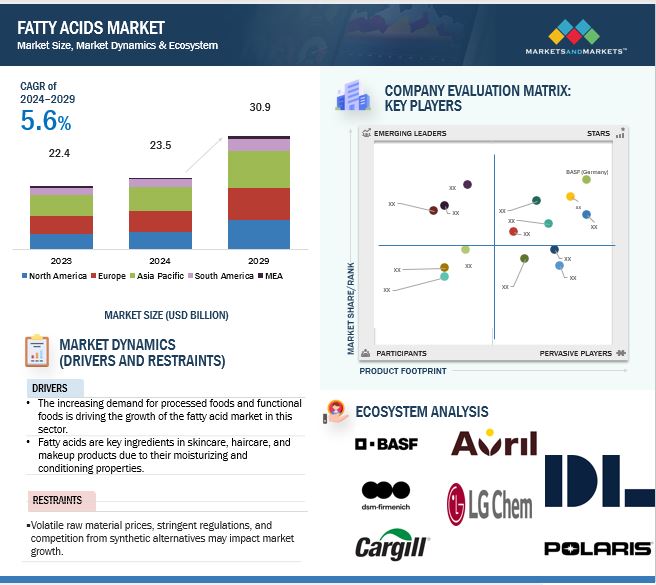

Fatty Acids Market

The fatty acids market is estimated at USD XX.X billion in 2024 and is projected to reach USD XX.X billion by 2029, at a CAGR of X.X% from 2024 to 2029. As more health-conscious products and innovations in encapsulation technology expand growth prospects for the fatty acid market in the coming years, demand for these fatty acids is increasing across food, supplement, and personal care industries due to an increase in awareness regarding the health benefits of fatty acids, mainly concerning omega-3 and omega-6. This also encompasses the modification of healthier fat consumption patterns since functional ingredients, such as anti-inflammatory and heart health, are in demand.

The encapsulation technologies also bring benefits to the market, as fatty acids are delivered more effectively within a wide variety of products. In response, these technologies enhance the stability, bioavailability, and controlled release of fatty acids, making them suitable for use in food, pharmaceuticals, and cosmetics. Capturing fatty acids in a protective layer protects the properties of fatty acids and extends their shelf life for easier absorption by the body. The factors of increased health awareness together with new technologies put the fatty acids market on course for sustained growth in the future.

Fatty Acids Market Dynamics

Drivers: Rising demand in the cleaning industry drives the growth of fatty acids market

Fatty acids have been a backbone in the cleaning and hygiene industries, most especially in the fabrication of detergents and other cleaning agents. Lauric acid is widely used in household and industrial detergents, using its excellent cleansing and antimicrobial properties. Myristic acid gives good-quality foam and is added to both dishwashing liquids and laundry detergents. Palmitic acid is an additive which provides stability and feel to cleaning products, while stearic acid is a thickener used in liquid soaps. Ricinoleic acid comes from castor oil and often applied in surfactants due to its excellent emulsifying properties. Oleic acid is a lubricant that enhances the ability to apply cleaning products, while linoleic and linolenic acids are added in order to ensure the stabilization of products as well as the improvement of cleaning efficiency.

The cleaning and hygiene products market is one of the largest sectors contributing to the European economy, whereby a "2024 study by the International Association for Soaps, Detergents, and Maintenance Products" showed that the sector amounts to USD 49.2 billion annually. The household care products sector constitutes USD 39.3 billion while the professional cleaning and hygiene products sector makes up USD 9.9 billion. The significance of fatty acids in such products places them as core ingredients, promoting innovation and growth within the industry. Increased use of fatty acids will not only improve the quality of the product but boost the production rate, thereby increasing the market and opening up more opportunities among the manufacturers and suppliers in this industry.

Restraint: EU's deforestation ban disrupts palm oil supply for fatty acid industry in European countries

European Union rules to prohibit deforestation interfere with the supply of palm oil for fatty acid production in European countries. Therefore, it will directly impact the industries of commodities based on commodities like palm oil because critical sectors of fatty acid production would need shifting in place. Palm oil is a very viable commodity because it is cost-effective and versatile; hence, one of the most consumed commodities due to its universal usage in various applications as a raw material to produce different fatty acids used in personal care, food, and industrial applications. However, new EU regulations could severely disrupt supply chains and impose costs for fatty acid manufacturers as it will impose more rigorous compliance demands on them. Center for Strategic and International Studies May 2024 reports that the EU recently rolled out the EUDR that prohibits products linked with deforestation from entering or exiting the EU market where it has been in effect since June 2023. This law requires companies to document that their products, such as palm oil, soy, and wood, did not originate in recently cleared forests or otherwise contribute to forest degradation. The penalties for noncompliance include the confiscation of goods and fines of up to 4 percent of total annual turnover within the EU.

Opportunity: Growing demand for personal care products drives the fatty acid market

Fatty acids are of crucial importance to personal care and cosmetics applications: they function as moisturizers, emollients, and emulsifiers that enhance the effectiveness of the product along with the experience of its users. As an emollient oleic and linoleic acids hydrate skin and provide a smooth feel by retaining the moisture and softening the epidermis. In addition, their ability as emulsifying agents helps to stabilize the formulations and thus contributes to a smooth uniform texture in creams and lotions by blending both water- and oil-based ingredients. Palmitic acid also stabilizes the formulations, reduces the transepidermal water loss, and enhances the smoothness of the skin, thus being so relevant to an anti-aging product. Fatty acids also act as foam-builders in cleansers. Human skin has natural fatty acids which replenish lost nutrients, strengthen the barrier function of the skin and trigger elasticity. These are the most important elements in keeping the skin healthy and battling signs of aging. According to an India Brand Equity Foundation report dated December 2023, the personal care and cosmetics market in India is booming with growth anticipated at a CAGR of 25% to reach USD 20 billion by 2025. This growth has been supported by international brands as well as by increased retail and boutique presence across the country. In the United States, the Personal Care Products Council revealed in 2022 that this industry added USD 308.7 billion to the GDP, had a trade surplus of USD 2.6 billion, and contributed to 4.6 million jobs. Thus, it shows how this sector economically contributes to both countries and supports strong industrial expansion.

With the demand for personal care increasing, the market for these fatty acids is expected to blossom, as they will be used as a basis for high-quality products that will hydrate and be stable. This will give way to new opportunities in innovation applications of fatty acids, thereby supporting a flourishing cosmetics and personal care market worldwide.

Challenge: Climate challenges impact the fatty acid market

That has significant environmental impacts such as climate change and extreme weather conditions, affecting the type of fatty acid market produced. For instance, The USDA reduced the 2022/2023 estimate for Argentine soybean production to 23.9 million metric tons (MMT)-its lowest level in 24 years yields hitting a record low not seen in nearly 50 years, primarily due to severe drought conditions. The severe reductions in soybean production drove the competition for available vegetable oils and their prices even more. Such supply instability increases the production costs of fatty acids from vegetable oils and may even result in real raw material shortages. Therefore, manufacturers face unstable pricing and supply chains, which naturally affect the availability and affordability of fatty acids in different markets such as food, cosmetics, and industrial applications.

Market Ecosystem

Polyunsaturated fatty acids (PUFAs) are expected to be the fastest-growing segment in the fatty acids market during the forecast period leading up to 2029.

PUFAs are gaining popularity in health-focused products, as they contain various health-benefiting properties, such as a decrease in inflammation, improvement in heart health, and enhancement of brain function. Thus, their demand is increasing significantly in the food, pharmaceutical, and dietary supplement industries. The increasing demand for functional ingredients that contribute to better overall health in the food industry has, on its part, led to a rise in the utilization of PUFAs in fortified foods and beverages.

The pharmaceutical and nutraceutical industries are also adding fuel to the PUFA segment. PUFAs are utilized in supplements for cardiovascular and anti-inflammatory benefits, but the major component of many supplements has come to be omega-3 fatty acids, popular in products targeted for heart health and chronic disease prevention.

Besides, with advancements in technologies related to the extraction and stabilization of PUFAs, along with an emerging awareness of health benefits supported by these fatty acids, their growth will be sustained in the near future years.

The capsule form of fatty acids is expected to be the fastest-growing segment in the forecast period through 2029

Capsules are a very preferred dosing method for both omega-3s and omega-6s. Fatty acid supplements are increasingly being consumed by health-conscious consumers demanding enhancing heart health, cognitive function, and inflammatory health.

The increased demand for plant-based and fish-derived fatty acids in capsule format. The clean-label and sustainable demands of consumers in places like North America and Europe are bailing out more of these supplements. This also gives a controlled release with fatty acids getting effectively absorbed into the body, which makes capsules more appealing.

The rise of individualized health products drives the rise in capsule consumption since users require products that suit their specific requirements for health. Improvements in pharmaceutical innovations with soft gels and liquid-filled capsules enhance supply, making such products more appealing to consumers.

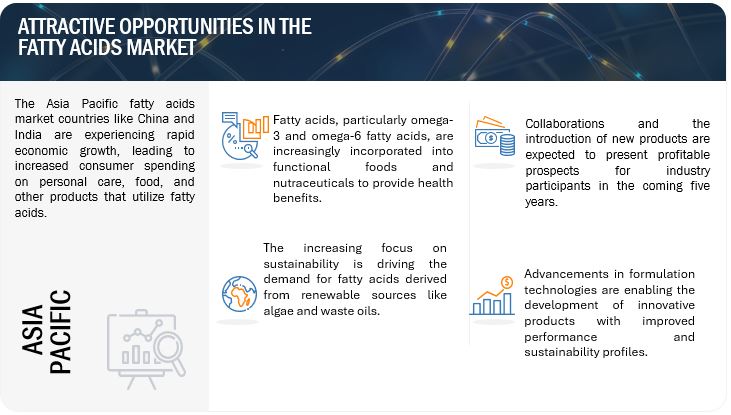

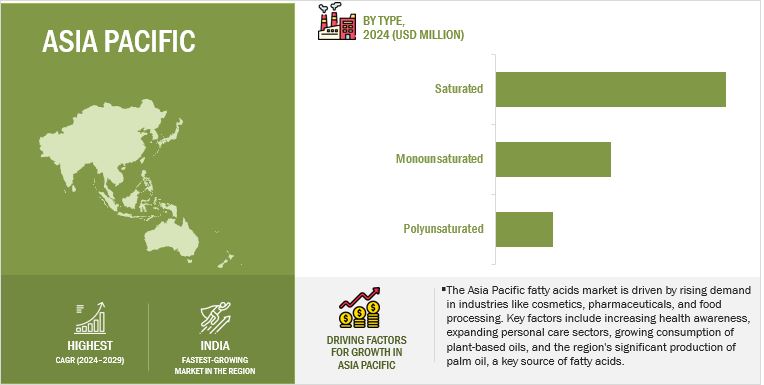

The Asia Pacific region is anticipated to experience the fastest growth between 2024 and 2029.

An increase in demand from consumers, and also due to ample availability of raw materials. Some of the countries supporting this growth are China, India, and Indonesia, mainly because of the growth in their population, increase in disposable income, and urbanization, thereby supporting demand growth in food, personal care, and biofuels, among others.

Demand for plant-based fatty acids, including omega-3 and omega-6, is highly spurred by the growth in the food sector as healthier diets and functional ingredients account for the majority of their use in fortified foods and dietary supplements. The personal care industry is growing at a tremendous rate in South Korea and Japan and has increased its usage in skincare and haircare. These products take up the humectant and emulsifying action of fatty acids, coinciding with the greater demand for natural ingredients.

Asia Pacific is one of the leading manufacturers of biodiesel with government support for renewable sources of energy. Another key raw material for the production of biodiesel is fatty acids, especially palm oil. With an aggressive agricultural base, these areas offer a continuous supply of raw materials to the manufacturing industries. Such low-cost manufacturing also ensures the availability of these locations, hence Asia Pacific is the fastest-growing segment in the global market for fatty acids.

Key Market Players

The key players in this market include BASF (Germany), Godrej Industries Limited (India), Cargill, Incorporated (US), Wilmar International Ltd (Singapore), LG Chem (Republic of Korea), Ingevity (US), Corbion (Netherlands), dsm-firmenich (Switzerland), Ashland (US), Pelagia AS (Norway), AAK AB (Sweden), KLK OLEO (Malaysia), Vantage Specialty Chemicals (US), AVRIL SCA (France), DL Holdings (Republic of Korea), Polaris (France).

These market players are focusing on increasing their presence through agreements and collaborations. These companies have a strong presence in North America, Asia Pacific, and Europe. They also have manufacturing facilities along with strong distribution networks across these regions.

Recent Developments

- In October 2024, DSM and Evonik formed a joint venture to develop algae-based omega-3 fatty acids, focusing on animal nutrition. The partnership strengthened its market presence by providing sustainable omega-3 solutions, addressing the growing demand for eco-friendly alternatives in the fatty acid market.

- In June 2024, The approval of the industry standard for "Industrial Linseed Oil Fatty Acid," primarily drafted by Anhui Refined Oil and Fat Co. Ltd, marks a significant milestone for the company. Set to be implemented in the second half of 2024, this standard will enhance product quality and consistency across the linolenic acid sector in China. It is expected to bolster the company's reputation and competitiveness in the fatty acids market, fostering growth and innovation within the industry.

- In October 2023, dsm-firmenich launched life’sOMEGA 03020, a new algal-based omega-3 ingredient with an EPA/DHA ratio matching fish oil. This sustainable alternative offers a 1.5:1 EPA to DHA ratio, addressing supply challenges in the marine omega-3 market and supporting consumer demand for environmentally friendly nutrition solutions.

- In September 2023, Corbion's launch of AlgaPrime™ DHA P3, a high-performance omega-3 ingredient for pet food, strengthens its presence in the fatty acid market by offering higher DHA levels while reducing reliance on traditional marine-based omega-3 sources. This innovation meets the growing demand for sustainable nutrition and enhances the carbon footprint of pet diets, advancing Corbion's role in active nutrition solutions.

Frequently Asked Questions (FAQ):

What is the current size of the fatty acids market?

The fatty acids market is estimated at USD XX.X billion in 2024 and is projected to reach USD XX.X billion by 2029, at a CAGR of X.X% from 2024 to 2029

Which are the key players in the fatty acids market, and how intense is the competition?

Key players in the fatty acids market include BASF (Germany), Godrej Industries Limited (India), Cargill, Incorporated (US), Wilmar International Ltd (Singapore), and LG Chem (Republic of Korea). The competition in this market is highly intense, driven by ongoing investments in research and development (R&D), innovations in product formulations, mergers and acquisitions, and advancements in sustainable production technologies.

Which region is expected to dominate the fatty acids market?

The Asia Pacific region is anticipated to hold the largest share of the fatty acids market, primarily due to the high demand in countries like China and India, strong manufacturing capabilities, and growing consumer needs in sectors such as food, personal care, and biofuels.

What are the key factors driving the growth of the fatty acids market?

The growth of the fatty acids market is driven by several factors, including the increasing demand for plant-based fatty acids, the rise in health-conscious consumer preferences for omega-3 and omega-6 fatty acids, and the expansion of the biofuels industry. Additionally, the development of innovative encapsulation technologies for use in food, pharmaceuticals, and personal care products is also contributing to market growth.

What are the applications of fatty acids in various industries?

Fatty acids have diverse applications in industries such as food and beverages (as ingredients and functional fats), personal care (in skincare, haircare, and cosmetics), pharmaceuticals (for controlled drug delivery systems), and biofuels (in biodiesel production). Their use is expanding in sectors focusing on sustainability and health-conscious products.

What kind of information is included in the company profiles section?

The company profiles section provides detailed insights into market-leading companies, including their business overviews, financial performance, product offerings, geographic presence, strategic initiatives, and recent innovations. This information helps in understanding the companies' strategies and competitive positioning in the market.

What role does sustainability play in the fatty acids market?

Sustainability is a growing driver in the fatty acids market, as consumers and industries increasingly seek eco-friendly and renewable sources of fatty acids. Manufacturers are focusing on plant-based fatty acids, sourced from crops like soy, palm, and canola, and are also exploring waste-based sources such as algae to minimize environmental impact and ensure sustainable production practices.

What is the outlook for the fatty acids market over the next five years?

The fatty acids market is expected to experience strong growth due to increased demand in health-conscious applications, biofuel production, and the growing use of fatty acids in various industrial processes. Technological innovations, such as more efficient methods of extraction and clean label formulations, will also enhance market opportunities and contribute to a favorable market outlook.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Growth opportunities and latent adjacency in Fatty Acids Market