Fat Replacers Market by Type (Carbohydrate-based, Protein-based, Lipid-based), Application (Bakery & Confectionery, Dairy & Frozen Desserts, Convenience Food & beverages, Sauces, Dressings, and Spreads), Form, Source, and Region - Global Forecast to 2022

[134 Pages Report] The fat replacers market was valued at USD 1.40 Billion in 2016, and is projected to reach USD 2.01 Billion by 2022, at a CAGR of 6.2% from 2017. The fat replacers market has been segmented on the basis of type, application, form, source, and region.

The years considered for the study are as follows:

|

Report Metric |

Details |

|

Base year |

2016 |

|

Estimated year |

2017 |

|

Projected year |

2022 |

|

Forecast period |

2017-2022 |

The objectives of the study are as follows:

- To define, segment, and project the global market size for fat replacers

- To understand the structure of the fat replacers market by identifying its various subsegments

- To provide detailed information about the key factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To analyze the opportunities in the market for stakeholders and provide the competitive landscape of the market trends.

Research Methodology

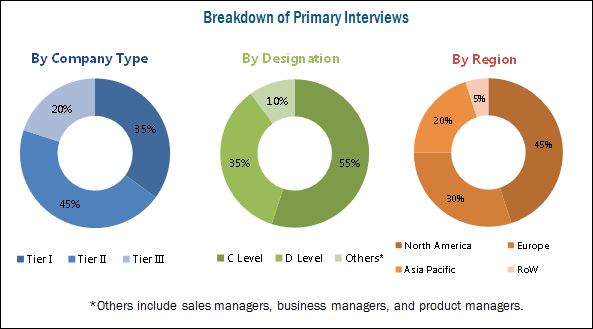

This report includes an estimation of the market size in terms of value (USD million). Both, top-down and bottom-up approaches have been used to estimate and validate the size of the fat replacers market and various other dependent submarkets in the overall market. Key players in the market have been identified through secondary research such as Hoovers, Forbes, and Bloomberg Businessweek, company websites, annual reports, and their market share in respective regions has been determined through primary and secondary research. All percentage shares, splits, and breakdowns have been determined using secondary sources and were verified through primary sources.

To know about the assumptions considered for the study, download the pdf brochure

Target audience:

- Fat replacer manufacturers

- Technology providers to the fat replacer manufacturers

- Fat replacer manufacturers/suppliers

- Importers and exporters of fat replacer ingredients

- Dairy product manufacturers/suppliers

- Raw material suppliers

- Commercial research & development (R&D) institutions and financial institutions

- Intermediary suppliers

- Dealers

- End users (fat replacers manufacturers)

Scope of the report

This research report categorizes the fat replacers market based on type, application, form, source, and region.

Based on Type, the fat replacers market has been segmented as follows:

- Carbohydrate-based

- Protein-based

- Lipid-based

Based on Application, the market has been segmented as follows:

- Bakery & confectionery products

- Dairy & frozen desserts

- Convenience foods & beverages

- Sauces, dressings, and spreads

- Others (functional foods and processed meat)

Based on Form, the fat replacers market has been segmented as follows:

- Powder

- Liquid

Based on Source, the market has been segmented as follows:

- Plant

- Animal

Based on Region, the market has been segmented as follows:

- North America

- Europe

- Asia Pacific

- RoW (South America and the Middle East & Africa)

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to client-specific needs.

The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of the Rest of Europe fat replacers market into Spain, the Netherlands, Russia, Sweden, and Belgium

- Further breakdown of the Rest of Asia-Pacific fat replacers market into South Korea, Indonesia, and Vietnam

- Further breakdown of the RoW market into Brazil, Argentina, and South Africa

Company Information

- Detailed analysis and profiling of additional market players (up to two)

Increasing prevalence of obesity and the growing awareness about health and wellness are the major drivers contributing to the growth of this market.

The fat replacers market, by type, is segmented into carbohydrate-based, protein-based, and lipid-based. The increasing demand for food products with high-protein content but low-fat content is expected to fuel the growth of the protein-based fat replacers market.

By application, the market has been segmented into bakery & confectionery products, dairy & frozen desserts, convenience foods & beverages, sauces, dressings, and spreads, and others (functional foods and processed meat). The bakery & confectionery products industry led the market due to the increasing awareness about leading a healthy lifestyle. This led to the reduction of fat content in bakery & confectionery products, leading to the demand for fat replacers.

By form, the market has been segmented into powder and liquid. The powdered segment accounted for a relatively larger market share as it is easy to use and maintain. This form of fat replacers is preferred for fried foods and bakery products.

By source, the market has been segmented into plant and animal. The plant-sourced segment is projected to grow at a relatively higher CAGR. Animal-sourced protein is expensive to obtain, and therefore it is easier for food manufacturers to opt for plant-sourced fat replacers.

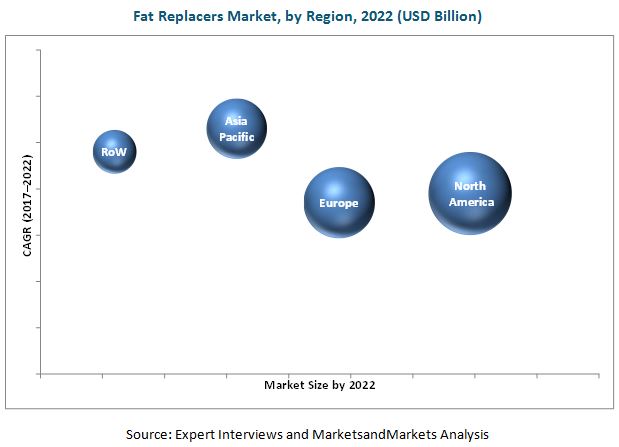

The global fat replacers market was dominated by North America in 2016. Asia Pacific is projected to be the fastest-growing market from 2017 to 2022. The change in consumers eating habits in terms of western cuisine, as well as the growth in the processed food industry, has led to the need for fat replacers.

The global fat replacers market is characterized by moderate to low competition. Expansions & new product launches are the key strategies adopted by the key market players to ensure their growth in the market. The market is dominated by players such as ADM (US), DuPont (US), Cargill (US), Kerry Group (Ireland), FMC Corporation (US), Ingredion (US), Koninklijke DSM (Netherlands), and Ashland Inc (US).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 13)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Study Scope

1.4 Periodization Considered

1.5 Currency Considered

1.6 Unit Considered

1.7 Stakeholders

2 Research Methodology (Page No. - 17)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primaries

2.2 Market Size Estimation

2.3 Market Breakdown & Data Triangulation

2.4 Research Assumptions and Limitations

2.4.1 Assumptions

2.4.2 Limitations

3 Executive Summary (Page No. - 26)

4 Premium Insights (Page No. - 31)

4.1 Opportunities in the Fat Replacers Market

4.2 Fat Replacers Market, By Type

4.3 Market, By Food Application & Region

4.4 Asia Pacific: Market, By Application & Country

4.5 Market, By Type & Region

5 Market Overview (Page No. - 35)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Increasing Awareness About Health & Wellness

5.2.1.2 Increasing Prevalence of Obesity

5.2.2 Restraints

5.2.2.1 Compliance With the International Quality Standards and Regulations for Food Ingredients

5.2.3 Opportunities

5.2.3.1 Increasing Consumption of Convenience Food

5.2.3.2 Asia Pacific Market Provides Immense Potential for Fat Replacers

5.2.4 Challenges

5.2.4.1 Consumer Perception About the Flavor of Fat Replacers

5.3 Value Chain Analysis

6 Fat Replacers Market, By Type (Page No. - 41)

6.1 Introduction

6.2 Carbohydrate-Based

6.2.1 Cellulose

6.2.2 Gum

6.2.3 Starch

6.2.4 Others

6.3 Protein-Based

6.3.1 Milk Protein

6.3.2 Egg Protein

6.3.3 Soy Protein

6.3.4 Whey Protein

6.3.5 Others

6.4 Lipid-Based

6.4.1 Olestra

6.4.2 Others

7 Fat Replacers Market, By Application (Page No. - 49)

7.1 Introduction

7.2 Bakery & Confectionery Products

7.3 Dairy & Frozen Desserts

7.4 Convenience Foods & Beverages

7.5 Sauces, Dressings, and Spreads

7.6 Others

8 Fat Replacers Market, By Form (Page No. - 55)

8.1 Introduction

8.2 Powder

8.3 Liquid

9 Fat Replacers Market, By Source (Page No. - 59)

9.1 Introduction

9.2 Plant

9.3 Animal

10 Fat Replacers Market, By Region (Page No. - 63)

10.1 Introduction

10.2 North America

10.2.1 US

10.2.2 Canada

10.2.3 Mexico

10.3 Europe

10.3.1 Germany

10.3.2 France

10.3.3 UK

10.3.4 Italy

10.3.5 Rest of Europe

10.4 Asia Pacific

10.4.1 China

10.4.2 Japan

10.4.3 India

10.4.4 Australia & New Zealand

10.4.5 Rest of Asia Pacific

10.5 Rest of the World (RoW)

10.5.1 South America

10.5.2 Middle East & Africa

11 Company Profiles (Page No. - 96)

(Business Overview, Strength of Product Portfolio, Products Offered, Business Strategy Excellence & Recent Developments)*

11.1 Introduction

11.2 Cargill

11.3 ADM

11.4 Kerry Group

11.5 FMC Corporation

11.6 Du Pont

11.7 Ingredion

11.8 Koninklijke DSM

11.9 Ashland Inc.

11.10 CP Kelco

11.11 Tate & Lyle

11.12 Corbion

11.13 Fiberstar, Inc.

*Details on Business Overview, Strength of Product Portfolio, Products Offered, Business Strategy Excellence & Recent Developments Might Not Be Captured in Case of Unlisted Companies.

12 Appendix (Page No. - 128)

12.1 Discussion Guide

12.2 Knowledge Store: Marketsandmarkets Subscription Portal

12.3 Introducing RT: Real-Time Market Intelligence

12.4 Available Customizations

12.5 Related Reports

12.6 Author Details

List of Tables (75 Tables)

Table 1 Fat Replacers Market Size, By Type, 20152022 (USD Million)

Table 2 Carbohydrate-Based Fat Replacer Market Size, By Subtype, 20152022 (USD Million)

Table 3 Carbohydrate-Based Market Size, By Region, 20152022 (USD Million)

Table 4 Protein-Based Fat Replacer Market Size, By Subtype, 20152022 (USD Million)

Table 5 Protein-Based Market Size, By Region, 20152022 (USD Million)

Table 6 Lipid-Based Fat Replacer Market Size, By Subtype, 20152022 (USD Million)

Table 7 Lipid-Based Market Size, By Region, 20152022 (USD Million)

Table 8 Fat Replacer Market Size, By Application, 20152022 (USD Million)

Table 9 Bakery & Confectionery Products Market Size, By Region, 20152022 (USD Million)

Table 10 Dairy & Frozen Desserts Market Size, By Region, 20152022 (USD Million)

Table 11 Convenience Foods & Beverages Market Size, By Region, 20152022 (USD Million)

Table 12 Sauces, Dressings, and Spreads Market Size, By Region, 20152022 (USD Million)

Table 13 Other Applications Market Size, By Region, 20152022 (USD Million)

Table 14 Fat Replacers Market Size, By Form, 20152022 (USD Million)

Table 15 Powdered Fat Replacer Market Size, By Region, 20152022 (USD Million)

Table 16 Liquid Fat Replacer Market Size, By Region, 20152022 (USD Million)

Table 17 Fat Replacer Market Size, By Source, 20152022 (USD Million)

Table 18 Plant-Sourced Fat Replacer Market Size, By Region, 20152022 (USD Million)

Table 19 Animal-Sourced Fat Replacer Market Size, By Region, 20152022 (USD Million)

Table 20 Fat Replacer Market Size, By Region, 20152022 (USD Million)

Table 21 Market Size, By Region, 20152022 (KT)

Table 22 North America: Fat Replacers Market Size, By Country, 20152022 (USD Million)

Table 23 North America: Market Size, By Country, 20152022 (KT)

Table 24 North America: Market Size, By Type, 20152022 (USD Million)

Table 25 North America: Market Size, By Application, 20152022 (USD Million)

Table 26 North America: Market Size, By Form, 20152022 (USD Million)

Table 27 North America: Market Size, By Source, 20172022 (USD Million)

Table 28 US: Market Size, By Type, 20152022 (USD Million)

Table 29 US: Market Size, By Application, 20152022 (USD Million)

Table 30 Canada: Market Size, By Type, 20152022 (USD Million)

Table 31 Canada: Market Size, By Application, 20152022 (USD Million)

Table 32 Mexico: Market Size, By Type, 20152022 (USD Million)

Table 33 Mexico: Market Size, By Application, 20152022 (USD Million)

Table 34 Europe: Fat Replacers Market Size, By Country, 20152022 (USD Million)

Table 35 Europe: Market Size, By Country, 20152022 (KT)

Table 36 Europe: Market Size, By Type, 20152022 (USD Million)

Table 37 Europe: Market Size, By Application, 20152022 (USD Million)

Table 38 Europe: Market Size, By Form, 20152022 (USD Million)

Table 39 Europe: Market Size, By Source, 20152022 (USD Million)

Table 40 Germany: Market Size, By Type, 20152022 (USD Million)

Table 41 Germany: Market Size, By Application, 20152022 (USD Million)

Table 42 France: Market Size, By Type, 20152022 (USD Million)

Table 43 France: Market Size, By Application, 20152022 (USD Million)

Table 44 UK: Market Size, By Type, 20152022 (USD Million)

Table 45 UK: Market Size, By Application, 20152022 (USD Million)

Table 46 Italy: Market Size, By Type, 20152022 (USD Million)

Table 47 Italy: Market Size, By Application, 20152022 (USD Million)

Table 48 Rest of Europe: Fat Replacers Market Size, By Type, 20152022 (USD Million)

Table 49 Rest of Europe: Market Size, By Application, 20152022 (USD Million)

Table 50 Asia Pacific: Fat Replacers Market Size, By Country, 20152022 (USD Million)

Table 51 Asia Pacific: Market Size, By Country, 20152022 (KT)

Table 52 Asia Pacific: Market Size, By Type, 20152022 (USD Million)

Table 53 Asia Pacific: Market Size, By Application, 20152022 (USD Million)

Table 54 Asia Pacific: Market Size, By Form, 20152022 (USD Million)

Table 55 Asia Pacific: Market Size, By Source, 20152022 (USD Million)

Table 56 China: Market Size, By Type, 20152022 (USD Million)

Table 57 China: Market Size, By Application, 20152022 (USD Million)

Table 58 Japan: Market Size, By Type, 20152022 (USD Million)

Table 59 Japan: Market Size, By Application, 20152022 (USD Million)

Table 60 India: Market Size, By Type, 20152022 (USD Million)

Table 61 India: Market Size, By Application, 20152022 (USD Million)

Table 62 Australia & New Zealand: Market Size, By Type, 20152022 (USD Million)

Table 63 Australia & New Zealand: Market Size, By Application, 20152022 (USD Million)

Table 64 Rest of Asia Pacific: Fat Replacers Market Size, By Type, 20152022 (USD Million)

Table 65 Rest of Asia Pacific: Market Size, By Type, 20152022 (USD Million)

Table 66 RoW: Fat Replacers Market Size, By Region, 20152022 (USD Million)

Table 67 RoW: Market Size, By Region, 20152022 (KT)

Table 68 RoW: Market Size, By Type, 20152022 (USD Million)

Table 69 RoW: Market Size, By Application, 20152022 (USD Million)

Table 70 RoW: Market Size, By Form, 20152022 (USD Million)

Table 71 RoW: Market Size, By Source, 20152022 (USD Million)

Table 72 South America: Fat Replacers Market Size, By Type, 20152022 (USD Million)

Table 73 South America: Market Size, By Application, 20152022 (USD Million)

Table 74 Middle East & Africa: Market Size, By Type, 20152022 (USD Million)

Table 75 Middle East & Africa: Market Size, By Application, 20152022 (USD Million)

List of Figures (39 Figures)

Figure 1 Fat Replacers Market Segmentation

Figure 2 Market Segmentation, By Region

Figure 3 Market: Research Design

Figure 4 Market Size Estimation: Bottom-Up Approach

Figure 5 Market Size Estimation Methodology: Top-Down Approach

Figure 6 Market Breakdown & Data Triangulation

Figure 7 Fat Replacers Market Size, By Type, 20172022 (USD Million)

Figure 8 Market Size, By Application, 2017 vs 2022 (USD Million)

Figure 9 Market Size, By Form, 20162022 (USD Million)

Figure 10 Market Size, By Source, 20162022 (USD Million)

Figure 11 Market Share, By Region, 2016

Figure 12 Rising Awareness for Health & Wellness to Drive the Market

Figure 13 Carbohydrate-Based Segment Estimated to Lead the Market During the Review Period

Figure 14 Bakery & Confectionery Products Segment Recorded the Largest Share in 2016 (USD Million)

Figure 15 Bakery & Confectionery Products Segment Accounted for the Largest Share in Asia Pacific, 2016

Figure 16 North America has the Largest Market for All Types in 2016

Figure 17 Increasing Awareness About Health & Wellness to Drive the Fat Replacers Market Growth

Figure 18 Deaths Caused By Non-Communicable Diseases at A Global Level, 20002015

Figure 19 US: Estimated Percentage of Youth Suffering From Obesity, 20132014

Figure 20 GDP of Top Countries in Asia Pacific (2014-2016)

Figure 21 Value Chain Analysis of Fat Replacers: Major Value is Added During the Manufacturing Stage

Figure 22 Carbohydrate-Based Fat Replacers Segment is Projected to Dominate the Market Through 2022

Figure 23 Bakery & Confectionery Products Segment is Projected to Dominate the Market Through 2022

Figure 24 Powdered Form is Projected to Dominate the Market Through 2022

Figure 25 Plant-Sourced Fat Replacers Projected to Dominate the Market Through 2022

Figure 26 Geographic Snapshot: India to Be the Fastest-Growing Market During the Forecast Period

Figure 27 North American Fat Replacers Market Snapshot

Figure 28 European Market Snapshot

Figure 29 Asia Pacific Market Snapshot

Figure 30 Cargill: Company Snapshot

Figure 31 ADM: Company Snapshot

Figure 32 Kerry Group: Company Snapshot

Figure 33 FMC Corporation: Company Snapshot

Figure 34 Dupont: Company Snapshot

Figure 35 Ingredion: Company Snapshot

Figure 36 Koninklijke DSM : Company Snapshot

Figure 37 Ashland Inc.: Company Snapshot

Figure 38 Tate & Lyle: Company Snapshot

Figure 39 Corbion: Company Snapshot

Growth opportunities and latent adjacency in Fat Replacers Market