Expanded Beam Connector Market - Global Forecast to 2030

In contrast to physical contact connectors that are used to join optical fibers, expanded beam connectors are contactless. Expanded beam connectors utilize use lenses to expand and collimate light signals, expanding the signal from smaller fiber core size into a much larger diameter and sends the light signals in parallel to each other. This expanded beam can be as much as 150 times larger compared to the beam in the fiber core.

The second lens then refocuses the expanded light into the connecting fiber core by contracting the light signal back down to the size of the smaller core diameter. Expanded beam connectors can be segmented into multimode and single-mode types, and are available in multiple fiber counts, ranging anywhere from 2 to 16 fibers.

To know about the assumptions considered for the study, Request for Free Sample Report

Drivers: Deployment of optical fiber connectivity in harsh environments

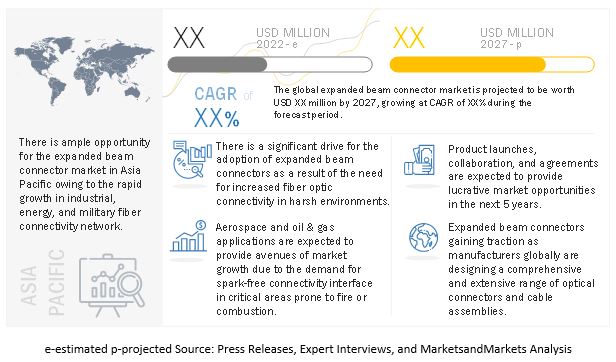

The rising deployment of optical fiber connectivity in harsh environments such as mining, outside broadcasting, offshore, and in some factory automation settings (5G and edge computing) is driving the need for expanded beam connectors as is offers the benefit of tolerating dust, debris and other contaminates on the fiber endface.

Need for extended beam connectors in clinical applications

The need for fiber optic connectors that can withstand microorganisms, fluids and other contaminants in medical environments is also driving the market for expanded beam connectors. Extended beam connectors are becoming critical as they can withstand thousands of mating cycles in clinical applications.

Challenges: Large size of extended beam connectors and limited wavelength support

Due to beam expansion, the connector size of expanded beam connectors is larger than physical contact connectors, which can be a challenge in space constrained applications. In addition, the use of lenses in expanded beam connectors can limit the wavelengths supported and hence, are not recommended for wavelength division multiplexing (WDM) applications.

Key players in the market

Amphenol Fiber Systems International (US), TechOptics (UK), Bulgin (UK), 3M (US), NEUTRIK (Liechtenstein), Radiall (France), TE Connectivity (Switzerland), Foss (Norway), Rosenberger (Germany), Bel Fuse (US), JOWO Systemtechnik (Germany), and Strain Technologies (US) are a few key players in the expanded beam connector market globally.

Recent Developments

- In March 2022, NEUTRIK (Liechtenstein) announced its new NEUTRIK FIBERFOX Expanded Beam Fiber Optic Connectors have been designed to meet the requirements of MIL-DTL-83526 specifications for deployment in harsh environments and use nonphysical contact fiber optic termini that are IP68 sealed behind an anti-reflective coated ball lens.

- In November 2021, Amphenol FSI (US) announced that it one of the first to adapt to the new specifications for M28876 optical fiber connectors. The company announced that its M28876 connector finish has transitioned from cadmium/CR+6 to Black Hard Anodized PTFE or SnZn.

- In May 2021, TechOptics (UK) announce a formal distribution agreement with EXFO, a leading manufacturer of fibre optic test and measurement solutions. The agreement covers EXFO’s huge range of fibre inspection tools, OTDRs, sources, power meters and network test equipment addressing a wide range of applications across enterprise networks, optical physical layer, transport, and datacom.

TABLE OF CONTENTS

1 Introduction

1.1. Study Objectives

1.2. Market definition

1.2.1. Inclusions and exclusions

1.3. Study scope

1.3.1. Markets Covered

1.3.2. Geographic Scope

1.3.3. Years considered

1.4. Currency

1.5. Stakeholders

1.6. Summary of Changes

2 Research Methodology

2.1. Research Data

2.1.1. Secondary Data

2.1.1.1. Key data from primary sources

2.1.2. Primary Data

2.1.2.1. Key industry insights

2.1.2.2. Breakdown of primaries

2.1.2.3. Key data from primary sources

2.2. Market size estimation

2.2.1. Bottom-Up Approach

2.2.2. Top-Down Approach

2.3. Market Breakdown and Data Triangulation

2.4. Research Assumptions

2.5. Limitations

2.6. Risk Assessment

3 Executive Summary

4 Premium Insights

5 Market Overview

5.1. Introduction

5.2. Market Dynamics

5.2.1. Drivers

5.2.2. Restraints

5.2.3. Opportunities

5.2.4. Challenges

5.3. Supply/Value Chain Analysis

5.4. Ecosystem/Market Map

5.5. Pricing Analysis

5.5.1. Average Selling Price of Key Players, By Applications

5.5.2. Average Selling Price Trends

5.6. Trends/Disruption Impacting Customer Businesses

5.7. Technology Analysis

5.7.1. Insertion Loss Requirements

5.7.2. Reflected Power Requirements

5.8. Porters 5 Forces Analysis

5.9. Key Stakeholder & Buying Criteria

5.10. Case Study Analysis

5.11. Trade Analysis

5.12. Patent Analysis

5.13. Key Conferences & Events

5.14. Tariff & Regulatory Landscape

5.14.1. Regulatory Bodies, Government Agencies and Other Organizations

6 Expanded Beam Connector Market, By Cable Type

6.1. Introduction

6.2. Single Mode

6.3. Multi-Mode

7 Expanded Beam Connector Market, By Beam Diameter

7.1. Introduction

7.2. <1.0mm

7.3. 1.0-2.0 mm

7.4. 2.0-3.0 mm

8 Expanded Beam Connector Market, By Form Factor

8.1. Introduction

8.2. Rack & Panel

8.3. Panel Mount Connectors

8.4. In-Line Circular

8.5. Quick-Disconnect

9 Expanded Beam Connector Market, By Connector Type

9.1. Introduction

9.2. Single Channel

9.3. Multi-Channel

10 Expanded Beam Connector Market, By Application

10.1. Introduction

10.2. Military & Defense

10.3. Oil & Gas

10.4. Medical

10.5. Industrial

10.6. Aerospace

10.7. Others (Robotics, Railway, Marine)

11 Expanded Beam Connector Market, By Region

11.1. Introduction

11.2. North America

11.2.1. US

11.2.2. Canada

11.2.3. Mexico

11.3. Europe

11.3.1. Germany

11.3.2. UK

11.3.3. France

11.3.4. Rest of Europe

11.4. APAC

11.4.1. China

11.4.2. Japan

11.4.3. India

11.4.4. Rest of APAC

11.5. RoW

11.5.1. South America

11.5.2. Middle East and Africa

12 Competitive Landscape

12.1. Key Player Strategies/Right to Win

12.2. Revenue Analysis of Leading Players (2017-2021)

12.3. Market Share Analysis

12.4. Company Product Footprint Analysis

12.5. Company Evaluation Quadrant

12.5.1. Star

12.5.2. Emerging Leader

12.5.3. Pervasive

12.5.4. Participant

12.6. Startup/SME Evaluation Quadrant

12.6.1. Progressive Company

12.6.2. Responsive Company

12.6.3. Dynamic Company

12.6.4. Starting Block

12.7. Competitive Situations and Trends

12.7.1. Product Launches

12.7.2. Deals

12.7.3. Others

13 Company Profiles

13.1. Major Players

13.1.1. TE Connectivity

13.1.2. 3M

13.1.3. Broadcom

13.1.4. Molex

13.1.5. Amphenol

13.1.6. Glenair

13.1.7. ODU

13.1.8. COTSWorks

13.1.9. Corning Incorporated

13.1.10. Amphenol

13.1.11. Sumitomo

13.1.12. Bel Fuse

13.1.13. Nissin Kasei USA

13.1.14. Radiall

13.2. Other Players

14 Appendix

14.1. Discussion Guide

14.2. Knowledge Store: Marketsandmarkets’ Subscription Portal

14.3. Author Details

Note: Average selling price and technical product comparison can be provided for top 5 companies only.

Growth opportunities and latent adjacency in Expanded Beam Connector Market