacturers (OEMs)/Original Device Manufacturers (ODMs)

- Fault detection and classification System Manufacturers

- Semiconductor Component Suppliers/Foundries

- fault detection and classification Material and Component Suppliers

- Manufacturing Equipment Suppliers

- System Integrators

- Technology/IP Developers

- Consulting and Market Research Service Providers

- Fault detection and classification and Material-related Associations, Organizations, Forums, and Alliances

- Venture Capitalists and Startups

- Research and Educational Institutes

- Distributors and Resellers

- End Users

Report Objectives

- To describe and forecast the size of the fault detection and classification market, based on offering, application, and end use

- To describe and forecast the market size of various segments across four key regions—North America, Europe, Asia Pacific, and Rest of the World (RoW), in terms of value

- To describe the technology and fault type in fault detection and classification

- To provide detailed information regarding the drivers, restraints, opportunities, and challenges influencing the growth of the fault detection and classification market

- To provide an overview of the value chain pertaining to the augmented and virtual reality in education ecosystem, along with the average selling price of fault detection and classification devices

- To strategically analyze the ecosystem, regulatory landscape, patent landscape, Porter’s five forces, import and export scenarios, trade landscape, and case studies pertaining to the market under study

- To strategically analyze micromarkets1 with regard to individual growth trends, prospects, and contributions to the overall market

- To analyze opportunities in the market for stakeholders by identifying high-growth segments

- To provide details of the competitive landscape for market leaders

- To analyze strategies, such as product launches and developments, acquisitions, investment, partnerships, collaborations, and expansion were adopted by players in fault detection and classification market

- To profile key players in the fault detection and classification market and comprehensively analyze their market ranking based on their revenue, market share, and core competencies2

Available customizations:

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

- Detailed analysis and profiling of additional market players based on various blocks of the supply chain

Growth opportunities and latent adjacency in Fault Detection and Classification (FDC) Market