Fault Current Limiter Market by Type (Superconducting & Non-superconducting), by Voltage Range (High, Medium & Low), by End-Users (Power Stations, Oil & Gas, Automotive, Steel & Aluminum, Paper Mills & Chemicals) and by Region - Global Forecast to 2020

[133 Pages Report] Fault current limiter technology provides a perfect solution to control fault current levels on utility distribution and transmission networks. The device remains invisible unlike reactors which possess some resistance during normal operation. This technology increases the efficiency and reliability of the electrical system and eliminates wide area blackouts, reduce localized disruptions, and improve recovery time when faults do occur. Factors driving the Fault Current Limiter Market include increase in interconnection of electric utility grid in emerging economies, demand for efficient & reliable power and growing government initiatives to expand and upgrade the existing T&D system.

Global Fault Current Limiter Market stands at USD 3.1 billion in 2014, and is expected to grow at a CAGR of 9.2% during 2015-2020.

Fault current limiter market is segmented on the basis of its type, voltage range, end-users industries and region. The years considered for the study are:

- Historical Year 2013

- Base Year 2014

- Estimated Year 2015

- Projected Year 2020

- Forecast Period 2015 to 2020

For company profiles in the report, 2014 has been considered. Where information is unavailable for the base year, the prior year has been considered.

Research Methodology

This research study involves extensive usage of secondary sources, directories, and databases (such as Hoovers, Bloomberg, Businessweek, Factiva, and OneSource) to identify and collect information useful for this technical, market-oriented, and commercial aspects of fault current limiter. The below explain the research methodology.

- Analysis of all the operational and upcoming FCL projects across the globe along with capacity and voltage range

- Analysis of country-wise rate of electrification for the past three years

- Analysis of the grid upgrade and integration across various regions

- Estimation of installation cost of fault current limiters in various regions using the cost variance models

- Estimation of unit shipments of fault current limiter and arriving at the total market size using market engineering process

- Analyzing market trends in various regions/ and countries supported by the on-going T&D infrastructure spending in respective regions/ countries

- Overall market size values are finalized by triangulation with the supply side data which include the product developments, supply chain and annual shipments of fault current limiter across the globe

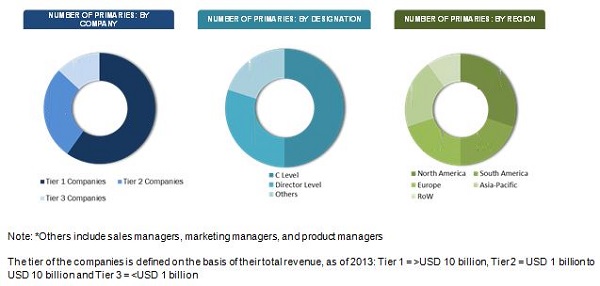

After arriving at the overall market size the total market has been split into several segments and sub-segments. The figure below shows the break-down of the primaries on the basis of company, designation, and region, conducted during the research study.

The figure below shows the break-down of the primaries on the basis of company, designation, and region, conducted during the research study.

Market Ecosystem:

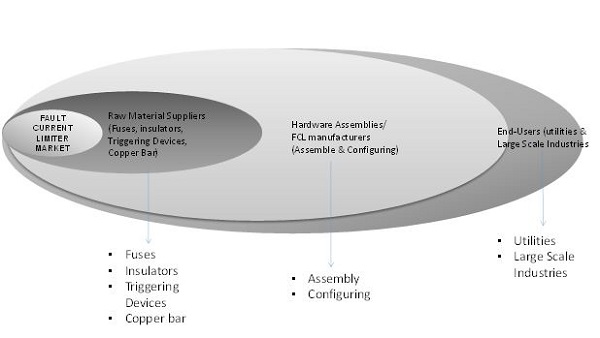

Fault current limiter market starts with raw material suppliers which include current limiting fuses, triggering devices, insulators, copper bars, and so on. In the later stage, manufacturing of fault current limiters takes place where all raw materials are assembled. These devices are then distributed to large scale industries, utilities, and commercial facilities.

Stakeholders:

The stakeholders for the report includes:

- Raw material suppliers- these include Saint Gobain (France), AGC Group (Japan), Corning Inc. (U.S.), Fairchild Semiconductor (U.S.), Analog Devices (U.S.), Rotex (India), and Deltrol Controls (U.S.) among others

- OEMs/FCL Manufacturers - these include ABB Group (Switzerland), Alstom (France), Nexans (France), American superconductors (U.S.), and GridON among others

Scope of the report:

- By Type:

- Superconducting fault current limiter (SFCL)

- Resistive

- Inductive

- Others

- Non-superconducting fault current limiter (NSFCL)

- Saturable core

- Solid State

- Superconducting fault current limiter (SFCL)

- By Voltage Range:

- Low (Less than 1kV)

- Medium (1-40 kV)

- High (More than 40 kV)

- By End-Users

- Power Stations

- Oi & Gas

- Automotive

- Steel & Aluminum

- Paper Mills

- Chemicals

- By Region

- North America

- Europe

- Asia-Pacific

- RoW

Available Customizations:

With the given market data, MarketsandMarkets offers customizations as per the clients specific needs. The following customization options are available for the report:

Regional Analysis

- Further breakdown of region/country-specific analysis

Company Information

- Detailed analysis and profiling of additional market players (Up to 5)

Global Fault Current Limiter Market is projected to grow at a CAGR of 9.2% during 2015-2020, to reach a value of USD 5.2 Billion by 2020. This growth is attributed to increasing interconnections of electric utility grid and rise in government initiatives to expand & upgrade the existing T&D system.

Applications of fault current limiter are not limited to any single industry. There is scope for their usage in almost every industry related to technology, power, and transmission. All equipment and services related to electricity, power transmission, and electronics require circuit protection from overloads. Fault current limiter plays a crucial role in safeguarding the equipment and related machinery from circuit overload in almost every industry.

The report segments fault current limiter market on the basis of its major end-users industries which include power stations, oil & gas, steel & aluminum, paper mills, chemicals and automotive. Chemicals, automotive and power stations are the fastest growth markets for fault current limiter.

Superconducting fault current limiter (SFCL) is the fastest growing segment. It is considered as the best alternative when compared to conventional protection equipment. With increasing applications in end-user industries such as energy, defense, transportation, chemicals, and many others, the SFCL segment is expected to continue to dominate the market. In this report, the SFCL segment has been categorized into two major types: resistive and inductive. The former is widely used due to its compactness and stability.

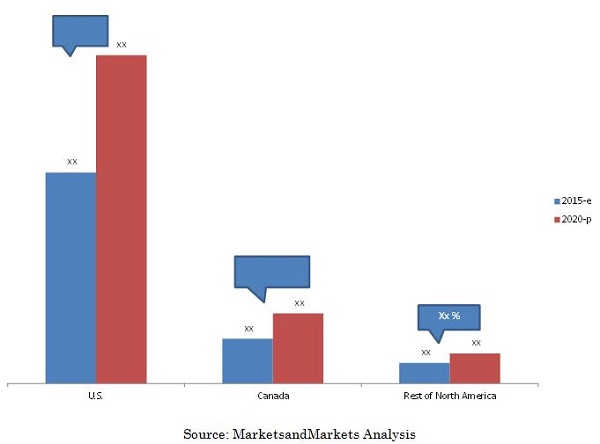

North America has been the leading market for fault current limiter in 2014 with the help of renowned power FCL manufacturing companies in the U.S. The region is currently focusing on upgrade and replacement of its aging infrastructure, improving grid reliability, and enabling smarter power networks. The U.S. and Canada are the fastest growth markets in the region with CAGR of 9.2% and 9.4%, respectively, during 2015-2020. The figure below shows the North American countries market size in 2015 and 2020 with respective CAGRs during 2015-2020.

Fault current limiter includes multiple components made of glass, visitors, diodes, solenoids, copper, and metal wirings among others. Prices of the raw materials for these components are rising causing a weak control on cost of manufacturing. Certain limiters such as solid state, inductive also have gold and silver content, particularly for tolerance purpose, which makes the overall assembly of the device expensive. This has proved to be a restraining factor on the fault current limiter market.

Some of the leading players in the fault current limiter market include ABB Limited (Switzerland), Siemens AG (Germany), Alstom (France), Nexans (France), and AMSC (U.S.) among others. Contracts & agreements was the most commonly used strategy by top players in the market, constituting half of the total developments share. It was followed by new product launches, expansion and other developments.

Table of Contents

1 Introduction (Page No. - 12)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 16)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.3 Breakdown of Primaries

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Market Breakdown & Data Triangulation

2.4 Research Assumptions & Limitations

2.4.1 Assumptions

2.4.2 Limitations

3 Executive Summary (Page No. - 25)

4 Premium Insights (Page No. - 32)

4.1 Attractive Growth Opportunities in Fault Current Limiter Market

4.2 Fault Current Limiter Market- Region Wise Analysis

4.3 Fault Current Limiter Market, By Type

4.4 Fault Current Limiter Market: Asia-Pacific

5 Market Overview (Page No. - 37)

5.1 Introduction

5.2 Market Segmentation

5.2.1 By Type

5.2.2 By Voltage Range

5.2.3 By Application

5.2.4 By Region

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Interconnection to Electric Utility Grid

5.3.1.2 Growing Concern for Efficient & Reliable Power

5.3.1.3 Government Initiatives to Expand Or Upgrade the T&D System

5.3.1.4 Inadequacy of Circuit Breakers & Fuses

5.3.2 Restraints

5.3.2.1 Rising Price of Raw Materials

5.3.3 Opportunities

5.3.3.1 Demand for Intelligent & Modernized Power Grid Infrastructure

5.3.3.2 Rise in Renewable Energy Targets

5.3.4 Challenges

5.3.4.1 Safety Concerns

5.3.5 Value Chain Analysis

5.3.6 Porters Five Forces Analysis

5.3.6.1 Threat of Substitutes

5.3.6.2 Threat of New Entrants

5.3.6.3 Bargaining Power of Buyers

5.3.6.4 Bargaining Power of Suppliers

5.3.6.5 Intensity of Competitive Rivalry

6 Market, By Type (Page No. - 47)

6.1 Introduction

6.2 Superconducting Fault Current Limiter

6.2.1 By Sub-Type

6.3 Non-Superconducting Fault Current Limiter

6.3.1 By Sub-Type

7 Market, By Voltage Range (Page No. - 57)

7.1 Introduction

7.2 Medium Voltage Fault Current Limiter

7.3 Low Voltage Fault Current Limiter

7.4 High Voltage Fault Current Limiter

8 Market, By End-User (Page No. - 62)

8.1 Introduction

8.2 Power Stations

8.3 Oil & Gas

8.3.1 By Sub-Type

8.4 Automotive

8.5 Paper Mills

8.6 Chemicals

8.7 Steel & Aluminum

9 Market, By Region (Page No. - 70)

9.1 Introduction

9.2 North America

9.2.1 Introduction

9.2.2 By Country

9.2.2.1 U.S.

9.2.2.2 Canada

9.2.2.3 Rest of North America

9.3 Asia-Pacific

9.3.1 Introduction

9.3.2 By Country

9.3.2.1 China

9.3.2.2 Japan

9.3.2.3 South Korea

9.3.2.4 India

9.3.2.5 Rest of Asia-Pacific

9.4 Europe

9.4.1 Introduction

9.4.2 By Country

9.4.2.1 U.K.

9.4.2.2 Germany

9.4.2.3 France

9.4.2.4 Rest of Europe

9.5 Rest of the World

9.5.1 Introduction

9.5.2 By Country

9.5.2.1 Brazil

9.5.2.2 Saudi Arabia

9.5.2.3 UAE

9.5.2.4 Argentina

9.5.2.5 Others

10 Competitive Landscape (Page No. - 95)

10.1 Overview

10.2 Competitive Situation & Trends

10.3 Contracts & Agreements

10.4 Expansions

10.5 New Product/Technology Launches

10.6 Other Developments

11 Company Profiles (Page No. - 105)

11.1 Introduction

11.2 ABB Ltd.

11.2.1 Business Overview

11.2.2 Products Offered

11.2.3 Recent Developments, 20122015

11.2.4 SWOT Analysis

11.2.5 MNM View

11.3 Alstom

11.3.1 Business Overview

11.3.2 Product Offerings

11.3.3 Recent Developments

11.3.4 SWOT Analysis

11.3.5 MNM View

11.4 American Superconductor Corporation

11.4.1 Business Overview

11.4.2 Product/Service Offerings

11.4.3 Recent Developments, 20122015

11.4.4 SWOT Analysis

11.4.5 MNM View

11.5 Siemens AG

11.5.1 Business Overview

11.5.2 Products Offered

11.5.3 Recent Developments, 20122015

11.5.4 SWOT Analysis

11.5.5 MNM View

11.6 Applied Materials

11.6.1 Business Overview

11.6.2 Products Offered

11.6.3 Recent Developments, 20122015

11.7 Gridon

11.7.1 Business Overview

11.7.2 Products Offered

11.7.3 Recent Developments, 2011-2014

11.8 Superpower Inc.

11.8.1 Business Overview

11.8.2 Products Offered

11.8.3 Recent Developments, 20132015

11.9 Superconductor Technologies Inc.

11.9.1 Business Overview

11.9.2 Products Offered

11.9.3 Recent Developments, 2015

11.10 Rongxin Power Electronic Co. Ltd.

11.10.1 Products Offered

11.10.2 Recent Developments

11.11 Zenergy Power

11.11.1 Business Overview

11.11.2 Products Offered

11.11.3 Recent Developments, 20112015

12 Appendix (Page No. - 133)

12.1 Available Customizations

12.2 Introducing RT: Real-Time Market Intelligence

12.3 Related Reports

List of Tables (64 Tables)

Table 1 Fault Current Limiter Market Size, By Type, 20132020 (USD Million)

Table 2 Key Superconducting Fault Current Limiter Projects

Table 3 Superconducting Fault Current Limiter Market Size, By Region, 20132020 (USD Million)

Table 4 Superconducting Fault Current Limiter Market Size, By Sub-Type, 20132020 (USD Million)

Table 5 Resistive Superconducting Fault Current Limiter Market Size, By Region, 20132020 (USD Million)

Table 6 Inductive Core Superconducting Fault Current Limiter Market Size, By Region, 20132020 (USD Million)

Table 7 Other Superconducting Fault Current Limiter Market Size, By Region, 20132020 (USD Million )

Table 8 Non-Superconducting Fault Current Limiter Market Size, By Region, 20132020 (USD Million)

Table 9 Non-Superconducting Fault Current Limiter Market Size, By Sub-Type, 20132020 (USD Million)

Table 10 Solid State Non-Superconducting Fault Current Limiter Market Size, By Region, 20132020 (USD Million)

Table 11 Saturable Core Non-Superconducting Fault Current Limiter Market Size, By Region, 20132020 (USD Million)

Table 12 Market, By Sub-Type, 20132020 (USD Million)

Table 13 Market Size, By Voltage Range, 20132020 (USD Million)

Table 14 Medium Voltage Fault Current Limiter Market Size, By Region, 20132020 (USD Million)

Table 15 Low Voltage Fault Current Limiter Market Size, By Region, 20132020 (USD Million)

Table 16 High Voltage Fault Current Limiter Market Size, By Region, 20132020 (USD Million)

Table 17 Market Size, By End-User, 20132020 (USD Million)

Table 18 Power Stations Market Size, By Region, 20132020( USD Million)

Table 19 Oil & Gas Market Size, By Region, 20132020 (USD Million)

Table 20 Oil & Gas Market Size, By Sub-Type, 20132020 (USD Million)

Table 21 Automotive Market Size, By Region, 20132020 (USD Million)

Table 22 Paper Mills Market Size, By Region, 20132020 (USD Million)

Table 23 Chemicals Market Size, By Region, 20132020 (USD Million)

Table 24 Steel & Aluminum Market Size, By Region, 20132020 (USD Million)

Table 25 Fault Current Limiter: Top Five Countries Market Size, 20132020 (USD Million)

Table 26 Fault Current Limiter Market Size, By Region, 20132020 (USD Million)

Table 27 North America: Market Size, By Country, 20132020 (USD Million)

Table 28 North America: Market Size, By Type, 20132020 (USD Million)

Table 29 North America: Market Size, By Voltage Range, 20132020 (USD Million)

Table 30 North America: Market Size, By End-User, 20132020 (USD Million)

Table 31 U.S.: Renewable Consumption, 2013-2016 (Quadrillion Btu)

Table 32 U.S.: Market Size, By Type, 20132020 (USD Million)

Table 33 Canada: Market Size, By Type, 20132020 (USD Million)

Table 34 Rest of North America: Market Size, By Type, 20132020 (USD Million)

Table 35 Asia-Pacific: Market Size, By Country, 20132020 (USD Million)

Table 36 Asia-Pacific: Market Size, By Type, 20132020 (USD Million)

Table 37 Asia-Pacific: Market Size, By Voltage Range, 20132020 (USD Million)

Table 38 Asia-Pacific: Market Size, By End-User, 20132020 (USD Million)

Table 39 China: Market Size, By Type, 20132020 (USD Million)

Table 40 Japan: Market Size, By Type, 20132020 (USD Million)

Table 41 South Korea: Market Size, By Type, 20132020 (USD Million)

Table 42 India: Market Size, By Type, 20132020 (USD Million)

Table 43 Rest of Asia-Pacific: Market Size, By Type, 20132020 (USD Million)

Table 44 Europe: Market Size, By Country, 20132020 (USD Million)

Table 45 Europe: Market Size, By Type, 20132020 (USD Million)

Table 46 Europe: Market Size, By Voltage Range, 20132020 (USD Million)

Table 47 Europe: Market Size, By End-User, 20132020 (USD Million)

Table 48 U.K.: Market Size, By Type, 20132020(USD Million)

Table 49 Germany:Market Size, By Type, 20132020(USD Million)

Table 50 France: Market Size, By Type, 20132020 (USD Million)

Table 51 Rest of Europe: Market Size, By Type, 20132020 (USD Million)

Table 52 RoW: Market Size, By Country, 20132020 (USD Million)

Table 53 RoW: Market Size, By Type, 20132020 (USD Million)

Table 54 RoW: Market Size, By Voltage Range, 20132020 (USD Million)

Table 55 RoW: Market Size, By End-Users, 20132020 (USD Million)

Table 56 Brazil: Market Size, By Type, 20132020 (USD Million)

Table 57 Saudi Arabia: Market Size, By Type, 20132020 (USD Million)

Table 58 UAE: Market Size, By Type, 20132020 (USD Million)

Table 59 Argentina: Market Size, By Type, 20132020 (USD Million)

Table 60 Others: Market Size, By Type, 20132020 (USD Million)

Table 61 Contracts & Agreements, 20112015

Table 62 Expansions, 20142015

Table 63 New Product/Technology Launches, 2011-2012

Table 64 Other Developments, 20122015

List of Figures (49 Figures)

Figure 1 Markets Covered: Fault Current Limiter Market

Figure 2 Fault Current Limiter Market: Research Design

Figure 3 Bottom-Up Approach

Figure 4 Top-Down Approach

Figure 5 Assumptions of the Research Study

Figure 6 Limitations of the Research Study

Figure 7 North America Occupied the Largest Market Share in 2014

Figure 8 Fault Current Limiter Market Snapshot (2015 vs. 2020): Europe is Expected to Exhibit the Highest Growth Rate in the Next Five Years

Figure 9 The Superconducting Fault Current Limiter Segment is Projected to Dominate the Market During the Forecast Period

Figure 10 The Power Stations Segment is Expected to Capture the Largest Market Share During the Forecast Period

Figure 11 Fault Current Limiter Market Size, 2015 & 2020 (USD Million)

Figure 12 Upgrading Existing Network & Rising Investment in T&D Infrastructure to Boost Fault Current Limiter Market

Figure 13 North America Dominated this Market in 2014

Figure 14 Superconducting Fault Current Limiter (Sfcl) to Capture Lions Share in this Market

Figure 15 Asia-Pacific: China, Japan, & South Korea are Major Contributors to the Market, 2014

Figure 16 Fault Current Limiter Market Segmentation, By Type

Figure 17 Fault Current Limiter Market Segmentation, By Voltage Range

Figure 18 Fault Current Limiter Market Segmentation, By End-User

Figure 19 Fault Current Limiter Market Segmentation, By Region

Figure 20 Interconnection of Grid Along With Rising Investments in T&D Infrastructure is Expected to Propel the Growth of the Market

Figure 21 Access to Electricity (% of Population)

Figure 22 Growing Renewable Energy Mix By 2030

Figure 23 Value Chain: Fault Current Limiter Market

Figure 24 Fault Current Limiter Market: Porters Five Forces Analysis

Figure 25 Fault Current Limiter Market Share (Value), By Type, 2014

Figure 26 Fault Current Limiter Market Share (Value), By Voltage Range, 2014

Figure 27 Fault Current Limiter Market Share (Value), By End-User, 2014

Figure 28 Power Stations to Capture the Maximum Share in the Fault Current Limiter Market

Figure 29 Fault Current Limiter Market Analysis, By Country

Figure 30 Fault Current Limiter Market Share (Value), By Region, 2014

Figure 31 Companies Adopted Various Growth Strategies in the Past Five Years, 20112015*

Figure 32 Battle for Market Share: Contract & Agreement is the Key Strategy Adopted By the Players, 20112015*

Figure 33 Market Evolution Framework: Contracts & Agreements has Led to the Market Growth, 20112015*

Figure 34 Regional Revenue Mix of the Top Five Market Players

Figure 35 ABB Ltd. SWOT Analysis

Figure 36 Alstom: Company Snapshot

Figure 37 Alstom: SWOT Analysis

Figure 38 Nexans S.A.: Company Snapshot

Figure 39 Nexans S.A.: SWOT Analysis

Figure 40 AMSC: Company Snapshot

Figure 41 AMSC: SWOT Analysis

Figure 42 Siemens AG: Company Snapshot

Figure 43 SWOT Analysis: Siemens AG

Figure 44 Applied Materials: Company Snapshot

Figure 45 Gridon: Company Snapshot

Figure 46 Superpower Inc.: Company Snapshot

Figure 47 Superconductor Technologies Inc.: Company Snapshot

Figure 48 Rongxin Power Electronic Co. Ltd.: Company Snapshot

Figure 49 Zenergy Power: Company Snapshot

Growth opportunities and latent adjacency in Fault Current Limiter Market